Utilizing such a resource offers several advantages. It enables owners and managers to monitor financial health, assess the impact of operational changes, and secure funding from lenders or investors. Regularly generating these statements fosters financial awareness, facilitates informed resource allocation, and supports sustainable growth. Furthermore, readily available templates simplify the process, saving time and effort.

Understanding the structure and application of these statements is essential for effective financial management. The following sections will delve into the key components, provide practical guidance on their use, and explore various resources available to small businesses.

1. Accessibility

Accessibility is a critical factor influencing the practical utility of free small business profit and loss statement templates. Removing barriers to utilization empowers businesses to leverage these tools for improved financial management. This section explores key facets of accessibility and their implications.

- Cost-EffectivenessEliminating financial barriers to acquiring these templates is paramount. Free resources ensure that all businesses, regardless of financial constraints, can access essential financial management tools. This democratization of resources levels the playing field, enabling startups and small enterprises to compete effectively.

- Ease of UseTemplates should be user-friendly, requiring minimal technical expertise. Intuitive design and clear instructions facilitate seamless integration into existing workflows. A business owner with limited accounting experience should be able to readily input data and interpret results. For example, clearly labeled fields for revenue and expenses simplify data entry.

- AvailabilityWidespread availability across various platforms and formats (e.g., spreadsheets, downloadable documents) ensures convenient access. Online accessibility, coupled with downloadable options, caters to diverse technological capabilities and preferences. A downloadable spreadsheet allows offline use, beneficial in areas with limited internet connectivity.

- AdaptabilityTemplates should be adaptable to various business models and industry specifics. Customizable fields and categories allow businesses to tailor the template to their unique needs. For example, a freelance consultant can adapt a template to track project-specific income and expenses.

These facets of accessibility collectively enhance the usability and effectiveness of free profit and loss statement templates. By reducing barriers and promoting widespread adoption, these resources contribute significantly to improved financial management practices within the small business community. This, in turn, fosters growth, sustainability, and economic vitality.

2. Simplicity

Simplicity in the design and utilization of a free small business profit and loss statement template is crucial for its effectiveness. An overly complex structure can deter usage and hinder accurate financial analysis, particularly for users with limited accounting expertise. A straightforward template promotes regular engagement and informed decision-making.

- Clear StructureA well-organized template with clearly defined sections for revenue, cost of goods sold, operating expenses, and net income simplifies data entry and interpretation. A logical flow, mirroring standard accounting practices, ensures consistency and accuracy. For example, separating fixed costs like rent from variable costs like raw materials allows for clearer cost analysis.

- Concise TerminologyAvoiding complex accounting jargon in favor of straightforward language makes the template accessible to a wider audience. Using terms like “sales” instead of “gross receipts” or “profit” instead of “net operating income” enhances understanding and encourages utilization. This clarity reduces the likelihood of misinterpretations and improves the accuracy of financial reporting.

- Minimal Data RequirementsFocusing on essential financial data avoids overwhelming users. A template requiring only key figures, such as total sales, major expense categories, and net income, simplifies the process while still providing valuable insights. For example, a small e-commerce business might not need to itemize every marketing expense initially, but could track total marketing spend as a single line item.

- Intuitive FormattingVisual clarity through clean formatting, consistent font usage, and logical spacing enhances readability and comprehension. A visually appealing template encourages regular use and reduces errors. For example, using bold text for section headings and clear separators between data entry fields improves navigation and reduces eye strain.

These aspects of simplicity contribute to the overall usability and effectiveness of free profit and loss statement templates. By reducing complexity and promoting ease of use, these tools empower small businesses to gain valuable financial insights without requiring extensive accounting knowledge. This facilitates more informed decision-making, contributing to improved financial management and ultimately, business success.

3. Profitability Tracking

Profitability tracking forms the core purpose of a free small business profit and loss statement template. The template provides a structured framework for recording revenue and expenses, enabling calculation of net income or loss over a specific period. This regular monitoring of financial performance is essential for understanding business health and identifying areas for improvement. Cause-and-effect relationships between operational changes and profit margins become clearer through consistent use. For example, a restaurant might track the impact of a new menu item on overall profitability by analyzing changes in revenue and ingredient costs reflected in the statement.

As a critical component, profitability tracking within the template facilitates informed decision-making. Identifying trends in sales, cost of goods sold, and operating expenses provides actionable insights. Rising material costs, for instance, may necessitate price adjustments or sourcing alternative suppliers. Declining sales in a specific product line might trigger marketing campaigns or product revisions. The template serves as a diagnostic tool, highlighting financial strengths and weaknesses, enabling proactive adjustments to business strategies. A clothing retailer, for example, might observe declining profitability due to increasing advertising costs and subsequently decide to explore more cost-effective marketing channels.

