Utilizing such a document offers several advantages. It can streamline personal finance management by offering a readily available format for tracking income and expenses. Furthermore, it can be valuable in situations requiring proof of funds or transaction history, offering a temporary stand-in until official records can be obtained. This accessibility and adaptability makes it a practical resource for individuals and businesses alike.

This foundation of understanding lays the groundwork for a deeper exploration of topics like the legal and ethical considerations surrounding the use of such documents, available resources for acquiring them, and best practices for ensuring accuracy and security. Further discussion will also cover potential applications and scenarios where these documents prove particularly useful.

1. Data Accuracy

Data accuracy is paramount when utilizing a fillable document mimicking a financial record. Inaccurate information can lead to misinformed financial decisions, flawed budgeting, and potential legal complications. Maintaining accurate data ensures the document’s utility as a reliable tool for personal finance management or other legitimate purposes.

- Reconciliation with Official StatementsRegular comparison of entered data with official bank statements is crucial. This process identifies discrepancies, ensuring the fillable document remains a faithful reflection of actual financial activity. For example, verifying deposits and withdrawals against official records helps maintain accuracy and highlights any overlooked transactions.

- Meticulous Data EntryCareful and precise data entry minimizes errors. Typos or incorrect numerical entries can significantly skew financial projections and analyses. Double-checking entries and employing data validation techniques, such as verifying transaction dates and amounts, contribute to a more reliable dataset.

- Regular UpdatesConsistent and timely updates keep the information current and relevant. Neglecting to update the document regularly diminishes its accuracy and usefulness for tracking financial progress or demonstrating financial standing. Updating the template at least monthly, or ideally after each transaction, ensures a consistently accurate reflection of financial status.

- Source VerificationWhen incorporating data from external sources, such as investment accounts or loan statements, verifying the information’s origin and accuracy is essential. This practice prevents the propagation of errors and ensures the integrity of the compiled financial information within the document.

Maintaining accurate data within these documents is essential for their effective use in various applications. Whether employed for personal budgeting, financial forecasting, or demonstrating proof of funds, data accuracy reinforces the document’s credibility and value as a reliable financial tool. Failure to prioritize accuracy undermines the document’s purpose and can have significant consequences, impacting financial planning and potentially leading to legal issues if used for official purposes.

2. Ethical Considerations

Ethical considerations are paramount when utilizing a fillable document designed to resemble a financial statement. While such documents offer legitimate applications for personal finance management, the potential for misuse necessitates a clear understanding of ethical boundaries. The core principle lies in the intent and context of usage. Employing a fillable template for personal budgeting or financial forecasting is ethically sound. However, presenting a fabricated document as genuine for purposes like loan applications, fraudulent activities, or misrepresenting financial status crosses ethical and legal boundaries. This distinction is crucial. For example, using a template to track spending habits and project future expenses is acceptable. Conversely, submitting a modified template inflated with false deposits to secure a loan constitutes fraud.

The ethical implications extend beyond direct misrepresentation. Even seemingly innocuous alterations, like modifying transaction dates or amounts, can have ethical ramifications if used to create a misleading impression of financial stability. Consider a scenario where an individual alters transaction dates to suggest consistent income flow when, in reality, income is sporadic. This manipulation, while not outright fabrication, creates a deceptive portrayal of financial health. Therefore, ethical considerations demand not only factual accuracy but also transparency and honesty in the document’s usage. Maintaining ethical conduct ensures responsible and legitimate application of these tools, preventing potential harm and preserving trust in financial interactions.

Navigating the ethical landscape surrounding these documents requires constant vigilance and awareness of potential pitfalls. The ease of modification necessitates a strong ethical compass, guiding users toward responsible practices. The ultimate responsibility rests on the individual to employ these tools ethically, ensuring their actions align with legal and moral principles. Failure to uphold these ethical standards can lead to severe consequences, damaging personal credibility and potentially incurring legal penalties. Understanding and adhering to ethical guidelines is therefore not merely a suggestion but a fundamental requirement for anyone utilizing these adaptable financial documents.

