Utilizing these resources allows businesses to track performance, identify trends, and make informed decisions without incurring the cost of specialized software or professional accounting services. This accessibility can be especially beneficial for startups and small businesses operating with limited budgets. Well-organized financial records are also crucial for securing loans, attracting investors, and ensuring compliance with tax regulations.

The following sections will explore the different types of readily available statement formats, offer guidance on selecting the most appropriate option, and provide practical tips for effective utilization.

1. Accessibility

Accessibility is a critical factor in the effective utilization of financial statement templates for small businesses. Removing barriers to entry empowers businesses to manage finances efficiently, regardless of technological expertise or financial resources. This accessibility fosters better financial practices and contributes to overall business health.

- Cost-EffectivenessEliminating the financial burden associated with proprietary software or professional accounting services allows businesses to allocate resources to other critical areas. A freely available template provides the necessary structure for financial reporting without requiring significant investment. This is particularly advantageous for startups or businesses operating with limited capital.

- Ease of UseTemplates often feature intuitive layouts and pre-built formulas, simplifying the process of data entry and analysis. This ease of use reduces the technical expertise required, allowing business owners to focus on interpreting the financial information rather than grappling with complex software. For example, a simple profit and loss template can be readily understood and utilized by someone without accounting experience.

- AvailabilityFree templates are readily available online from various reputable sources, eliminating the need for extensive searches or costly subscriptions. This widespread availability ensures quick access to essential financial management tools. Businesses can download and implement these resources immediately, enabling prompt financial tracking and analysis.

- Device CompatibilityMany free templates are designed to be compatible across various devices, including computers, tablets, and smartphones. This flexibility allows business owners to access and manage their financial data from anywhere, promoting real-time monitoring and agile decision-making.

By providing accessible tools for financial organization and analysis, free templates contribute significantly to the financial well-being of small businesses. This accessibility promotes informed decision-making, encourages proactive financial management, and ultimately supports sustainable growth.

2. Standardized Formats

Standardized formats are a cornerstone of financial reporting, providing a consistent structure for presenting financial data. Within the context of free small business financial statement templates, these formats ensure comparability, facilitate analysis, and promote clarity for both internal and external stakeholders. Adherence to established conventions ensures data is presented in a recognizable and readily interpretable manner.

- Consistency and ComparabilityStandardized templates ensure consistent presentation of financial information across reporting periods. This consistency allows for accurate trend analysis and performance evaluation over time. It also facilitates benchmarking against industry averages or competitors, providing valuable insights into a business’s relative financial standing. For example, using a standardized balance sheet template allows for direct comparison of assets, liabilities, and equity across different fiscal years.

- Simplified AnalysisStandardized formats organize financial data into predefined categories, simplifying analysis and interpretation. Key financial ratios, such as profitability and liquidity ratios, can be readily calculated using data presented in these standard formats. This streamlined analysis allows business owners and stakeholders to quickly assess financial health and performance. For instance, a standardized income statement template simplifies the calculation of gross profit margin and net profit margin.

- Enhanced CommunicationUsing standardized formats enhances communication with external stakeholders, such as lenders and investors. These familiar formats present information in a way that is easily understood and analyzed by those outside the business. This clarity fosters trust and credibility, increasing the likelihood of securing funding or investment. A standardized cash flow statement, for example, clearly communicates the sources and uses of cash, crucial information for potential investors.

- Compliance and RegulationStandardized financial statements are often required for regulatory compliance and tax reporting. Using free templates that adhere to these standards ensures businesses meet these obligations efficiently and accurately. This adherence simplifies the reporting process and minimizes the risk of penalties or legal issues. For instance, using a standardized income statement ensures accurate reporting of revenue and expenses for tax purposes.

By leveraging standardized formats, free small business financial statement templates provide a valuable tool for effective financial management. This standardization promotes clarity, facilitates analysis, and ensures compliance, ultimately contributing to the financial health and sustainability of small businesses.

3. Key Financial Indicators

Financial statement templates provide the raw data necessary for calculating key financial indicators. These indicators offer valuable insights into a business’s performance, profitability, liquidity, and solvency. Understanding these metrics is crucial for informed decision-making, strategic planning, and overall financial health assessment.

- ProfitabilityProfitability metrics, such as gross profit margin and net profit margin, assess a business’s ability to generate profit from sales. These are calculated using data from the income statement, a key component of financial statement templates. For example, a declining gross profit margin might indicate increasing costs of goods sold, requiring investigation and potential adjustments to pricing or sourcing strategies. Strong profitability indicators are essential for long-term sustainability and growth.

