Utilizing such a framework offers several advantages. It enables property owners to monitor profitability, identify areas for cost reduction, and make informed decisions about rent adjustments and property improvements. This structured approach simplifies tax preparation and provides valuable documentation for loan applications or potential property sales. Ultimately, it facilitates better financial management and contributes to the long-term success of a rental property investment.

Understanding the components and benefits of a structured financial statement is crucial for effective property management. The following sections delve deeper into practical applications, offering guidance on utilizing these tools to maximize profitability and streamline financial operations.

1. Accessibility

Accessibility is a critical factor in the utility of a free rental property profit and loss statement template. Widespread availability removes financial barriers often associated with sophisticated property management software, enabling a broader range of individuals and organizations to benefit from structured financial tracking. Online availability through websites, downloadable spreadsheets, and mobile-compatible formats further enhances accessibility, eliminating geographical constraints and allowing access from various devices. This ease of access empowers landlords, property managers, and investors, regardless of technical expertise or financial resources, to implement sound financial practices.

Consider a small-scale landlord managing a few properties. Accessing a free template online eliminates the need for expensive software or manual spreadsheet creation, saving both time and money. This accessibility allows them to track income and expenses efficiently, identify potential issues, and ultimately manage their investments more effectively. Similarly, a property management company overseeing a larger portfolio can leverage free templates to standardize financial reporting across multiple properties, ensuring consistency and simplifying portfolio-level analysis.

In conclusion, the accessibility of free templates democratizes sound financial management within the rental property sector. Removing cost and technical barriers empowers users of varying scales and expertise to implement best practices, leading to improved financial outcomes and more informed decision-making. This widespread accessibility fosters greater financial transparency and efficiency within the industry as a whole.

2. Customizability

Customizability is a key feature of effective financial tracking tools. A free rental property profit and loss statement template, while often providing a standardized structure, allows for modifications to suit individual property needs and management styles. This adaptability ensures the template remains relevant and useful across diverse property types and investment strategies. Tailoring the template enhances accuracy and provides a more granular view of financial performance, leading to better-informed decision-making.

- Income CategoriesStandard templates typically include common income sources like rent. However, properties may generate income from other avenues, such as laundry facilities, parking fees, or pet rent. Customizability allows users to add these specific income streams, providing a more complete picture of revenue generation. For instance, a property with significant pet-related income can accurately track this revenue, facilitating informed decisions about pet policies and associated fees.

- Expense TrackingExpense categories are crucial for identifying areas of potential cost savings. Customizable templates allow for detailed expense tracking beyond standard categories like maintenance and property taxes. Adding fields for specific expenses, such as landscaping, pest control, or advertising, enables a more precise analysis of operational costs. This detailed breakdown can reveal areas where expenses may be optimized, leading to increased profitability.

- Reporting PeriodsWhile many templates default to monthly or annual reporting, customizability allows for adjustments to match specific management needs. A property owner focusing on short-term rentals might benefit from weekly or even daily reporting to monitor performance closely. Conversely, long-term investment strategies might require less frequent reporting. This flexibility ensures the template aligns with the investor’s timeframe and analytical requirements.

- Integration with Other ToolsSome free templates offer compatibility with other software or platforms. This interoperability streamlines data entry and reporting processes. For example, integration with property management software can automatically populate income and expense data into the profit and loss statement, saving time and reducing the risk of manual errors. This streamlined approach enhances efficiency and allows for a more holistic view of property performance.

The ability to customize a free rental property profit and loss statement template enhances its utility across various property management contexts. By tailoring income categories, expense tracking, reporting periods, and integrations, users gain a more accurate, granular, and relevant view of their property’s financial health. This customized approach ultimately empowers property owners and managers to make data-driven decisions that optimize profitability and support long-term investment success.

3. Accuracy

Accuracy in data entry is paramount when utilizing a free rental property profit and loss statement template. The template’s effectiveness as a financial management tool hinges directly on the reliability of the information it contains. Inaccurate data leads to flawed analyses, potentially misrepresenting a property’s financial health and hindering informed decision-making. Systematic errors, such as consistently misclassifying expenses or omitting income sources, can create a distorted view of profitability, potentially obscuring underlying financial issues or exaggerating positive performance. For example, failing to accurately record repair costs could lead to an overestimation of net income, potentially delaying necessary maintenance and ultimately resulting in more costly repairs down the line.

