Utilizing such a document can offer several advantages. It allows for creating hypothetical financial scenarios for budgeting or forecasting. It can also be helpful for record-keeping when official statements are unavailable or for educational purposes in learning about financial documents. This customizable format offers flexibility and control over financial information presentation.

This foundation of understanding paves the way for a deeper exploration of generating, using, and maximizing the potential of these adaptable financial resources. Topics such as practical applications, ethical considerations, and available software options will be discussed further.

1. Customizable Document

The concept of a “customizable document” is central to the utility of a fillable Chime bank statement template. Customization empowers users to adapt the template to specific needs, transforming a generic form into a personalized tool for financial management.

- Data InputThe ability to input specific financial data is the core function of a customizable template. Users can enter transaction details, balances, and other relevant information, mirroring the structure of an official statement but populated with personalized figures. This allows for creating realistic mock statements for various purposes.

- Scenario PlanningCustomizable documents facilitate hypothetical financial scenario planning. By adjusting inputs, users can explore the potential impact of different financial decisions, such as increased savings or loan repayments, visualizing outcomes and informing strategic planning. This empowers proactive financial management.

- Format ControlControl over formatting offers further customization options. Users might adjust date formats, currency symbols, or the presentation of transaction details to align with specific software or reporting requirements. This adaptability enhances compatibility and utility.

- Educational ApplicationsCustomizable templates can serve as educational tools. By manipulating data and observing the resulting changes in the statement structure, users can gain a deeper understanding of financial statements and their components. This hands-on approach facilitates financial literacy.

These facets of customizability highlight the versatility of a fillable Chime bank statement template. The ability to tailor the document to individual circumstances transforms it from a static form into a dynamic tool for financial exploration, planning, and education, underscoring its practical value in various contexts.

2. Replicates Chime Format

Accuracy in replicating the official Chime bank statement format is paramount for a fillable template’s effectiveness. This faithful reproduction ensures familiarity and allows for seamless integration with existing financial workflows. Several key facets underscore the importance of format replication:

- Visual ConsistencyVisual consistency encompasses the layout, typography, and overall presentation of the document. A template replicating the Chime format offers users a familiar interface, reducing the cognitive load associated with interpreting financial information. This familiarity facilitates efficient data analysis and minimizes potential confusion. An accurate visual representation also enhances credibility when used for demonstrations or hypothetical scenarios.

- Data Field AlignmentPrecise alignment of data fields, such as transaction dates, descriptions, and amounts, is crucial for data integrity and compatibility with other financial tools. Consistent field placement ensures data can be easily extracted, analyzed, and imported or exported to other software applications, maintaining accuracy and streamlining financial management processes.

- Terminology and LanguageEmploying consistent terminology and phrasing as found in official Chime statements enhances clarity and understanding. Using familiar language minimizes ambiguity and ensures that the information presented in the template is readily comprehensible to anyone accustomed to Chime’s standard communication. This consistency strengthens the template’s educational value and practical applicability.

- Compliance and LegalityWhile a fillable template is not a legal document, mimicking the official format aids in maintaining ethical standards. Clear differentiation from official statements is crucial to prevent misuse. Responsible use involves explicit labeling as a “template” or “sample” to avoid misrepresentation. Adhering to ethical guidelines ensures responsible application and mitigates potential legal risks.

Faithful replication of the Chime format enhances a fillable template’s usability, credibility, and ethical implications. This attention to detail transforms a simple form into a valuable tool for financial management, education, and planning, ensuring compatibility and responsible application within established financial practices.

3. User-inputted Data

The functionality of a fillable Chime bank statement template hinges on user-inputted data. This data transforms a static form into a dynamic tool, enabling personalized financial scenarios and offering practical applications for budgeting, forecasting, and educational purposes. Exploring the facets of user-inputted data reveals its crucial role in maximizing the template’s utility.

- Data Accuracy and IntegrityAccurate data entry is fundamental. Errors can lead to misleading financial projections and compromise the template’s value. Validating entered data against existing financial records is crucial for maintaining data integrity. For example, verifying transaction amounts and dates against receipts ensures reliable and meaningful results. Data accuracy directly impacts the reliability of any analysis derived from the template.

- Data Types and CategoriesUnderstanding the various data types within a bank statement is essential for proper utilization. These typically include transaction dates, descriptions, debit and credit amounts, and running balances. Categorizing transactions, such as “groceries,” “rent,” or “utilities,” enhances analytical capabilities, allowing for detailed expense tracking and budget analysis within the template. Proper categorization allows for a granular understanding of spending patterns.

