Utilizing a readily available, standardized pay stub form offers several advantages. It ensures consistent and accurate record-keeping, simplifying financial management for all parties. Such forms can help maintain transparency and build trust between employers and their workforce. Moreover, readily accessible templates can save valuable time and resources, allowing businesses to focus on core operations.

This foundational understanding of pay stub documentation paves the way for a deeper exploration of payroll management best practices, legal compliance, and the selection of appropriate tools and resources for effective compensation administration.

1. Accessibility

Accessibility, in the context of complimentary pay stub templates, refers to the ease with which employers can obtain and utilize these resources. Readily available templates empower businesses, particularly small businesses or those with limited resources, to manage payroll effectively. Limited access can create administrative burdens and hinder efficient compensation practices.

- Format and AvailabilityTemplates available in various formats (e.g., .docx, .xlsx, .pdf) and through diverse channels (e.g., websites, software platforms) enhance accessibility. A downloadable .xlsx template allows for direct manipulation within spreadsheet software, while a .pdf offers a printable, readily shareable format. The availability of diverse formats caters to varying technological capabilities and preferences.

- Ease of UseTemplates designed with user-friendly interfaces and clear instructions simplify implementation. Pre-built formulas for calculating deductions and net pay minimize manual input and reduce the risk of errors. Intuitive design allows users with limited technical expertise to generate accurate pay stubs efficiently.

- Device CompatibilityTemplates accessible across various devices (e.g., desktops, laptops, tablets, smartphones) offer flexibility and convenience. Cloud-based access further enhances accessibility, enabling employers to manage payroll from any location with an internet connection. This is particularly beneficial for businesses with remote workforces or those operating across multiple locations.

- Cost-EffectivenessCost is a significant factor for many businesses. Complimentary templates eliminate the financial barrier associated with proprietary payroll software or professional services. This allows businesses to allocate resources to other critical areas while maintaining accurate and professional payroll practices.

By considering these facets of accessibility, businesses can select templates that align with their specific needs and resources. Ultimately, readily accessible templates contribute to streamlined payroll processes, improved accuracy, and enhanced transparency between employers and employees.

2. Customization

Customization capabilities are essential when selecting a complimentary pay stub template. Adaptability to specific business needs ensures accurate and comprehensive pay information. A templates flexibility directly impacts its practical utility and long-term effectiveness.

- Company BrandingIntegrating company logos and specific color schemes reinforces brand identity and presents a professional image. For example, a template allowing logo placement ensures consistent branding across all company documents. This seemingly minor detail contributes to a cohesive and professional brand experience for employees.

- Data FieldsThe ability to add, remove, or modify data fields allows businesses to capture all relevant compensation details. A company offering unique benefits, like stock options or profit sharing, needs a template adaptable to include these specific fields. This ensures comprehensive and accurate reflection of employee earnings.

- Payment FrequencyTemplates adaptable to various payment schedules (e.g., weekly, bi-weekly, monthly) accommodate diverse payroll practices. A business paying employees weekly requires a template that accurately calculates and displays weekly earnings and deductions, unlike a business operating on a monthly payroll cycle. Flexibility in payment frequency ensures accurate representation of payment practices.

- Language OptionsIn multilingual work environments, templates offering multiple language options facilitate clear communication and understanding. Providing pay stubs in an employee’s native language improves comprehension and demonstrates inclusivity. This is particularly important in diverse workplaces where clear communication about compensation is critical.

A highly customizable template empowers businesses to tailor pay stubs to unique requirements, ensuring accurate, comprehensive, and professional documentation of employee compensation. This adaptability contributes to improved clarity, efficiency, and compliance within payroll processes.

3. Compliance

Compliance, in the context of complimentary pay stub templates, refers to adherence to relevant legal and regulatory requirements governing payroll practices. Utilizing compliant templates safeguards businesses from potential legal issues and ensures accurate and transparent compensation processes. Non-compliance can result in penalties, legal disputes, and damage to employee trust.

- Wage and Hour LawsTemplates must accurately reflect legal requirements regarding minimum wage, overtime pay, and working hours. For example, a template must correctly calculate overtime pay based on federal or state regulations. Failure to comply with these laws can result in significant fines and back pay obligations.

- Tax WithholdingAccurate calculation and reporting of federal, state, and local taxes are crucial for compliance. Templates should facilitate proper withholding based on employee W-4 forms and relevant tax regulations. Inaccurate tax withholding can lead to penalties for both the employer and the employee.

