Utilizing a pre-built structure ensures consistency, accuracy, and ease of analysis. This streamlined approach saves time and reduces the risk of errors, allowing for efficient financial reporting and better-informed strategic planning. Moreover, a standardized format allows for easy comparison across different periods and against industry benchmarks, promoting transparency and accountability.

This foundation of financial information allows for deeper exploration of key financial ratios, trend analysis, and informed forecasting. Understanding this structured presentation is crucial for effective financial management and strategic decision-making.

1. Standardized Structure

A standardized structure is fundamental to the efficacy of a financial statement balance sheet template. Consistency in presentation allows for efficient analysis, comparison across reporting periods, and benchmarking against industry peers. This structure ensures data clarity and reduces the risk of misinterpretation.

- Consistent Categorization:Assets, liabilities, and equity are consistently categorized within the template, ensuring uniformity. This facilitates understanding the relationships between different financial elements. For example, current assets are always presented separately from long-term assets, providing a clear distinction between short-term and long-term resources.

- Predefined Formulas:Built-in formulas automate calculations, minimizing errors and ensuring accuracy. Calculations such as working capital (current assets minus current liabilities) are automatically derived, providing immediate insights into financial health. This automation streamlines the reporting process and reduces manual effort.

- Comparable Format:The standardized format enables comparison across different reporting periods, revealing trends and performance changes over time. Consistent presentation allows for year-over-year analysis of key metrics like total assets or net equity. This longitudinal perspective is vital for strategic planning.

- Industry Benchmarking:Standardized templates facilitate benchmarking against industry averages, providing context for evaluating a company’s financial position relative to its competitors. This comparative analysis allows for identification of strengths and weaknesses, informing strategic adjustments. For instance, comparing debt-to-equity ratios highlights relative financial leverage.

These facets of a standardized structure contribute significantly to the value of a financial statement balance sheet template. Consistent categorization, automated calculations, comparable formatting, and industry benchmarking collectively empower informed financial analysis, decision-making, and strategic planning.

2. Key Financial Data

A financial statement balance sheet template serves as a structured repository for key financial data, providing a concise overview of a company’s financial position. Accurate and comprehensive data within this framework is crucial for informed decision-making, performance evaluation, and stakeholder communication. Understanding the composition and implications of this data is fundamental to utilizing the template effectively.

- AssetsAssets represent resources owned or controlled by a company, expected to provide future economic benefit. Examples include cash, accounts receivable, inventory, property, plant, and equipment. Within the template, assets are categorized (current and non-current) to reflect their liquidity. Accurate asset valuation is critical for determining a company’s overall financial strength.

- LiabilitiesLiabilities represent obligations owed to external parties. Examples include accounts payable, loans payable, and deferred revenue. Categorization within the template (current and non-current) reflects the timing of repayment obligations. Understanding a company’s liabilities is essential for assessing financial risk and solvency.

- EquityEquity represents the residual interest in a company’s assets after deducting liabilities. It reflects the owners’ stake in the company. Components of equity include common stock, retained earnings, and additional paid-in capital. Equity data within the template provides insights into a company’s financial structure and ownership distribution.

- InterrelationshipsThe fundamental accounting equation (Assets = Liabilities + Equity) governs the relationships between these key data elements. The balance sheet template reflects this equation, ensuring that the total assets always equal the sum of liabilities and equity. This inherent balance provides a crucial check on the accuracy and completeness of the financial data presented.

The accurate presentation of assets, liabilities, and equity within a standardized template enables comprehensive analysis of a company’s financial health, supporting strategic decision-making, performance evaluation, and stakeholder communication. This interconnected data, governed by the fundamental accounting equation, provides a robust framework for understanding a company’s financial position and potential for future growth.

3. Snapshot in Time

A financial statement balance sheet template provides a static view of a company’s financial position at a specific moment. This “snapshot in time” characteristic is crucial for understanding the dynamic nature of financial reporting and the limitations inherent in a single balance sheet. Analyzing sequential balance sheets reveals trends and provides a more comprehensive understanding of financial performance.

- Specific Date RelevanceBalance sheets are date-dependent, reflecting assets, liabilities, and equity on a particular day. This differs from income statements, which cover a period. For example, a balance sheet dated December 31, 2023, shows the financial position only on that date, not for the entire year. Subsequent events can significantly alter the financial picture.

- Dynamic Financial PositionA company’s financial position constantly changes due to ongoing business operations. Transactions like sales, purchases, and financing activities continuously impact assets, liabilities, and equity. Therefore, a single balance sheet represents a momentary view within a constantly evolving financial landscape.

- Trend Analysis NecessityComparing balance sheets from different dates reveals trends in financial performance and position. Analyzing changes in asset composition, liability levels, and equity growth over time provides deeper insights than a single snapshot. This comparative analysis is crucial for assessing financial health and identifying potential risks or opportunities.

- Contextual UnderstandingInterpreting a balance sheet requires understanding the context of the specific date. External factors like economic conditions or industry trends can significantly influence a company’s financial position at a particular point in time. Therefore, considering the broader business environment enhances the analysis and interpretation of the snapshot provided by the balance sheet.

