Utilizing such a document provides users with a convenient tool for personal finance management. It allows for clear visualization of spending habits, simplifies reconciliation processes, and can be instrumental in preparing for loan applications, rental agreements, or other situations requiring proof of funds or financial history. This empowers individuals to maintain organized records and access financial information readily.

Understanding the structure and utility of this type of document provides a foundation for exploring broader topics in personal finance management, including budgeting techniques, expense tracking, and strategies for improving financial well-being. Further exploration of these areas can empower individuals to take control of their finances and achieve their financial goals.

1. Accessibility

Accessibility, in the context of a complimentary Chime bank statement template, refers to the ease and convenience with which individuals can obtain and utilize such a document. This ease of access plays a crucial role in facilitating better financial management practices.

- Immediate AvailabilityUnlike waiting for official bank statements, a template offers immediate access. This allows users to generate mock statements whenever needed, such as when preparing a budget or tracking expenses. This immediate availability empowers proactive financial management.

- Device CompatibilityTemplates are typically designed for use across various devices computers, tablets, and smartphones. This cross-platform compatibility allows users to access and manage financial information on their preferred device, regardless of location.

- Simplified FormatTemplates often present information in a clear, concise, and user-friendly format. This simplified presentation, compared to complex banking software or dense official statements, makes it easier for individuals to understand and interpret their financial data.

- No Cost BarrierThe free nature of these templates removes any financial obstacle to accessing this valuable tool. This ensures that anyone, regardless of their financial situation, can benefit from organized financial record-keeping and efficient budgeting.

The accessibility of these complimentary templates significantly contributes to better financial practices. By removing barriers to access and providing a user-friendly format, these templates empower individuals to take control of their finances through informed decision-making and effective financial planning.

2. Cost-Effective

Financial management tools often come with associated costs. The cost-effectiveness of a free Chime bank statement template distinguishes it as a valuable resource. Eliminating expenses related to acquiring financial tracking tools allows individuals to allocate resources more efficiently.

- No Purchase PriceThe absence of a purchase price eliminates a common barrier to accessing financial organizational tools. This allows individuals to utilize a structured format for tracking finances without incurring any upfront costs, making it particularly beneficial for those operating on tight budgets.

- Reduced Administrative CostsCreating a similar document from scratch can involve significant time and effort. Utilizing a readily available template streamlines the process, reducing the administrative burden and associated costs related to time investment.

- Opportunity Cost SavingsBy opting for a free template, individuals avoid the opportunity costs associated with purchasing alternative software or professional services. The resources saved can be redirected towards other financial goals, such as investing or debt reduction.

- Long-Term SavingsConsistent use of a free template fosters responsible financial habits. This can lead to long-term savings by facilitating better budgeting, expense tracking, and informed financial decision-making.

The cost-effectiveness of a free Chime bank statement template contributes significantly to its overall value. By removing financial barriers and streamlining the financial tracking process, this resource empowers individuals to manage their finances effectively without incurring unnecessary expenses, maximizing the potential for financial well-being.

3. Replicates Official Format

Accurate replication of the official Chime bank statement format is a critical feature of a complimentary template. This precise mirroring of structure and data presentation ensures compatibility with various financial applications and provides a reliable reference for personal financial management. The ability to readily identify key information, such as transaction dates, descriptions, and amounts, directly corresponds to the template’s efficacy. For instance, using a template that accurately reflects the official statement simplifies the process of reconciling personal records with official bank data. This minimizes discrepancies and facilitates a clearer understanding of one’s financial position.

Furthermore, a template mirroring the official format can serve as a valuable tool for practice and familiarization. Individuals can utilize the template to simulate real-world scenarios, such as budgeting based on projected income and expenses or analyzing spending patterns. This practical application enhances financial literacy and promotes responsible financial behavior. For example, someone preparing a loan application can use a template to organize financial information in a format readily accepted by lenders, demonstrating preparedness and financial responsibility.