- Data Manipulation and AnalysisA key advantage of user-inputted data lies in its manipulability. Users can adjust figures to explore hypothetical scenarios. For example, increasing savings contributions or simulating loan repayments allows for visualizing potential financial outcomes. This dynamic manipulation empowers informed decision-making by providing a platform for experimenting with different financial strategies within a controlled environment.

- Data Privacy and SecurityWhile templates offer flexibility, data privacy remains paramount. Users must exercise caution regarding where and how these documents are stored and shared. Avoiding sensitive information, such as account numbers or social security details, minimizes potential risks. Using fictionalized data for demonstration or educational purposes is a prudent approach to safeguarding sensitive financial information.

These facets of user-inputted data underscore its central role in a fillable Chime bank statement template. Data accuracy ensures reliable analysis, while data manipulation enables hypothetical scenario planning. Understanding data types and prioritizing data privacy are crucial for responsible and effective template utilization. By addressing these considerations, users can leverage the template’s full potential as a robust tool for financial management and education.

4. Financial Planning Tool

A fillable Chime bank statement template functions as a practical financial planning tool, offering a structured framework for organizing financial information and exploring potential scenarios. Its adaptability allows users to simulate various financial situations, facilitating informed decision-making and promoting proactive financial management. The following facets illustrate this connection:

- Budgeting and Expense TrackingTemplates facilitate detailed budgeting by enabling users to input projected income and expenses. This allows for visualizing cash flow and identifying potential shortfalls. By comparing projected data against actual figures from official statements, individuals can refine budgeting strategies and gain insights into spending patterns. For example, allocating expenses to specific categories within the template, like “housing,” “transportation,” or “entertainment,” provides a granular view of spending habits, enabling targeted adjustments for improved financial control.

- Goal Setting and Savings ProjectionsFinancial goals, such as saving for a down payment or retirement, can be modeled within the template. Users can input anticipated savings contributions and project growth over time, considering factors like interest rates. This visualization aids in setting realistic goals and tracking progress. For instance, by adjusting contribution amounts and interest rates within the template, individuals can explore different saving scenarios and determine the optimal strategy to reach their financial objectives. This dynamic approach empowers proactive goal setting and motivates consistent saving habits.

- Debt Management and Loan RepaymentTemplates can assist in managing debt by allowing users to simulate loan repayment scenarios. Inputting loan details and varying repayment amounts allows for visualizing the impact on overall finances and determining the most efficient repayment strategy. For example, exploring different repayment schedules within the template can reveal the long-term cost savings associated with accelerated payments, encouraging strategic debt management. This feature empowers informed decision-making and promotes responsible borrowing practices.

- Scenario Planning and Financial ForecastingThe ability to manipulate data within a template enables exploring various financial “what-if” scenarios. This could include anticipating the impact of a salary increase, a job loss, or unexpected expenses. By adjusting income and expense figures, individuals can assess their financial resilience and develop contingency plans. This proactive approach to financial forecasting enhances preparedness for unforeseen circumstances and promotes long-term financial stability.

These facets demonstrate the utility of a fillable Chime bank statement template as a versatile financial planning tool. By providing a structured environment for data input, manipulation, and analysis, the template empowers informed decision-making, promotes proactive financial management, and facilitates a deeper understanding of personal finances. Its adaptability across various financial planning contexts underscores its value as a practical resource for individuals seeking to enhance their financial well-being.

5. Hypothetical Scenarios

Financial planning often necessitates exploring potential outcomes based on various assumptions. A fillable Chime bank statement template provides a structured framework for constructing and analyzing these hypothetical scenarios, allowing individuals to test different financial strategies and assess their potential impact. This exploration enhances financial preparedness and promotes informed decision-making.

- Projected Income ChangesAnticipating future income changes, such as a salary increase or a career transition, can be modeled within the template. By adjusting income figures, individuals can project the effects on their overall financial standing and plan accordingly. For example, exploring the impact of a potential raise can inform decisions regarding savings, investments, or debt repayment. This proactive approach enables individuals to prepare for future financial realities and maximize opportunities.

- Expense Fluctuations and Unexpected CostsLife often presents unforeseen expenses, from medical bills to home repairs. A fillable template allows individuals to simulate the financial impact of these unexpected costs. By incorporating potential expense fluctuations, individuals can assess their financial vulnerability and develop contingency plans. This preparedness mitigates the potential disruption of unexpected events and reinforces financial stability.

