Utilizing these resources allows organizations to streamline financial reporting processes, saving valuable time and resources. Pre-built formulas and formatting minimize the risk of errors, promoting accuracy and reliability in financial data. This accessibility fosters informed decision-making, improved financial transparency, and enhanced communication with investors, lenders, and other stakeholders. Furthermore, it allows businesses to allocate funds strategically, focusing on growth and operational efficiency rather than expensive software solutions.

Understanding the structure, benefits, and available types of these resources is crucial for effective financial management. The following sections delve into specific statement types, offering practical guidance and insights for businesses seeking to leverage these tools for improved financial health.

1. Accessibility

Accessibility is a critical factor driving the widespread adoption of free business financial statement templates. It removes financial barriers, enabling organizations of all sizes and budgetary constraints to implement sound financial practices. This democratization of financial management tools has significant implications for businesses, particularly startups and small enterprises.

- Reduced Financial BarriersCost often presents a significant obstacle for businesses seeking sophisticated financial management tools. Free templates eliminate this barrier, providing access to essential resources without requiring upfront investment. This is particularly beneficial for startups operating with limited capital or small businesses seeking cost-effective solutions.

- Empowerment Through TechnologyDigital accessibility plays a crucial role in disseminating these templates. Widely available online, they can be readily downloaded and utilized, regardless of geographical location or technical infrastructure. This empowers entrepreneurs and business owners in diverse settings with the tools needed for effective financial management.

- Facilitating Early-Stage Financial ManagementFor startups, early-stage financial planning is crucial for securing funding and ensuring long-term viability. Free templates provide a foundation for organizing financial data, tracking key metrics, and creating projections, even before dedicated accounting software becomes financially feasible.

- Promoting Financial LiteracyUtilizing these templates can also contribute to improved financial literacy within organizations. By working directly with financial statements, individuals gain a deeper understanding of core financial concepts and their practical applications. This enhanced understanding strengthens financial decision-making across the business.

By lowering the barrier to entry for sound financial practices, free templates contribute to a more informed and financially stable business environment. This increased accessibility promotes better financial management, ultimately benefiting individual organizations and the broader economy.

2. Standardized Formats

Standardized formats are a defining characteristic of effective financial statement templates. These pre-designed structures ensure consistency and comparability, facilitating clear communication of financial information. Adherence to established accounting principles, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), provides a framework for organizing financial data in a universally understood manner. This standardization is essential for both internal analysis and external reporting.

Consider a small business seeking a loan. Providing financial statements based on a standardized template allows lenders to readily assess financial health. The consistent presentation of data, following established norms, simplifies analysis, enabling lenders to compare performance across different businesses and make informed decisions regarding creditworthiness. Similarly, investors rely on standardized financial reports to evaluate investment opportunities, making comparability across different companies a crucial factor in their decision-making process. Internally, consistent formatting assists in tracking trends and analyzing performance over time. For instance, using the same template for income statements each quarter facilitates direct comparison of revenue, expenses, and profitability, revealing valuable insights into operational efficiency and growth.

While variations exist across different template providers, adherence to core accounting principles ensures a degree of uniformity. This standardized structure simplifies data entry, minimizes the risk of errors, and facilitates analysis. Ultimately, the consistent presentation afforded by standardized formats strengthens financial transparency and promotes informed decision-making by all stakeholders. Understanding the importance of these formats within the context of free business financial statement templates underscores their value in promoting effective financial management.

3. Cost-Effectiveness

Cost-effectiveness represents a significant advantage of utilizing free business financial statement templates. For startups and small businesses, resource allocation is a critical concern. Minimizing expenses, particularly during the early stages of operation, can significantly impact long-term viability. Free templates address this concern directly, providing essential financial management tools without incurring software licensing or subscription fees.

- Reduced OverheadEliminating software costs directly reduces overhead expenses. This is particularly beneficial for businesses operating on tight budgets. The funds saved can be reallocated to other critical areas, such as marketing, product development, or talent acquisition, fostering growth and enhancing competitiveness.

