Utilizing a structured format for these crucial financial projections offers several advantages. It allows entrepreneurs and potential investors to easily grasp the financial trajectory of the business, assess its viability, and identify potential strengths and weaknesses. A standardized framework also ensures all essential financial elements are considered, reducing the risk of overlooking critical factors. Furthermore, a readily available model streamlines the planning process, saving valuable time and resources. This ultimately contributes to a more robust and persuasive business plan, increasing the likelihood of securing funding or achieving other strategic objectives.

This understanding of the purpose and advantages of structured financial projections provides a foundation for exploring the specific elements within each core financial statement and how they contribute to a comprehensive business plan.

1. Projected Income Statement

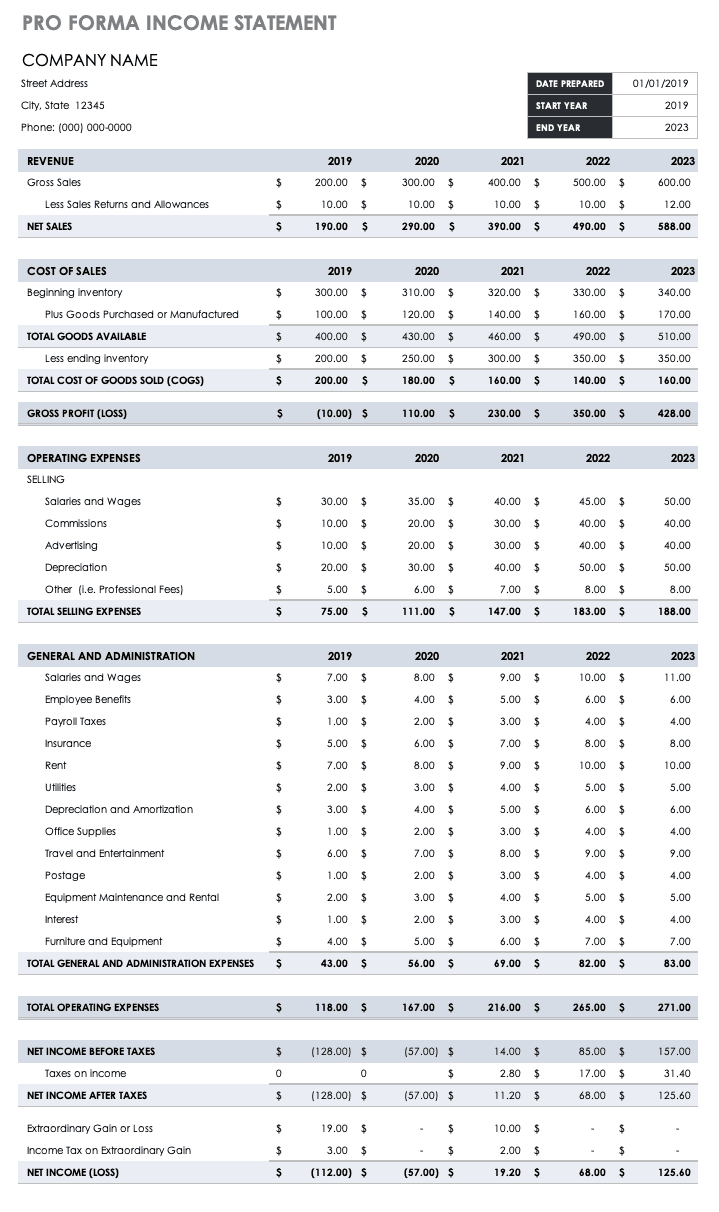

A projected income statement forms a cornerstone of any robust financial plan, providing a forward-looking view of a business’s financial performance. Within the broader context of a financial statement for a business plan template, this document offers crucial insights into anticipated profitability and serves as a basis for strategic decision-making.

- Revenue ProjectionsForecasting revenue involves estimating future sales based on market analysis, pricing strategies, and anticipated sales volumes. For example, a software company might project revenue based on anticipated subscription growth. Accurate revenue projections are fundamental to a credible financial plan, impacting all other aspects of the projected financial statements.

