Utilizing pre-designed formats for these reports offers several key advantages. They streamline the reporting process, ensuring consistency and reducing the likelihood of errors. These formats often incorporate best practices and comply with industry standards, enhancing credibility and simplifying comparisons across organizations. Furthermore, they can simplify internal financial analysis, enabling informed decision-making for strategic planning and resource allocation.

This article will delve deeper into specific components commonly found in these reports, including the statement of financial position, the statement of activities, and the statement of cash flows. It will also explore best practices for their preparation and utilization, ultimately empowering nonprofit organizations to leverage these crucial tools for effective financial management and communication.

1. Standardized Format

Standardized formats are fundamental to the efficacy of financial statement templates for nonprofit organizations. A consistent structure ensures comparability across reporting periods and between different organizations. This comparability allows stakeholders, including funders and regulators, to readily assess financial health, performance, and the effective utilization of resources. Standardized templates typically adhere to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), providing a framework for consistent reporting of revenues, expenses, assets, and liabilities. This consistency enables trend analysis, benchmarking against similar organizations, and informed decision-making based on reliable data.

For example, a standardized statement of financial position template ensures that assets and liabilities are categorized and presented uniformly, facilitating direct comparisons of an organization’s financial standing year over year. Similarly, a standardized statement of activities template ensures consistency in the reporting of revenues and expenses, enabling stakeholders to track program effectiveness and administrative costs over time. Without a standardized format, comparing financial data would be significantly more complex and potentially misleading, hindering effective analysis and oversight.

In conclusion, the adoption of standardized formats in financial statement templates is crucial for nonprofit transparency, accountability, and effective financial management. It facilitates meaningful comparisons, simplifies analysis, and supports informed decision-making by stakeholders. Adherence to established accounting standards through standardized templates strengthens the credibility of nonprofit reporting and fosters trust within the sector.

2. Transparency and Accountability

Transparency and accountability are cornerstones of effective nonprofit governance. They foster trust with donors, grant-making organizations, and the public, demonstrating responsible resource management and commitment to mission fulfillment. Financial statement templates play a crucial role in achieving these essential elements of nonprofit operations.

- Public Trust and Donor ConfidenceOpenly communicating financial information through standardized reports builds public trust and strengthens donor confidence. Clear and accessible financial data demonstrates how contributions are utilized and the impact they achieve. This transparency encourages continued support and attracts new donors, bolstering an organization’s financial stability. For instance, a transparent statement of activities clearly outlines program expenses, demonstrating the direct impact of donor contributions on the organization’s mission.

- Regulatory Compliance and Legal RequirementsNonprofit organizations operate within a regulatory framework that mandates financial reporting and disclosure. Utilizing templates ensures compliance with these requirements, mitigating legal risks and maintaining operational integrity. Accurate and consistent reporting through standardized templates facilitates audits and regulatory reviews, demonstrating adherence to legal obligations. Failure to meet these requirements can result in penalties, loss of tax-exempt status, and damage to reputation.

- Internal Controls and Fraud PreventionStructured financial reporting through templates strengthens internal controls, reducing the risk of financial mismanagement and fraud. Templates enforce consistency and standardization, making discrepancies and irregularities easier to detect. This enhanced oversight protects organizational assets and ensures resources are used ethically and efficiently. For example, a well-designed template for cash flow statements helps monitor cash inflows and outflows, identifying potential areas of vulnerability to fraud.

- Strategic Planning and Performance MeasurementTransparent financial data, readily available through standardized templates, informs strategic planning and facilitates performance measurement. By analyzing historical financial trends and comparing performance against benchmarks, organizations can make data-driven decisions, allocate resources effectively, and refine strategies to achieve their mission. Consistent reporting allows for the tracking of key performance indicators (KPIs) over time, providing valuable insights into program effectiveness and overall organizational performance.

In conclusion, transparency and accountability are inextricably linked to the effective utilization of financial statement templates. By providing a standardized framework for reporting financial data, these templates enable nonprofit organizations to build trust with stakeholders, comply with regulatory requirements, strengthen internal controls, and enhance strategic decision-making. These factors contribute to the long-term sustainability and success of nonprofit organizations in fulfilling their missions.

