Using such a structured document offers several advantages. It promotes a clear understanding of one’s financial position, empowering individuals to make sound financial choices. The readily available information streamlines applications for credit or financial assistance, reducing processing time and effort. Moreover, a consistently updated financial record provides valuable insights into spending habits and areas for potential improvement.

Understanding the structure and benefits of organized financial documentation leads naturally to exploring its various applications in diverse financial contexts. Topics such as asset management, debt reduction, and long-term financial planning become more accessible and manageable with a clear and comprehensive financial overview.

1. Digital Format

The digital format of a personal financial statement template offers significant advantages over traditional paper-based methods. This format allows for dynamic updates, ensuring information remains current and accurate. Calculations are automated, reducing the risk of manual errors and saving considerable time. Furthermore, digital files are easily shareable with financial advisors, lenders, or other relevant parties, streamlining communication and facilitating collaborative financial planning. For instance, when applying for a mortgage, a readily accessible digital statement can expedite the application process. Similarly, sharing a current digital statement with a financial advisor allows for real-time analysis and personalized advice.

The inherent flexibility of the digital format also contributes to its utility. Users can readily adjust entries, add new information, and track changes over time. This facilitates ongoing monitoring of financial progress and identification of potential areas for improvement. Version control features allow for comparisons between different periods, providing insights into spending patterns, investment performance, and overall financial health. Consider a scenario where an individual seeks to refinance existing debt. A digital financial statement allows for swift adjustments reflecting current interest rates and loan terms, enabling accurate comparisons and informed decision-making.

In conclusion, the digital format enhances the practicality and effectiveness of a personal financial statement template. It promotes accuracy, accessibility, and efficient data management. This, in turn, empowers individuals to make well-informed financial decisions, optimize their financial strategies, and achieve their financial goals. While the initial setup might require some effort, the long-term benefits of maintaining a digital financial statement far outweigh any initial investment of time and resources. This shift towards digital financial management represents a crucial step toward greater financial control and security.

2. Comprehensive Overview

A truly effective personal financial statement provides a comprehensive overview of one’s financial health. This comprehensive view is crucial for informed decision-making and requires a structured approach. A fillable template facilitates this process by organizing key financial data into a cohesive and readily understandable format.

- AssetsAccurate representation of all owned assets, including liquid assets like cash and checking accounts, and non-liquid assets such as real estate and investments, is fundamental. A detailed asset inventory within the template provides a clear picture of total net worth. For example, including the current market value of a property alongside outstanding mortgage balances allows for precise calculation of equity. Understanding the composition of assets and their relative liquidity informs investment strategies and potential borrowing power.

- LiabilitiesA comprehensive overview necessitates meticulous tracking of all outstanding debts. This includes mortgages, student loans, credit card balances, and other forms of borrowing. Accurately recording these liabilities within the template allows for precise net worth calculation and facilitates debt management strategies. For instance, listing all outstanding loans with their respective interest rates allows for prioritization of high-interest debt repayment.

- Net Worth CalculationThe template automatically calculates net worth by subtracting total liabilities from total assets. This key figure provides a snapshot of current financial standing and serves as a benchmark for tracking financial progress over time. Regularly updating the template allows individuals to monitor the impact of financial decisions on their net worth. For instance, a significant increase in net worth might reflect successful investment strategies or effective debt reduction efforts.

- Cash Flow AnalysisWhile not always directly included, a comprehensive overview often incorporates cash flow analysis. This involves tracking income and expenses to understand spending patterns and identify potential areas for savings. Connecting the template to budgeting tools can further enhance this analysis. For example, integrating the template with a budgeting app could automatically categorize expenses and provide visualizations of spending habits, facilitating better budget allocation.

By consolidating these facets within a structured template, individuals gain a holistic view of their financial landscape. This comprehensive perspective allows for more effective financial planning, informed decision-making, and ultimately, greater financial well-being. Regularly updating and analyzing the information within the template allows for proactive adjustments to financial strategies and maximizes the potential for achieving long-term financial goals. This comprehensive approach fosters a more resilient and adaptable financial foundation.

3. Regular Updates

Maintaining an accurate and up-to-date personal financial statement is crucial for effective financial management. Regular updates ensure the documented financial position aligns with current reality. This dynamic reflection of financial status is essential for informed decision-making, allowing individuals to assess the impact of financial activities and adjust strategies as needed. Without regular updates, the document becomes a static, outdated representation, losing its value as a tool for financial planning and analysis.

