Utilizing a pre-designed structure for presenting these financial projections offers several advantages. It promotes transparency and clarity in lease negotiations by providing a consistent format for presenting financial information. This clarity can facilitate more informed decision-making and reduce the potential for misunderstandings between parties. Moreover, a standardized format allows for efficient comparison of different lease options and simplifies the process of due diligence. This can lead to time savings and potentially more favorable lease terms.

This structured approach to financial reporting in commercial leasing plays a vital role in risk management and strategic planning. A detailed financial overview allows stakeholders to assess potential risks and opportunities associated with the lease. This understanding empowers informed negotiations and contributes to the development of sound financial strategies. The following sections will delve deeper into the specific components and applications of this structured approach, exploring its practical implications for both landlords and tenants.

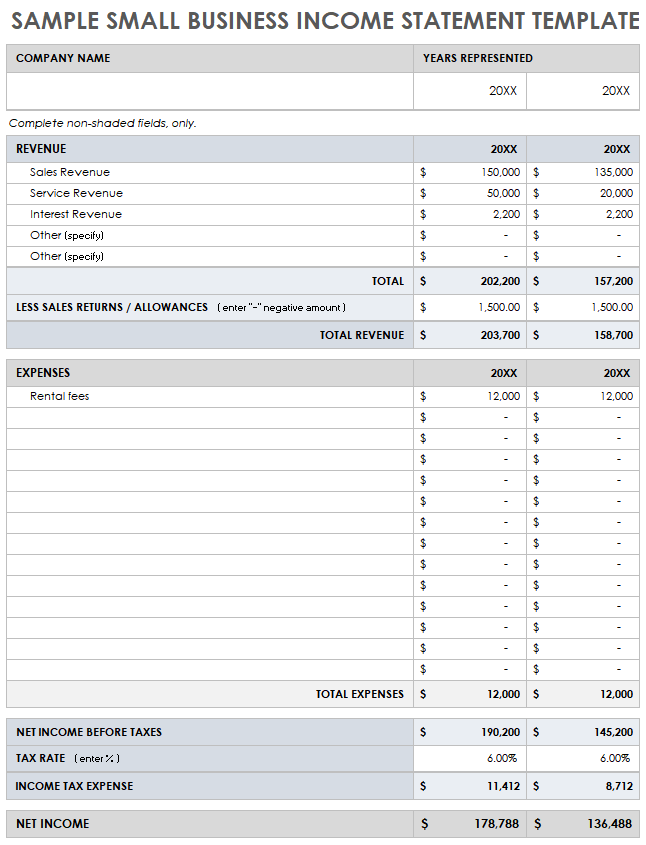

1. Income Statement

Within the framework of a financial statement for commercial leasing, the income statement holds a crucial position. It provides a snapshot of the financial performance of a property over a specific period, typically a year. This statement allows stakeholders to assess the profitability of the lease arrangement by outlining revenues and expenses associated with the property.

- Rental IncomeThis constitutes the primary revenue source in a commercial lease. It encompasses all payments received from tenants occupying the property. Understanding the projected rental income is fundamental for both landlords (to ensure sufficient return on investment) and tenants (to budget accurately for occupancy costs). Variations in rental income, such as escalations or concessions, are clearly detailed within this section.

- Operating ExpensesThese expenses encompass the costs associated with maintaining and operating the property. Examples include property taxes, insurance, maintenance, and utilities. A detailed breakdown of operating expenses allows for a clear understanding of the costs involved and facilitates informed negotiations regarding their allocation between landlord and tenant (e.g., net lease, gross lease).

- Net Operating Income (NOI)Derived by subtracting operating expenses from the total revenue, NOI represents the property’s profitability before accounting for debt service and capital expenditures. This key metric is crucial for evaluating the investment’s financial health and is often used in valuation calculations and loan underwriting.

- Depreciation and AmortizationWhile not representing actual cash outflows, these non-cash expenses account for the decrease in value of assets over time. Including them in the income statement provides a more accurate reflection of the property’s overall financial performance and impacts taxable income calculations.

