Leveraging a pre-designed structure offers several advantages. It streamlines the request process, reducing the time and effort required by both the requesting and providing parties. Clear communication reduces the likelihood of misunderstandings and ensures the provided documents meet the requester’s specific needs. This efficiency ultimately leads to faster access to critical financial information, enabling more timely decision-making. Furthermore, a consistent format promotes professionalism and strengthens the credibility of the request.

This article will delve deeper into the components of effective requests, provide practical examples, and explore various scenarios where these requests are commonly utilized.

1. Clear Recipient Identification

Accurate recipient identification is paramount within a financial statement request. Misdirected requests lead to delays, potentially jeopardizing critical business decisions. A clear identification process ensures the request reaches the appropriate individual or department promptly and efficiently.

- Correct Name and Title:Addressing the request to the correct individual, using their full name and accurate title, minimizes processing time. This demonstrates professionalism and respect, fostering a positive working relationship. For example, addressing the Chief Financial Officer directly, rather than a general department, ensures prompt attention.

- Accurate Department/Division:When the specific individual is unknown, directing the request to the correct department or division is essential. This ensures the request reaches individuals responsible for handling such requests. For instance, directing the request to the “Financial Reporting Department” is more effective than simply “Accounting.”

- Complete Mailing/Email Address:Providing a complete and accurate mailing address or email address is crucial for successful delivery. This eliminates potential routing errors and ensures timely receipt. Double-checking these details minimizes delays caused by returned mail or misdirected emails.

- Reference or Account Numbers:Including relevant reference or account numbers, particularly in ongoing business relationships, further streamlines processing. This information connects the request to specific accounts or previous communications, expediting retrieval and response times. This is particularly important in requests related to loans, investments, or audits.

These components of clear recipient identification contribute significantly to the overall effectiveness of a financial statement request. Accurate identification ensures the request reaches the intended recipient promptly, facilitating a smooth and efficient process for obtaining the necessary financial information.

2. Specific Statement Types

Clarity regarding the specific financial statements required is crucial for an effective request. Ambiguity in the request can lead to the provision of incorrect or incomplete information, necessitating further clarification and causing delays. A well-defined request specifies the exact documents needed, ensuring the recipient understands the request’s scope.

- Balance Sheet:Requesting a balance sheet provides a snapshot of an entity’s financial position at a specific point in time. It details assets, liabilities, and equity, offering insights into an entity’s financial health and solvency. For loan applications, lenders often require balance sheets to assess an applicant’s current financial standing.

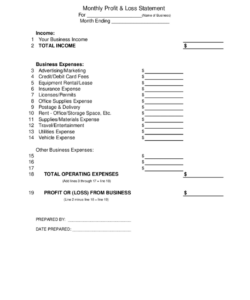

- Income Statement:An income statement, or profit and loss statement, reports an entity’s financial performance over a specific period. It details revenues, expenses, and resulting profit or loss, providing insights into an entity’s operational efficiency and profitability. Investors frequently analyze income statements to evaluate a company’s earning potential.

- Cash Flow Statement:A cash flow statement tracks the movement of cash both into and out of an entity during a specific period. It categorizes cash flows into operating, investing, and financing activities, offering a clear picture of an entity’s liquidity and cash management practices. Creditors may use cash flow statements to assess an entity’s ability to repay debt.

- Statement of Changes in Equity:This statement details the changes in an entity’s equity over a specific period. It outlines investments by owners, distributions to owners, and changes resulting from net income or loss. This statement is particularly relevant for understanding ownership structure and changes in retained earnings.

Specifying the required statement types within the request ensures the recipient provides the correct documentation, facilitating efficient analysis and decision-making. This clarity minimizes back-and-forth communication, accelerating the process of obtaining the necessary financial information and contributing to the overall effectiveness of the request. Furthermore, specifying the required statements demonstrates professionalism and a clear understanding of the information needed.

3. Precise Reporting Period

A precise reporting period is a critical component of a robust financial statement request letter template. Financial statements represent a snapshot of an entity’s financial position or performance at a specific point in time or over a defined period. Without a clearly defined reporting period, the recipient may provide information that does not align with the requester’s needs, leading to misinterpretations and potentially flawed decisions. A specific timeframe ensures the provided data is relevant to the analysis or decision-making process at hand. For example, a request for an income statement “for the year 2024” is ambiguous. A precise request would specify “for the fiscal year ended December 31, 2024,” or “for the calendar year 2024.” This clarity eliminates potential confusion and ensures the provided statement covers the correct period.