3. Specific Purposes

Defining the specific purpose for utilizing a fillable document mirroring a Chase bank statement is essential for ensuring its proper and effective application. The intended use dictates the level of detail required, the ethical considerations, and the potential legal implications. A clear understanding of purpose prevents misuse and maximizes the document’s utility. Different purposes necessitate varying approaches to data input, accuracy requirements, and overall handling. For instance, utilizing a template for personal budgeting requires less stringent accuracy than submitting a representation of financial history for loan approval. In the former case, minor discrepancies might be tolerable, whereas the latter demands meticulous precision and adherence to factual data.

Consider several scenarios illustrating the connection between purpose and application. When employed for personal financial planning, a fillable template allows individuals to project future expenses, track spending habits, and experiment with different budgeting strategies. In this context, the focus lies on estimated figures and hypothetical scenarios. Conversely, when used to demonstrate proof of funds for a rental application, the data must accurately reflect current financial standing. Similarly, using a template to prepare for tax season requires meticulous record-keeping and precise data entry to ensure compliance with tax regulations. Each purpose, therefore, carries specific implications for data handling and accuracy expectations. Failure to align the document’s usage with its intended purpose can lead to inaccuracies, misinterpretations, and potential legal complications.

Understanding the specific purpose for utilizing these adaptable financial documents provides a crucial framework for their appropriate and ethical application. It informs data entry practices, accuracy requirements, and overall handling of the document. This conscious approach to purpose ensures the document serves as a valuable tool for financial management, while mitigating the risks of misuse and misrepresentation. Clarifying the intended application from the outset is essential for maintaining ethical standards, ensuring legal compliance, and maximizing the effectiveness of these versatile financial instruments.

4. Security Measures

Security measures are crucial when handling documents containing sensitive financial information, especially those resembling official bank statements. Protecting these documents from unauthorized access, alteration, and distribution is paramount to safeguarding financial integrity and preventing potential fraud. Implementing robust security protocols is not merely a recommendation but a necessity for responsible and ethical use.

- Password ProtectionEmploying strong, unique passwords for digital versions of these documents is fundamental. This prevents unauthorized access and safeguards the information contained within. Consider using a password manager to generate and securely store complex passwords, minimizing the risk of compromise.

- EncryptionEncrypting digital files adds another layer of security. Encryption scrambles the data, rendering it unreadable without the decryption key. This protects the information even if the file falls into the wrong hands. Employing readily available encryption software or utilizing cloud storage services with built-in encryption safeguards sensitive data.

- Secure StoragePhysical copies of these documents require secure storage, preferably in locked cabinets or safes. This restricts access and minimizes the risk of theft or unauthorized viewing. Avoid leaving sensitive documents in easily accessible locations, such as desks or vehicles, where they are vulnerable to theft or accidental disclosure.

- Secure DisposalProper disposal of physical or digital copies is essential. Shredding physical documents prevents information retrieval from discarded materials. Securely deleting digital files, including emptying the recycle bin, ensures permanent erasure and minimizes the risk of data recovery.

These security measures, when implemented diligently, significantly reduce the risks associated with handling sensitive financial information contained within fillable documents resembling bank statements. Neglecting these precautions can lead to data breaches, identity theft, and financial fraud. Therefore, prioritizing security is not merely a best practice but a fundamental responsibility for anyone utilizing these documents. Robust security protocols protect personal financial information and maintain the integrity of these documents for their intended purposes.

5. Legal Implications

Legal implications surrounding the use of fillable documents resembling bank statements are significant and necessitate careful consideration. While these documents offer legitimate applications for personal financial management, misuse can lead to severe legal consequences. The critical distinction lies in the intent and context of their application. Utilizing a template for personal budgeting is legally sound; however, presenting a fabricated document as genuine for purposes such as loan applications, fraudulent activities, or misrepresenting financial status constitutes a serious offense. This distinction is paramount. For example, using a template to track spending habits and project future expenses is permissible. Conversely, submitting a modified template inflated with false deposits to secure a loan constitutes fraud and can result in criminal charges.

