Utilizing readily available, pre-formatted financial reporting structures offers numerous advantages. These resources can save significant time and effort, ensuring compliance with standard accounting practices and providing a clear framework for analysis. For startups, small businesses, or individuals managing personal finances, these tools offer an accessible entry point to financial organization.

This article will explore the core components of these financial reports, discuss various resources for obtaining them, and highlight best practices for their effective use. Further topics will cover interpreting the data, common pitfalls to avoid, and tailoring these resources to specific needs.

1. Accessibility

Accessibility is a critical aspect of free income statement and balance sheet templates. Widespread availability of these resources removes significant barriers to entry for individuals and businesses seeking to manage their finances effectively. Previously, access to such templates may have been limited due to cost or specialized software requirements. Free, readily available templates democratize financial management by providing essential tools to a broader audience, regardless of technical expertise or financial resources. This accessibility facilitates better financial planning and analysis, particularly for startups, small businesses, and individuals, fostering financial literacy and enabling informed decision-making.

Consider a small business owner seeking funding. Without readily available templates, creating professional financial statements might require hiring an accountant, incurring significant expense. A free, accessible template empowers the owner to generate these statements independently, saving money and demonstrating financial competence to potential investors. Similarly, an individual tracking personal finances can benefit from readily accessible templates, promoting better budgeting and financial control. This empowerment contributes to improved financial well-being on a broader scale.

The significance of accessibility extends beyond individual use cases. By making financial management tools more accessible, these templates contribute to a more informed and financially stable economy. Challenges remain in ensuring that individuals possess the necessary skills to interpret and utilize these templates effectively. Bridging this knowledge gap through educational resources and support is crucial to fully realizing the potential of accessible financial management tools.

2. Standardized Format

Standardized formatting is a cornerstone of effective financial reporting. Consistency in presenting financial data ensures comparability across different businesses and time periods. Free income statement and balance sheet templates adhere to these established standards, providing a reliable framework for organizing and interpreting financial information. This uniformity simplifies analysis, facilitates benchmarking, and enhances communication with stakeholders.

- ComparabilityStandardized templates enable direct comparisons between financial statements of different entities or across reporting periods within the same entity. This allows investors, creditors, and other stakeholders to assess relative performance and identify trends. For example, comparing profitability ratios across competitors using standardized income statements provides valuable market insights. Similarly, tracking a company’s own performance over time using consistent balance sheet formats reveals shifts in asset allocation and financial stability.

- Clarity and TransparencyA standardized format promotes clarity and transparency in financial reporting. Specific sections for revenues, expenses, assets, liabilities, and equity ensure that information is presented systematically. This structured approach reduces ambiguity and allows stakeholders to quickly locate and understand key financial metrics. For instance, presenting operating expenses consistently across periods clarifies cost structures and facilitates analysis of operational efficiency.

- Compliance and AuditabilityAdhering to standardized formats is often a requirement for regulatory compliance and external audits. Templates designed according to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) ensure that financial statements meet established accounting standards. This simplifies the audit process and reduces the risk of discrepancies or misinterpretations. For example, a standardized balance sheet facilitates the verification of assets and liabilities, ensuring accurate representation of a company’s financial position.

- Efficiency and AutomationStandardized formats lend themselves to automation and integration with accounting software. This streamlines data entry, reduces manual errors, and facilitates efficient generation of financial reports. Many free templates are available in spreadsheet formats compatible with common software, enabling automated calculations and report generation. This improves efficiency, reduces administrative burden, and allows for more timely analysis of financial data.

Leveraging the standardized format of free templates offers significant advantages in terms of comparability, clarity, compliance, and efficiency. These benefits contribute to more informed decision-making, improved communication with stakeholders, and ultimately, better financial management practices. By adopting these standardized frameworks, businesses and individuals can establish a solid foundation for financial analysis and planning.

