Utilizing such a resource allows businesses, particularly startups and small enterprises, to monitor financial progress without incurring additional software costs. Regularly generating these statements facilitates timely identification of trends, potential issues, and opportunities for improvement. This proactive approach to financial management empowers informed decision-making and contributes to stronger financial stability.

Understanding the components and application of this financial tool is essential for effective business management. The following sections will delve deeper into constructing and interpreting these statements, exploring best practices and offering practical guidance for leveraging this resource to its full potential.

1. Accessibility

Accessibility, in the context of free quarterly profit and loss statement templates, signifies the ease with which businesses can obtain and utilize these crucial financial tools. Previously, generating such reports often required specialized software or professional accounting services, creating a barrier for smaller organizations or those with limited resources. Freely available templates remove this barrier, democratizing access to structured financial analysis. This empowers entrepreneurs and managers to gain a clearer understanding of their financial position without significant upfront investment.

Consider a small bakery operating on tight margins. Manually tracking income and expenses can be time-consuming and error-prone. A free, readily available template provides a structured format for recording transactions and calculating key metrics. This accessibility translates directly into improved financial management capabilities, enabling the bakery owner to identify areas for cost savings, optimize pricing strategies, and ultimately enhance profitability. The ability to readily access and implement such tools contributes to a more level playing field for small businesses competing in larger markets.

Ultimately, the accessibility of these templates promotes better financial practices across a broader spectrum of businesses. This increased transparency empowers more informed decision-making, facilitates growth, and strengthens the overall economic landscape. While freely available resources may not encompass the advanced features of paid software, they offer a vital entry point for effective financial management, paving the way for sustainable business development.

2. Regular Monitoring

Regular monitoring of financial performance constitutes a cornerstone of sound business management. Utilizing a free quarterly profit and loss statement template provides a structured framework for this essential practice. Consistent application allows businesses to track revenue streams, cost of goods sold, operating expenses, and ultimately, profitability over time. This frequency enables prompt identification of emerging trends, both positive and negative. For example, a steady increase in operating expenses could indicate inefficiencies requiring attention, while consistent revenue growth might signal opportunities for expansion.

Consider a subscription-based service provider. By regularly populating a quarterly profit and loss statement, fluctuations in customer churn rate become readily apparent. A sudden increase in churn, coupled with rising customer acquisition costs, could signify underlying issues with service quality or pricing strategy. Early detection, facilitated by consistent monitoring, allows for timely intervention and corrective action, potentially mitigating significant financial losses. Conversely, identifying consistent growth in specific customer segments can highlight successful marketing initiatives and inform future resource allocation.

Consistent engagement with these statements cultivates a deeper understanding of the financial drivers within a business. This understanding, derived from consistent data analysis, empowers proactive management. Challenges, such as rising material costs or declining sales, can be addressed promptly rather than reactively. This proactive approach, facilitated by regular monitoring, strengthens financial stability and enhances the likelihood of long-term success. While the template itself provides a valuable tool, its effectiveness ultimately depends on consistent and disciplined application.

3. Informed Decisions

Informed decisions represent the cornerstone of effective business management. A free quarterly profit and loss statement template provides the necessary data foundation for such decisions. By offering a clear and concise overview of financial performance, these statements empower stakeholders to move beyond intuition and speculation, basing strategic choices on concrete evidence. The ability to analyze revenue trends, cost structures, and profitability metrics allows for data-driven adjustments to pricing strategies, marketing campaigns, and operational efficiencies. For instance, identifying a consistently underperforming product line, through profit and loss analysis, could lead to informed decisions regarding discontinuation or reformulation, optimizing resource allocation and maximizing overall profitability.

Consider a retail business experiencing declining profit margins. A quarterly profit and loss statement can pinpoint the contributing factors. Perhaps rising cost of goods sold, coupled with stagnant sales, indicates a need to renegotiate supplier contracts or adjust pricing strategies. Alternatively, increasing operating expenses, such as rent or utilities, might necessitate exploring cost-saving measures or alternative locations. The data provided by the statement allows for targeted interventions, addressing the root causes of declining profitability rather than implementing generic, potentially ineffective solutions. This targeted approach maximizes the impact of corrective actions and enhances the likelihood of achieving desired outcomes.

