Tailored financial reporting offers several advantages. It allows businesses to track key metrics specific to their operations, providing insights not readily available through generic templates. This granular level of detail enables proactive identification of potential financial challenges and opportunities for growth. Furthermore, a consistent internal reporting structure simplifies audits and regulatory compliance, ultimately saving time and resources.

The following sections will explore the key components of effective financial reporting systems, best practices for development and implementation, and considerations for adapting these systems to evolving business needs.

1. Customization

Customization is paramount when developing an effective internal financial reporting system. Generic templates often lack the flexibility required to capture the nuances of individual business operations. A tailored approach allows organizations to select key performance indicators (KPIs) relevant to their specific industry, business model, and strategic objectives. For example, a retail business might prioritize inventory turnover and sales per square foot, while a software-as-a-service (SaaS) company focuses on customer churn and monthly recurring revenue. Without customization, critical data points may be overlooked, hindering effective analysis and decision-making.

The ability to tailor financial statements also enables businesses to incorporate industry-specific metrics or calculations. A manufacturing company, for instance, may need to track production costs per unit or equipment utilization rates. These specialized metrics are essential for evaluating operational efficiency and identifying areas for improvement. Moreover, customization facilitates integration with existing internal systems, streamlining data collection and reducing manual data entry. This integration minimizes the risk of errors and ensures that financial reporting reflects real-time operational performance.

By aligning financial reporting with specific business requirements, organizations gain a deeper understanding of their financial health and performance drivers. This granular level of insight enables proactive identification of trends, potential risks, and opportunities for growth. While implementing a customized system requires initial investment in development and training, the long-term benefits of improved decision-making and enhanced financial control significantly outweigh these costs. Therefore, customization is not merely a desirable feature but a critical component of any robust internal financial reporting system.

2. Standardization

Standardization within internal financial reporting ensures consistency, comparability, and reliability of financial data. A standardized template provides a structured framework for data entry and presentation, eliminating ambiguity and promoting clarity across all financial statements. This is crucial for accurate trend analysis, performance evaluation, and informed decision-making.

- Consistent Chart of Accounts:A standardized chart of accounts ensures consistent categorization of financial transactions. Every transaction is assigned a specific account code, allowing for uniform reporting across departments and periods. For instance, all marketing expenses are consistently recorded under the same account code, regardless of the specific marketing activity. This facilitates accurate tracking of spending across different marketing initiatives and comparison of marketing ROI across periods.

- Uniform Reporting Periods:Standardized reporting periods (monthly, quarterly, annually) provide a consistent timeframe for financial analysis. This allows for meaningful comparisons of performance over time and simplifies the identification of trends and seasonal fluctuations. Consistent reporting periods are also essential for budget planning and forecasting.

- Defined Calculation Methods:Standardizing calculation methods for key financial metrics, such as gross profit margin or return on investment, eliminates discrepancies arising from different interpretations or methodologies. For example, consistently using the same depreciation method across all assets ensures accurate and comparable reporting of asset values over time.

- Consistent Terminology and Formatting:Using consistent terminology and formatting throughout financial statements enhances clarity and understandability. This reduces the risk of misinterpretations and ensures all stakeholders are working with the same definitions and presentation formats. For example, consistent use of terms like “revenue” versus “sales” or specific formatting for dates and currencies ensures clear communication of financial information.

By enforcing these standardization principles within a template, organizations enhance the integrity and reliability of their financial data. This creates a strong foundation for effective financial management, enabling data-driven insights, accurate performance evaluations, and informed strategic decisions. A standardized approach also streamlines audits and regulatory compliance processes, ultimately contributing to greater operational efficiency.

3. Accuracy

Accurate financial data is the cornerstone of sound financial management. Within the context of an internally developed financial statement template, accuracy is paramount for informed decision-making, performance evaluation, and strategic planning. Inaccurate data can lead to misinformed decisions, flawed performance assessments, and ultimately, jeopardize an organization’s financial health. A robust template minimizes errors and ensures data integrity through structured input, automated calculations, and validation rules.

- Data Validation:Implementing data validation rules within the template prevents input errors and ensures data integrity. These rules can restrict data types, enforce numerical ranges, and mandate required fields. For instance, a rule could prevent negative values in revenue fields or require supporting documentation for expense entries. Such validation mechanisms minimize human error and maintain data accuracy from the point of entry.

- Automated Calculations:Automated calculations within the template eliminate manual calculation errors, a common source of inaccuracies. Formulas and functions can automatically compute key financial metrics, such as gross profit, net income, and various ratios. This automation not only saves time but also ensures consistency and accuracy across all financial reports. For instance, automatically calculating depreciation expense based on predefined methods eliminates potential discrepancies arising from manual calculations.

