Utilizing such a tool offers several advantages. It empowers users to identify areas of overspending, track progress toward financial goals, and prepare for future financial needs. This understanding can lead to improved budgeting, increased savings, and reduced financial stress. It can also be valuable for loan applications, scholarship applications or other situations requiring proof of income and expenses.

This foundation of financial awareness is crucial for effective money management. The following sections will explore the key components of this resource, providing practical guidance on its utilization and demonstrating how it can be incorporated into broader financial planning strategies.

1. Accessibility

Accessibility is a critical factor in the efficacy of complimentary personal income statement templates. Widespread availability, coupled with ease of use, ensures these tools can reach and benefit a broad audience. Removing financial barriers, such as subscription fees or software purchases, democratizes access to essential financial management resources. This is particularly important for individuals with limited financial resources, students, or those new to managing their finances. For example, a readily available online template, downloadable in various formats (e.g., spreadsheet, PDF), eliminates cost and technical obstacles, enabling anyone with internet access to utilize the tool.

Furthermore, accessibility extends beyond mere availability. Templates should be designed with user-friendliness in mind. Clear instructions, intuitive layouts, and compatibility with common software applications contribute to ease of use. Consider a template that pre-populates common income and expense categories, offers helpful tips within the document, and functions seamlessly with readily available spreadsheet programs. Such a design promotes adoption and consistent usage, even among individuals lacking extensive financial expertise. This ultimately contributes to broader financial literacy and improved personal financial management practices.

In conclusion, accessibility, encompassing both availability and usability, is paramount for maximizing the impact of these valuable financial tools. Addressing barriers to access empowers individuals to take control of their financial well-being, fostering responsible financial behavior and contributing to greater financial stability. Challenges remain in ensuring digital literacy and internet access for all demographics. However, the increasing availability of free, user-friendly templates represents a significant step toward democratizing financial management tools and promoting wider financial inclusion.

2. Customization

Customization is a key feature of effective personal income statement templates, allowing individuals to tailor the tool to their specific financial situations. This adaptability ensures relevance and accuracy in tracking income and expenses, leading to a more meaningful analysis of financial health. A generic template may not adequately capture the nuances of individual financial lives, making customization crucial for practical application.

- Income SourcesStandard templates often include common income categories like salary and wages. However, individuals may have diverse income streams, including investment dividends, rental income, freelance earnings, or alimony. Customization allows for the addition or modification of income categories to accurately reflect an individual’s specific sources. For instance, someone with income from multiple freelance clients can customize the template to track earnings from each client separately, providing a granular view of income distribution.

- Expense CategoriesSimilar to income, expenses can vary significantly based on lifestyle and individual circumstances. While standard categories like housing, transportation, and food are typically included, customization allows for the addition of specific expense categories, such as pet care, subscriptions, or childcare. This granular tracking provides a more precise understanding of spending patterns. Someone tracking expenses related to a home renovation project, for example, could add a dedicated category to monitor those costs effectively.

- Tracking FrequencyWhile some individuals may prefer tracking income and expenses monthly, others may find it more beneficial to track weekly or even daily. Customizable templates accommodate varying tracking frequencies. For example, a freelancer with fluctuating income might opt for weekly tracking to monitor cash flow effectively, while someone with stable bi-weekly paychecks may prefer a monthly overview. This flexibility enhances the tool’s practicality and encourages consistent use.

- Reporting PeriodThe ability to define the reporting period is another crucial customization feature. Users may need to generate income statements for various durations, such as monthly, quarterly, or annually. This flexibility is crucial for different financial planning needs. For instance, analyzing a quarterly income statement can reveal seasonal spending patterns, while an annual statement provides a broader overview of financial performance over a longer time frame. This allows for more effective long-term financial planning.

The ability to customize a free personal income statement template significantly enhances its value as a financial management tool. By tailoring the template to individual circumstances, users gain a more accurate and relevant understanding of their financial situation. This personalized approach promotes better financial decision-making, leading to improved budgeting, increased savings, and greater financial well-being.

