Utilizing such a resource offers several advantages. It enables efficient budget monitoring, facilitates informed cost management, aids in identifying areas for improvement, and supports data-driven decision-making. Accessibility to cost-free options further reduces financial barriers for businesses, particularly startups and small enterprises.

This foundation of financial understanding allows for deeper exploration of key performance indicators, effective budgeting strategies, and advanced financial analysis techniques, which will be discussed further.

1. Accessibility

Cost presents a significant barrier to resource acquisition for many businesses, particularly startups and small enterprises. Accessibility, a key advantage of free monthly profit and loss statement templates, directly addresses this challenge. Removing financial obstacles facilitates broader adoption of essential financial management tools.

- Reduced Financial BurdenEliminating the cost associated with acquiring financial management tools allows businesses to allocate limited resources to other critical areas like marketing, product development, or talent acquisition. This is particularly significant for early-stage ventures where budgets are often constrained.

- Empowerment of Small BusinessesSmall businesses, often operating with tighter margins, benefit significantly from free resources. Access to profit and loss templates empowers them to implement robust financial practices typically associated with larger, more established organizations. This levels the playing field and promotes growth.

- Wider Adoption of Best PracticesFree availability encourages broader adoption of sound financial management practices. Businesses that might have otherwise forgone these crucial tools due to cost constraints can now implement standardized reporting, leading to improved financial oversight and decision-making across industries.

- Facilitated Growth and ScalabilityBy reducing initial investment requirements, these accessible templates enable businesses to scale more rapidly. As operations expand, the established foundation of financial tracking ensures continued monitoring and control, mitigating potential risks associated with rapid growth.

The accessibility of free monthly profit and loss statement templates promotes wider adoption of essential financial management practices, contributing to greater financial stability and informed decision-making across a diverse range of businesses. This readily available resource empowers businesses to track performance, identify areas for improvement, and ultimately achieve sustainable growth.

2. Regular Tracking

Regular tracking, facilitated by a free monthly profit and loss statement template, forms the cornerstone of effective financial management. Consistent use of such a template provides a chronological record of financial performance, enabling businesses to identify emerging trends, potential problems, and opportunities for improvement. This ongoing monitoring allows for proactive adjustments rather than reactive responses to significant financial deviations.

Consider a retail business experiencing a steady decline in net profit over several months. Regular tracking, using a profit and loss statement, allows for a detailed analysis of sales figures, cost of goods sold, operating expenses, and other relevant factors. This detailed insight can pinpoint the source of the decline, perhaps revealing increased supplier costs, rising marketing expenditures, or a drop in customer traffic. Without consistent monitoring, such issues might go unnoticed until the business faces a significant financial crisis.

Furthermore, regular tracking supports informed forecasting and budgeting. Historical data, compiled through consistent use of the template, provides a basis for projecting future performance and setting realistic financial goals. This predictive capability enables proactive resource allocation, minimizing the risk of overspending or underestimating revenue potential. Consistent monitoring, therefore, bridges the gap between past performance and future planning, contributing to long-term financial stability and growth.

In summary, regular tracking, enabled by readily available free monthly profit and loss templates, is not merely a bookkeeping exercise but a crucial management tool. It empowers businesses to identify trends, anticipate challenges, and make informed decisions, ultimately fostering financial health and sustainable growth. This proactive approach to financial management, grounded in consistent data analysis, distinguishes successful businesses from those that react passively to financial fluctuations.

3. Informed Decisions

Sound financial decisions rely on accurate, readily available data. A free monthly profit and loss statement template provides this crucial foundation, empowering businesses to move beyond guesswork and make informed choices based on concrete financial performance. This data-driven approach minimizes risks and maximizes opportunities for growth and profitability.

- Strategic PricingUnderstanding cost structures, profit margins, and sales volume is essential for effective pricing strategies. A profit and loss statement illuminates these key metrics, enabling businesses to adjust pricing to optimize profitability without compromising market competitiveness. For example, if a statement reveals rising material costs impacting profit margins, a business can make informed decisions about raising prices, finding alternative suppliers, or adjusting product specifications.

- Resource AllocationEffective resource allocation requires a clear understanding of where funds are being utilized and their impact on profitability. A monthly profit and loss statement provides this visibility, enabling informed decisions regarding investment in marketing campaigns, equipment upgrades, or personnel expansion. For instance, if a statement reveals consistently low returns on a specific marketing initiative, resources can be redirected to more effective channels.

