Utilizing such a structured document provides several advantages. It simplifies financial record-keeping, enabling efficient tracking and analysis of performance. Automated calculations reduce the risk of manual errors, improving accuracy and reliability. The readily available data supports informed decision-making, from budgeting and forecasting to identifying areas for cost optimization. Furthermore, the standardized format simplifies sharing financial information with stakeholders like investors and lenders.

Understanding the structure and benefits of organized financial record-keeping is essential for effective business management. The following sections will explore specific elements within these documents, providing practical guidance on their utilization and interpretation for improved financial performance.

1. Automated Calculations

Automated calculations represent a crucial feature within fillable profit and loss statement templates, significantly enhancing accuracy and efficiency in financial analysis. By eliminating manual data entry and calculations, these templates streamline the process of generating key financial metrics. This automation minimizes the risk of human error, leading to more reliable financial reporting.

- Formula-driven calculations:Pre-defined formulas automatically compute values based on entered data. For example, gross profit is calculated by subtracting the cost of goods sold from revenue. This eliminates manual calculations, saving time and reducing the potential for errors. The accuracy of these calculations is crucial for generating reliable financial statements.

- Real-time updates:Changes to any input field automatically trigger recalculations throughout the template. This ensures that all figures remain consistent and up-to-date. For instance, adjusting sales figures immediately updates related metrics like gross profit and net income. This real-time feedback facilitates dynamic financial modeling and analysis.

- Aggregation of data:Templates consolidate data from various sources, automatically summarizing information across different categories. This facilitates the analysis of overall financial performance. For example, total operating expenses are calculated by summing individual expense categories. This automated aggregation streamlines reporting and analysis.

- Integration with other financial tools:Some templates offer integration with other financial software, enabling seamless data transfer and analysis. This integration further enhances efficiency and provides a comprehensive view of financial performance. For example, linking the template to accounting software allows for automatic data import, eliminating manual data entry and ensuring consistency across platforms. This integration simplifies financial management and reporting.

These automated features significantly enhance the utility of fillable profit and loss statement templates, allowing businesses to focus on interpreting financial data rather than manual calculations. This efficiency and accuracy contribute to better informed decision-making and more effective financial management. By providing reliable and readily available data, these automated calculations empower businesses to gain deeper insights into their financial health and make strategic adjustments as needed.

2. Standardized Format

Standardized formatting within a fillable profit and loss statement template ensures consistency, comparability, and ease of interpretation. This structured approach facilitates efficient analysis, both internally and externally, promoting informed financial decision-making and effective communication with stakeholders.

- Consistent Structure:A standardized template follows a prescribed structure, presenting financial data in a consistent order and format. This consistency allows for easy comparison of performance across different periods or against industry benchmarks. For example, revenue is always presented before expenses, and specific expense categories are consistently grouped. This predictable structure simplifies analysis and trend identification.

- Comparability:Standardized formatting enables direct comparison of financial data across different businesses or divisions within an organization. This comparability is crucial for benchmarking performance and identifying areas for improvement. For example, analyzing profit margins across similar businesses using standardized statements can reveal competitive advantages or areas needing attention. This facilitates informed strategic planning.

- Simplified Interpretation:A standardized format enhances clarity and simplifies the interpretation of financial data. Stakeholders, including investors and lenders, can readily understand the information presented, facilitating informed decision-making. For instance, a clearly defined section for operating expenses enables stakeholders to quickly assess cost efficiency. This transparency promotes trust and facilitates communication.

- Regulatory Compliance:Standardized formats often align with regulatory requirements for financial reporting. This simplifies compliance and ensures that financial statements meet industry standards. For example, adhering to generally accepted accounting principles (GAAP) ensures consistency and comparability across financial statements. This compliance is essential for legal and regulatory adherence.

The standardized format of fillable profit and loss statement templates provides a framework for clear, concise, and comparable financial reporting. This structure facilitates efficient analysis, supports informed decision-making, and enhances communication with stakeholders, contributing to effective financial management and business success.

3. Error Reduction

Accuracy in financial reporting is paramount for sound decision-making. Fillable profit and loss statement templates contribute significantly to error reduction, minimizing inaccuracies that can arise from manual data entry and calculations. This enhanced accuracy strengthens financial analysis and supports more informed business strategies.

- Automated Calculations:Templates automate calculations, eliminating manual entry and reducing the risk of transposition errors or incorrect formulas. For example, if a business manually calculates its cost of goods sold, a simple mathematical error can significantly impact the reported profit. Automated calculations within the template prevent such errors, ensuring accurate gross profit and net income figures.

