Utilizing such a document offers significant advantages. It provides control over financial information, enabling users to tailor data for specific needs while maintaining a realistic format. This adaptability can save time and resources compared to manually creating or altering existing bank statements. Furthermore, it empowers users to work with financial data in a secure and private environment.

This foundation of understanding is crucial for exploring the various applications and ethical considerations surrounding such adaptable financial documents. Topics such as proper usage, potential misuse, and the legal landscape surrounding these tools will be examined in detail.

1. Customization

Customization is a core feature of a fillable editable bank statement template, offering significant flexibility and control over financial data representation. This adaptability makes these templates valuable tools for various applications, from personal finance management to business simulations.

- Transaction DetailsUsers can modify transaction descriptions, dates, and amounts. This allows for creating realistic scenarios for budgeting, financial forecasting, or testing accounting software. For instance, one might simulate a series of recurring expenses or a large deposit to analyze its impact on overall finances. This granular control over transaction data is crucial for accurate and meaningful simulations.

- Account InformationModifying account details like account holder name, account number, and bank branch information allows tailoring the template to specific needs. This is essential for creating realistic mock statements for presentations or demonstrations. For example, a business might create a customized statement for training purposes, reflecting their specific banking relationship without revealing sensitive real data.

- Balance AdjustmentsThe ability to adjust the starting and ending balance allows users to create specific financial scenarios. This is useful for demonstrating financial stability for loan applications (within ethical and legal boundaries) or visualizing the impact of financial decisions over time. Manipulating balances provides a dynamic view of financial progress or decline based on hypothetical scenarios.

- Time Period CustomizationDefining the statement period, whether it’s a single month, a quarter, or a year, adds another layer of flexibility. This feature is invaluable for analyzing financial trends over different timeframes or creating historical data for testing purposes. Customizing the time period provides a tailored view of financial activity relevant to specific reporting or analytical needs.

These customizable elements collectively empower users to create highly specific and realistic bank statement representations for diverse applications. However, the ethical implications of this flexibility must always be considered. While customization offers valuable tools for legitimate financial management and testing, it also carries the potential for misuse, highlighting the importance of responsible and informed usage.

2. Data Control

Data control is a paramount aspect of utilizing fillable editable bank statement templates. This control allows users to determine precisely what information is included, modified, or excluded, affording a high degree of privacy and security. Unlike working with actual bank statements, which contain sensitive personal information, these templates provide a safe sandbox for financial experimentation and demonstration. This distinction is critical for both individuals and businesses seeking to protect their financial data. For instance, a business developing financial software can use realistic mock statements for testing without jeopardizing actual customer data.

The ability to manipulate data within a controlled environment opens opportunities for various practical applications. Entrepreneurs can create hypothetical financial scenarios to project business growth and secure funding. Individuals can experiment with different budgeting strategies by adjusting income and expenses within a template, gaining a clearer picture of their financial health without risking real-world consequences. Moreover, data control enables compliance with privacy regulations, as sensitive information is never exposed during these simulations or demonstrations.

In conclusion, data control within fillable editable bank statement templates is essential for responsible and effective use. It empowers users to explore financial scenarios, test software, and demonstrate financial standing without compromising the security of real financial data. This capacity is crucial for both innovation and protection in the financial landscape, fostering a secure environment for experimentation and learning.

3. Format Accuracy

Format accuracy is paramount when utilizing a fillable editable bank statement template. A credible template must precisely mirror the structure and layout of an authentic bank statement. This accuracy is crucial not only for practical applications like software testing but also for maintaining ethical standards and avoiding misrepresentation. Deviations from established formatting can raise red flags and undermine the intended purpose of using such a template.

- Logo and BrandingAccurate reproduction of bank logos, fonts, and color schemes is essential for visual authenticity. A poorly replicated logo or incorrect font can immediately signal a fabricated document. For instance, a slight variation in the bank’s logo color could compromise the template’s credibility, especially in situations where scrutiny is high, such as loan applications.

- Transaction LayoutThe arrangement of transaction details, including date, description, debit/credit columns, and running balance, must conform to standard banking practices. Inconsistencies in the presentation of these details can lead to confusion or suspicion. For example, if the debit and credit columns are reversed or the running balance is calculated incorrectly, the template loses its value as a realistic representation of a bank statement.

