Utilizing such a document offers several advantages, including streamlined financial management, simplified record-keeping processes, and the ability to create sample documents for testing or training. This can save time and effort compared to manual data entry or the use of static documents.

Understanding the functions and benefits of such digital resources provides a foundation for exploring broader topics related to personal finance, such as budgeting techniques, expense tracking, and financial planning. Further exploration of these areas can lead to improved financial literacy and more effective management of personal finances.

1. Data Accuracy

Data accuracy is paramount when utilizing a customizable bank statement replica. The integrity of any financial analysis or decision-making process relying on this document hinges on the precision of the entered data. Inaccurate figures can lead to flawed conclusions, misinformed budgeting, and potentially serious financial missteps. For example, an overstated income figure on a replica used for loan application purposes could lead to approval for a loan amount one cannot realistically afford. Conversely, understating income could result in an unnecessary denial of credit.

Maintaining data accuracy requires meticulous attention to detail and rigorous verification. One should cross-reference the entered figures with legitimate financial records. Understanding the implications of each data point within the context of the statement is crucial. For instance, accurately reflecting transaction dates, descriptions, and amounts ensures the replica provides a reliable representation of actual financial activity. This precision is vital whether the document is used for personal budgeting, software testing, or illustrative purposes.

The potential consequences of data inaccuracy underscore the importance of careful data entry and validation. Challenges can arise from manual data entry errors, incorrect data sources, or misunderstanding the structure of the statement itself. Addressing these challenges through diligent review processes and a thorough understanding of the financial information being represented strengthens the reliability and practical utility of the customizable document. This careful approach ultimately supports sound financial practices and informed decision-making.

2. Format Compliance

Format compliance is crucial when utilizing a customizable bank statement replica. A document’s credibility and effectiveness depend heavily on its adherence to the specific financial institution’s official layout. Deviations in formatting can raise concerns about authenticity and reliability, undermining the document’s intended purpose.

- Logo and Branding:Accurate reproduction of the financial institution’s logo, typeface, and color scheme is essential for visual authenticity. Discrepancies in these elements can immediately signal a lack of legitimacy. For instance, a distorted logo or incorrect font can raise red flags, potentially rendering the document unusable for its intended application.

- Data Field Placement:Precise alignment of data fields, such as account numbers, transaction dates, and balances, is crucial for readability and data extraction. Incorrect placement can lead to misinterpretation of information and hinder the document’s usability. Consider a scenario where the transaction date field is misaligned; this could lead to confusion regarding the timing of specific transactions.

- Terminology and Language:Consistent use of official terminology and phrasing ensures the document mirrors the genuine article. Deviations in language can raise suspicions and undermine the document’s perceived authenticity. Using informal language in a formal financial document, for example, would compromise its credibility.

- Date and Number Formats:Adhering to specific date and number formats used by the financial institution is crucial for data consistency and accuracy. Inconsistencies in these formats can lead to errors in data interpretation and processing. For instance, using a different date format could lead to confusion when comparing the document to official records.

Maintaining format compliance ensures the customizable bank statement replica serves its intended purpose effectively. Whether used for personal budgeting, software testing, or demonstrations, a properly formatted document enhances credibility and facilitates seamless integration with existing financial tools and processes. Failure to adhere to these formatting guidelines can compromise the document’s value and potentially lead to unintended consequences.

3. Privacy Protection

Privacy protection is paramount when handling sensitive financial information within a customizable bank statement replica. The document’s editable nature necessitates robust security measures to prevent unauthorized access, misuse, and potential financial harm. Neglecting these precautions can expose individuals to identity theft, financial fraud, and other serious consequences. This section explores crucial facets of privacy protection within this context.

- Data Encryption:Employing strong encryption methods safeguards sensitive data within the document. Encryption transforms readable information into an unreadable format, accessible only with the correct decryption key. This measure protects against unauthorized access, even if the document is intercepted or stored insecurely. For instance, utilizing AES-256 encryption provides a robust level of protection against unauthorized decryption attempts.

- Secure Storage:Storing the customizable document on secure platforms, such as password-protected devices or encrypted cloud storage services, minimizes vulnerability to data breaches. Restricting access to authorized personnel further strengthens security. Storing a replica on a publicly accessible server without password protection, for example, would represent a significant security risk.

- Access Control:Implementing strict access control measures, such as password protection and user authentication, limits document access to authorized individuals only. This prevents unauthorized viewing, modification, or distribution of sensitive financial information. Sharing a password-protected document without proper authorization, for example, compromises its security.

- Data Minimization:Including only necessary information within the customizable document reduces the potential impact of a data breach. Omitting unnecessary sensitive data, such as full account numbers or social security numbers, limits the potential damage if the document is compromised. Including the full social security number when only the last four digits are required, for example, unnecessarily increases the risk.

These privacy protection measures are crucial for responsible and secure handling of customizable bank statement replicas. Implementing these safeguards ensures the document’s utility without compromising sensitive financial information. Failure to prioritize privacy can have severe consequences, highlighting the importance of incorporating these practices into any workflow involving such documents.