- Cost ControlIdentifying and controlling costs is crucial for maintaining profitability. Regularly reviewing a profit and loss statement allows businesses to pinpoint areas of excessive spending or inefficient resource utilization. This insight facilitates informed decisions regarding cost reduction strategies, such as renegotiating vendor contracts, streamlining operational processes, or implementing energy-saving measures.

- Performance EvaluationEvaluating business performance against established goals requires a clear metric for success. The net income or loss reported on a profit and loss statement serves as this key performance indicator. This information informs decisions regarding strategic adjustments, operational improvements, and future growth plans. For instance, consistently exceeding profit targets might justify expansion into new markets or product development, while recurring losses necessitate a comprehensive review of operations and strategic direction.

By providing a clear, concise overview of financial performance, a free monthly profit and loss statement template empowers businesses to make informed decisions across all aspects of operations. This data-driven approach fosters financial stability, maximizes profitability, and positions businesses for sustainable growth. Consistent utilization of this resource allows for proactive adjustments, informed forecasting, and ultimately, greater control over financial outcomes.

4. Performance Analysis

Performance analysis, a critical component of financial management, relies heavily on accurate and readily available data. A free monthly profit and loss statement template provides the necessary framework for conducting meaningful performance evaluations. This structured approach allows businesses to gain insights into profitability, cost management, and overall financial health, enabling data-driven decision-making and strategic adjustments.

- Revenue Stream EvaluationAnalyzing revenue streams is crucial for identifying growth opportunities and potential weaknesses. A profit and loss statement provides a detailed breakdown of revenue sources, allowing businesses to assess the performance of individual products, services, or customer segments. For example, a declining revenue stream might indicate a need for product innovation, targeted marketing campaigns, or revised pricing strategies.

- Expense AnalysisControlling costs is essential for maintaining profitability. A profit and loss statement facilitates detailed expense analysis, enabling businesses to identify areas of overspending, inefficiency, or potential cost-saving opportunities. For instance, a significant increase in operating expenses might prompt investigation into specific cost categories, such as rent, utilities, or marketing expenditures, leading to targeted cost reduction initiatives.

- Profitability AssessmentAssessing profitability is fundamental to business success. A profit and loss statement provides a clear picture of net income or loss, allowing businesses to evaluate overall financial performance and identify trends over time. Consistent profitability analysis informs strategic decisions related to expansion, investment, and resource allocation. Conversely, recurring losses necessitate a thorough review of operations, pricing strategies, and cost structures.

- Key Performance Indicator (KPI) TrackingMonitoring key performance indicators (KPIs) provides valuable insights into specific aspects of business performance. A profit and loss statement facilitates the tracking of essential KPIs such as gross profit margin, net profit margin, and operating expense ratio. These metrics provide benchmarks for evaluating performance against industry averages, competitor performance, or internal targets, informing strategic adjustments and operational improvements.

Utilizing a free monthly profit and loss statement template provides the structured data necessary for robust performance analysis. By tracking revenue, expenses, profitability, and key performance indicators, businesses gain a comprehensive understanding of their financial health, enabling data-driven decisions that contribute to long-term stability and sustainable growth. This analytical approach empowers businesses to identify strengths, address weaknesses, and capitalize on opportunities for improvement.

5. Financial Control

Financial control, crucial for sustainable business operations, requires consistent monitoring and analysis of financial data. A free monthly profit and loss statement template provides the framework for achieving this control, enabling organizations to track income, expenses, and profitability, thereby facilitating informed decision-making and proactive financial management.

- Budget AdherenceBudgets provide a roadmap for financial resource allocation. Regularly comparing actual results, as detailed in the profit and loss statement, against the budget allows organizations to identify variances and take corrective action. For instance, significant deviations in marketing expenditures, revealed through the statement, might necessitate adjustments in campaign strategies or budget reallocations. Consistent monitoring ensures adherence to budgetary guidelines, promoting financial discipline.

- Expense ManagementControlling expenses is paramount for profitability. A profit and loss statement provides a detailed breakdown of expenses, categorized for analysis. This granular view enables organizations to identify areas of excessive spending, inefficient resource utilization, or potential cost-saving opportunities. For example, consistently high utility costs might prompt an investigation into energy efficiency measures. The statement facilitates proactive expense management, optimizing resource allocation and maximizing profitability.