Careful analysis of the income statement within a commercial lease context provides critical insights into the financial viability of the lease agreement. By understanding the interplay between rental income, operating expenses, and resulting NOI, stakeholders can make informed decisions regarding lease terms, rent adjustments, and overall investment strategy.

2. Balance Sheet

Within the context of a financial statement for commercial leasing, the balance sheet provides a snapshot of the financial position of a property at a specific point in time. Unlike the income statement, which reflects performance over a period, the balance sheet details the property’s assets, liabilities, and equity. This information is crucial for assessing the financial health and stability of the investment and understanding the landlord’s financial standing.

- AssetsRepresenting what the property owner controls, assets are categorized as current (easily convertible to cash, such as prepaid rent) or non-current (held long-term, like the building itself and land). Understanding the composition and value of these assets is essential for assessing the overall worth and liquidity of the property. This information allows tenants to gauge the landlord’s capacity for property maintenance and future investments.

- LiabilitiesThese are the financial obligations or debts associated with the property. Current liabilities (due within a year, like outstanding utility bills) and non-current liabilities (long-term obligations, like the mortgage) are detailed. Analyzing the liabilities provides insights into the property’s financial leverage and potential risks associated with debt. For prospective tenants, a heavily leveraged property might signal potential challenges in maintenance or responsiveness from the landlord.

- EquityRepresenting the owner’s stake in the property, equity is calculated as the difference between assets and liabilities. A healthy equity position indicates financial stability and a lower risk of default. This information provides tenants with an understanding of the landlord’s financial commitment to the property and potential for long-term stability.

- Working CapitalWhile not directly listed on the balance sheet, working capital (calculated as current assets minus current liabilities) offers valuable insights into the property’s short-term financial health. Sufficient working capital ensures the landlord can meet immediate obligations and maintain the property effectively. This factor is crucial for tenants to ensure timely maintenance and a responsive landlord.

Analyzing the balance sheet in conjunction with other financial statements provides a comprehensive understanding of the landlord’s financial stability and the property’s financial health. This information empowers both landlords and tenants to make informed decisions regarding lease terms, rent negotiations, and the long-term viability of the lease agreement.

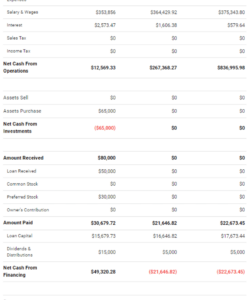

3. Cash Flow Projection

Cash flow projection forms a critical component of a comprehensive financial statement for commercial lease analysis. It provides a forward-looking perspective on the anticipated movement of money into and out of a property over a specified period. This projection considers factors such as rental income, operating expenses, debt service, and capital expenditures to estimate the net cash flow generated by the property. Understanding projected cash flows is essential for both landlords and tenants to assess the financial viability and sustainability of the lease agreement.

For landlords, a robust cash flow projection helps determine the investment’s profitability and ability to meet financial obligations. For instance, a property with consistently positive cash flow can cover mortgage payments, operating expenses, and potentially provide a return on investment. Conversely, a negative cash flow projection might signal potential financial distress and necessitate adjustments to rental rates or operating expenses. Consider a scenario where rising property taxes significantly impact a landlord’s projected cash flow. This projection allows the landlord to proactively explore options such as rent escalations or cost-cutting measures to maintain financial stability.

Tenants also benefit from analyzing cash flow projections. A landlord’s stable and positive cash flow can indicate their ability to maintain the property effectively and respond to tenant needs. This can translate to a better tenant experience with timely maintenance and a responsive management team. Conversely, a landlord struggling with cash flow might defer maintenance or struggle to address tenant concerns, potentially impacting business operations for the tenant. A tenant reviewing a potential lease might find that the landlord’s projected cash flow relies heavily on high occupancy rates. This insight allows the tenant to assess the risk associated with potential vacancies impacting the landlord’s ability to maintain the property adequately.