- Bridging the Gap to Scalable SolutionsFree templates can serve as an effective interim solution before a business scales to the point of requiring dedicated accounting software. This allows organizations to establish sound financial practices from the outset without incurring unnecessary expenses in the early stages. As the business grows and financial complexity increases, transitioning to more robust software becomes a strategic investment rather than an initial burden.

- Leveling the Playing FieldAccess to essential financial management tools should not be contingent on financial resources. Free templates level the playing field, enabling smaller businesses to compete effectively with larger, more established organizations. This fosters a more equitable business environment, promoting entrepreneurship and innovation.

- Resource Optimization for Non-ProfitsNon-profit organizations often operate under stringent budgetary constraints. Free templates are particularly valuable in this context, enabling effective stewardship of donated funds. Minimizing administrative expenses allows non-profits to maximize the impact of their resources, furthering their mission and serving their beneficiaries more effectively.

The cost-effectiveness of free business financial statement templates allows businesses to establish and maintain robust financial practices without straining limited resources. This accessibility promotes financial stability, facilitates growth, and ultimately contributes to a more vibrant and sustainable business ecosystem. By leveraging these freely available tools, organizations can prioritize strategic investments, ensuring long-term financial health and competitiveness.

4. Error Reduction

Error reduction represents a critical advantage conferred by the use of free business financial statement templates. Manual preparation of financial statements is susceptible to various errors, ranging from simple data entry mistakes to complex formula miscalculations. Templates mitigate these risks through pre-built formulas and structured formats. Automated calculations minimize the potential for mathematical errors, while clearly defined fields reduce the likelihood of data entry inaccuracies. For example, a template for a balance sheet will automatically calculate the sum of assets and liabilities, ensuring these figures balance accurately. This built-in functionality significantly reduces the risk of human error, leading to more accurate and reliable financial reporting. Consider a scenario where a small business owner manually calculates cost of goods sold. A simple transposition of digits could significantly misrepresent profitability, potentially leading to flawed business decisions. Utilizing a template with automated calculations mitigates this risk, ensuring accuracy and fostering sound decision-making.

The impact of accurate financial information extends beyond internal operations. Inaccurate data can mislead stakeholders, including investors and lenders, potentially jeopardizing funding opportunities or damaging credibility. Consistent and reliable financial reporting builds trust and demonstrates sound financial management practices. Furthermore, error reduction contributes to more efficient financial analysis. When data is reliable, businesses can confidently identify trends, assess performance, and make informed decisions about future operations. Time spent correcting errors is minimized, freeing up resources for more strategic activities. For instance, an accurate cash flow statement allows a business to anticipate potential cash shortages, enabling proactive measures to secure financing or adjust expenditures.

In conclusion, error reduction is a key benefit of employing free business financial statement templates. Pre-built formulas and structured formats minimize the risk of both simple and complex errors, leading to more accurate and reliable financial reporting. This accuracy strengthens internal decision-making, builds trust with external stakeholders, and promotes overall financial health. Leveraging these templates empowers businesses to focus on strategic activities, knowing their financial data provides a solid foundation for informed decision-making and sustainable growth.

5. Informed Decisions

Informed decision-making represents a cornerstone of successful business management. Access to accurate, organized, and readily available financial data is essential for driving this process. Free business financial statement templates play a crucial role in empowering businesses to make informed decisions by providing a structured framework for collecting, organizing, and analyzing key financial information. This connection between accessible templates and informed decisions is fundamental to understanding their value in fostering financial health and stability.

Cause and effect relationships underpin this connection. Utilizing a template for an income statement, for example, facilitates the tracking of revenue and expenses over time. Analysis of this data reveals trends in profitability, enabling informed decisions regarding pricing strategies, cost control measures, or investment in new product lines. Similarly, a cash flow statement template provides insights into cash inflows and outflows. Understanding cash flow patterns allows businesses to anticipate potential shortages, make informed decisions about financing options, or adjust operational expenditures to maintain healthy cash reserves. Consider a retail business experiencing seasonal fluctuations in sales. Analysis of historical data from a template can inform inventory management decisions, ensuring adequate stock levels during peak seasons while minimizing excess inventory during slower periods. Without access to organized financial data, such decisions would be based on intuition rather than evidence, increasing the risk of costly mistakes.