In conclusion, the replication of the official format in a complimentary Chime bank statement template is essential for its practical utility. This accurate representation ensures compatibility, simplifies financial analysis, and promotes financial literacy. By providing a reliable and accessible tool for managing personal finances, the template empowers individuals to make informed financial decisions and achieve greater financial well-being. This precise formatting avoids potential confusion or misinterpretations when comparing the template with official documentation, ensuring consistent and reliable financial management.

4. Facilitates Budgeting

Effective budgeting relies on clear insight into financial inflows and outflows. A free Chime bank statement template provides a structured framework for organizing financial data, thus facilitating the budgeting process. This structured approach enables individuals to analyze spending patterns, project future expenses, and allocate funds effectively.

- Visualizing Spending PatternsThe template allows users to visualize spending across different categories. By inputting transaction data into the template, individuals can gain a clear understanding of where their money is going. For example, categorizing expenses such as groceries, transportation, and entertainment provides a visual representation of spending habits, enabling informed budget adjustments. This visualization is crucial for identifying areas of overspending and potential savings.

- Projecting Future ExpensesUtilizing a template that mirrors the official statement format assists in projecting future expenses. By analyzing past transactions recorded in the template, individuals can anticipate upcoming costs and allocate funds accordingly. For example, recurring monthly bills can be accurately forecasted and incorporated into the budget, promoting financial stability.

- Allocating Funds EffectivelyA clear overview of income and expenses, facilitated by the template, enables effective fund allocation. By understanding spending patterns and projecting future needs, individuals can allocate resources strategically, prioritizing essential expenses and minimizing unnecessary spending. This structured approach promotes responsible financial management and supports long-term financial goals. For instance, allocating a specific portion of income to savings or debt repayment becomes more manageable with a clear budget facilitated by the template.

- Scenario PlanningThe template allows for scenario planning by enabling users to adjust projected income and expenses. This feature is crucial for preparing for unexpected financial changes or pursuing specific financial goals. For example, individuals can use the template to explore the financial implications of a salary increase, a large purchase, or an emergency fund allocation, promoting proactive financial management. This flexibility empowers informed decision-making and enhances financial preparedness.

By providing a structured format for organizing and analyzing financial data, a free Chime bank statement template plays a key role in facilitating effective budgeting. This, in turn, empowers individuals to make informed financial decisions, control spending, and work towards their financial goals. The template’s ability to facilitate scenario planning and visualize spending patterns contributes significantly to responsible financial behavior and long-term financial well-being.

5. Supports Record-Keeping

Maintaining organized financial records is fundamental to sound financial management. A free Chime bank statement template provides a valuable tool for supporting comprehensive and accessible record-keeping. This structured approach to organizing financial data facilitates efficient tracking of transactions, balances, and other pertinent information, contributing to a more thorough understanding of one’s financial position.

- Organized Transaction HistoryThe template offers a structured format for recording transaction details. This allows individuals to maintain a chronological and categorized record of all financial activities, facilitating easy retrieval and analysis of specific transactions. For example, tracking expenses by category (e.g., groceries, utilities, transportation) provides valuable insights into spending habits. This organized history is essential for budgeting, tax preparation, and identifying potential areas for cost savings.

- Simplified ReconciliationReconciling personal records with official bank statements is a critical aspect of financial management. The template simplifies this process by providing a format consistent with official statements. This consistency allows for easy comparison and identification of discrepancies, ensuring accuracy and facilitating timely resolution of any inconsistencies. This process is crucial for maintaining accurate financial records and preventing errors.

- Accessible Financial OverviewA readily accessible overview of financial activity is essential for informed decision-making. The template provides a consolidated view of transactions, balances, and other relevant information, offering a comprehensive snapshot of one’s financial status. This accessible overview empowers individuals to monitor their financial health, track progress towards financial goals, and make informed adjustments to spending and saving habits. For instance, readily accessible records can assist in identifying trends, such as increasing utility costs or consistent overspending in a specific category.

- Enhanced Financial AccountabilityMaintaining organized financial records promotes accountability. By meticulously tracking income and expenses using the template, individuals gain a clear understanding of their financial flows. This heightened awareness encourages responsible financial behavior and facilitates informed decision-making. This accountability is crucial for achieving financial goals and maintaining long-term financial stability. For example, tracking spending against a budget encourages adherence to spending limits and promotes responsible financial habits.