The legal ramifications extend beyond direct misrepresentation. Even seemingly minor alterations, like modifying transaction dates or amounts, can have legal consequences if used to create a misleading impression of financial stability. Consider a scenario where an individual alters transaction dates to suggest consistent income flow when, in reality, income is sporadic. This manipulation, while not outright fabrication, can be considered misrepresentation and may have legal repercussions, particularly in contractual agreements or legal proceedings. Therefore, legal considerations demand not only factual accuracy but also transparency and honesty in the document’s usage. Maintaining legal compliance ensures responsible and legitimate application of these tools, preventing potential legal challenges and upholding the integrity of financial interactions.

Understanding the legal landscape surrounding these documents is crucial for mitigating risks and ensuring compliance. The ease of modification necessitates a strong awareness of legal boundaries, guiding users toward responsible practices. The ultimate responsibility rests on the individual to employ these tools legally and ethically. Failure to uphold these standards can lead to severe consequences, including legal penalties, damage to reputation, and potential civil liabilities. Therefore, legal compliance is not merely a suggestion but a fundamental requirement for anyone utilizing these adaptable financial documents. A thorough understanding of the applicable laws and regulations is essential for navigating this complex area and ensuring all actions remain within legal parameters.

6. Source Identification

Source identification is a critical aspect of utilizing fillable documents resembling bank statements. Verifying the origin and legitimacy of these templates ensures their accuracy, reliability, and legal compliance. Using templates from untrusted sources can lead to inaccuracies, legal complications, and potential security risks. Therefore, establishing the source’s credibility is paramount before utilizing such documents for any purpose.

- Official Financial Institution WebsitesReputable sources for legitimate templates sometimes include official financial institution websites. These institutions may provide downloadable templates for customer convenience, often within their online banking portals. For example, some banks offer official blank statement templates for customers to use for budgeting or record-keeping purposes. Using templates obtained directly from the financial institution ensures accuracy and compliance with the institution’s formatting requirements.

- Reputable Financial Software ProvidersEstablished financial software providers often offer template creation tools or libraries of pre-designed templates, including those resembling bank statements. These providers typically adhere to strict data security and accuracy standards. For instance, personal finance software may include features for generating customized financial statements compatible with various financial institutions. Leveraging reputable software providers offers assurance regarding the template’s quality, accuracy, and security.

- Legal Professionals Specializing in FinanceLegal professionals specializing in financial matters can provide access to legally compliant and accurate templates. They can also offer guidance on the appropriate use and legal implications of utilizing such documents. Consulting a legal professional is particularly advisable when using templates for legally sensitive purposes, such as court proceedings or official financial reporting. Their expertise ensures compliance with legal requirements and mitigates potential legal risks.

- Government Agencies or Regulatory BodiesIn certain cases, government agencies or regulatory bodies may provide official templates or guidelines for specific financial reporting requirements. For example, tax agencies might offer standardized templates for reporting income or expenses. Utilizing templates provided by these official sources guarantees compliance with regulatory standards and simplifies financial reporting processes.

Thorough source identification is crucial for mitigating risks and ensuring the responsible use of fillable documents resembling bank statements. Relying on trustworthy sources guarantees the template’s accuracy, legitimacy, and compliance with legal and regulatory standards. Failure to verify the source can lead to inaccuracies, security vulnerabilities, and potential legal complications. Therefore, prioritizing source identification is essential for anyone utilizing these documents, safeguarding financial integrity, and maintaining legal compliance.

Key Components of a Fillable Bank Statement Template

Understanding the key components of a fillable bank statement template is crucial for accurate and effective utilization. These components represent the essential data points typically found in official bank statements and are necessary for creating a realistic and functional document.