Accurate cash flow projections are essential for informed decision-making in commercial leasing. By analyzing projected inflows and outflows, stakeholders can assess potential risks and opportunities, negotiate favorable lease terms, and develop sound financial strategies for the duration of the lease agreement. This forward-looking perspective provided by the cash flow projection complements the historical data presented in other financial statements, creating a comprehensive financial overview crucial for sound investment and occupancy decisions.

4. Operating Expenses

Operating expenses represent a crucial aspect of financial statements within commercial leasing. A detailed understanding of these expenses is essential for both landlords and tenants to accurately assess the financial viability of a lease agreement. These expenses directly impact the net operating income (NOI) of a property and, consequently, the overall return on investment for the landlord and the occupancy cost for the tenant. Careful analysis of operating expenses facilitates informed negotiations and contributes to a transparent and sustainable lease arrangement.

- Property TaxesProperty taxes are levied by local governments and represent a significant portion of operating expenses. Rates can vary based on property location and assessed value. Increases in property taxes can impact both the landlord’s profitability and the tenant’s expenses, especially under a net lease agreement where the tenant is responsible for a portion of these costs. For example, a significant reassessment of a property’s value leading to higher taxes could necessitate rent adjustments to maintain the landlord’s desired return.

- InsuranceProperty insurance protects against potential losses from events like fire, natural disasters, or liability claims. Premiums can fluctuate based on factors like location, property type, and coverage levels. Adequate insurance coverage is critical for both the landlord and tenant, and its cost is a significant operating expense. A change in insurance requirements due to increased risk factors in the area could lead to higher premiums, impacting the overall operating costs of the property.

- Maintenance and RepairsRegular maintenance and unforeseen repairs are essential for preserving the property’s value and functionality. These expenses can vary significantly depending on the property’s age, condition, and complexity of systems. Clearly defining responsibilities for maintenance and repairs within the lease agreement is essential to avoid disputes. A major repair, such as replacing a roof or HVAC system, can have a substantial impact on cash flow and potentially necessitate adjustments to operating budgets for both landlord and tenant.

- UtilitiesUtilities, including water, electricity, gas, and waste disposal, are ongoing operating expenses. Consumption levels depend on the property’s usage, efficiency of systems, and tenant behavior. Understanding utility cost allocation is crucial, especially in multi-tenant buildings. Implementing energy-efficient measures can contribute to cost savings for both the landlord and tenant, positively impacting the overall financial performance of the lease.

A thorough understanding of operating expenses and their potential impact on the bottom line is critical for successful commercial leasing. Transparency and clear communication regarding these expenses contribute to a mutually beneficial and sustainable landlord-tenant relationship. By carefully analyzing these costs, both parties can make informed decisions regarding lease terms, rent adjustments, and overall financial planning. Furthermore, considering these expenses within the broader context of the financial statement allows for a more comprehensive assessment of the lease’s financial viability.

5. Rent Payment Schedule

The rent payment schedule acts as a critical bridge between the overarching financial statement for a commercial lease and the practical implementation of the lease agreement. It delineates the concrete terms of rent payments, outlining the amount, frequency, and due dates throughout the lease term. This schedule directly influences the landlord’s projected cash flow and the tenant’s budgeting for occupancy costs. A clearly defined rent payment schedule provides transparency and predictability, minimizing potential disputes and fostering a stable landlord-tenant relationship. For instance, a lease might stipulate monthly rent payments of $10,000 due on the first of each month, with specific provisions for late payment penalties. This detailed schedule allows both parties to accurately forecast their financial obligations and manage their respective cash flows effectively.

Beyond the basic payment details, the rent payment schedule can also incorporate provisions for rent escalations, percentage rent, or other variable rent structures. Rent escalations, often tied to inflation indices or market rates, provide a mechanism for adjusting rent periodically. Percentage rent, common in retail leases, links rent payments to the tenant’s sales performance, aligning the landlord’s income with the tenant’s success. These variable rent structures introduce complexities that require careful consideration within the broader financial statement. For example, projecting future cash flows under a percentage rent structure necessitates forecasting the tenant’s sales performance, adding a layer of uncertainty to the financial analysis. Understanding these nuances within the rent payment schedule is crucial for accurate financial forecasting and informed decision-making.