- Cash Flow MonitoringMaintaining healthy cash flow is essential for meeting operational obligations. While not a direct measure of cash flow, a profit and loss statement provides insights into profitability, a key driver of cash generation. Understanding the relationship between revenue, expenses, and net income informs decisions regarding pricing strategies, credit policies, and inventory management, all of which impact cash flow. This indirect influence contributes to improved cash flow forecasting and management.

- Profitability OptimizationUltimately, financial control aims to optimize profitability. A profit and loss statement serves as a scorecard, reflecting the effectiveness of operational and financial strategies. Analyzing trends in revenue, cost of goods sold, and operating expenses allows organizations to identify areas for improvement and implement strategies to enhance profitability. Consistent monitoring and analysis, facilitated by the statement, enable data-driven decisions that contribute to long-term financial success.

Utilizing a free monthly profit and loss statement template empowers organizations to exercise greater financial control. By providing a structured framework for tracking financial performance, analyzing key metrics, and identifying areas for improvement, the template enables proactive management of resources, optimization of profitability, and enhanced financial stability. This consistent monitoring and analysis contributes significantly to long-term financial health and sustainable growth.

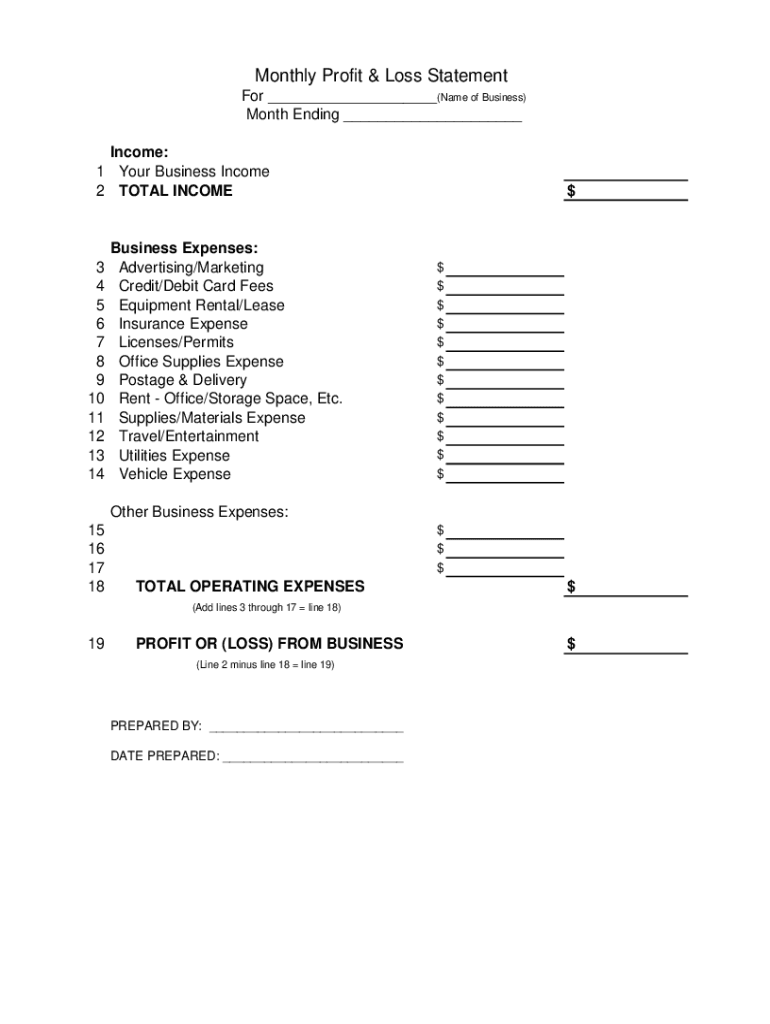

Key Components of a Free Monthly Profit and Loss Statement Template

A comprehensive understanding of the key components within a free monthly profit and loss statement template is essential for accurate financial analysis and informed decision-making. These components provide a structured overview of financial performance, enabling businesses to track progress, identify areas for improvement, and ultimately achieve financial stability and growth.

1. Revenue: This section details all income generated from business operations, including sales of goods or services, interest earned, and other income sources. Accurate revenue reporting is crucial for assessing overall financial performance and identifying growth opportunities. It often includes subcategories for different revenue streams, allowing for detailed analysis of each income source.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or delivering services. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit and understanding the profitability of core business operations. It is particularly relevant for businesses involved in manufacturing or retail.

3. Gross Profit: Calculated by subtracting COGS from revenue, gross profit reflects the profitability of core business operations before accounting for operating expenses. Analyzing gross profit helps assess the efficiency of production or service delivery processes. Changes in gross profit margin over time can indicate shifts in pricing strategies, production costs, or sales volume.

