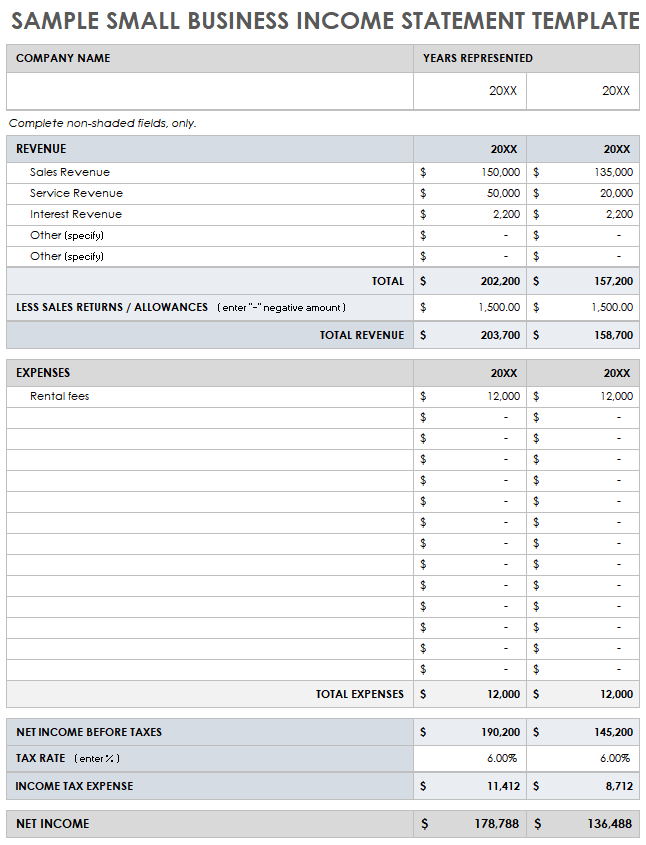

Utilizing such a structure facilitates accurate financial reporting, simplifies budgeting processes, and enables informed decision-making. It provides a consistent format for analyzing profitability, identifying areas for cost reduction, and tracking progress toward financial goals. This standardized approach also simplifies tax preparation and can be invaluable for securing funding or investment.This foundation is crucial for understanding key financial concepts, such as profit margins, operating expenses, and net income. Exploring these concepts further will provide a deeper understanding of financial health and contribute to more effective financial management.

1. Standardized Format

A standardized format is fundamental to the efficacy of an income and expense statement template. Consistency ensures data integrity, facilitates comparison across periods, and simplifies analysis. A standardized structure provides a reliable framework for interpreting financial performance.

- Consistent LayoutA consistent layout ensures all essential information is presented uniformly. This includes consistent placement of income sections, expense categories, and summary calculations. For example, gross profit is always calculated before net profit, ensuring clear and predictable reporting. This predictability aids in rapid comprehension and reduces the risk of misinterpretation.

- Uniform TerminologyUsing uniform terminology ensures clarity and prevents ambiguity. Consistent labels for revenue streams (e.g., “Sales Revenue,” not interchangeably with “Revenue from Sales”) and expense categories (e.g., “Operating Expenses,” not mixed with “Operational Costs”) reduces confusion and promotes accurate data entry. This precision supports reliable financial reporting.

- Predefined CalculationsPredefined calculations, such as gross profit, operating income, and net income, automate key metrics and minimize errors. These formulas, embedded within the template, ensure accuracy and consistency in reporting critical financial figures. Automated calculations reduce manual effort and improve the efficiency of the financial analysis process.

- Date Format and Period SpecificationA standardized date format and clear period specification ensure unambiguous reporting timelines. Using a consistent format (e.g., YYYY-MM-DD) and clearly identifying the reporting period (e.g., “Month Ending YYYY-MM-DD”) eliminates confusion regarding the data timeframe. This clarity is vital for trend analysis and comparison across different periods.

Adhering to a standardized format within an income and expense statement template enhances data reliability, streamlines analysis, and supports informed financial decisions. This structured approach enables efficient tracking of financial performance and provides a solid foundation for future planning.

2. Categorized Income

Effective financial analysis requires a clear understanding of income sources. Categorizing income within a statement template provides this clarity, enabling informed decision-making and strategic financial planning. Detailed categorization facilitates the identification of key revenue drivers and their contribution to overall profitability.

- Sales RevenueThis category represents income generated from the core business operations, typically the sale of goods or services. For a retail business, this would include revenue from product sales; for a consulting firm, it would encompass fees earned from client projects. Accurate tracking of sales revenue is crucial for assessing business growth and market performance.

- Investment IncomeIncome derived from investments, such as dividends from stocks, interest from bonds, or rental income from properties, falls under this category. Tracking investment income separately allows for evaluation of investment portfolio performance and its contribution to overall financial health. This segregation also simplifies tax reporting related to investment income.