Informed decisions are not merely a byproduct of using free business financial statement templates; they are a central component of their value proposition. These templates are designed specifically to facilitate informed financial management. The structure they provide promotes transparency, enabling stakeholders to understand the financial health of the business and contribute meaningfully to strategic planning. Furthermore, these templates can facilitate communication with external stakeholders. Providing potential investors or lenders with clearly presented financial statements based on standardized templates strengthens credibility and fosters trust, increasing the likelihood of securing funding or favorable loan terms. The accessibility of free templates democratizes access to this crucial element of financial management, empowering businesses of all sizes to make sound, data-driven decisions. This, in turn, contributes to a more stable and resilient business environment.

Key Components of Financial Statement Templates

Effective utilization of financial statement templates requires an understanding of their key components. These components, when accurately populated and analyzed, provide a comprehensive overview of a business’s financial health, facilitating informed decision-making and strategic planning.

1. Balance Sheet: The balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It adheres to the fundamental accounting equation: Assets = Liabilities + Equity. This statement reveals the resources a company owns (assets), its obligations (liabilities), and the residual interest belonging to owners (equity). A template ensures proper categorization and calculation of these elements.

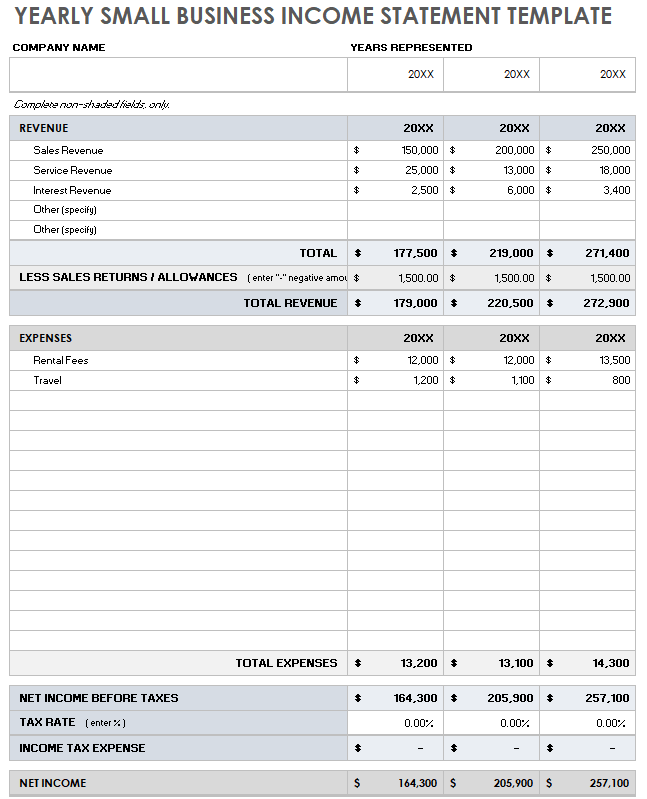

2. Income Statement: The income statement, also known as the profit and loss statement, reports a company’s financial performance over a specific period. It summarizes revenues, expenses, and resulting net income or loss. A template facilitates accurate calculation of gross profit, operating income, and net income, providing insights into profitability and operational efficiency.

3. Cash Flow Statement: The cash flow statement tracks the movement of cash both into and out of a company during a specific period. It categorizes cash flows into operating activities, investing activities, and financing activities. A template ensures accurate reporting of these flows, providing insights into liquidity and cash management practices.

4. Statement of Changes in Equity: This statement details changes in owners’ equity over a specific period. It accounts for factors such as net income, dividends, and stock issuances. A template helps organize these changes, providing a clear picture of how equity has evolved over time.

