Utilizing a readily available standardized form offers several advantages. It simplifies accounting processes, reduces the likelihood of errors, and ensures consistent communication with clients. Accessibility to such resources empowers businesses, especially smaller enterprises, to maintain professional financial record-keeping without incurring additional expenses. This contributes to improved client relationships and efficient financial management.

The following sections will delve deeper into the components of effective record forms, explore various available formats, and offer practical guidance on their implementation and customization to suit specific business needs.

1. Accessibility

Accessibility, in the context of complimentary statement templates, refers to the ease with which businesses can obtain and utilize these resources. This ease of access is a critical factor influencing efficient financial management, particularly for small businesses and startups often operating with limited resources.

- Cost-EffectivenessEliminating the financial barrier associated with purchasing proprietary software or hiring professional designers allows businesses to allocate resources to other critical areas. Freely available templates represent a significant cost saving, enabling even the smallest enterprises to maintain professional and organized financial records.

- Availability and Ease of AcquisitionNumerous online platforms offer a wide selection of templates readily available for download. This widespread availability eliminates the need for extensive searches or complex acquisition processes, enabling businesses to implement these resources quickly and efficiently.

- Format Compatibility and UsabilityTemplates are typically available in commonly used formats like Microsoft Word or Excel, ensuring compatibility with most business software. This interoperability simplifies the process of integrating the templates into existing workflows and minimizes the need for specialized software or technical expertise.

- Adaptability Across DevicesMany free templates are designed with responsiveness in mind, enabling access and utilization across various devices, including desktops, laptops, tablets, and smartphones. This flexibility facilitates remote work and allows for convenient access to financial information regardless of location.

The accessibility of free statement templates empowers businesses to maintain organized financial records, fostering transparency with clients and contributing to better financial management practices. This ease of access is particularly beneficial for smaller entities, allowing them to project a professional image and manage finances efficiently without incurring significant costs. By leveraging these readily available resources, businesses can establish strong financial foundations and focus on growth and development.

2. Customization

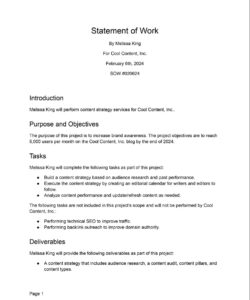

Customization is a crucial aspect of free statement of account templates, enabling businesses to tailor these resources to specific needs and branding requirements. While the free availability offers a convenient starting point, the ability to modify these templates significantly enhances their practical value and effectiveness in professional communication. This adaptability allows for the seamless integration of company branding, specific payment terms, and other pertinent details, ensuring clarity and reinforcing a professional image.

Modifiable elements often include the company logo, contact information, and color schemes. Beyond visual branding, customization extends to the inclusion of specific payment instructions, detailed breakdown of charges, or the addition of personalized messages. For instance, a service-based business might add a section detailing the services rendered, while a product-based business might include product codes and quantities. This level of detail strengthens transparency and clarity in client communication. Further, customizing payment termsclearly outlining due dates, accepted payment methods, and late payment policiesminimizes potential misunderstandings and facilitates timely payments. These adjustments transform a generic template into a bespoke communication tool, reflecting the unique characteristics of the business and fostering stronger client relationships.

The ability to customize free statement of account templates significantly contributes to their utility. It allows businesses to create professional, informative, and client-specific documents without the expense of designing templates from scratch. This flexibility not only streamlines administrative processes but also reinforces brand identity and promotes clear communication regarding financial transactions. The practical implication is enhanced efficiency in accounting practices and improved client relationships, supporting overall business growth and stability.

3. Professionalism

Professionalism, as it pertains to financial documentation, reflects a business’s commitment to accuracy, clarity, and respectful client communication. Utilizing a well-structured, easy-to-understand statement of account template contributes significantly to this image of professionalism. Even when utilizing a free resource, attention to detail and thoughtful customization can elevate a simple document into a powerful tool for building trust and reinforcing a positive brand image.