Diligent data entry practices are crucial for maintaining accuracy. Regularly reconciling bank statements with recorded transactions helps identify discrepancies and rectify errors promptly. Utilizing consistent categorization for income and expenses ensures uniformity in reporting and facilitates accurate comparisons across different periods. Leveraging features like drop-down menus or automated calculations within spreadsheet-based templates minimizes manual entry errors. Consider a scenario where a property manager uses a template to track expenses across multiple units. Consistent categorization of expenses like “Plumbing Repairs” or “Landscaping” ensures clear reporting and facilitates analysis of cost trends across the entire portfolio. Neglecting accuracy can have significant repercussions, particularly during tax season or when seeking financing. Inaccurate financial records can complicate tax preparation, potentially leading to penalties or audits. Similarly, lenders rely on accurate financial statements to assess creditworthiness and make lending decisions. Inaccurate data can jeopardize loan applications or result in unfavorable loan terms.

In conclusion, accuracy forms the bedrock of effective financial management using free rental property profit and loss statement templates. The template’s value as an analytical tool directly correlates with the reliability of the data it contains. Prioritizing accurate data entry, employing consistent categorization, and regularly reconciling records are essential practices for ensuring the integrity of financial analysis and facilitating informed decision-making regarding property investments. This commitment to accuracy not only strengthens financial management practices but also builds credibility with financial institutions and tax authorities.

4. Organization

A free rental property profit and loss statement template provides a structured framework for organizing financial data, crucial for effective property management. Systematic organization facilitates clear and efficient tracking of income and expenses, enabling accurate financial analysis and informed decision-making. Without a structured approach, financial data can become unwieldy, hindering analysis and potentially obscuring critical performance indicators. Organized financial records streamline tax preparation, simplify reporting, and support informed investment strategies.

- Categorization of Income and ExpensesClear categorization is fundamental to organized financial records. Templates typically categorize income sources, such as rental income, late fees, or parking fees. Expenses are categorized into operating expenses (e.g., maintenance, property taxes, insurance) and financing costs (e.g., mortgage interest). This structured approach allows for detailed tracking of individual income and expense streams, facilitating analysis of spending patterns and revenue trends. For example, separating maintenance costs into subcategories like plumbing, electrical, and landscaping allows for a more granular analysis of property-specific maintenance needs.

- Chronological OrderingTemplates organize financial data chronologically, typically on a monthly, quarterly, or annual basis. This chronological structure enables tracking of financial performance over time, facilitating trend analysis and identification of seasonal variations in income or expenses. For instance, a property manager can identify periods of increased utility expenses, potentially correlating with seasonal changes in heating or cooling needs. This chronological overview supports proactive budgeting and resource allocation.

- Consistent FormattingConsistent formatting ensures clarity and readability. Standard templates utilize a consistent format for presenting financial data, including clear headings, subtotals, and totals. This uniformity simplifies interpretation and comparison of financial information across different periods. Consistent formatting is particularly important when managing multiple properties, as it allows for standardized reporting and portfolio-level analysis.

- Supporting DocumentationWhile not directly part of the template itself, organized record-keeping extends to maintaining supporting documentation for all transactions. Linking receipts, invoices, and bank statements to corresponding entries in the profit and loss statement strengthens financial accountability and simplifies audits or tax inquiries. This organized approach to documentation provides a verifiable audit trail and supports the accuracy of the financial records.

The organizational structure provided by a free rental property profit and loss statement template is essential for effective financial management. Categorization, chronological ordering, consistent formatting, and supporting documentation contribute to a clear and comprehensive overview of a property’s financial performance. This organized approach empowers property owners and managers to make data-driven decisions, optimize profitability, and ensure long-term investment success. Furthermore, organized financial records simplify communication with financial institutions, tax professionals, and potential investors, enhancing transparency and credibility.

5. Analysis

Analysis of a completed rental property profit and loss statement is crucial for extracting actionable insights and optimizing financial performance. The template serves as a foundation for this analysis, providing the organized data necessary for evaluating profitability, identifying trends, and informing strategic decision-making. Effective analysis transforms raw financial data into a tool for improving investment outcomes.

- Profitability AssessmentDetermining profitability is a primary objective of financial analysis. Calculating key metrics like net operating income (NOI) and capitalization rate provides a clear picture of a property’s financial health. Analyzing trends in profitability over time helps assess the effectiveness of management strategies and identify potential areas for improvement. For example, declining NOI might indicate increasing operating expenses or decreasing rental income, prompting further investigation into underlying causes.

