Utilizing a standardized form for combined financial reporting offers numerous advantages. It ensures consistency and completeness in presenting financial information, facilitating clear communication with financial institutions and advisors. A standardized format also simplifies complex financial data, making it easier to analyze and understand joint financial standing. This clarity can empower individuals to make informed decisions regarding shared financial goals.

This overview provides a foundation for understanding the function and utility of combined personal financial summaries. Further exploration will delve into specific applications, including obtaining mortgages, managing joint investments, and developing comprehensive financial plans. Additional discussion will address practical aspects such as how to complete such forms accurately and efficiently.

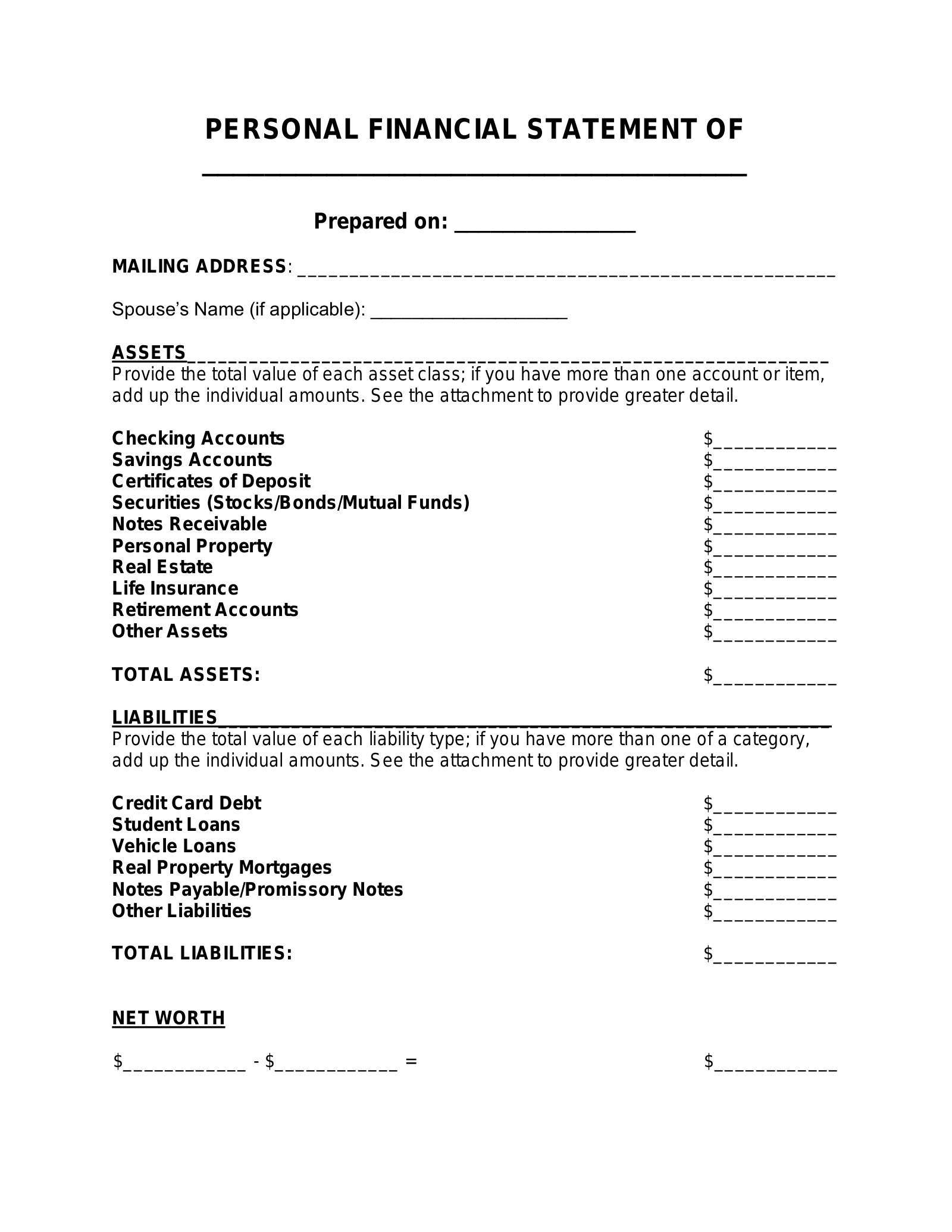

1. Assets (shared)

Accurately representing shared assets is a critical component of a joint personal financial statement template. This section provides a comprehensive overview of combined holdings, offering a clear picture of joint ownership and contributing significantly to the overall financial assessment. Understanding the nuances of categorizing and valuing shared assets is essential for a complete and accurate representation of joint financial standing.