- Terminology and LanguageUsing accurate banking terminology and consistent language is crucial for maintaining realism. Incorrect or ambiguous terms can undermine the document’s authenticity. For example, using the term “payment received” instead of the bank’s standard terminology like “credit” could raise questions about the document’s legitimacy.

- Date and Number FormatsConsistency in date formats (e.g., DD/MM/YYYY or MM/DD/YYYY) and number formats (e.g., use of commas and decimal points) is essential. Discrepancies in these formats can signal manipulation or carelessness, diminishing the template’s credibility. Using a different date format than the one typically used by the bank in question could raise suspicion.

Maintaining format accuracy is therefore not merely an aesthetic concern but a critical factor influencing the effectiveness and ethical implications of using a fillable editable bank statement template. A template lacking in accuracy undermines its utility and raises concerns about its intended purpose. Careful attention to these details ensures the template serves as a reliable tool for various applications while upholding ethical considerations.

4. Time Efficiency

Time efficiency is a significant advantage offered by fillable editable bank statement templates. Manually creating or altering bank statements is a laborious process, often involving tedious data entry and formatting adjustments. Templates streamline this process significantly, allowing users to generate or modify statements quickly and easily. This time-saving aspect is particularly beneficial in situations requiring multiple iterations or variations of bank statements. For example, a business preparing financial projections might need to create several versions of projected statements under different scenarios. Using a template drastically reduces the time required for this task.

The automated nature of these templates further enhances time efficiency. Calculations are performed automatically, minimizing the risk of human error and eliminating the need for manual recalculations. This automated approach is particularly valuable when dealing with complex transactions or extended periods. Consider a scenario where an individual needs to demonstrate consistent financial activity over several months for a visa application. A template can quickly generate statements for the required period, automatically calculating balances and ensuring accuracy, a task that would be significantly more time-consuming if done manually.

In summary, fillable editable bank statement templates offer significant time savings compared to manual methods. This efficiency allows for greater productivity, reduces the potential for errors, and facilitates complex financial analysis and reporting. The ability to quickly generate and modify statements empowers individuals and businesses to focus on strategic financial decisions rather than administrative tasks. This enhanced efficiency is a key factor contributing to the practical value and widespread adoption of these tools.

5. Ethical Implications

While fillable editable bank statement templates offer numerous legitimate applications, their potential for misuse necessitates careful consideration of the ethical implications. The flexibility and control provided by these templates can be exploited for fraudulent purposes, underscoring the importance of responsible usage and awareness of potential ethical pitfalls. Understanding these implications is crucial for navigating the legal and moral landscape surrounding these tools.

- Fraudulent MisrepresentationThe most significant ethical concern arises from the potential to create falsified bank statements for deceptive purposes. This could include inflating account balances to secure loans, misrepresenting financial stability to potential investors, or concealing financial difficulties from creditors. Such actions are illegal and carry severe consequences. For instance, submitting a fabricated bank statement to obtain a mortgage constitutes fraud and can result in criminal charges.

- Privacy ViolationsWhile templates themselves don’t inherently violate privacy, they can be misused to create documents that appear authentic, potentially jeopardizing the privacy of others. Using someone else’s name and banking details without their consent to create a fictitious statement is a clear violation of privacy and can lead to legal repercussions. For example, creating a false statement using a colleague’s information to secure a personal loan is both unethical and illegal.

- Misleading InformationEven when not used for outright fraud, templates can be employed to create misleading financial representations. Exaggerating income or minimizing expenses to present a more favorable financial picture, even in personal contexts, can be ethically problematic. For example, creating an overly optimistic financial projection to impress a potential business partner, while not necessarily illegal, can damage trust and create future complications.

- Enabling Unethical BehaviorThe availability of easily accessible templates can inadvertently facilitate unethical behavior by others. Even if a template creator has no malicious intent, the tool itself can be misused by individuals seeking to deceive or defraud. This raises questions about the responsibility of template creators to mitigate potential misuse, perhaps through clear disclaimers or built-in safeguards.

The ethical considerations surrounding fillable editable bank statement templates are complex and multifaceted. While these tools offer valuable functionality for legitimate purposes, their potential for misuse cannot be ignored. A clear understanding of these ethical implications is crucial for responsible development, distribution, and utilization of these templates. Promoting ethical awareness and implementing safeguards against misuse are essential steps in ensuring these tools contribute positively to the financial landscape without enabling harmful practices.

