Utilizing a readily available, no-cost, adaptable format offers numerous advantages. It allows individuals to track their financial progress, identify areas for improvement, and make informed decisions about spending, saving, and investing. Accessibility eliminates cost barriers, while adaptability allows customization to individual circumstances. This empowers individuals to take proactive steps toward financial well-being.

This understanding of the purpose and benefits of organized personal financial summaries lays the groundwork for a deeper exploration of budgeting, debt management, and other key components of sound financial planning.

1. Accessibility

Accessibility, a defining characteristic of free printable personal financial statement templates, democratizes financial planning. Eliminating cost barriers empowers individuals across diverse socioeconomic backgrounds to take control of their finances. Previously, access to personalized financial guidance might have been limited to those who could afford professional services. Now, anyone with an internet connection can download and utilize these tools. This widespread availability fosters financial literacy and promotes responsible financial behavior across broader segments of the population. Consider, for example, a young adult starting their first job or a family navigating unexpected expenses; readily available templates provide a crucial resource for organizing financial information and planning for the future.

This enhanced accessibility also reduces reliance on complex financial software or paid applications. The simplicity of a printable template removes technical barriers, making financial planning achievable for individuals with limited computer skills or access to technology. Moreover, the printable format allows for offline use, extending its reach to those with unreliable internet access. Practical applications include utilizing the template to track spending, consolidate debts, or prepare for loan applications. This ease of use encourages consistent engagement with personal finances, promoting long-term financial stability.

In summary, accessibility significantly enhances the utility of free printable personal financial statement templates. By removing financial and technical barriers, these tools empower individuals to actively engage in financial planning, regardless of their background or resources. This contributes to a more financially informed and responsible populace, ultimately fostering greater economic well-being.

2. Customizability

Customizability is a critical feature of free printable personal financial statement templates, enabling adaptation to individual financial circumstances. This flexibility ensures the template remains relevant and useful regardless of one’s specific financial situation, whether managing a complex investment portfolio or tracking basic income and expenses. This adaptability allows for a more accurate and insightful representation of one’s financial health.

- Asset CategorizationStandard templates may offer broad asset categories. Customizability allows for more granular categorization, such as differentiating between various types of investments (stocks, bonds, real estate) or specifying individual asset details. This detailed breakdown provides a more nuanced understanding of asset allocation and potential investment risks.

- Liability SpecificityCustomizable templates accommodate various liability types, from mortgages and student loans to credit card debt and personal loans. Specifying interest rates, repayment terms, and other relevant details facilitates more effective debt management strategies and allows for accurate net worth calculations.

- Income Stream DifferentiationBeyond salary, individuals may have diverse income streams like rental income, investment dividends, or freelance earnings. Customizability allows for incorporating these various sources, providing a comprehensive overview of total income and its composition. This comprehensive view is essential for accurate financial planning.

- Expense Tracking DetailCustomizable templates offer flexibility in tracking expenses. Individuals can categorize expenses based on their specific needs and priorities, whether tracking household expenses, healthcare costs, or education expenses. This granular detail facilitates budget analysis and identification of areas for potential savings.

The customizability of free printable personal financial statement templates allows individuals to create a document that truly reflects their unique financial situation. This tailored approach fosters a deeper understanding of one’s financial health and empowers informed decision-making regarding budgeting, debt management, and investment strategies. By adapting the template to individual circumstances, users gain a more accurate and actionable tool for managing their finances effectively.

3. Comprehensiveness

Comprehensiveness is a defining characteristic of effective personal financial statements. A free printable template facilitates this crucial aspect by providing a structured framework for capturing all relevant financial data. This includes assets (e.g., cash, investments, property), liabilities (e.g., loans, credit card debt), and income sources (e.g., salary, investments). Consider a scenario where an individual is applying for a mortgage. A comprehensive financial statement, generated from a template, provides the lender with a clear picture of the applicant’s financial health, increasing the likelihood of loan approval. Similarly, when planning for retirement, a comprehensive statement helps project future needs and develop appropriate saving and investment strategies.