Consider a scenario involving significant market fluctuations impacting investment portfolios. Regularly updating the investment section of the template reflects these changes, providing an accurate picture of current net worth. This, in turn, influences decisions regarding asset allocation, risk management, and potential investment opportunities. Similarly, regular tracking of debt reduction efforts provides a tangible measure of progress, motivating continued adherence to debt management plans. Failure to update these details could lead to an inaccurate perception of financial health, potentially hindering effective planning.

The practicality of regular updates is significantly enhanced through the use of a fillable template. The digital format facilitates quick and easy modifications, eliminating the cumbersome process of manual revisions. Automated calculations ensure accuracy, reducing the risk of errors inherent in manual updates. This efficiency promotes consistent engagement with the financial statement, fostering a proactive approach to financial management. Regular engagement fosters a deeper understanding of one’s financial landscape, leading to more informed decisions and ultimately, improved financial outcomes. It allows for timely identification of potential financial challenges and proactive implementation of corrective measures.

4. Informed Decisions

Sound financial decisions rely on a clear and accurate understanding of one’s financial position. A fillable personal financial statement template provides the necessary framework for developing this understanding, empowering individuals to make informed choices across various financial domains.

- Strategic BudgetingA detailed financial statement allows for the creation of realistic and effective budgets. By understanding income streams, asset allocation, and existing liabilities, individuals can allocate resources strategically, prioritize essential expenses, and identify opportunities for saving and investment. For example, awareness of high-interest debt burdens, clearly presented within the statement, can lead to prioritized debt reduction strategies within the budget. This informed approach maximizes the impact of financial resources and promotes long-term financial stability.

- Effective Debt ManagementThe template facilitates informed debt management by providing a consolidated view of all outstanding liabilities. This comprehensive perspective allows for strategic prioritization of debt repayment, focusing on high-interest debts first. Understanding the overall debt burden relative to assets and income enables informed decisions regarding debt consolidation, refinancing, or other debt management strategies. For instance, a clear overview of outstanding loan balances and interest rates may reveal opportunities for refinancing at lower rates, potentially saving significant amounts over the loan term.

- Investment PlanningInformed investment decisions require a thorough understanding of available resources and risk tolerance. A personal financial statement provides this foundation by outlining asset allocation, liquidity, and overall net worth. This information enables informed choices regarding diversification, risk assessment, and alignment of investments with long-term financial goals. For example, an individual with a substantial net worth and diversified portfolio might consider higher-risk investments, while someone with limited assets may prioritize lower-risk options. The statement provides the necessary context for these decisions.

- Retirement PlanningPreparing for retirement necessitates a long-term perspective and careful consideration of current financial standing. The template facilitates this process by providing a clear snapshot of assets, liabilities, and net worth. This information informs decisions regarding retirement savings contributions, investment strategies, and projected retirement income. Regularly updating the template allows individuals to track progress towards retirement goals and make adjustments as needed. For instance, an individual nearing retirement might shift investment strategies towards lower-risk options based on the current portfolio value reflected in the statement.

By providing a structured and comprehensive overview of one’s financial landscape, a fillable personal financial statement template empowers informed decision-making across various financial aspects. This informed approach fosters greater financial control, reduces financial stress, and promotes long-term financial well-being. Consistent use of the template cultivates a proactive and strategic approach to personal finance, maximizing the potential for achieving financial goals.

5. Financial Clarity

Financial clarity, a crucial element of sound financial management, is intrinsically linked to the utilization of a fillable personal financial statement template. The template serves as a tool for achieving this clarity, providing a structured framework for organizing and analyzing financial data. This structured approach transforms disparate financial information into a cohesive and understandable overview, enabling individuals to grasp their true financial standing. The cause-and-effect relationship is clear: consistent use of the template leads to a greater understanding of one’s financial position, thereby fostering financial clarity. For instance, an individual struggling with multiple debts might find it challenging to assess their overall debt burden. Using the template to consolidate all debts, including interest rates and minimum payments, provides a clear picture of the total liability and facilitates the development of effective debt management strategies. Without this organized overview, the complexity of the situation can obscure true financial standing, hindering informed decision-making.

