Such documentation offers significant advantages. For landlords, it protects against accusations of unfair practices and provides a clear justification for deductions. For tenants, it offers a comprehensive understanding of why specific amounts were withheld, enabling them to challenge any discrepancies or unjustified charges. This detailed accounting fosters a more transparent and equitable conclusion to the tenancy.

The following sections will delve deeper into the key components of this type of documentation, offering guidance on its creation and utilization for both landlords and tenants. Topics covered include common deduction categories, best practices for documentation, and strategies for resolving disputes.

1. Itemized Deductions

Itemized deductions form the core of a comprehensive security deposit statement. Without a clear breakdown of individual charges, the document loses its value as a tool for transparency and accountability. A generalized statement of deductions, such as “cleaning fees” or “repairs,” lacks the specificity required to justify withholding funds. Itemization transforms a vague assertion into a substantiated account, providing tenants with a clear understanding of the disposition of their security deposit. This practice minimizes disputes by providing concrete evidence for each deduction. For instance, rather than simply stating “wall damage,” an itemized deduction would specify “repair of hole in bedroom wall caused by nail,” accompanied by the cost of repair and potentially a photograph of the damage.

The absence of itemized deductions can lead to misunderstandings and legal challenges. Tenants are entitled to a clear explanation of any withheld funds. A lump-sum deduction offers no such clarity and can create an environment of mistrust. Furthermore, without supporting evidence linked to specific deductions, landlords may face difficulty justifying their claims in a dispute resolution process. Consider a scenario where a landlord deducts a significant amount for “general cleaning.” An itemized statement, however, might reveal that a portion of this deduction was for specialized cleaning not necessitated by the tenant’s actions, opening the door for a legitimate challenge.

In conclusion, itemized deductions are not merely a best practice but a fundamental requirement for a valid and effective security deposit statement. They provide the necessary transparency and accountability that protect both landlords and tenants. This detailed approach ensures that deductions are justified, documented, and easily understood, fostering a fairer and more transparent conclusion to the tenancy.

2. Clear Descriptions

Clarity in descriptions within an itemized security deposit statement is paramount. Vague or ambiguous language can lead to disputes and misunderstandings. While itemization provides a breakdown of individual charges, clear descriptions provide the necessary context for each deduction. A simple line item stating “damage repair – $100” lacks the specificity required for a tenant to understand the justification. A clear description, such as “repair of hole in living room wall caused by picture hook – $100,” provides the necessary detail and transparency. This specificity allows tenants to assess the validity of the deduction and minimizes the potential for disagreements. Consider a scenario where a tenant unknowingly caused minor damage during move-in. A clear description connecting the damage to the move-in process might prompt the tenant to recall the incident and accept the charge, whereas a vague description might lead to unnecessary contention.

The practical significance of clear descriptions extends beyond dispute resolution. They serve as a valuable record for both landlords and tenants. Detailed descriptions can help landlords track property maintenance and identify recurring issues. For tenants, these descriptions provide a clear understanding of the condition of the property upon move-out and can serve as a reference for future rentals. Imagine a scenario where a landlord consistently notes “excessive wear and tear” on carpets without further clarification. Clear descriptions, such as “carpet stains in the dining area” or “carpet damage near the entryway,” provide actionable information for both parties, allowing tenants to address specific concerns and landlords to identify areas requiring attention.

In summary, clear descriptions are essential for a comprehensive and effective security deposit statement. They provide the context necessary for understanding individual deductions, minimizing disputes and fostering transparency. This level of detail benefits both landlords and tenants by providing a clear and accurate record of the property’s condition and the justification for any deductions. Moving forward, prioritizing descriptive clarity within these documents contributes significantly to a more equitable and transparent rental process.

3. Supporting Evidence

Supporting evidence forms a critical component of a robust itemized security deposit statement. Without verifiable proof, even meticulously itemized deductions can lack credibility. Supporting evidence transforms assertions into substantiated claims, protecting landlords from accusations of unfair practice and providing tenants with concrete justification for any withheld funds. Photographs, videos, invoices, and dated correspondence serve as compelling evidence, corroborating the stated reasons for deductions. For instance, a claim for damaged carpeting gains significant weight when accompanied by a timestamped photograph and a cleaning invoice. Similarly, a deduction for unpaid rent becomes indisputable with documented reminders and lease agreement clauses.