The comprehensiveness offered by these templates promotes informed financial decision-making. For example, a complete picture of assets and liabilities enables accurate net worth calculation. This understanding allows individuals to assess their progress toward financial goals and identify potential areas for improvement. Further, a comprehensive overview of income and expenses facilitates effective budgeting and expense management. Tracking all income streams, including salary, investments, and other sources, provides a clear picture of total resources available. Similarly, detailed expense tracking allows for identification of unnecessary spending and opportunities for cost reduction. This level of detail enables informed adjustments to financial strategies and promotes long-term financial stability.

In summary, the comprehensiveness fostered by free printable personal financial statement templates provides a holistic view of an individual’s financial standing. This complete picture is essential for informed decision-making across various financial contexts, from loan applications to retirement planning and budgeting. By capturing all relevant financial data within a structured format, these templates empower individuals to take control of their finances and work towards long-term financial well-being. The absence of comprehensiveness can lead to inaccurate assessments and potentially detrimental financial decisions, underscoring the importance of this attribute.

4. Organization

Financial clarity often hinges on effective organization. Free printable personal financial statement templates provide a structured framework for managing financial data, transforming potentially overwhelming information into an accessible and manageable format. This organized approach facilitates informed decision-making, reduces financial stress, and promotes long-term financial well-being. Without a structured approach, crucial financial details can be easily overlooked, leading to inaccurate assessments and potentially detrimental financial choices.

- Standardized StructureTemplates provide pre-defined sections for assets, liabilities, income, and expenses. This standardized structure ensures consistency and facilitates easy comparison across different time periods. For example, tracking net worth over several months becomes straightforward when data is consistently organized within the same framework. This allows for clear visualization of financial progress and identification of trends.

- Categorization of InformationTemplates promote categorization of financial information. Assets can be categorized by type (e.g., liquid assets, investments, real estate), liabilities by source (e.g., mortgage, student loans), and expenses by category (e.g., housing, transportation, entertainment). This categorization simplifies analysis and allows for a more nuanced understanding of financial health. Consider an individual seeking to reduce spending. Categorized expense data highlights areas where reductions can be most effectively implemented.

- Clear Visual RepresentationThe organized format of a template presents financial information in a clear, visually accessible manner. This facilitates quick comprehension of key financial metrics, such as net worth, debt-to-income ratio, and savings rate. A clear visual representation can be particularly helpful when reviewing financial goals or communicating financial information to a financial advisor.

- Facilitated Record-KeepingTemplates provide a designated space for recording financial transactions, promoting diligent record-keeping. This organized approach simplifies tax preparation, budgeting, and financial planning. Maintaining organized records also streamlines loan applications and other financial processes that require documentation of financial history. This organized record-keeping fosters financial responsibility and allows for more effective long-term financial management.

The organizational benefits offered by free printable personal financial statement templates are instrumental in promoting effective financial management. By providing a structured framework for data entry, categorization, and visual representation, these templates empower individuals to take control of their financial lives. This organized approach fosters informed decision-making, reduces financial stress, and paves the way for long-term financial stability and success.

5. Actionable Insights

A free printable personal financial statement template, when properly utilized, generates actionable insights crucial for effective financial management. The template serves as a tool for collecting and organizing financial data, but its true value lies in the insights derived from the organized information. These insights empower informed decision-making regarding budgeting, debt management, investment strategies, and overall financial planning. Consider an individual who discovers a high debt-to-income ratio through a completed template. This insight might prompt action to consolidate debts, reduce spending, or explore additional income streams. Similarly, identifying a significant portion of assets tied up in low-yield investments might lead to portfolio rebalancing to optimize returns.

The process of populating the template itself can be a source of valuable insights. Gathering information on assets, liabilities, income, and expenses often reveals overlooked areas of financial activity. This awareness facilitates a more comprehensive understanding of one’s financial situation. For example, tracking expenses through a template might reveal previously unnoticed spending patterns, such as excessive dining out or subscription services. This awareness can then prompt adjustments in spending habits. Similarly, compiling a list of assets can highlight underutilized resources, such as dormant savings accounts or valuable possessions that could be liquidated. The template, therefore, becomes more than just a static record; it acts as a catalyst for financial awareness and behavioral change.