- Data Validation:Some templates incorporate data validation features, restricting input to specific formats or ranges. This prevents the entry of incorrect data types, such as text in a numerical field. For instance, a data validation rule might restrict entries in the “Sales Revenue” field to positive numerical values. This prevents accidental entry of negative sales figures, ensuring data integrity.

- Pre-defined Formulas:Templates embed pre-defined formulas for key financial metrics, eliminating the need for manual formula creation. This ensures consistent application of calculations across different reporting periods. For example, the formula for calculating gross profit margin is consistently applied, preventing inconsistencies that might arise from using different formulas across reports. This consistency enhances comparability and reliability.

- Reduced Data Redundancy:Templates centralize data entry, reducing the need to input the same information multiple times. This minimizes data redundancy and the associated risk of inconsistencies. For instance, entering sales data once in the template automatically populates related calculations, eliminating the need to re-enter the same sales figures in different sections of the statement. This streamlines data management and reduces the potential for errors arising from inconsistent data entries.

By minimizing manual intervention, fillable profit and loss statement templates significantly reduce the risk of errors in financial reporting. This enhanced accuracy provides a more reliable foundation for financial analysis, supporting informed decision-making and contributing to the overall financial health of a business. The reduced risk of errors not only improves the quality of internal financial analysis but also enhances the credibility of financial reports shared with external stakeholders, such as investors and lenders.

4. Informed Decisions

Informed financial decisions are crucial for business success. A fillable profit and loss statement template plays a vital role in facilitating such decisions by providing readily accessible and accurately calculated financial data. This data-driven approach empowers businesses to move beyond guesswork and make strategic choices based on concrete evidence.

Consider a retail business seeking to optimize inventory management. A completed template, tracking sales revenue, cost of goods sold, and inventory holding expenses, provides a clear picture of profitability for each product line. This insight allows the business to identify underperforming products, adjust pricing strategies, or discontinue unprofitable lines altogether. Without this structured financial data, decisions about inventory management would rely on intuition rather than data-driven insights, potentially leading to inefficient stock levels and reduced profitability. Another example involves a service-based business evaluating the effectiveness of its marketing campaigns. By tracking marketing expenses against generated revenue within the template, the business can calculate the return on investment for each campaign. This analysis informs decisions about future marketing strategies, allowing the business to allocate resources to the most effective channels and optimize campaign performance. In both scenarios, the template facilitates informed decisions, driving strategic actions that improve financial performance.

The ability to generate accurate and timely financial reports through a fillable profit and loss statement template empowers businesses to proactively address challenges and capitalize on opportunities. This proactive approach, grounded in reliable financial data, contributes significantly to long-term sustainability and growth. While generating a profit and loss statement is essential, the true value lies in the informed decisions it enables. These decisions, driven by data insights, form the basis of effective financial management, leading to increased profitability, improved operational efficiency, and sustained business growth. Failing to leverage these insights can lead to missed opportunities, reactive rather than proactive strategies, and ultimately, compromised financial health.

5. Simplified Sharing

Simplified sharing, facilitated by fillable profit and loss statement templates, significantly enhances communication and collaboration among stakeholders. These digital documents, easily shared electronically, streamline the dissemination of financial information, fostering transparency and informed decision-making among internal teams, investors, lenders, and other relevant parties. Previously, sharing financial statements often involved printing and physically distributing documents, a cumbersome and time-consuming process. Digital templates eliminate these inefficiencies, allowing stakeholders to access information quickly and conveniently.

Consider a startup seeking funding from venture capitalists. A well-structured, easily shareable profit and loss statement provides potential investors with a clear and concise overview of the company’s financial performance. This transparency builds trust and facilitates informed investment decisions. Similarly, within a larger organization, department heads can readily share their respective profit and loss statements with executive management, enabling a comprehensive overview of the company’s overall financial health. This streamlined sharing fosters data-driven discussions and collaborative strategic planning. Furthermore, digital templates often offer features that enhance collaboration, such as commenting and version control. These features allow stakeholders to provide feedback directly within the document, fostering a more interactive and efficient communication process.

Efficient communication of financial information is fundamental to effective business management and stakeholder engagement. Fillable profit and loss statement templates, through simplified sharing, streamline this process, fostering transparency, collaboration, and informed decision-making. This improved communication strengthens relationships with stakeholders and contributes to the overall financial health and stability of the organization. The ability to quickly and easily share accurate financial data empowers stakeholders to make timely and informed decisions, fostering agility and responsiveness in a dynamic business environment. Conversely, inefficient sharing processes can lead to communication breakdowns, delayed decisions, and ultimately, compromised business performance.