The absence of supporting evidence can undermine the entire security deposit return process. Deductions lacking verifiable proof become vulnerable to challenges. A tenant might reasonably dispute a charge for a broken window without photographic evidence or a repair invoice. Conversely, landlords possessing comprehensive documentation are better equipped to navigate disputes and defend justified deductions. Consider a scenario where a tenant denies responsibility for a plumbing issue. A landlord with a dated plumber’s invoice and photographic evidence of the damage holds a significantly stronger position. This underscores the practical significance of maintaining meticulous records throughout the tenancy.

In conclusion, supporting evidence is not merely a recommended addition but a vital element of a comprehensive and legally sound security deposit statement. It provides the necessary substantiation for deductions, promoting transparency and minimizing the potential for disputes. This practice reinforces the credibility of the documentation, protecting the interests of both landlords and tenants. Prioritizing the inclusion of supporting evidence contributes to a more equitable and transparent conclusion to the rental agreement.

4. Date of Deductions

Accurate dating of deductions within an itemized security deposit statement provides a crucial chronological context, enhancing transparency and facilitating the verification of charges. This precise timeline allows both landlords and tenants to correlate deductions with specific events or periods during the tenancy, ensuring accountability and clarity.

- Establishing a TimelineDates associated with each deduction establish a clear timeline of events, enabling both parties to reconcile charges with the duration of the tenancy. This chronological record helps determine the relevance of specific deductions, particularly in cases of pre-existing damage or issues arising after the tenant’s departure. For example, a deduction for carpet cleaning dated after the tenant’s move-out date raises immediate questions regarding responsibility.

- Verifying Service DatesDocumented dates allow for the verification of services performed. Comparing the deduction date with invoices for repairs or cleaning confirms that services occurred during the relevant period. This verification prevents discrepancies and ensures that tenants are not charged for services rendered before their occupancy or after their departure. For instance, a repair invoice dated prior to the lease commencement clearly indicates a pre-existing issue.

- Supporting Dispute ResolutionAccurate dates provide crucial evidence in dispute resolution processes. A clear timeline of deductions, supported by corresponding documentation, strengthens a landlord’s position in justifying charges. Conversely, discrepancies in dates can expose inaccuracies or unsubstantiated claims. Consider a scenario where a tenant disputes a charge for a broken appliance. A dated repair invoice matching the reported incident reinforces the landlord’s claim.

- Facilitating Accurate AccountingPrecise dating ensures accurate accounting practices. This detailed record-keeping allows landlords to track expenses related to specific tenancies and provides tenants with a clear understanding of the timing and reasons for deductions. This meticulous approach promotes financial transparency and facilitates a smoother transition at the end of the lease term.

In conclusion, accurate dating of deductions is an essential component of a comprehensive and transparent security deposit statement. This precise chronological record strengthens the validity of deductions, facilitates verification, and supports a more equitable and efficient resolution of any potential disputes, contributing to a clearer and more accountable conclusion to the tenancy.

5. Contact Information

Inclusion of accurate and accessible contact information within an itemized security deposit statement is crucial for facilitating communication and resolving potential discrepancies. This information acts as a bridge between landlords and tenants, enabling efficient dialogue regarding deductions and ensuring a transparent and accountable process. Without clear communication channels, misunderstandings can escalate into disputes, delaying the return of funds and creating unnecessary friction.

- Facilitating CommunicationContact information enables direct communication between landlords and tenants. This open channel allows tenants to inquire about specific deductions, request further clarification, or provide additional documentation. Direct dialogue often resolves minor discrepancies quickly, preventing escalation into formal disputes. For instance, a tenant might contact the landlord to clarify a cleaning charge, providing evidence of professional cleaning prior to move-out.

- Expediting Dispute ResolutionAccessible contact information streamlines the dispute resolution process. Should disagreements arise, direct communication between parties can lead to swift and amicable solutions. This avoids lengthy delays and potential legal action, benefiting both landlords and tenants. A readily available phone number or email address allows for timely discussion and negotiation, potentially resolving the issue without external intervention.

- Ensuring Transparency and AccountabilityThe presence of contact information promotes transparency and accountability. It signals a landlord’s willingness to engage in open communication and address tenant concerns. This fosters trust and reduces the likelihood of misunderstandings. A landlord providing multiple contact options demonstrates a commitment to accessibility and responsiveness.