The insights gleaned from a completed personal financial statement template translate directly into improved financial outcomes. Reduced debt, increased savings, optimized investments, and enhanced budgeting practices contribute to greater financial stability and long-term financial well-being. Furthermore, the ongoing use of the template allows for monitoring progress over time. Regularly updating the template provides a clear picture of the effectiveness of implemented strategies and enables timely adjustments to maintain financial health. By transforming raw financial data into actionable insights, free printable personal financial statement templates empower individuals to take control of their finances and work toward their financial goals. The absence of such a tool can perpetuate a cycle of uninformed financial decisions, underscoring the importance of leveraging these readily available resources.

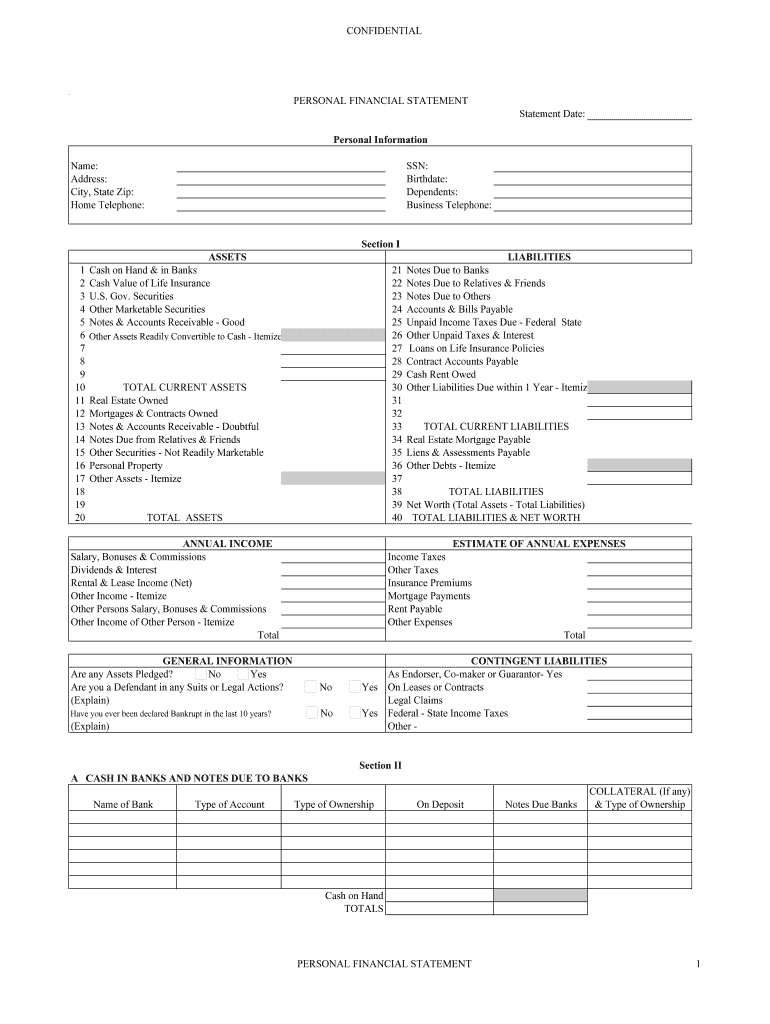

Key Components of a Personal Financial Statement Template

A well-structured personal financial statement template facilitates a thorough understanding of one’s financial position. Key components ensure comprehensive data capture and analysis.

1. Assets: This section details everything owned of value. Categorization typically includes liquid assets (cash, checking accounts, savings accounts), investments (stocks, bonds, mutual funds), and fixed assets (real estate, vehicles, personal property). Accurate valuation is crucial for a realistic net worth calculation.