- Regular Reconciliation:Reconciliation processes, facilitated by a well-designed template, ensure that internal records align with external sources, such as bank statements and vendor invoices. Regular reconciliation identifies and rectifies discrepancies, maintaining the accuracy of financial data. For example, monthly bank reconciliations identify any discrepancies between internal cash balances and bank records, allowing for prompt investigation and correction of errors.

- Audit Trails:Maintaining clear audit trails within the template enhances transparency and accountability. An audit trail records every change made to the financial data, including who made the change, when, and why. This facilitates error tracking, simplifies audits, and ensures data integrity. For instance, if an unusual expense is recorded, the audit trail can provide details about the transaction, enabling verification and validation of its legitimacy.

These facets of accuracy, when incorporated within an in-house financial statement template, establish a robust framework for reliable financial reporting. Accurate data provides a clear and dependable view of an organization’s financial position, enabling informed decision-making, effective performance evaluation, and ultimately, the achievement of strategic financial objectives. By prioritizing accuracy, organizations build a strong foundation for long-term financial health and stability.

4. Accessibility

Accessibility, within the context of an in-house financial statement template, refers to the ease and efficiency with which authorized personnel can access, understand, and utilize financial data. A well-designed template ensures that relevant stakeholders can readily retrieve the information they need, when they need it, in a format conducive to their specific requirements. This accessibility is crucial for timely decision-making, effective performance monitoring, and collaborative financial management. Restricted access or complex, unwieldy templates hinder these processes and can negatively impact an organization’s ability to respond effectively to financial challenges and opportunities.

Several factors contribute to accessibility. A user-friendly interface with clear navigation and intuitive design simplifies data retrieval. Role-based access controls ensure that sensitive financial information is only accessible to authorized personnel, maintaining data security and confidentiality. Furthermore, the ability to export data in various formats (e.g., CSV, Excel, PDF) allows users to analyze and manipulate data using their preferred tools. For example, a sales manager might need access to sales data by region, while a finance executive requires consolidated financial statements for the entire organization. A well-designed template accommodates these diverse needs, providing tailored access and reporting capabilities.

The practical significance of accessibility extends beyond individual users. It fosters collaboration and communication across departments. When financial data is readily available and easily understood, teams can work together more effectively to analyze performance, identify trends, and develop strategies. Moreover, accessibility streamlines reporting processes. Automated report generation eliminates manual data compilation, saving time and reducing the risk of errors. This efficiency allows finance teams to focus on higher-value activities, such as analysis and interpretation, rather than data gathering. Ultimately, a readily accessible, user-friendly template empowers informed decision-making at all levels of the organization, contributing to improved financial performance and strategic success. Neglecting accessibility, however, can lead to information silos, delayed decision-making, and ultimately, hinder an organization’s ability to achieve its financial objectives. Therefore, accessibility should be a paramount consideration in the design and implementation of any internal financial reporting system.

5. Scalability

Scalability, in the context of an in-house financial statement template, refers to its ability to adapt to evolving business needs and growth. A scalable template accommodates increasing data volumes, expanding business operations, and evolving reporting requirements without requiring significant system overhauls. This adaptability is crucial for long-term utility and cost-effectiveness. A non-scalable template can become a bottleneck, hindering growth and requiring costly replacements as the organization expands.

- Modular Design:A modular design allows the template to be expanded or modified incrementally. New sections or metrics can be added as needed without disrupting the existing structure. For example, a business expanding into new product lines can add new product-specific cost and revenue sections to the template without redesigning the entire system. This modularity allows for flexible adaptation to changing business requirements.

- Data Capacity:The template must handle increasing data volumes as the organization grows. This requires robust data storage and processing capabilities. A template designed for a small startup with limited transactions may not be suitable for a larger enterprise with significantly higher data volume. Scalability in data capacity ensures the template remains efficient and effective regardless of transactional volume.

- Integration with Other Systems:As businesses grow, they often adopt new software and systems. A scalable template integrates seamlessly with other business applications, such as CRM, ERP, and inventory management systems. This interoperability streamlines data flow, reduces manual data entry, and ensures data consistency across all platforms. For instance, integration with an ERP system allows for automatic import of financial data, eliminating manual entry and reducing the risk of errors.

- User Adaptability:A scalable template accommodates an increasing number of users and varying user roles. This might involve implementing role-based access controls, customized reporting views, and user-specific dashboards. As the organization grows and more individuals require access to financial data, the template must adapt to accommodate diverse user needs and maintain data security. This adaptability ensures that the template remains user-friendly and efficient for all stakeholders.

These facets of scalability ensure the long-term viability and effectiveness of an in-house financial statement template. A scalable template evolves with the organization, providing consistent, accurate, and accessible financial information regardless of size or complexity. Investing in a scalable template upfront minimizes future costs associated with system replacements or upgrades, providing a robust foundation for sustainable financial management.

