Utilizing readily available, no-cost formats for these statements offers advantages for both the organization and its congregants. Churches can streamline administrative tasks and reduce expenses, while members receive a clear, organized record of their giving, simplifying tax preparation and promoting financial transparency. This accessibility fosters trust and encourages continued generosity within the community.

This resource will explore the various aspects of charitable giving records within religious contexts, including available formats, legal considerations, and best practices for both donors and religious institutions.

1. Accessibility

Accessibility in the context of contribution statements refers to the ease with which individuals can obtain, comprehend, and utilize these documents. A readily available, free template significantly enhances accessibility for both church administrators and members. For administrators, readily available templates eliminate the need to create statements from scratch, saving valuable time and resources. For members, accessible formats, such as downloadable PDFs or online portals, facilitate easy access to giving records whenever needed. This ease of access is particularly crucial during tax season. For instance, a church member needing to quickly locate contribution information for tax filing benefits significantly from a readily available online statement or a downloadable template that can be easily printed. Conversely, if statements are only available upon request or in complex formats, access becomes cumbersome, potentially delaying tax filing or leading to inaccuracies.

Furthermore, accessible templates often incorporate features that enhance comprehension. Clear, concise language, logical organization, and consistent formatting make it easier for individuals to understand their giving history. For example, a template that clearly separates different types of contributions (e.g., tithes, offerings, special funds) promotes clarity and simplifies record-keeping. Individuals with varying levels of financial literacy benefit from easily understandable statements, fostering greater transparency and accountability within the church community. An accessible format can also be more easily adapted for individuals with disabilities, for example, by being compatible with screen readers or offering large-print versions.

Ensuring accessibility through free and user-friendly templates fosters a more positive and efficient experience for all stakeholders involved in managing and tracking church contributions. This contributes to greater financial transparency and builds trust between the church and its members. Addressing potential barriers to access, such as technical limitations or language differences, further strengthens the church’s commitment to inclusivity and effective financial management.

2. Customization

Customization capabilities are a crucial factor when selecting a free church contribution statement template. While cost-effectiveness is important, a template’s ability to reflect the specific needs and branding of an individual church significantly impacts its utility. A generic template might lack essential fields or include irrelevant information, potentially creating confusion or requiring additional manual adjustments. Therefore, the adaptability of a free template is paramount for effective financial record-keeping and presenting a professional image.

- Branding ElementsIncorporating church-specific branding, such as logos, colors, and fonts, transforms a generic statement into a polished, professional document. A cohesive visual identity strengthens the church’s image and reinforces its communication with members. For example, a statement bearing the church’s logo fosters a sense of connection and reinforces the origin of the document. Conversely, a generic, unbranded statement may appear less official or trustworthy.

- Designated Giving CategoriesChurches often receive contributions designated for specific purposes (e.g., building funds, missions, outreach programs). A customizable template allows the inclusion of these specific designations, providing detailed breakdowns of member giving. This granularity enhances transparency and helps members understand the impact of their contributions. Without this customization, tracking designated giving becomes complex and may require manual reconciliation.

- Inclusion of Specific FieldsDifferent churches may require specific information on their contribution statements. A customizable template permits the addition or removal of fields to match these requirements. For instance, a church utilizing an online giving platform might include a transaction ID field for easy cross-referencing. This flexibility ensures the statement captures all necessary data without unnecessary clutter.

- Multilingual SupportIn diverse communities, offering contribution statements in multiple languages is crucial for inclusivity. A customizable template allows for language adjustments, ensuring all members can understand their giving records. This feature is particularly important for churches with significant non-native speaking populations, facilitating clear communication and fostering a welcoming environment.

The ability to customize a free church contribution statement template significantly enhances its value. By tailoring the statement to reflect the unique needs and brand of a church, these free resources become powerful tools for financial management, transparency, and communication within the congregation. Selecting a template with robust customization options ensures the statement serves as a professional and informative record of member giving, strengthening the relationship between the church and its community.

3. Tax Compliance

Tax compliance represents a critical aspect of charitable giving and record-keeping for both donors and religious organizations. A free church contribution statement template plays a significant role in facilitating this compliance. Accurate and readily available contribution records are essential for individuals claiming charitable deductions on their tax returns. These statements serve as verifiable proof of donations, allowing individuals to substantiate their claims and potentially reduce their tax liability. Without proper documentation, deductions may be challenged or disallowed by tax authorities.

The connection between tax compliance and these templates lies in the information they provide. A well-designed template ensures the inclusion of all necessary information required for tax reporting, such as the donor’s name, the recipient organization’s name and identification number, the date and amount of each contribution, and any specific designations for the donation. This comprehensive record simplifies the tax filing process for individuals and provides a clear audit trail for both the donor and the church. For example, if a taxpayer is audited, the contribution statement serves as verifiable proof of the donation, minimizing potential complications. Conversely, incomplete or inaccurate statements can lead to delays, penalties, or even legal challenges.