Effective profitability tracking, facilitated by free templates, is fundamental to long-term business sustainability. Understanding financial performance empowers owners to make data-driven decisions, optimize resource allocation, and navigate economic fluctuations. Regularly utilizing a profit and loss statement provides a clear picture of financial health, enabling course correction and facilitating sustainable growth. This understanding is crucial not only for internal management but also for communicating financial performance to external stakeholders, such as investors or lenders. Over time, consistent tracking reveals trends in profitability, allowing for more accurate forecasting and strategic planning.

4. Performance Analysis

Performance analysis, facilitated by a free small business profit and loss statement template, provides crucial insights into operational efficiency and financial health. Analyzing data within the statement enables identification of trends, strengths, and weaknesses, informing strategic decisions for improved profitability and sustainability. Utilizing a template allows businesses to dissect financial performance systematically, revealing opportunities for optimization and growth. This structured approach transforms raw financial data into actionable intelligence.

- Cost AnalysisExamining cost of goods sold (COGS) and operating expenses reveals areas for potential cost reduction. A template allows comparison of costs across different periods, identifying increases or decreases in specific expense categories. For example, a manufacturing business might analyze raw material costs over several quarters, identifying fluctuations and exploring opportunities for bulk purchasing or alternative suppliers to reduce expenses.

- Sales Performance EvaluationAnalyzing revenue streams reveals top-performing products or services and identifies areas of declining sales. A template facilitates tracking sales data over time, enabling businesses to understand seasonal trends, customer preferences, and the effectiveness of marketing campaigns. A bookstore, for example, can analyze sales figures for various genres to identify popular categories and adjust inventory accordingly.

- Profit Margin AssessmentCalculating gross profit margin (revenue less COGS) and net profit margin (net income divided by revenue) provides insights into profitability. A template enables comparison of margins across periods, revealing the impact of pricing strategies, cost control measures, and operational efficiency. A software company, for instance, can track the impact of subscription price changes on its profit margins.

- Trend IdentificationAnalyzing data over multiple reporting periods reveals trends in revenue, expenses, and profitability. A template facilitates visual representation of these trends, highlighting patterns and enabling proactive adjustments to business strategies. A caf, for example, might observe a consistent increase in utility costs during summer months and implement energy-saving measures to mitigate future expenses.

These facets of performance analysis, facilitated by free small business profit and loss statement templates, contribute significantly to informed decision-making. By enabling businesses to dissect their financial performance systematically, these tools empower owners and managers to optimize operations, improve profitability, and achieve long-term sustainability. Regular analysis, coupled with strategic action based on identified trends and insights, is essential for navigating competitive landscapes and ensuring continued business success.

5. Informed Decisions

Informed decision-making is crucial for navigating the complexities of the business landscape. A free small business profit and loss statement template provides the necessary financial insights to drive strategic choices, fostering growth and sustainability. By offering a clear view of financial performance, these templates empower business owners to make data-driven decisions rather than relying on intuition or guesswork. This structured approach to financial analysis minimizes risks and maximizes opportunities.

- Strategic PlanningUnderstanding profitability trends, cost structures, and revenue streams, as revealed through the profit and loss statement, informs strategic planning. A business can identify growth areas, allocate resources effectively, and develop realistic financial projections. For example, consistent profitability in a specific product line might justify investment in expanding that segment. Conversely, losses might necessitate restructuring or discontinuation. The template provides the concrete data required for sound strategic planning.

- Pricing StrategiesAnalyzing cost of goods sold (COGS) and operating expenses through the template informs pricing decisions. Understanding the relationship between costs and revenue empowers businesses to set optimal prices that maintain profitability while remaining competitive. For instance, rising material costs, identified through the statement, might necessitate price adjustments to maintain profit margins. Data-driven pricing ensures long-term financial viability.

- Resource AllocationA profit and loss statement illuminates the efficiency of resource allocation. By analyzing expenses and their impact on profitability, businesses can optimize spending, eliminate wasteful expenditures, and prioritize investments in areas with the highest return potential. For example, a business might realize through the statement that marketing spend in a particular channel yields minimal returns and redirect those resources to more effective strategies. Data-driven resource allocation maximizes efficiency and profitability.

- Investment DecisionsA clear understanding of financial performance, as provided by the profit and loss statement, is essential for attracting investment. Investors rely on financial data to assess risk and potential returns. A well-maintained profit and loss statement demonstrates financial stability and growth potential, increasing the likelihood of securing funding. Likewise, internal investment decisions regarding equipment purchases or expansion projects are guided by the financial insights derived from the template.