Financial clarity, as a component of a fillable personal financial statement template, goes beyond simply knowing one’s net worth. It encompasses a deeper understanding of asset allocation, debt management, cash flow, and the interplay between these factors. This comprehensive understanding empowers individuals to make informed decisions regarding budgeting, saving, investing, and retirement planning. Consider a scenario where an individual is contemplating a major purchase, such as a new home. Utilizing a financial statement template allows for a realistic assessment of affordability, taking into account existing assets, liabilities, and projected future income. This informed approach mitigates the risk of overextending financially and promotes responsible financial decision-making. Without this clarity, such decisions could be based on assumptions rather than concrete data, potentially leading to adverse financial consequences.

In conclusion, the pursuit of financial clarity necessitates the utilization of tools and strategies that promote organization and understanding. A fillable personal financial statement template serves as a cornerstone in this pursuit, providing the structure and framework for achieving a comprehensive view of one’s financial landscape. While the process of compiling and updating the template requires effort and diligence, the resulting financial clarity empowers informed decision-making, reduces financial stress, and contributes significantly to long-term financial well-being. Overcoming the initial hurdle of data collection leads to substantial long-term benefits, positioning individuals for greater financial success and security.

6. Accessibility

Accessibility, in the context of a fillable personal financial statement template, refers to the ease and convenience with which individuals can access, update, and utilize their financial information. This accessibility is a critical component of effective financial management, enabling informed decisions and promoting financial well-being. A readily accessible financial statement empowers individuals to proactively monitor their financial health, identify potential challenges, and adapt strategies as needed. Cause and effect are evident: enhanced accessibility promotes greater engagement with financial data, leading to improved financial awareness and more informed decision-making. For example, readily accessible digital templates allow individuals to quickly update their financial information after significant transactions, such as a large purchase or a salary increase, ensuring the statement accurately reflects current financial standing. This real-time awareness facilitates informed adjustments to budgeting and spending habits.

As a key component of a fillable personal financial statement template, accessibility extends beyond mere availability of the information. It encompasses the user-friendliness of the template itself, the ease of data entry and modification, and the availability across various devices. A well-designed template simplifies complex financial data, making it understandable and actionable for individuals regardless of their financial expertise. Consider a scenario where an individual needs to access their financial statement while meeting with a financial advisor. A readily accessible digital template, available on a mobile device, allows for real-time review and discussion, facilitating productive collaboration and informed decision-making. Conversely, a cumbersome, paper-based system hinders accessibility and limits the opportunity for timely financial analysis and action.

In conclusion, accessibility significantly impacts the practical utility of a fillable personal financial statement template. It empowers individuals to take control of their finances, make informed decisions, and achieve their financial goals. While some initial effort is required to establish and populate the template, the long-term benefits of accessible financial data far outweigh the initial investment. This proactive approach to financial management fosters greater financial security and promotes long-term financial well-being. Addressing potential barriers to accessibility, such as technological limitations or lack of digital literacy, is crucial for ensuring that all individuals can benefit from the empowering potential of accessible financial information.

Key Components of a Personal Financial Statement Template

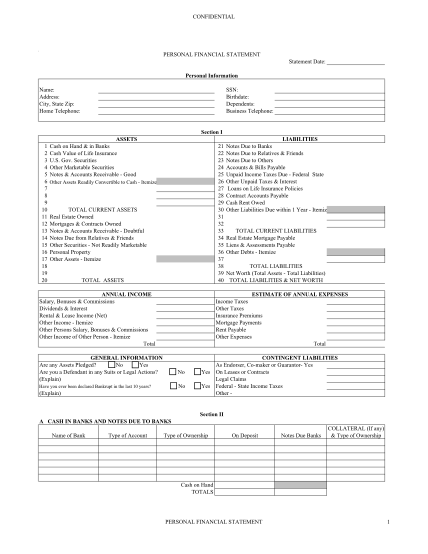

A comprehensive personal financial statement template provides a structured overview of an individual’s financial health. Key components work together to present a clear and accurate snapshot of one’s financial position, facilitating informed decision-making.

1. Assets: Accurate documentation of all owned assets is fundamental. This includes liquid assets (e.g., cash, checking accounts) and non-liquid assets (e.g., real estate, investments). Detailed asset listings, including current market values, provide a basis for calculating net worth and assessing investment portfolios.