- Investment Growth and Portfolio PerformanceWhile not a direct reflection of investment accounts, a fillable bank statement template can indirectly model the impact of investment growth on overall finances. By adjusting income figures to reflect potential investment returns, individuals can visualize the long-term benefits of investing and refine their investment strategies. This holistic view reinforces the importance of long-term financial planning and encourages informed investment decisions.

- Debt Repayment Strategies and Loan ManagementExploring different debt repayment strategies is a key application of hypothetical scenarios. By adjusting payment amounts and frequencies within the template, individuals can compare the long-term costs and benefits of various approaches. This analysis empowers informed decisions regarding debt management and facilitates the development of efficient repayment plans. This structured approach to debt management promotes financial responsibility and minimizes long-term interest costs.

The ability to construct and analyze hypothetical scenarios within a fillable Chime bank statement template empowers informed financial decision-making. By exploring potential outcomes based on various assumptions, individuals can refine their financial strategies, assess their preparedness for unforeseen events, and gain a deeper understanding of their overall financial well-being. This proactive approach to financial planning fosters greater control over personal finances and promotes long-term financial stability.

6. Record-keeping Aid

A fillable Chime bank statement template serves as a valuable record-keeping aid, particularly in situations where access to official statements is limited or delayed. This function bridges gaps in documentation, facilitating financial analysis and informed decision-making. Consider scenarios such as tax preparation, applying for loans, or tracking expenses for specific projects. In these instances, a readily available, organized record of financial activity is crucial. A completed template, based on verifiable transaction data, provides a temporary substitute for an official statement, enabling continued financial management despite potential access limitations. This capability proves essential for maintaining financial continuity and informed decision-making during periods of transition or when dealing with archival data.

The organized structure of a fillable template simplifies the process of categorizing and analyzing financial data. For instance, individuals can categorize expenses within the template, facilitating detailed budget analysis and spending pattern identification. This organized approach to record-keeping enhances financial awareness and allows for proactive adjustments to spending habits. Furthermore, a fillable template can act as a supplementary record, providing a more detailed breakdown of transactions compared to summarized official statements. This granularity can be particularly beneficial for small business owners or freelancers tracking project-specific expenses. The template, therefore, transforms from a simple form into a dynamic tool for detailed financial analysis and informed financial management.

Effective financial management relies on accurate and accessible records. A fillable Chime bank statement template enhances record-keeping practices by offering a structured, adaptable format for organizing financial data. This function addresses potential gaps in official documentation, facilitating continuous financial analysis and informed decision-making even when access to official records is limited. Understanding this connection strengthens the template’s practical value as a tool for maintaining organized financial records and underscores its significance in broader financial management strategies. The ability to bridge these informational gaps ensures continuity in financial analysis and reinforces responsible financial practices.

Key Components of a Fillable Chime Bank Statement Template

Effective utilization of a fillable Chime bank statement template necessitates understanding its core components. These elements contribute to the template’s functionality and inform its application in various financial contexts.

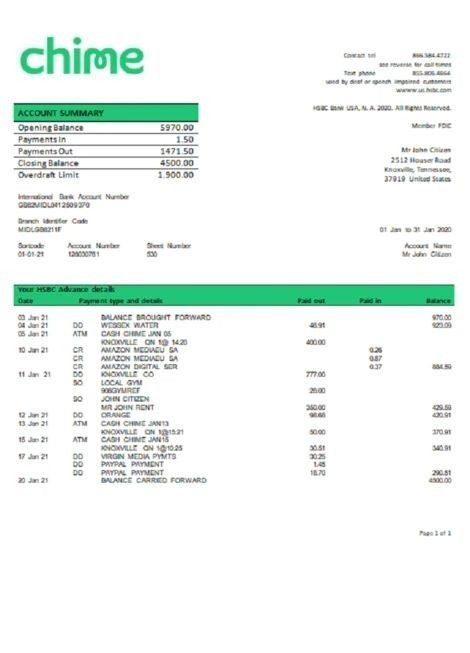

1. Date Range: Specifies the period covered by the statement, crucial for accurate financial tracking and analysis. Precise date ranges ensure alignment with specific reporting requirements and facilitate comparisons with official statements.

2. Account Information: Includes account holder name, account number, and potentially other identifying details. Accurate account information is essential for proper record-keeping and integration with other financial tools. Clear identification links the template to a specific financial entity, enhancing clarity and organization.

3. Beginning Balance: Indicates the account balance at the start of the specified date range. This serves as the foundation for calculating subsequent transactions and arriving at the ending balance. The beginning balance provides context for all subsequent financial activity within the specified period.