- Cost of Goods Sold (COGS)COGS represents the direct costs associated with producing goods or services. A manufacturing company would include raw material costs, direct labor, and manufacturing overhead. Accurately projecting COGS is crucial for determining gross profit margins and understanding the relationship between production costs and revenue.

- Operating ExpensesOperating expenses encompass all costs incurred in running the business, excluding COGS. Examples include rent, salaries, marketing, and administrative expenses. Projecting these expenses requires careful consideration of planned growth and operational efficiency strategies. These projections contribute significantly to understanding overall profitability.

- Net Income (Profit)The projected net income, derived by subtracting total expenses from total revenues, represents the anticipated bottom line. This figure is a key indicator of financial health and sustainability. Investors and lenders rely heavily on projected net income to assess the viability and potential return on investment of a business venture.

These interconnected elements of the projected income statement contribute significantly to a comprehensive understanding of a business’s future financial performance. Within a complete financial statement for a business plan template, this statement works in concert with projected balance sheets and cash flow statements to provide a holistic financial picture, enabling informed decision-making and enhancing the credibility of the business plan.

2. Projected Balance Sheet

A projected balance sheet is a crucial component of any financial statement for a business plan template. It provides a forward-looking snapshot of a company’s financial position, estimating its assets, liabilities, and equity at specific points in the future, typically covering the same period as the projected income statement and cash flow statement. This projection allows stakeholders to understand the anticipated financial health and stability of the business.

- AssetsAssets represent what the company owns and can be categorized as current (easily convertible to cash within one year) or non-current (long-term holdings). Current assets include cash, accounts receivable, and inventory. Non-current assets typically encompass fixed assets like property, plant, and equipment (PP&E), as well as intangible assets such as patents and trademarks. Projecting assets requires careful consideration of planned capital expenditures, sales growth, and operational efficiency. For example, a growing e-commerce business might project increases in inventory and potentially investments in new warehouse facilities.

- LiabilitiesLiabilities represent what the company owes to others. Similar to assets, they can be classified as current (due within one year) or non-current (long-term obligations). Current liabilities often include accounts payable, short-term loans, and accrued expenses. Non-current liabilities typically involve long-term debt and deferred revenue. Accurate liability projections are crucial for understanding the company’s future financial obligations and its ability to meet them. A company seeking expansion might project increased long-term debt to finance new projects.

- EquityEquity represents the owners’ stake in the company. It’s calculated as the difference between assets and liabilities. On a projected balance sheet, equity considers factors like retained earnings (accumulated profits) and potential future investments. A profitable company will likely show increasing retained earnings over the projected period. A company seeking external funding might project an increase in equity from new investors. This element of the balance sheet offers insights into the ownership structure and financial strength of the business.

- Working CapitalWhile not directly listed on the balance sheet, working capital (calculated as current assets minus current liabilities) is a crucial metric derived from it. Projected working capital provides insights into a company’s short-term liquidity and operational efficiency. A positive working capital balance indicates the company’s ability to meet its short-term obligations. Monitoring projected working capital helps ensure the business can effectively manage its day-to-day operations and fund growth initiatives. For instance, a retail business might project increases in inventory leading up to peak seasons, impacting its working capital needs.

These interconnected elements of the projected balance sheet, when integrated with the income statement and cash flow statement within a financial statement for a business plan template, provide a comprehensive view of a company’s anticipated financial position. This forward-looking perspective enables businesses to anticipate future capital needs, manage growth effectively, and demonstrate financial viability to potential investors and lenders.

3. Projected Cash Flow Statement

The projected cash flow statement is a critical element within a financial statement for a business plan template. Unlike the income statement, which focuses on profitability, the cash flow statement tracks the actual movement of cash both into and out of the business. This dynamic view of cash flow is essential for assessing a company’s short-term viability and its ability to meet immediate financial obligations, making it a key component for securing funding and ensuring sustainable growth. A thorough understanding of projected cash flow is paramount for demonstrating financial stability and operational efficiency to potential investors and lenders.

