Utilizing such a document allows owners to monitor profitability, identify potential cash shortages, and make informed decisions regarding pricing, inventory, and staffing. This proactive financial management enables informed, data-driven decisions, contributing to long-term sustainability and success in a competitive market. It also proves invaluable when seeking loans or investments, demonstrating financial stability and viability to potential lenders or partners.

This understanding of financial tracking lays the groundwork for exploring related topics such as budgeting, profit forecasting, and securing funding for mobile food operations. A thorough exploration of these interconnected concepts will empower food truck operators to build thriving and resilient businesses.

1. Operating Activities

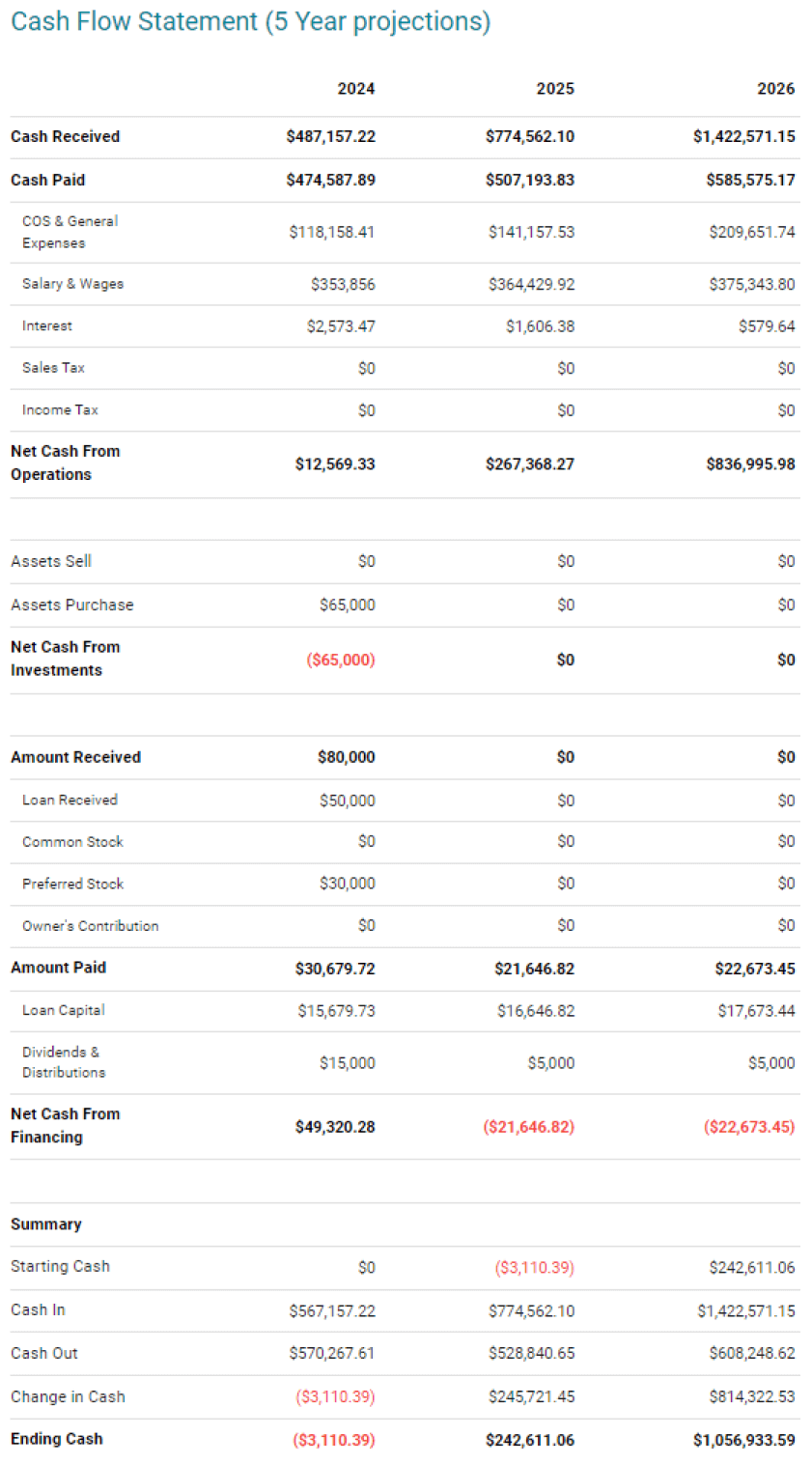

Operating activities form the core of a food truck cash flow statement template, representing the day-to-day financial transactions directly related to food production and sales. This section captures the inflows and outflows of cash generated by the core business operations. Accurately recording these activities provides essential insights into profitability and operational efficiency. For example, daily sales revenue from menu items constitutes a primary cash inflow. Conversely, outflows include expenses such as ingredient purchases, staff wages, fuel costs, and permit fees. The difference between these inflows and outflows reveals the net cash flow from operations, a key indicator of the business’s health.