Furthermore, adherence to tax regulations reinforces public trust in religious organizations. By providing clear, accurate, and readily accessible contribution statements, churches demonstrate transparency and accountability in their financial practices. This transparency strengthens the relationship between the church and its members and contributes to the overall integrity of the organization. Failure to comply with tax regulations can damage an organization’s reputation and erode public trust. Therefore, utilizing a free church contribution statement template not only simplifies tax reporting for individuals but also strengthens the financial integrity and public standing of the religious institution.

4. Record Keeping

Meticulous record keeping is paramount for sound financial management within any organization, and religious institutions are no exception. A free church contribution statement template serves as a foundational tool for maintaining accurate and organized records of donations. This organized approach facilitates efficient tracking of contributions, simplifies financial reporting, and strengthens accountability within the church. Effective record keeping, facilitated by these templates, enables churches to analyze giving trends, forecast future income, and make informed budgetary decisions. For example, consistent records can reveal seasonal giving patterns, informing resource allocation strategies and future fundraising efforts.

Beyond internal financial management, comprehensive contribution records are essential for compliance with legal and regulatory requirements. Accurate records provide the necessary documentation for audits, ensuring the church can demonstrate responsible financial stewardship. Furthermore, detailed records protect both the church and its members in potential disputes. For instance, in cases of discrepancies or questions regarding individual contributions, well-maintained records provide clear, verifiable documentation, preventing misunderstandings and protecting all parties involved. This level of transparency strengthens trust between the church and its congregation, fostering a stronger community bond.

In summary, a free church contribution statement template acts as a catalyst for sound record-keeping practices within religious organizations. By providing a structured framework for documenting contributions, these templates empower churches to effectively manage their finances, ensure regulatory compliance, and build trust with their members. Implementing and consistently utilizing these templates strengthens financial transparency and promotes long-term stability for the organization.

5. Transparency

Transparency in financial matters is crucial for building and maintaining trust within any organization, especially religious institutions. A free church contribution statement template plays a vital role in fostering this transparency by providing a clear and accessible record of donations. This open access to financial information empowers members to understand how their contributions are being utilized, fostering accountability and strengthening the bond between the congregation and its leadership. When individuals can readily access and comprehend their giving history and see how funds are allocated, it cultivates a sense of ownership and shared responsibility within the church community. Conversely, a lack of transparency can breed suspicion and distrust, potentially leading to decreased giving and diminished community engagement. For example, if a church undertakes a significant building project, providing transparent records of donations and expenditures related to the project reassures members that funds are being managed responsibly and ethically.

Furthermore, transparency, facilitated by readily available contribution statements, promotes ethical financial practices within the organization. Knowing that financial records are accessible to members encourages responsible stewardship and discourages potential mismanagement of funds. This accountability strengthens the integrity of the church and reinforces its commitment to ethical conduct. For instance, readily available statements allow members to verify that designated contributions are being used for their intended purposes, such as supporting specific missions or local outreach programs. This level of transparency reinforces trust and encourages continued generosity within the congregation. It also allows for community feedback and ensures that financial decisions align with the shared values and goals of the church.

In summary, utilizing a free church contribution statement template is a practical step towards achieving financial transparency within religious organizations. By providing clear, accessible records of contributions, these templates empower members, promote accountability, and foster trust between the congregation and its leadership. This transparency strengthens the financial integrity of the church, encourages responsible stewardship, and cultivates a stronger, more engaged community. Embracing transparency through readily available financial information is not merely a best practice, but a cornerstone of building a healthy and thriving religious institution.

6. Ease of Use

The ease of use associated with a free church contribution statement template directly impacts its effectiveness as a tool for both administrators and members. A user-friendly template simplifies the process of generating, distributing, and interpreting contribution records, promoting efficient financial management and enhancing transparency within the church. A cumbersome or complicated template, regardless of cost, can deter usage and undermine the intended benefits of organized record-keeping. This section explores key facets contributing to the ease of use of these templates.

- Intuitive InterfaceAn intuitive interface is characterized by clear, logical organization and readily understandable labels. This allows individuals with varying levels of technical proficiency to navigate the template effortlessly. For example, clearly marked fields for date, amount, and contribution type minimize confusion and data entry errors. A well-designed interface reduces the time and effort required to generate accurate contribution statements, encouraging consistent usage and minimizing frustration.