- Deductions and GarnishmentsTemplates must handle deductions (e.g., health insurance, retirement contributions) and wage garnishments (e.g., child support, court orders) according to legal mandates. Accurate tracking and reporting of these deductions and garnishments protect both employers and employees from potential legal complications. Incorrect handling of garnishments can result in legal action against the employer.

- Data Privacy and SecurityMaintaining employee data confidentiality is paramount. Templates should adhere to data privacy regulations (e.g., GDPR, CCPA) and incorporate security measures to protect sensitive information. Failure to safeguard employee data can result in substantial fines and reputational damage.

Utilizing compliant complimentary pay stub templates demonstrates a commitment to legal and ethical payroll practices. This protects businesses from potential legal repercussions, fosters trust with employees, and contributes to a transparent and efficient compensation system. Selecting templates that prioritize compliance ensures accurate record-keeping and minimizes the risk of costly errors or legal disputes.

4. Accuracy

Accuracy in pay stub generation is paramount, directly impacting employee morale and legal compliance. A complimentary pay stub template, while offering cost benefits, must facilitate precise calculations and data entry to ensure financial integrity. Errors, regardless of source, can erode trust and lead to costly repercussions.

- Precise CalculationsAccurate calculation of gross pay, deductions, and net pay is fundamental. A template with pre-built formulas for common deductions (taxes, insurance, retirement contributions) minimizes manual input and reduces the risk of mathematical errors. For example, incorrect calculation of overtime hours can lead to underpayment and potential legal disputes. Automated calculations within the template contribute significantly to accuracy and efficiency.

- Data Entry ValidationTemplates incorporating data validation features minimize the risk of incorrect data input. For instance, restricting fields to numerical values for pay rates prevents accidental entry of text characters, a common source of errors. Such features improve data integrity and reduce the need for manual error checking.

- Clear Data PresentationA well-structured template presents information clearly, minimizing ambiguity and misinterpretations. Clear labeling of each deduction, with corresponding amounts, enhances transparency and allows employees to easily verify the accuracy of their pay stubs. Ambiguous or poorly formatted data can lead to confusion and distrust.

- Regular UpdatesMaintaining accuracy requires staying current with legal and regulatory changes impacting payroll. Using a template from a reputable source ensures access to updated versions reflecting current tax laws, deduction limits, and other relevant regulations. Outdated templates can lead to non-compliance and financial inaccuracies.

Prioritizing accuracy through the selection and proper utilization of a complimentary pay stub template contributes to financial integrity, legal compliance, and a positive employer-employee relationship. Consistent accuracy builds trust and demonstrates a commitment to fair and transparent compensation practices. This, in turn, supports a positive work environment and minimizes the risk of costly errors and disputes.

5. Professionalism

Professionalism, as it pertains to complimentary pay stub templates, reflects a commitment to presenting clear, accurate, and respectfully formatted compensation documentation. This seemingly minor detail significantly impacts employee perception and reinforces a positive employer brand image. A professional presentation demonstrates respect for employees and underscores the importance of accurate financial record-keeping.

- Clear and Concise LanguageUsing unambiguous language and avoiding jargon ensures easy comprehension for all employees. Clearly defined terminology for deductions (e.g., “Health Insurance Premium” instead of “HIP”) avoids confusion and promotes transparency. This clarity reduces the need for employees to seek clarification and fosters trust in the accuracy of the information presented.

- Organized Layout and FormattingA well-structured layout with logical grouping of information (earnings, deductions, net pay) improves readability and comprehension. Consistent font styles and sizes contribute to a professional and organized appearance. For example, separating deductions into clear categories (taxes, benefits, other deductions) simplifies review and understanding. A cluttered or poorly formatted pay stub can create confusion and detract from the perceived professionalism of the document.

- Company Branding and IdentityIncorporating company logos and consistent branding elements reinforces a professional image. Including contact information for payroll inquiries further enhances professionalism and provides a clear channel for employee questions. This reinforces the company’s identity and adds a layer of credibility to the document. Consistent branding across all company communications, including pay stubs, strengthens brand recognition and projects a professional image.

- Error-Free PresentationA professional pay stub is free of typographical errors, miscalculations, and inconsistencies. Thorough review and quality control prior to distribution ensure accuracy and prevent the dissemination of incorrect information. For example, an error in an employee’s name or social security number undermines the credibility of the entire document. Error-free presentation demonstrates attention to detail and reinforces the company’s commitment to accuracy and professionalism.