By offering a structured framework for organizing and tracking financial data, a free Chime bank statement template plays a crucial role in supporting effective record-keeping. This organized approach empowers individuals to gain a deeper understanding of their financial position, make informed decisions, and achieve greater financial well-being. The consistent format, combined with the ability to readily access and analyze financial information, contributes significantly to long-term financial stability and success.

6. Aids Financial Overview

Gaining a comprehensive financial overview is crucial for effective money management. A free Chime bank statement template contributes significantly to this overview by providing a structured and accessible format for organizing financial data. This structure allows individuals to readily assess their financial standing, identify trends, and make informed decisions. The following facets illustrate how such a template aids in achieving a clear and actionable financial overview.

- Consolidated Financial PictureThe template consolidates essential financial information into a single, accessible document. This consolidated view encompasses income, expenses, and account balances, providing a holistic understanding of one’s financial position. For example, by inputting transaction data into the template, individuals can quickly assess their overall spending and identify areas for potential savings. This comprehensive perspective is essential for effective budgeting and financial planning.

- Trend IdentificationRegular use of the template allows for the identification of financial trends over time. By consistently recording transactions, individuals can observe patterns in their spending and income. For instance, tracking monthly grocery expenses over a period of several months can reveal seasonal variations or spending habits. Recognizing these trends allows for proactive adjustments to budgets and spending plans, promoting better financial control.

- Informed Decision-MakingA clear financial overview is fundamental to informed financial decision-making. The template provides the necessary data and structure for assessing the financial implications of various choices. For example, before making a significant purchase, an individual can use the template to project the impact on their budget and available funds. This informed approach reduces the risk of financial strain and supports responsible spending habits.

- Simplified Financial Goal SettingSetting and achieving financial goals requires a clear understanding of one’s current financial standing. The template facilitates this understanding by providing a readily accessible overview of income, expenses, and available resources. This clear picture empowers individuals to set realistic financial goals, track progress, and make informed adjustments to their financial strategies. For instance, visualizing savings progress within the template can motivate continued saving and facilitate adjustments to reach savings targets efficiently.

By providing a structured framework for organizing and analyzing financial data, a free Chime bank statement template empowers individuals to gain a comprehensive financial overview. This overview, encompassing consolidated data, trend identification, informed decision-making, and simplified goal setting, is crucial for effective financial management and achieving long-term financial well-being. The accessibility and user-friendly format of the template contribute significantly to its value as a tool for enhancing financial literacy and promoting responsible financial behavior.

Key Components of a Complimentary Chime Bank Statement Template

Understanding the key components of a complimentary Chime bank statement template is crucial for maximizing its utility. These components provide a structured framework for organizing and analyzing financial data, enabling informed financial management.

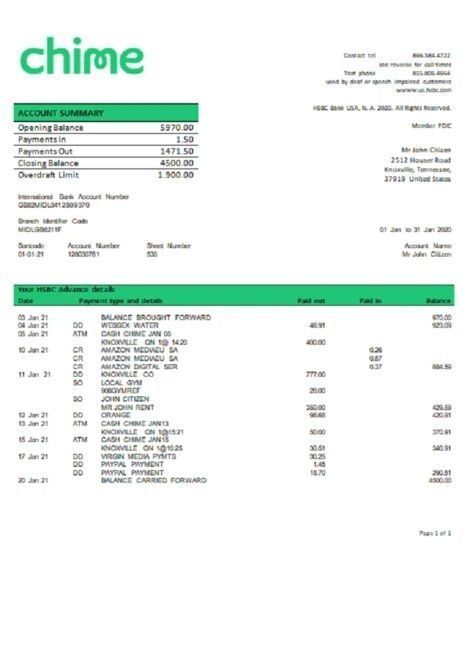

1. Account Information: This section typically includes the account holder’s name, account number, and statement period. Accurate account information is essential for proper record-keeping and reconciliation with official bank statements. This ensures that the template accurately reflects the individual’s financial position.