- Expense EvaluationAnalyzing expenses helps identify areas for cost reduction and improved efficiency. Comparing expenses across different periods or against industry benchmarks can reveal areas where costs are excessive. This analysis can lead to strategic decisions, such as renegotiating service contracts or implementing energy-saving measures. For instance, consistently high utility costs might prompt an investigation into energy-efficient upgrades or tenant usage patterns.

- Income OptimizationAnalyzing income streams helps identify opportunities to maximize revenue. Evaluating vacancy rates, rental rates, and other income sources, such as parking or laundry fees, informs strategies for increasing overall income. This analysis can support decisions regarding rent adjustments, property improvements to attract higher-paying tenants, or exploring additional income-generating amenities. For example, a high vacancy rate might indicate the need for more effective marketing or competitive rental pricing.

- Return on Investment (ROI) CalculationCalculating ROI provides a comprehensive assessment of investment performance. Analyzing factors contributing to ROI, such as income, expenses, and property value appreciation, allows for informed decisions regarding future investments and property management strategies. Comparing ROI across different properties within a portfolio helps prioritize resource allocation and optimize overall investment returns. Consistently low ROI might trigger a reassessment of the investment strategy or a decision to divest.

Analyzing the data within a free rental property profit and loss statement template is essential for converting raw financial data into actionable insights. By assessing profitability, evaluating expenses, optimizing income, and calculating ROI, property owners and managers gain a comprehensive understanding of their investment’s performance. This analysis forms the basis for strategic decision-making, ultimately leading to improved financial outcomes and long-term investment success. Utilizing the template as an analytical tool empowers informed decisions regarding property management, resource allocation, and overall investment strategy.

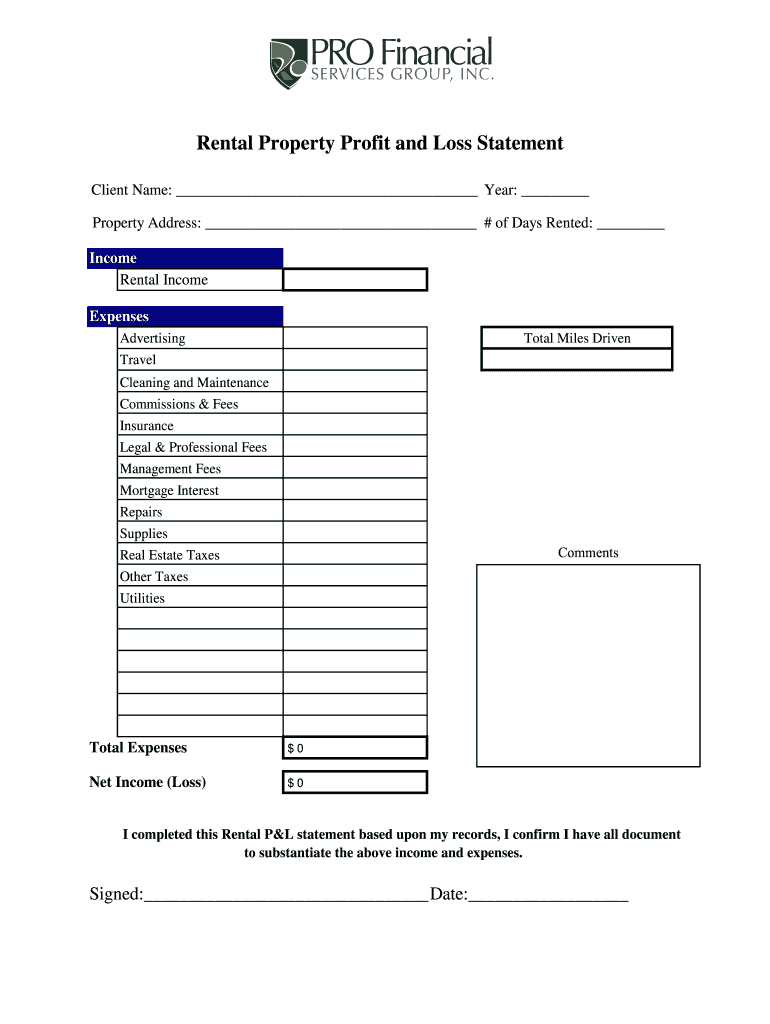

Key Components of a Free Rental Property Profit and Loss Statement Template

A comprehensive understanding of key components within a free rental property profit and loss statement template is essential for accurate financial analysis and informed decision-making. These components provide a structured framework for organizing and interpreting financial data related to rental property investments.