3. Comprehensive Tracking

Comprehensive tracking forms the cornerstone of effective personal financial management enabled by a free personal income statement template. It provides a holistic view of financial inflows and outflows, capturing all income sources and expense categories. This detailed record facilitates a thorough understanding of spending habits, income patterns, and overall financial health. Without comprehensive tracking, a personal income statement remains an incomplete picture, hindering accurate financial assessment and informed decision-making. For example, omitting occasional freelance income or neglecting to categorize recurring subscription fees would skew the overall financial picture, leading to potentially inaccurate conclusions about spending and saving habits.

The practical significance of comprehensive tracking lies in its ability to empower informed financial decisions. By meticulously recording all financial transactions, individuals gain insights into areas of overspending, identify potential savings opportunities, and track progress toward financial goals. This granular level of detail is crucial for effective budgeting, debt management, and long-term financial planning. Consider an individual aiming to reduce discretionary spending. Comprehensive tracking allows them to pinpoint exactly how much is spent on dining out, entertainment, or non-essential purchases, facilitating targeted adjustments to achieve the desired savings. Similarly, tracking income from various sources can highlight opportunities for income diversification or identify periods of fluctuating income that require adjustments to budgeting strategies.

Implementing comprehensive tracking within a free personal income statement template requires diligence and consistent effort. Challenges may include accurately categorizing expenses, remembering to record all transactions, and maintaining consistent tracking habits over time. However, the benefits of a complete financial overview far outweigh the effort required. Leveraging technology, such as budgeting apps or spreadsheet software, can streamline the tracking process and minimize manual data entry. Ultimately, comprehensive tracking empowers individuals to take control of their financial well-being, fostering responsible financial behavior and contributing to greater long-term financial stability.

4. Informed Decisions

A free personal income statement template empowers informed financial decisions through the structured analysis of income and expenses. By providing a clear overview of financial inflows and outflows, these templates facilitate a deeper understanding of spending patterns, income stability, and overall financial health. This understanding forms the basis for sound financial decision-making, impacting budgeting, saving, investing, and debt management. Without this structured analysis, financial decisions may be based on assumptions or incomplete information, increasing the risk of financial missteps. For instance, an individual considering a significant purchase, such as a car or a home, can utilize a personal income statement to assess affordability, taking into account current income, existing expenses, and potential loan repayments. This informed approach reduces the likelihood of overextending finances and promotes responsible borrowing.

The connection between informed decisions and these templates lies in the template’s ability to transform raw financial data into actionable insights. Categorizing expenses reveals spending patterns that might otherwise go unnoticed. For example, an individual might discover they are spending a significant portion of their income on dining out, prompting a reevaluation of spending priorities and potential adjustments to their budget. Similarly, tracking income sources over time can reveal fluctuations in earnings, highlighting the need for emergency funds or alternative income streams. These insights, derived from the structured analysis provided by the template, enable informed adjustments to financial strategies, promoting greater financial stability. Consider an individual with inconsistent freelance income. By analyzing income patterns over several months using a personal income statement, they can identify periods of lower earnings and adjust their spending accordingly, avoiding debt accumulation during lean times.

Effective financial management hinges on informed decision-making, a process significantly enhanced by utilizing a free personal income statement template. While these templates provide valuable insights, the ultimate responsibility for informed decisions rests with the individual. Factors such as financial goals, risk tolerance, and personal circumstances must be considered in conjunction with the data provided by the template. The template serves as a tool, but its effectiveness depends on the user’s ability to interpret the data and apply it to their specific situation. Overcoming potential challenges, such as maintaining consistent record-keeping and accurately categorizing expenses, is essential for maximizing the benefits of these tools and fostering informed financial decisions that contribute to long-term financial well-being.

5. Financial Clarity

Financial clarity, a critical component of sound financial management, is significantly enhanced through the utilization of a free personal income statement template. This structured approach to tracking income and expenses provides a transparent view of financial health, replacing guesswork and assumptions with concrete data. Understanding one’s financial position is fundamental to effective budgeting, saving, and achieving long-term financial goals. Without this clarity, individuals may struggle to make informed decisions about their finances, potentially leading to debt accumulation, missed financial opportunities, and increased financial stress.