- Clear PresentationA professional statement of account presents information in a logical, easy-to-follow format. Clear headings, well-defined sections, and consistent formatting contribute to readability and minimize the risk of misinterpretation. This clarity reflects attention to detail and respect for the client’s time, contributing to a positive overall impression.

- Accurate InformationAccuracy is paramount in financial documentation. Errors in calculations, dates, or other details can erode client trust and lead to disputes. A professional statement meticulously verifies all information, ensuring its reliability and contributing to the business’s credibility.

- Branding ConsistencyIncorporating company branding elements, such as logos, color schemes, and fonts, reinforces brand identity and presents a cohesive, professional image. Consistency across all business communications, including financial statements, strengthens brand recognition and contributes to a perception of established reliability.

- Timely DeliveryProviding statements promptly demonstrates efficiency and respect for client schedules. Regular, predictable delivery cycles allow clients to manage their finances effectively and contributes to a positive working relationship. Timeliness further reinforces the perception of organized and reliable business practices.

By focusing on these elements of professionalism, even businesses using free statement of account templates can project a competent and trustworthy image. This meticulous approach to financial communication fosters positive client relationships, strengthens brand reputation, and contributes to the long-term success of the business.

4. Clarity

Clarity in financial documentation is paramount for effective communication and positive client relationships. Within the context of free statement of account templates, clarity ensures that clients can easily understand their financial obligations, minimizing misunderstandings and promoting timely payments. A clear, concise statement fosters transparency and reinforces professional credibility.

- Unambiguous LanguageAvoiding technical jargon or complex terminology ensures accessibility for all clients. Using plain, straightforward language to describe transactions, fees, and balances simplifies comprehension and reduces the likelihood of confusion. For example, instead of using “debit memorandum,” a clearer term would be “payment received.” This directness fosters understanding and promotes efficient communication.

- Logical Structure and FormattingA well-organized statement facilitates quick and easy access to key information. Grouping related items, using clear headings, and consistent formatting guides the reader through the document, ensuring that crucial details, such as the current balance and payment due date, are readily apparent. Consistent date formats and clear delineation of individual transactions contribute significantly to overall clarity.

- Detailed Transaction DescriptionsProviding comprehensive descriptions for each transaction eliminates ambiguity and empowers clients to reconcile their records effectively. Including details such as invoice numbers, service dates, or product descriptions allows clients to readily identify the context of each transaction, minimizing the need for follow-up inquiries. This level of detail strengthens transparency and promotes trust.

- Visually Appealing LayoutA visually appealing layout, even within a simple template, enhances readability and professionalism. Utilizing appropriate spacing, font sizes, and color contrast improves the document’s aesthetics and makes it easier to navigate and comprehend. While maintaining a professional appearance, incorporating subtle visual cues can guide the reader’s eye to essential information. This enhances the overall clarity and reinforces the perception of professionalism.

These facets of clarity, when incorporated into free statement of account templates, contribute significantly to efficient and transparent financial communication. A clear, concise statement strengthens client relationships by minimizing potential misunderstandings and facilitating timely payments. Ultimately, prioritizing clarity reflects a commitment to professional best practices and contributes to the long-term success of any business.

5. Efficiency

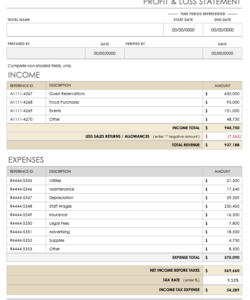

Efficiency in financial management is crucial for any business, regardless of size. Leveraging free statement of account templates contributes significantly to streamlined accounting processes, reducing administrative overhead and freeing up valuable time and resources. This efficiency translates to cost savings and allows businesses to focus on core operations and growth strategies.

- Automated CalculationsTemplates often include built-in formulas for automatic calculations of balances, payments due, and other key figures. This eliminates manual calculations, reducing the risk of errors and significantly speeding up the statement generation process. Automated calculations ensure accuracy and consistency, freeing staff to focus on higher-value tasks.

