Utilizing this no-cost resource empowers individuals to gain a clear understanding of their financial position. This awareness can inform better financial decisions, from budgeting and saving to investing and retirement planning. Access to such a tool can be particularly beneficial for those just beginning their financial journey or seeking to improve their financial literacy.

This understanding of financial status serves as a crucial foundation for exploring various aspects of personal finance. Topics such as budgeting, debt management, and investment strategies become more relevant and actionable with a clear picture of one’s net worth.

1. Accessibility

Cost can be a significant barrier to accessing essential financial tools. Removing this barrier is crucial for promoting financial literacy and empowering individuals to take control of their financial well-being. Free net worth statement templates provide a readily available solution, democratizing access to this important resource.

- Cost-EffectivenessEliminating the financial burden associated with acquiring such a tool allows a broader range of individuals to benefit, regardless of income level. This ensures that valuable financial planning resources are available to everyone. For example, a student or young professional starting their career can utilize a free template to begin building strong financial habits early on, without incurring unnecessary expenses.

- Ease of AccessFree templates are often readily available online, downloadable in various formats. This widespread availability makes it convenient for individuals to access and utilize the tool whenever needed. One can quickly find and download a template from a reputable website, often within minutes.

- Technological InclusivityMany free templates are available in universally accessible formats, such as spreadsheets or printable documents. This inclusivity ensures compatibility across various devices and software, catering to users with different technological capabilities and preferences. Individuals can access and utilize the template on their computers, tablets, or even smartphones.

- Empowerment Through AvailabilityThe ready availability of these free resources encourages proactive financial management. Individuals are more likely to engage with financial planning when the tools are easily accessible and free of charge. This empowerment can lead to improved financial outcomes and a greater sense of financial security.

By removing financial and technological barriers, free net worth statement templates promote widespread adoption of responsible financial practices. This accessibility ultimately contributes to greater financial literacy and improved financial well-being across diverse populations.

2. Organization

A well-organized financial life contributes significantly to financial health. A free net worth statement template provides the structure necessary for individuals to arrange their financial data logically. This organized approach facilitates a comprehensive understanding of one’s assets, liabilities, and overall net worth. A template typically categorizes assets (e.g., cash, investments, property) and liabilities (e.g., loans, credit card debt, mortgages) into distinct sections, promoting clarity and accuracy in calculations. For example, separating short-term assets like checking account balances from long-term investments like retirement accounts provides a clearer picture of readily available funds versus long-term savings.

The structured format inherent in these templates simplifies the process of data entry and analysis. Users can readily input their financial information into designated fields, minimizing the risk of errors and omissions. This organized presentation of data enables efficient calculation of net worth and facilitates the identification of areas for improvement. For instance, clearly categorizing different types of debt can reveal opportunities for consolidation or prioritizing high-interest payoffs.

Systematic organization through such templates allows for effective tracking of financial progress over time. By regularly updating the template, individuals can monitor changes in their net worth, observing the impact of financial decisions. This ongoing assessment enables adaptive strategies for achieving financial goals. The ability to visualize progress, such as a growing net worth or decreasing debt, reinforces positive financial behaviors and motivates continued effort. This organizational framework provides a solid foundation for proactive financial management and long-term financial well-being.

3. Clarity

Understanding one’s financial position requires clear, readily interpretable data. A free net worth statement template provides this clarity by presenting financial information in a structured and accessible format. This structured approach facilitates informed decision-making and contributes to a more comprehensive understanding of overall financial health. The template’s organization allows users to quickly grasp their current financial standing and identify areas needing attention.

- Visual RepresentationTemplates often employ visual aids, such as charts and graphs, to represent complex financial data in a more digestible manner. These visual representations simplify the process of understanding the relationship between assets and liabilities, providing a clear snapshot of net worth. For example, a pie chart could illustrate the proportion of net worth attributed to different asset classes, like real estate versus investments.

- Standardized FormatThe standardized format of a template ensures consistency in data presentation. This consistency eliminates ambiguity and facilitates accurate interpretation of financial information. Using consistent terminology and categories across different sections of the template prevents confusion and promotes clarity. For instance, clearly labeling sections for “Current Assets” and “Long-Term Liabilities” ensures consistent categorization of financial data.

- Simplified TerminologyTemplates typically utilize clear, concise language, avoiding complex financial jargon. This simplified terminology makes the information accessible to a wider audience, regardless of financial expertise. Replacing complex terms with simpler alternatives, such as using “Debts” instead of “Liabilities,” ensures broader understanding. This approach promotes financial literacy and empowers individuals to engage with their finances more effectively.

- Accessibility of InformationThe clear presentation of information within a template facilitates quick access to key financial metrics. Users can readily locate and interpret their net worth, asset allocation, and debt levels. This accessibility empowers informed decision-making and promotes proactive financial management. For example, readily accessible data on outstanding debt balances can inform decisions about debt repayment strategies.

The clarity provided by these templates empowers individuals to take control of their financial lives. By presenting complex financial data in a clear and accessible manner, these tools promote informed financial decision-making and contribute to greater financial well-being. This clarity lays the groundwork for effective financial planning and sets the stage for achieving long-term financial goals.