A professional approach to pay stub presentation, even with complimentary templates, reinforces a positive company image, promotes transparency, and demonstrates respect for employees. By prioritizing these elements, organizations can leverage even no-cost resources to cultivate a professional and trustworthy payroll process. This contributes to a positive work environment and reinforces the importance of accurate and respectful communication regarding employee compensation.

Key Components of a Complimentary Pay Stub Template

Essential elements comprise a comprehensive and compliant pay stub template. Understanding these core components ensures accurate reflection of earnings, deductions, and net pay, contributing to transparent and legally sound payroll practices.

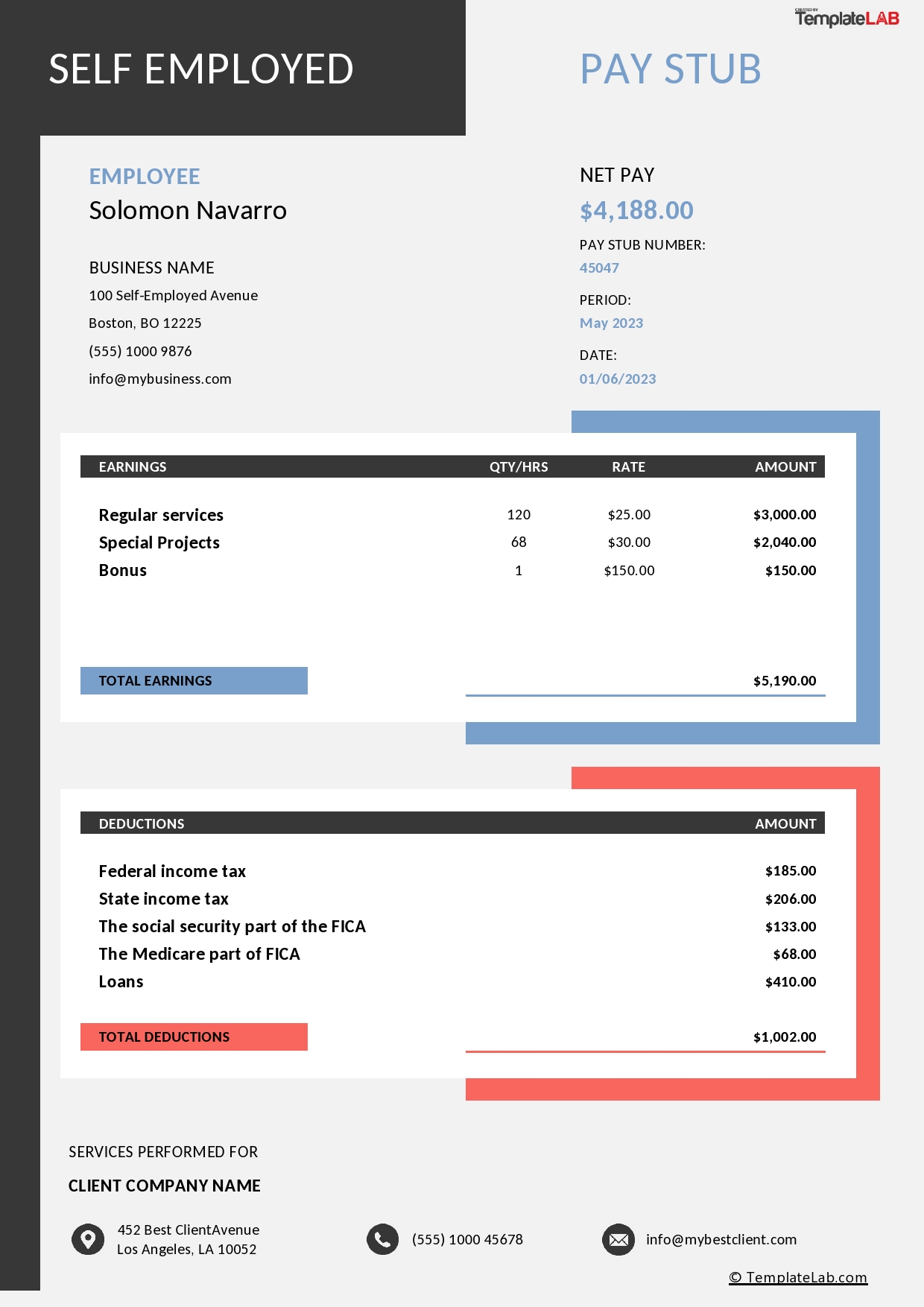

1. Employee Information: This section identifies the employee with their full name, address, and social security number. Accurate employee identification is crucial for tax reporting and record-keeping.