- Real EstateReal estate held jointly, such as a primary residence or investment property, forms a significant portion of shared assets. Accurate valuation, typically based on fair market value, is crucial. Documentation, including property deeds and mortgage statements, supports these valuations and provides evidence of ownership. Including real estate accurately reflects its contribution to overall net worth.

- Financial AccountsJointly held financial accounts, including checking, savings, and investment accounts, must be fully disclosed. Account statements provide current balances and transaction history. Clearly identifying the ownership structure of these accounts ensures transparency and accurately reflects joint financial holdings. This information is vital for assessing liquidity and overall financial health.

- VehiclesJointly owned vehicles, including cars, boats, or recreational vehicles, are listed as shared assets. Current market value, supported by appraisals or online valuation tools, is typically used. Ownership documentation, such as titles and registration, should be readily available. Including these assets contributes to a complete picture of joint property holdings.

- Other Tangible AssetsOther jointly owned tangible assets, including valuable collectibles, jewelry, or artwork, should be included. Appraisals are often necessary to establish fair market value for these items. Documentation of ownership and supporting valuation information ensures accurate representation within the overall financial statement. This category captures the value of less conventional but potentially significant shared holdings.

Accurate and comprehensive disclosure of shared assets forms the foundation of a robust joint personal financial statement. This detailed view of joint holdings provides crucial context for lenders, financial advisors, and other stakeholders involved in financial planning and decision-making. This detailed inventory of shared resources offers a transparent and comprehensive basis for evaluating overall financial health and making informed decisions regarding joint financial matters.

2. Liabilities (joint)

Accurate representation of joint liabilities is fundamental to a comprehensive joint personal financial statement template. This section details shared financial obligations, providing a transparent view of joint debts and contributing significantly to the overall financial assessment. Understanding the nuances of categorizing and quantifying shared liabilities is crucial for accurately representing joint financial standing.

- MortgagesJoint mortgages, representing loans secured by real estate owned jointly, are typically the most significant liability. Outstanding principal balances, interest rates, and loan terms should be clearly documented. Mortgage statements provide necessary details for accurate reporting. Accurate mortgage information is essential for assessing debt levels and overall financial health.

- LoansJointly held loans, including auto loans, personal loans, or student loans, must be fully disclosed. Outstanding balances, interest rates, and repayment terms should be clearly specified. Loan statements and agreements provide the necessary supporting documentation. This information provides a clear picture of outstanding debt obligations.

- Credit Card DebtJoint credit card accounts and their outstanding balances represent a significant liability. Credit card statements provide current balances, interest rates, and minimum payment amounts. Accurately reporting credit card debt is crucial for assessing debt levels and credit utilization, impacting creditworthiness.

- Other LiabilitiesOther shared financial obligations, such as medical bills, legal judgments, or outstanding taxes, should be included. Supporting documentation, such as invoices or legal notices, should be readily available. This category ensures a complete and accurate representation of all joint financial obligations, contributing to a holistic view of financial standing.

Thorough disclosure of joint liabilities is critical for a comprehensive joint personal financial statement. This transparent view of shared debt obligations is essential for lenders, financial advisors, and anyone involved in financial planning and decision-making. This detailed record of joint obligations facilitates a clear and comprehensive evaluation of overall financial health and informs sound decisions regarding joint financial matters.

3. Net Worth (Combined)

Combined net worth represents a pivotal element within a joint personal financial statement template. Calculated as the difference between total shared assets and total joint liabilities, this figure provides a concise snapshot of joint financial health. Understanding its calculation and implications is crucial for effective financial planning and decision-making.

- CalculationNet worth is derived by subtracting total liabilities from total assets. For example, if a couple’s shared assets total $500,000 and their joint liabilities amount to $200,000, their combined net worth is $300,000. Accurate calculation requires meticulous accounting of all assets and liabilities, ensuring a realistic portrayal of financial standing.

- Financial Health IndicatorCombined net worth serves as a key indicator of overall financial health. A positive net worth suggests financial stability and the ability to meet current and future obligations. A negative net worth, conversely, indicates that liabilities exceed assets, potentially signaling financial vulnerability. Tracking net worth over time provides valuable insights into financial progress.

- Loan Applications and CreditworthinessLenders frequently assess combined net worth when evaluating loan applications. A strong net worth can enhance creditworthiness, increasing the likelihood of loan approval and potentially securing favorable interest rates. It demonstrates an ability to manage finances responsibly and reduces perceived risk for lenders.

- Financial Planning and Goal SettingCombined net worth plays a crucial role in financial planning and goal setting. Understanding current net worth provides a baseline for setting realistic financial goals, such as retirement planning or major purchases. Tracking net worth progress helps monitor progress toward these goals and informs adjustments to financial strategies.

