Utilizing such a standardized structure offers several advantages. It facilitates efficient budgeting and expense tracking, aids in financial planning and analysis, and can be instrumental in identifying discrepancies or potential fraudulent activities. It also proves useful when creating mock financial documents for educational or training purposes.

Understanding the structure and utility of these standardized documents provides a foundation for exploring broader topics related to personal finance management, including budgeting techniques, financial record keeping, and fraud prevention strategies. This knowledge can empower individuals to take control of their finances and make informed financial decisions.

1. Structure

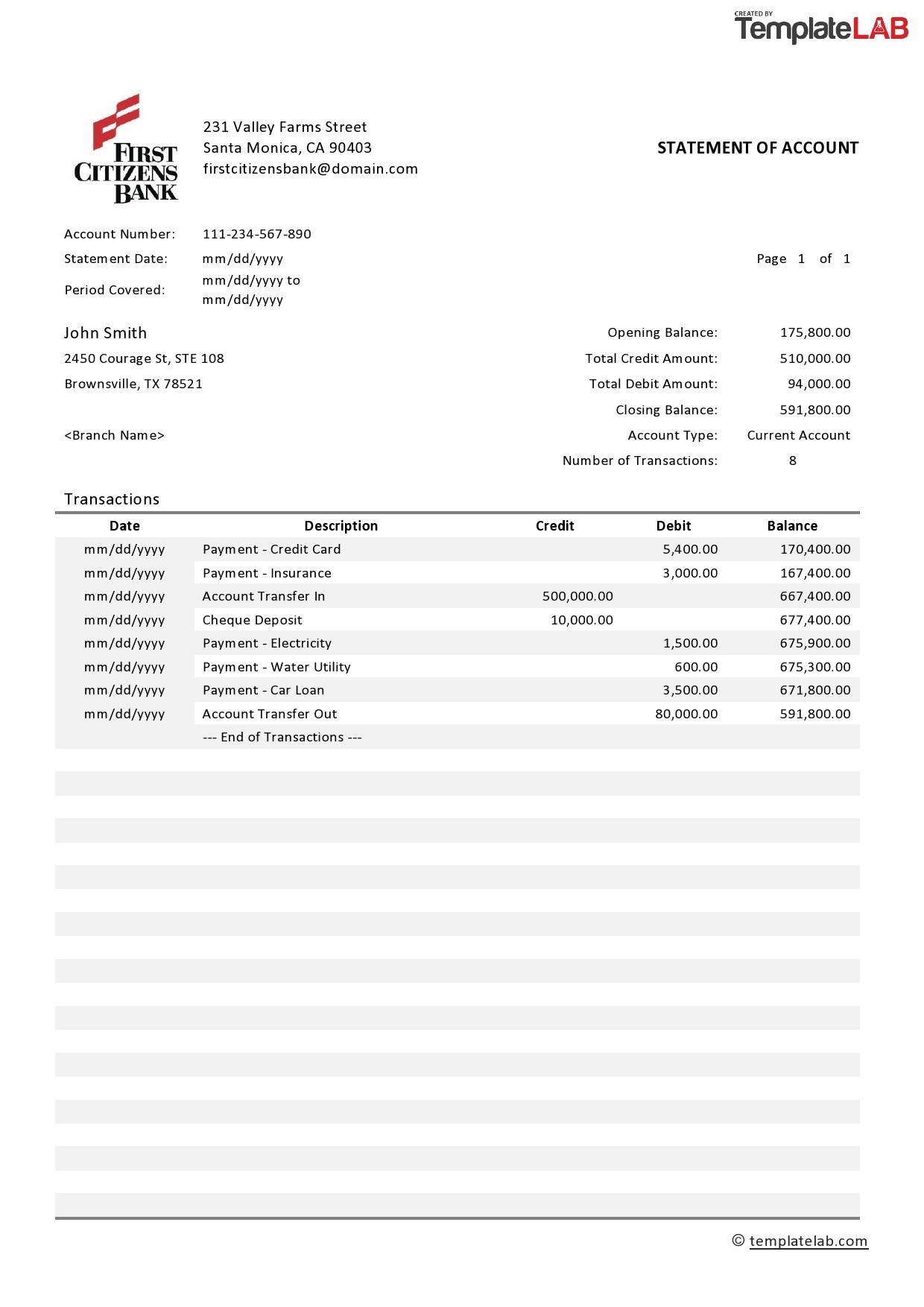

The structure of a bank statement template, including one replicating that of Fifth Third Bank, is crucial for organizing and presenting financial information clearly and consistently. A well-defined structure ensures that users can readily locate and interpret key data points, facilitating effective financial management.

