Utilizing a readily available, periodic financial summary offers several advantages. It facilitates budget management, identifies areas for potential cost savings, and supports more accurate financial forecasting. Accessibility to this type of resource empowers users to gain a clearer understanding of their financial standing without incurring additional expense.

This foundation of financial awareness leads naturally into discussions of specific report components, resource acquisition, and practical application strategies. Exploring these topics will further enhance comprehension and enable effective utilization of this valuable tool.

1. Accessibility

Accessibility is a critical factor driving the utility of complimentary, periodic financial reporting formats. Widespread availability through online platforms, software applications, and template repositories removes financial barriers to entry for individuals and small businesses. This democratization of financial management tools empowers users to track performance, analyze trends, and make informed decisions without requiring specialized software or costly professional services. For example, a freelancer could leverage a readily available template to monitor project profitability, while a small business owner might use one to track overhead costs and identify potential savings. The ease of acquiring and implementing these resources contributes significantly to their practical value.

Furthermore, accessibility extends beyond mere availability. User-friendly design and compatibility with common software applications contribute to seamless integration into existing workflows. Templates available in various formats, such as spreadsheets or downloadable documents, cater to diverse technical capabilities and preferences. This adaptability ensures that individuals with varying levels of technological expertise can leverage these resources effectively. Consider a non-profit organization using a simple spreadsheet template to track grant expenditures, compared to a startup utilizing a cloud-based template integrated with accounting software; both benefit from accessibility tailored to their specific needs.

In summary, the accessibility of complimentary periodic financial report structures plays a vital role in promoting informed financial management. By removing cost and technical barriers, these resources empower individuals and organizations to gain greater control over their financial well-being. While challenges may arise in adapting templates to unique circumstances, the overall benefits of increased accessibility significantly contribute to wider financial literacy and improved economic outcomes.

2. Regular Tracking

Regular tracking of financial performance is essential for maintaining fiscal health and achieving financial goals. A complimentary monthly income statement template provides the structure necessary for this consistent monitoring, offering a recurring snapshot of income and expenses. This cyclical review fosters proactive financial management, enabling timely identification of trends, potential issues, and opportunities for improvement.

- Trend AnalysisConsistent data collection facilitated by regular use of a template allows for trend analysis. Observing patterns in income and expenses over several months reveals valuable insights. For example, a seasonal business might observe predictable fluctuations in sales, allowing for proactive inventory management or marketing adjustments. A consistent approach to data collection ensures the reliability of such analyses.

- Early Issue DetectionRegular monitoring through the use of a monthly income statement template enables early detection of potential financial issues. Consistently tracking expenses can reveal creeping costs, such as rising subscription fees or utility bills, before they significantly impact profitability. Early identification allows for timely intervention and corrective action. For example, a steady increase in office supply expenses could prompt a review of purchasing practices.

- Performance Evaluation Against BudgetA monthly income statement serves as a tool to evaluate performance against a pre-determined budget. Regular comparison of actual results with projected figures provides valuable feedback on budget efficacy and adherence. This process allows for adjustments to spending habits, revenue projections, and overall financial strategy. For instance, consistently exceeding a marketing budget might indicate a need for reallocation of resources.

- Informed Decision-MakingThe data accumulated through regular tracking informs data-driven decision-making. Having a clear understanding of monthly income and expenses allows for strategic allocation of resources, informed investment choices, and proactive adjustments to operational strategies. This data-backed approach reduces reliance on guesswork and promotes sound financial management. For example, consistent profitability could support a decision to expand operations or invest in new equipment.

By facilitating these functions, regular use of a complimentary monthly income statement template provides a crucial foundation for sound financial management. The insights gained from consistent tracking empower informed decision-making, contributing to both short-term stability and long-term financial success. While the initial effort required for consistent data entry might present a challenge, the long-term benefits of proactive financial management far outweigh the investment.

3. Profit/Loss Overview

A profit/loss overview, derived from a complimentary monthly income statement template, forms the core of financial performance assessment. This overview provides a concise summary of financial outcomes over a specified period, typically one month. The direct relationship between revenue generated and expenses incurred reveals the net profit or loss. This crucial metric allows businesses to gauge financial health and operational efficiency. For example, a positive net profit indicates revenue exceeds expenses, while a net loss signals the opposite. Understanding this fundamental relationship is paramount for effective financial management.