2. Liabilities: This section outlines all outstanding debts and obligations. Common categories include secured debt (mortgages, auto loans), unsecured debt (credit card debt, personal loans), and other liabilities (taxes owed, outstanding medical bills). Details such as interest rates and payment terms provide a complete picture of debt obligations.

3. Income: All sources of income are documented in this section. Common sources include salary, wages, investment income (dividends, interest), rental income, and other income streams (freelance work, alimony). Accurate income reporting is essential for budgeting and financial planning.

4. Expenses: This section details all spending activity. Categorization typically includes housing, transportation, food, healthcare, entertainment, and other expenses. Detailed expense tracking allows for identification of areas for potential cost reduction and improved budget management.

5. Net Worth Calculation: This crucial component presents the difference between total assets and total liabilities. Net worth provides a snapshot of one’s overall financial health and serves as a key metric for tracking financial progress over time. Regular monitoring of net worth enables proactive adjustments to financial strategies.

Accurate and detailed completion of these components provides a comprehensive overview of one’s financial health, enabling informed financial decisions and fostering long-term financial stability.

How to Create a Personal Financial Statement Template

Creating a personal financial statement template involves structuring a document to effectively capture and organize key financial data. A well-designed template facilitates accurate net worth calculation and informed financial decision-making.

1. Establish Key Sections: The template should include distinct sections for assets, liabilities, income, and expenses. Clear section headings ensure organized data entry and easy retrieval of information.

2. Categorize Within Sections: Within each section, create categories for different types of data. Assets might be categorized as liquid assets, investments, and fixed assets. Liabilities could be categorized as secured debt and unsecured debt. Income can be categorized by source, and expenses by type (housing, transportation, etc.).

3. Include Space for Details: Provide adequate space within each category for detailed information. For assets, this might include descriptions, acquisition dates, and current values. For liabilities, details might include interest rates, payment terms, and outstanding balances. Income entries should specify sources and amounts, while expense entries should include dates and descriptions.

4. Incorporate a Net Worth Calculation Section: Dedicate a section for calculating net worth. This section should clearly display the formula: Total Assets – Total Liabilities = Net Worth. This calculation provides a snapshot of overall financial health.

5. Consider a Summary Section: A summary section can provide a concise overview of key financial metrics, such as total assets, total liabilities, net worth, total income, and total expenses. This summary facilitates quick review and analysis of financial data.

6. Choose a Format: Select a format that facilitates easy data entry and readability. A spreadsheet format allows for automated calculations and sorting. Alternatively, a table format within a word processing document can provide a more visually appealing presentation. Ensure the chosen format allows for printing and easy modification.

7. Test and Refine: Populate the template with sample data to ensure its functionality and effectiveness. Review the organization and layout for clarity and ease of use. Make adjustments as needed to optimize the template for individual needs and preferences. Regular review and refinement ensures the template remains relevant and useful over time.

A well-structured template provides a framework for organizing financial information, calculating net worth, and gaining valuable insights into one’s financial health. Regular use and updates promote informed financial decision-making and long-term financial well-being.

Access to readily available, adaptable, and cost-free personal financial statement templates empowers individuals to take control of their financial lives. These tools provide a structured framework for organizing financial data, calculating net worth, and gaining valuable insights into spending patterns, debt management, and investment strategies. The ability to customize these templates ensures relevance across diverse financial situations, from managing basic income and expenses to navigating complex investment portfolios. The comprehensive nature of these tools allows for a holistic view of financial health, facilitating informed decision-making regarding budgeting, debt reduction, and long-term financial planning.

Leveraging these accessible resources fosters financial literacy and promotes responsible financial behavior. Regular utilization of personal financial statement templates, coupled with ongoing review and analysis, contributes significantly to improved financial outcomes and long-term financial well-being. This proactive approach to financial management empowers individuals to navigate financial complexities with confidence and work toward achieving their financial goals. A well-defined financial roadmap, facilitated by these readily available tools, is essential for navigating the complexities of personal finance and building a secure financial future.