3. Simplified Reporting

Simplified reporting is a direct benefit derived from utilizing well-designed financial statement templates for nonprofit organizations. Templates streamline the reporting process by providing a pre-defined structure for organizing and presenting financial data. This eliminates the need to create reports from scratch, saving significant time and resources. Standardized templates ensure consistency across reporting periods, reducing the likelihood of errors and simplifying the analysis of financial trends. This efficiency allows staff to focus on core mission-related activities rather than complex reporting procedures. For example, a template for a statement of cash flows guides the categorization and reporting of cash inflows and outflows, simplifying a complex aspect of financial reporting. Templates also often incorporate formulas and automated calculations, further reducing manual data entry and minimizing the potential for human error. This automation enhances accuracy and efficiency, freeing up staff time for analysis and interpretation of the financial data.

The use of templates fosters greater accuracy in financial reporting. Pre-defined fields and standardized formats minimize data entry errors and ensure consistent application of accounting principles. This accuracy is critical for maintaining the credibility of the organization with funders, regulators, and other stakeholders. Furthermore, simplified reporting through templates enhances the accessibility of financial information for board members and non-financial staff. Clear and concise presentations of financial data facilitate better understanding and informed decision-making at all levels of the organization. For instance, a readily understandable statement of activities template can empower program managers to monitor their budgets effectively and make informed spending decisions.

In conclusion, simplified reporting through the use of financial statement templates significantly benefits nonprofit organizations. Streamlined processes, enhanced accuracy, and improved accessibility of financial information contribute to more efficient operations, stronger internal controls, and better-informed decision-making. By reducing the administrative burden of financial reporting, templates enable organizations to allocate more time and resources to fulfilling their core missions and achieving their strategic objectives. The long-term benefits of simplified reporting extend beyond efficiency gains, contributing to greater transparency, accountability, and ultimately, the sustainability of the organization.

4. Informed Decision-Making

Effective financial management within nonprofit organizations hinges on the ability to make informed decisions based on accurate and accessible financial data. Standardized financial statement templates provide the framework for organizing and presenting this crucial information, enabling stakeholders to understand an organization’s financial health, performance, and resource allocation. These templates empower data-driven decision-making across all levels of the organization, from program managers to executive leadership and the board of directors.

- Strategic Planning and Resource AllocationTemplates for statements of activities and cash flow projections provide insights into revenue streams, expense trends, and funding gaps. This information is essential for developing realistic budgets, prioritizing programs, and allocating resources effectively. For example, analyzing historical expense data from a statement of activities can inform decisions about future program expansion or cost-cutting measures. Accurate financial projections facilitated by templates enable informed resource allocation, ensuring that funds are directed towards programs with the greatest impact.

- Program Evaluation and Performance MeasurementFinancial statement templates enable the tracking of program-specific expenses and outcomes. By comparing actual results against budgeted figures, organizations can assess program effectiveness and make data-driven adjustments to improve performance. For instance, a statement of functional expenses can reveal the cost-effectiveness of various fundraising initiatives, enabling organizations to optimize their fundraising strategies. This data-driven approach to program evaluation strengthens accountability and ensures that resources are used efficiently.

- Financial Risk Management and SustainabilityAnalyzing financial statements generated through templates allows organizations to identify potential financial risks and vulnerabilities. Understanding cash flow patterns, debt levels, and reliance on specific funding sources enables proactive risk mitigation and strengthens long-term financial sustainability. For example, consistent monitoring of the statement of financial position can alert organizations to declining asset levels or increasing liabilities, prompting corrective action. This proactive approach to financial management enhances organizational resilience and safeguards against unforeseen financial challenges.

- Stakeholder Communication and TransparencyClear and concise financial statements, generated using standardized templates, facilitate transparent communication with stakeholders, including donors, grant-makers, and regulatory bodies. Providing readily accessible financial information builds trust, demonstrates accountability, and strengthens relationships with key stakeholders. For instance, sharing a well-structured statement of activities with donors demonstrates how their contributions are being utilized, fostering continued support. Transparent financial reporting enhances an organization’s credibility and reinforces its commitment to responsible resource management.