4. Operating Expenses: This section encompasses all costs associated with running the business, excluding COGS. These expenses include rent, utilities, salaries, marketing, and administrative costs. Careful monitoring of operating expenses is crucial for identifying areas of potential cost savings and improving operational efficiency.

5. Operating Income: Calculated by subtracting operating expenses from gross profit, operating income reflects the profitability of the business after accounting for all operating costs. This metric provides a clear picture of the business’s ability to generate profit from its core operations. Analyzing operating income trends helps assess the effectiveness of operational strategies and cost management efforts.

6. Other Income/Expenses: This section accounts for income or expenses not directly related to core business operations, such as interest income, investment gains or losses, and one-time expenses. Including these items provides a comprehensive picture of the organization’s overall financial performance.

7. Net Income/Loss: This bottom-line figure represents the overall profit or loss generated by the business after accounting for all revenues and expenses. Net income is a key indicator of financial health and sustainability. Tracking net income over time provides valuable insights into the effectiveness of overall business strategy and operational efficiency.

These core components, when regularly monitored and analyzed, provide valuable insights into financial performance, enabling informed decision-making, proactive financial management, and ultimately, the achievement of sustainable growth and long-term financial stability. Regular use of a template ensures consistent data collection, facilitating trend analysis and identification of areas for improvement.

How to Create a Free Monthly Profit and Loss Statement Template

Creating a template for tracking monthly profit and loss involves structuring a document to systematically capture and analyze key financial data. This organized approach facilitates informed decision-making and proactive financial management. The following steps outline the process of creating such a template.

1. Define Reporting Period: Clearly specify the start and end dates for the monthly reporting period. Consistent reporting periods facilitate accurate comparisons and trend analysis over time.

2. Structure Revenue Section: Create a section to record all revenue streams. Categorize revenue sources for detailed analysis. Include subcategories for different product lines, service offerings, or customer segments as needed.

3. Establish Cost of Goods Sold (COGS) Section: Develop a section to capture all direct costs associated with producing goods or delivering services. Include line items for raw materials, direct labor, and manufacturing overhead. Ensure accurate and consistent COGS calculation methodology.

4. Outline Operating Expenses: Create a detailed section for all operating expenses, categorized for analysis. Include line items for rent, utilities, salaries, marketing, and administrative costs. Categorization allows for targeted cost control measures.

5. Calculate Key Metrics: Incorporate formulas to automatically calculate key metrics such as gross profit (revenue – COGS), operating income (gross profit – operating expenses), and net income (operating income + other income – other expenses). Automated calculations improve accuracy and efficiency.

6. Include Other Income/Expenses Section: Create a dedicated section to account for income or expenses not directly related to core operations, such as interest income or one-time expenses. This comprehensive approach provides a holistic financial overview.

7. Format for Clarity: Organize the template with clear headings, subheadings, and labels. Use a consistent format for dates, currency, and numerical values. A well-formatted template enhances readability and facilitates efficient data entry and analysis.

8. Utilize Spreadsheet Software: Leverage spreadsheet software for efficient template creation and automated calculations. Most spreadsheet applications offer pre-built templates that can be customized to specific business needs. This approach simplifies the process and reduces the risk of errors.

A well-structured template provides a clear and organized overview of financial performance, enabling businesses to identify trends, make informed decisions, and implement effective financial management strategies. Consistent use of the template ensures data integrity and facilitates accurate performance analysis over time. Regular review and adjustments to the template, as business needs evolve, maintain its relevance and effectiveness as a financial management tool.

Regular utilization of readily available, no-cost profit and loss reporting tools provides essential insights into financial performance. This structured approach facilitates proactive financial management through detailed tracking of revenue, expenses, and profitability. Understanding key components, such as cost of goods sold, operating expenses, and net income, empowers informed decision-making regarding pricing strategies, resource allocation, and cost control measures. Accessibility to these tools eliminates financial barriers, particularly for startups and small businesses, fostering wider adoption of sound financial practices.

Effective financial management is not a one-time endeavor but an ongoing process requiring consistent monitoring, analysis, and adaptation. Leveraging accessible profit and loss reporting mechanisms empowers organizations to navigate the complexities of the financial landscape, optimizing resource allocation, mitigating risks, and ultimately achieving sustainable growth and long-term financial stability. Consistent application of these principles positions businesses for sustained success in a dynamic economic environment.