In conclusion, the rent payment schedule serves as a vital component of the financial statement for a commercial lease. It translates the abstract financial projections into concrete payment terms, providing clarity and predictability for both landlord and tenant. Careful analysis of the rent payment schedule, including any variable rent components, is crucial for accurate financial forecasting, effective budgeting, and a successful landlord-tenant relationship. Its integration within the broader financial statement allows for a comprehensive understanding of the lease’s financial implications, fostering informed decision-making and contributing to the long-term success of the lease agreement.

6. Tenant Improvements Allowance

Tenant improvements allowance (TIA) represents a crucial financial component within commercial lease agreements and holds significant relevance within the broader context of a financial statement for such a lease. TIA refers to the funds provided by the landlord to the tenant to customize the leased space to meet the tenant’s specific business needs. This allowance can cover costs associated with renovations, alterations, fixtures, and other improvements. The inclusion and accurate reflection of TIA within the financial statement are crucial for both landlords and tenants to understand the true financial implications of the lease agreement. For landlords, TIA represents a capital expenditure that impacts their investment’s overall profitability. For tenants, TIA provides a valuable resource for creating a functional and productive workspace without incurring substantial upfront costs. For example, a landlord offering a $50 per square foot TIA for a 10,000 square foot space would allocate $500,000 towards tenant improvements. This amount needs to be reflected accurately in the landlord’s financial statement as an outflow. The tenant, on the other hand, can utilize this allowance to tailor the space to their specific needs, reducing their initial capital outlay for setting up operations. This understanding fosters transparency and helps manage expectations effectively.

The accounting treatment of TIA further underscores its importance within the financial statement. For landlords, TIA is typically amortized over the lease term, impacting the property’s depreciation schedule and influencing net operating income calculations. This amortization reflects the gradual consumption of the investment in tenant improvements over time. Understanding the impact of TIA amortization on the landlord’s financial statement is crucial for accurate profit projections and tax planning. For tenants, while not directly impacting their financial statements, TIA significantly influences their initial cash outlay and overall project budget. Consider a scenario where a tenant plans to open a restaurant in a newly leased space. The TIA provided by the landlord can cover essential build-out costs such as kitchen equipment installation and interior design, significantly reducing the tenant’s initial investment and impacting their cash flow projections.

In conclusion, TIA represents a significant financial element in commercial leasing, playing a crucial role in the overall financial statement. Accurate accounting and transparent communication regarding TIA are essential for both landlords and tenants. By understanding the impact of TIA on financial projections, cash flow, and budgeting, both parties can make informed decisions, negotiate favorable lease terms, and build a sustainable landlord-tenant relationship. Ignoring or misrepresenting TIA within the financial statement can lead to misaligned expectations, potential disputes, and inaccurate financial forecasting, highlighting the practical significance of this understanding within the context of commercial leasing.

Key Components of a Financial Statement for a Commercial Lease

A comprehensive financial statement for a commercial lease encompasses several key components, each providing crucial insights into the financial viability and sustainability of the lease agreement. These components, when analyzed collectively, offer a robust framework for informed decision-making by both landlords and tenants.

1. Income Statement: This statement details the property’s financial performance over a specific period, outlining revenues (primarily rental income) and expenses (operating costs, depreciation). Net operating income (NOI), a key metric derived from the income statement, reveals the property’s profitability before debt service.

2. Balance Sheet: Providing a snapshot of the property’s financial position at a specific point in time, the balance sheet outlines assets, liabilities, and equity. This information is essential for assessing the landlord’s financial stability and the property’s overall financial health.

3. Cash Flow Projection: This forward-looking statement projects the anticipated movement of money into and out of the property. It considers factors like rental income, operating expenses, and capital expenditures to estimate future net cash flows, crucial for assessing investment viability and budgeting.

