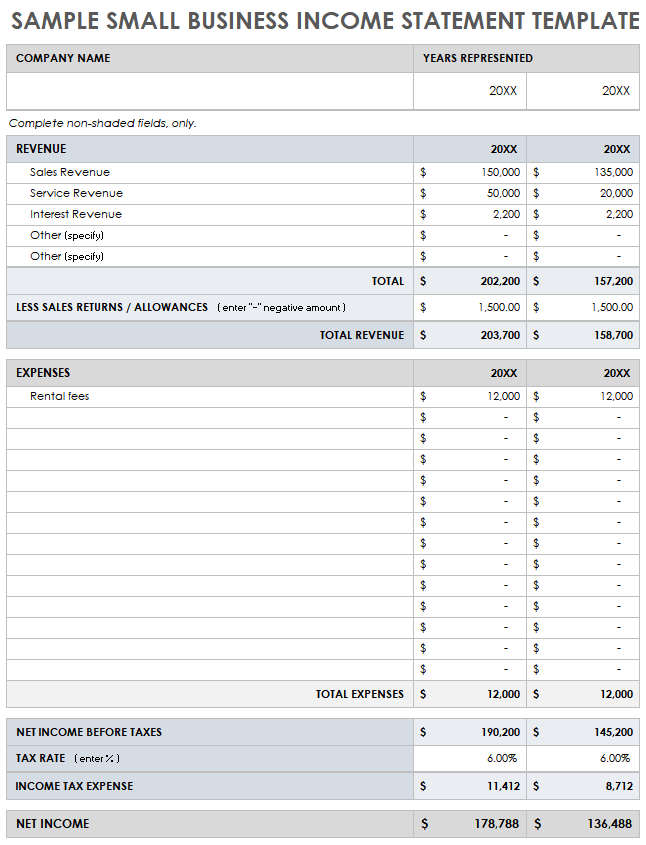

Utilizing a standardized structure for this type of financial reporting offers several advantages. It facilitates tracking key performance indicators, aids in identifying areas for potential cost reduction and revenue growth, and simplifies comparisons across different periods or against industry benchmarks. This structured approach also streamlines tax preparation and can be crucial for securing funding from investors or lenders.

The following sections will delve deeper into the specific components of this essential financial tool, exploring its practical application and offering guidance on its effective utilization.

1. Revenue

Revenue represents the lifeblood of any service business and forms the cornerstone of the income statement. Accurate revenue reporting is essential for assessing financial performance and making informed strategic decisions. A clear understanding of its various components is crucial for effective financial management.

- Service FeesThis constitutes the primary revenue source for service businesses, encompassing payments received for services rendered. Examples include consulting fees, design services, or maintenance contracts. Accurately recording these fees, differentiating between fixed and variable pricing models, is fundamental to a reliable income statement. Inaccuracies here can significantly distort profitability calculations.

- Project-Based IncomeFor businesses operating on a project basis, revenue recognition may differ. Income is often recognized upon project completion or at specified milestones. Tracking progress against project budgets and recognizing revenue accordingly ensures an accurate reflection of financial performance over time. This is particularly relevant for long-term projects.

- Recurring RevenueSubscription-based services or ongoing maintenance agreements generate recurring revenue streams. This predictable income offers stability and allows for more accurate forecasting. Clearly identifying and tracking these recurring revenue streams provides valuable insights into long-term financial health and allows for more effective resource allocation.

- Other RevenueWhile service fees typically dominate, other revenue sources may exist. These can include interest earned on cash reserves, sales of ancillary products, or licensing fees. Proper categorization of these miscellaneous revenue streams ensures a comprehensive and accurate picture of the business’s overall financial performance.

A comprehensive understanding of these revenue components and their accurate representation within the income statement provides valuable insights into a service business’s financial health. This granular view allows for better decision-making regarding pricing strategies, resource allocation, and future growth initiatives. Analyzing revenue trends can also reveal areas for improvement and potential opportunities for expansion.