6. Accessible Tracking

Accessible tracking, facilitated by fillable profit and loss statement templates, provides businesses with the ability to readily monitor financial performance and identify trends. This accessibility is crucial for proactive financial management, allowing organizations to quickly analyze data, pinpoint areas requiring attention, and adapt strategies as needed. Without readily accessible data, organizations risk reactive rather than proactive management, potentially leading to missed opportunities or delayed responses to financial challenges.

- Real-time Monitoring:Digital templates enable real-time monitoring of financial data. As transactions are recorded, the template automatically updates calculations, providing an immediate snapshot of the organization’s financial position. This immediacy contrasts sharply with traditional manual tracking methods, which often involve delays in data entry and analysis. For example, a business can track sales performance daily, identifying any dips or surges immediately, rather than waiting for monthly or quarterly reports. This real-time insight allows for timely adjustments to sales strategies, maximizing revenue potential.

- Simplified Analysis:Templates present financial information in a structured and organized manner, simplifying analysis. Pre-defined categories for revenue and expenses facilitate the identification of trends and anomalies. For example, a consistent increase in operating expenses over several months can be readily identified within the template, prompting investigation and potential cost-saving measures. This streamlined analysis allows businesses to quickly identify and address financial challenges.

- Comparative Analysis:Fillable templates enable comparative analysis across different periods. By comparing current performance to previous periods, businesses can identify trends, assess the impact of strategic initiatives, and make data-driven adjustments. For example, comparing profit margins from the current quarter to the previous quarter can reveal the effectiveness of cost-cutting measures or pricing adjustments. This comparative analysis provides valuable insights into the impact of business strategies.

- Accessibility Across Devices:Cloud-based templates offer accessibility across various devices, allowing stakeholders to access financial information anytime, anywhere. This accessibility fosters collaboration and informed decision-making, even when team members are geographically dispersed. For example, a sales manager traveling for business can access real-time sales data on their mobile device, enabling informed decisions on the go. This accessibility promotes agility and responsiveness within the organization.

The accessibility of financial data provided by fillable profit and loss statement templates empowers organizations with the insights needed for proactive financial management. This accessibility supports data-driven decision-making, enhances responsiveness to changing market conditions, and ultimately contributes to improved financial performance and long-term sustainability. By fostering a culture of data-driven decision-making, these templates facilitate strategic planning and execution, enabling organizations to achieve their financial objectives.

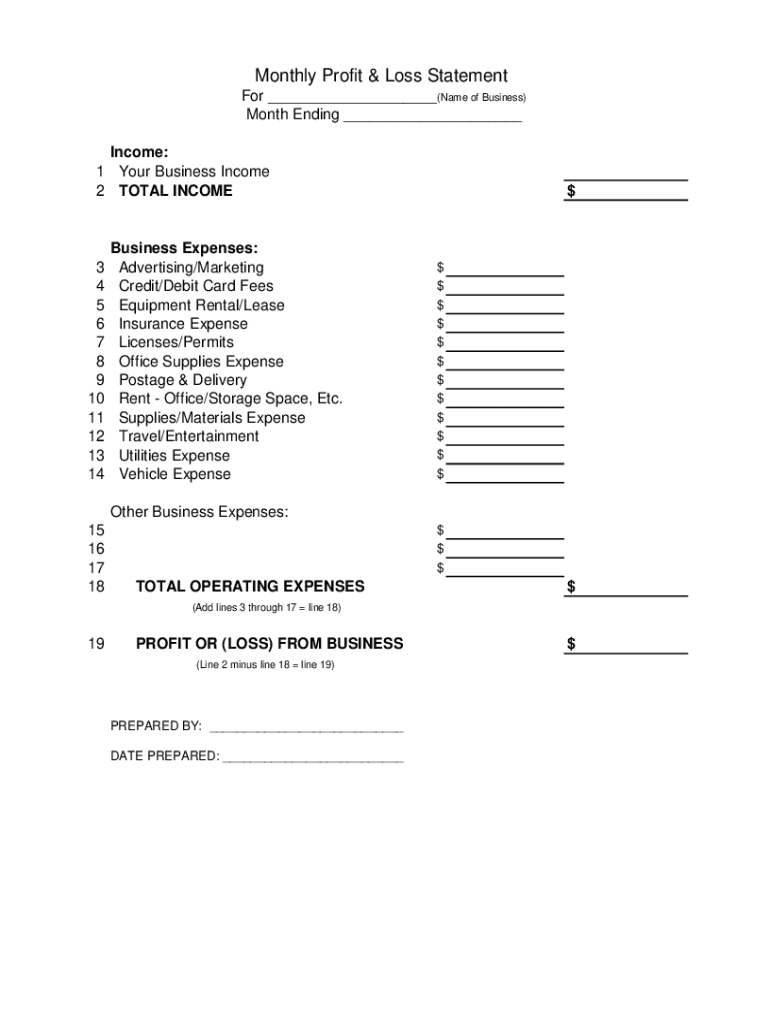

Key Components of a Profit and Loss Statement Template

A comprehensive understanding of the key components within a profit and loss statement template is essential for accurate financial analysis and informed decision-making. These components provide a structured framework for recording and analyzing financial performance.