- Other IncomeThis category encompasses income generated from sources outside core operations and investments. Examples include interest earned on cash balances, income from asset sales, or one-time gains. Categorizing other income separately provides a clearer picture of overall financial performance by distinguishing between recurring and non-recurring income streams.

- Cost of Goods Sold (COGS)While not strictly income, COGS is directly related to sales revenue and is often included in the income statement. This category represents the direct costs associated with producing goods sold, including raw materials, direct labor, and manufacturing overhead. Tracking COGS is crucial for calculating gross profit and understanding the profitability of core business operations.

Categorizing income within a statement template provides a granular view of financial performance, enabling businesses to identify strengths, weaknesses, and opportunities for growth. This detailed breakdown facilitates accurate profit analysis, informed resource allocation, and effective long-term financial planning.

3. Itemized Expenses

A comprehensive understanding of expenditure is crucial for effective financial management. Itemizing expenses within an income and expense statement template provides this granular view, enabling informed decision-making regarding cost control and resource allocation. Detailed expense categorization facilitates identification of areas for potential savings and optimization of operational efficiency.

- Operating ExpensesThese recurring expenses are essential for daily business operations. Examples include rent, utilities, salaries, marketing costs, and office supplies. Tracking operating expenses allows for analysis of cost trends, identification of potential inefficiencies, and implementation of cost-saving measures. Effective management of operating expenses is critical for maintaining profitability.

- Cost of Goods Sold (COGS)While discussed under income, COGS is an expense directly tied to revenue generation. It represents the direct costs associated with producing goods or services sold. Accurate tracking of COGS is essential for calculating gross profit margins and understanding the profitability of core business operations. Analyzing COGS can reveal opportunities for optimizing production processes and reducing material costs.

- Capital Expenditures (CAPEX)These investments in long-term assets, such as equipment, property, or software, contribute to future growth and productivity. While not directly impacting short-term profitability, tracking CAPEX is essential for understanding long-term investment strategies and their impact on overall financial health. Careful planning of CAPEX ensures efficient allocation of resources for sustainable growth.

- Non-Operating ExpensesThese expenses are not directly related to core business operations. Examples include interest payments on debt, losses from asset sales, or legal fees. Tracking non-operating expenses separately provides a clearer picture of overall financial performance by distinguishing between operational costs and other financial obligations. This segregation also simplifies analysis of financial risks and opportunities.

Itemized expense tracking within a statement template provides a detailed understanding of cost structures, facilitating informed resource allocation, cost control measures, and ultimately, improved profitability. This granular approach is essential for effective financial management and long-term business sustainability.

4. Specified Period

A defined timeframe is crucial for the accuracy and relevance of an income and expense statement template. This specified period determines the scope of financial data included in the statement, enabling meaningful analysis and comparison of performance across different timeframes. Without a clearly defined period, the financial information lacks context and becomes less useful for decision-making.

- Fiscal YearA fiscal year represents a 12-month period used for accounting purposes. It may align with the calendar year or follow a different schedule based on the organization’s operational cycle. A fiscal year provides a consistent timeframe for evaluating annual financial performance and facilitates year-over-year comparisons. For example, a retail business might choose a fiscal year ending in January to capture holiday sales.

- Calendar YearThe calendar year, running from January 1st to December 31st, provides a readily understood timeframe for financial reporting. Using the calendar year simplifies comparison with publicly available financial data and aligns with standard reporting practices. This is a common choice for businesses whose operations don’t follow a specific seasonal cycle.

- Quarterly ReportingBreaking down financial data into quarterly periods (three-month intervals) provides more frequent insights into performance trends. Quarterly reporting enables faster identification of potential issues and allows for more timely adjustments to business strategies. This is particularly useful for businesses operating in dynamic markets.

- Monthly ReportingMonthly reporting offers the most granular view of financial performance, enabling close monitoring of income and expenses. This frequency allows for rapid response to changing market conditions and facilitates proactive financial management. Monthly statements are valuable for businesses with tight cash flow management needs.

The specified period provides the essential timeframe for the income and expense statement, ensuring the data’s relevance and enabling meaningful analysis of financial performance. Selecting the appropriate reporting period depends on the specific needs of the organization, balancing the need for detailed insights with the practicalities of data collection and analysis. Consistent application of the chosen period facilitates accurate trend analysis, performance evaluation, and informed financial decision-making.

5. Calculated Totals

Calculated totals represent a critical component of an income and expense statement template. These totals provide a summarized view of financial performance over the specified period, enabling stakeholders to quickly assess profitability and overall financial health. The accuracy and reliability of these calculations are paramount for informed decision-making.

