Utilizing a predefined structure offers several advantages. It ensures consistency and comparability across reporting periods, simplifying trend analysis and performance evaluation. It also facilitates compliance with accounting standards and reduces the risk of errors. Furthermore, this structured approach provides a clear framework for identifying areas of strength and weakness in cash management, enabling informed decision-making and strategic planning.

The following sections will delve deeper into the specific components of this reporting structure, offering practical guidance on its preparation and interpretation, as well as illustrating its application in various business contexts.

1. Standardized Format

A standardized format is fundamental to the utility of an indirect cash flow statement. Consistency in structure ensures comparability across reporting periods, allowing for trend analysis and performance evaluation. This standardization also facilitates benchmarking against industry peers, providing valuable context for assessing financial health. Without a standardized format, analyzing cash flow data would be significantly more complex and less reliable. For example, if one company reports depreciation within operating activities while another includes it under investing activities, direct comparison becomes misleading.

The standardized format mandates the categorization of cash flows into three core activities: operating, investing, and financing. Operating activities encompass the day-to-day business functions, such as sales and inventory management. Investing activities involve the acquisition and disposal of long-term assets, like property, plant, and equipment. Financing activities relate to changes in equity and debt, including dividends and loan repayments. This structured presentation allows stakeholders to understand the sources and uses of cash, providing insights into the company’s financial strategy and sustainability.

Adherence to a standardized format is not merely a matter of best practice; it is often a regulatory requirement. Financial reporting standards typically dictate the structure and content of cash flow statements, ensuring transparency and accountability. This enforced consistency benefits investors, creditors, and other stakeholders by providing reliable information for decision-making. Furthermore, a standardized template simplifies the auditing process, reducing the risk of errors and enhancing the credibility of financial reports.

2. Starts with Net Income

The indirect method of cash flow statement preparation distinguishes itself by using net income as its starting point. This approach focuses on reconciling accrual-based net income with the actual change in cash during the reporting period. Understanding this foundational element is crucial for interpreting the statement accurately and gaining insights into a company’s financial performance.

- Accrual Accounting AdjustmentsNet income, derived from accrual accounting, reflects revenues earned and expenses incurred, regardless of when cash is exchanged. The indirect method adjusts for non-cash transactions included in net income, such as depreciation, amortization, and changes in working capital accounts (e.g., accounts receivable, inventory, accounts payable). These adjustments bridge the gap between net income and cash flow from operations.

- Reconciliation ProcessStarting with net income, the indirect method systematically adds back non-cash expenses and subtracts non-cash revenues. Increases in current asset accounts (except cash) are subtracted, while decreases are added. Conversely, increases in current liability accounts are added, and decreases are subtracted. This meticulous process isolates the cash impact of operating activities.

- Impact of Non-Cash ItemsDepreciation, a prime example of a non-cash expense, reduces net income but does not involve an outflow of cash. Therefore, it is added back to net income in the operating activities section. Similarly, gains or losses on the sale of assets are adjusted to reflect only the cash portion of the transaction. Understanding these adjustments is vital for a clear picture of operational cash flow.

- Contrast with Direct MethodUnlike the direct method, which directly reports cash inflows and outflows from operating activities, the indirect method begins with net income and utilizes a reconciliation process. While both methods arrive at the same net cash flow from operating activities, the indirect method offers greater insight into the relationship between net income and cash flow. It provides a clearer understanding of how non-cash items influence a company’s cash position.

By starting with net income and systematically adjusting for non-cash items, the indirect cash flow statement provides a comprehensive view of how operating decisions translate into cash flow. This approach facilitates analysis of a company’s ability to generate cash from its core business operations and provides crucial information for financial planning and investment decisions.

3. Adjusts Non-Cash Items

A defining characteristic of the indirect cash flow statement template is its adjustment for non-cash items. These adjustments are crucial for bridging the gap between net income, an accrual-based figure, and the actual change in cash. Accrual accounting recognizes revenue when earned and expenses when incurred, regardless of when cash changes hands. Therefore, non-cash transactions, which impact net income but do not involve a cash inflow or outflow, require adjustment to accurately reflect cash flow.

- Depreciation and AmortizationDepreciation, the allocation of an asset’s cost over its useful life, and amortization, the similar process for intangible assets, are common non-cash expenses. They reduce net income but do not represent cash outflows. Consequently, they are added back to net income in the operating activities section of the indirect cash flow statement. For instance, if a company reports $10,000 in depreciation expense, this amount is added back to net income, increasing the reported cash flow from operations.