- Operating ActivitiesThis section details cash flow generated from the core business operations. It includes cash received from customers, cash paid to suppliers, and operating expenses such as salaries and rent. Analyzing projected cash flow from operating activities provides insights into the efficiency of day-to-day operations and the ability to generate cash from core business functions. For example, a subscription-based service might demonstrate strong positive cash flow from operating activities due to recurring revenue streams.

- Investing ActivitiesInvesting activities capture cash flow related to long-term investments. This includes purchases and sales of fixed assets (like equipment or property), investments in other companies, and changes in long-term securities. Projecting cash flow from investing activities helps stakeholders understand how a business plans to allocate capital for future growth and expansion. A manufacturing company investing in new machinery would reflect this as a cash outflow in this section.

- Financing ActivitiesFinancing activities track cash flow related to funding sources. This encompasses proceeds from debt or equity financing, loan repayments, and dividend payments. Analyzing projected cash flow from financing activities provides insight into a company’s capital structure and its reliance on external funding. A startup securing venture capital funding would show this as a cash inflow in this section.

- Net Change in CashThis crucial bottom-line figure represents the overall change in a companys cash balance over the projected period. It’s derived by summing the cash flows from operating, investing, and financing activities. A positive net change indicates a growing cash balance, while a negative change signals a decline. Monitoring this metric is essential for ensuring sufficient liquidity to meet operational needs and capitalize on growth opportunities. Even a profitable company on paper could face financial distress if its projected net change in cash is consistently negative.

The projected cash flow statement, within a financial statement for a business plan template, offers critical insights into a company’s ability to manage its cash resources effectively. When analyzed in conjunction with projected income statements and balance sheets, the cash flow statement provides a comprehensive picture of a businesss financial health, its ability to meet its obligations, and its potential for sustainable growth, thus significantly enhancing the credibility and persuasiveness of the business plan. Accurately projecting cash flow and understanding its drivers is essential for securing funding, navigating financial challenges, and achieving long-term success.

4. Key Assumptions

Financial projections within a business plan template rely on a set of underlying assumptions. These assumptions, while not explicitly part of the financial statements themselves, form the foundation upon which the projections are built. Clearly articulating these key assumptions is crucial for transparency and allows stakeholders to understand the basis of the financial forecasts. Without well-defined and justifiable assumptions, the financial projections lack credibility and offer limited value for decision-making. Careful consideration and documentation of these assumptions are essential for building a robust and persuasive business plan.

- Sales Growth RateA critical assumption underpinning revenue projections is the anticipated sales growth rate. This rate reflects the expected increase in sales over the projected period. For instance, a new restaurant might assume a 20% year-over-year sales growth for the first three years based on market analysis and comparable businesses. This assumption significantly impacts the projected income statement and, consequently, the overall financial health depicted in the business plan. Overly optimistic or pessimistic sales growth assumptions can lead to unrealistic financial projections, undermining the credibility of the entire plan.

- Gross MarginGross margin, the difference between revenue and the cost of goods sold (COGS), is a key profitability metric. Assumptions regarding gross margin reflect expectations about pricing strategies, production costs, and competitive pressures. A software company might assume a consistent gross margin of 80% based on historical data and industry benchmarks. This assumption directly influences projected profitability on the income statement and can significantly impact the overall financial outlook presented in the business plan. Changes in assumed gross margin can have a substantial impact on projected net income.

- Operating Expense RatioOperating expenses, such as rent, salaries, and marketing costs, play a significant role in determining a company’s profitability. The operating expense ratio, calculated as operating expenses divided by revenue, reflects how efficiently a company manages its costs. A retail business might assume a decreasing operating expense ratio over time as it scales operations and benefits from economies of scale. This assumption directly affects projected net income on the income statement and reflects operational efficiency within the business plan. Unrealistic assumptions about operating expenses can lead to inaccurate profitability projections.