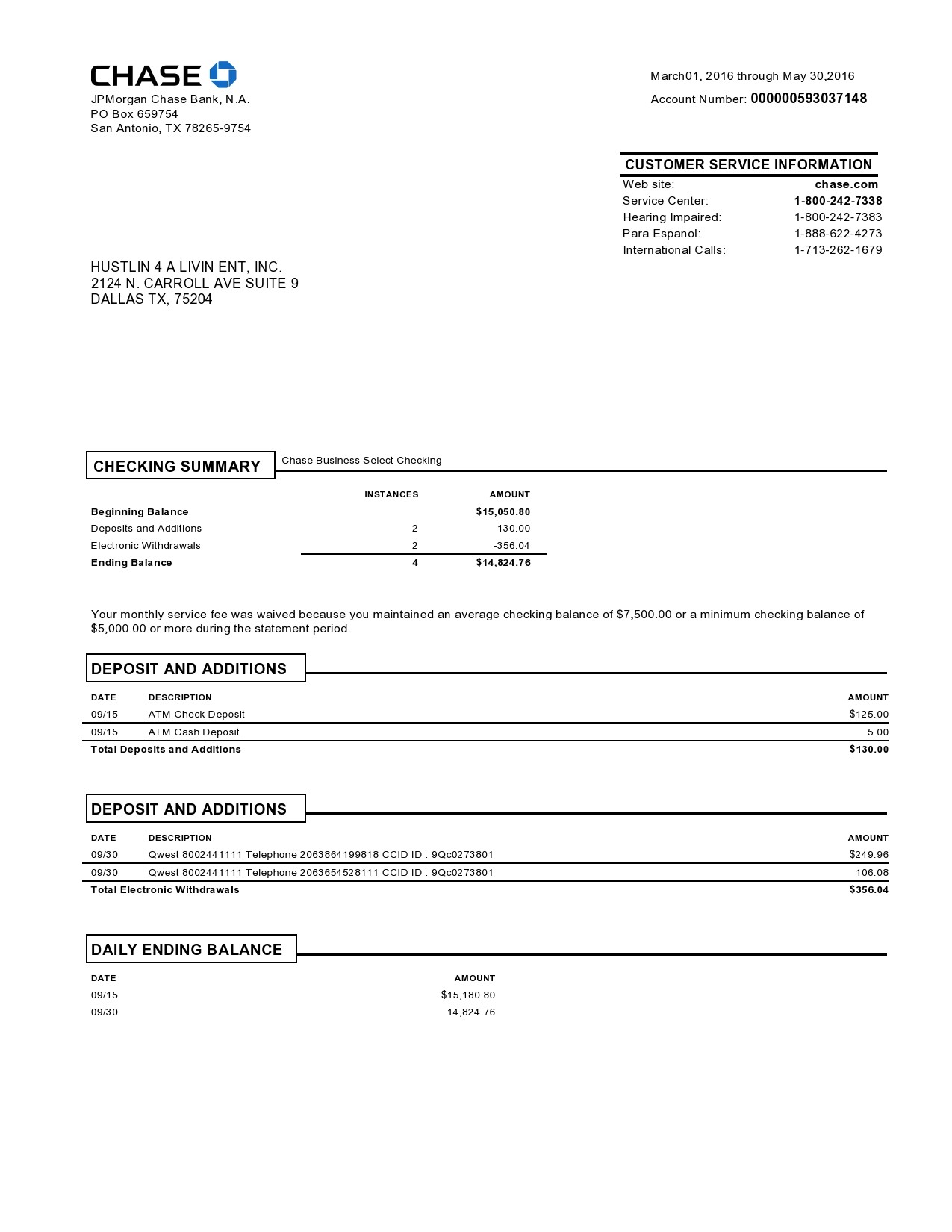

1. Account Information: This section identifies the account holder and their specific account details. Crucially, it includes the account number, account type (checking, savings, etc.), and the financial institution’s name and address. Accurate account information is essential for proper record-keeping and identification.