- Gains and Losses on Asset SalesGains or losses on the sale of assets also require adjustment. Net income reflects the entire gain or loss, but only the cash portion impacts cash flow. The non-cash portion, representing the difference between the asset’s book value and its sale price, is removed. For example, if a company sells equipment for $5,000 with a book value of $2,000, the $3,000 gain is reflected in net income. However, only the $5,000 cash received affects cash flow. Therefore, the $3,000 gain is subtracted from net income in the operating activities section.

- Changes in Working CapitalFluctuations in current assets and liabilities, such as accounts receivable, inventory, and accounts payable, impact cash flow. Increases in current assets (excluding cash) represent cash outflows, while decreases represent cash inflows. Conversely, increases in current liabilities represent cash inflows, and decreases represent cash outflows. These changes are adjusted in the operating activities section. For example, an increase in accounts receivable indicates revenue recognized but cash not yet collected, thus reducing cash flow.

- Stock-Based CompensationStock-based compensation, like stock options granted to employees, is a non-cash expense that impacts net income. Although no cash is paid out, the expense is recorded in the income statement, reducing net income. Therefore, it is added back to net income in the operating activities section to accurately reflect the cash impact. This adjustment ensures the cash flow statement accurately represents the company’s cash position.

By adjusting for these non-cash items, the indirect cash flow statement template provides a more accurate depiction of a companys cash generation capabilities. This process of reconciliation is crucial for understanding the relationship between reported earnings and actual cash flow, enabling stakeholders to make informed decisions based on a comprehensive view of a company’s financial health.

4. Reconciles to Cash Change

A critical function of the indirect cash flow statement template is its reconciliation of net income to the actual change in cash and cash equivalents. This reconciliation ensures the accuracy and completeness of the statement, validating that the reported cash flow aligns with the observed change in a company’s cash balance. Without this reconciliation, the statement would be incomplete, potentially misleading stakeholders about the true cash position.

- Validation of AccuracyThe reconciliation process serves as a crucial validation step, ensuring that the adjustments made for non-cash items and the reported cash flows from operating, investing, and financing activities accurately reflect the overall change in cash. This validation enhances the reliability of the statement, providing stakeholders with confidence in the reported figures. Discrepancies between the calculated cash flow and the actual change in cash signal potential errors that require investigation and correction.

- Completeness of the StatementReconciling to the cash change ensures the statement captures all cash inflows and outflows during the reporting period. This comprehensive view of cash activity provides a complete picture of a company’s financial performance, enabling informed decision-making. For example, if a company issues new debt, the cash inflow from this financing activity must be reflected in the reconciliation to ensure the statement accurately portrays the company’s cash position.

- Interplay of Three ActivitiesThe reconciliation process highlights the interplay of operating, investing, and financing activities and their combined impact on the change in cash. This integrated view facilitates analysis of a company’s cash management strategies and their effectiveness in generating and utilizing cash. For instance, a company might generate positive cash flow from operations but experience a decrease in overall cash due to significant investments in new equipment or repayment of debt.

- Importance for Financial AnalysisThe reconciled change in cash serves as a critical input for various financial analyses, including liquidity assessments and forecasting. It provides a clear understanding of a company’s ability to meet short-term obligations and fund future growth. Furthermore, the reconciliation process helps identify trends in cash flow and assess the sustainability of a company’s operations. By comparing the reconciled change in cash across multiple periods, analysts can gain insights into a company’s financial trajectory.

The reconciliation of net income to the actual change in cash is an integral component of the indirect cash flow statement template. It serves as a final check, ensuring the accuracy and completeness of the statement and providing critical information for evaluating a company’s financial health and making informed investment decisions. This reconciliation strengthens the statement’s role as a crucial tool for financial analysis and reporting, enhancing transparency and promoting sound financial management.

5. Three Main Activities

The indirect cash flow statement template categorizes all cash inflows and outflows into three principal activities: operating, investing, and financing. This structured presentation provides a comprehensive overview of how a company generates and utilizes cash, offering valuable insights into its financial health and sustainability. Analyzing these activities individually and collectively is essential for understanding a company’s financial strategy and performance.