The ability to make informed decisions, grounded in accurate and timely financial data, distinguishes successful businesses from those struggling to maintain stability. While readily available templates offer a valuable starting point, their true value lies in their consistent and disciplined application. Regularly generating and analyzing these statements cultivates a proactive management approach, enabling businesses to anticipate challenges, capitalize on opportunities, and navigate the complexities of the market with greater confidence and control. This data-driven approach fosters resilience and positions businesses for sustained growth and long-term success.

4. Cost-effective analysis

Cost-effective analysis represents a critical aspect of responsible financial management, particularly for businesses operating under budget constraints. Leveraging a free quarterly profit and loss statement template directly contributes to this objective by providing a readily accessible and structured framework for analyzing financial performance without incurring the expense of specialized software or external accounting services. This accessibility empowers businesses to gain valuable insights into their financial health, identify areas for potential cost savings, and optimize resource allocation without significant upfront investment.

- Reduced operational expensesUtilizing a free template eliminates the need for costly software subscriptions or outsourced accounting services. This allows businesses to allocate resources more strategically, reinvesting saved funds into core operations, marketing initiatives, or research and development. For instance, a startup can utilize a free template to track its burn rate and identify areas for cost optimization, extending its runway and increasing its chances of securing further funding.

- Timely identification of cost overrunsRegularly generating quarterly statements facilitates prompt identification of escalating expenses. This allows businesses to take corrective action swiftly, mitigating potential financial losses. For example, a manufacturing company noticing a consistent increase in raw material costs can proactively explore alternative suppliers or adjust production processes to minimize the impact on profit margins. Early intervention, enabled by consistent monitoring, preserves financial stability and supports long-term sustainability.

- Data-driven decision making for resource allocationThe insights derived from a profit and loss statement inform strategic resource allocation. By analyzing revenue streams and expense categories, businesses can identify areas of high return on investment and prioritize accordingly. A software company, for example, might discover that its marketing spend on a specific channel yields significantly higher customer acquisition compared to others. This data-driven insight allows for optimized budget allocation, maximizing the impact of marketing efforts and driving revenue growth.

- Enhanced financial transparency and controlClear and organized financial data fosters transparency and enhances control over financial operations. This is particularly beneficial for small businesses or startups seeking external funding. Presenting potential investors with well-structured financial statements, generated using a free template, demonstrates financial acumen and strengthens credibility. This increased transparency builds trust and improves the likelihood of securing investment, fueling further growth and expansion.

By leveraging the readily available resource of a free quarterly profit and loss statement template, businesses gain a cost-effective means of analyzing financial performance. This accessibility democratizes essential financial management tools, empowering organizations of all sizes to make informed decisions, optimize resource allocation, and navigate the complexities of the market with greater financial control and confidence. The cumulative effect of these advantages contributes significantly to long-term sustainability and success in a competitive business environment.

5. Financial Clarity

Financial clarity represents a critical element of effective business management. A free quarterly profit and loss statement template serves as a valuable tool for achieving this clarity. By providing a structured framework for recording and analyzing financial data, these templates empower businesses to gain a comprehensive understanding of their financial performance, facilitating informed decision-making and contributing to long-term stability.

- Understanding Revenue StreamsA profit and loss statement meticulously categorizes revenue streams, providing insights beyond top-line figures. This granular view enables businesses to identify their most profitable products or services, understand seasonal fluctuations, and assess the effectiveness of sales and marketing initiatives. For example, an e-commerce business can track revenue generated from different product categories, identifying top performers and areas requiring improvement. This detailed analysis allows for data-driven decisions regarding product development, pricing adjustments, and inventory management.

- Cost Structure AnalysisDissecting the cost structure is crucial for identifying areas of potential cost savings and operational efficiencies. A profit and loss statement breaks down costs into distinct categories, such as cost of goods sold, operating expenses, and administrative expenses. This detailed breakdown allows businesses to pinpoint areas of excessive spending. For instance, a restaurant can analyze food costs, labor costs, and overhead expenses to identify opportunities for optimization. This granular approach empowers informed decisions regarding menu pricing, staffing levels, and operational processes.