- Income AwarenessA personal income statement provides a detailed breakdown of all income sources, offering a comprehensive view of earnings beyond just the headline salary figure. This includes secondary income streams, investment returns, and any other inflows. Understanding the proportion of income derived from various sources is crucial for diversification strategies and assessing income stability. For example, an individual relying heavily on freelance work can gain a clearer picture of income variability throughout the year, informing decisions about savings and expense management during periods of lower earnings. This detailed income awareness empowers informed financial planning and reduces reliance on estimations.

- Expense Tracking and CategorizationCategorizing expenses is fundamental to understanding where money is being spent. A free personal income statement template facilitates this process, allowing users to allocate expenses to specific categories such as housing, transportation, food, and entertainment. This detailed breakdown reveals spending patterns, highlighting areas of potential overspending. For example, an individual might be surprised to discover how much they spend on subscription services or dining out, prompting a reassessment of priorities and potential budget adjustments. This granular view of expenses promotes mindful spending and empowers informed choices about resource allocation.

- Net Income AnalysisCalculating net income, the difference between total income and total expenses, provides a clear picture of financial performance over a specific period. A positive net income indicates a surplus, offering opportunities for saving and investing. Conversely, a negative net income signals a deficit, requiring adjustments to spending habits or income generation strategies. Tracking net income over time reveals trends in financial health, enabling proactive adjustments to maintain financial stability. For instance, consistent negative net income might indicate the need to reduce expenses, explore additional income sources, or seek professional financial guidance.

- Goal Setting and Progress MonitoringFinancial clarity, facilitated by a personal income statement, is crucial for setting realistic financial goals and monitoring progress toward those goals. Whether the goal is saving for a down payment on a house, paying off debt, or building an emergency fund, tracking income and expenses provides a clear picture of how close an individual is to achieving their objectives. This clarity empowers informed adjustments to spending and saving habits, increasing the likelihood of successful goal attainment. For example, an individual saving for a down payment can track their progress monthly, adjusting their savings contributions based on income and expenses to stay on track with their target.

By providing a structured framework for analyzing income and expenses, free personal income statement templates offer a pathway to greater financial clarity. This clarity empowers informed decision-making, reduces financial stress, and fosters responsible financial behavior. The insights gained from these templates enable individuals to take control of their financial well-being, paving the way for greater financial stability and long-term success. Utilizing a template consistently, combined with regular review and analysis of the data, maximizes the benefits of this valuable financial management tool.

6. Budgeting Enhancement

Budgeting enhancement is intrinsically linked to the utilization of a free personal income statement template. The template serves as a foundational tool for creating and refining a realistic budget by providing a clear, organized view of income and expenses. This structured approach facilitates informed budget adjustments, promotes responsible spending habits, and increases the likelihood of achieving financial goals. Without a comprehensive understanding of income and expenses, as provided by the template, budgeting becomes an exercise in guesswork, hindering effective financial management.

- Data-Driven Budget CreationA free personal income statement template provides the necessary data for creating a data-driven budget. By tracking income and expenses over a specific period, individuals gain a concrete understanding of their financial inflows and outflows. This information informs realistic budget allocations, ensuring alignment between income, expenses, and financial goals. For instance, an individual tracking their spending for several months using a template can identify areas of consistent overspending, such as dining out or entertainment, and make informed adjustments to their budget accordingly. This data-driven approach replaces arbitrary budget limits with informed spending targets based on actual financial behavior.

- Identifying Spending Patterns and Areas for AdjustmentThe categorized expense tracking within a template reveals spending patterns that might otherwise go unnoticed. Visualizing spending across different categories, such as housing, transportation, and entertainment, provides insights into areas where adjustments may be necessary. For example, someone using a template might discover they are spending a disproportionate amount of their income on non-essential purchases, prompting a reevaluation of spending priorities and adjustments to their budget to allocate more funds towards savings or debt reduction.

