Utilizing a no-cost sample document offers several advantages. It provides a safe way to practice importing data into financial software or creating personalized budgeting spreadsheets. It can also serve as an educational resource for understanding the various components of an official statement. This eliminates the risk of errors when working with live account data and allows for comfortable experimentation with different financial management techniques.

This foundation in understanding the structure and content of financial documents allows for a smoother transition into more complex topics such as automated financial tracking, budgeting strategies, and financial analysis.

1. Accessibility

Accessibility, a critical aspect of complimentary financial document replicas, ensures ease of acquisition and utilization for a wide range of users. Open availability removes barriers such as cost or account restrictions, allowing individuals to explore the structure and data presentation without needing an active account or incurring expenses. This empowers prospective clients, financial educators, or software developers to familiarize themselves with the format, enabling them to prepare for account management, develop educational resources, or ensure software compatibility. For instance, someone considering opening an account can access a template to understand the layout and information presented before committing.

Furthermore, readily available templates can be integrated into various platforms and applications, enhancing accessibility for individuals with disabilities. Screen readers, for example, can interpret the template’s structure, making the information accessible to visually impaired users. This inclusivity underscores the importance of readily available templates in facilitating financial literacy and management across diverse user groups. The ability to download and readily manipulate the template also allows users to adapt it to individual needs, such as enlarging font sizes or translating content.

In summary, accessibility through free availability and adaptable formats broadens the reach of these resources, fostering financial understanding and empowering individuals to engage confidently with financial information. This democratization of access plays a crucial role in promoting financial literacy and responsible financial management.

2. Structure Replication

Structure replication in a complimentary financial document replica holds significant practical value. Accurate mirroring of the official document’s layout, including sections for transactions, balances, fees, and other relevant information, enables users to gain a realistic preview. This precise replication allows for effective preparation for managing actual financial statements. For example, individuals can familiarize themselves with the location of key data points like account numbers, transaction dates, and balance summaries, streamlining the process of navigating their own statements when received.

This structural fidelity extends beyond mere visual similarity. It also encompasses the logical organization of data. Replicating the hierarchical structurehow information is grouped and presentedallows users to understand the relationships between different data elements. For instance, seeing how individual transactions contribute to the overall monthly balance within the template prepares users to analyze their spending patterns and track financial progress effectively. Furthermore, accurate structure replication ensures compatibility with financial management software. Users can confidently test data import processes, knowing the template’s structure aligns with the software’s requirements, minimizing potential errors or compatibility issues.

In conclusion, structure replication in a complimentary document replica is essential for practical application and effective user preparation. It facilitates efficient navigation, comprehension of data relationships, and seamless integration with financial software. This accurate representation empowers users to confidently manage their finances and maximize the utility of financial management tools. The ability to anticipate the structure and organization of data in an official statement ultimately reduces the cognitive load associated with interpreting financial information, promoting better financial decision-making.

3. Data familiarity

Data familiarity, facilitated by access to complimentary financial document replicas, plays a crucial role in developing financial literacy and promoting effective financial management. Exposure to the typical data points present in a financial statementsuch as transaction descriptions, dates, amounts, and running balancesallows individuals to understand how financial information is organized and presented. This understanding reduces the cognitive load associated with interpreting real financial statements and empowers individuals to engage more confidently with their financial data. For example, recognizing the difference between a debit and a credit within the structured context of a template prepares users to analyze their own transactions accurately.

Furthermore, data familiarity acquired through template usage can enhance the effectiveness of financial planning and budgeting. By observing how different types of transactions are categorized and displayed within the template, individuals can develop a clearer understanding of their spending patterns and identify areas for potential improvement. This, in turn, enables more informed decision-making regarding budgeting, saving, and investment strategies. Practical applications include using the template to practice categorizing expenses, creating mock budgets based on the template’s structure, or experimenting with different budgeting methods before applying them to real financial data. This preparatory practice fosters a sense of control and preparedness when managing actual finances.

In summary, data familiarity cultivated through access to complimentary document replicas serves as a crucial stepping stone toward informed financial management. It demystifies the presentation of financial information, enabling individuals to interpret their own financial data with greater confidence and make more effective financial decisions. This foundation of data familiarity ultimately empowers individuals to take control of their financial well-being and work toward achieving their financial goals. The ability to anticipate the type and format of data presented in a financial statement reduces anxiety and promotes proactive engagement with personal finances.

