Regular, short-term financial overviews offer numerous advantages. They facilitate proactive management decisions based on current performance trends, allowing for timely adjustments to strategy and operations. These insights are invaluable for securing financing, attracting investors, and monitoring progress towards key performance indicators (KPIs). Additionally, they promote transparency and accountability within the organization.

This understanding of short-term financial reporting forms the basis for exploring crucial related topics such as the different types of reports available, best practices for their preparation, and their significance in various business contexts. A deeper dive into these areas will further illuminate the value of frequent financial analysis.

1. Standardized Format

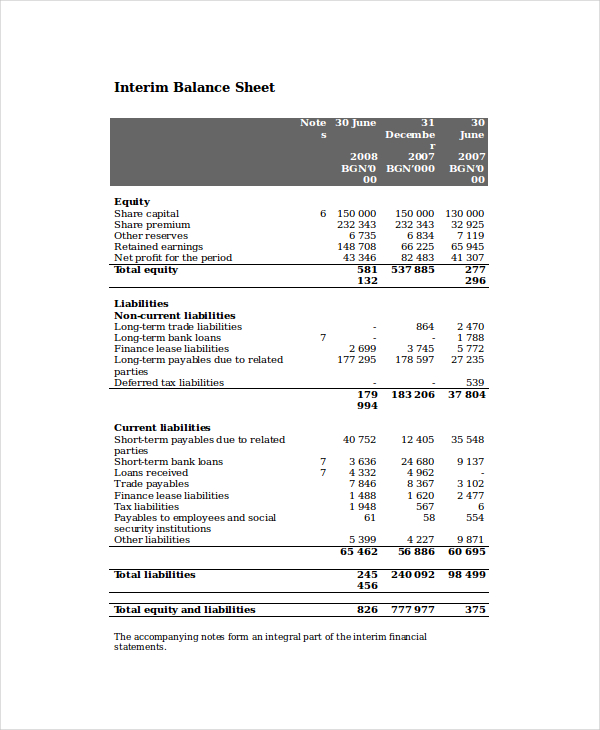

Standardized formatting is crucial for interim business financial statement templates. Consistency in presentation ensures comparability across reporting periods, facilitating trend analysis and informed decision-making. A standardized structure also simplifies the review process for stakeholders, both internal and external. Uniformity in reporting elements, such as the placement of assets, liabilities, and equity on the balance sheet, allows for rapid assessment of financial health and performance. Without a standardized format, comparing financial data across different periods would be significantly more challenging, potentially obscuring important trends and hindering effective analysis.

Consider a manufacturing company that uses an interim income statement template. Consistent presentation of revenue, cost of goods sold, and operating expenses allows management to quickly identify deviations from expected performance. For example, a sudden increase in raw material costs, readily apparent due to the standardized format, can trigger a timely investigation and potential adjustments to pricing or sourcing strategies. This ability to quickly identify and react to changes is a key benefit of standardized financial reporting.

In conclusion, standardized formatting is essential for maximizing the utility of interim business financial statement templates. It promotes comparability, simplifies review, and facilitates timely identification of critical trends. While specific formatting requirements might vary depending on industry regulations and internal policies, the underlying principle of consistency remains paramount for effective financial analysis and decision-making.

2. Key Financial Data

Interim business financial statement templates serve as structured containers for key financial data, providing a concise overview of an organization’s financial performance over a specific period. The selection and presentation of this data are crucial for informed decision-making and effective communication with stakeholders. Understanding the core components of this data provides a foundation for interpreting these statements accurately.

- RevenueRevenue represents the income generated from an organization’s primary business activities. For a retail company, this would be sales of goods; for a service provider, it would be fees earned. In an interim statement, revenue figures demonstrate performance trends within the specified period, offering insights into market demand and pricing strategies. Comparing interim revenue with prior periods or budget projections can reveal growth patterns, seasonal fluctuations, or potential concerns requiring further investigation.