The practical significance of a profit/loss overview extends beyond mere numerical representation. It acts as a catalyst for informed decision-making. A consistent pattern of losses might necessitate operational adjustments, such as cost reduction strategies or revenue enhancement initiatives. Conversely, sustained profitability might justify expansion plans or investments in new ventures. Consider a retail business experiencing declining profits despite consistent sales volume. Analysis of the income statement might reveal increasing operating expenses, such as rent or utilities, prompting a review of vendor contracts or energy consumption patterns. In this scenario, the profit/loss overview facilitates targeted interventions based on empirical data.

Furthermore, regular generation of profit/loss overviews, facilitated by the consistent use of a monthly template, allows for trend analysis over time. Observing patterns of profit and loss across multiple periods provides valuable insights into the long-term financial trajectory of a business or individual. This historical perspective informs strategic planning, budget forecasting, and overall financial management. Challenges may arise in interpreting fluctuations in profit/loss due to unforeseen circumstances, such as economic downturns or unexpected expenses. However, the consistent application of this framework provides a crucial foundation for financial awareness and sound decision-making.

4. Informed Decisions

Sound financial decisions rely on accurate, readily available data. A complimentary monthly income statement template provides this crucial foundation, empowering individuals and businesses to make informed choices based on a clear understanding of their financial performance. Regular use of such a template fosters proactive financial management, moving beyond reactive responses to financial challenges towards strategic planning and informed resource allocation.

- Strategic PricingUnderstanding the relationship between revenue, cost of goods sold, and operating expenses, as revealed through a monthly income statement, allows for strategic pricing decisions. A business can analyze profit margins on individual products or services and adjust pricing accordingly to optimize profitability. For example, if a product line consistently generates low profit margins despite strong sales, the income statement data can inform a decision to increase prices or reduce production costs. This data-driven approach ensures pricing strategies align with overall financial goals.

- Cost ManagementRegular review of a monthly income statement facilitates effective cost management. Tracking expenses across different categories reveals areas of potential overspending or inefficiency. This granular view allows for targeted interventions, such as renegotiating vendor contracts, optimizing energy consumption, or streamlining operational processes. For example, consistently high utility expenses might prompt an investigation into energy efficiency measures. This data-driven approach to cost management maximizes resource utilization and contributes to improved profitability.

- Investment DecisionsInformed investment decisions rely on a clear understanding of financial performance. A monthly income statement provides the necessary data to assess the viability of potential investments, whether in new equipment, marketing campaigns, or expansion projects. By analyzing historical and current financial trends, individuals and businesses can make informed judgments about the potential return on investment and the associated risks. For instance, consistent profitability might support a decision to invest in new technology to enhance productivity.

- Resource AllocationEffective resource allocation requires a comprehensive view of financial inflows and outflows. A monthly income statement provides this overview, enabling strategic allocation of resources to maximize impact and achieve financial objectives. By understanding which areas generate the highest returns and which incur the greatest costs, individuals and businesses can prioritize investments and allocate resources accordingly. For example, a business might choose to allocate more resources to a high-performing product line or reduce spending on less profitable ventures based on insights gleaned from the income statement.

By providing a clear, concise, and regularly updated overview of financial performance, a complimentary monthly income statement template empowers informed decision-making across various aspects of financial management. This data-driven approach promotes proactive planning, strategic resource allocation, and ultimately, greater financial success. While the specific decisions made will vary depending on individual circumstances and goals, the consistent use of this tool provides a crucial foundation for informed financial management.

5. Financial Clarity

Financial clarity, a critical component of sound financial management, is significantly enhanced through the utilization of a complimentary monthly income statement template. This structured framework provides a clear, concise, and readily accessible overview of financial performance. The consistent categorization of income and expenses illuminates financial inflows and outflows, revealing the underlying dynamics driving profitability or losses. This transparency empowers informed decision-making, enabling strategic resource allocation and proactive adjustments to financial strategies. For example, a small business owner using a template can readily identify the proportion of revenue allocated to operating expenses, such as rent, utilities, or marketing, facilitating targeted cost-saving measures. Without such a structured approach, these crucial insights might remain obscured, hindering effective financial management. The cause-and-effect relationship is clear: utilization of a template directly contributes to enhanced financial clarity.