- Account InformationThis section typically includes the account holder’s name, account number, and the statement period. This information allows for clear identification of the account and the timeframe of the transactions listed. Accurate account information is essential for record-keeping and reconciliation.

- Transaction DetailsThis section forms the core of the statement, detailing each transaction with date, description, amount, and running balance. Transactions might include deposits, withdrawals, checks, and electronic transfers. A clear presentation of transaction details enables users to track spending and income effectively.

- Balance SummaryThis section usually presents the beginning and ending balances for the statement period. It may also include other summary information like interest earned or fees charged. The balance summary provides a concise overview of the account’s financial status during the specified period.

- Other InformationThis section might include contact information for the financial institution, details about relevant services, or other important notices. This additional information can be valuable for addressing account-related inquiries or accessing further resources.

These structural elements work together to provide a comprehensive and organized view of account activity. A consistent structure, such as that found in standardized templates, simplifies financial analysis, reconciliation, and record-keeping, ultimately contributing to sound financial management practices.

2. Transactions

Transactions form the core of any bank statement, including those modeled after Fifth Third Bank’s format. A comprehensive understanding of how transactions are recorded and presented within the statement structure is essential for accurate financial analysis and reconciliation. Each transaction reflects a specific financial activity affecting the account balance.

- DepositsDeposits represent additions to the account balance. These can include direct deposits, mobile check deposits, or cash deposits made at a branch or ATM. Within the statement, deposits are typically indicated by a positive value and contribute to an increased balance. Accurately recording deposits is crucial for maintaining a correct understanding of available funds.

- WithdrawalsWithdrawals represent deductions from the account balance. Examples include cash withdrawals from ATMs, debit card purchases, and electronic transfers. These are typically represented by a negative value and decrease the overall balance. Tracking withdrawals allows for effective monitoring of spending habits.

- ChecksChecks represent payments made from the account using physical checks. The statement will usually include the check number, date, and amount. Like withdrawals, checks decrease the account balance. Reconciling cleared checks against issued checks helps ensure accurate record-keeping.

- Electronic TransfersElectronic transfers encompass a range of digital transactions, including online bill payments, wire transfers, and peer-to-peer payments. These transactions can either increase (incoming transfers) or decrease (outgoing transfers) the account balance, and are usually detailed with transaction specifics. Understanding the nature of each electronic transfer is crucial for accurate categorization and reconciliation.

Accurate and detailed recording of these transactions within a bank statement template, such as one mirroring Fifth Third Bank’s format, provides a comprehensive overview of account activity, facilitating effective financial management. This detailed record allows users to track income and expenses, identify spending patterns, and reconcile their records with the bank’s data, ultimately contributing to a clearer understanding of their financial position.

3. Balance Details

Balance details within a bank statement template, such as one mimicking Fifth Third Bank’s structure, represent a crucial component for understanding account activity and financial health. These details provide a snapshot of the account’s financial status at specific points in time, allowing for effective tracking of funds and informed financial decision-making. The relationship between balance details and the overall statement structure is integral to accurate financial analysis. Balance details typically comprise the beginning balance, representing the account’s status at the start of the statement period, and the ending balance, reflecting the account’s status after all transactions within the period have been processed. These balances, when considered alongside transaction details, provide a complete picture of financial flow.

For example, consider a scenario where the beginning balance is $1,000. Throughout the statement period, several transactions occur: a deposit of $500, a withdrawal of $200, and a debit card purchase of $100. The ending balance would then be $1,200, accurately reflecting the net effect of these transactions. This clear presentation of balance details allows users to readily assess the impact of individual transactions on their overall financial standing. Discrepancies between expected and actual ending balances can indicate errors or unauthorized activity, prompting timely investigation and corrective action.

Understanding balance details within the context of a bank statement template, like those modeled after Fifth Third Bank’s structure, is fundamental for sound financial management. This comprehension facilitates accurate reconciliation, informed budgeting, and effective tracking of financial goals. Analyzing balance trends over time can also provide valuable insights into spending patterns and financial health. Therefore, accurate and readily accessible balance details are essential components of any effective bank statement template.