Consider a scenario where an investor is evaluating a company’s performance before making an investment decision. A request for financial statements without a specified reporting period might result in receiving statements from a period that doesn’t reflect the company’s current financial health. Conversely, a precise request, such as “for the fiscal year ended June 30, 2024,” provides the investor with the necessary information to make an informed decision. Similarly, regulatory bodies often require financial statements for specific reporting periods to ensure compliance. A clearly defined timeframe ensures the submitted statements meet regulatory requirements, avoiding potential penalties or delays in processing.

The inclusion of a precise reporting period within a financial statement request letter template is essential for obtaining relevant and accurate financial information. This specificity minimizes ambiguity, reduces the need for clarification, and ultimately contributes to informed decision-making. Challenges can arise when dealing with entities operating on different fiscal year-ends. Therefore, confirming the entity’s fiscal year-end is crucial before making the request, further reinforcing the importance of precision within financial communication.

4. Purpose of the Request

Articulating the purpose within a financial statement request strengthens the communication and facilitates efficient processing. A clear statement of purpose provides context, enabling the recipient to understand the reason behind the request and potentially expedite its fulfillment. This transparency fosters trust and professionalism, enhancing the overall effectiveness of the request process. Understanding the rationale behind the request allows the recipient to anticipate potential follow-up questions or required supporting documentation.

- Creditworthiness Assessment:When financial statements are required for a loan application or credit review, explicitly stating this purpose allows the recipient to prioritize the request and potentially tailor the information provided. Lenders utilize these statements to assess an applicant’s ability to repay debt, making a clear purpose essential for a timely and accurate credit decision. Providing context, such as the loan amount or type, further strengthens the request.

- Investment Due Diligence:Investors often request financial statements to conduct due diligence before making investment decisions. Clearly stating this purpose, along with the type of investment being considered, allows the recipient to provide relevant information, such as projected future performance or detailed breakdowns of revenue streams. This transparency enhances the investor’s understanding of the entity’s financial health and prospects.

- Regulatory Compliance:Regulatory bodies frequently require financial statements for compliance purposes. Specifying the regulatory requirement, such as an annual audit or a specific reporting obligation, ensures the recipient provides the correct information in the required format. This clarity minimizes potential delays or requests for clarification from the regulatory body, ensuring a smooth and efficient compliance process.

- Mergers and Acquisitions:Financial statements play a crucial role in mergers and acquisitions. When requesting statements for this purpose, specifying the nature of the transaction, such as a potential acquisition or merger, allows the recipient to provide comprehensive and relevant information. This transparency facilitates a thorough analysis of the target entity’s financial position, supporting informed decision-making during the transaction process.

By clearly articulating the purpose of the request within a financial statement request letter template, requesters enhance the efficiency and transparency of the process. This clarity fosters a more productive exchange of information, benefiting both the requester and the recipient. Providing context allows for a more tailored response, ensuring the provided financial statements meet the specific needs of the request and ultimately contribute to more informed decision-making.

5. Deadline for Submission

A clearly stipulated deadline within a financial statement request letter template is essential for managing expectations and ensuring timely receipt of the requested documents. This deadline serves as a critical component, driving the response process and facilitating efficient decision-making. Without a specified timeframe, responses may be delayed, potentially jeopardizing critical business activities reliant on the requested information. The deadline establishes a shared understanding between the requester and recipient regarding the expected delivery timeframe. This shared understanding promotes accountability and facilitates proactive communication in case unforeseen circumstances hinder adherence to the deadline.

Consider a scenario where a lender requires financial statements to finalize a loan approval. A request without a deadline could lead to an indeterminate waiting period, delaying the loan disbursement and potentially impacting the borrower’s business operations. Conversely, a clearly stated deadline allows the lender to manage the loan approval process effectively and communicate proactively with the borrower if further information or clarification is needed. Similarly, in mergers and acquisitions, adherence to deadlines for financial statement submissions is crucial for maintaining transaction timelines. Delays in receiving these statements can impede due diligence processes and potentially jeopardize the entire transaction. Therefore, a well-defined deadline serves as a critical control mechanism in such time-sensitive situations.

Specifying a realistic and achievable deadline within the request letter template benefits both the requester and recipient. An unrealistic deadline can create undue pressure and potentially compromise the accuracy of the provided information. A reasonable timeframe, considering the complexity and volume of the requested documents, allows the recipient sufficient time to gather and prepare the necessary information accurately. This promotes efficiency and reduces the likelihood of errors or omissions within the financial statements. Furthermore, incorporating a deadline fosters professionalism and demonstrates respect for the recipient’s time and resources. It reinforces the importance of the request and encourages timely action, ultimately contributing to a more effective and efficient information exchange process.