The “snapshot in time” nature of a financial statement balance sheet template emphasizes the importance of analyzing trends through comparative analysis of multiple balance sheets from different dates. While a single balance sheet provides a valuable overview of financial position at a specific moment, a dynamic perspective, informed by sequential data, offers a richer understanding of a company’s financial health and trajectory.

4. Facilitates Analysis

A well-structured financial statement balance sheet template facilitates in-depth financial analysis, enabling stakeholders to gain valuable insights into a company’s financial health, performance, and stability. This analytical capability is crucial for informed decision-making, strategic planning, and performance evaluation.

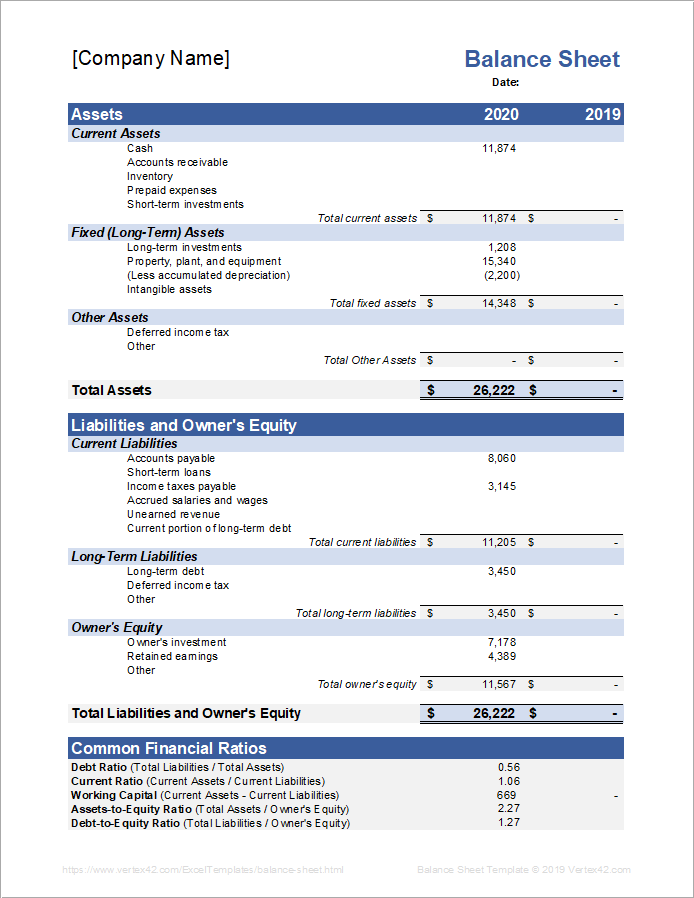

- Ratio AnalysisTemplates allow for the easy calculation and interpretation of key financial ratios. For example, the current ratio (current assets divided by current liabilities) assesses short-term liquidity, while the debt-to-equity ratio (total debt divided by total equity) measures financial leverage. These ratios provide benchmarks for evaluating financial health and risk.

- Trend AnalysisComparing data across multiple reporting periods within the template facilitates trend analysis. Observing changes in asset composition, liability levels, or equity growth over time reveals performance patterns and potential risks or opportunities. This historical perspective is crucial for forecasting and strategic planning.

- Comparative AnalysisStandardized templates enable comparisons with industry benchmarks and competitors’ performance. Analyzing key metrics relative to industry averages provides insights into a company’s competitive position and potential areas for improvement. This comparative analysis informs strategic adjustments and performance optimization.

- Common-Size AnalysisExpressing balance sheet items as percentages of total assets allows for common-size analysis. This technique facilitates comparisons across companies of different sizes and identifies changes in the relative proportions of assets, liabilities, and equity. This standardized view enhances understanding of financial structure and composition.

The ability to perform ratio analysis, trend analysis, comparative analysis, and common-size analysis underscores the importance of a well-designed financial statement balance sheet template. These analytical tools empower stakeholders to extract meaningful insights from the data, supporting informed decision-making and strategic planning. The structured presentation of financial information within the template facilitates a comprehensive understanding of a company’s financial position, performance, and potential.

5. Aids Decision-Making

A financial statement balance sheet template plays a critical role in supporting informed decision-making across various business functions. By providing a clear, concise, and structured overview of a company’s financial position, the template empowers stakeholders to assess financial health, evaluate performance, and make strategic choices based on reliable data.

- Investment DecisionsPotential investors utilize balance sheet data to assess a company’s financial stability and growth potential. Key metrics such as debt-to-equity ratio and asset composition inform investment decisions. For instance, a high debt-to-equity ratio might signal higher risk, while a strong asset base could indicate stability and future growth prospects.

- Lending DecisionsCreditors rely on balance sheet information to evaluate creditworthiness and determine lending terms. Liquidity ratios, like the current ratio, help assess a company’s ability to meet short-term obligations. A healthy current ratio increases the likelihood of loan approval and favorable interest rates.

- Operational DecisionsManagement uses balance sheet data to make operational decisions regarding inventory management, asset allocation, and cost control. Analyzing inventory turnover ratios can identify inefficiencies in inventory management, while reviewing asset utilization helps optimize resource allocation for maximum profitability.