4. Testing Purposes

Testing purposes represent a crucial function facilitated by complimentary financial document replicas. These templates provide a risk-free environment for experimenting with financial software and data management tools. Users can simulate data import and export processes, ensuring compatibility between the template’s structure and the software’s requirements. This preemptive testing minimizes the risk of errors or data corruption when working with actual financial statements. For example, developers creating budgeting apps can utilize the template to test data integration functionality, ensuring accurate parsing and categorization of financial transactions within their application. Similarly, individuals can configure personal finance software using the template, verifying proper data handling before importing sensitive financial information.

The ability to test data manipulation techniques without jeopardizing real financial data offers significant practical advantages. Users can explore various data analysis methods, create custom reports, and experiment with different data visualization techniques within the safe confines of the template environment. This allows for refined data management strategies and optimized reporting procedures before applying them to live account data. For instance, one could test complex spreadsheet formulas for calculating financial ratios or practice generating customized reports tailored to specific financial goals, all without risking errors that could impact actual account balances or transaction records. This experimentation fosters confidence in data handling skills and facilitates the development of personalized financial management workflows.

In conclusion, leveraging complimentary financial document replicas for testing purposes provides a crucial safeguard in managing financial data. This risk-free environment enables software compatibility verification, data manipulation practice, and the development of personalized financial management strategies. This proactive approach minimizes potential errors, streamlines data integration processes, and ultimately empowers users to manage their financial information with greater confidence and control. The ability to test and refine data management techniques without consequence contributes significantly to responsible and effective financial practices.

5. Educational Value

Complimentary replicas of financial documents offer significant educational value, serving as practical tools for enhancing financial literacy. These templates provide a risk-free environment for individuals to familiarize themselves with the structure, content, and terminology commonly found in official financial statements. This exposure fosters a deeper understanding of personal finance principles and promotes informed financial decision-making.

- Understanding Statement ComponentsTemplates allow individuals to explore various sections of a statement, such as transaction details, balance summaries, and fee disclosures, without the pressure of dealing with real financial data. This exploration demystifies complex terminology and clarifies the purpose of each component, fostering a foundational understanding of financial statement structure. For instance, one can examine how interest accrues or how fees are calculated within the template’s structured format.

- Financial Terminology FamiliarizationExposure to the language used in financial statements through templates aids in building vocabulary and comprehension. Terms like “debit,” “credit,” “balance,” “APR,” and “transaction date” become clearer within the context of the template, promoting financial literacy and reducing potential confusion when encountering these terms in real-world financial scenarios. This familiarity empowers individuals to interpret financial communications and engage confidently in financial discussions.

- Practical Application of Financial ConceptsTemplates bridge the gap between theoretical financial knowledge and practical application. Users can apply budgeting principles, track hypothetical expenses, and analyze simulated financial scenarios using the template as a guide. This hands-on experience solidifies understanding and cultivates essential financial management skills. For example, one can practice categorizing transactions within the template, mirroring real-world budgeting practices.

- Preparation for Real-World Financial ManagementBy interacting with a template, individuals gain valuable experience navigating the format and content of a financial statement, preparing them to manage their own finances effectively. This prior exposure reduces anxiety associated with interpreting official documents and fosters a sense of preparedness when dealing with real financial data. This confidence translates to more proactive and informed financial decision-making.

In conclusion, the educational value of complimentary financial document replicas significantly contributes to improved financial literacy and responsible financial management. These templates serve as invaluable educational resources, empowering individuals to navigate the complexities of personal finance with confidence and make informed decisions to achieve their financial goals. By fostering understanding and practical application of key financial concepts, these templates play a crucial role in promoting financial well-being.

6. Risk-free practice

Risk-free practice, facilitated by complimentary replicas of financial documents from institutions like Navy Federal Credit Union, provides a crucial sandbox for developing and refining financial management skills without the potential consequences associated with using real account data. This safe environment allows users to explore various aspects of financial management, fostering confidence and competence before applying these skills to actual financial situations. This preparatory practice contributes significantly to responsible and effective financial behavior.

- Software Integration and TestingIndividuals can utilize these templates to configure financial software and test data import/export processes without risking corruption or errors in their actual account data. This allows for seamless integration of financial management tools and ensures accurate data handling prior to connecting them to live accounts. One can experiment with different software settings, import formats, and data categorization methods, refining their workflow without fear of negative consequences.

- Budgeting and Financial Planning PracticeTemplates provide a structured format for practicing budgeting and financial planning techniques. Users can input hypothetical income and expenses, experiment with different budgeting strategies, and analyze simulated financial scenarios. This allows for iterative refinement of budgeting approaches and facilitates the development of personalized financial plans tailored to individual circumstances, without the risk of impacting real financial resources.