4. Actionable Insights

Financial awareness transforms into meaningful action through actionable insights. A free net worth statement template provides the foundation for generating such insights, empowering informed financial decisions and fostering proactive financial management. By organizing and clarifying financial data, these templates illuminate areas of strength and weakness, guiding users toward effective strategies for improvement.

- Debt ManagementA template allows for clear visualization of outstanding debt, including balances, interest rates, and minimum payments. This comprehensive view enables prioritization of debt repayment, focusing on high-interest debts or consolidating multiple debts for more efficient management. For example, identifying a high-interest credit card balance might prompt a user to explore balance transfer options or prioritize paying down that debt aggressively.

- Investment StrategiesUnderstanding asset allocation within a net worth statement informs investment decisions. Recognizing a heavy concentration in one asset class might prompt diversification to mitigate risk. Conversely, a significant cash position might signal opportunities to explore investment options aligned with financial goals. For instance, a substantial cash balance might lead to exploring investments in stocks, bonds, or real estate, depending on risk tolerance and investment horizon.

- Budgeting and SavingA clear picture of net worth highlights the impact of spending and saving habits. Tracking net worth changes over time, in conjunction with budgeting efforts, can reveal areas where spending can be optimized to accelerate savings growth. This awareness motivates adherence to budget plans and encourages consistent saving practices. For example, observing a slow growth in net worth despite consistent income might prompt a review of monthly expenses to identify areas for potential savings.

- Financial Goal SettingA net worth statement serves as a benchmark for setting and tracking financial goals. Whether the goal is purchasing a home, early retirement, or funding education, a regularly updated statement provides measurable progress towards these objectives. This tangible progress reinforces positive financial behaviors and motivates continued efforts towards achieving financial aspirations. For instance, tracking net worth growth alongside savings earmarked for a down payment on a house provides a clear measure of progress towards that goal.

These actionable insights, derived from a free net worth statement template, transform passive financial awareness into proactive financial management. By providing a clear understanding of one’s financial position, these templates empower informed decisions and pave the way for achieving long-term financial well-being. This data-driven approach to financial planning fosters a sense of control and responsibility, leading to more secure and prosperous financial futures.

5. Financial Empowerment

Financial empowerment signifies the ability to understand and control one’s financial situation. A free net worth statement template plays a crucial role in fostering this empowerment. By providing a structured framework for organizing financial data, these templates facilitate a clear understanding of assets, liabilities, and overall net worth. This understanding forms the bedrock of informed financial decision-making. For instance, individuals tracking their net worth can observe the impact of debt reduction strategies, motivating continued responsible financial behavior. This direct link between actions and outcomes fosters a sense of control over one’s financial trajectory. The template becomes a tool for self-assessment, enabling individuals to identify areas for improvement and take proactive steps towards achieving financial goals.

Access to a free template democratizes financial planning. Regardless of income level or financial expertise, individuals can utilize this resource to gain a comprehensive view of their financial standing. This accessibility breaks down barriers to financial literacy and empowers individuals to take ownership of their financial well-being. Consider a young adult starting their first job. Utilizing a free template allows them to establish strong financial habits early on, building a foundation for long-term financial security. This early engagement with financial planning fosters responsible financial behavior and contributes to greater financial stability throughout life.

The insights derived from a net worth statement template empower individuals to make informed choices regarding budgeting, saving, investing, and debt management. These informed choices contribute to greater financial security and create a pathway towards achieving long-term financial goals. Challenges may arise, such as maintaining accurate records and consistently updating the template. However, the potential long-term benefits of improved financial health significantly outweigh these challenges. Regular engagement with a net worth statement template fosters a sense of responsibility and control, essential components of long-term financial well-being. This proactive approach to financial management empowers individuals to navigate financial complexities with confidence and build a more secure financial future.

Key Components of a Net Worth Statement Template

Several key components comprise a comprehensive and effective net worth statement template. These components work together to provide a clear, organized, and actionable overview of an individual’s financial position.