- Market Conditions and CompetitionWhile not quantifiable in the same way as other assumptions, projections inherently rely on assumptions about broader market conditions and competitive landscape. These qualitative assumptions are crucial for contextualizing the financial projections. For example, a new technology company might assume a rapidly expanding market with limited direct competition in the short term. These assumptions, while difficult to quantify, significantly impact the feasibility and credibility of the financial projections within the business plan. Failing to acknowledge potential market shifts or competitive pressures can lead to unrealistic and ultimately flawed financial forecasts. Articulating these assumptions transparently helps stakeholders understand the context and potential risks associated with the projected financial performance.

Clearly stating and justifying these key assumptions within a business plan template is essential for ensuring transparency and building credibility. These assumptions directly influence the projected financial statements and provide context for understanding the projected financial performance. Robust and well-supported assumptions are crucial for creating a persuasive business plan that effectively communicates the financial viability and potential of the business venture.

5. Financial Metrics

Financial metrics derived from projected financial statements within a business plan template provide crucial insights into a company’s anticipated performance and financial health. These metrics, calculated from the projected income statement, balance sheet, and cash flow statement, translate raw financial data into meaningful indicators that facilitate analysis, comparison, and informed decision-making. Understanding these metrics is essential for both internal planning and communicating the financial viability of the business to external stakeholders, such as investors and lenders. A well-defined set of financial metrics strengthens a business plan by demonstrating a clear understanding of the business’s financial drivers and potential.

Several key financial metrics play a vital role in evaluating a business plan. Profitability metrics, such as gross profit margin, operating profit margin, and net profit margin, offer insights into a company’s ability to generate profit from its operations. Liquidity metrics, including the current ratio and quick ratio, assess a company’s ability to meet short-term obligations. Solvency metrics, such as the debt-to-equity ratio, evaluate a company’s long-term financial stability and its ability to manage debt. Efficiency metrics, like inventory turnover and accounts receivable turnover, gauge how effectively a company utilizes its assets. Growth metrics, such as revenue growth rate and earnings per share (EPS) growth rate, provide insights into a company’s potential for future expansion. For example, a high projected gross profit margin might attract investors, while a low current ratio could raise concerns about short-term liquidity. Understanding these metrics and their interrelationships provides a comprehensive view of a company’s projected financial performance and its potential for success.

The analysis of financial metrics within a business plan template enables informed decision-making and enhances the credibility of the plan. By tracking and analyzing these metrics, businesses can identify potential strengths and weaknesses, anticipate future challenges, and adjust their strategies accordingly. This proactive approach strengthens the business plan and increases the likelihood of achieving financial objectives. Furthermore, presenting well-defined financial metrics, supported by realistic assumptions and clear explanations, enhances the persuasiveness of the business plan for potential investors and lenders. A thorough understanding and effective communication of these metrics are crucial for securing funding, attracting partners, and ultimately achieving long-term success. Failure to analyze and interpret these metrics can lead to missed opportunities, inadequate planning, and potentially jeopardize the viability of the business venture. Therefore, a comprehensive analysis of financial metrics is an indispensable element of a well-structured and effective business plan.

Key Components of Financial Projections for a Business Plan

Robust financial projections are the backbone of any successful business plan. These projections provide a roadmap for financial performance and demonstrate viability to stakeholders. Several key components form a comprehensive set of financial projections.

1. Projected Income Statement: This statement forecasts revenue, cost of goods sold (COGS), operating expenses, and ultimately, net income. It provides a forward-looking view of profitability and operational efficiency.

2. Projected Balance Sheet: This snapshot in time projects assets, liabilities, and equity at specific future points. It reveals the anticipated financial position and capital structure of the business.

3. Projected Cash Flow Statement: This statement tracks the movement of cash into and out of the business, categorized by operating, investing, and financing activities. It’s crucial for understanding liquidity and short-term financial health.