- Accessibility Across PlatformsCompatibility with various software and operating systems ensures accessibility for a wider range of users. A template readily accessible on different devices (e.g., computers, tablets, smartphones) and compatible with common software (e.g., spreadsheet programs, word processors) promotes flexibility and convenience. For instance, a church member using a mobile device should be able to access and review their statement as easily as someone using a desktop computer. This cross-platform accessibility is especially important in today’s increasingly mobile world.

- Automated CalculationsTemplates with built-in formulas for calculating totals and subtotals significantly reduce manual data entry and minimize the risk of errors. Automated calculations streamline the process of generating accurate statements, saving time and improving efficiency. For example, a template that automatically calculates the total contributions for the year eliminates the need for manual summation, improving accuracy and efficiency. This feature is particularly beneficial for churches with large congregations or complex giving structures.

- Clear Instructions and SupportComprehensive instructions and readily available support resources empower users to effectively utilize the template and troubleshoot any issues that may arise. Clear, concise documentation explaining how to use the template, along with readily accessible support channels (e.g., FAQs, tutorials, contact information), fosters confidence and encourages adoption. For example, a template accompanied by a step-by-step guide on how to customize fields or generate reports empowers users to fully utilize its features and resolve any challenges independently. This accessible support minimizes reliance on technical assistance and promotes self-sufficiency.

Prioritizing ease of use when selecting a free church contribution statement template ensures that the template serves as a practical and effective tool for managing donations. A user-friendly template encourages consistent usage, improves accuracy, and enhances transparency within the church. By simplifying the process of generating and interpreting contribution records, these templates contribute to stronger financial management practices and build trust within the congregation. Selecting a template that prioritizes these facets of usability ultimately strengthens the financial health and overall well-being of the religious organization.