The practical significance of this enhanced financial clarity is substantial. A clear understanding of financial performance empowers data-driven decision-making across various aspects of financial management. Consider a freelancer using a template to track project profitability. By clearly identifying the most and least profitable projects, they can make informed decisions about client selection, project pricing, and resource allocation in future engagements. Similarly, a non-profit organization using a template to monitor grant expenditures can demonstrate responsible financial stewardship to donors, enhancing transparency and trust. These practical applications underscore the importance of financial clarity as a component of effective financial management, facilitated by readily available resources.

In conclusion, the connection between financial clarity and complimentary monthly income statement templates is undeniable. The structured framework provided by these templates fosters transparency, illuminating the dynamics driving financial performance. This clarity, in turn, empowers informed decision-making, contributing to more effective resource allocation, strategic planning, and ultimately, greater financial success. While challenges may arise in consistently maintaining accurate records and adapting templates to unique circumstances, the overall benefits of enhanced financial clarity, facilitated by these readily available tools, significantly outweigh the associated effort. This understanding reinforces the broader theme of accessible and proactive financial management as a cornerstone of individual and organizational financial health.

6. Cost Management

Effective cost management is crucial for financial stability and growth, regardless of individual or organizational scale. A complimentary monthly income statement template provides a foundational tool for implementing sound cost management strategies. By offering a structured overview of income and expenses, these templates empower users to identify areas of potential overspending, track cost-saving initiatives, and ultimately, optimize resource allocation. This structured approach transforms cost management from a reactive process to a proactive, data-driven endeavor.

- Expense Tracking and CategorizationTemplates facilitate systematic expense tracking and categorization. By diligently recording all expenses and assigning them to specific categories (e.g., rent, utilities, marketing, salaries), users gain a granular view of spending patterns. This detailed breakdown reveals areas where costs might be exceeding expectations or where inefficiencies exist. For example, a business might discover that office supply expenses are disproportionately high, prompting a review of purchasing practices or vendor contracts. This granular approach to expense tracking is essential for identifying cost-saving opportunities.

- Budgeting and Variance AnalysisA monthly income statement template serves as a basis for creating realistic budgets and performing variance analysis. By comparing actual expenses against budgeted amounts, users can identify deviations and investigate their underlying causes. Favorable variances, where actual expenses are lower than budgeted, highlight areas of effective cost control. Unfavorable variances, on the other hand, signal potential overspending and trigger further investigation. For instance, if marketing expenses consistently exceed the budget, it might indicate a need to reassess the marketing strategy or explore more cost-effective channels. This ongoing process of budgeting and variance analysis ensures proactive cost management.

- Trend Identification and AnalysisConsistent use of a monthly income statement template enables the identification and analysis of cost trends over time. By tracking expenses across multiple periods, users can observe patterns and identify potential issues before they escalate. For example, a steady increase in utility costs might prompt an investigation into energy efficiency measures or a renegotiation of utility contracts. This proactive approach to cost management, facilitated by trend analysis, helps mitigate financial risks and maintain long-term stability. Visual representations, such as charts and graphs, can further enhance trend identification and analysis, providing valuable insights into long-term cost patterns.

- Performance Evaluation and BenchmarkingThe data collected within a monthly income statement template allows for performance evaluation and benchmarking. By comparing current expenses to historical data or industry averages, users can assess the effectiveness of cost management strategies and identify areas for improvement. This benchmarking process provides valuable context and motivates continuous improvement in cost control efforts. For instance, a restaurant owner might compare their food costs as a percentage of revenue to industry benchmarks to identify potential areas for cost optimization. Benchmarking against competitors or internal targets can also highlight areas of strength and opportunities for further cost reduction.

In conclusion, a complimentary monthly income statement template provides a powerful tool for implementing effective cost management strategies. By facilitating detailed expense tracking, budgeting, trend analysis, and benchmarking, these templates empower individuals and businesses to gain greater control over their finances. The insights derived from this structured approach to cost management contribute not only to short-term cost savings but also to long-term financial stability and sustainable growth. This reinforces the importance of accessible and user-friendly financial tools in promoting informed financial management practices.

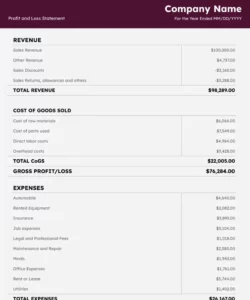

Key Components of a Complimentary Monthly Income Statement Template

Understanding the core components of a complimentary monthly income statement template is essential for effective financial analysis and management. These components provide a structured framework for recording and interpreting financial data, enabling informed decision-making.