Combined net worth, as a central component of the joint personal financial statement template, provides a powerful tool for assessing financial health and informing strategic decision-making. Its accurate calculation and interpretation are fundamental for effective financial planning, loan applications, and achieving shared financial goals. Regularly reviewing and analyzing combined net worth allows for proactive financial management and facilitates informed decisions to secure long-term financial well-being.

4. Income (Total Household)

Total household income forms a cornerstone of the joint personal financial statement template. Accurately representing all income sources provides a comprehensive view of financial capacity and plays a crucial role in assessing overall financial health and stability. This section explores the key components of total household income and its significance within the broader context of joint financial statements.

- Salaries and WagesSalaries and wages from all employment held by each individual contribute significantly to total household income. Documentation, including pay stubs or employment contracts, substantiates reported income. This information is crucial for lenders assessing repayment capacity and forms the foundation for budgeting and financial planning.

- Investment IncomeIncome derived from investments, including dividends, interest, and capital gains, forms another component of total household income. Investment statements and tax records provide supporting documentation. This information demonstrates financial diversification and contributes to a comprehensive understanding of income streams.

- Self-Employment and Business IncomeIncome generated through self-employment or business ownership requires detailed documentation. Profit and loss statements, tax returns, and bank statements offer supporting evidence. Accurately reporting business income is crucial for demonstrating financial stability, particularly for loan applications.

- Other Income SourcesOther income sources, such as rental income, alimony, or government benefits, should be included. Supporting documentation, such as lease agreements or benefit statements, adds credibility to reported figures. This category ensures a complete representation of all income streams contributing to the household’s financial picture.

Accurate reporting of total household income is fundamental for a comprehensive and reliable joint personal financial statement. This information is essential for lenders, financial advisors, and individuals engaged in joint financial planning. A clear understanding of total income empowers informed decisions regarding budgeting, debt management, and long-term financial goals. Furthermore, it contributes to a transparent and trustworthy representation of joint financial health, facilitating sound financial decision-making and contributing to overall financial stability.

5. Expenses (shared household)

Shared household expenses represent a critical component of a joint personal financial statement template. Accurate and detailed accounting of these expenses provides essential insights into spending patterns, informs budgeting decisions, and contributes significantly to a comprehensive understanding of overall financial health. The relationship between shared expenses and the joint financial statement is integral for effective financial planning and management.

Categorizing shared household expenses provides a structured view of financial outflows. Key categories typically include housing (mortgage or rent, property taxes, utilities), transportation (car payments, insurance, fuel), food, healthcare, and debt repayment. Detailed tracking within each category allows for a granular understanding of spending habits and informs potential areas for cost optimization. For instance, tracking grocery expenses over several months can reveal opportunities to reduce spending through meal planning or utilizing coupons. Similarly, monitoring utility usage can identify potential savings through energy-efficient practices.

Understanding shared household expenses is crucial for several reasons. Firstly, it facilitates realistic budgeting. A clear picture of where money is being spent allows for informed decisions regarding resource allocation and prioritization. Secondly, it plays a vital role in assessing affordability for significant financial commitments, such as purchasing a home or taking on new debt. Finally, accurate expense tracking empowers informed financial goal setting. By understanding current spending patterns, individuals can identify adjustments needed to achieve desired financial outcomes, such as saving for retirement or a down payment on a house. Accurate and comprehensive documentation of shared household expenses within the joint personal financial statement template provides invaluable insights into financial behavior, supports informed decision-making, and contributes significantly to achieving shared financial goals.

6. Date (snapshot in time)

The date included on a joint personal financial statement template serves a crucial function: it establishes the precise moment in time the financial information represents. This “snapshot” functionality is essential for accurate interpretation and effective utilization of the statement. Without a specified date, the information lacks context and relevance, potentially leading to misinterpretations and flawed financial decisions. The date transforms the document from a collection of figures into a meaningful representation of financial standing at a specific point in time. For example, asset valuations can fluctuate significantly, particularly in volatile markets. A statement dated June 1, 2024, provides a different financial picture than one dated December 1, 2024. This distinction is crucial for lenders, investors, and anyone relying on the information for decision-making.

The importance of the date extends beyond simply providing context. It enables tracking of financial progress over time. By comparing statements with different dates, individuals can monitor changes in net worth, debt levels, and income. This tracking facilitates informed adjustments to financial strategies and provides valuable insights into the effectiveness of financial planning efforts. Consider a couple applying for a mortgage in January 2025. The lender will likely require a recent financial statement. Comparing this statement to one from January 2024 allows the lender to assess the couple’s financial trajectory and their ability to manage debt responsibly. This temporal perspective offered by the date is fundamental for sound financial analysis.