Key Components of an Effective Financial Statement Template

Effective financial reporting hinges on a well-structured template. Key components ensure comprehensive data capture and analysis, facilitating informed decision-making.

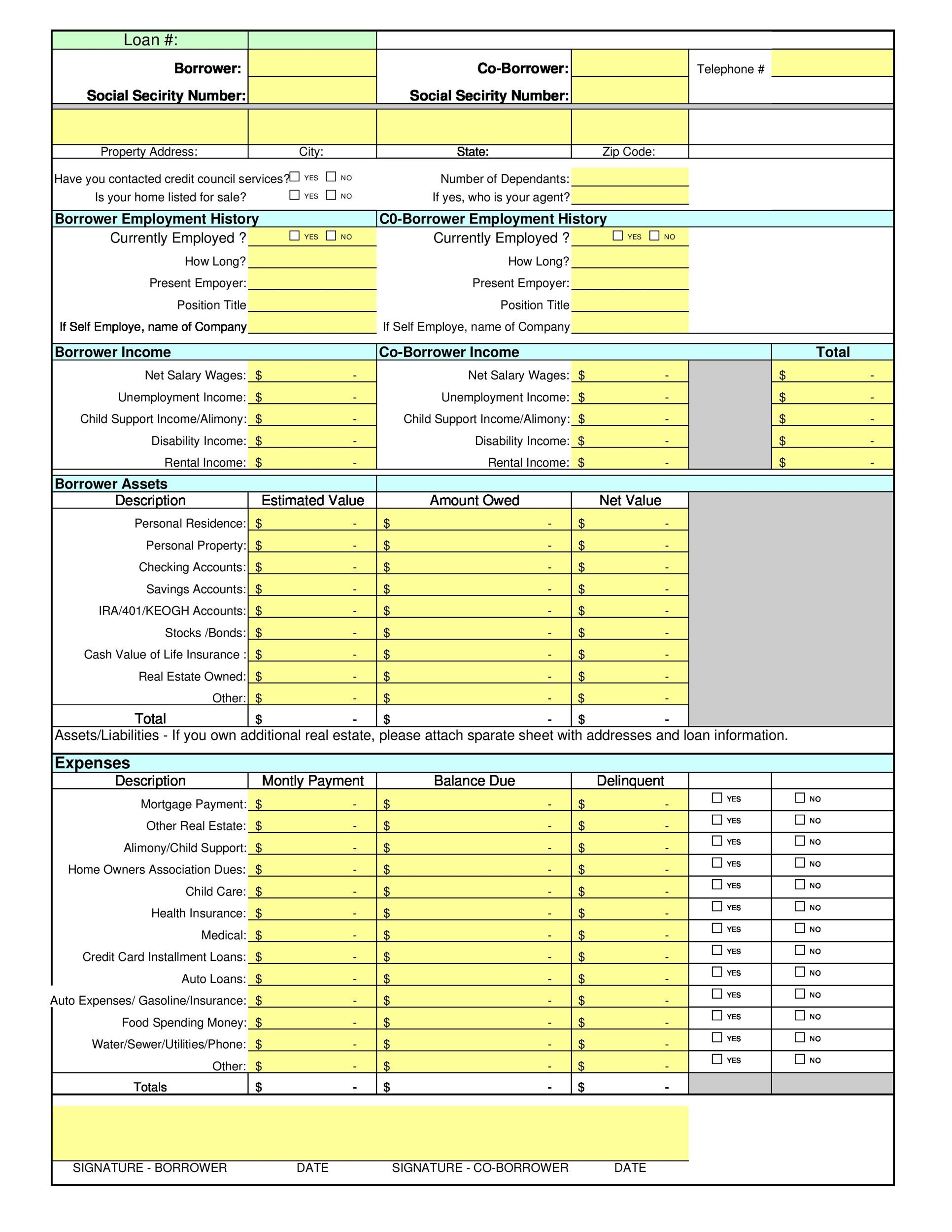

1. Income Statement: This component details revenues, costs, and expenses over a specific period, ultimately revealing net income or loss. Accurate revenue recognition and expense categorization are critical for profitability assessment.

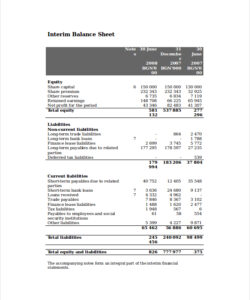

2. Balance Sheet: The balance sheet provides a snapshot of an organization’s financial position at a specific point in time. It outlines assets, liabilities, and equity, demonstrating the fundamental accounting equation (Assets = Liabilities + Equity). A clear understanding of asset valuation and liability management is essential for interpreting this statement.

3. Cash Flow Statement: This component tracks cash inflows and outflows over a given period, categorized by operating, investing, and financing activities. Analyzing cash flow is vital for assessing liquidity and short-term financial health. Effective cash flow management is crucial for operational stability.