3. Cost-Effectiveness

Cost-effectiveness is a crucial consideration in financial management, particularly for startups, small businesses, and individuals with limited resources. Free income statement and balance sheet templates offer a significant advantage in this regard, eliminating the financial barriers associated with procuring proprietary software or hiring professional accounting services. This affordability allows resources to be allocated to other critical business needs, maximizing overall financial efficiency.

- Reduced ExpensesEliminating the cost of purchasing software or outsourcing financial statement preparation allows for substantial savings. These funds can be reallocated to other essential areas such as marketing, product development, or operational improvements, contributing directly to business growth and sustainability. For individuals, these savings can be directed towards investments, debt reduction, or other financial goals.

- Accessibility for Startups and Small BusinessesStartups and small businesses often operate with limited budgets. Free templates provide access to essential financial management tools without straining financial resources during critical early stages. This accessibility levels the playing field, allowing smaller entities to compete effectively with larger organizations by implementing sound financial practices from the outset. For instance, a new e-commerce venture can utilize free templates to track sales, expenses, and profitability, informing crucial decisions regarding pricing, inventory management, and marketing strategies.

- Empowerment for Personal Finance ManagementIndividuals seeking to manage personal finances effectively can benefit significantly from the cost-effectiveness of free templates. Tracking income, expenses, assets, and liabilities becomes accessible without the need for expensive personal finance software. This empowers individuals to take control of their financial well-being, facilitating better budgeting, saving, and investment decisions. For example, individuals can use free templates to monitor spending patterns, identify areas for potential savings, and track progress towards financial goals like retirement planning or homeownership.

- Focus on Core Business ActivitiesBy utilizing free templates, businesses can reduce time spent on administrative tasks related to financial statement preparation. This allows personnel to focus on core business activities that generate revenue and drive growth. The time saved translates into increased productivity and improved overall operational efficiency. For example, a small restaurant owner can leverage free templates to quickly generate financial reports, freeing up time to focus on menu development, customer service, and staff management. This streamlined approach optimizes resource allocation and enhances the business’s overall competitiveness.

The cost-effectiveness of free income statement and balance sheet templates contributes significantly to financial accessibility and efficient resource allocation. By removing financial barriers, these resources empower individuals and businesses to implement sound financial practices, promoting growth, stability, and informed decision-making. This accessibility is particularly crucial in today’s dynamic economic landscape, enabling businesses to adapt, innovate, and thrive while empowering individuals to achieve their financial goals.

4. Ease of Use

Ease of use is a critical factor driving the adoption of financial management tools. Free income statement and balance sheet templates are designed with user-friendliness in mind, simplifying the process of creating and interpreting these crucial financial documents. This accessibility empowers individuals and businesses to manage finances effectively, regardless of their accounting expertise. Simplified interfaces, clear instructions, and readily available support resources contribute to a smoother user experience, promoting better financial practices and informed decision-making.

- Intuitive DesignMany free templates feature intuitive designs that require minimal technical expertise. Clear labels, logical layouts, and pre-built formulas simplify data entry and reduce the likelihood of errors. For example, a template might clearly delineate sections for revenue, cost of goods sold, and operating expenses, guiding users through the process of completing an income statement. This intuitive structure reduces the learning curve and allows users to focus on analyzing the financial data rather than navigating complex software.

- Accessibility Across PlatformsFree templates are often available in various formats, including spreadsheets, word processing documents, and even online platforms. This cross-platform compatibility ensures accessibility regardless of the user’s preferred software or operating system. A small business owner might prefer using a spreadsheet program on their desktop, while a freelancer might opt for a cloud-based template accessible from any device. This flexibility promotes wider adoption and ensures that users can access financial management tools conveniently.

- Availability of Supporting ResourcesMany providers of free templates offer supplementary resources such as tutorials, FAQs, and user guides. These resources provide additional support and guidance, addressing common user queries and facilitating a deeper understanding of financial statements. For example, a tutorial might explain how to calculate key financial ratios using the data entered into the template, providing valuable insights into a company’s performance. These supporting resources enhance the overall user experience and contribute to greater financial literacy.