- LiquidityLiquidity ratios, such as the current ratio and quick ratio, measure a business’s ability to meet short-term obligations. These ratios are derived from the balance sheet, another crucial element found in financial statement templates. A low current ratio could signal potential difficulties in meeting immediate financial obligations, prompting actions like improved inventory management or securing short-term financing. Maintaining healthy liquidity is crucial for operational stability.

- SolvencySolvency ratios, including the debt-to-equity ratio, assess a business’s long-term financial stability and its ability to meet long-term obligations. Data for these calculations comes from the balance sheet. A high debt-to-equity ratio might suggest over-reliance on borrowed funds, potentially increasing financial risk. Maintaining a healthy balance between debt and equity is essential for long-term financial health.

- EfficiencyEfficiency ratios, such as inventory turnover and accounts receivable turnover, measure how effectively a business manages its assets. These ratios rely on data from both the income statement and balance sheet. A low inventory turnover ratio could indicate excess inventory or slow sales, requiring adjustments to inventory management practices or marketing strategies. Efficient asset management is crucial for maximizing profitability and minimizing waste.

By providing the structured data needed to calculate these key financial indicators, free small business financial statement templates empower businesses to monitor performance, identify areas for improvement, and make informed decisions that contribute to sustainable growth and financial success. Regularly reviewing these indicators allows businesses to proactively address potential challenges and capitalize on opportunities.

4. Informed Decision-Making

Sound financial decisions are the cornerstone of any successful business. Utilizing financial statement templates provides the structured financial data necessary for informed decision-making, enabling businesses to navigate challenges, capitalize on opportunities, and chart a course toward sustainable growth. Access to organized financial information empowers businesses to move beyond reactive management and embrace proactive strategies.

- Strategic PlanningDeveloping effective business strategies requires a clear understanding of current financial performance. Financial statement templates provide the necessary data to assess profitability, liquidity, and solvency, informing strategic decisions related to expansion, product development, and market positioning. For example, consistent profitability, as revealed by income statement analysis, might justify investment in new product development, while a low current ratio, evident on the balance sheet, might necessitate a more conservative approach to expansion.

- Resource AllocationEffective resource allocation depends on accurate financial data. By analyzing financial statements generated from templates, businesses can identify areas where resources are being utilized effectively and areas where adjustments are needed. For instance, a high inventory turnover ratio suggests efficient inventory management, while a low accounts receivable turnover ratio might indicate the need for stricter credit policies or improved collection procedures. Informed resource allocation maximizes efficiency and profitability.

- Performance EvaluationRegular review of financial statements allows businesses to track performance against goals and identify areas for improvement. Templates facilitate consistent reporting, enabling businesses to monitor trends, identify deviations from projections, and implement corrective actions. For example, declining profit margins over several reporting periods, as revealed by income statement analysis, might necessitate cost-cutting measures or price adjustments. Consistent performance evaluation is essential for achieving long-term objectives.

- Risk ManagementUnderstanding a business’s financial position is crucial for effective risk management. Financial statement templates provide the data necessary to assess financial vulnerabilities and implement appropriate mitigation strategies. For instance, a high debt-to-equity ratio, as calculated from balance sheet data, might indicate increased financial risk, prompting efforts to reduce debt or secure additional equity financing. Proactive risk management safeguards the business against potential financial instability.

By providing the structured framework for generating accurate and organized financial data, free small business financial statement templates empower businesses to make informed decisions across all aspects of operations. This data-driven approach fosters proactive management, minimizes financial risks, and ultimately contributes to sustained growth and long-term success. Regularly utilizing and analyzing these statements enables businesses to adapt to changing market conditions, capitalize on emerging opportunities, and navigate challenges effectively.

5. Financial Health Monitoring

Regular financial health monitoring is essential for the long-term viability and success of any business. Leveraging free small business financial statement templates provides a readily accessible and structured approach to this crucial process. Consistent monitoring enables proactive identification of potential financial challenges and opportunities, allowing for timely interventions and strategic adjustments. This proactive approach fosters stability and facilitates informed decision-making.

- Regular Financial Check-upsJust as regular health check-ups are crucial for personal well-being, consistent review of financial statements is vital for business health. Utilizing readily available templates enables businesses to establish a routine for generating and analyzing these statements. For example, reviewing a cash flow statement monthly can help identify potential shortfalls and allow for timely adjustments to spending or revenue generation strategies. Regular check-ups enable proactive management rather than reactive responses to crises.