6. Contact Information

Comprehensive contact information is a critical component of a robust financial statement request letter template. Its inclusion facilitates clear communication channels between the requesting and providing parties, enabling efficient follow-up, clarification, and resolution of any potential issues related to the request. Without clear contact details, the process can become stalled, leading to delays in obtaining the required financial information. This can have significant consequences, particularly in time-sensitive situations such as loan applications, investment decisions, or regulatory compliance filings.

Providing multiple avenues for contact, such as telephone numbers, email addresses, and physical mailing addresses, maximizes accessibility and responsiveness. For example, a telephone number allows for immediate clarification of any ambiguities within the request, while an email address facilitates the secure transmission of electronic documents. Including a physical mailing address provides an alternative channel for communication, particularly for situations requiring formal documentation or when electronic communication is unavailable. Furthermore, specifying preferred contact methods and optimal times for reaching the requester streamlines the communication process, minimizing delays and ensuring prompt attention to any inquiries. Consider a scenario where the provided financial statements are incomplete or require further clarification. Clear contact information enables the recipient to promptly communicate the discrepancy to the requester, facilitating a rapid resolution and minimizing disruption to the overall process. Conversely, the absence of clear contact information can lead to significant delays and frustration, potentially hindering crucial business decisions.

In conclusion, the inclusion of comprehensive contact information within a financial statement request letter template is essential for ensuring a smooth and efficient process. It facilitates clear communication, enables prompt follow-up and clarification, and ultimately contributes to the timely acquisition of the necessary financial information. This seemingly minor detail plays a significant role in promoting professionalism, minimizing potential delays, and ensuring the effectiveness of the entire request process. Challenges related to outdated or incorrect contact information can be mitigated by emphasizing the importance of accurate contact details within the request letter template itself and implementing verification procedures within the requesting entity’s workflow.

Key Components of a Financial Statement Request

Effective requests for financial documentation necessitate careful attention to several key components to ensure clarity, completeness, and efficiency. These components contribute to a streamlined process, minimizing potential delays and facilitating informed decision-making.

1. Precise Identification of Requester: Full legal name, contact details (telephone, email, and physical address), and any relevant identification numbers (e.g., client, account, or reference numbers) are crucial for efficient processing and accurate routing.

2. Unambiguous Recipient Identification: Correct name, title, department, and complete contact information of the intended recipient are essential to prevent misdirection and delays. Accuracy minimizes processing time and ensures prompt attention.

3. Specific Statement Types: Clearly listing the required financial statements (e.g., balance sheet, income statement, statement of cash flows) eliminates ambiguity. Precise identification ensures the provided information aligns with the request’s objectives.

4. Explicit Reporting Period: A well-defined reporting period (e.g., fiscal year ending December 31, 2024) is essential for obtaining relevant and accurate data. This precision prevents the submission of outdated or irrelevant information.

5. Stated Purpose of the Request: Articulating the purpose of the request (e.g., loan application, investment due diligence, regulatory compliance) provides context and allows for a tailored response. This transparency fosters efficiency and facilitates better communication.

6. Reasonable Submission Deadline: A reasonable and clearly stated deadline facilitates timely responses and allows for effective planning. This promotes accountability and ensures the information is received within the required timeframe.

7. Authorization (If Applicable): When necessary, including explicit authorization or signed consent ensures compliance with privacy regulations and internal policies. This safeguards sensitive financial information and maintains ethical practices.

These components work in concert to create a robust and effective request, optimizing the process of obtaining necessary financial documentation and contributing to informed decision-making. Careful consideration of these elements ensures clarity, minimizes potential misunderstandings, and fosters professionalism in financial communication.