- ExpensesExpenses encompass the costs incurred in generating revenue. These can include the cost of goods sold, operating expenses (such as salaries and rent), and interest expenses. Analyzing expense trends within interim statements allows for efficient cost management and identification of potential inefficiencies. For example, a significant increase in operating expenses during a period of stagnant revenue could signal the need for cost-cutting measures.

- Net Income/LossNet income, or net loss, represents the difference between revenue and expenses. This bottom-line figure is a critical indicator of profitability during the reporting period. Interim net income figures enable timely adjustments to business strategies and resource allocation. Consistent losses over consecutive interim periods could trigger a reassessment of the overall business model or operational strategies.

- Cash FlowCash flow reflects the movement of cash both into and out of the organization. Interim statements typically include a condensed statement of cash flows, highlighting key sources and uses of cash during the reporting period. Monitoring cash flow is critical for short-term liquidity management. A consistently negative cash flow, even in the face of positive net income, can indicate underlying financial challenges requiring immediate attention.

The interplay of these key financial data points within the structure of an interim business financial statement template provides a comprehensive, albeit condensed, view of an organization’s financial health. Analyzing these elements in conjunction with comparative data from prior periods, budgets, or industry benchmarks allows stakeholders to gain actionable insights, facilitating proactive management and informed decision-making.

3. Period Specificity

Period specificity is a defining characteristic of interim business financial statement templates. Unlike annual reports that cover a full fiscal year, these templates focus on shorter, distinct periods, enabling timely monitoring and analysis of financial performance. This characteristic allows for proactive management and strategic adjustments throughout the fiscal year, rather than relying solely on an annual overview.

- Monthly StatementsMonthly statements provide the most granular view of financial performance. They are particularly useful for businesses with volatile revenue streams or those requiring tight control over cash flow. A retail business, for example, might use monthly statements to track sales trends, manage inventory levels, and adjust marketing campaigns in response to real-time data. However, the frequency of monthly reporting can be resource-intensive and may not be necessary for all organizations.

- Quarterly StatementsQuarterly statements offer a balance between detailed insight and reporting frequency. They are commonly used for internal management reporting, allowing for performance evaluation against quarterly budgets and identification of emerging trends. A manufacturing company, for instance, might use quarterly statements to assess production efficiency, monitor raw material costs, and track progress towards production targets. This frequency provides sufficient detail for strategic adjustments without the intensity of monthly reporting.

- Semi-Annual StatementsSemi-annual statements provide a broader perspective on financial performance over a six-month period. They are often used for external reporting to investors and lenders, offering a more comprehensive view than quarterly statements while maintaining a reasonable reporting frequency. A publicly traded company, for example, might release semi-annual statements to keep investors informed about financial progress and maintain market confidence.

- Custom PeriodsWhile monthly, quarterly, and semi-annual periods are common, some businesses may require reporting for custom periods based on specific project timelines or operational cycles. A construction company, for example, might use custom periods aligned with project phases to track costs, revenue, and profitability for each individual project. This flexibility allows for tailored financial reporting that aligns with specific business needs.

The choice of reporting period significantly impacts the utility of interim business financial statement templates. Selecting the appropriate period requires careful consideration of the organization’s specific needs, industry norms, and reporting requirements. The chosen period should provide sufficient detail for timely decision-making without creating an undue administrative burden. Ultimately, the effective use of these templates hinges on selecting a reporting period that aligns with the organization’s strategic goals and operational realities.

4. Comparative Analysis

Comparative analysis is essential for extracting meaningful insights from interim business financial statement templates. It provides context for evaluating financial performance by comparing current data with relevant benchmarks, revealing trends, and informing strategic decisions. Without comparative analysis, interim statements remain isolated snapshots, lacking the depth and perspective necessary for effective financial management.

- Trend AnalysisTrend analysis involves comparing financial data across multiple reporting periods. This reveals patterns in revenue growth, expense fluctuations, and profitability changes. For example, consistently increasing operating expenses over several quarters, identified through trend analysis, could signal underlying inefficiencies requiring attention. Understanding these trends allows for proactive adjustments to operational strategies and resource allocation.