- Tracking Progress and Maintaining AccountabilityA personal income statement facilitates ongoing budget monitoring and promotes accountability. By regularly comparing actual spending against budgeted amounts, individuals can track their progress and identify deviations from their financial plan. This ongoing monitoring enables timely adjustments to spending habits, ensuring adherence to budget limits and increasing the likelihood of achieving financial goals. For instance, if an individual consistently overspends in a specific category, the template provides a clear visual representation of the discrepancy, prompting corrective action and fostering greater financial discipline.

- Informed Goal Setting and Financial PlanningThe financial clarity provided by a free personal income statement template is essential for informed goal setting and long-term financial planning. Understanding one’s financial position empowers realistic goal setting, whether saving for a down payment, paying off debt, or investing for retirement. The template provides the data necessary to determine how much can realistically be saved or allocated toward debt repayment each month, enabling informed adjustments to the budget to align with financial objectives. This informed approach enhances the likelihood of successful goal attainment and promotes responsible financial planning.

In conclusion, a free personal income statement template is an invaluable tool for budgeting enhancement. By providing a structured framework for tracking and analyzing income and expenses, these templates empower informed budget creation, facilitate the identification of spending patterns, promote accountability, and support informed financial goal setting. Consistent utilization of this tool, combined with regular review and analysis of the data, strengthens financial discipline and contributes significantly to improved financial well-being.

Key Components of a Free Personal Income Statement Template

A well-structured template facilitates a comprehensive understanding of personal finances. Several key components contribute to its effectiveness as a financial management tool.

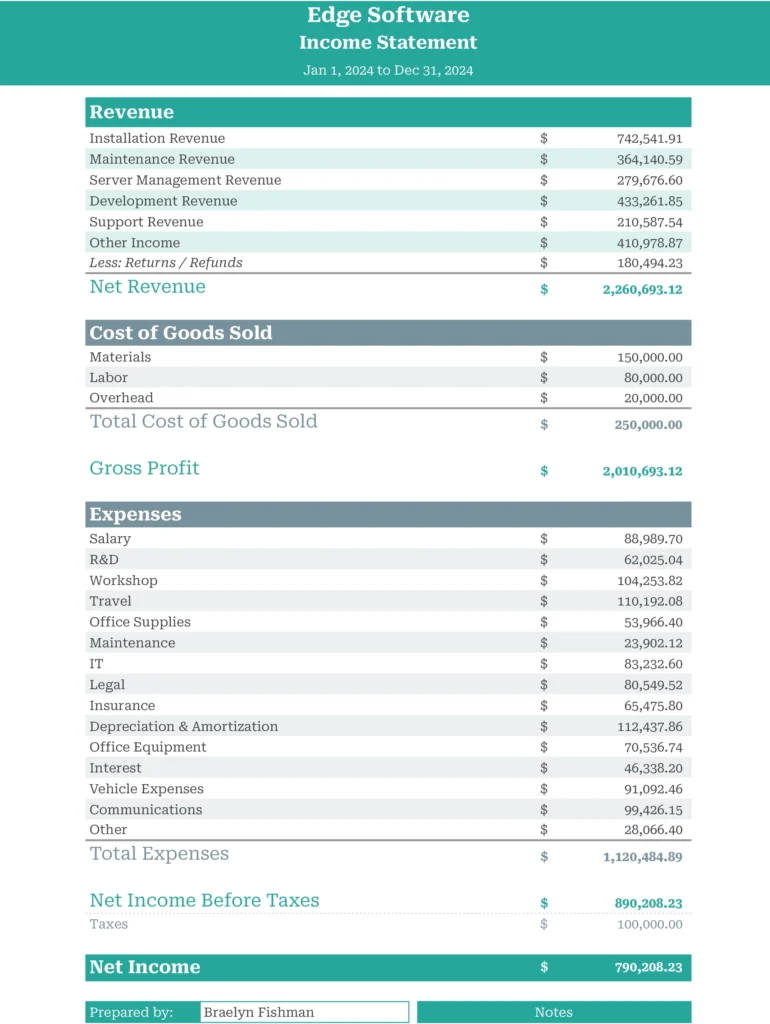

1. Income Section: This section details all sources of income, including salaries, wages, investment returns, and other earnings. Accurate and detailed income reporting is crucial for assessing overall financial health.