- Strategic PlanningBalance sheet trends inform long-term strategic planning. Analyzing changes in asset composition, liability levels, and equity growth over time guides decisions related to expansion, diversification, or mergers and acquisitions. A consistently growing equity position, for example, might support aggressive expansion strategies.

The insights derived from a financial statement balance sheet template are instrumental in driving informed decision-making across various levels of an organization. From investment and lending decisions to operational adjustments and long-term strategic planning, the template provides a crucial foundation for sound financial management and sustainable growth. The structured presentation of financial data empowers stakeholders to assess risks, identify opportunities, and make strategic choices that align with overall business objectives.

Key Components of a Financial Statement Balance Sheet Template

A comprehensive understanding of a financial statement balance sheet template requires familiarity with its core components. These elements work together to provide a structured snapshot of a company’s financial position.

1. Assets: Resources controlled by a company as a result of past events and from which future economic benefits are expected to flow to the entity. These are categorized as current (easily convertible to cash within one year) and non-current (long-term holdings).

2. Liabilities: Present obligations of a company arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits. These are also categorized as current (due within one year) and non-current (long-term obligations).

3. Equity: The residual interest in the assets of the entity after deducting all its liabilities. This represents the owners’ stake in the company and includes retained earnings and contributed capital.

4. Header: The header typically includes the company name, the title “Balance Sheet,” and the specific date for which the information is presented. This date signifies the “snapshot in time” nature of the balance sheet.

5. Categorization and Subtotals: Assets and liabilities are further categorized and subtotaled to provide a clearer picture of the company’s financial structure. This allows for easier analysis and comparison.

6. Formatting and Presentation: A clear and consistent format, often using a tabular structure, ensures readability and facilitates analysis. Proper formatting enhances the understandability of the presented information.

7. Accounting Equation: The fundamental accounting equation (Assets = Liabilities + Equity) is the underlying principle of the balance sheet. This equation must always balance, ensuring the accuracy and completeness of the data.

These components provide a structured representation of a company’s financial position at a specific point in time, enabling informed analysis, decision-making, and stakeholder communication. Accurate and consistent presentation of these elements is crucial for a comprehensive understanding of a company’s financial health and prospects.

How to Create a Financial Statement Balance Sheet Template

Creating a robust template ensures consistent and accurate representation of a company’s financial position. A well-structured template facilitates analysis, aids decision-making, and promotes transparency. The following steps outline the process of creating an effective template.

1. Define Reporting Period and Date: Clearly establish the reporting period and the specific date for the balance sheet. This “snapshot in time” is crucial for accurate representation and subsequent analysis. The reporting period may be a month, quarter, or year-end.

2. Establish the Basic Structure: Create a clear, tabular format with distinct sections for assets, liabilities, and equity. This structure ensures consistency and facilitates easy comparison across periods.

3. Categorize Assets: List and categorize assets into current and non-current. Current assets include cash, accounts receivable, and inventory. Non-current assets encompass property, plant, equipment, and long-term investments. Provide subtotals for each category.

4. Categorize Liabilities: List and categorize liabilities into current and non-current. Current liabilities include accounts payable, short-term debt, and accrued expenses. Non-current liabilities include long-term debt, deferred revenue, and lease obligations. Provide subtotals for each category.

5. Detail Equity Components: Outline the components of equity, including common stock, retained earnings, and additional paid-in capital. Clearly distinguish between contributed capital and earned capital.

6. Incorporate Formulas for Calculations: Integrate formulas for calculating key metrics like total assets, total liabilities, and total equity. Automated calculations ensure accuracy and efficiency. Include formulas for commonly used financial ratios, such as the current ratio and debt-to-equity ratio.

7. Ensure Adherence to Accounting Principles: The template must adhere to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS), as applicable. Compliance with these standards ensures accuracy, reliability, and comparability.

8. Implement Clear Formatting and Labeling: Use clear and consistent formatting, including appropriate labels and headings. This enhances readability and facilitates interpretation by stakeholders. Consider using a visually appealing layout to enhance user experience.

A well-designed financial statement balance sheet template provides a robust framework for presenting a company’s financial position. Consistent structure, accurate categorization, and adherence to accounting principles ensure the reliability and utility of this crucial financial reporting tool.

Financial statement balance sheet templates provide a crucial framework for understanding a company’s financial position. Standardized structure, accurate data presentation, and adherence to accounting principles ensure the reliability and comparability of this information. Analysis facilitated by such templates, including ratio analysis, trend analysis, and comparative analysis, empowers stakeholders with valuable insights for informed decision-making. From assessing investment opportunities and creditworthiness to guiding operational adjustments and strategic planning, these templates serve as a cornerstone of sound financial management.

Effective utilization of financial statement balance sheet templates contributes significantly to financial transparency and accountability. Consistent application and thoughtful analysis of the data presented within these templates enable stakeholders to make informed judgments about a company’s financial health, performance, and potential. This understanding is essential for navigating the complexities of the financial landscape and fostering sustainable growth.