- Profitability AssessmentAccurately assessing profitability is essential for evaluating business health and guiding future strategies. A profit and loss statement clearly presents key profitability metrics, such as gross profit margin, operating profit margin, and net profit margin. These metrics offer valuable insights into the efficiency of operations and the overall financial health of the business. For example, a consulting firm can track its billable hours, project expenses, and overhead costs to determine the profitability of individual projects and client engagements. This data-driven analysis informs pricing decisions, resource allocation, and future client acquisition strategies.

- Trend IdentificationConsistent utilization of quarterly profit and loss statements enables businesses to identify trends in revenue, costs, and profitability. This trend analysis allows for proactive adjustments to business strategies, maximizing growth opportunities and mitigating potential risks. For example, a subscription-based service can track customer churn rate, acquisition costs, and lifetime value over multiple quarters. Identifying negative trends, such as increasing churn or declining customer lifetime value, enables timely intervention and corrective action, preserving revenue streams and ensuring long-term sustainability.

The insights derived from regularly generated and analyzed profit and loss statements empower businesses to make informed decisions, optimize resource allocation, and navigate the complexities of the market with greater confidence and control. By leveraging the readily accessible resource of a free quarterly profit and loss statement template, businesses gain a cost-effective tool for achieving financial clarity, a cornerstone of sustained growth and long-term success.

Key Components of a Quarterly Profit and Loss Statement

A comprehensive understanding of key components is essential for effective utilization of a quarterly profit and loss statement. These components provide a structured view of financial performance, enabling informed decision-making and contributing to long-term financial stability.

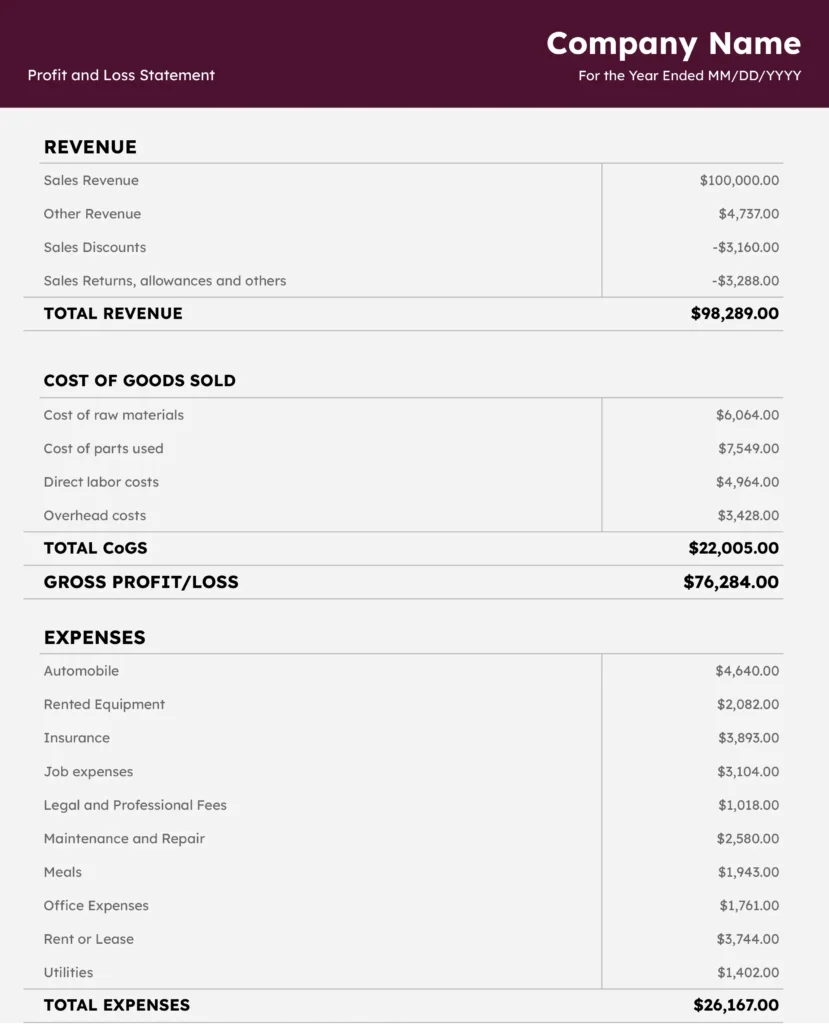

1. Revenue: This section details all income generated from sales of goods or services during the quarter. It represents the top line of the statement and serves as the starting point for calculating profitability.