2. Expense Section: This section comprehensively captures all expenditures, categorized for detailed analysis. Common categories include housing, transportation, food, utilities, and debt payments. Granular expense tracking allows for identification of spending patterns and potential areas for adjustment.

3. Reporting Period: The template specifies a defined timeframe for income and expense tracking, such as monthly, quarterly, or annually. Selecting an appropriate reporting period allows for consistent monitoring of financial progress.

4. Net Income Calculation: The template automatically calculates net income by subtracting total expenses from total income. This key metric provides a clear picture of financial performance over the reporting period.

5. Summary and Analysis Section: This section may include visualizations, such as charts or graphs, to represent income and expense data, facilitating a more intuitive understanding of financial trends. Some templates may also offer basic financial ratios or metrics for further analysis.

6. Customization Options: Effective templates offer flexibility in customizing income and expense categories to accommodate individual financial situations. This adaptability ensures relevance and accuracy in tracking various income streams and expense types.

These components work together to provide a structured, comprehensive overview of personal finances, empowering informed financial decisions and contributing to improved financial well-being.

How to Create a Free Personal Income Statement Template

Creating a personal income statement template provides a structured approach to managing personal finances. The following steps outline the process of developing a customizable and effective template.

1. Define the Reporting Period: Specify the timeframe for the income statement, such as monthly, quarterly, or annually. A consistent reporting period facilitates accurate tracking and analysis of financial trends.

2. Create the Income Section: List all potential income sources, including salaries, wages, investment income, rental income, and other earnings. Ensure clear labeling of each income category for accurate tracking.

3. Develop the Expense Section: Categorize expenses for detailed tracking and analysis. Include common categories such as housing, transportation, food, utilities, healthcare, and debt payments. Consider adding customizable categories to accommodate individual spending habits.

4. Incorporate a Net Income Calculation: Include a formula to automatically calculate net income by subtracting total expenses from total income. This key metric provides a clear overview of financial performance.

5. Add a Summary/Analysis Section (Optional): Incorporate space for summarizing key findings and analyzing spending patterns. Consider including visual representations of income and expenses, such as charts or graphs, for enhanced clarity.

6. Design for Customization: Ensure the template can be easily adapted to individual circumstances. Allow for the addition or modification of income and expense categories to accommodate unique financial situations.

7. Choose a Format: Select a suitable format for the template, such as a spreadsheet, word processing document, or dedicated budgeting software. Consider accessibility and ease of use when choosing the format.

8. Test and Refine: Populate the template with sample data to ensure functionality and identify potential areas for improvement. Refine the template based on user feedback and evolving financial needs.

A well-designed template provides a clear and organized structure for tracking income and expenses, empowering informed financial management. Regular use and analysis of the data contribute significantly to improved financial well-being. Adaptability and consistent tracking are essential for maximizing the template’s effectiveness.

A free personal income statement template provides a structured, accessible framework for understanding personal finances. Its value lies in enabling informed financial decisions through comprehensive tracking, customizable categorization, and clear visualization of income and expenses. From budgeting enhancement and expense analysis to setting realistic financial goals, the template empowers informed control over financial well-being, promoting financial stability and responsible financial behavior.

Effective financial management requires consistent effort and adaptation. Regular utilization of a personal income statement template, combined with thoughtful analysis of the data, fosters financial awareness and empowers proactive financial planning. This proactive approach is crucial for navigating financial complexities, achieving financial goals, and building a secure financial future. Embracing accessible tools, coupled with consistent financial practices, positions individuals for greater financial success and long-term financial security.