1. Revenue: This section details all sources of income generated during the month. It includes operating revenue from core business activities and any non-operating revenue from other sources, such as interest or investments. Accurate revenue recording is fundamental to assessing overall financial performance.

2. Cost of Goods Sold (COGS): For businesses selling tangible products, COGS represents the direct costs associated with producing those goods. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is critical for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit reflects the profitability of core business operations before considering operating expenses. This metric provides insight into the efficiency of production and pricing strategies.

4. Operating Expenses: This section encompasses all costs incurred in running the business, excluding COGS. Examples include rent, utilities, salaries, marketing, and administrative expenses. Careful tracking of operating expenses is crucial for identifying areas of potential cost savings.

5. Operating Income: Derived by subtracting operating expenses from gross profit, operating income represents the profitability of the business after accounting for all operating costs. This key metric reflects the efficiency of core business operations.

6. Other Income/Expenses: This section captures any non-operating income or expenses, such as interest income, investment gains or losses, or one-time charges. These items are typically separated from operating activities to provide a clearer picture of core business performance.

7. Net Income: Representing the bottom line, net income is calculated by adding other income (and subtracting other expenses) to operating income. This final figure reflects the overall profitability of the business for the month and is a crucial indicator of financial health.

A well-structured template ensures consistent data capture and facilitates meaningful analysis. Regular use of these components promotes informed financial management, enabling strategic decision-making, cost optimization, and improved financial outcomes.

How to Create a Complimentary Monthly Income Statement Template

Creating a complimentary monthly income statement template involves structuring a document or spreadsheet to systematically track income and expenses, ultimately calculating net profit or loss. This process can be achieved using readily available software or even manually using a structured format. The following steps outline the process.

1: Choose a Format: Select a suitable format, either a spreadsheet program (e.g., Google Sheets, Microsoft Excel) or a word processing document. Spreadsheets offer greater flexibility for calculations and data manipulation.

2: Create Column Headers: Establish clear column headers. Essential columns include “Date,” “Description,” “Income,” and “Expenses.” Additional columns can be added for specific categories (e.g., “Rent,” “Utilities,” “Sales”).

3: Input Income Data: Systematically record all income received during the month. Include details such as date, description, and amount. Categorize income sources as appropriate (e.g., “Sales Revenue,” “Interest Income”).

4: Input Expense Data: Diligently record all expenses incurred during the month. Provide details such as date, description, and amount. Categorize expenses as appropriate (e.g., “Rent,” “Utilities,” “Marketing”).

5: Calculate Totals: Use formulas or functions within the chosen software (if applicable) to calculate total income and total expenses for the month. Ensure accuracy by double-checking calculations.

6: Calculate Net Income/Loss: Subtract total expenses from total income to determine the net income or loss for the month. This key metric reflects the overall financial performance for the period.

7: Review and Refine: Regularly review the income statement for accuracy and completeness. Refine the template as needed to accommodate evolving business needs or to enhance clarity. Consistent review ensures the template remains a valuable tool for financial management.

8: Consider Additional Features (Optional): Enhance the template by incorporating additional features such as budgeting columns, variance analysis calculations, or visual representations (charts, graphs). These additions provide deeper insights into financial performance and support more informed decision-making.

Systematic data entry and accurate calculations are crucial for generating meaningful insights. A well-structured template provides a framework for consistent financial tracking, empowering informed financial management and contributing to both short-term and long-term financial success. Regular use fosters proactive financial management and supports informed decision-making.

Complimentary monthly income statement templates offer accessible and valuable resources for enhancing financial management practices. They provide a structured framework for tracking income and expenses, enabling clear profit/loss overviews, and supporting informed decision-making. Accessibility, regular tracking, and detailed categorization of financial data contribute to greater financial clarity and more effective cost management strategies. Leveraging these readily available tools empowers individuals and businesses to gain a deeper understanding of their financial performance, promoting proactive financial planning and improved outcomes.

Financial well-being hinges on informed decision-making, driven by accurate and readily available data. Adopting consistent financial tracking practices, facilitated by readily available templates, represents a crucial step towards achieving financial goals and ensuring long-term stability. The insights derived from regular analysis of financial performance contribute not only to immediate improvements but also to a stronger foundation for future financial success. Embracing these tools and practices positions individuals and organizations for greater financial control and resilience in a dynamic economic landscape.