4. Account Information

Account information within a bank statement template, particularly one resembling Fifth Third Bank’s format, provides crucial context for the financial data presented. This information anchors the statement to a specific account, ensuring accurate tracking and interpretation of transactions. Without clear account identification, the financial data loses its relevance and utility for account holders and financial professionals.

- Account Holder NameThe account holder’s name, as officially registered with the financial institution, is a primary identifier. This ensures that the statement is correctly attributed and prevents confusion in cases of joint accounts or multiple accounts held by the same individual. Accurate name representation is essential for legal and administrative purposes.

- Account NumberThe unique account number designates the specific financial account to which the statement pertains. This number is crucial for internal tracking within the financial institution’s systems and enables precise reconciliation of transactions. It differentiates the account from all others and ensures accurate posting of financial activities.

- Statement PeriodThe statement period defines the timeframe covered by the documented transactions. This period, typically a month or a quarter, provides boundaries for the financial activity being reported, enabling clear analysis of income and expenditure within a specific timeframe. Understanding the statement period is crucial for accurate reconciliation and financial planning.

- Branch Information (Optional)While not always present, branch information, such as the address and contact details of the associated bank branch, can be helpful for customers. This allows for direct inquiries or assistance related to the account. This information, though optional, can enhance the statement’s utility for account holders needing localized support.

These elements of account information, when presented accurately and clearly within a bank statement template, like one modeled after Fifth Third Bank’s, ensure the document’s integrity and relevance. This information connects the financial data to a specific account holder and time period, facilitating effective financial management, accurate record-keeping, and informed decision-making. The clear presentation of account information establishes the context necessary for meaningful interpretation and utilization of the financial data within the statement.

5. Period Covered

The “period covered” designates the specific timeframe encompassed by a bank statement, including those structured like Fifth Third Bank’s template. This defined timeframe, typically a month or a quarter, provides essential context for the financial data presented. The period covered acts as a boundary for the transactions listed, enabling accurate analysis of account activity within that specific duration. A clear delineation of the period covered is crucial for effective financial management, reconciliation, and trend analysis. Without this temporal anchor, the financial information loses its contextual relevance and becomes difficult to interpret meaningfully within the broader scope of financial activity. For instance, comparing spending habits or income fluctuations requires analyzing data within consistent timeframes. The period covered facilitates such comparisons.

Consider a scenario involving two consecutive bank statements. The first covers January 1st to January 31st, showing an ending balance of $2,000. The second covers February 1st to February 28th, showing an ending balance of $2,500. The period covered allows for a clear understanding of the $500 increase as occurring during February. Without distinct period designations, attributing this change to a specific timeframe becomes impossible. This principle applies to all financial reports, including those replicating Fifth Third Bank’s format. The defined period enables users to track financial progress, identify trends, and make informed financial decisions based on specific timeframes.

Accurate specification of the period covered is essential for the integrity and utility of any bank statement template. This element allows for precise tracking of financial activity within defined timeframes, facilitating effective reconciliation, informed financial planning, and insightful trend analysis. Understanding the period covered empowers users to contextualize the financial data, draw meaningful conclusions, and make sound financial decisions based on a clear chronological perspective. This specificity also supports accurate comparisons across multiple statements and contributes to a comprehensive understanding of long-term financial trends.

6. Reconciliation Uses

Reconciliation, the process of verifying the accuracy of financial records, relies heavily on bank statements. A template mirroring the structure of a Fifth Third Bank statement provides a standardized format for this crucial process. This structured format facilitates the systematic comparison of transactions recorded in personal or business financial records against those reported by the bank. This comparison identifies discrepancies, ensuring that all transactions are accounted for and that recorded balances accurately reflect the actual financial position. Reconciliation using a standardized template allows for efficient identification of errors, omissions, or unauthorized transactions. For example, a missing deposit in personal records, when compared against the bank statement, highlights the need to investigate and correct the discrepancy. Similarly, an unrecognized withdrawal might reveal an unauthorized transaction, prompting immediate action.

Consider a small business utilizing a template similar to a Fifth Third Bank statement for reconciliation. The business records indicate an ending balance of $5,000, while the bank statement reports $4,800. Reconciliation reveals a $200 check issued by the business but not yet cleared by the bank. This process clarifies the difference, preventing potential overdraft issues and maintaining accurate financial records. Similarly, individuals can use reconciliation to identify bank errors, such as incorrectly processed transactions, ensuring that their records reflect the correct balance. Without regular reconciliation, such discrepancies could go unnoticed, leading to inaccurate financial planning and potential financial difficulties.