- Streamlined Data Entry and ReportingFree templates often incorporate features that streamline data entry and reporting. Pre-built formulas automatically calculate totals and subtotals, reducing manual effort and minimizing the risk of errors. Some templates also offer customizable reporting options, allowing users to generate specific reports tailored to their needs. For instance, a business owner might customize a report to track monthly expenses by category, providing valuable insights into cost management. This streamlined approach enhances efficiency and facilitates timely analysis of financial data.

The ease of use associated with free income statement and balance sheet templates contributes significantly to their widespread adoption and effectiveness. By simplifying financial management processes, these resources empower individuals and businesses to make informed decisions, track performance, and achieve financial goals. This accessibility, combined with intuitive design and readily available support, fosters greater financial literacy and promotes sound financial practices across a broader audience.

5. Financial Clarity

Financial clarity is essential for effective decision-making in any financial context, from personal budgeting to corporate strategic planning. Utilizing accessible, standardized financial statement templates plays a key role in achieving this clarity. These templates provide a structured framework for organizing financial data, enabling users to gain a comprehensive overview of their financial position and performance. This understanding is crucial for identifying trends, making informed decisions, and achieving financial goals.

- Performance TrackingTemplates facilitate tracking financial performance over time. By consistently recording revenue and expenses in a standardized income statement format, businesses can identify trends in profitability and cost management. This historical data informs future projections and enables data-driven decisions regarding pricing strategies, operational efficiency, and resource allocation. Similarly, individuals can track personal income and expenses, identifying areas for potential savings and budgeting adjustments.

- Financial Position AssessmentBalance sheet templates provide a snapshot of an entity’s financial position at a specific point in time. By organizing assets, liabilities, and equity, these templates clarify the overall financial health of a business or individual. This understanding is critical for securing loans, attracting investors, and making informed decisions about investments, debt management, and asset allocation. For example, a clear overview of assets and liabilities can inform decisions regarding expansion plans or debt refinancing.

- Informed Decision-MakingFinancial clarity empowers stakeholders to make informed decisions. By providing readily accessible and organized financial data, templates enable businesses to evaluate the potential impact of strategic initiatives, investment opportunities, and operational changes. This data-driven approach reduces reliance on guesswork and minimizes financial risks. For individuals, clear financial data informs decisions regarding major purchases, retirement planning, and investment strategies.

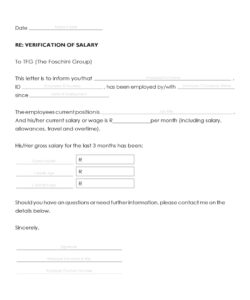

- Communication with StakeholdersClear and concise financial statements are essential for effective communication with stakeholders. Investors, creditors, and other stakeholders rely on these documents to assess the financial health and viability of a business. Standardized templates ensure that financial information is presented in a consistent and understandable format, facilitating transparent communication and building trust. For individuals, organized financial records can be essential for loan applications, tax preparation, and other financial interactions.

The use of free income statement and balance sheet templates directly contributes to achieving financial clarity. By providing a structured framework for organizing and interpreting financial data, these resources empower individuals and businesses to gain a comprehensive understanding of their financial position, track performance, make informed decisions, and communicate effectively with stakeholders. This clarity is fundamental to sound financial management and the achievement of financial goals.

6. Informed Decisions

Sound financial decisions rely on accurate and accessible data. Free income statement and balance sheet templates provide the necessary framework for organizing financial information, enabling informed decisions across various financial contexts. From evaluating profitability to assessing financial stability, these templates empower stakeholders to make data-driven choices that align with their financial goals.

- Strategic PlanningAccurate financial statements are crucial for effective strategic planning. By analyzing historical trends in revenue, expenses, and profitability revealed through income statements, businesses can identify areas for growth and improvement. Balance sheets provide insights into asset utilization and debt management, informing decisions regarding expansion, diversification, and resource allocation. For example, consistent profitability documented in income statements might support a decision to expand operations, while a high debt-to-equity ratio revealed in a balance sheet might encourage a focus on debt reduction before considering expansion.