2. Liabilities: Thorough tracking of all outstanding debts is essential. This encompasses mortgages, student loans, credit card balances, and other forms of borrowing. Accurate liability documentation allows for precise net worth calculation and informed debt management strategies.

3. Net Worth Calculation: The template automatically calculates net worth (assets minus liabilities). This key figure provides a concise overview of current financial standing and serves as a benchmark for tracking financial progress.

4. Income and Expenses: Documenting income sources and tracking expenses provide insights into cash flow patterns. This information informs budgeting decisions, identifies areas for potential savings, and supports effective financial planning.

5. Digital Format and Accessibility: The digital format facilitates easy updates, automated calculations, and secure storage. Accessibility across various devices enhances practicality and promotes consistent engagement with the financial statement.

6. Customization and Flexibility: A robust template allows for customization to meet individual needs. Flexibility in adding, modifying, and tracking financial data ensures the template remains relevant and adaptable to changing financial circumstances.

A well-structured template facilitates a holistic understanding of one’s financial landscape. Regular updates and analysis empower informed decisions, leading to improved financial outcomes and long-term financial well-being. Effective use promotes greater control over personal finances and enables proactive planning for future financial goals.

How to Create a Fillable Personal Financial Statement Template

Creating a robust and effective personal financial statement template requires a structured approach. The following steps outline the process of developing a template that facilitates accurate financial tracking and informed decision-making.

1. Choose a Format: Selecting the appropriate format is the first step. Spreadsheet software offers flexibility and built-in calculation capabilities, making it a suitable choice. Alternatively, dedicated financial software or online template resources provide structured frameworks.

2. Structure the Template: A well-structured template should include distinct sections for assets, liabilities, income, and expenses. Clear categorization within each section ensures accurate data entry and facilitates analysis. Consider incorporating separate subsections for different asset classes (e.g., liquid assets, investments, real estate) and liability types (e.g., short-term debt, long-term debt).

3. Input Asset Information: List all owned assets with accurate current market values. Include details such as account numbers, financial institution names, and relevant dates. For investment assets, specify the type of investment, quantity held, and current market price.

4. Input Liability Information: Document all outstanding debts, including loan balances, interest rates, and payment terms. Ensure accurate and up-to-date information for each liability to facilitate precise net worth calculation.

5. Implement Automated Calculations: Utilize formulas within the chosen software to automate calculations for net worth (assets minus liabilities), total assets, and total liabilities. Automated calculations minimize the risk of manual errors and ensure accuracy.

6. Incorporate Income and Expense Tracking: Include sections for documenting income sources and tracking expenses. Categorize expenses to facilitate analysis of spending patterns and identify potential areas for savings.

7. Regularly Update and Review: Maintaining an accurate and up-to-date financial statement requires regular updates. Set a schedule for reviewing and updating the template, ensuring it reflects current financial reality. Regular review fosters financial awareness and enables timely adjustments to financial strategies.

8. Ensure Accessibility and Security: Store the digital template securely and ensure accessibility across devices as needed. Consider cloud-based storage solutions for convenient access and automatic backups. Implement appropriate security measures to protect sensitive financial data.

A well-designed template, consistently updated and reviewed, empowers informed financial decision-making, contributing significantly to long-term financial well-being and stability.

A fillable personal financial statement template provides a structured framework for organizing and analyzing financial data, enabling informed decision-making and promoting financial well-being. Key benefits include enhanced clarity of financial standing, streamlined financial processes such as loan applications, and informed decisions related to budgeting, debt management, and investment strategies. Regular updates, facilitated by the digital format, ensure the accuracy and relevance of the information, allowing individuals to adapt to changing financial circumstances. A comprehensive overview of assets, liabilities, income, and expenses empowers proactive financial management and facilitates progress toward long-term financial goals. Accessibility across devices promotes consistent engagement with the template, fostering greater financial awareness and control.

Effective financial management requires a commitment to understanding and actively managing one’s financial position. Utilizing a fillable personal financial statement template represents a crucial step toward achieving this objective. The insights gained from consistent use of the template contribute not only to improved financial outcomes but also to reduced financial stress and enhanced financial security. This proactive approach to financial management empowers individuals to navigate financial complexities with confidence and positions them for long-term financial success.