- Early Problem DetectionConsistent financial monitoring, facilitated by the use of templates, allows for early detection of potential financial problems. Analyzing trends in key financial indicators, such as declining profit margins or increasing debt-to-equity ratios, can signal underlying issues requiring attention. For example, consistently declining gross profit margins, revealed through regular income statement analysis, might indicate escalating production costs, prompting investigation and potential adjustments to pricing or sourcing strategies. Early detection allows for timely intervention and prevents small issues from escalating into major crises.

- Performance Tracking and BenchmarkingTemplates provide the structured framework for tracking financial performance against established goals and industry benchmarks. Regular analysis enables businesses to identify areas of strength and weakness, allowing for strategic adjustments to optimize performance. For instance, comparing a business’s liquidity ratios to industry averages can reveal areas for improvement in working capital management. Consistent performance tracking provides valuable insights for strategic planning and informed decision-making.

- Informed Strategic AdjustmentsThe insights gained through regular financial monitoring, using easily accessible statement templates, inform strategic adjustments and facilitate data-driven decision-making. Whether adjusting pricing strategies in response to declining profit margins or implementing cost-cutting measures due to cash flow constraints, data-driven decisions improve the likelihood of success. This approach ensures decisions are based on concrete financial data rather than intuition or guesswork.

Free small business financial statement templates provide accessible tools for regular financial health monitoring. By leveraging these resources, businesses gain valuable insights into their financial performance, enabling proactive management, informed decision-making, and ultimately, enhanced financial stability and long-term success. Consistent monitoring transforms financial data into actionable intelligence, empowering businesses to navigate challenges and capitalize on opportunities effectively.

Key Components of Financial Statement Templates

Effective financial management requires a clear understanding of the key components within financial statement templates. These components provide a structured framework for organizing and presenting crucial financial data, enabling informed decision-making and proactive financial management.

1. Balance Sheet: The balance sheet provides a snapshot of a business’s financial position at a specific point in time. It outlines assets, liabilities, and equity, illustrating what a business owns, what it owes, and the owner’s stake in the company. This information is crucial for assessing solvency and overall financial health.

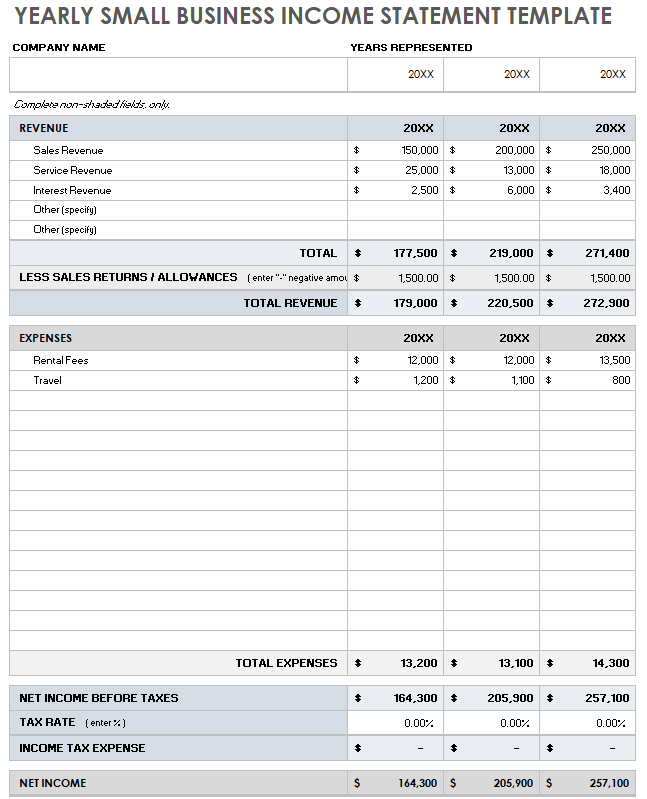

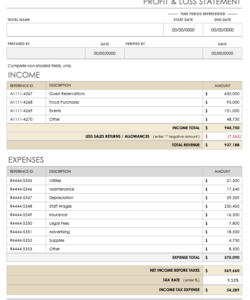

2. Income Statement: The income statement, also known as the profit and loss statement, details a business’s financial performance over a specific period. It outlines revenues, expenses, and resulting profit or loss, providing insights into profitability and operational efficiency. This information is essential for evaluating revenue streams, managing expenses, and assessing overall profitability.