2. Cost of Goods Sold (COGS): COGS encompasses all direct costs associated with producing goods or delivering services sold during the quarter. This includes raw materials, direct labor, and manufacturing overhead.

3. Gross Profit: Calculated by subtracting COGS from revenue, gross profit reflects the profitability of core business operations before considering operating expenses.

4. Operating Expenses: This section details all costs incurred in running the business during the quarter, excluding COGS. Examples include rent, utilities, marketing expenses, salaries, and administrative costs.

5. Operating Income: Operating income, derived by subtracting operating expenses from gross profit, represents the profitability of the business after accounting for all operating costs.

6. Other Income/Expenses: This section captures any non-operational income or expenses, such as interest income, investment gains or losses, and one-time charges.

7. Net Income/Loss: Representing the bottom line of the statement, net income or loss is the final result after considering all revenues, costs, and expenses. It reflects the overall profitability of the business during the quarter.

Careful analysis of these components provides valuable insights into financial performance, enabling data-driven decisions regarding pricing strategies, cost management, and resource allocation. Understanding the interrelationships between these elements is crucial for effective financial management and long-term business success.

How to Create a Free Quarterly Profit and Loss Statement Template

Creating a free quarterly profit and loss statement template involves structuring a document to effectively capture and analyze financial data over a three-month period. This structured approach facilitates informed financial decision-making and contributes to long-term business stability.

1. Define Reporting Period: Clearly specify the start and end dates for the quarter being analyzed. This ensures consistency and accuracy in financial reporting.

2. Revenue Section: Create a section to record all revenue generated during the quarter. Categorize revenue streams for a more granular analysis. For example, separate sales revenue from service revenue or subscription fees.

3. Cost of Goods Sold (COGS) Section: Establish a dedicated section for COGS, including all direct costs associated with producing goods or delivering services. Categorize COGS for detailed analysis, separating raw materials from direct labor and manufacturing overhead.

4. Gross Profit Calculation: Incorporate a formula to automatically calculate gross profit by subtracting COGS from total revenue. This key metric reflects the profitability of core business operations.

5. Operating Expenses Section: Create a section for operating expenses, including all costs associated with running the business, excluding COGS. Categorize expenses for detailed analysis, such as rent, utilities, marketing, salaries, and administrative costs.

6. Operating Income Calculation: Include a formula to automatically calculate operating income by subtracting total operating expenses from gross profit. This metric reveals profitability after accounting for operating costs.

7. Other Income/Expenses Section: Establish a section for recording non-operational income and expenses, such as interest income, investment gains or losses, and one-time charges.

8. Net Income/Loss Calculation: Incorporate a formula to calculate net income or loss by adding other income and subtracting other expenses from operating income. This bottom-line figure reflects the overall profitability for the quarter.

Utilizing a spreadsheet software or dedicated template software simplifies the creation process and allows for automated calculations and data visualization. A well-structured template facilitates consistent tracking of financial performance, enabling informed decision-making and contributing to long-term business success. This organized approach allows for efficient data analysis and supports proactive financial management.

Access to complimentary quarterly income statement templates provides businesses with a crucial tool for monitoring and analyzing financial performance. Regular utilization of these templates fosters informed decision-making regarding pricing strategies, cost management, and resource allocation. Understanding key components, such as revenue streams, cost of goods sold, operating expenses, and net income/loss, is essential for extracting actionable insights from these statements. Cost-effective analysis, facilitated by readily available templates, empowers businesses to identify trends, optimize operations, and enhance profitability.

Leveraging these readily available resources empowers organizations to navigate the complexities of the financial landscape with greater clarity and control. Consistent engagement with these statements cultivates a proactive management approach, fostering financial stability and positioning businesses for long-term success. The insights gleaned from these analyses provide a critical foundation for strategic planning and informed decision-making, ultimately contributing to sustainable growth and a stronger financial future.