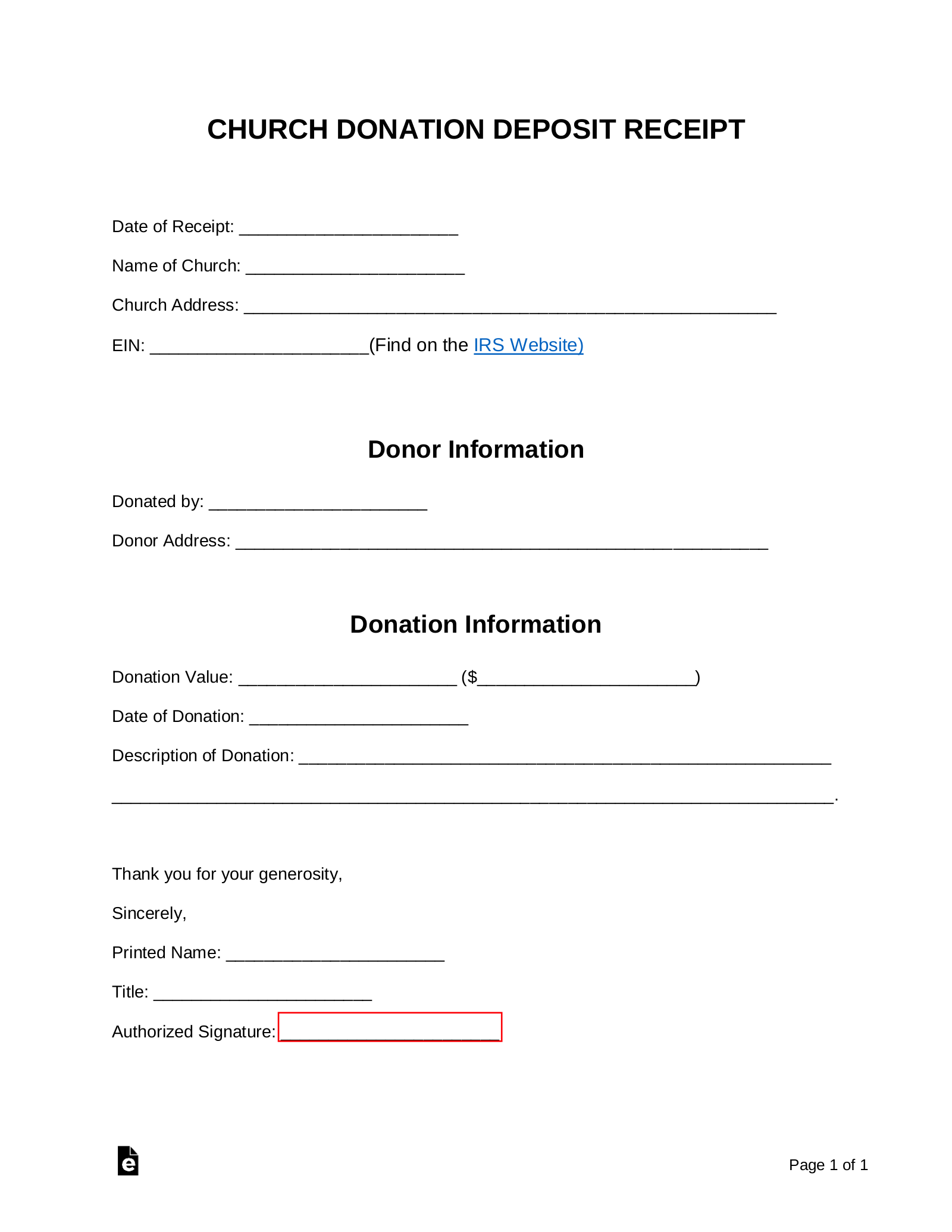

Key Components of a Contribution Statement

Essential elements ensure a contribution statement serves its purpose effectively. These components provide clarity, facilitate tax compliance, and promote transparency within the church community.

1. Church Identification: Clear identification of the issuing church, including its legal name, address, and tax identification number, is crucial for official record-keeping and tax purposes.

2. Donor Information: Accurate donor information, comprising the individual’s full name and address as recorded by the church, ensures proper attribution and facilitates personalized record-keeping for members.

3. Contribution Period: Specifying the covered period, typically a calendar year, clarifies the timeframe of the contributions recorded within the statement.

4. Date of Each Contribution: Recording individual contribution dates enables detailed tracking and allows members to reconcile their giving history with personal records.

5. Amount of Each Contribution: Accurate recording of each contribution amount is fundamental for both the donor and the church to maintain accurate financial records.

6. Contribution Method: Noting the method of contribution (e.g., cash, check, online) adds another layer of detail for reconciliation and record-keeping.

7. Designated Giving (Optional): If applicable, specifying designations for contributions, such as specific funds or initiatives, enhances transparency and demonstrates how funds are allocated.

8. Total Contributions: A clear summary of total contributions for the specified period provides a convenient overview for tax reporting and personal financial management.

These components work together to create a comprehensive record of giving, supporting both the donor’s tax obligations and the church’s financial transparency.

How to Create a Free Church Contribution Statement Template

Creating a functional and accessible contribution statement template requires careful consideration of several factors. The following steps outline the process of developing a template that meets the needs of both the church and its members.

1: Choose a Format: Selecting an appropriate format is the initial step. Common options include spreadsheet software (e.g., Microsoft Excel, Google Sheets), word processing software (e.g., Microsoft Word, Google Docs), or dedicated template creation tools. Spreadsheet software offers advantages for calculations and data management, while word processors provide flexibility for formatting and design. Choosing a format compatible with existing church software and accessible to members is crucial.

2: Incorporate Key Components: Essential elements must be included in the template. These include church identification (name, address, tax ID), donor information (name, address), contribution period, date and amount of each contribution, contribution method, and a total contributions summary. Optional fields, such as designated giving categories, can be added for enhanced detail.

3: Ensure Customization Options: Templates should offer flexibility for customization. Churches may need to adjust fields, incorporate branding elements (logos, colors), or add specific sections for different types of contributions. The ability to tailor the template to the church’s unique needs is essential.

4: Prioritize Clarity and Accessibility: Templates should be designed for ease of use and comprehension. Clear labels, logical organization, and consistent formatting enhance readability. Consider providing instructions or a guide for using the template, especially if complex features are included. Accessibility features, such as large font sizes or compatibility with screen readers, should also be considered.

5: Test and Refine: Before widespread implementation, thorough testing is vital. Review the template for accuracy, functionality, and ease of use. Gather feedback from staff and members to identify any areas for improvement. Refine the template based on this feedback to ensure it meets the needs of all users.

6: Distribute and Maintain: Once finalized, the template should be readily accessible to members. Options include providing downloadable files on the church website, distributing printed copies, or utilizing online contribution platforms that automatically generate statements. Regularly review and update the template to ensure ongoing compliance with tax regulations and evolving church needs.

Developing a robust contribution statement template requires a thoughtful approach. Careful planning, attention to detail, and a focus on user needs result in a tool that strengthens financial transparency, simplifies record-keeping, and fosters trust within the church community.

Access to complimentary, customizable templates for documenting charitable giving empowers religious organizations and their members. These resources facilitate efficient financial management, accurate tax reporting, and transparent communication within the church community. Key considerations include accessibility, customization options, compliance with tax regulations, robust record-keeping practices, and a user-friendly design. Understanding and implementing best practices related to these templates contributes to the financial health and overall well-being of religious institutions.

Accurate and accessible records of giving are essential for maintaining financial integrity and fostering trust within any religious community. Implementing readily available, adaptable templates represents a proactive step towards strengthening financial transparency and promoting responsible stewardship. By embracing best practices in record-keeping and communication, religious organizations cultivate stronger relationships with their members and contribute to the long-term sustainability of their mission.