Key Components of a Fillable Editable Bank Statement Template

Essential elements comprise a comprehensive and functional bank statement template. These components ensure the template serves its intended purpose, whether for personal finance management, business projections, or software testing. A thorough understanding of these key components is crucial for effective utilization.

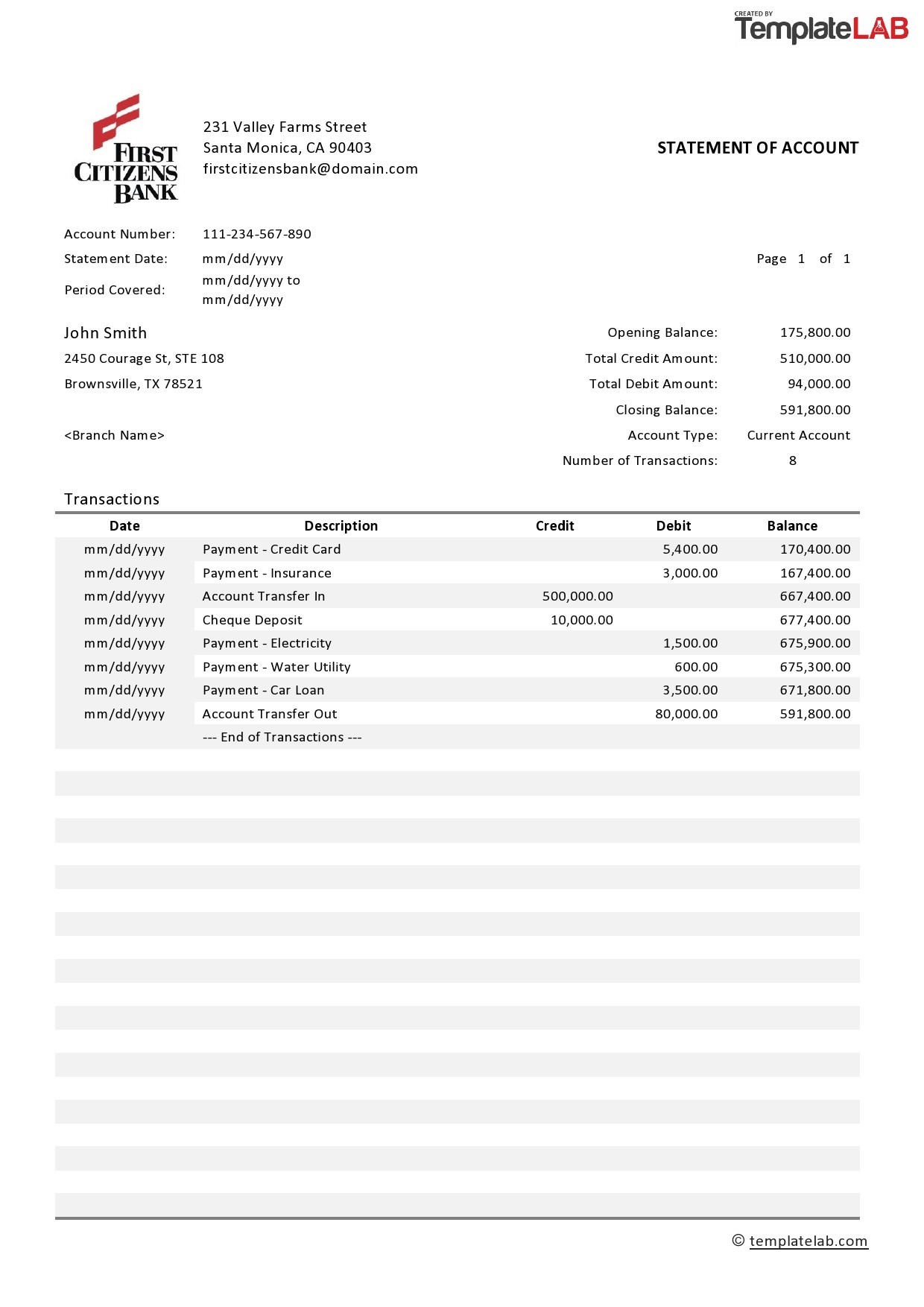

1. Account Information: This section typically includes the account holder’s name, account number, bank name and logo, branch address, and the statement period. Accurate representation of this information is vital for realism and credibility.