Accurate dating of joint personal financial statements is paramount for transparency and accountability. It ensures all parties involved are working with the same, current information, reducing the potential for misunderstandings and facilitating informed decision-making. Moreover, it supports legal and regulatory compliance, as many financial transactions require documentation of financial standing at a specific point in time. The seemingly simple act of dating the statement provides crucial context, enables tracking of progress, and reinforces the integrity of the financial information presented. Understanding the significance of the date is essential for anyone utilizing or interpreting joint personal financial statements.

Key Components of a Joint Personal Financial Statement Template

A comprehensive joint personal financial statement template provides a consolidated overview of the financial standing of two individuals. Understanding the key components is crucial for accurate completion and effective utilization of this document.

1. Assets (Shared): This section details all jointly owned assets, including real estate, financial accounts, vehicles, and other tangible assets. Accurate valuation and documentation of ownership are essential. This component reveals the combined resources available to the individuals.

2. Liabilities (Joint): This section outlines all shared debts and financial obligations, such as mortgages, loans, credit card debt, and other liabilities. Accurate reporting of outstanding balances, interest rates, and payment terms is vital. This component reveals the combined financial burdens.

3. Net Worth (Combined): Calculated by subtracting total liabilities from total assets, net worth represents the overall financial position. This key figure provides a snapshot of financial health and stability.

4. Income (Total Household): This section includes all sources of income for both individuals, such as salaries, wages, investment income, business income, and other income sources. Accurate income reporting is essential for assessing financial capacity.

5. Expenses (Shared Household): Detailed tracking of shared living expenses, including housing, transportation, food, healthcare, and debt repayment provides critical insights into spending patterns and informs budget management.

6. Date (Snapshot in Time): The date specifies the exact point in time the financial information represents. This is crucial for accurate interpretation and allows for tracking of financial progress over time.

Accurate and comprehensive completion of each component within the joint personal financial statement template provides a robust and transparent view of joint financial standing. This information is crucial for various financial planning activities, loan applications, and other financial decision-making processes. A thorough understanding of these components empowers informed financial management and facilitates sound decision-making.

How to Create a Joint Personal Financial Statement

Creating a comprehensive joint personal financial statement requires careful organization and accurate data entry. The following steps outline the process for developing this crucial financial document.

1. Gather Necessary Documents: Begin by collecting all relevant financial documents, including bank statements, investment account statements, loan documents, mortgage statements, property tax assessments, and recent pay stubs. These documents provide the necessary data for accurate completion of the statement.

2. Choose a Template or Software: Select a pre-designed template or utilize personal finance software. Many templates are readily available online or through financial institutions. Software options offer automated calculations and enhanced organization.

3. List Shared Assets: Itemize all jointly owned assets, including real estate, financial accounts, vehicles, and other tangible assets. Determine the current market value for each asset. Supporting documentation, such as appraisals or recent sales data, may be necessary.

4. Detail Joint Liabilities: List all shared debts and financial obligations, including mortgages, loans, credit card balances, and other liabilities. Provide accurate details for each liability, including outstanding balances, interest rates, and payment terms.

5. Calculate Combined Net Worth: Subtract the total value of joint liabilities from the total value of shared assets. This calculation reveals the combined net worth, a crucial indicator of overall financial health.

6. Document Total Household Income: List all sources of income for both individuals, including salaries, wages, investment income, business income, and any other income sources. Provide supporting documentation, such as pay stubs or tax returns.

7. Itemize Shared Household Expenses: Track all shared household expenses, including housing costs, transportation expenses, food costs, healthcare expenses, debt repayment, and other regular expenses. This information provides valuable insights into spending patterns.

8. Specify the Date: Clearly indicate the date the financial information represents. This date provides crucial context and allows for tracking financial progress over time. Review the completed statement for accuracy and completeness. Ensure all information is current and accurately reflects the joint financial position.

Accurate completion of these steps facilitates a clear and comprehensive understanding of joint financial standing, enabling informed financial planning and decision-making. This organized approach ensures all necessary information is readily available and presented in a clear, concise format.

Accurate and comprehensive completion of a joint personal financial statement template provides a powerful tool for understanding and managing shared finances. This document, encompassing a detailed inventory of assets and liabilities, a clear calculation of net worth, a comprehensive overview of income and expenses, and a precise date of record, offers a consolidated view of financial health. Meticulous attention to detail and accurate data entry are crucial for ensuring the reliability and utility of this document for informed financial decision-making.

Leveraging this financial tool empowers individuals to navigate complex financial landscapes, from securing loans and managing investments to planning for retirement and other long-term financial goals. Regular review and updates to this statement facilitate proactive financial management and contribute to long-term financial stability and success. This proactive approach to joint financial management fosters informed decisions and empowers individuals to achieve shared financial objectives.