1. Rental Income: This section captures all income generated from rental payments. Accuracy is paramount, requiring meticulous recording of all received rents. Additional income streams, such as late fees or pet rent, should be itemized separately for a granular income overview.

2. Operating Expenses: Operating expenses encompass the costs associated with day-to-day property management. These include essential expenditures like property taxes, insurance premiums, maintenance and repair costs, advertising expenses, and property management fees if applicable. Accurate categorization and detailed tracking are crucial for identifying areas of potential cost optimization.

3. Financing Costs: Financing costs represent expenses related to securing and maintaining property financing. Mortgage interest payments are a primary component, along with any associated loan fees or charges. Accurate tracking of these costs is essential for understanding the true cost of property ownership and assessing investment profitability.

4. Net Operating Income (NOI): NOI is a critical profitability metric calculated by subtracting operating expenses from total rental income. It represents the income generated from property operations before accounting for financing costs. Analyzing NOI trends provides valuable insights into property performance and informs strategic decision-making.

5. Depreciation: Depreciation represents the decrease in a property’s value over time due to wear and tear. While not a cash outflow, it is a significant tax deduction that impacts overall profitability. Accurate calculation and application of depreciation are essential for tax planning and investment analysis.

6. Net Income: Net income represents the property’s bottom line, calculated by subtracting all expenses, including financing costs and depreciation, from total income. This figure provides a comprehensive overview of the property’s profitability after accounting for all associated costs. Monitoring net income trends is crucial for assessing investment performance and making informed financial decisions.

Accurate data entry and consistent categorization within these core components are fundamental for leveraging the template’s analytical power. This structured approach provides a clear and comprehensive financial overview, facilitating informed decision-making, optimizing profitability, and enhancing long-term investment success.

How to Create a Free Rental Property Profit and Loss Statement Template

Creating a free rental property profit and loss statement template provides a structured approach to financial management. This process involves organizing key components within a standardized format, enabling accurate tracking of income and expenses and facilitating informed decision-making.

1. Choose a Format: Select a format suitable for individual needs and technical proficiency. Options include spreadsheet software (e.g., Google Sheets, Microsoft Excel), dedicated template websites, or word processing software for basic templates. Spreadsheet software offers greater flexibility for calculations and data manipulation.

2. Establish Reporting Periods: Define the timeframe for the statement, typically monthly, quarterly, or annually. Consistent reporting periods facilitate trend analysis and comparison across periods. Choose a frequency aligned with management needs and investment goals.

3. Create Income Section: Establish a dedicated section for recording all income generated from the property. Include separate lines for different income streams (e.g., rent, late fees, parking income). Clear labeling ensures accurate income tracking and facilitates analysis of individual income sources.

4. Develop Expense Section: Categorize expenses into relevant groups, such as operating expenses (e.g., property taxes, insurance, maintenance) and financing costs (e.g., mortgage interest). Detailed categorization enables precise expense tracking and identification of potential cost-saving opportunities.

5. Calculate Net Operating Income (NOI): Dedicate a section for calculating NOI by subtracting total operating expenses from total income. NOI provides a key profitability metric for assessing property performance independent of financing costs.

6. Include Depreciation: Account for property depreciation, a non-cash expense representing the decrease in property value over time. Accurate depreciation calculation is crucial for tax purposes and provides a more complete picture of property profitability.

7. Determine Net Income: Calculate net income by subtracting all expenses, including financing costs and depreciation, from total income. This bottom-line figure provides a comprehensive overview of property profitability.

8. Test and Refine: Populate the template with sample data to ensure accurate calculations and functionality. Review and refine the template based on specific property needs and management practices. Regularly review and update the template as needed to ensure continued accuracy and relevance.

A well-structured template facilitates accurate financial tracking, simplifies analysis, and supports informed decision-making related to property investments. Regular review and refinement of the template ensures its continued effectiveness as a financial management tool.

A free rental property profit and loss statement template provides a crucial framework for effective financial management. Accessibility, customizability, accuracy, organization, and insightful analysis are key aspects of utilizing such a template effectively. From understanding individual income and expense components to calculating key metrics like net operating income and return on investment, the template empowers informed decision-making. Its structured approach facilitates clear financial tracking, simplifies tax preparation, and supports strategic planning for long-term investment success.

Effective property management requires a commitment to diligent financial tracking and analysis. Leveraging readily available resources, such as free templates, empowers property owners and managers to gain a comprehensive understanding of their financial performance. This proactive approach to financial management is essential for optimizing profitability, mitigating risks, and achieving long-term financial goals in the dynamic landscape of rental property investment.