4. Key Assumptions: Underlying all projections are key assumptions about factors like sales growth, gross margin, and operating expenses. Clearly stating these assumptions is critical for transparency and credibility. Realistic assumptions are essential for accurate projections.

5. Financial Metrics: Key financial metrics, such as profitability ratios, liquidity ratios, and solvency ratios, provide valuable insights into the projected financial performance. These metrics facilitate analysis and comparison, enabling informed decision-making.

These interconnected components provide a comprehensive financial picture, enabling informed decision-making and significantly enhancing the credibility and persuasiveness of a business plan. They offer insights into profitability, financial stability, and the ability to generate and manage cash flow effectively. A thorough understanding of these components is crucial for developing a robust and compelling business plan.

How to Create Financial Projections for a Business Plan

Developing robust financial projections requires a structured approach and careful consideration of key factors. The following steps outline the process of creating comprehensive financial statements for a business plan.

1. Define the Projection Period: Establish a realistic timeframe for the projections, typically spanning three to five years. A shorter timeframe may be appropriate for early-stage ventures, while established businesses may project further into the future. The chosen timeframe should align with the overall strategic goals outlined in the business plan.

2. Gather Historical Data: If available, utilize historical financial data to inform projections. Past performance can provide valuable insights into trends and patterns, serving as a baseline for future estimations. For startups without historical data, industry benchmarks and market research can serve as proxies.

3. Develop Revenue Projections: Forecast future sales based on market analysis, pricing strategies, and anticipated sales volumes. Consider factors such as market size, target customer demographics, and competitive landscape. Justify revenue projections with supporting data and market research.

4. Project Cost of Goods Sold (COGS): Estimate the direct costs associated with producing goods or services. This includes raw materials, direct labor, and manufacturing overhead. Accurately projecting COGS is crucial for determining gross profit margins. Base COGS projections on historical data, industry benchmarks, and supplier agreements.

5. Project Operating Expenses: Forecast all other costs incurred in running the business, excluding COGS. This includes rent, salaries, marketing, and administrative expenses. Project operating expenses based on historical data, anticipated growth, and operational efficiency strategies.

6. Create Projected Financial Statements: Using the gathered data and developed projections, create the core financial statements: projected income statement, projected balance sheet, and projected cash flow statement. Ensure consistency and accuracy across all three statements, verifying that they interconnect logically.

7. Document Key Assumptions: Clearly articulate all underlying assumptions driving the projections, including sales growth rates, gross margins, and operating expense ratios. Transparent documentation of assumptions strengthens credibility and allows stakeholders to understand the basis of the projections.

8. Calculate and Analyze Key Financial Metrics: Derive key financial metrics from the projected financial statements. This includes profitability ratios, liquidity ratios, solvency ratios, and efficiency ratios. Analyze these metrics to gain insights into projected financial performance and identify potential strengths and weaknesses.

Comprehensive financial projections, built on realistic assumptions and rigorous analysis, are essential for a successful business plan. These projections demonstrate financial viability, inform strategic decision-making, and enhance the persuasiveness of the plan to potential investors and lenders. They serve as a roadmap for financial success and provide a framework for monitoring progress and adapting to changing market conditions.

Developing comprehensive financial projections using a structured template provides a crucial foundation for any business plan. Accurate and well-researched projections, encompassing income statements, balance sheets, and cash flow statements, offer a clear financial roadmap for the venture. The transparency provided by clearly stated assumptions and the insights derived from key financial metrics enable informed decision-making and enhance the credibility of the plan. These projections not only demonstrate financial viability to potential investors and lenders but also serve as a valuable management tool for monitoring progress and adapting to changing market conditions.

A robust financial plan, built on a solid framework, empowers businesses to navigate challenges, secure necessary resources, and achieve sustainable growth. Careful consideration of these financial elements significantly increases the likelihood of long-term success, transforming a vision into a viable and thriving enterprise. Therefore, a well-defined financial statement template is not merely a formality but a critical strategic tool for any business seeking to achieve its objectives and secure its future.