In conclusion, informed decision-making is inextricably linked to the effective utilization of financial statement templates in nonprofit organizations. These templates provide the crucial framework for organizing, analyzing, and communicating financial information, enabling data-driven decisions at all levels. By empowering stakeholders with accurate and accessible financial data, these templates contribute to more effective strategic planning, program evaluation, risk management, and stakeholder communication, ultimately strengthening the organization’s mission fulfillment and long-term sustainability. Consistent use of templates promotes a culture of data-driven decision-making, fostering financial stability and enhancing the impact of nonprofit organizations.

5. Compliance and Credibility

Maintaining compliance with regulatory requirements and establishing credibility with stakeholders are paramount for nonprofit organizations. Financial statement templates play a critical role in achieving both. Accurately prepared and consistently presented financial statements demonstrate responsible stewardship of resources, build trust with funders and the public, and ensure adherence to legal obligations. Utilizing templates strengthens internal controls, reduces the risk of errors, and promotes transparency, all of which contribute to an organization’s credibility and long-term sustainability.

- Regulatory ComplianceNonprofit organizations operate under stringent regulatory frameworks, including federal and state laws, as well as guidelines from governing bodies. Financial statement templates help ensure compliance with these regulations by providing a standardized framework for reporting financial data. Adherence to Generally Accepted Accounting Principles (GAAP) through the use of templates strengthens an organization’s legal standing and facilitates audits and regulatory reviews. For example, correctly categorizing and reporting restricted contributions according to GAAP using a designated template ensures compliance with regulations governing the use of such funds. Failure to comply with regulatory requirements can result in penalties, loss of tax-exempt status, and damage to reputation.

- Donor Confidence and Funding OpportunitiesCredibility with donors is essential for securing funding and ensuring the long-term sustainability of a nonprofit. Transparent and accurate financial reporting, facilitated by templates, demonstrates responsible financial management and builds trust with funders. Clear presentation of financial data through standardized templates allows donors to readily understand how their contributions are being utilized, fostering continued support and attracting new funding opportunities. Conversely, inconsistent or opaque financial reporting can erode donor confidence and jeopardize future funding prospects.

- Internal Controls and Fraud PreventionRobust internal controls are crucial for preventing fraud and ensuring the ethical and efficient use of resources. Financial statement templates strengthen internal controls by standardizing reporting processes and reducing the risk of errors and inconsistencies. Templates facilitate the implementation of checks and balances, such as segregation of duties and regular reconciliations, which are critical for preventing and detecting financial irregularities. For example, using a template for bank reconciliations helps identify discrepancies and potential instances of fraud. Strong internal controls, supported by standardized templates, protect organizational assets and enhance credibility with stakeholders.

- Public Accountability and TransparencyNonprofit organizations have a responsibility to operate transparently and be accountable to the public. Financial statement templates support this accountability by providing a clear and accessible format for presenting financial information. Publishing annual reports that include standardized financial statements demonstrates a commitment to transparency and builds public trust. This transparency strengthens an organization’s reputation and fosters public support for its mission. For example, a readily understandable statement of activities clearly demonstrates how an organization allocates its resources, promoting public understanding and fostering confidence.

In conclusion, compliance and credibility are intertwined and essential for the long-term health and sustainability of nonprofit organizations. Financial statement templates serve as invaluable tools for achieving both. By providing a standardized framework for reporting financial data, these templates ensure adherence to regulatory requirements, build trust with donors and the public, strengthen internal controls, and promote transparency. The consistent and accurate use of financial statement templates strengthens an organization’s financial integrity, enhances its reputation, and ultimately empowers it to fulfill its mission effectively.

Key Components of Nonprofit Financial Statements

Nonprofit financial statements provide a comprehensive overview of an organization’s financial health and activities. Understanding the key components of these statements is crucial for effective financial management, transparency, and accountability. The following elements provide a standardized framework for presenting financial information to stakeholders.