Detailed tracking of operating activities allows owners to identify trends and potential issues. For instance, consistently high ingredient costs relative to sales may indicate a need to adjust menu pricing or sourcing strategies. Monitoring staff wages alongside sales volume can help optimize staffing levels. By analyzing these trends, operators can make informed decisions to improve profitability and operational efficiency. Without a clear understanding of operating cash flow, businesses risk overlooking critical financial vulnerabilities.

In summary, meticulous documentation of operating activities within a cash flow statement template provides a crucial foundation for sound financial management. This data-driven approach allows food truck operators to monitor profitability, identify areas for improvement, and make strategic decisions to ensure long-term financial stability. A comprehensive grasp of this section allows for proactive management of resources, contributing significantly to the overall success of the food truck business.

2. Investing Activities

Investing activities within a food truck cash flow statement template encompass the acquisition and disposal of long-term assets crucial for business operations. These activities, distinct from daily operational expenses, represent significant capital expenditures or divestitures that impact the business’s long-term financial health. Examples include purchasing a new food truck, upgrading kitchen equipment, or selling existing assets. Accurately recording these transactions provides essential insights into capital allocation and its effect on overall financial stability. The outflow of cash for a new, more efficient fryer, for example, represents an investment that may reduce future operating costs and increase revenue through expanded menu options. Conversely, selling an older, less efficient food truck generates a cash inflow but may impact service capacity.

Analyzing investing activities allows owners to assess the long-term return on investment for capital expenditures. Did the purchase of a new grill increase sales enough to justify its cost? Has the upgrade to a more energy-efficient refrigerator reduced operating expenses as anticipated? Understanding the financial impact of these decisions helps optimize capital allocation strategies and ensures resources are utilized effectively. A well-maintained record of investing activities also facilitates accurate valuation of the business, a crucial aspect when seeking financing or considering a sale.

In summary, the “Investing Activities” section of a food truck cash flow statement template provides a critical lens for evaluating long-term capital management strategies. By carefully tracking these investments and their subsequent impact on the business, owners gain a comprehensive understanding of their financial position. This informed perspective empowers data-driven decisions, contributing to sustainable growth and maximizing the potential for long-term profitability.

3. Financing Activities

Financing activities within a food truck cash flow statement template detail how a business raises capital and repays its financial obligations. This section provides insights into the business’s financial structure and its ability to meet its long-term debt commitments. Common financing activities include securing loans, receiving investments, repaying principal and interest, and distributing dividends (if applicable). For example, securing a small business loan results in a cash inflow, while repaying the loan principal represents a cash outflow. Equity investments from investors also generate cash inflows, potentially diluting ownership. Understanding these cash flows is crucial for assessing the long-term financial stability of the food truck operation.

Careful tracking of financing activities provides a clear picture of the business’s capital structure and debt burden. A high reliance on debt financing may indicate higher financial risk, especially during periods of slow sales. Conversely, a strong equity position suggests greater financial flexibility and stability. This information is critical for making informed decisions regarding future financing strategies. For example, a food truck owner considering expansion may analyze their current debt-to-equity ratio to determine the feasibility of securing additional financing. This analysis also aids in evaluating the overall cost of capital and its impact on profitability. Furthermore, maintaining a transparent record of financing activities is essential when seeking additional investments or securing loans, demonstrating financial responsibility to potential lenders or investors.

In conclusion, the “Financing Activities” section of the cash flow statement template offers essential insights into the long-term financial health of a food truck business. By meticulously tracking these activities, operators gain a comprehensive understanding of their capital structure, debt obligations, and ability to meet future financial commitments. This understanding empowers informed decision-making regarding growth, expansion, and overall financial strategy, contributing significantly to the long-term sustainability and success of the food truck operation.

4. Cash Flow Projections

Cash flow projections represent a forward-looking estimation of anticipated income and expenses, built upon the foundation of historical data provided by the food truck cash flow statement template. These projections serve as a crucial planning tool, enabling informed decision-making regarding future investments, operational adjustments, and overall financial strategy. Accurate projections empower food truck operators to anticipate potential cash shortages or surpluses, allowing proactive adjustments to mitigate risks and capitalize on opportunities.