- Operating ActivitiesOperating activities represent the cash flows generated from a company’s core business operations. These include cash received from customers, cash paid to suppliers, salaries and wages, and other operating expenses. In the indirect method, this section starts with net income and adjusts for non-cash items like depreciation and changes in working capital. Analyzing operating cash flow reveals a company’s ability to generate cash from its day-to-day business activities.

- Investing ActivitiesInvesting activities encompass cash flows related to the acquisition and disposal of long-term assets. This includes purchases and sales of property, plant, and equipment (PP&E), investments in other companies, and changes in other long-term assets. Analyzing investing cash flow provides insights into a company’s capital expenditure decisions and its strategy for long-term growth. Significant cash outflows in this section may indicate investments for future expansion, while substantial inflows could suggest asset divestitures.

- Financing ActivitiesFinancing activities involve cash flows related to changes in a company’s capital structure. This includes proceeds from issuing debt or equity, repayments of debt, dividend payments, and stock repurchases. Analyzing financing cash flow reveals how a company funds its operations and investments. Large cash inflows from debt issuance may indicate increased financial leverage, while significant dividend payments could suggest a mature company returning capital to shareholders.

By segregating cash flows into these three core activities, the indirect cash flow statement template offers a detailed and organized view of a company’s cash generation and utilization. This structured presentation allows stakeholders to assess the company’s financial performance, identify trends, and make informed decisions about its future prospects. Examining the interplay between these activities provides a comprehensive understanding of a company’s overall financial strategy and its ability to create value for stakeholders.

6. Enhances Comparability

Standardized reporting through a structured template significantly enhances the comparability of cash flow data. Consistent presentation allows for meaningful comparisons of performance across different reporting periods within the same company, facilitating trend analysis and identification of changes in cash flow patterns. This consistency also enables benchmarking against competitors or industry averages, providing valuable context for evaluating financial health and identifying areas for improvement. Without a standardized approach, variations in presentation would obscure underlying trends and hinder meaningful comparisons.

Consider two companies operating in the same industry: Company A consistently reports cash flows from operating activities before changes in working capital, while Company B includes these changes within operating activities. This difference in presentation makes it challenging to directly compare their operational cash generation. A standardized template ensures consistent categorization, allowing for accurate assessment of core operational performance. Furthermore, consistent reporting of investing and financing activities facilitates comparison of capital allocation strategies and funding sources, offering deeper insights into long-term financial planning and risk management.

The enhanced comparability afforded by a standardized indirect cash flow statement template provides crucial information for investors, creditors, and other stakeholders. Consistent reporting promotes transparency and accountability, enabling informed decision-making based on reliable and comparable data. This transparency fosters trust in financial reporting and contributes to a more stable and efficient financial market. Furthermore, comparability simplifies the audit process, reducing the risk of misinterpretation and enhancing the overall credibility of financial reports.

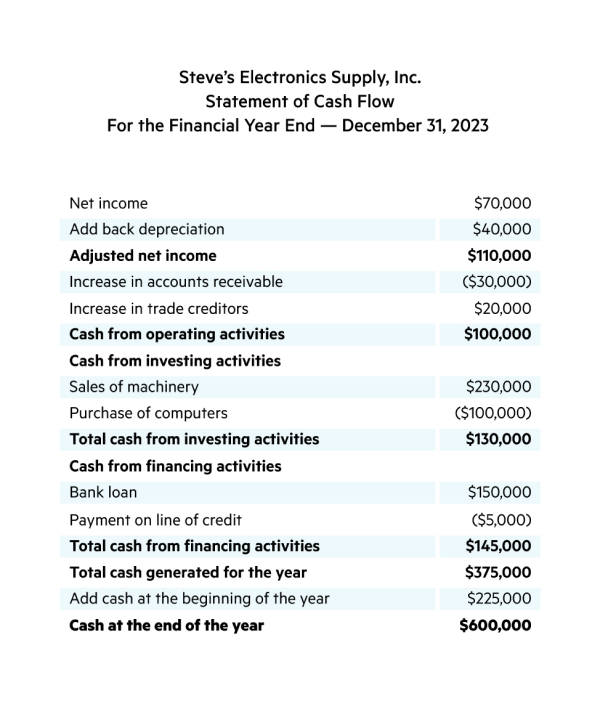

Key Components of an Indirect Cash Flow Statement

An indirect cash flow statement template comprises several key components, each contributing to a comprehensive understanding of a company’s cash flow dynamics. These components, when presented consistently, provide valuable insights for financial analysis and decision-making.