- Budget vs. Actual PerformanceComparing actual results against budgeted figures is crucial for performance evaluation and accountability. Variances between budgeted and actual performance can highlight areas of strength and weakness. For instance, a significant shortfall in sales revenue compared to the budget could necessitate a review of marketing strategies or pricing models. This comparison allows for timely corrective actions and improved budget forecasting.

- Prior Period ComparisonComparing current performance with the corresponding period in the previous year provides a valuable benchmark for assessing growth and identifying seasonal fluctuations. For example, a retail business might compare sales figures for the current quarter with the same quarter of the previous year to assess year-over-year growth, accounting for seasonal sales patterns. This comparison offers a normalized view of performance, isolating true growth from cyclical variations.

- Industry BenchmarkingBenchmarking against industry averages provides external context for evaluating financial performance. This comparison reveals an organization’s standing relative to its competitors. For example, a company with a lower profit margin than the industry average might need to explore cost-cutting measures or revenue enhancement strategies. Industry benchmarking provides a broader perspective on competitiveness and identifies areas for potential improvement.

These facets of comparative analysis transform interim business financial statement templates from static reports into dynamic tools for financial management. By providing context and revealing trends, comparative analysis enables informed decision-making, facilitates performance evaluation, and enhances strategic planning. Ultimately, it empowers organizations to leverage financial data effectively, driving operational efficiency and achieving financial objectives.

5. Conciseness and Clarity

Conciseness and clarity are paramount for effective interim business financial statement templates. These reports serve as crucial communication tools, conveying complex financial information to a variety of stakeholders. Overly detailed or ambiguous reporting can obscure critical insights and hinder informed decision-making. A concise and clear presentation, however, ensures rapid comprehension and facilitates effective action.

- Focused Data PresentationInterim statements, by their nature, cover shorter periods than annual reports. This necessitates a focused approach to data presentation, prioritizing key performance indicators and omitting extraneous details. For example, a monthly income statement should focus on revenue and expense trends within that specific month, avoiding detailed breakdowns of individual transactions that are better suited for internal accounting records. This focused approach ensures the report remains concise and relevant to the reporting period.

- Unambiguous LanguageFinancial reporting relies on precise terminology and consistent accounting principles. Using unambiguous language avoids misinterpretations and ensures all stakeholders derive the same understanding from the data. For instance, clearly labeling line items as “Operating Expenses” or “Cost of Goods Sold,” rather than using generic terms like “Costs,” enhances clarity and prevents confusion. Consistent application of accounting standards further reinforces this clarity.

- Visual PresentationEffective use of visual elements, such as charts, graphs, and tables, can significantly enhance clarity, particularly when presenting complex data. Visualizations can quickly convey trends and comparisons, making the information more accessible and easier to digest. For example, a line graph depicting revenue trends over several quarters can quickly reveal growth patterns or seasonal variations, providing immediate insight into performance. However, visual aids should be used judiciously and should complement, not replace, clear textual explanations.

- Accessibility for Diverse AudiencesInterim financial statements often reach a diverse audience, including internal management, external investors, lenders, and regulators. The presentation must be accessible to all stakeholders, regardless of their financial expertise. This requires clear explanations of key metrics and avoidance of technical jargon that might be unfamiliar to non-financial professionals. Providing a brief glossary of terms can further enhance accessibility and ensure consistent understanding across all audiences.

Conciseness and clarity are not merely stylistic choices; they are essential for the efficacy of interim business financial statement templates. These qualities ensure that the reports effectively communicate critical financial information, empowering stakeholders to make informed decisions, monitor performance, and drive organizational success. By prioritizing these attributes, organizations can maximize the value of interim reporting and foster a culture of transparency and accountability.