4. Transactions: Lists individual transactions, including dates, descriptions, debit and credit amounts, and potentially transaction categories. Detailed transaction records form the core of the statement, enabling comprehensive tracking of financial activity. Accurate transaction details provide a granular view of spending and income patterns.

5. Running Balance: Displays the account balance after each transaction, reflecting the cumulative effect of debits and credits. The running balance provides a continuous snapshot of the account’s financial status throughout the statement period, facilitating ongoing monitoring and analysis.

6. Ending Balance: Represents the account balance at the end of the specified date range. This figure summarizes the net effect of all transactions during the statement period and serves as the beginning balance for the subsequent period. The ending balance provides a concise overview of the account’s financial position at the close of the reporting period.

7. Customizable Fields: Allows users to input and modify data within the template. This adaptability facilitates creating personalized financial scenarios for planning, forecasting, and educational purposes. Customizable fields transform a static document into a dynamic tool for financial exploration and analysis.

These components work in concert to provide a comprehensive overview of financial activity within a specified period. Accurate data entry and careful analysis of these elements enable informed financial management and facilitate effective utilization of the template in diverse financial contexts. The structured format allows for detailed tracking of transactions, enabling users to develop a clearer understanding of their financial position and make more informed decisions regarding budgeting, saving, and spending.

How to Create a Fillable Chime Bank Statement Template

Creating a fillable Chime bank statement template requires careful attention to replicating the format and functionality of an official statement. This process involves several key steps, from selecting appropriate software to populating data fields and ensuring data accuracy.

1. Choose a Software Application: Spreadsheet software (e.g., Google Sheets, Microsoft Excel) or word processing software with table functionality (e.g., Microsoft Word, Google Docs) can be utilized. Selecting an application offering robust table and formatting features facilitates accurate replication of the Chime statement layout.

2. Replicate the Chime Statement Format: Obtain a legitimate Chime bank statement as a reference. Precisely replicate the layout, including headers, footers, fonts, and spacing. Accuracy in mimicking the visual presentation ensures familiarity and enhances the template’s credibility. This visual consistency aids in seamless integration with existing financial workflows.

3. Establish Key Data Fields: Create table cells or form fields corresponding to essential data points, including date, transaction description, debit/credit amounts, and running balance. Clear labeling and consistent data field placement are crucial for data integrity and compatibility with other financial tools. Accurate data field alignment ensures accurate data extraction and analysis.

4. Incorporate Formulas for Calculations: In spreadsheet software, utilize formulas to automate calculations, such as the running balance. Automating calculations minimizes manual data entry, reducing the risk of errors and enhancing efficiency. Accurate formulas ensure the integrity of financial projections and analysis.

5. Implement Data Validation (Optional): Consider incorporating data validation features to restrict input to specific data types (e.g., dates, numbers). Data validation enhances data accuracy and prevents input errors, ensuring data integrity. This feature contributes to the reliability of financial analysis derived from the template.

6. Test and Refine: Populate the template with sample data to test its functionality and identify potential formatting or calculation errors. Thorough testing ensures accuracy and usability. Addressing any discrepancies during the testing phase optimizes the template’s effectiveness.

7. Clearly Label as “Template”: Prominently label the document as a “template” or “sample” to prevent misuse and clearly differentiate it from an official statement. Ethical considerations are paramount. Clear labeling mitigates potential legal risks and maintains ethical standards.

Careful attention to these steps ensures the creation of a functional and ethically sound fillable Chime bank statement template. Accurate format replication, precise data field placement, and thorough testing contribute to a reliable and effective tool for various financial management purposes. The template’s utility lies in its ability to facilitate financial planning, budgeting, and analysis within a controlled and adaptable environment.

Fillable Chime bank statement templates offer a versatile tool for financial management, enabling users to create personalized, adaptable representations of financial data. Understanding the template’s structure, components, and potential applications is crucial for maximizing its utility. From budgeting and expense tracking to exploring hypothetical scenarios and supplementing official records, fillable templates empower informed financial decision-making and promote proactive financial planning. Careful attention to data accuracy, ethical considerations, and responsible usage ensures the template’s effective application within a robust financial management strategy.

Leveraging the power of adaptable financial tools like fillable templates offers significant potential for enhancing financial literacy and promoting responsible financial practices. As financial technologies continue to evolve, exploring and understanding these tools becomes increasingly crucial for navigating the complexities of personal finance. The ability to model, analyze, and project financial data empowers individuals to take control of their financial well-being and make informed decisions that pave the way for long-term financial stability and success. Continued exploration and responsible utilization of these resources are essential for informed financial management in an increasingly complex financial landscape.