2. Transaction Details: This section forms the core of the statement, detailing individual transactions. Key elements include transaction dates, descriptions, debit and credit amounts, and the running balance. Precise recording and formatting of these details are essential for accurate financial representation.

3. Balance Summary: This section provides a snapshot of the account’s financial status. It typically includes the opening balance, total debits and credits for the statement period, and the closing balance. Accuracy in these calculations is crucial for reliable financial analysis.

4. Customization Options: A key feature of these templates is the ability to customize various aspects of the statement. This includes modifying transaction details, adjusting balances, and altering the statement period. This flexibility allows for creating tailored financial scenarios.

5. Formatting and Layout: Accurate replication of a genuine bank statement’s visual appearance is essential. This includes using the correct fonts, logo placement, and spacing between elements. Maintaining format consistency enhances credibility and professionalism.

6. Data Input Mechanisms: User-friendly input methods are crucial for efficient template utilization. These can include fillable fields, dropdown menus, and automated calculations. Intuitive data entry streamlines the process and minimizes errors.

Careful consideration of these components ensures the creation of a robust and functional bank statement template. These elements work in concert to provide a realistic and adaptable tool for various financial applications. Accuracy, flexibility, and user-friendliness are paramount for maximizing the template’s utility and effectiveness.

How to Create a Fillable Editable Bank Statement Template

Creating a functional and realistic bank statement template requires careful planning and attention to detail. The following steps outline the process, emphasizing accuracy and ethical considerations.

1. Choose a Software Application: Select appropriate software for template creation. Spreadsheet programs like Microsoft Excel or Google Sheets offer robust functionality for calculations and formatting, while word processing software may suffice for simpler templates. Consider the level of customization and complexity required.

2. Obtain a Legitimate Bank Statement Sample: Acquire a genuine bank statement (with personal information redacted) as a reference for accurate replication. This ensures proper formatting, terminology, and layout. Focus on the structure and arrangement of information rather than the specific data.

3. Replicate the Layout and Formatting: Recreate the bank statement’s structure within the chosen software. Pay close attention to fonts, spacing, logo placement, and the arrangement of key elements like account information and transaction details. Precision in replication is essential for visual authenticity.

4. Implement Data Input Fields: Introduce fillable fields or cells for data entry. Clearly label each field (e.g., “Transaction Date,” “Description,” “Debit/Credit”) to facilitate user input. Consider using dropdown menus for standardized entries like transaction types.

5. Incorporate Formulas and Calculations: Implement formulas for automatic calculations, such as the running balance. This ensures accuracy and reduces manual effort. Verify the correctness of formulas to prevent errors in financial representation.

6. Add Customization Options: Include features for customizing the statement period, account details, and other relevant information. This enhances the template’s versatility and adaptability to various scenarios.

7. Thoroughly Test the Template: Rigorously test the template’s functionality by entering sample data and verifying calculations. Ensure all features work as intended and that the generated statement accurately reflects the inputted information. Testing is crucial for identifying and correcting any errors before distribution or usage.

8. Consider Ethical Implications: Include a clear disclaimer emphasizing the ethical responsibilities associated with using the template. Discourage misuse for fraudulent activities and emphasize the importance of responsible usage for legitimate purposes.

Developing a fillable editable bank statement template involves meticulous replication of a legitimate statement’s structure and incorporating interactive elements for data input and calculation. Thorough testing and a focus on ethical considerations are essential for responsible and effective utilization.

Fillable editable bank statement templates offer significant utility across various applications, from personal finance management to business operations and software development. Their adaptability and capacity for customization empower users to manipulate financial data within a controlled environment, facilitating tasks such as budgeting, forecasting, and testing. However, the potential for misuse underscores the crucial importance of ethical considerations. Accuracy in replicating legitimate bank statement formats is paramount for maintaining credibility and avoiding misrepresentation. Understanding the key components, creation process, and ethical implications ensures responsible and effective utilization of these powerful tools.

The increasing prevalence of digital financial tools necessitates a thorough understanding of their capabilities and potential risks. Responsible development and utilization of fillable editable bank statement templates, coupled with heightened awareness of ethical boundaries, are essential for fostering a secure and productive financial environment. As technology continues to evolve, so too will the tools at our disposal; vigilance and informed decision-making remain crucial for navigating this evolving landscape and mitigating potential harm while maximizing the benefits of these technological advancements.