Key Components of Interim Business Financial Statements

Effective utilization of interim financial statement templates requires a clear understanding of their crucial components. These elements ensure the reports accurately reflect financial performance and provide actionable insights for stakeholders.

1. Standardized Format: A consistent structure ensures comparability across reporting periods, facilitating trend analysis and simplifying review. Uniformity in presenting assets, liabilities, and equity enables rapid assessment of financial health.

2. Key Financial Data: Templates must include essential data points such as revenue, expenses, net income/loss, and cash flow. These figures provide a concise snapshot of performance within the specified period.

3. Period Specificity: Defining the reporting periodmonthly, quarterly, semi-annually, or customis crucial. The chosen timeframe should align with the organization’s needs, providing sufficient detail without excessive frequency.

4. Comparative Analysis: Meaningful insights emerge from comparing current data with budgets, prior periods, and industry benchmarks. This analysis reveals trends, identifies variances, and provides external context for performance evaluation.

5. Conciseness and Clarity: A focused presentation, unambiguous language, and effective use of visuals enhance comprehension. Clarity ensures all stakeholders, regardless of financial expertise, can readily understand the information.

These components work in concert to provide a comprehensive yet concise view of financial performance. Understanding their interplay is fundamental for leveraging the full potential of interim business financial statement templates and making informed decisions based on accurate, timely data.

How to Create an Interim Business Financial Statement Template

Creating a robust template ensures consistent and informative interim financial reporting. A well-structured template facilitates efficient data entry, analysis, and communication with stakeholders. The following steps outline a practical approach to template development.

1. Determine the Reporting Period: Establish the specific time frame covered by the templatemonthly, quarterly, semi-annually, or a custom period. This choice should align with the organization’s information needs and decision-making cycles.

2. Select Key Financial Metrics: Identify the essential data points to include, such as revenue, cost of goods sold, operating expenses, net income, and key cash flow figures. The selection should reflect the organization’s specific industry and operational characteristics.

3. Choose a Standardized Format: Adopt a consistent layout for presenting financial information. This ensures comparability across reporting periods and simplifies the review process for stakeholders. Consider established accounting principles and industry best practices.

4. Incorporate Comparative Data: Include columns or sections for comparing current performance with budget projections, prior periods, and relevant industry benchmarks. This facilitates trend analysis and performance evaluation.

5. Design for Clarity and Conciseness: Use clear, unambiguous language and avoid unnecessary jargon. Employ visual aids like charts and graphs judiciously to enhance understanding and highlight key trends. Ensure the layout is visually appealing and easy to navigate.

6. Build in Flexibility: While standardization is crucial, the template should accommodate potential adjustments for unique circumstances or evolving business needs. Consider using a modular design that allows for customization without compromising overall consistency.

7. Test and Refine: Before widespread implementation, pilot test the template with a small group of users to identify potential improvements and ensure its practicality. Gather feedback and refine the template based on user experience.

A well-designed template provides a framework for consistent and informative interim financial reporting. By following these steps, organizations can create a valuable tool for monitoring performance, informing strategic decisions, and communicating effectively with stakeholders. Regular review and refinement of the template ensure it remains aligned with evolving business needs and reporting requirements.

Interim business financial statement templates provide a crucial mechanism for monitoring financial performance, enabling informed decision-making, and fostering transparency within organizations. Standardized formatting, key financial data inclusion, period specificity, comparative analysis, and conciseness are vital components of effective templates. Understanding these elements allows stakeholders to leverage the full potential of interim reporting, gaining valuable insights into financial trends, operational efficiency, and overall financial health. Well-designed templates facilitate proactive management, enabling timely adjustments to strategy and resource allocation throughout the fiscal year.

Regularly reviewing and refining these templates ensures continued alignment with evolving business needs and industry best practices. This proactive approach to financial reporting empowers organizations to navigate dynamic market conditions, capitalize on emerging opportunities, and achieve sustainable growth. Effective utilization of interim financial statements provides a significant competitive advantage, fostering financial stability and long-term success.