- Legal and Regulatory ComplianceIn many jurisdictions, providing contact information on official documentation related to tenancy agreements is a legal or regulatory requirement. Including this information on the security deposit statement ensures compliance with applicable laws and regulations. This adherence to legal standards protects both parties and reinforces the validity of the document.

In summary, the inclusion of accurate and accessible contact information on an itemized security deposit statement is essential for facilitating communication, resolving disputes, ensuring transparency, and complying with legal requirements. This seemingly minor detail plays a significant role in fostering a smooth and equitable conclusion to the tenancy, ultimately benefiting both landlords and tenants.

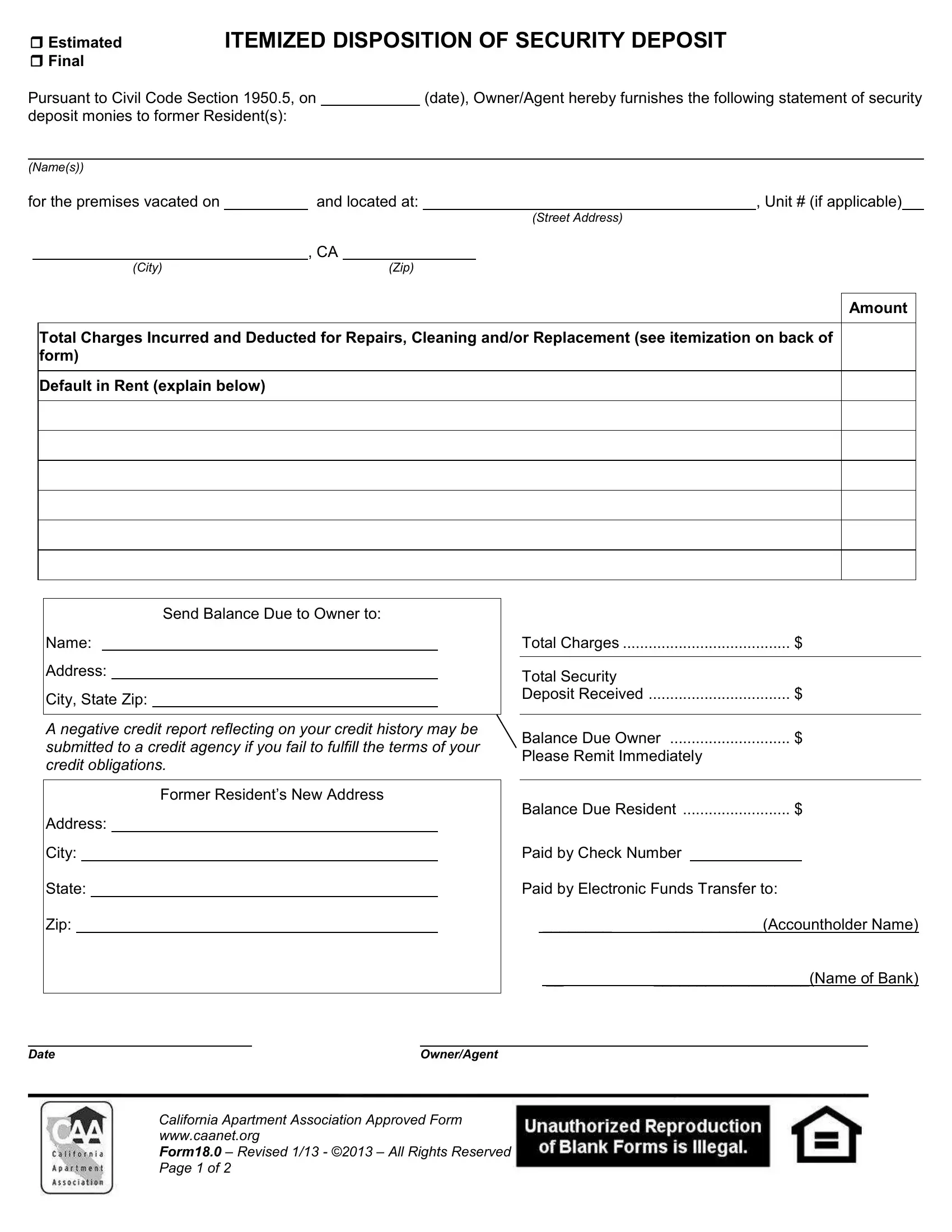

Key Components of an Itemized Security Deposit Statement

A comprehensive security deposit statement requires specific elements to ensure clarity, transparency, and legal validity. These components protect both landlords and tenants by providing a clear record of the disposition of the security deposit.