- Investment DecisionsWhether evaluating potential business investments or managing personal finances, access to organized financial data is essential. Income statements provide insights into the profitability of different ventures, enabling comparisons and informed investment choices. Balance sheets offer a clear overview of assets, liabilities, and equity, informing decisions about asset allocation, portfolio diversification, and risk management. For instance, an investor might compare the profitability of two companies using their income statements before deciding where to allocate capital. Similarly, an individual might analyze their personal balance sheet to determine the appropriate mix of stocks, bonds, and real estate in their investment portfolio.

- Performance EvaluationRegularly generated financial statements facilitate ongoing performance evaluation. Businesses can track key performance indicators (KPIs) such as revenue growth, profit margins, and return on investment, identifying areas of strength and weakness. This data-driven approach enables timely corrective actions and adjustments to business strategies. Similarly, individuals can track their spending habits, monitor progress towards savings goals, and assess the overall health of their personal finances. For example, a business might identify declining profit margins through income statement analysis, prompting a review of pricing strategies or cost-cutting measures. An individual might analyze their personal income statement to identify areas of overspending and adjust their budget accordingly.

- Financial Risk ManagementUnderstanding financial risks is crucial for both businesses and individuals. Analyzing financial statements can reveal potential vulnerabilities and inform risk mitigation strategies. Income statements can highlight dependence on specific revenue streams or vulnerabilities to fluctuating costs. Balance sheets can reveal high levels of debt or insufficient liquid assets, prompting actions to improve financial stability. For instance, a business heavily reliant on a single client might diversify its customer base to mitigate the risk of revenue loss. An individual with a high debt-to-income ratio might prioritize debt reduction to improve their financial resilience.

By providing a structured framework for organizing and analyzing financial data, free income statement and balance sheet templates empower informed decision-making across various financial contexts. From strategic planning and investment decisions to performance evaluation and risk management, these readily available tools contribute significantly to achieving financial goals and ensuring long-term financial stability. Their accessibility and ease of use democratize financial management, enabling individuals and businesses to navigate the complexities of the financial landscape with greater confidence and clarity.

Key Components of Financial Statement Templates

Understanding the core components of financial statement templates is fundamental to effective financial management. These components provide a structured framework for organizing and interpreting financial data, enabling informed decision-making and effective communication with stakeholders.

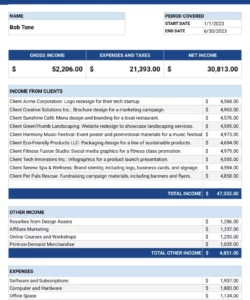

1. Revenue: Income generated from a company’s primary business activities. In an income statement template, this section details various revenue streams, providing insights into the core drivers of a company’s financial performance. This component is crucial for assessing a company’s ability to generate sales and sustain operations.

2. Expenses: Costs incurred in the process of generating revenue. Income statement templates categorize expenses, including cost of goods sold, operating expenses, and interest expenses, enabling analysis of cost structures and profitability. Accurate expense tracking is critical for effective cost management and profitability analysis.

3. Net Income/Loss: The difference between total revenues and total expenses. This bottom-line figure represents a company’s overall profitability during a specific period. A positive net income indicates profitability, while a negative net income signifies a loss. This key metric is a central focus of income statement analysis.

4. Assets: Resources owned or controlled by a company. Balance sheet templates categorize assets into current and non-current, providing an overview of a company’s investments and resources available for generating future economic benefits. Understanding asset composition is crucial for assessing a company’s financial strength and liquidity.

5. Liabilities: Obligations or debts owed by a company to external parties. Balance sheet templates classify liabilities as current and non-current, offering insights into a company’s financial obligations and debt management practices. Analyzing liabilities is essential for evaluating a company’s financial risk and solvency.