- Reduced Administrative BurdenUtilizing readily available templates eliminates the need to create statements from scratch, saving considerable time and effort. This reduction in administrative burden allows staff to allocate their time to more strategic activities, such as client relationship management or business development. The readily available format eliminates repetitive tasks, optimizing workflow efficiency.

- Improved Record-KeepingConsistent use of standardized templates promotes organized record-keeping. This simplifies tracking of financial transactions, facilitates reporting, and supports effective financial analysis. Well-maintained records, facilitated by consistent template usage, are crucial for informed decision-making and long-term financial stability. This systematic approach reduces the time required to locate specific information, further enhancing overall efficiency.

- Enhanced Client CommunicationClear, professional statements contribute to efficient client communication. Easy-to-understand formats minimize inquiries and disputes related to billing, promoting timely payments and strengthening client relationships. Efficient communication reduces the time spent addressing payment-related issues, contributing to smoother business operations. Prompt, clear statements contribute to positive client interactions and reinforce professional credibility.

By leveraging the efficiency gains offered by free statement of account templates, businesses can optimize their financial processes, reduce administrative overhead, and improve communication with clients. These benefits contribute to a more professional, organized, and ultimately more successful operation. The time and resources saved through increased efficiency can be strategically reinvested in core business activities, fostering growth and sustainability.

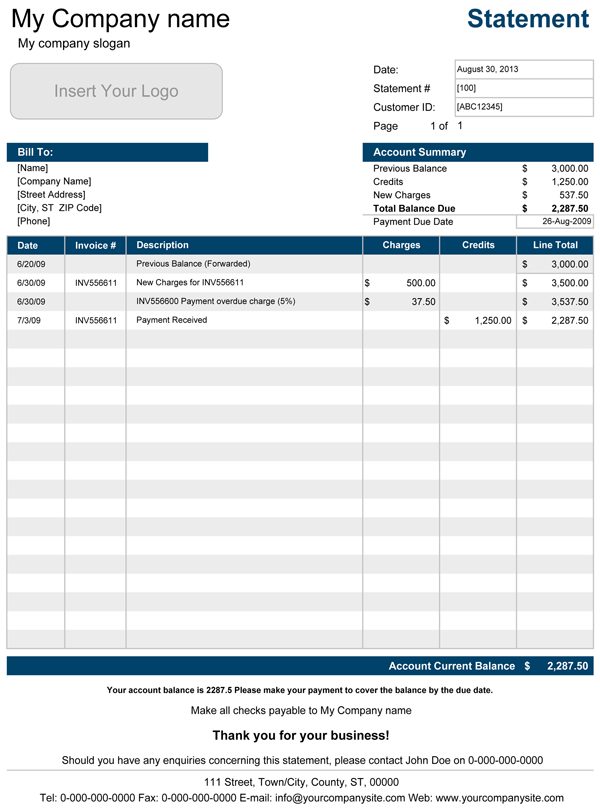

Key Components of a Statement of Account Template

Essential elements ensure a statement of account effectively communicates financial information and promotes clarity between businesses and clients. These components contribute to accurate record-keeping, transparency, and professional communication.

1. Company Information: Clear identification of the issuing business is crucial. This includes the full legal business name, address, contact phone number, and email address. Placement of this information typically occurs at the top of the statement.

2. Client Information: Accurate client details ensure proper delivery and facilitate client record reconciliation. This section includes the client’s full name, billing address, and account number. Accurate client information is essential for effective communication and record-keeping.

3. Statement Date: The statement date indicates the period covered by the included transactions. Accurate date recording is essential for proper bookkeeping and facilitates tracking of financial activity within specific timeframes.

4. Statement Period: The statement period specifies the date range covered by the statement (e.g., “From: [Date] To: [Date]”). This clearly defines the timeframe for the reported transactions, promoting transparency and facilitating reconciliation.