2. Transaction Details: This section forms the core of the template, providing a detailed record of all transactions during the statement period. Essential information includes transaction dates, descriptions, and amounts. Clear and accurate transaction details are fundamental for tracking spending habits and identifying potential areas for budget adjustments. Categorizing transactions further enhances analysis and facilitates budgeting.

3. Beginning and Ending Balances: These figures represent the account balance at the start and end of the statement period. Tracking these balances is crucial for monitoring overall financial health and assessing the impact of income and expenses on available funds. This information provides a clear snapshot of financial progress over time.

4. Summary Information: Some templates may include summary information, such as total deposits, total withdrawals, and net account activity during the statement period. This summarized data provides a concise overview of financial performance and facilitates quick assessment of key financial metrics. This aggregated view simplifies the process of identifying trends and evaluating overall financial health.

5. Customizable Fields: The flexibility of customizable fields enhances the utility of the template. These fields allow users to tailor the template to their specific needs. For example, users can add categories for tracking expenses, notes for specific transactions, or personalized budgeting goals. This customizability ensures that the template effectively supports individual financial management practices.

Accurate and detailed information within these key components provides a reliable foundation for managing personal finances. Leveraging this structured format empowers informed financial decision-making and promotes effective financial planning. This allows for a clear and organized approach to budgeting, expense tracking, and financial goal setting.

How to Create a Free Chime Bank Statement Template

Creating a complimentary Chime bank statement template requires careful consideration of key components and structural elements to ensure accurate representation of financial information. The following steps outline the process of developing a functional and effective template.

1. Software Selection: Select appropriate software for template creation. Spreadsheet software or word processing applications with table functionality offer the necessary tools for structuring data effectively. Choosing a familiar platform streamlines the creation process.

2. Replicating the Header: Replicate the header section of an official Chime bank statement. This typically includes the Chime logo (optional, but enhances visual similarity), account holder name, account number, and statement period. Accurate replication ensures consistency and facilitates reconciliation with official documents.

3. Establishing Columns: Establish columns for transaction details. Essential columns include transaction date, description, and amount. Additional columns can be added for categorization, notes, or other relevant information. Clear column headers ensure easy data entry and interpretation.

4. Incorporating Balance Fields: Incorporate fields for the beginning and ending balances. These fields provide a clear overview of account activity during the statement period and facilitate reconciliation with official bank records. Accurate balance tracking is crucial for effective financial management.

5. Formatting for Clarity: Format the template for clarity and readability. Use clear fonts, consistent formatting, and appropriate spacing. This enhances visual appeal and simplifies data interpretation, promoting efficient financial analysis.

6. Testing and Refinement: Input sample transaction data to test the template’s functionality. Verify accurate calculation of balances and ensure all fields function as intended. Refinement based on testing ensures a functional and user-friendly template. This iterative process optimizes the template’s efficacy.

7. Customization (Optional): Incorporate customizable fields based on individual needs. Adding fields for budgeting categories, notes, or personalized financial goals enhances the template’s utility for specific financial management practices. This tailored approach maximizes the template’s value for individual users.

A well-designed template provides a structured framework for managing financial information effectively. Accurate replication of key components, combined with clear formatting and customization options, results in a valuable tool for enhancing financial organization and promoting informed financial decision-making.

A complimentary Chime bank statement template offers a valuable tool for enhancing financial organization and promoting informed financial management. Its accessibility, cost-effectiveness, and accurate replication of the official format empower individuals to gain a clearer understanding of their financial position. From facilitating budgeting and supporting meticulous record-keeping to aiding in comprehensive financial overview and trend analysis, the template provides a structured framework for managing personal finances effectively. Understanding its key components and creation process further maximizes its utility, enabling individuals to tailor the template to their specific needs and financial goals.

Effective financial management requires consistent effort and access to appropriate tools. Leveraging resources like a complimentary Chime bank statement template empowers individuals to take control of their financial well-being. This proactive approach to financial organization contributes significantly to long-term financial stability and success, enabling informed decision-making and facilitating the achievement of financial aspirations. Consistent utilization of such tools, combined with sound financial practices, paves the way for a secure and prosperous financial future.