4. Rent Payment Schedule: This schedule outlines the concrete terms of rent payments, specifying the amount, frequency, and due dates. It may also incorporate provisions for rent escalations or percentage rent, adding complexity to financial projections.

5. Operating Expenses Statement: This statement provides a detailed breakdown of all operating costs associated with the property, including property taxes, insurance, maintenance, and utilities. Understanding these expenses is crucial for both landlords and tenants to accurately assess profitability and occupancy costs.

6. Tenant Improvements Allowance (TIA) Schedule: This component details the funds allocated by the landlord for tenant-specific customizations to the leased space. Proper accounting for TIA within the financial statement is crucial for accurate financial forecasting and budgeting by both parties.

Accurate analysis and interpretation of these interconnected elements are essential for successful commercial leasing. This detailed financial overview empowers both landlords and tenants to assess potential risks and opportunities, negotiate favorable lease terms, and develop sound financial strategies for the duration of the lease agreement.

How to Create a Financial Statement for a Commercial Lease

Developing a robust financial statement for a commercial lease requires a structured approach and careful consideration of key financial components. This process facilitates transparency, informed decision-making, and a clear understanding of the lease’s financial implications for both landlords and tenants.

1. Define the Lease Term and Property Details: Begin by clearly defining the lease term and specifying the property’s details, including address, size, and intended use. This contextual information sets the foundation for subsequent financial analysis.

2. Project Rental Income: Project the rental income based on agreed-upon terms, considering factors like base rent, rent escalations, and any percentage rent arrangements. Accurate rental income projection is fundamental to assessing profitability.

3. Estimate Operating Expenses: Develop a comprehensive estimate of operating expenses, including property taxes, insurance, maintenance, utilities, and management fees. Detailed expense projections are crucial for accurate NOI calculation.

4. Calculate Net Operating Income (NOI): Subtract projected operating expenses from projected rental income to arrive at the NOI. NOI is a key metric for assessing the property’s profitability and potential return on investment.

5. Develop a Cash Flow Projection: Project the anticipated cash inflows and outflows associated with the property over the lease term. Consider factors like rental income, operating expenses, debt service, and capital expenditures to estimate net cash flow.

6. Outline the Rent Payment Schedule: Clearly specify the rent payment terms, including amount, frequency, and due dates. Incorporate any provisions for rent escalations or percentage rent. A detailed schedule ensures clarity and predictability for both parties.

7. Detail Tenant Improvements Allowance (TIA): Specify the amount and terms of any TIA offered by the landlord. Clearly outline how TIA will be disbursed and accounted for within the financial statement. Transparency regarding TIA is crucial for both parties.

8. Review and Refine: Regularly review and refine the financial statement to reflect changes in market conditions, operating expenses, or lease terms. This ongoing process ensures the statement remains accurate and relevant throughout the lease term.

A well-structured financial statement, incorporating these key components, provides a comprehensive financial overview of the commercial lease, facilitating informed decision-making, transparent negotiations, and a successful landlord-tenant relationship. This structured approach allows stakeholders to accurately assess potential risks and opportunities, ultimately contributing to the long-term viability and success of the lease agreement.

Careful consideration of a structured financial approach to commercial leasing, encompassing key elements such as income statements, balance sheets, cash flow projections, operating expenses, rent payment schedules, and tenant improvement allowances, provides crucial insights into the financial implications of such agreements. Understanding these components empowers both landlords and tenants to make informed decisions, negotiate favorable terms, and mitigate potential financial risks. A thorough analysis of these financial documents facilitates transparency and promotes a sustainable landlord-tenant relationship built on a shared understanding of the financial dynamics at play.

In the complex landscape of commercial real estate, a robust financial framework serves as an indispensable tool for navigating lease negotiations and ensuring the long-term success of such arrangements. Proactive financial planning and a commitment to transparency in financial reporting contribute significantly to mutually beneficial outcomes. This meticulous approach to financial analysis fosters trust, mitigates potential disputes, and lays the groundwork for a stable and prosperous landlord-tenant partnership.