2. Employer Information: This includes the company’s legal name, address, and Employer Identification Number (EIN). Clear employer identification ensures legal compliance and facilitates proper tax reporting.

3. Pay Period: The specific start and end dates of the pay period are clearly defined. This provides a precise timeframe for the earnings and deductions listed.

4. Gross Earnings: This section details the total earnings before any deductions. It typically includes regular wages, overtime pay, bonuses, and commissions. Accurate calculation and presentation of gross earnings are fundamental to transparent compensation.

5. Deductions: Itemized deductions include taxes (federal, state, local), insurance premiums (health, life, disability), retirement contributions (401k, IRA), and other deductions (e.g., wage garnishments, union dues). Transparency in deductions fosters trust and clarifies net pay calculations.

6. Net Pay: This represents the employee’s take-home pay after all deductions. Accurate calculation of net pay is crucial for employee financial planning and satisfaction.

7. Year-to-Date (YTD) Totals: Cumulative totals for earnings and deductions provide a comprehensive overview of compensation throughout the year. This information is essential for tax filing and financial planning.

8. Pay Stub Number or Identifier: A unique identifier for each pay stub facilitates record-keeping and retrieval. This is particularly important for resolving discrepancies or addressing inquiries.

A well-designed template incorporates these elements to provide a comprehensive and legally compliant record of employee compensation. Consistent use of a standardized template ensures clarity, accuracy, and professionalism in payroll practices, fostering trust and transparency between employers and employees. Proper documentation facilitates effective financial management for both parties and supports compliance with relevant regulations.

How to Create a Complimentary Employee Earnings Statement Template

Creating a complimentary employee earnings statement template requires careful consideration of essential components and legal compliance. A well-structured template ensures accurate and transparent documentation of employee compensation. The following steps outline the process.

1. Choose a Format: Select a suitable formatspreadsheet software (e.g., Microsoft Excel, Google Sheets) or word processing software (e.g., Microsoft Word, Google Docs)based on desired functionality and accessibility. Spreadsheet software offers automated calculation capabilities, while word processing software allows for greater design flexibility.

2. Essential Information Fields: Incorporate essential fields for employee information (name, address, social security number), employer information (company name, address, EIN), pay period dates, and a unique pay stub identifier. Complete and accurate information ensures proper identification and record-keeping.

3. Earnings Section: Designate a section for gross earnings, including regular wages, overtime pay, bonuses, and commissions. Clear labeling of each earning type ensures transparency and facilitates understanding.

4. Deductions Section: Create a detailed deductions section encompassing taxes (federal, state, local), insurance premiums, retirement contributions, and other deductions (e.g., wage garnishments, union dues). Itemized deductions promote transparency and allow employees to verify the accuracy of their pay stubs.

5. Calculations and Formulas: Utilize formulas within spreadsheet software or clearly defined calculation methods to determine net pay accurately. Automated calculations minimize manual input and reduce the risk of errors.

6. Year-to-Date (YTD) Tracking: Incorporate fields for YTD earnings and deductions. This provides a comprehensive overview of compensation and facilitates year-end tax reporting.

7. Formatting and Layout: Organize the template with a clear and logical structure, utilizing consistent font styles and sizes. A professional and organized layout enhances readability and comprehension.

8. Compliance Review: Ensure the template adheres to all applicable federal, state, and local regulations regarding wage and hour laws, tax withholding, and deductions. Compliance safeguards businesses from legal repercussions and ensures accurate compensation practices.

A meticulously crafted template, incorporating these elements, ensures accurate, transparent, and legally compliant pay stubs. This contributes to positive employee relations, streamlines payroll processes, and facilitates efficient financial management. Regular review and updates of the template are essential to maintain compliance with evolving regulations and ensure ongoing accuracy in compensation practices.

Access to complimentary pay stub templates empowers businesses to implement accurate and professional payroll practices without incurring additional software costs. Understanding the core components, customization options, and legal compliance requirements ensures effective utilization of these resources. Prioritizing accuracy, professionalism, and accessibility contributes to transparent employer-employee relationships and efficient financial management. Careful selection and implementation of a suitable template are crucial steps in establishing a robust and legally sound payroll system.

Accurate and transparent compensation practices are essential for any successful business. Leveraging available resources, such as complimentary pay stub templates, allows organizations to streamline payroll processes while maintaining legal compliance and fostering positive employee relationships. Continued focus on accuracy, accessibility, and compliance in payroll management contributes to long-term stability and success.