These interconnected facets of informed decision-making, facilitated by free small business profit and loss statement templates, empower businesses to navigate challenges and capitalize on opportunities. By leveraging the financial insights provided by these accessible tools, business owners can make strategic choices that drive growth, enhance profitability, and ensure long-term sustainability. Regularly utilizing these templates fosters a culture of data-driven decision-making, a critical factor for success in today’s competitive environment. The template becomes a cornerstone of sound financial management, enabling businesses to adapt, evolve, and thrive.

6. Financial Health

Financial health represents the overall stability and well-being of a business, reflecting its ability to meet financial obligations, withstand economic fluctuations, and pursue growth opportunities. A free small business profit and loss statement template plays a crucial role in assessing and maintaining this health, providing a structured framework for monitoring financial performance and identifying potential risks or areas for improvement. Regular utilization of such a template empowers businesses to make informed decisions that contribute to long-term financial stability and success.

- Liquidity AssessmentLiquidity refers to a business’s ability to meet short-term financial obligations. While a profit and loss statement doesn’t directly measure liquidity, it provides crucial insights into the generation of profits that contribute to available cash flow. Analyzing profitability trends helps businesses anticipate potential cash shortfalls and implement strategies to maintain sufficient liquidity. For example, consistently declining profits, as revealed by the statement, might signal an impending liquidity crisis, prompting the business to explore financing options or implement cost-cutting measures.

- Profitability AnalysisProfitability, a core indicator of financial health, is directly measured by the profit and loss statement. Tracking revenue and expenses reveals the business’s ability to generate profit from its operations. Analyzing profit margins over time helps identify factors impacting profitability, enabling informed decisions regarding pricing strategies, cost control, and operational efficiency. For example, a declining gross profit margin might indicate rising production costs, prompting the business to explore alternative suppliers or streamline manufacturing processes.

- Debt ManagementWhile not directly reflected in the profit and loss statement, a business’s ability to manage debt effectively is crucial for financial health. Profitability, as measured by the statement, directly influences debt capacity. Higher profits contribute to stronger debt service coverage ratios, increasing the business’s ability to secure financing and manage existing debt obligations. Sustainable profitability, as revealed through consistent use of the template, enhances creditworthiness and strengthens financial stability.

- Operational EfficiencyAnalyzing the relationship between revenue and expenses within the profit and loss statement provides insights into operational efficiency. Identifying areas where costs are disproportionately high relative to revenue allows businesses to implement strategies for streamlining operations and improving efficiency. For example, high operating expenses relative to revenue might indicate inefficient processes, prompting the business to implement automation or process improvements to reduce costs and enhance profitability.

These facets of financial health are intrinsically linked to the data provided by a free small business profit and loss statement template. By regularly utilizing this tool, businesses gain a comprehensive understanding of their financial performance, enabling informed decisions that promote stability, growth, and long-term success. The template becomes a cornerstone of sound financial management, empowering businesses to navigate economic challenges, capitalize on opportunities, and maintain a healthy financial position. Consistent use of the template, coupled with proactive adjustments based on the insights gained, fosters a culture of financial awareness and contributes significantly to overall business health.

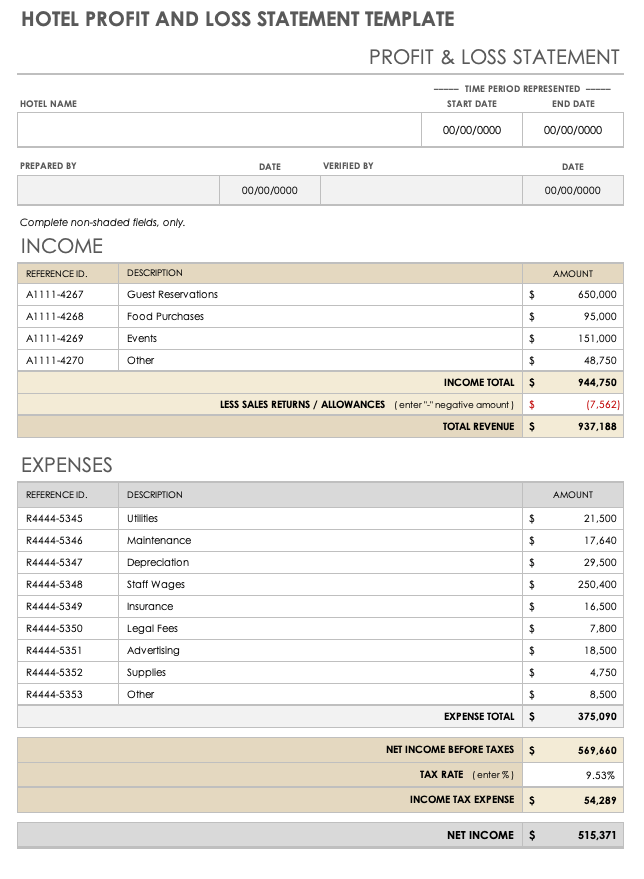

Key Components of a Free Small Business Profit and Loss Statement Template

Understanding the core components of a profit and loss statement is essential for accurate financial analysis and informed decision-making. This section outlines the key elements typically found in free templates designed for small businesses.