2. Expenses

A comprehensive understanding of expenses is crucial for the accurate and insightful interpretation of a service business’s income statement. Accurately categorizing and tracking expenses provides a clear picture of the costs associated with service delivery and supports informed decision-making regarding profitability and resource allocation.

- Direct CostsDirect costs are expenses directly attributable to service delivery. These include salaries of service personnel, materials used in service provision, and travel expenses directly related to client engagements. Accurate tracking of direct costs allows for precise calculation of profit margins on individual services and informs pricing strategies.

- Operating ExpensesOperating expenses are necessary for the day-to-day functioning of the business but are not directly tied to specific service delivery. These include rent, utilities, marketing and advertising costs, and administrative salaries. Monitoring operating expenses is critical for identifying areas for potential cost optimization and efficiency improvements.

- Salaries and BenefitsFor service-based businesses, employee compensation often represents a significant portion of total expenses. This category includes salaries, wages, bonuses, and employee benefits such as health insurance and retirement contributions. Effective management of salary and benefit expenses is essential for maintaining profitability while attracting and retaining qualified personnel.

- Depreciation and AmortizationThese represent the allocation of the cost of tangible and intangible assets over their useful lives. Depreciation applies to physical assets like equipment and computers, while amortization applies to intangible assets like software licenses and patents. Accurately accounting for depreciation and amortization ensures a more accurate reflection of the true cost of doing business over time.

Careful analysis of these expense categories within the context of the income statement provides crucial insights into a service business’s financial performance. Understanding the relationship between revenue and various expense categories allows for informed decisions regarding pricing strategies, cost management initiatives, and resource allocation, ultimately contributing to improved profitability and sustainable growth. Regularly reviewing and analyzing expense trends can also help identify potential financial challenges and opportunities for optimization.

3. Profitability

Profitability, a core objective of any business, represents the ultimate measure of financial success. The income statement serves as the primary tool for assessing profitability, providing a structured overview of revenues, expenses, and the resulting net income or loss. This direct link between the income statement and profitability highlights its critical role in informed decision-making and strategic planning for service-oriented enterprises. For example, a consulting firm can analyze its income statement to determine the profitability of different service offerings, identifying high-margin services to prioritize and low-margin services to potentially restructure or discontinue.

A key aspect of profitability analysis within the context of the income statement lies in understanding the relationship between revenue and expenses. While increasing revenue is a primary driver of profitability, effective expense management plays an equally crucial role. Analyzing the income statement allows businesses to identify areas where expenses can be optimized without compromising service quality. For instance, a software development company might identify opportunities to reduce operating expenses by negotiating more favorable terms with vendors or consolidating office space. Similarly, understanding the contribution of individual service lines to overall profitability enables businesses to make strategic decisions regarding resource allocation, pricing strategies, and future service offerings.

In conclusion, the income statement provides a structured framework for assessing and understanding profitability. By analyzing revenue streams, expense categories, and the resulting net income, service businesses can gain valuable insights into their financial performance. This understanding enables informed decision-making regarding pricing, cost management, resource allocation, and ultimately drives sustainable growth and long-term financial success. Challenges in maintaining profitability can arise from fluctuating market conditions, increasing competition, or unexpected expenses. Regularly reviewing and analyzing the income statement allows businesses to proactively address these challenges and adapt their strategies to maintain and improve profitability over time. This consistent monitoring and analysis are crucial for navigating dynamic market conditions and ensuring long-term financial health.

4. Time Period

The specified time period provides the temporal context for the income statement, defining the timeframe over which financial performance is measured. This temporal dimension is crucial for accurate analysis and meaningful comparisons, allowing businesses to track performance trends and identify areas for improvement. Selecting the appropriate time period is essential for gaining relevant insights and making informed decisions based on the financial data presented.