- Data Analysis and Reporting ExplorationComplimentary templates allow users to explore different data analysis methods and reporting techniques. One can practice generating customized reports, calculating financial ratios, and experimenting with data visualization tools. This exploration enhances data interpretation skills and facilitates the development of insightful financial reports, contributing to more informed financial decision-making, all without jeopardizing sensitive account information.

- Financial Education and Skill DevelopmentThese templates serve as valuable educational tools, allowing individuals to familiarize themselves with the structure and content of financial documents. Users can practice identifying key data points, understanding transaction details, and interpreting balance summaries. This hands-on experience builds financial literacy and prepares individuals to manage their own financial information effectively and confidently, without the need to access or manipulate live account data during the learning process. This promotes greater confidence and preparedness when engaging with real financial statements.

By providing a safe and accessible platform for experimentation and skill development, complimentary financial document replicas empower individuals to cultivate responsible financial practices, enhance their understanding of financial information, and confidently navigate the complexities of personal finance management. This risk-free practice ultimately contributes to greater financial well-being and informed financial decision-making, bridging the gap between theory and practical application in a secure and empowering environment. This approach fosters proactive engagement with personal finances and encourages continuous improvement in financial management skills.

Key Components of a Complimentary Financial Statement Replica

Understanding the core components of a complimentary financial statement replica provides valuable context for its effective utilization. The following points highlight key structural and informational elements:

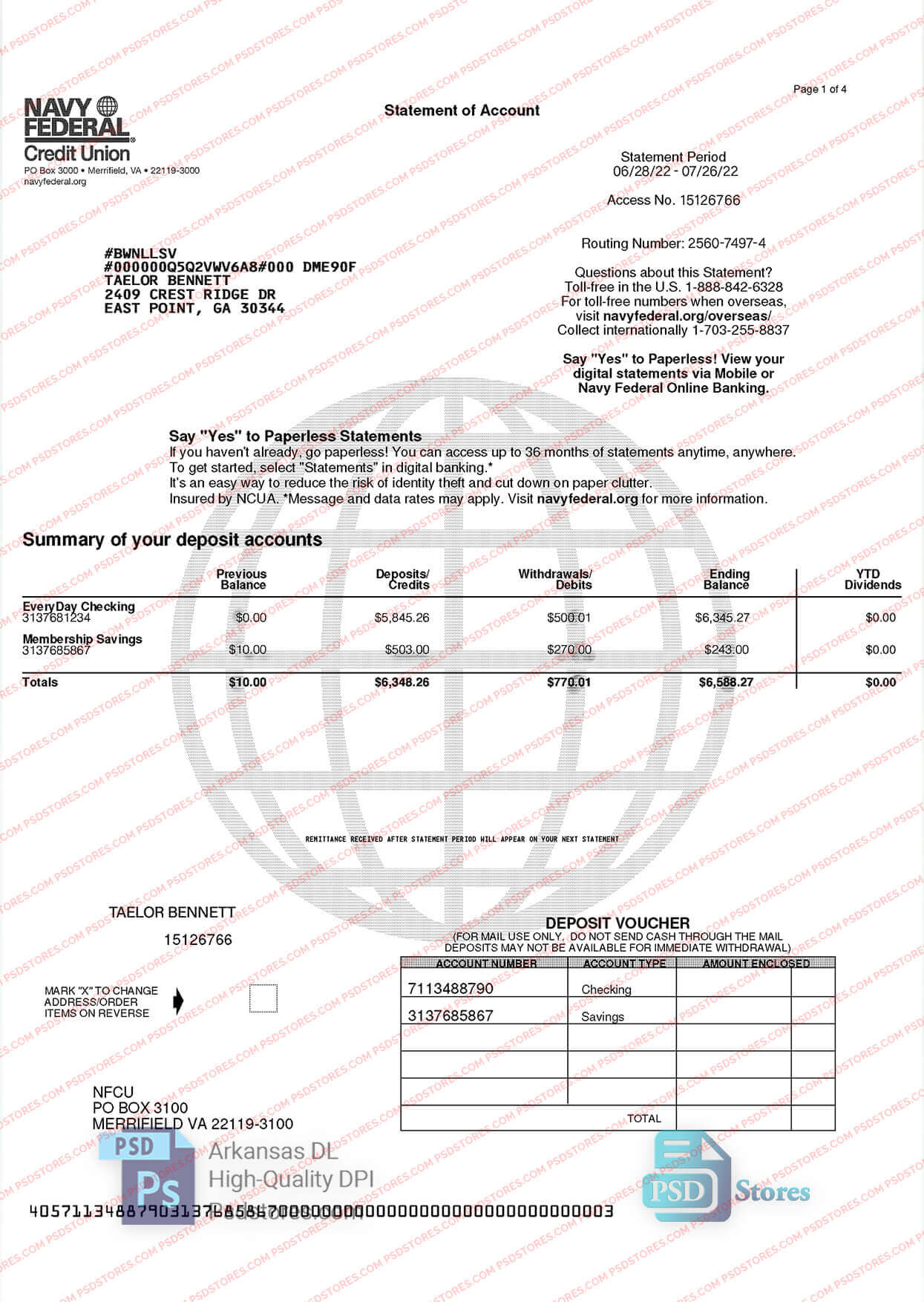

1. Header Information: The header typically includes the financial institution’s name and logo, alongside essential identifying information such as the account holder’s name and account number. This section establishes the document’s context and authenticity.

2. Statement Period: A clearly defined statement period indicates the timeframe covered by the document, typically a month or a specific date range. This allows users to understand the chronological scope of the information presented.

3. Opening/Closing Balances: The statement presents both the opening balance at the start of the period and the closing balance at the end. This provides a clear overview of the net change in account funds during the specified timeframe.

4. Transaction Details: A detailed list of transactions forms the core of the statement. Each transaction entry typically includes the date, description, amount, and potentially a transaction ID. This provides a comprehensive record of account activity.

5. Transaction Summary: A summary section may categorize transactions into different types, such as deposits, withdrawals, fees, and interest earned. This categorization facilitates analysis of spending patterns and overall account activity.

6. Fees and Interest: This section details any fees charged and interest earned during the statement period. Clear presentation of this information is crucial for understanding the impact of these factors on the account balance.

7. Contact Information: The statement generally includes contact information for the financial institution, enabling users to address inquiries or report discrepancies. This provides a direct channel for communication regarding account-related matters.

8. Disclaimer: Since the document is a replica, a disclaimer clarifies its non-official status and emphasizes it should not be used for official transactions or verification. This protects both the user and the financial institution.

Accurate replication of these components in a complimentary statement replica provides users with a realistic representation of an official document. This allows for effective familiarization with the structure, content, and terminology commonly found in financial statements, fostering better financial literacy and management practices.

How to Create a Complimentary Financial Statement Replica

Creating a complimentary replica of a financial statement requires careful attention to structure and data representation. The following steps outline the process of generating a realistic and informative template.

1. Software Selection: Select appropriate software for creating the template. Spreadsheet software or word processing applications with table functionality offer sufficient flexibility for structuring the document. Specialized financial software may also be suitable.

2. Header Design: Replicate the header of an official statement, including the financial institution’s name and logo. Placeholder information for account holder name and account number should be clearly indicated.

3. Statement Period Definition: Clearly define the statement period, typically a month or specified date range. This ensures chronological clarity within the template.

4. Balance Representation: Designate areas for opening and closing balances. These fields represent the starting and ending points for the account balance during the defined period.

5. Transaction Table Creation: Create a table to house transaction details. Columns should include date, description, amount, and optionally a transaction ID. This structure mirrors the transaction listing in an actual statement.

6. Summary Section Design: Include a summary section to categorize transactions, mirroring a real statement. This section can summarize deposits, withdrawals, fees, and interest.

7. Fee and Interest Inclusion: Incorporate sections for fees charged and interest earned. These sections provide a realistic representation of how these factors impact account balances.

8. Contact Information and Disclaimer: Include placeholder contact information for the financial institution and a clear disclaimer stating the document is a replica and not for official use.

Accurate replication of these elements ensures the template provides a realistic and informative representation of a financial statement, facilitating practice, testing, and educational purposes. Careful attention to structure and data representation enhances the template’s utility and educational value.

Access to complimentary replicas of financial documents provides a valuable resource for enhancing financial literacy, practicing data management techniques, and testing software compatibility. Understanding the structure, data components, and practical applications of these templates empowers individuals to navigate their financial information with greater confidence. The ability to explore financial data representation in a risk-free environment fosters responsible financial behavior and promotes informed decision-making. Accurate replication of official document structure and content maximizes the educational and practical benefits of these resources, enabling users to develop essential financial management skills effectively.

Leveraging these accessible tools contributes to a more proactive and informed approach to personal finance. Cultivating financial literacy and responsible data management practices empowers individuals to achieve greater financial well-being. As financial technology continues to evolve, access to such educational resources will play an increasingly crucial role in fostering financial understanding and enabling individuals to navigate the complexities of modern financial landscapes effectively.