1. Statement of Financial Position (Balance Sheet): This statement presents a snapshot of an organization’s assets, liabilities, and net assets at a specific point in time. Assets represent what the organization owns, liabilities represent what it owes, and net assets represent the difference between the two. The statement of financial position provides insights into an organization’s financial strength and stability.

2. Statement of Activities (Income Statement): This statement reports an organization’s revenues and expenses over a specific period, typically a fiscal year. It shows how resources were generated and utilized during that period. The difference between revenues and expenses represents the change in net assets, indicating whether the organization operated at a surplus or deficit.

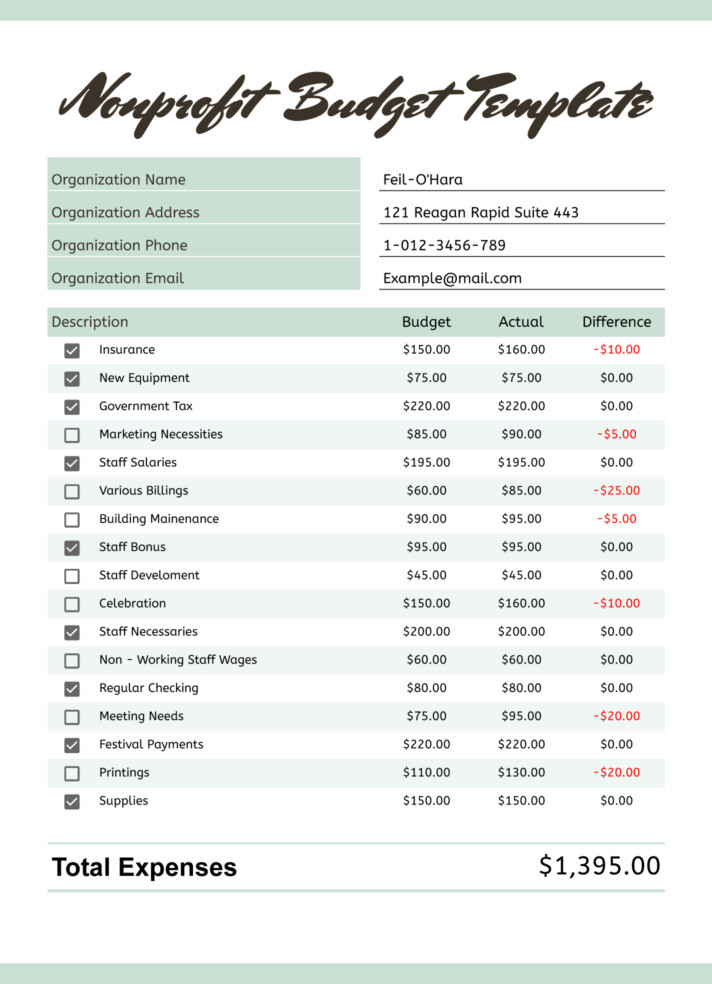

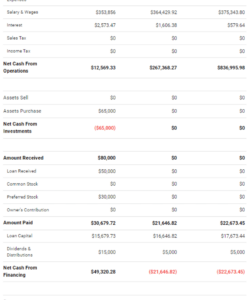

3. Statement of Cash Flows: This statement tracks the flow of cash both into and out of an organization during a specific period. It categorizes cash flows into operating activities, investing activities, and financing activities. The statement of cash flows provides insights into an organization’s liquidity and its ability to meet short-term obligations.

4. Statement of Functional Expenses: This statement details how expenses are allocated across different functional areas, such as program services, administration, and fundraising. It provides a clearer picture of how resources are utilized to support the organization’s mission and operations. This breakdown enhances transparency and allows stakeholders to assess the proportion of resources dedicated to program activities versus supporting functions.

5. Notes to the Financial Statements: These notes provide additional details and context to the information presented in the core financial statements. They include explanations of accounting policies, significant events, and other relevant disclosures necessary for a comprehensive understanding of an organization’s financial position. The notes enhance transparency and ensure compliance with accounting standards.