1. Revenue: This section details all income generated from business activities. It typically includes sales revenue, interest income, and any other income generated from core operations. Accuracy in this section is paramount as it forms the basis for calculating profitability.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold by the business. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Calculated as revenue less COGS, gross profit represents the profit generated from core sales activities before accounting for operating expenses. This metric provides insights into production efficiency and pricing strategies.

4. Operating Expenses: This section details all expenses incurred in running the business, excluding COGS. It includes items such as rent, salaries, marketing expenses, and administrative costs. Categorizing operating expenses allows for detailed analysis and cost control.

5. Operating Income: Calculated as gross profit less operating expenses, operating income reflects the profitability of core business operations. This key metric reveals the efficiency of cost management and the effectiveness of operational strategies.

6. Other Income/Expenses: This section accounts for income or expenses not directly related to core business operations. Examples include interest income, investment gains, or losses from asset sales. These items are typically separated to provide a clearer picture of operational profitability.

7. Net Income/Loss: This bottom-line figure represents the overall profit or loss generated by the business after accounting for all revenues and expenses. Net income is a crucial indicator of financial performance and sustainability. It informs key decisions regarding investments, distributions, and future strategic planning.

These interconnected components provide a comprehensive overview of financial performance. Accurate data entry and careful analysis of these elements are essential for informed decision-making and long-term business success. Regularly reviewing these components empowers businesses to identify trends, optimize operations, and achieve financial stability.

How to Create a Free Small Business Profit and Loss Statement Template

Creating a profit and loss (P&L) statement template allows for consistent financial tracking and analysis. While numerous free templates are available online, creating a customized template offers greater control and ensures alignment with specific business needs. The following steps outline the process.

1. Choose a Software: Spreadsheet software (e.g., Google Sheets, Microsoft Excel) provides the necessary functionality for creating a P&L template. These programs offer formulas for automated calculations and flexible formatting options.

2. Establish Reporting Period: Define the timeframe for the P&L statement (e.g., monthly, quarterly, annually). Consistent reporting periods facilitate trend analysis and performance comparisons.

3. Create Revenue Section: List all revenue streams relevant to the business. Include clear labels (e.g., “Sales Revenue,” “Interest Income”). Formulas can be added to automatically calculate total revenue.

4. Develop COGS Section (if applicable): For businesses selling physical goods, create a section for Cost of Goods Sold. Include line items for direct materials, direct labor, and manufacturing overhead.

5. Outline Operating Expenses: Categorize and list all operating expenses (e.g., “Rent,” “Salaries,” “Marketing”). Detailed categorization enables better cost analysis and control.

6. Include Other Income/Expenses: Create a section for income or expenses not directly related to core operations, such as interest income or gains/losses from investments.

7. Calculate Key Metrics: Use formulas to calculate Gross Profit (Revenue – COGS), Operating Income (Gross Profit – Operating Expenses), and Net Income (Operating Income + Other Income – Other Expenses).

8. Format for Clarity: Use clear labels, consistent formatting, and visual separators (e.g., borders, bold text) to enhance readability and ensure the template is user-friendly. Consider using a separate worksheet for data input and another for the formatted P&L statement.

A well-structured template, tailored to specific business needs, facilitates consistent financial tracking and analysis. Regularly updating and reviewing the P&L statement provides crucial insights into business performance, enabling data-driven decisions for improved profitability and long-term sustainability.

Access to complimentary profit and loss statement templates designed for small businesses offers a crucial pathway to informed financial management. Understanding revenue streams, cost structures, and operational expenses provides essential insights for data-driven decision-making. Utilizing these readily available resources enables businesses to track profitability, analyze performance, and implement strategic adjustments for enhanced financial health and sustainability. Simplicity and accessibility are key features, empowering owners and managers with limited accounting expertise to gain a comprehensive understanding of their financial landscape. From cost analysis and sales performance evaluation to trend identification and resource allocation, these templates become indispensable tools for navigating the complexities of business finance. Regular engagement with these statements fosters a proactive approach to financial management, a cornerstone of long-term success.

Financial awareness, facilitated by readily available and user-friendly templates, empowers informed decisions that shape the trajectory of a small business. Consistent utilization of these tools cultivates a data-driven approach to management, contributing significantly to long-term viability and growth. Embracing these resources represents an investment in financial clarity and a commitment to sustainable business practices. The insights derived from regular analysis pave the way for strategic adaptation, optimized resource allocation, and enhanced financial stability, ultimately contributing to a thriving and resilient business landscape.