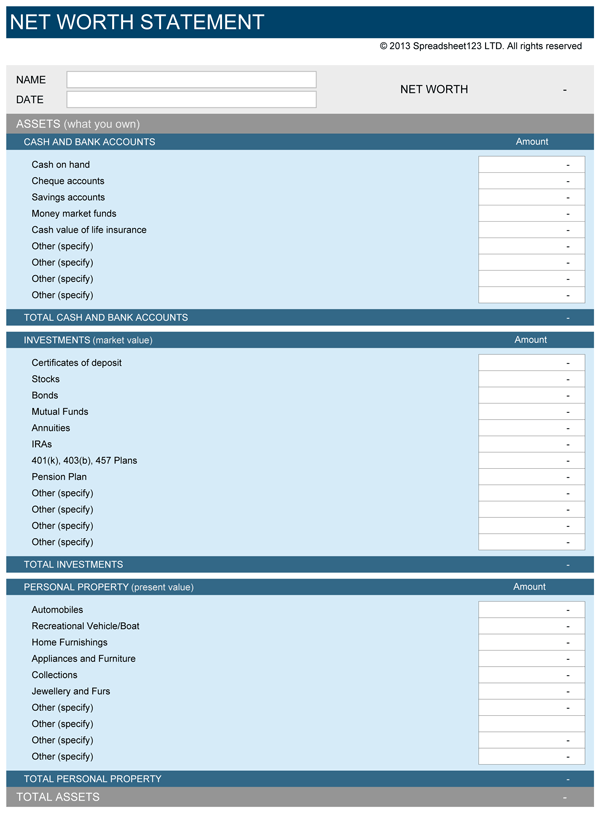

1. Asset Listing: A dedicated section for listing all assets, categorized for clarity. Typical categories include liquid assets (cash, checking accounts, savings accounts), investment assets (stocks, bonds, mutual funds, retirement accounts), and fixed assets (real estate, vehicles, personal property). Accurate valuation of assets is crucial for a realistic net worth calculation.

2. Liability Listing: A separate section dedicated to listing all liabilities, also categorized for clarity. Common categories include short-term liabilities (credit card debt, utility bills) and long-term liabilities (mortgages, student loans, auto loans). Accurate recording of outstanding balances is essential for determining true indebtedness.

3. Net Worth Calculation: A clearly defined area for calculating net worth, typically displayed prominently. This section automatically subtracts total liabilities from total assets, providing a readily visible snapshot of overall financial health.

4. Date and Time Stamp: Inclusion of a date and time stamp on the statement provides a clear reference point for tracking progress. This allows for analysis of net worth changes over time and assessment of the effectiveness of financial strategies.

5. Summary Section (Optional): Some templates include a summary section offering a concise overview of key financial metrics. This might include total asset value, total liability value, and net worth, presented in a visually accessible format. This section facilitates quick comprehension of overall financial standing.

6. Supporting Information (Optional): Certain templates offer space for including supporting documentation or notes. This might include account statements, loan documents, or personal financial goals. This feature enhances the template’s utility as a comprehensive financial management tool.

These components work together to provide a comprehensive snapshot of financial health, facilitating informed financial decision-making and promoting effective financial planning. Regular use of a well-designed template, coupled with accurate data entry, empowers individuals to take control of their financial future.

How to Create a Free Net Worth Statement Template

Creating a personalized template provides a structured approach to organizing financial data and calculating net worth. This process involves several key steps ensuring a comprehensive and effective tool for managing one’s financial position.

1: Choose a Format: Select a format suitable for individual needs and technological preferences. Options include spreadsheet software, word processing documents, or dedicated personal finance applications. Spreadsheet software offers robust calculation capabilities, while word processing documents provide simpler formatting. Personal finance applications often integrate net worth calculations with other financial management features.

2: Create Asset Section: Establish a clearly labeled section for listing assets. Categorize assets into logical groupings, such as liquid assets, investment assets, and fixed assets. Include fields for item descriptions, current values, and relevant account details. This categorization facilitates clear organization and accurate valuation of holdings.

3: Create Liability Section: Establish a separate section for listing liabilities. Categorize liabilities into relevant groups, such as short-term and long-term debt. Include fields for creditor names, outstanding balances, interest rates, and minimum payment amounts. This detailed information aids in prioritizing debt management strategies.

4: Implement Net Worth Calculation: Incorporate a formula to automatically calculate net worth. This formula should subtract the sum of all liabilities from the sum of all assets. Display the calculated net worth prominently within the template. Automated calculation minimizes manual effort and ensures accuracy.

5: Incorporate Date and Timestamp: Include fields for recording the date and time of each update. This feature facilitates tracking progress over time and analyzing the impact of financial decisions on net worth. Regular updates create a historical record of financial progress.

6: Add Optional Features (Optional): Consider incorporating additional features to enhance the template’s utility. These might include sections for notes, supporting documentation, or financial goals. A summary section providing key financial metrics at a glance can also prove beneficial. These additions personalize the template to individual needs.

7: Regularly Update and Review: Maintain the template’s accuracy and relevance through regular updates. Review the information periodically to identify trends, assess progress towards financial goals, and adjust financial strategies as needed. Consistent engagement maximizes the template’s effectiveness as a financial management tool.

A well-structured template, diligently maintained and regularly reviewed, provides valuable insights into financial health and empowers informed financial decision-making. This proactive approach to financial management contributes significantly to achieving long-term financial well-being.

Regular use of these no-cost tools offers a structured approach to understanding financial health. Accessibility, organization, clarity, and actionable insights derived from these templates empower informed financial decisions. From budgeting and debt management to investment strategies and goal setting, a clear understanding of net worth provides a crucial foundation for effective financial planning.

Financial well-being relies on proactive engagement with one’s financial situation. Leveraging available resources, such as complimentary net worth statement templates, equips individuals with the knowledge and control necessary to navigate financial complexities and build a more secure future. This empowerment lays the groundwork for achieving long-term financial stability and prosperity.