Utilizing such a document offers several advantages. It facilitates better budgeting by providing a clear picture of cash flow. It enables users to identify unnecessary expenditures and make informed choices about savings and investments. This, in turn, can lead to improved financial stability, reduced debt, and increased savings for future goals. The clarity and control gained empower individuals to make proactive financial decisions, leading to greater peace of mind.

The following sections will delve into the core components of creating and utilizing such a document, including practical examples and tips for effective personal finance management.

1. Income Tracking

Accurate income tracking forms the foundation of a comprehensive household profit and loss statement. A clear understanding of all income streams is essential for effective financial planning and analysis. Without precise income data, the statement loses its accuracy and utility in guiding financial decisions.

- Identifying All SourcesMeticulous identification of all income sources is paramount. This includes salaries, wages, investment returns, rental income, and any other form of revenue. For example, accurately recording dividends from stock holdings or interest earned on savings accounts ensures a complete picture of incoming funds. Overlooking even small sources can skew the overall financial assessment.

- Regular RecordingConsistent and timely recording of income is crucial. Whether it’s a regular paycheck or sporadic freelance earnings, documenting income as it arrives prevents omissions and maintains an up-to-date record. Utilizing a spreadsheet or dedicated financial software can streamline this process.

- Gross vs. Net IncomeDistinguishing between gross and net income is vital. Gross income represents total earnings before deductions, while net income reflects the amount received after taxes, insurance, and other withholdings. Understanding this difference provides a more realistic view of available funds for budgeting and expense management.

- Verification and AccuracyRegularly verifying the accuracy of recorded income against pay stubs, bank statements, or other supporting documentation is essential. This practice ensures the integrity of the financial data and prevents discrepancies from affecting financial planning and analysis.

By diligently tracking income, individuals gain a precise understanding of their financial resources, enabling informed decision-making regarding budgeting, saving, and investing. Accurate income data empowers informed choices and contributes significantly to the overall effectiveness of the household profit and loss statement as a tool for financial management.

2. Expense Categorization

Effective expense categorization is crucial for a meaningful household profit and loss statement. Detailed categorization provides insights into spending patterns, facilitates informed budget adjustments, and ultimately enhances financial control. Without a structured approach to categorizing expenses, the statement’s value in identifying areas for potential savings diminishes significantly.

- Essential ExpensesCategorizing essential expenses, such as housing, utilities, and groceries, allows for accurate tracking of unavoidable costs. Understanding the proportion of income allocated to these necessities provides a baseline for evaluating discretionary spending. For example, tracking monthly grocery bills can reveal opportunities to optimize purchasing habits and reduce food costs.

- Discretionary ExpensesSeparating discretionary expenses like entertainment, dining out, and subscriptions highlights areas where adjustments can be made. This categorization allows for conscious decisions about spending priorities and potential reductions in non-essential areas. Analyzing spending on entertainment, for instance, can reveal potential savings by reducing subscription services or exploring more cost-effective leisure activities.

- Periodic ExpensesAccounting for periodic expenses, such as annual insurance premiums or quarterly tax payments, ensures a comprehensive financial overview. Allocating funds for these less frequent but significant costs prevents unexpected financial strain and promotes better long-term planning. For example, setting aside a portion of each paycheck for annual property taxes avoids a large lump-sum payment and facilitates consistent cash flow management.

- Debt PaymentsCategorizing debt payments, including mortgage payments, student loans, and credit card payments, clarifies the allocation of funds towards debt reduction. Tracking debt payments alongside other expenses provides a clear picture of overall financial obligations and informs strategies for debt management. This categorization can also highlight opportunities to prioritize high-interest debt repayment and accelerate progress towards financial freedom.

By meticulously categorizing expenses within a household profit and loss statement, individuals gain a comprehensive understanding of their spending habits. This structured approach enables informed budget adjustments, facilitates the identification of areas for potential savings, and ultimately empowers more effective financial management.

3. Regular Monitoring

Regular monitoring of a household profit and loss statement is essential for maintaining financial health and achieving financial goals. Consistent review provides a dynamic understanding of income and expenses, enabling proactive adjustments and informed financial decisions. Without regular monitoring, the statement becomes a static document, failing to reflect evolving financial circumstances and hindering effective financial management.