6. Equity: The residual interest in the assets of a company after deducting liabilities. This represents the owners’ stake in the company. Balance sheet templates detail the components of equity, including contributed capital and retained earnings, providing insight into the ownership structure and financial health of the company. Equity analysis is fundamental for understanding a company’s long-term financial stability and growth potential.

These interconnected components provide a comprehensive overview of an entity’s financial performance and position. Analyzing these elements within the standardized framework of financial statement templates allows for informed assessments of profitability, stability, and growth potential, contributing to effective financial management and strategic decision-making.

How to Create Free Income Statement and Balance Sheet Templates

Creating accessible financial statement templates involves leveraging readily available tools and adhering to standardized accounting principles. This process enables efficient financial record-keeping and analysis, supporting informed decision-making.

1. Utilize Spreadsheet Software: Leverage spreadsheet software like Google Sheets or Microsoft Excel. These programs offer pre-built functions for calculations and formatting, simplifying the template creation process. Their widespread availability and familiarity contribute to accessibility and ease of use.

2. Structure the Income Statement: Establish clear sections for revenue and expenses. Categorize revenue streams (e.g., sales, services) and expense types (e.g., cost of goods sold, operating expenses, interest expense). Incorporate formulas to calculate gross profit, operating income, and net income/loss automatically.

3. Structure the Balance Sheet: Organize the balance sheet into assets, liabilities, and equity sections. Categorize assets as current (e.g., cash, accounts receivable) or non-current (e.g., property, plant, and equipment). Similarly, classify liabilities as current (e.g., accounts payable) or non-current (e.g., long-term debt). Ensure the balance sheet equation (Assets = Liabilities + Equity) is maintained through formulas.

4. Implement Formulas and Functions: Integrate formulas to automate calculations. Utilize SUM functions for totaling revenue and expense categories, and incorporate formulas for calculating key metrics like gross profit margin, net profit margin, and current ratio. Automated calculations enhance accuracy and efficiency.

5. Adhere to Accounting Principles: Ensure the templates adhere to relevant accounting principles (e.g., Generally Accepted Accounting Principles – GAAP, or International Financial Reporting Standards – IFRS). Consistent application of these principles ensures comparability and reliability of financial data.

6. Consider Customization Options: Incorporate features for customization. Allow users to add or modify categories based on their specific needs. Offer options for generating reports tailored to different time periods or specific financial metrics. Flexibility enhances the utility and applicability of the templates.

7. Test and Refine: Thoroughly test the templates with sample data to ensure accuracy and functionality. Solicit feedback from potential users and refine the templates based on their input. Rigorous testing ensures reliability and usability.

8. Provide Clear Instructions and Documentation: Include clear instructions and documentation explaining how to use the templates effectively. Offer guidance on data entry, formula usage, and report generation. Comprehensive documentation enhances user understanding and promotes proper utilization of the templates.

Creating effective financial statement templates involves structuring data logically, automating calculations, adhering to accounting standards, and prioritizing user-friendliness. These practices ensure accuracy, accessibility, and practical application in diverse financial contexts.

Access to well-structured financial statement templates offers significant advantages for managing finances effectively. Leveraging these readily available resources empowers informed decision-making through organized financial data analysis. From evaluating profitability and financial stability to supporting strategic planning and risk management, these templates contribute to sound financial practices. Standardized formats ensure consistency and comparability, while cost-effectiveness promotes accessibility for individuals and businesses of all sizes. Furthermore, the ease of use and availability of supporting resources facilitate broader adoption and understanding of fundamental financial principles.

Effective financial management is crucial for navigating today’s complex economic landscape. Utilizing readily available tools like free income statement and balance sheet templates provides a practical pathway to achieving financial clarity and making sound financial decisions. These resources represent a valuable asset for fostering financial literacy, promoting stability, and driving growth in both personal and professional financial endeavors. Continued emphasis on accessibility, education, and responsible financial practices will further empower individuals and businesses to achieve their financial objectives and contribute to a more robust and sustainable economic future.