2. Statement Period: This specifies the date range covered by the statement, typically one month. A clearly defined statement period is crucial for organizing financial records and tracking transactions within a specific timeframe.

3. Beginning and Ending Balance: These figures represent the account balance at the start and end of the statement period, respectively. They provide a snapshot of the account’s overall financial status during the covered period.

4. Transaction History: This section details all transactions processed during the statement period. Each transaction entry includes the date, description, amount, and running balance. A comprehensive transaction history is vital for tracking income, expenses, and account activity.

5. Deposit Information: This details all deposits made to the account during the statement period, including the date, source, and amount of each deposit. Accurate deposit information is essential for reconciling income and tracking fund sources.

6. Withdrawal Information: This section outlines all withdrawals made from the account during the statement period. Similar to deposit information, it includes the date, description, and amount of each withdrawal. Detailed withdrawal information is vital for monitoring spending and managing account balances.

7. Interest Earned (if applicable): For interest-bearing accounts, this section displays the interest accrued during the statement period. This component is essential for tracking investment growth and calculating overall returns.

Accurate representation of these components within a fillable template allows for effective financial management, budgeting, and record-keeping. A comprehensive understanding of these elements ensures the template serves as a reliable tool for various financial purposes.

How to Create a Fillable Bank Statement Template

Creating a fillable bank statement template requires careful attention to detail and an understanding of the key components found in legitimate bank statements. While replicating the exact format and security features of an official bank statement is neither recommended nor feasible, a functional template for personal use can be created using various software tools.

1. Software Selection: Choosing appropriate software is the first step. Spreadsheet software, word processing software, or dedicated form creation applications offer the necessary tools for creating fillable fields and formatting the document. Selecting software with robust formatting capabilities and security features is crucial.

2. Template Layout Design: Designing the layout involves replicating the general structure of a bank statement. This includes sections for account information, statement period, beginning and ending balances, transaction history, deposit and withdrawal details, and any applicable interest earned. Clear organization and logical flow enhance readability and usability.

3. Fillable Field Implementation: Creating fillable fields within the template allows for data entry. These fields should correspond to the various data points within a bank statement, enabling users to input their own financial information. Properly implemented fillable fields ensure efficient data entry and accurate record-keeping.

4. Data Validation (Optional): Implementing data validation features enhances accuracy. Data validation restricts input to specific formats, such as dates or numerical values, minimizing errors and ensuring data integrity. This step, while optional, significantly improves the reliability of entered data.

5. Security Considerations: Protecting the template, especially if it contains sensitive information, requires implementing security measures. Password protection and encryption safeguards the document from unauthorized access and maintains data confidentiality. Prioritizing security is crucial for protecting sensitive financial information.

6. Testing and Refinement: Testing the template’s functionality is crucial before widespread use. Entering sample data and verifying accurate calculations and formatting ensures the template functions as intended. Thorough testing and refinement ensure the templates usability and reliability.

Creating a functional and secure fillable bank statement template requires careful planning, meticulous execution, and an understanding of data security. Following these steps allows for the creation of a valuable tool for personal financial management, while prioritizing security and accuracy. Utilizing readily available software and focusing on accurate data representation ensures the templates effectiveness for various financial purposes.

Careful consideration of data accuracy, ethical implications, specific purposes, security measures, legal ramifications, and source identification is paramount when utilizing a fillable Chase bank statement template. Understanding the key components, such as account information, statement period, balances, transaction details, and interest earned, ensures proper utilization. Creating such a template requires selecting appropriate software, designing a clear layout, implementing fillable fields, considering data validation, and prioritizing security measures. Thorough testing and refinement ensure functionality and accuracy.

Responsible use of these templates requires a thorough understanding of both their potential benefits and inherent risks. Balancing utility with ethical considerations and legal compliance is essential. Data integrity, security, and appropriate application are crucial for leveraging the benefits of these tools while mitigating potential harm. Further exploration of financial management best practices and relevant legal guidelines is encouraged for informed and responsible utilization.