4. Statement of Changes in Equity: This statement details changes in equity over a specific period, including investments by owners, retained earnings, and distributions. It provides insights into how an organization’s equity base evolves over time. This statement is particularly relevant for businesses with multiple shareholders or complex ownership structures.

5. Supporting Schedules: These supplementary documents provide detailed breakdowns of specific line items within the primary financial statements. Examples include schedules for accounts receivable, inventory, or fixed assets. These schedules provide greater granularity and transparency for in-depth analysis.

6. Key Performance Indicators (KPIs): While not strictly part of the financial statements themselves, incorporating KPIs within the template facilitates performance monitoring and trend analysis. These metrics can include profitability ratios, liquidity ratios, and operational efficiency metrics, tailored to the specific business. KPIs provide actionable insights for management decision-making.

7. Notes to the Financial Statements: These notes provide additional context and explanation for the information presented in the financial statements. They offer details on accounting policies, significant accounting judgments, and other relevant disclosures required for comprehensive reporting. These notes are crucial for ensuring transparency and providing a complete picture of an organization’s financial position.

These interconnected components provide a comprehensive view of an organization’s financial performance and position. A well-designed template ensures these components work together seamlessly, providing accurate, accessible, and scalable financial information for effective management.

How to Create an In-House Financial Statement Template

Developing a customized financial statement template requires careful planning and execution. A structured approach ensures the template meets specific organizational needs and facilitates accurate, accessible, and scalable financial reporting. The following steps outline the process:

1. Define Reporting Requirements: Clearly define the specific information needs of the organization. Consider the key stakeholders, their reporting requirements, and the decisions they need to make based on the financial data. This initial step ensures the template captures relevant information and aligns with strategic objectives. For example, a high-growth startup might prioritize metrics related to customer acquisition cost and burn rate, while a mature company focuses on profitability and return on investment.

2. Select Key Financial Statements: Determine which financial statements (income statement, balance sheet, cash flow statement, statement of changes in equity) are necessary to meet reporting requirements. Consider industry best practices and regulatory requirements. Not all organizations require all four primary financial statements. A small business might focus primarily on the income statement and balance sheet, while a larger corporation requires a more comprehensive set of statements.

3. Design the Template Structure: Choose a suitable format (spreadsheet, database, dedicated software) for the template. Consider factors such as ease of use, data capacity, and integration with existing systems. A simple spreadsheet might suffice for a small organization, while a larger enterprise may benefit from a database or dedicated financial reporting software.

4. Develop Standardized Chart of Accounts: Establish a consistent chart of accounts to categorize financial transactions uniformly. Ensure each account is clearly defined and consistently applied across all departments. This standardization is crucial for accurate data aggregation and analysis.

5. Incorporate Formulas and Calculations: Implement automated calculations for key financial metrics within the template. This minimizes manual data entry, reduces errors, and ensures consistency in reporting. For example, formulas can automatically calculate gross profit margin, net income, and various financial ratios.

6. Implement Data Validation Rules: Integrate data validation rules to prevent input errors and maintain data integrity. Rules can restrict data types, enforce numerical ranges, and mandate required fields. This proactive approach minimizes errors and ensures data accuracy from the point of entry.

7. Establish Access Controls: Implement role-based access controls to restrict access to sensitive financial data. This ensures data security and confidentiality while providing authorized personnel with the information they need. Different user roles might have access to different levels of detail or specific sections of the financial statements.

8. Test and Refine: Thoroughly test the template with realistic data to identify and rectify any errors or inconsistencies. Gather feedback from key users and refine the template based on their input. Regular review and updates ensure the template remains relevant and effective as the organization evolves.

A well-designed template provides a robust framework for consistent and accurate financial reporting. Regular review and adaptation ensure the template remains aligned with evolving business needs and regulatory requirements. This structured approach strengthens financial management, enabling informed decision-making and strategic planning.

Customizable, internally-developed financial statement templates provide organizations with a crucial tool for effective financial management. From ensuring data accuracy and standardization to promoting accessibility and scalability, a well-designed template empowers informed decision-making, streamlines reporting processes, and enhances financial control. Understanding the key components, creation process, and best practices for implementation is essential for leveraging the full potential of these systems. By prioritizing customization, standardization, accuracy, accessibility, and scalability, organizations equip themselves with the insights needed to navigate complex financial landscapes and achieve strategic objectives.

Effective financial reporting serves as a cornerstone of organizational success. A robust, adaptable, and internally-managed financial statement template is not merely a reporting tool, but a strategic asset. Its implementation signifies a commitment to financial transparency, accountability, and data-driven decision-making, ultimately positioning organizations for long-term growth and stability. Continuous refinement and adaptation of these templates, in response to evolving business needs and industry best practices, are essential for maintaining their effectiveness and maximizing their value as a strategic resource.