These interconnected statements, along with accompanying notes, provide a robust and transparent view of a nonprofit’s financial operations, enabling informed decision-making by stakeholders, fostering accountability, and promoting sound financial management practices. Consistent and accurate preparation of these components is fundamental to the long-term sustainability and success of any nonprofit organization.

How to Create a Financial Statement Template for Nonprofits

Creating effective financial statement templates requires careful planning and adherence to established accounting principles. A well-structured template ensures consistency, accuracy, and transparency in financial reporting, supporting informed decision-making and strengthening accountability. The following steps outline the process of developing robust and practical templates for nonprofit organizations.

1. Determine Reporting Requirements: Begin by identifying the specific reporting requirements relevant to the organization. This includes legal obligations, funder mandates, and internal management needs. Consider the necessary financial statements, such as the Statement of Financial Position, Statement of Activities, and Statement of Cash Flows, along with any required supplementary schedules. Understanding these requirements ensures the template captures all essential financial data.

2. Select an Appropriate Software: Choose spreadsheet software or dedicated accounting software capable of handling financial data and generating reports. Consider factors such as ease of use, data security, and the ability to customize templates. Spreadsheet software offers flexibility for smaller organizations, while dedicated accounting software may be necessary for larger organizations with complex financial transactions. Selecting the right software is crucial for efficient and accurate reporting.

3. Design the Template Structure: Develop a clear and consistent structure for each financial statement template. Use standardized formats and headings to ensure comparability across reporting periods. Incorporate formulas and automated calculations where possible to minimize manual data entry and reduce the risk of errors. A well-structured template simplifies data entry and ensures accuracy.

4. Incorporate Chart of Accounts: Integrate the organization’s chart of accounts into the template. This ensures consistent categorization of financial transactions and facilitates the generation of accurate reports. The chart of accounts provides a standardized framework for classifying revenues, expenses, assets, and liabilities. Accurate categorization is crucial for meaningful financial analysis.

5. Establish Data Validation Rules: Implement data validation rules within the template to prevent data entry errors and ensure data integrity. These rules can restrict input to specific data types or ranges, minimizing the risk of inaccuracies. Data validation enhances the reliability of financial information and supports informed decision-making.

6. Test and Refine the Template: Thoroughly test the template with sample data to identify and correct any errors or inconsistencies. Solicit feedback from staff and stakeholders to ensure the template meets their needs and is user-friendly. Testing and refinement are essential for ensuring the template’s effectiveness and accuracy.

7. Document and Train Staff: Develop clear documentation explaining how to use the templates effectively. Provide training to staff responsible for data entry and report generation. Proper documentation and training ensure consistent application of the templates and minimize errors. Ongoing support and training enhance staff proficiency and ensure data accuracy.

8. Regularly Review and Update: Periodically review and update the templates to reflect changes in accounting standards, regulatory requirements, or organizational needs. Regular review ensures the templates remain relevant and effective in supporting accurate and compliant financial reporting. Adaptability to changing requirements is essential for maintaining the template’s usefulness.

By following these steps, nonprofit organizations can develop effective financial statement templates that streamline reporting processes, enhance accuracy, promote transparency, and support informed decision-making. These templates serve as valuable tools for effective financial management and strengthen accountability to stakeholders.

Standardized financial reporting documents tailored for the nonprofit sector offer a crucial framework for communicating financial health, performance, and accountability. This structured approach to presenting financial data empowers organizations to demonstrate responsible resource management, build trust with stakeholders, and make informed decisions. From simplified reporting processes to enhanced transparency and compliance, the utilization of these pre-designed formats offers significant benefits. Understanding the key components of these reportsincluding the statement of financial position, statement of activities, and statement of cash flowsand adhering to best practices for their creation and utilization are essential for effective financial management.

Effective financial stewardship is paramount for the long-term sustainability and success of any nonprofit organization. Embracing standardized reporting through thoughtfully designed templates strengthens not only financial management but also the organization’s ability to fulfill its mission and achieve its strategic objectives. Consistent, accurate, and transparent financial reporting fosters trust, attracts support, and ultimately empowers organizations to make a greater impact on the communities they serve.