Accurate reconciliation, facilitated by a clear and consistent bank statement template, is fundamental to sound financial management for both individuals and businesses. This process ensures the integrity of financial records, enabling accurate tracking of income and expenses, and informed financial decision-making. Regular reconciliation, utilizing a structured template, minimizes the risk of errors, identifies potential fraud, and provides a clear understanding of one’s financial position. This practice ultimately contributes to greater financial control and stability.

Key Components of a Bank Statement Template

Understanding the core components of a bank statement template, such as one modeled after Fifth Third Bank’s structure, is fundamental for accurate interpretation and effective utilization of financial data. These components work together to provide a comprehensive overview of account activity within a specific timeframe.

1. Account Information: This section identifies the specific account and account holder. Key elements include the account holder’s name, account number, and the statement period. Accurate account information is paramount for proper record-keeping and reconciliation.

2. Transaction Details: This section forms the core of the statement, detailing each transaction affecting the account balance. Information typically includes the transaction date, description, amount, and running balance. Clear and comprehensive transaction details are essential for tracking income and expenses.

3. Balance Summary: This section provides a snapshot of the account’s financial status during the statement period. It typically includes the beginning balance, ending balance, and any applicable interest earned or fees charged. The balance summary allows for quick assessment of the overall account activity.

4. Period Covered: This defines the specific timeframe encompassed by the statement, usually a month or a quarter. The period covered provides crucial context for the transactions listed and is essential for accurate reconciliation and trend analysis.

5. Contact Information: This section typically includes contact information for the financial institution, offering avenues for customer support or inquiries regarding the account or statement information. This facilitates easy access to assistance when needed.

These components, when presented clearly and consistently within a structured format, empower users to effectively manage their finances, track their spending, and make informed financial decisions. Accurate and readily accessible information within each component contributes significantly to a comprehensive understanding of financial health.

How to Create a Fifth Third Bank Statement Template

Creating a document that mirrors the structure of a Fifth Third Bank statement requires careful attention to detail and a thorough understanding of the key components. While replicating the precise design and security features of an official bank statement is neither advisable nor feasible, creating a template for personal use or educational purposes can be achieved by following these steps.

1: Software Selection: Choose appropriate software. Spreadsheet software offers robust functionality for creating structured documents with formulas for automatic calculations. Word processing software can also be utilized, but requires manual calculations.

2: Header Design: Replicate the header section, including fields for account information such as the account holder’s name, account number, and statement period. This information provides crucial context for the financial data.

3: Transaction Table Creation: Create a table with columns for transaction details: date, description, debit amount, credit amount, and running balance. This structure ensures clear organization of financial activity.

4: Balance Summary Inclusion: Include a section for the beginning balance, ending balance, and any applicable interest or fees. This summary offers a quick overview of account activity during the specified period.

5: Footer Design: Incorporate a footer area for any disclaimers, contact information, or additional details typically found on a bank statement. This enhances the template’s realism and provides essential information.

6: Formula Implementation (Spreadsheet Software): If using spreadsheet software, implement formulas for automatic calculation of the running balance and other relevant totals. This ensures accuracy and simplifies data entry.

7: Data Population (Optional): For illustrative purposes, populate the template with sample transactions. This helps visualize how the template functions and aids in identifying any structural or formatting issues.

By adhering to these steps, a functional template mimicking the core structure and informational elements of a Fifth Third Bank statement can be created. This template can be used for personal budgeting, educational demonstrations, or other legitimate purposes where a structured representation of financial data is required. Remember, however, that this template is for personal use and should not be used for fraudulent purposes.

Careful examination of a document structured like a Fifth Third Bank statement reveals the importance of organized financial data presentation. Key elements such as account information, transaction details, balance summaries, and the period covered contribute to a comprehensive overview of account activity. Understanding the structure and components facilitates accurate reconciliation, informed financial management, and effective trend analysis. Creating templates based on this structure, while adhering to ethical and legal guidelines, can provide valuable tools for personal budgeting and educational purposes.

Accurate financial record-keeping is paramount for informed financial decision-making. Leveraging structured formats, similar to bank statement templates, empowers individuals and businesses to maintain clear financial oversight. This practice contributes to financial stability, informed planning, and proactive management of financial resources. Continued emphasis on structured financial documentation promotes financial literacy and responsible financial behavior.