3. Cash Flow Statement: The cash flow statement tracks the movement of cash both into and out of a business over a specific period. It categorizes cash flow into operating, investing, and financing activities, providing a clear picture of cash generation and utilization. This information is critical for managing liquidity and ensuring sufficient cash flow to meet operational needs.

4. Statement of Owner’s Equity: This statement tracks changes in the owner’s equity over a specific period. It details investments, withdrawals, and net income or loss, providing a clear picture of how the owner’s stake in the business has changed. This information is important for understanding the impact of business operations on the owner’s investment.

5. Supporting Schedules: While not always included in basic templates, supporting schedules provide detailed breakdowns of specific accounts within the main financial statements. Examples include schedules for accounts receivable, accounts payable, and inventory. These schedules offer a granular view of financial data, enabling more in-depth analysis and informed decision-making. They facilitate better management of individual asset and liability accounts.

6. Notes to the Financial Statements: Often accompanying the core financial statements, notes provide additional context and explanations regarding accounting policies, assumptions, and significant events. These notes enhance transparency and provide stakeholders with a more comprehensive understanding of the financial data. They ensure clarity and provide a deeper context for interpreting the financial figures.

These components, working in concert, provide a comprehensive overview of a business’s financial position, performance, and cash flow. This structured presentation of financial information is crucial for informed decision-making, proactive financial management, and the long-term success of any business. Understanding the interrelationships between these components provides a holistic view of financial health and facilitates effective strategic planning.

How to Create Free Small Business Financial Statement Templates

Creating accessible financial statement templates requires a structured approach, ensuring clarity, accuracy, and relevance for small businesses. The following steps outline the process of developing effective templates for key financial statements.

1. Define the Purpose and Scope: Clarify the specific purpose and scope of the template. Determine which financial statements are necessary (balance sheet, income statement, cash flow statement, etc.) and the target audience (e.g., startups, established businesses). A clearly defined scope ensures the template meets the specific needs of its users.

2. Choose a Software Tool: Select an appropriate software tool for creating the template. Spreadsheet software is commonly used due to its flexibility and built-in formulas. Consider factors such as ease of use, accessibility, and compatibility with other software. The chosen tool should facilitate easy data entry and manipulation.

3. Design the Layout: Design a clear and intuitive layout for each financial statement. Use clear labels for each line item and organize information logically. Consider incorporating visual elements, such as borders and shading, to enhance readability. A well-designed layout facilitates easy data entry and interpretation.

4. Incorporate Formulas and Calculations: Incorporate formulas and automated calculations where appropriate. This reduces manual data entry and minimizes the risk of errors. For example, in an income statement template, gross profit can be automatically calculated by subtracting the cost of goods sold from revenue. Automated calculations improve accuracy and efficiency.

5. Include Instructions and Guidance: Provide clear instructions and guidance on how to use the template. Explain the purpose of each section, how to enter data, and how to interpret the results. Consider including examples or sample data to illustrate proper usage. Clear instructions ensure users can effectively utilize the template.

6. Test and Refine: Thoroughly test the template with sample data to ensure accuracy and functionality. Solicit feedback from potential users and make revisions as needed. Testing ensures the template is user-friendly and error-free.

7. Ensure Accessibility: Make the template accessible to a wide range of users. Consider factors such as file format compatibility, device compatibility, and accessibility for users with disabilities. Wide accessibility maximizes the template’s reach and usefulness.

8. Regularly Update: Regularly review and update the template to ensure it remains relevant and accurate. Incorporate changes to accounting standards or regulations as needed. Regular updates maintain the template’s accuracy and usefulness over time.

Developing effective financial statement templates requires careful planning, design, and testing. By following these steps, one can create accessible and user-friendly resources that empower small businesses to effectively manage their finances and make informed decisions. Well-designed templates provide a valuable tool for financial success.

Access to well-designed, no-cost financial statement templates provides essential support for small businesses navigating the complexities of financial management. From foundational setup to ongoing monitoring, these readily available resources offer structured formats for organizing financial data, calculating key performance indicators, and ultimately, making informed decisions that drive sustainable growth. Understanding the core components of these templates, including balance sheets, income statements, and cash flow statements, empowers businesses to gain a comprehensive view of their financial health. The ability to accurately assess profitability, liquidity, and solvency enables proactive adjustments and strategic planning, fostering long-term financial stability.

Regular utilization of these tools transforms raw financial data into actionable insights, equipping businesses to navigate challenges, capitalize on opportunities, and achieve financial objectives. The integration of these accessible resources into routine financial practices is not merely a recommended best practice, but a critical factor in fostering a financially sound and thriving business landscape.