- Sales ForecastingProjecting future sales revenue forms the cornerstone of cash flow projections. This involves analyzing historical sales data, considering factors such as seasonality, local events, and marketing campaigns. Realistic sales forecasts provide a basis for estimating incoming cash flow and inform decisions regarding inventory management and staffing levels. Overly optimistic or pessimistic sales projections can lead to significant discrepancies between projected and actual cash flow, hindering effective financial management.

- Expense BudgetingAccurately forecasting expenses is equally critical. This requires a detailed understanding of fixed costs, such as rent or loan payments, and variable costs, like food supplies and fuel. Analyzing historical expense data from the cash flow statement allows for informed budgeting, anticipating potential cost increases and identifying areas for potential savings. Accurate expense budgeting contributes to realistic cash flow projections, enabling proactive adjustments to maintain financial stability.

- Scenario PlanningDeveloping multiple cash flow projections based on varying assumptions allows food truck operators to assess the potential impact of different scenarios. A “best-case” scenario might assume higher-than-average sales growth, while a “worst-case” scenario could factor in unexpected equipment repairs or economic downturns. Scenario planning allows businesses to prepare for a range of possibilities, enhancing financial resilience and adaptability in a dynamic environment.

- Funding RequirementsCash flow projections play a vital role in determining funding requirements. By projecting future cash inflows and outflows, businesses can identify potential funding gaps and plan accordingly. This information proves essential when seeking loans or investments, providing potential lenders or investors with a clear understanding of the business’s financial needs and projected ability to repay obligations. Well-supported cash flow projections enhance credibility and increase the likelihood of securing necessary funding.

By integrating these facets, cash flow projections become an invaluable tool for strategic financial management. When grounded in the historical data provided by the food truck cash flow statement template, these projections offer actionable insights, empowering informed decisions that contribute to long-term profitability and sustainable growth within the competitive food truck industry.

5. Financial Health Analysis

Financial health analysis, grounded in the data provided by a food truck cash flow statement template, provides a crucial assessment of a business’s overall financial stability and performance. This analysis goes beyond simply tracking cash flow; it interprets the data to identify trends, assess risks, and inform strategic decision-making. A thorough financial health analysis empowers food truck operators to understand their current financial standing, identify areas for improvement, and make informed choices to enhance profitability and ensure long-term sustainability.

- Profitability AssessmentAnalyzing net profit margins, derived from the difference between revenue and expenses documented in the cash flow statement, provides insights into the core profitability of the food truck business. Consistently low profit margins may signal pricing issues, inefficient cost management, or declining sales volume, requiring corrective action. Regular profitability assessments allow operators to monitor financial performance and implement strategies for improvement, ensuring long-term financial viability.

- Liquidity EvaluationLiquidity analysis, using data from the cash flow statement, assesses the business’s ability to meet short-term obligations. Metrics such as the current ratio and quick ratio provide insights into whether the food truck has sufficient liquid assets to cover immediate expenses. Low liquidity can indicate potential cash flow problems, highlighting the need for improved working capital management or short-term financing solutions. Regular liquidity evaluations ensure the business can meet its financial obligations and maintain operational continuity.

- Debt Management AnalysisAnalyzing debt levels, including loan balances and repayment schedules tracked within the cash flow statement, provides a critical understanding of the business’s financial leverage. High debt-to-equity ratios may signify increased financial risk, particularly during periods of economic downturn or declining sales. Careful debt management analysis helps operators make informed decisions regarding financing strategies, ensuring long-term financial stability and avoiding excessive debt burdens.

- Operational Efficiency EvaluationAnalyzing key operational metrics, such as inventory turnover and sales per employee, using data from the cash flow statement, provides insights into the efficiency of the food truck’s operations. Low inventory turnover may indicate overstocking or spoilage, while low sales per employee could suggest staffing inefficiencies. Regular operational efficiency evaluations allow operators to identify areas for process improvement, optimize resource allocation, and enhance overall profitability.

By integrating these facets of financial health analysis, food truck operators gain a comprehensive understanding of their business’s financial performance. The data provided by the food truck cash flow statement template forms the foundation for this analysis, enabling informed decision-making, proactive risk management, and the development of effective strategies for long-term financial success. This analytical approach empowers businesses to navigate the challenges of the food truck industry and build a thriving, sustainable enterprise.