1. Starting Point: Net Income

The indirect method begins with net income, a figure derived from the income statement. This serves as the foundation for reconciling accrual-based accounting to cash-based reporting.

2. Adjustments for Non-Cash Items

Crucially, the template requires adjustments for transactions affecting net income but not involving cash movement. Common examples include depreciation, amortization, stock-based compensation, and gains/losses on asset sales.

3. Operating Activities

This section details cash flows from core business operations. Adjustments for changes in working capital, such as accounts receivable and inventory, are incorporated to reflect the cash impact of these operational fluctuations.

4. Investing Activities

Cash flows related to long-term assets, including purchases and sales of property, plant, and equipment, and investments in other entities, are categorized here. This section reveals capital allocation strategies.

5. Financing Activities

This component addresses cash flows related to changes in capital structure, encompassing debt issuance and repayment, equity transactions, and dividend payments, providing insights into funding sources and capital management.

6. Reconciliation to Net Change in Cash

The statement concludes by reconciling the net cash flows from all three activities to the actual change in the company’s cash balance during the reporting period. This crucial step validates the accuracy and completeness of the statement.

A structured template ensures consistent reporting, facilitating comparisons across different periods and companies. This standardized approach enables stakeholders to assess financial health, identify trends, and make informed decisions based on reliable and comparable cash flow data.

How to Create an Indirect Cash Flow Statement

Creating an indirect cash flow statement requires a systematic approach, starting with net income and adjusting for non-cash items to arrive at the net change in cash. The following steps outline the process.

1: Begin with Net Income: Obtain the net income figure from the company’s income statement for the relevant reporting period. This serves as the starting point for the indirect method.

2: Adjust for Non-Cash Items: Adjust net income for non-cash transactions impacting reported earnings but not involving actual cash flow. Common adjustments include:

- Add back depreciation and amortization expenses.

- Add back stock-based compensation expense.

- Subtract gains and add losses from the sale of long-term assets.

- Adjust for changes in deferred tax liabilities and assets.

3: Analyze Changes in Working Capital: Calculate the changes in current assets and liabilities (excluding cash and cash equivalents) from the balance sheet. Increases in current assets (except cash) should be subtracted from net income, while decreases should be added. Conversely, increases in current liabilities should be added, and decreases subtracted.

4: Calculate Cash Flow from Operating Activities: The result of steps 2 and 3 represents net cash flow from operating activities. This figure reflects the cash generated or used by the core business operations.

5: Analyze Cash Flow from Investing Activities: Calculate cash flows related to investments in and divestitures of long-term assets. This includes purchases and sales of property, plant, and equipment, as well as investments in securities.

6: Analyze Cash Flow from Financing Activities: Calculate cash flows related to financing the business. This encompasses proceeds from debt or equity issuance, debt repayments, dividend payments, and share repurchases.

7: Calculate Net Change in Cash: Sum the net cash flows from operating, investing, and financing activities. This figure represents the overall change in the company’s cash position during the reporting period.

8: Reconcile to the Balance Sheet: Verify that the calculated net change in cash matches the change in cash and cash equivalents reported on the balance sheet. This reconciliation ensures the accuracy and completeness of the statement.

A meticulously prepared indirect cash flow statement provides a comprehensive understanding of a company’s cash flow dynamics, enabling informed financial analysis and decision-making. Consistent application of these steps ensures comparability and transparency, promoting sound financial reporting practices.

Systematic analysis using a structured approach offers invaluable insights into financial health. Reconciling net income with actual cash flow changes illuminates the impact of non-cash transactions and operational decisions. Categorizing cash flows into operating, investing, and financing activities provides a comprehensive view of financial management strategies. Standardized reporting enhances comparability, enabling trend analysis, benchmarking, and informed assessments of financial performance and sustainability. Understanding these elements provides a robust framework for interpreting and utilizing cash flow data effectively.

Effective cash flow management is paramount for long-term success. Analyzing cash flow statements, particularly those prepared using the indirect method, is not merely a compliance exercise but a strategic imperative. This analysis empowers stakeholders to make informed decisions regarding resource allocation, investment strategies, and overall financial planning. The insights derived from this analysis contribute significantly to navigating financial complexities, mitigating risks, and achieving sustainable growth. Prioritizing comprehensive cash flow analysis remains essential for navigating the dynamic financial landscape and ensuring long-term prosperity.