5. Supporting Schedules: While not always included within the main statements, supporting schedules provide detailed breakdowns of specific line items. These schedules, such as an aging of accounts receivable or a detailed inventory listing, enhance transparency and provide deeper insights into the underlying data. A template often includes space or prompts for these supporting details.

6. Notes to the Financial Statements: These notes provide contextual information and further explanations of the financial data presented in the main statements. They clarify accounting policies, disclose contingent liabilities, and offer additional details that enhance understanding. Well-designed templates provide space for these important disclosures.

Templates provide a structured framework for organizing these components, promoting consistency, accuracy, and comparability. This structure facilitates both internal analysis and communication with external stakeholders, enabling informed decision-making and fostering financial transparency.

How to Create Free Business Financial Statement Templates

Creating effective financial statement templates requires careful planning and adherence to established accounting principles. The following steps outline the process of developing templates for the core financial statements: the balance sheet, income statement, and cash flow statement.

1. Determine the Reporting Period: Clearly define the reporting period covered by the template. This ensures consistency and facilitates accurate comparisons over time. Whether the period is a month, quarter, or year, this information should be prominently displayed.

2. Choose the Appropriate Accounting Basis: Select either cash basis or accrual basis accounting. Cash basis recognizes transactions when cash changes hands, while accrual basis recognizes transactions when they occur, regardless of cash flow. The chosen basis should be consistently applied.

3. Structure the Balance Sheet: Organize the balance sheet into assets, liabilities, and equity sections. List assets in order of liquidity, starting with current assets like cash and accounts receivable, followed by non-current assets like property, plant, and equipment. Liabilities should be similarly categorized into current and non-current. The equity section reflects the owners’ stake in the business.

4. Design the Income Statement: Structure the income statement to clearly present revenues, expenses, and resulting net income or loss. Group related expenses, such as cost of goods sold, operating expenses, and interest expense, for enhanced analysis. Ensure clear labeling of each line item.

5. Develop the Cash Flow Statement: Organize the cash flow statement into operating activities, investing activities, and financing activities. Operating activities reflect cash flows from the core business operations. Investing activities pertain to capital expenditures and investments. Financing activities relate to debt, equity, and dividends.

6. Incorporate Formulas and Automated Calculations: Utilize spreadsheet software functionality to incorporate formulas for automated calculations. This minimizes the risk of manual errors and ensures accurate totals and balances. For instance, the balance sheet template should automatically calculate total assets, total liabilities, and total equity.

7. Include Clear Labels and Headings: Use clear and concise labels for each line item. Descriptive headings enhance readability and ensure proper interpretation of the data. This clarity is essential for both internal use and external reporting.

8. Test and Refine: Thoroughly test the templates with sample data to verify the accuracy of formulas and calculations. Refine the design based on testing results to ensure functionality and ease of use. Ongoing review and refinement enhance the template’s effectiveness over time.

Developing well-structured and accurate financial statement templates promotes consistent financial reporting, reduces errors, and facilitates informed decision-making. Adherence to accounting principles, combined with clear design and automated calculations, empowers businesses to manage their finances effectively and make sound, data-driven decisions.

Templates for financial statements provide a crucial resource for businesses seeking to establish and maintain sound financial practices. Their accessibility, standardized formats, cost-effectiveness, and contribution to error reduction empower organizations to manage finances effectively. From facilitating informed decision-making to promoting transparency and building trust with stakeholders, these resources play a vital role in fostering financial health and stability. Understanding the core components of these statementsthe balance sheet, income statement, and cash flow statementand their interplay is essential for leveraging these tools effectively. Furthermore, recognizing the process of creating accurate and functional templates, incorporating automated calculations and clear labeling, contributes to the overall value derived from these readily available resources.

Leveraging these readily available resources empowers businesses to navigate the complexities of financial management with greater confidence and control. This proactive approach to financial reporting strengthens organizational resilience, promotes sustainable growth, and ultimately contributes to a more vibrant and robust business ecosystem. Accurate and accessible financial data empowers informed decision-making, driving not only individual business success but also broader economic stability.