4. Software Compatibility

Software compatibility plays a vital role in the effective utilization of a fillable, editable bank statement replica. The ability to seamlessly interact with various software applications dictates the document’s practicality for diverse financial tasks. Compatibility issues can hinder tasks such as data entry, analysis, and integration with financial management tools. For instance, a replica saved in a proprietary format might not open correctly in commonly used spreadsheet software, limiting its utility for financial analysis.

Several factors influence software compatibility. The file format of the replica is paramount. Commonly used formats like PDF, CSV, and XLSX generally offer broader compatibility than less common formats. Furthermore, the software version used to create and edit the replica can impact compatibility. An older version of spreadsheet software might not correctly interpret a file created in a newer version, potentially corrupting data or altering formatting. The operating system on which the software runs can also influence compatibility. A replica created on a Windows system might exhibit formatting inconsistencies when opened on a macOS system.

Understanding software compatibility is crucial for ensuring the fillable, editable bank statement replica serves its intended purpose. Choosing widely compatible file formats and ensuring software versions align across different systems minimizes potential issues. Testing the replica’s compatibility with intended software applications before extensive use is a prudent practice. Addressing potential compatibility challenges proactively ensures seamless integration with financial workflows and maximizes the document’s utility. Failure to consider software compatibility can lead to workflow disruptions, data loss, and ultimately, compromised financial management.

5. Appropriate Usage

Appropriate usage of a fillable, editable bank statement replica is paramount for ethical and legal compliance. While such documents offer valuable utility for various legitimate purposes, misuse can lead to severe consequences, including legal penalties and reputational damage. Understanding the boundaries of appropriate usage is crucial for leveraging these tools responsibly.

Legitimate applications include personal budgeting, financial planning, software testing, and educational demonstrations. Creating a replica to visualize financial scenarios for budgeting purposes or using a replica to test the functionality of financial software are examples of appropriate usage. Conversely, misrepresenting a replica as a genuine document for loan applications, fraudulent financial reporting, or any deceptive practice constitutes inappropriate and potentially illegal usage. Submitting a fabricated replica as proof of income for a mortgage application, for instance, carries significant legal and ethical ramifications.

The distinction between appropriate and inappropriate usage hinges on intent and representation. Using a replica as a stand-in for a genuine document in official contexts where authenticity is required crosses the line from ethical utilization to fraudulent misrepresentation. This distinction underscores the importance of transparency and disclosure when utilizing such documents. Clearly labeling a replica as “sample” or “for demonstration purposes only” mitigates the risk of misinterpretation and reinforces ethical usage. Furthermore, understanding the legal implications associated with document falsification is crucial for avoiding unintended legal repercussions. Ultimately, responsible and ethical conduct dictates the acceptable boundaries of usage for these tools. Failure to adhere to these principles can undermine the utility of these resources and erode trust in financial documentation practices.

Key Components of a Customizable Bank Statement Replica

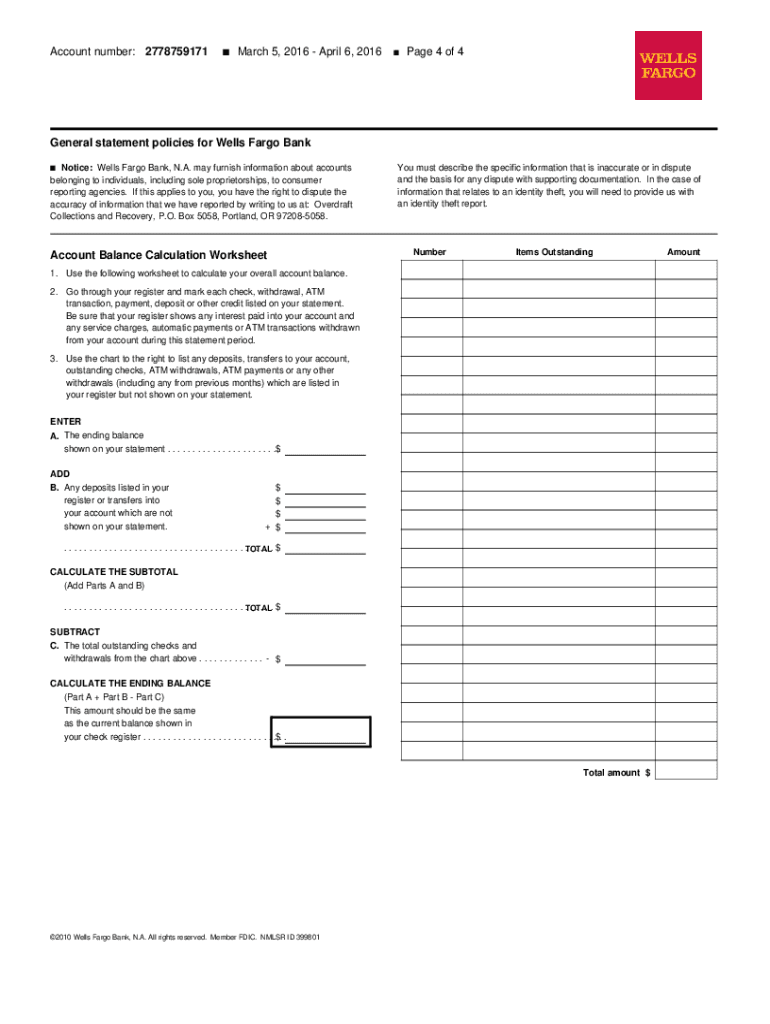

Accurate representation of a financial institution’s official statement requires careful attention to key components. These elements ensure the replica serves its intended purpose effectively while maintaining structural integrity and visual fidelity.