- Fiscal YearA fiscal year represents a 12-month period used for accounting purposes. It may or may not align with the calendar year. Analyzing the income statement for the entire fiscal year provides a comprehensive overview of annual performance, facilitating comparisons with previous years and supporting long-term strategic planning. For example, a marketing agency might analyze its fiscal year income statement to assess overall profitability and identify trends in revenue growth or expense fluctuations.

- Quarterly ReportingBreaking down the fiscal year into quarterly periods allows for more frequent performance monitoring. Quarterly income statements enable businesses to track progress towards annual goals, identify seasonal trends, and react more quickly to changing market conditions. This shorter timeframe provides a more granular view of performance and enables more timely adjustments to strategies. For instance, a retail business might use quarterly income statements to analyze the impact of seasonal promotions on sales and profitability.

- Monthly TrackingMonthly income statements provide the most frequent performance updates. This granular view is particularly useful for closely monitoring expenses, identifying emerging trends, and making timely operational adjustments. Monthly tracking is especially valuable for businesses with volatile revenue streams or those operating in rapidly changing markets. A subscription-based service, for example, might use monthly income statements to track customer churn and its impact on recurring revenue.

- Year-over-Year ComparisonsComparing income statements for the same time period across different years allows for insightful analysis of performance trends. This year-over-year analysis helps identify long-term growth patterns, assess the effectiveness of strategic initiatives, and make informed projections for future performance. For example, a manufacturing company might compare year-over-year income statements to evaluate the impact of investments in new equipment on productivity and profitability.

The choice of time period directly impacts the insights derived from the income statement. Selecting the appropriate timeframe, whether fiscal year, quarterly, or monthly, is crucial for effective financial analysis and informed decision-making. Furthermore, comparing income statements across different periods provides valuable context and facilitates the identification of trends, enabling service businesses to adapt their strategies, optimize resource allocation, and achieve sustainable growth.

5. Standardized Format

A standardized format is essential for maximizing the utility of a profit and loss report specifically designed for service-oriented enterprises. Consistency in presentation allows for meaningful comparisons across different reporting periods, facilitating trend analysis and informed decision-making. A standardized structure also simplifies benchmarking against industry averages, providing valuable context for performance evaluation. For example, a consistent format allows a consulting firm to track revenue growth over consecutive quarters, identify any seasonal patterns, and compare its performance to that of other consulting firms.

Adherence to a standardized format ensures all essential financial data is presented systematically. This includes clear categorization of revenue streams, detailed breakdown of operating expenses, and consistent calculation of key profitability metrics. This structured approach enhances transparency, simplifies audits, and facilitates communication with stakeholders. For instance, a standardized income statement enables potential investors to quickly grasp the financial health of a software development company, assess its revenue streams, and evaluate its expense management practices. This transparency promotes trust and facilitates informed investment decisions.

In summary, a standardized format enhances the value and interpretability of financial reporting for service businesses. Consistent presentation facilitates trend analysis, benchmarking, and stakeholder communication. This structured approach promotes transparency, supports informed decision-making, and ultimately contributes to more effective financial management. Challenges may arise in adapting a standardized format to the specific nuances of individual businesses. However, the long-term benefits of comparability and clear communication outweigh these initial implementation challenges. A standardized income statement provides a robust foundation for financial analysis, enabling service-based businesses to monitor performance, identify opportunities, and achieve sustainable growth.

Key Components of a Profit and Loss Statement for Service Businesses

A profit and loss statement tailored for service-oriented enterprises provides a structured overview of financial performance. Understanding its key components is crucial for accurate interpretation and effective utilization in decision-making.

1. Revenue: This section details all income generated from service delivery. It encompasses various streams, including service fees, project-based income, recurring revenue from subscriptions, and other miscellaneous income sources. Accurate revenue reporting is fundamental for assessing overall financial performance.