1. Itemized Deductions: Each deduction must be listed individually, specifying the reason and amount. Generalized deductions lack the necessary detail for proper accounting and can lead to disputes. Specificity is crucial for transparency.

2. Clear Descriptions: Accompanying each itemized deduction should be a concise, unambiguous description. Vague descriptions create room for misinterpretation. Detailed explanations provide context and facilitate understanding.

3. Supporting Evidence: Whenever possible, deductions should be substantiated with supporting evidence. This might include photographs, invoices, repair estimates, or relevant correspondence. Verifiable proof strengthens the validity of deductions.

4. Dates of Deductions: Each deduction should be associated with a specific date. This chronological record establishes a timeline of events, enabling both parties to correlate charges with specific periods during the tenancy. Accurate dates enhance transparency and facilitate verification.

5. Contact Information: Including landlord contact information facilitates communication and promotes transparency. This enables tenants to inquire about deductions and resolve potential discrepancies efficiently. Open communication channels minimize disputes.

Accurate documentation fosters accountability and transparency, minimizing potential disputes and ensuring a clear understanding of the security deposit disposition. This meticulous approach benefits all parties involved in the lease agreement.

How to Create an Itemized Security Deposit Statement

Creating a comprehensive and legally sound itemized security deposit statement requires careful attention to detail and adherence to best practices. This document serves as a crucial record for both landlords and tenants, ensuring transparency and accountability in the handling of security deposits.

1. Header Information: Begin by clearly identifying the document as an “Itemized Security Deposit Statement.” Include the property address, tenant name(s), lease dates, and the original security deposit amount. This information provides essential context.

2. Date of Statement: Clearly indicate the date the statement is being issued. This establishes a point of reference for all included information.

3. Itemized Deductions: Create a table or list with separate entries for each deduction. Each entry should include a concise description of the reason for the deduction, the associated date, and the amount withheld. Specificity is paramount.

4. Supporting Evidence: Attach copies of any supporting documentation, such as invoices, photographs, or estimates. Label each piece of evidence clearly and reference it within the itemized deductions section. This reinforces the validity of each deduction.

5. Total Deductions and Remaining Balance: Calculate the sum of all deductions and subtract this amount from the original security deposit. Clearly display the remaining balance due to the tenant, or the amount owed by the tenant if deductions exceed the deposit.

6. Payment Information: If a balance is due to the tenant, specify the method and timing of payment. This might include mailing a check or electronic transfer. Provide clear instructions.

7. Landlord Contact Information: Include the landlord’s name, address, phone number, and email address. This facilitates communication and provides an avenue for resolving potential discrepancies.

8. Signatures (Optional): While not always required, including signature lines for both the landlord and tenant can provide an additional layer of documentation and acknowledgement.

A well-constructed statement provides a clear and accurate accounting of the security deposit, minimizing potential disputes and promoting a transparent conclusion to the tenancy. Meticulous documentation benefits all parties involved.

Accurate and detailed accounting of a tenant’s prepaid funds, documented through a comprehensive statement of charges, is crucial for ensuring a transparent and legally sound conclusion to a lease agreement. This documentation provides a clear breakdown of deductions, supported by descriptions, evidence, and dates, offering both landlords and tenants a verifiable record of the security deposit disposition. The inclusion of contact information further facilitates communication and efficient resolution of potential discrepancies. Adherence to these practices promotes accountability and minimizes the likelihood of disputes, fostering a more equitable and professional landlord-tenant relationship.

Proper management of security deposits is a cornerstone of responsible rental management. Clear and comprehensive documentation protects the rights and interests of all parties involved, promoting trust and facilitating a smoother transition at the end of a tenancy. This meticulous approach ultimately contributes to a more stable and equitable rental market, benefiting both property owners and tenants. The careful creation and utilization of these statements underscores a commitment to professional and ethical conduct within the rental industry.