- Frequency and ConsistencyEstablishing a consistent monitoring schedule, whether weekly, bi-weekly, or monthly, ensures that financial trends are identified promptly. Regular review allows for timely adjustments to spending habits and prevents minor deviations from escalating into significant financial challenges. For example, consistently reviewing monthly utility bills can reveal seasonal fluctuations and prompt adjustments to energy consumption or budgeting strategies.

- Variance AnalysisComparing actual figures against budgeted amounts reveals variances that provide valuable insights into spending patterns. Analyzing these discrepancies highlights areas where spending exceeds projections, allowing for corrective action or budget revisions. For instance, if actual transportation costs consistently surpass the budgeted amount, it may indicate a need to explore alternative commuting options or adjust the transportation budget accordingly.

- Trend IdentificationRegular monitoring facilitates the identification of long-term financial trends. Observing patterns in income and expenses over time enables proactive adjustments to financial strategies and enhances long-term financial planning. For example, tracking investment returns over several months can reveal consistent growth or decline, informing decisions about portfolio diversification or investment strategies.

- Goal AlignmentRegularly reviewing the statement ensures that spending aligns with financial goals. Monitoring progress towards savings targets, debt reduction, or investment objectives allows for adjustments to spending habits and reinforces financial discipline. For instance, tracking progress towards a down payment goal can motivate adherence to a budget and reinforce the importance of saving consistently.

Consistent monitoring of the household profit and loss statement transforms it from a static record into a dynamic tool for financial management. By analyzing trends, identifying variances, and aligning spending with financial goals, individuals gain control over their financial well-being and enhance their ability to achieve long-term financial security.

4. Budgeting Tool

A household profit and loss statement template serves as a crucial budgeting tool, providing a structured framework for managing personal finances. It facilitates informed decision-making by offering a clear overview of income and expenses, enabling proactive planning and control over financial resources. Without this structured approach, budgeting becomes an abstract exercise, lacking the concrete data necessary for effective financial management.

- Forecasting and PlanningThe template facilitates forecasting future income and expenses based on historical data. This forward-looking perspective allows for proactive adjustments to spending habits and informed allocation of resources. For example, anticipating a seasonal increase in heating costs allows for adjustments to the budget, ensuring sufficient funds are available without disrupting other financial commitments.

- Spending AllocationUtilizing the template enables informed allocation of funds across various expense categories. By visualizing the proportion of income dedicated to different expenses, individuals can prioritize essential needs, reduce discretionary spending, and allocate resources towards financial goals. This structured approach promotes balanced spending and prevents overspending in specific areas.

- Goal Setting and TrackingThe template aids in setting realistic financial goals and tracking progress towards their achievement. By monitoring income and expenses against predefined targets, individuals can assess their progress, make necessary adjustments, and maintain motivation towards achieving financial objectives. For instance, tracking savings progress towards a down payment on a house provides a tangible measure of progress and reinforces commitment to the financial goal.

- Variance Analysis and ControlComparing actual spending against budgeted amounts within the template allows for variance analysis. Identifying discrepancies between planned and actual expenses highlights areas requiring attention, enabling corrective action and improved budget control. For example, consistently exceeding the budgeted amount for dining out may prompt a reassessment of dining habits and adjustments to spending in that category.

The household profit and loss statement template empowers informed financial decision-making by functioning as a comprehensive budgeting tool. By facilitating forecasting, guiding spending allocation, supporting goal setting, and enabling variance analysis, it promotes financial control, enhances savings potential, and contributes significantly to achieving long-term financial stability.

5. Financial Awareness

Financial awareness represents a cornerstone of sound financial management, and a household profit and loss statement template serves as a catalyst for cultivating this awareness. Utilizing the template fosters a deeper understanding of personal finances by providing a concrete framework for tracking income and expenses. This structured approach illuminates spending patterns, reveals areas of potential savings, and empowers informed financial decision-making. Without this tangible representation of financial flows, awareness remains abstract and less actionable. For example, consistently tracking entertainment expenses within the template may reveal a surprisingly high expenditure, prompting a reevaluation of spending habits and a shift towards more cost-effective leisure activities.