1. Header Information: This section typically includes the financial institution’s logo, name, and address, alongside customer information such as name and account number. Accurate reproduction of these details is essential for visual authenticity and proper identification.

2. Statement Period: Clear indication of the statement’s covered period (e.g., monthly, quarterly) is crucial for contextualizing the financial data presented within the document. Accurate date representation ensures proper tracking and reconciliation of financial activities.

3. Transaction Details: This section comprises the core of the statement, detailing individual transactions with precise dates, descriptions, and amounts. Accurate recording of these details provides a comprehensive overview of financial activity during the specified period.

4. Balance Information: Accurate representation of opening and closing balances, along with any applicable interest or fees, is essential for financial reconciliation and analysis. These figures provide a snapshot of the account’s financial status during the statement period.

5. Summary Information: This section may include summaries of various transactions, such as total deposits, withdrawals, and fees. These summaries offer a consolidated view of financial activity, facilitating analysis and budgeting.

6. Account Activity Codes: These codes, often accompanying transaction details, provide specific classifications for various transactions, such as deposits, withdrawals, and fees. Accurate representation of these codes ensures clarity and consistency in financial record-keeping.

7. Footer Information: This section may include contact information for customer support, legal disclaimers, and other relevant details. Accurate reproduction ensures access to necessary information and reinforces the document’s professional appearance.

Precise rendering of these components ensures the replica accurately reflects the structure and content of an official bank statement, enabling effective utilization for various purposes, including financial planning, software testing, and educational demonstrations. Accuracy in these areas enhances the document’s credibility and utility.

How to Create a Fillable, Editable Bank Statement Replica

Creating a fillable, editable bank statement replica requires careful attention to detail and adherence to specific formatting guidelines. The following steps outline the process for generating a functional and credible document.

1. Obtain a Sample Statement: Acquire a legitimate, blank bank statement from the specific financial institution. This serves as a template for replicating the precise layout and formatting.

2. Choose a Software Application: Select appropriate software capable of creating and editing fillable forms, such as PDF editing software, spreadsheet applications, or dedicated form creation tools. Consider software compatibility with desired output formats.

3. Recreate the Layout: Replicate the structure and formatting of the sample statement within the chosen software. Pay meticulous attention to fonts, spacing, logo placement, and data field alignment. Accuracy in replicating the visual aspects is crucial for maintaining document credibility.

4. Implement Fillable Fields: Utilize the software’s form creation tools to designate data entry fields for essential information, such as transaction dates, descriptions, amounts, and balance details. Ensure proper field formatting for numerical values, dates, and other data types.

5. Incorporate Formulas and Calculations: Implement formulas and calculations within the fillable fields to automate calculations of balances, totals, and other derived values. This ensures data accuracy and consistency within the replica.

6. Test and Validate Functionality: Thoroughly test the fillable fields and automated calculations to ensure proper functionality and accuracy. Verify data entry, calculations, and formatting consistency across various software and operating systems.

7. Save in a Compatible Format: Save the completed replica in a widely compatible file format, such as PDF, CSV, or XLSX, depending on the intended usage. Consider the recipient’s software environment for optimal compatibility.

8. Implement Security Measures (Optional): If the replica contains sensitive information, consider incorporating security measures such as password protection or encryption to protect against unauthorized access and data breaches.

Meticulous attention to detail throughout these steps ensures the creation of a functional and credible fillable, editable bank statement replica suitable for various legitimate purposes, from personal budgeting to software testing. Accuracy in replicating the formatting, incorporating fillable fields, and ensuring data integrity contributes to the document’s overall utility and effectiveness.

Careful consideration of data accuracy, format compliance, privacy protection, software compatibility, and appropriate usage is essential when utilizing customizable bank statement replicas. Accurate data entry and adherence to the financial institution’s specified format ensure the document’s credibility and reliability. Robust privacy protection measures safeguard sensitive financial information from unauthorized access and potential misuse. Understanding software compatibility ensures seamless integration with various financial tools and applications. Ethical and legal considerations dictate appropriate usage, restricting applications to legitimate purposes while avoiding fraudulent misrepresentation. Adherence to these principles ensures responsible and effective utilization of these valuable tools.

Effective financial management requires accurate and reliable financial documentation. Customizable bank statement replicas, when used responsibly and ethically, offer valuable support for various financial tasks. However, the potential for misuse necessitates a thorough understanding of best practices and ethical considerations. By prioritizing data integrity, privacy protection, and appropriate usage, individuals and organizations can leverage the utility of these tools while mitigating potential risks. This diligent approach ultimately contributes to sound financial practices and informed decision-making.