Several key calculated totals contribute to a comprehensive understanding of financial performance. Gross profit, calculated by subtracting the cost of goods sold (COGS) from revenue, reveals the profitability of core business operations. Operating income, derived from subtracting operating expenses from gross profit, reflects profitability after accounting for day-to-day business costs. Finally, net income, calculated by subtracting all expenses, including taxes and interest, from total revenue, represents the overall profit or loss for the period. For example, a business with $500,000 in revenue, $200,000 COGS, and $150,000 operating expenses would report a gross profit of $300,000 and an operating income of $150,000. The net income will depend on additional non-operating income and expenses.

Accurate calculated totals are essential for various stakeholders. Business owners and managers rely on these figures to assess performance, identify trends, and make strategic decisions regarding pricing, cost control, and resource allocation. Investors and lenders utilize these totals to evaluate financial stability and investment potential. Accurate and reliable financial reporting, driven by precise calculated totals, fosters transparency and strengthens stakeholder confidence. Failure to maintain accurate calculations can lead to misinformed decisions, misrepresentation of financial health, and potential legal or regulatory issues. Therefore, ensuring the integrity of calculated totals within an income and expense statement template is crucial for sound financial management and sustainable business growth.

Key Components of an Income and Expense Statement Template

A well-structured template ensures comprehensive financial oversight. Key components work together to provide a clear and accurate picture of financial performance.

1. Revenue Streams: Clear categorization of all income sources is essential. This includes sales revenue, investment income, and any other income generated. Precise categorization allows for analysis of individual revenue streams and their contribution to overall profitability.

2. Cost of Goods Sold (COGS): For businesses selling products, COGS represents the direct costs associated with production. Accurate COGS calculation is crucial for determining gross profit margins.

3. Operating Expenses: These recurring expenses are essential for daily business operations. Categorization provides insights into cost drivers and potential areas for optimization. Examples include rent, salaries, and marketing costs.

4. Non-Operating Expenses: Expenses not directly related to core business operations, such as interest payments or legal fees, are tracked separately to provide a comprehensive view of all expenditures.

5. Capital Expenditures (CAPEX): Investments in long-term assets are tracked to understand their impact on future growth and financial health. This includes purchases of equipment, property, and software.

6. Reporting Period: A clearly defined timeframe (e.g., monthly, quarterly, annual) ensures data relevance and allows for comparison across different periods. Consistent reporting periods facilitate trend analysis and performance evaluation.

7. Calculated Totals: Accurate calculation of key metrics, including gross profit, operating income, and net income, provides a summarized view of financial performance. These totals are critical for assessing profitability and making informed decisions.

These components provide a structured framework for analyzing financial performance, enabling informed decision-making and contributing to long-term financial stability.

How to Create an Income and Expense Statement Template

Creating a robust template ensures consistent and accurate financial tracking. The following steps outline the process of developing a template tailored to specific business needs.

1. Define the Reporting Period: Establish the timeframe for the statement (e.g., monthly, quarterly, annually). A consistent reporting period is crucial for accurate trend analysis.

2. Categorize Income Streams: Create distinct categories for all revenue sources. Examples include sales revenue, investment income, and other income. Detailed categorization facilitates analysis of individual revenue streams.

3. Itemize Expense Categories: Establish comprehensive expense categories relevant to the business. Examples include operating expenses (rent, salaries), cost of goods sold (COGS), and capital expenditures (CAPEX). Granular categorization enables detailed cost analysis.

4. Incorporate Formulas for Key Metrics: Include formulas for calculating key financial metrics such as gross profit (revenue – COGS), operating income (gross profit – operating expenses), and net income (total revenue – total expenses). Automated calculations ensure accuracy and efficiency.

5. Design the Template Layout: Structure the template with clear sections for income, expenses, and calculated totals. A well-organized layout enhances readability and simplifies data entry.

6. Choose a Suitable Format: Select a format conducive to data entry and analysis. Spreadsheet software offers flexibility and built-in calculation functionalities. Ensure the chosen format allows for easy export and sharing of data.

7. Test and Refine: Populate the template with sample data to ensure accurate calculations and identify any necessary adjustments. Regular review and refinement maintain the template’s effectiveness and relevance.

A well-designed template provides a structured framework for recording financial data, calculating key metrics, and generating insightful reports. Consistent use of the template supports informed financial management and facilitates data-driven decision-making.

Accurate financial record-keeping is paramount for any organization, regardless of size or industry. A well-designed income and expense statement template provides the necessary framework for tracking revenue and expenditures, calculating key profitability metrics, and facilitating informed financial decisions. Understanding the components of such a template, including income categorization, expense itemization, and the importance of a specified reporting period, allows for comprehensive financial analysis. Consistent use of a structured template fosters transparency, improves data reliability, and supports effective financial management.

Utilizing an income and expense statement template is not merely a bookkeeping exercise; it is a crucial tool for understanding financial health, identifying areas for improvement, and driving strategic growth. Careful attention to detail and consistent application of best practices in financial reporting contribute to long-term financial stability and sustainable success. Regular review and adaptation of the template to evolving business needs ensure its continued relevance and effectiveness in supporting informed financial management.