The templates structure facilitates a granular understanding of financial inflows and outflows. Categorizing expenses reveals the proportion of income allocated to various needs and wants, empowering informed choices about resource allocation. This detailed view enhances control over finances, reduces impulsive spending, and fosters a proactive approach to financial planning. For instance, observing a significant portion of income dedicated to debt repayment might motivate exploration of debt consolidation options or strategies for accelerating debt reduction. This active engagement with financial data transforms awareness into actionable steps towards financial well-being.

Cultivating financial awareness through the consistent use of a household profit and loss statement template empowers individuals to take control of their financial destinies. This awareness facilitates informed decision-making, promotes responsible spending habits, and ultimately enhances long-term financial stability. By providing a clear and comprehensive view of financial flows, the template becomes an invaluable tool for fostering financial literacy and achieving financial goals. The challenges lie in maintaining consistent tracking and analysis, but the rewards of informed financial management far outweigh the effort involved.

6. Debt Management

Effective debt management is crucial for financial well-being, and a household profit and loss statement template provides a critical framework for understanding and controlling debt. By providing a clear picture of income, expenses, and existing debt obligations, the template empowers informed decision-making regarding debt reduction strategies and promotes responsible financial behavior. Without a structured approach to tracking and analyzing debt, individuals risk escalating debt burdens and hindering long-term financial stability. The template facilitates proactive debt management by enabling users to visualize the impact of debt payments on overall financial health and prioritize debt reduction within their financial plan.

- Debt Identification and TrackingA household profit and loss statement requires meticulous tracking of all debt obligations, including credit card balances, student loans, mortgages, and other forms of borrowing. Listing each debt, its current balance, interest rate, and minimum payment provides a comprehensive overview of current indebtedness. For example, clearly outlining a high-interest credit card debt alongside a lower-interest mortgage allows for strategic prioritization of debt repayment efforts. This detailed tracking allows for informed decisions about debt consolidation or balance transfer options.

- Impact on Cash FlowIntegrating debt payments within the template reveals the impact of debt servicing on overall cash flow. Visualizing the proportion of income dedicated to debt repayment highlights the financial burden of debt and motivates strategic debt reduction planning. For example, observing that a significant portion of income is allocated to minimum credit card payments may prompt exploration of balance transfer options or strategies to accelerate debt payoff. This awareness empowers informed decisions about budgeting and resource allocation.

- Prioritization and StrategiesThe template facilitates prioritization of debt repayment efforts based on interest rates and outstanding balances. This structured approach enables informed decisions about debt reduction strategies, such as the avalanche or snowball methods. For instance, prioritizing high-interest debt accelerates overall debt reduction by minimizing interest accumulation. The template supports informed choices about which debts to address first and how to allocate resources effectively.

- Progress Monitoring and AdjustmentRegularly monitoring the household profit and loss statement allows individuals to track progress toward debt reduction goals. Observing decreasing debt balances over time reinforces positive financial behaviors and provides motivation for continued adherence to debt management strategies. For example, visually tracking the decline in a student loan balance reinforces the effectiveness of consistent payments and encourages continued adherence to the repayment plan. This ongoing monitoring enables adjustments to debt management strategies based on changing financial circumstances or progress toward goals.

By providing a structured framework for tracking, analyzing, and managing debt, the household profit and loss statement template empowers individuals to take control of their financial obligations. This informed approach to debt management promotes responsible financial behavior, accelerates progress toward debt reduction goals, and contributes significantly to overall financial well-being. The template facilitates a shift from reactive debt management to a proactive approach, empowering individuals to build a stronger financial foundation.

Key Components of a Household Profit and Loss Statement

A comprehensive household profit and loss statement requires several key components to provide a clear and accurate picture of financial health. These components work together to offer a structured overview of income, expenses, and overall financial performance.

1. Income Section: This section details all sources of income, including salaries, wages, investment returns, rental income, and other forms of revenue. Accurate recording of all income streams is crucial for a complete financial assessment.

2. Expense Section: This section meticulously categorizes all expenses, separating essential costs like housing and utilities from discretionary spending like entertainment and dining out. Detailed categorization facilitates analysis of spending patterns and identification of areas for potential savings.