1. Revenue: This section details all income generated from business activities. It typically includes sales revenue, interest income, and any other income streams. Accurate revenue reporting is fundamental to understanding a company’s financial health.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold by a business. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profit generated from core business operations before accounting for operating expenses. This metric provides insights into production efficiency and pricing strategies.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, excluding COGS. Examples include rent, salaries, marketing expenses, and administrative costs. Tracking operating expenses is crucial for understanding profitability and identifying areas for potential cost reduction.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income reflects the profitability of the business’s core operations. This metric provides insights into the efficiency of management and operational processes.

6. Other Income/Expenses: This section captures income or expenses not directly related to core business operations, such as interest income, investment gains or losses, and one-time expenses. These items provide a comprehensive view of the company’s overall financial performance.

7. Income Before Taxes: This represents the company’s income after accounting for all operating and non-operating income and expenses but before considering income tax obligations. This metric provides a clear picture of profitability before taxes.

8. Net Income: Calculated as Income Before Taxes minus Income Tax Expense, net income represents the company’s final profit after all expenses and taxes are accounted for. This is the bottom line and a key indicator of a company’s overall financial performance.

These interconnected components provide a structured view of financial performance, enabling stakeholders to assess profitability, identify trends, and make informed decisions. Accurate and detailed reporting within each component contributes to effective financial management and strategic planning.

How to Create a Fillable Profit and Loss Statement Template

Creating a fillable profit and loss statement template requires careful planning and a structured approach. The following steps outline the process for developing a template that promotes accurate financial reporting and analysis.

1. Choose a Software: Select appropriate software. Spreadsheet applications like Microsoft Excel or Google Sheets offer flexibility and built-in formulas, while dedicated accounting software may provide more advanced features and integrations. Consider the specific needs of the organization when selecting the platform.

2. Define Reporting Period: Specify the reporting period, whether monthly, quarterly, or annually. This ensures consistency in financial analysis and facilitates comparison across different periods.

3. Establish Key Components: Incorporate essential components, including revenue, cost of goods sold, gross profit, operating expenses, operating income, other income/expenses, income before taxes, and net income. These components form the foundation of a comprehensive profit and loss statement.

4. Design Input Fields: Create input fields for each revenue and expense category. Utilize clear and concise labels for each field to ensure accurate data entry. Consider grouping related categories for improved organization and analysis.

5. Implement Formulas: Implement formulas to automate calculations. For example, gross profit is calculated as revenue minus the cost of goods sold. Automated calculations enhance accuracy and efficiency in financial reporting.

6. Incorporate Data Validation: Utilize data validation features where appropriate to restrict input to specific formats or ranges. This helps prevent errors and ensures data integrity. For example, restrict sales revenue input to positive numerical values.

7. Formatting and Layout: Employ clear and consistent formatting to enhance readability. Use appropriate headings, subheadings, and formatting conventions to improve visual clarity and facilitate efficient analysis. A well-formatted template promotes accurate interpretation of financial data.

8. Testing and Refinement: Thoroughly test the template to ensure accuracy and functionality. Input sample data and verify that calculations and formatting are correct. Refine the template as needed based on testing results. Thorough testing ensures reliable and accurate financial reporting.

A well-designed fillable profit and loss statement template provides a valuable tool for managing finances. It streamlines data entry, automates calculations, and facilitates analysis, enabling informed decision-making and contributing to the overall financial health of an organization. Regular review and refinement of the template ensure its continued effectiveness in supporting financial management processes.

Fillable profit and loss statement templates offer a structured, efficient, and accurate approach to financial reporting. From automated calculations and standardized formatting to simplified sharing and accessible tracking, these templates empower organizations with the data-driven insights necessary for effective financial management. Understanding key components, such as revenue, cost of goods sold, and net income, allows for comprehensive analysis of financial performance. Furthermore, the ability to create customized templates ensures alignment with specific business needs and reporting requirements.

Effective financial management relies on accurate data and insightful analysis. Leveraging the capabilities of fillable profit and loss statement templates provides organizations with a crucial tool for navigating the complexities of financial reporting, enabling informed decision-making, fostering financial stability, and promoting sustainable growth. The ongoing refinement and adaptation of these templates, in response to evolving business needs and technological advancements, will further enhance their role as essential instruments for financial success.