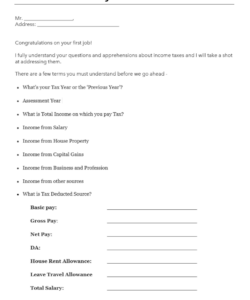

5. Transaction Details: This section forms the core of the statement, providing a detailed breakdown of all transactions during the specified period. Each transaction entry typically includes the date, description, debit or credit amount, and running balance. Clear and detailed transaction descriptions minimize ambiguity and facilitate accurate record-keeping.

6. Payment Information: This section outlines accepted payment methods, instructions for remitting payments, and relevant details, such as bank account information for direct transfers. Clear payment instructions facilitate timely payment processing and reduce the likelihood of payment-related inquiries.

7. Outstanding Balance: Clearly presenting the outstanding balance, including any applicable late payment fees or interest charges, is crucial. This prominent display ensures clients are fully aware of their current financial obligations. This clarity promotes timely payments and facilitates effective financial management.

8. Terms and Conditions (Optional): Including relevant terms and conditions regarding payment due dates, late payment policies, and dispute resolution procedures provides additional clarity and protects business interests. While optional, this inclusion can contribute to minimizing potential disputes and ensuring transparent communication.

Inclusion of these components in a statement of account contributes significantly to transparent communication, accurate record-keeping, and the development of positive client relationships. These elements facilitate efficient financial management and promote a professional image for the business.

How to Create a Free Statement of Account Template

Creating a professional, free statement of account template requires careful consideration of key components and formatting for clarity and accuracy. The following steps outline the process of developing a template suitable for various business needs.

1. Choose a Software Application: Select a readily available software application such as Microsoft Word or Google Docs. Spreadsheet software like Microsoft Excel or Google Sheets offers the advantage of automated calculations. Choosing a widely accessible format ensures compatibility and ease of use.

2. Set Up the Document Structure: Establish a clear document structure with designated areas for company information, client information, statement date, statement period, and a table for transaction details. A well-defined structure enhances readability and professionalism.

3. Include Company and Client Information Sections: Dedicate sections for both company and client information. Company details should include the full legal name, address, contact number, and email address. Client information should include the client’s name, billing address, and account number. Accurate contact information is essential for effective communication.

4. Design the Transaction Table: Create a table with columns for transaction date, description, debits, credits, and running balance. Clear column headings and consistent formatting facilitate easy comprehension of financial activity. Precise descriptions for each transaction enhance clarity and minimize ambiguity.

5. Incorporate Payment Information: Designate a section for payment information, including accepted payment methods and instructions for remitting payment. Providing clear and concise instructions facilitates timely payments.

6. Highlight the Outstanding Balance: Clearly display the outstanding balance, emphasizing the total amount due. A prominent display of the outstanding balance ensures client awareness and promotes timely payment.

7. Add Terms and Conditions (Optional): Consider including a section for terms and conditions outlining payment due dates, late payment policies, and dispute resolution procedures. While optional, this inclusion provides additional clarity and protects business interests.

8. Review and Test: Thoroughly review the template for accuracy, clarity, and completeness. Test the template with sample data to ensure calculations and formatting function correctly. Rigorous testing ensures the template’s reliability and effectiveness in real-world application.

Careful attention to these steps ensures a professional, functional, and free statement of account template suitable for clear and efficient communication of financial information. A well-designed template contributes to organized record-keeping, fosters transparency, and strengthens client relationships.

Effective financial management hinges on clear and consistent communication. Readily available, customizable statement of account templates provide a valuable resource for businesses seeking to streamline accounting processes and foster transparency with clients. Understanding the key components, benefits of customization, and the importance of professionalism in financial documentation empowers businesses to leverage these tools effectively. From enhancing clarity and efficiency to promoting timely payments and reinforcing a professional image, the strategic use of these resources contributes significantly to optimized financial operations and strengthened client relationships.

Accurate and accessible financial information empowers informed decision-making. By embracing best practices in financial reporting and communication, businesses establish a strong foundation for growth and stability. The readily available resources discussed offer a practical pathway for businesses of all sizes to enhance financial management practices and cultivate positive client interactions, contributing to long-term success and financial well-being.