Key Components of a Food Truck Cash Flow Statement Template

A well-structured template provides a comprehensive overview of a food truck’s financial performance. Key components categorize inflows and outflows, enabling informed financial management.

1. Operating Activities: This section captures cash flow generated from core business operations. Daily sales, ingredient costs, staff wages, and operating expenses are recorded here, providing insights into profitability and operational efficiency. Analyzing trends within operating activities allows for data-driven decisions regarding pricing, inventory control, and staffing.

2. Investing Activities: Capital expenditures, such as purchasing new equipment or selling existing assets, are recorded under investing activities. Tracking these transactions reveals long-term investment strategies and their impact on overall financial stability. Analyzing return on investment for capital expenditures ensures effective resource allocation.

3. Financing Activities: This component details how the business raises and repays capital. Loan proceeds, equity investments, principal and interest payments, and dividend distributions are documented here. Understanding financing activities provides insights into the business’s capital structure, debt burden, and ability to meet financial obligations.

4. Beginning Cash Balance: The starting cash balance for the given period provides context for the subsequent cash flow activities. It represents the financial foundation upon which inflows and outflows are built.

5. Net Cash Flow: This crucial figure represents the difference between total cash inflows and outflows during the specified period. A positive net cash flow indicates more cash entered the business than left, while a negative net cash flow signifies the opposite. Understanding net cash flow is essential for assessing financial performance.

6. Ending Cash Balance: The ending cash balance, calculated by adding the net cash flow to the beginning cash balance, reflects the available cash at the end of the period. This figure serves as the starting point for the next period’s cash flow analysis, ensuring continuity and accurate tracking of financial resources.

Effective financial management requires a thorough understanding of these interconnected components. Analyzing these elements collectively provides a comprehensive picture of the food truck’s financial health, enabling data-driven decisions for sustainable growth and long-term profitability.

How to Create a Food Truck Cash Flow Statement Template

Creating a tailored cash flow statement template provides a foundation for sound financial management within the mobile food industry. A structured approach ensures accurate tracking and analysis of financial performance. The following steps outline the process:

1. Choose a Time Period: Specify a timeframe for analysis, whether daily, weekly, monthly, or quarterly. Consistent reporting periods facilitate trend identification and performance comparison.

2. Define Operating Activities: List all sources of revenue generated by core business operations, including food sales, catering events, and merchandise. Categorize operating expenses, such as ingredient costs, staff wages, fuel, utilities, and permits.

3. Outline Investing Activities: Detail all capital expenditures and asset disposals, including the purchase or sale of equipment, vehicles, or property. This section captures long-term investments impacting the business’s asset base.

4. Detail Financing Activities: Document all sources and uses of financing, including loan proceeds, loan repayments, equity investments, and dividend distributions. This provides insights into capital structure and debt management.

5. Incorporate Beginning and Ending Cash Balances: Include fields for the beginning cash balance at the start of the period and the ending cash balance at the period’s close. These figures provide context for cash flow changes and ensure continuity between reporting periods.

6. Calculate Net Cash Flow: Include a formula to calculate net cash flow by subtracting total cash outflows from total cash inflows. This crucial metric reveals overall cash flow performance during the specified period.

7. Utilize a Spreadsheet Program: Leverage spreadsheet software to create the template, facilitating calculations, data organization, and report generation. Spreadsheet formulas ensure accuracy and automate updates as new data is entered.

8. Regularly Review and Adjust: Periodically review the template and adjust categories as needed to reflect evolving business operations. Regular updates ensure the template remains relevant and accurately captures all cash flow activities.

A comprehensive cash flow statement template enables food truck operators to monitor financial performance, analyze trends, and make informed decisions. This structured approach facilitates proactive financial management, contributing to long-term profitability and sustainable growth.

Effective financial management is paramount to success in the competitive food truck industry. A dedicated cash flow statement template provides the essential framework for tracking, analyzing, and projecting financial performance. From daily operational expenses to long-term investment decisions and financing strategies, a comprehensive understanding of cash flow dynamics empowers informed decision-making. By meticulously documenting inflows and outflows, food truck operators gain valuable insights into profitability, liquidity, and overall financial health. This data-driven approach enables proactive adjustments, mitigates potential risks, and maximizes opportunities for growth.

The insights derived from a well-maintained cash flow statement template are not merely historical records; they serve as a compass guiding future strategy. This financial roadmap empowers food truck operators to navigate the complexities of a dynamic market, optimize resource allocation, and build a resilient, profitable business. A commitment to disciplined financial tracking and analysis is an investment in long-term sustainability and success within the mobile food industry.