2. Cost of Services Sold (COGS): While less prominent than in product-based businesses, service businesses may incur direct costs related to service delivery. These could include contractor fees, travel expenses directly tied to projects, or materials consumed in providing services. Accurately tracking these costs provides insights into profit margins.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the earnings remaining after covering direct service delivery costs. This metric provides a preliminary indication of profitability before accounting for operating expenses.

4. Operating Expenses: This section encompasses all costs associated with running the business, excluding COGS. These expenses include rent, utilities, marketing and advertising, salaries and benefits for administrative staff, and depreciation of assets. Careful management of operating expenses is crucial for profitability.

5. Operating Income: Derived by subtracting operating expenses from gross profit, operating income reflects the profitability of core business operations. This metric provides a clearer picture of financial performance before considering non-operating income and expenses.

6. Other Income and Expenses: This category includes income or expenses not directly related to core business operations. Examples include interest income, gains or losses from investments, and one-time expenses. These items are typically infrequent or non-recurring.

7. Net Income: Representing the bottom line, net income is the ultimate measure of profitability. It’s calculated by adding other income and subtracting other expenses from operating income. Net income reflects the total earnings available to the business after accounting for all revenues and expenses.

Accurate categorization and analysis of these components provide a comprehensive understanding of financial performance, enabling informed decision-making regarding pricing strategies, cost management, and resource allocation. This structured overview facilitates the identification of trends, opportunities, and potential challenges, ultimately contributing to more effective financial management and sustainable growth.

How to Create an Income Statement for a Service Business

Creating a precise income statement is crucial for understanding the financial health of a service-based business. The following steps outline the process of developing this essential financial report.

1. Determine the Reporting Period: Specify the timeframe for the income statement, whether it’s a fiscal year, a quarter, or a month. This timeframe provides the basis for gathering and analyzing financial data.

2. Calculate Total Revenue: Sum all revenue generated from services rendered during the defined period. Include all income streams, such as service fees, project-based income, recurring revenue, and other miscellaneous income.

3. Determine Cost of Services Sold (COGS): Identify and calculate all direct costs associated with service delivery. These costs may include contractor fees, travel expenses directly related to projects, or materials consumed in providing services.

4. Calculate Gross Profit: Subtract the COGS from total revenue to determine the gross profit. This figure represents earnings after covering direct service-related costs.

5. Itemize Operating Expenses: List and total all operating expenses incurred during the reporting period. Include rent, utilities, marketing and advertising costs, salaries and benefits for administrative staff, and depreciation of assets.

6. Calculate Operating Income: Subtract total operating expenses from gross profit to arrive at the operating income. This metric reflects the profitability of core business operations.

7. Account for Other Income and Expenses: Include any non-operating income or expenses, such as interest income, investment gains or losses, and one-time expenses. These items are typically infrequent or non-recurring.

8. Calculate Net Income: Add other income and subtract other expenses from the operating income to determine net income. This final figure represents the overall profit or loss for the reporting period.

Accurate data entry and consistent categorization are crucial for generating a reliable and insightful income statement. Regularly generating and reviewing these reports provides a clear understanding of financial performance, enabling informed decision-making and contributing to sustainable business growth.

A standardized profit and loss report tailored for service-based enterprises provides crucial insights into financial performance. Understanding its structure, components, and creation process equips organizations with the tools necessary for effective financial management. From revenue streams and cost of services to operating expenses and profitability metrics, a comprehensive analysis of this report allows for informed decision-making regarding pricing strategies, cost optimization, and resource allocation. Consistent utilization of this structured reporting framework fosters financial transparency, supports strategic planning, and contributes to sustainable growth.

Regular review and analysis of this financial statement are essential for navigating the dynamic landscape of the service industry. Leveraging the insights derived from this report empowers organizations to adapt to changing market conditions, optimize operations, and achieve long-term financial success. A deep understanding of this report serves as a cornerstone of sound financial management, enabling service businesses to thrive in competitive markets and achieve sustainable growth.