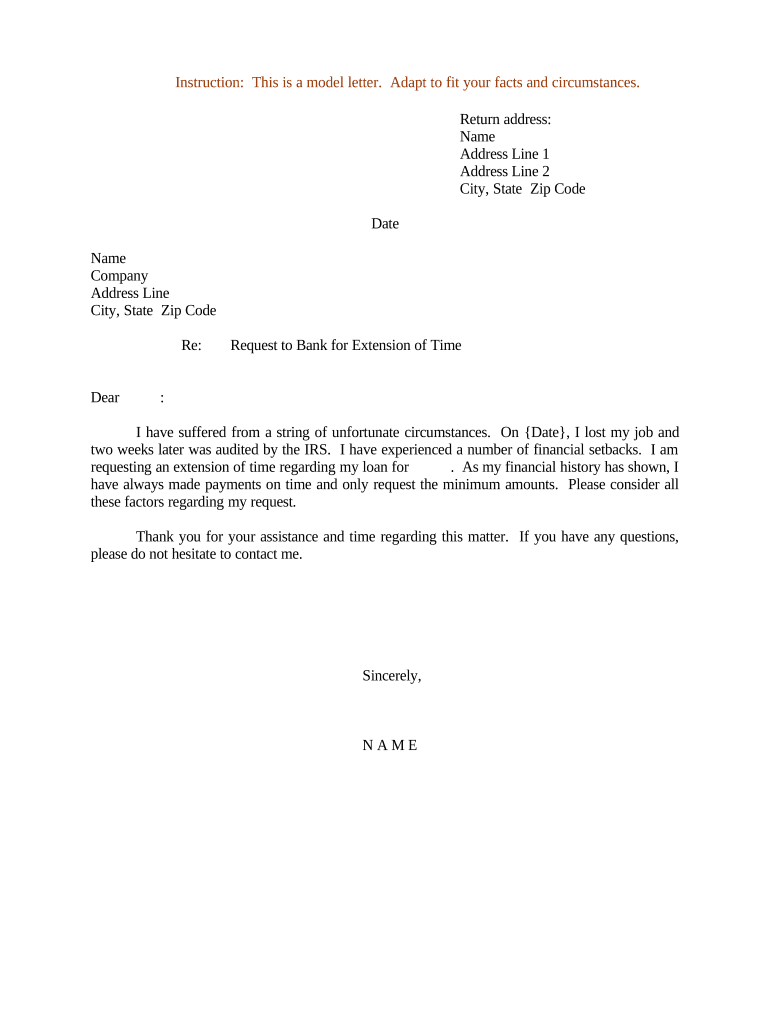

How to Create a Financial Statement Request Letter

Creating a well-structured request letter ensures clarity, efficiency, and professionalism in obtaining necessary financial documentation. Careful attention to key components facilitates a smooth process and minimizes potential delays.

1. Recipient Identification: Begin by accurately identifying the recipient’s full name, title, department, and complete contact information. Accurate addressing prevents misdirection and ensures prompt attention by the appropriate individual or department.

2. Requester Identification: Provide complete and accurate contact information, including the requester’s full legal name, telephone number, email address, and physical mailing address. This facilitates communication and enables efficient follow-up.

3. Date of Request: Clearly indicate the date of the request. This provides a reference point for tracking and managing the request within both the requesting and receiving entities.

4. Purpose of Request: Explicitly state the purpose for requesting the financial statements. This context allows the recipient to understand the request’s importance and potentially tailor the provided information accordingly. Examples include loan applications, investment due diligence, or regulatory compliance.

5. Specific Statement Types: Clearly specify the required financial statements, such as the balance sheet, income statement, cash flow statement, or statement of changes in equity. Avoid ambiguity by using precise terminology and, if necessary, specifying the reporting framework (e.g., US GAAP, IFRS).

6. Reporting Period: Define the precise reporting period for the requested statements. Use specific dates, such as “for the fiscal year ended December 31, 2024,” or “for the quarter ended September 30, 2024,” to avoid ambiguity. Ensure alignment with the recipient’s fiscal year-end if applicable.

7. Submission Deadline: Establish a reasonable and specific deadline for the submission of the requested documents. This facilitates timely responses and allows for effective planning within both organizations.

8. Authorization (if applicable): If required, include explicit authorization or signed consent to access and release the requested financial information, ensuring compliance with privacy regulations and internal policies.

A well-crafted request letter incorporates these elements to ensure clarity, promote efficiency, and maintain professionalism. This structured approach contributes to effective communication and facilitates the timely acquisition of required financial information.

Standardized formats for requesting financial documentation provide a crucial framework for obtaining essential business information. Accuracy in recipient and requester identification, coupled with precise articulation of the required statement types and reporting period, ensures clarity and minimizes potential delays. Explicitly stating the request’s purpose and establishing a reasonable deadline further strengthens the communication process. Attention to these details promotes efficiency and professionalism, contributing to informed decision-making processes reliant on accurate and timely financial data.

Effective financial communication underpins sound business practices. Adherence to established protocols and a commitment to clear, concise requests contribute to a more robust and transparent financial ecosystem. The ability to obtain necessary financial information efficiently empowers informed decisions, strengthens financial accountability, and ultimately fosters a more stable and prosperous business environment.