3. Reporting Period: The statement covers a specific period, typically a month, quarter, or year. Defining a clear reporting period ensures consistency and allows for tracking financial progress over time.

4. Net Income/Loss Calculation: The statement calculates the difference between total income and total expenses to determine the net income or loss for the reporting period. This key figure provides a snapshot of overall financial performance.

5. Supporting Documentation: Maintaining supporting documentation, such as pay stubs, bank statements, and receipts, validates the accuracy of the information within the statement and provides a valuable audit trail.

6. Regular Updates: Regularly updating the statement ensures its relevance and accuracy. Consistent updates facilitate timely identification of financial trends and enable proactive adjustments to spending habits.

Accurate and consistent documentation of income and expenses, coupled with regular review and analysis, allows for informed financial decision-making and contributes to long-term financial stability. This structured approach empowers effective budgeting, facilitates proactive debt management, and supports progress toward financial goals.

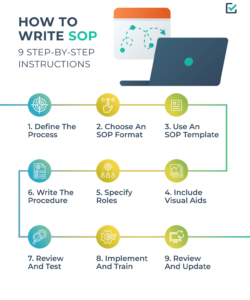

How to Create a Household Profit and Loss Statement

Creating a household profit and loss statement involves a structured approach to tracking income and expenses, providing a clear overview of financial health. The following steps outline the process of developing a comprehensive and effective statement.

1. Choose a Time Period: Select a specific timeframe for the statement, such as a month, quarter, or year. A consistent reporting period allows for accurate tracking and comparison over time.

2. List Income Sources: Meticulously document all sources of income within the chosen timeframe. This includes salaries, wages, investment returns, rental income, and any other forms of revenue. Accuracy in this step is paramount for a realistic financial assessment.

3. Categorize Expenses: Create distinct categories for expenses, such as housing, utilities, groceries, transportation, entertainment, and debt payments. Detailed categorization enables in-depth analysis of spending patterns and informs budget adjustments.

4. Track Income and Expenses: Consistently record income and expenses as they occur. Utilize a spreadsheet, budgeting software, or dedicated financial apps to maintain accurate and organized records. Accuracy and consistency in tracking are essential for meaningful analysis.

5. Calculate Net Income/Loss: Subtract total expenses from total income to determine the net income or loss for the reporting period. This key figure provides a snapshot of overall financial performance and informs future financial decisions.

6. Review and Analyze: Regularly review the statement to identify trends, analyze spending patterns, and make informed adjustments to budgeting and financial goals. Regular review transforms the statement from a static document into a dynamic tool for financial management.

7. Maintain Supporting Documentation: Retain supporting documentation, such as pay stubs, bank statements, and receipts, to validate the accuracy of the information recorded in the statement. This documentation provides an audit trail and supports financial record-keeping.

By following these steps and maintaining consistent tracking and analysis, individuals can gain a comprehensive understanding of their financial health, enabling informed decision-making and contributing to long-term financial stability. This structured approach empowers proactive financial management and fosters a stronger foundation for achieving financial goals.

Careful management of personal finances is paramount for achieving financial security, and a household profit and loss statement template provides an invaluable tool for this purpose. Through meticulous tracking of income and expenses, the template offers a structured overview of financial health, enabling informed decisions regarding budgeting, spending, and debt management. Detailed categorization of expenses illuminates spending patterns, highlighting areas for potential savings and fostering a proactive approach to financial planning. Regular monitoring and analysis of the statement empower individuals to identify trends, anticipate financial challenges, and align spending with long-term financial goals. The template facilitates informed decision-making, promotes financial awareness, and ultimately contributes to building a stronger foundation for long-term financial stability.

Utilizing a household profit and loss statement template represents a commitment to informed financial management. This proactive approach empowers individuals to take control of their financial well-being, fostering a sense of financial security and facilitating progress toward long-term financial objectives. The insights gained through consistent tracking and analysis provide a roadmap for navigating financial complexities, making sound financial decisions, and ultimately achieving financial peace of mind. Embracing this structured approach to personal finance management is an investment in a more secure and prosperous financial future.