Utilizing a pre-designed structure for financial reporting offers several advantages. It facilitates consistent tracking of key financial metrics, simplifies tax preparation, and allows for easy comparison of performance across different periods. This structured approach can also reveal areas for cost optimization and revenue enhancement, ultimately contributing to a more profitable and sustainable practice. Furthermore, it provides valuable data for securing loans or attracting investors.

This understanding of financial reporting for legal practices forms the basis for exploring related topics such as key performance indicators (KPIs) for law firms, effective budgeting strategies, and best practices for financial management in the legal profession.

1. Revenues

Accurate revenue recording is fundamental to a law firm’s income statement. A clear understanding of revenue sources and their proper categorization is essential for financial transparency and informed decision-making.

- Billable Hours:This constitutes a primary revenue stream for many firms. It encompasses the time attorneys and paralegals spend working directly on client cases. Accurate time tracking and appropriate billing rates are critical for maximizing this revenue source. Within the income statement, billable hours are often categorized by practice area or attorney, providing insights into profitability by sector and individual performance.

- Fixed Fees:Some legal services, such as document drafting or legal consultations, may be billed at a predetermined fixed fee. These amounts are recorded as revenue when the service is rendered. Clear documentation of fixed fee arrangements and timely invoicing contribute to accurate revenue reflection.

- Retainers:Upfront payments from clients, known as retainers, are recorded as liabilities until the corresponding services are provided. As services are performed, portions of the retainer are recognized as revenue. Proper accounting for retainers is crucial to avoid misrepresenting a firm’s financial position.

- Contingency Fees:These fees, collected only upon successful case outcomes, represent a unique revenue category. Accurately projecting and recording contingency fee revenue requires careful consideration of case probabilities and potential settlement amounts. Their impact on the income statement can be significant, but also less predictable than other revenue sources.

A comprehensive understanding of these revenue categories and their proper recording within the income statement template allows for accurate profitability assessment, effective financial planning, and data-driven strategic decision-making. Analysis of revenue trends over time can highlight practice areas requiring attention and inform pricing strategies.

2. Expenses

Accurate and detailed expense tracking is crucial for the financial health of any law firm. Within the context of an income statement template, expenses represent the costs incurred in operating the practice. A comprehensive understanding of these costs is essential for profitability analysis, budgeting, and strategic financial management. Categorizing expenses effectively within the template provides a clear picture of where resources are allocated and identifies potential areas for cost optimization. The relationship between revenue and expenses directly impacts a firm’s net income, a key metric reflected on the income statement.

Several key expense categories typically appear within a law firm income statement template. These include:

- Direct Expenses: These costs are directly tied to serving clients, such as court fees, expert witness fees, and travel expenses related to specific cases. Accurately allocating these expenses to individual cases or clients allows for precise profitability analysis by client or practice area.

- Operating Expenses: These are the costs of running the firm’s daily operations. Examples include salaries for attorneys and support staff, office rent, utilities, legal research subscriptions, and marketing costs. Careful monitoring of operating expenses is essential for maintaining profitability and ensuring efficient resource allocation.

- Overhead Expenses: These costs are not directly related to client services but are necessary for the firm’s functioning. They may include professional liability insurance, bar association dues, continuing legal education expenses, and depreciation of office equipment. Understanding and managing overhead contributes to a realistic assessment of overall profitability.

For example, a firm might notice a significant increase in operating expenses due to rising office rent. This insight, gleaned from the income statement, could prompt a review of lease agreements or exploration of alternative office spaces. Similarly, tracking direct expenses related to specific litigation cases allows firms to evaluate the profitability of taking on similar cases in the future.

Effective expense management, reflected in a well-structured income statement template, provides crucial insights into a law firm’s financial performance. By analyzing expense trends, identifying areas for cost reduction, and comparing expenses to revenue, firms can make data-driven decisions to improve profitability and ensure long-term financial stability. This understanding also contributes to more accurate budgeting and forecasting, enabling firms to anticipate future financial challenges and opportunities.

3. Profitability

Profitability, a core measure of a law firm’s financial health, is directly reflected in the income statement. This financial report provides a structured view of a firm’s revenue, expenses, and resulting net income over a specific period. Analyzing profitability through the income statement allows for informed decision-making regarding pricing strategies, expense management, and overall business strategy.

- Net Income:Net income, calculated as total revenue minus total expenses, represents the firm’s bottom line. A positive net income indicates profitability, while a negative net income signifies a loss. The income statement provides the data necessary to calculate and analyze net income, offering insights into the firm’s overall financial performance.

- Gross Profit Margin:This metric, calculated as gross profit divided by revenue, reflects the profitability of a firm’s core legal services before accounting for overhead and other indirect expenses. Analyzing gross profit margin on the income statement helps assess the efficiency of service delivery and pricing strategies.

- Profitability by Practice Area:Segmenting the income statement by practice area allows for a granular view of profitability across different legal specializations. This analysis can identify high-performing areas and areas requiring attention, informing resource allocation and strategic planning. For instance, a firm might discover that its real estate practice generates significantly higher profit margins than its family law practice, leading to strategic decisions regarding resource allocation and marketing efforts.

- Profitability Trends Over Time:Comparing income statements across different accounting periods reveals trends in profitability. This historical analysis enables firms to identify factors contributing to increased or decreased profitability, facilitating proactive adjustments to business strategy. For example, a consistent decline in profitability over several quarters might signal the need for cost-cutting measures or price adjustments.

Understanding these facets of profitability within the context of a law firm income statement template is crucial for effective financial management. Analyzing these metrics allows firms to assess their financial performance, identify areas for improvement, and make informed decisions to enhance profitability and ensure long-term sustainability. This data-driven approach empowers firms to adapt to changing market conditions and achieve their financial goals.

4. Time Period

The time period covered by a law firm income statement is a critical component for accurate financial analysis. A defined timeframe provides the boundaries for measuring revenue and expenses, enabling meaningful comparisons and trend identification. Common reporting periods include monthly, quarterly, and annually. The chosen timeframe influences the insights derived from the statement. For example, a monthly income statement offers a granular view of short-term financial performance, while an annual statement provides a broader perspective on overall financial health. Selecting the appropriate time period depends on the specific analytical goals, whether it’s monitoring short-term cash flow or assessing long-term profitability.

The consistent application of a chosen time period allows for accurate tracking of financial performance over time. Comparing income statements from consecutive periods reveals trends in revenue growth, expense fluctuations, and overall profitability. This historical data informs strategic decision-making and allows firms to proactively address potential financial challenges or capitalize on emerging opportunities. For instance, comparing quarterly income statements can reveal seasonal patterns in client activity, enabling firms to adjust staffing levels or marketing strategies accordingly. Analyzing year-over-year performance provides insights into long-term growth trajectories and the effectiveness of implemented strategies.

Understanding the integral role of the time period within a law firm income statement template is essential for effective financial management. Selecting the appropriate reporting period and maintaining consistency allows for meaningful performance analysis, trend identification, and informed decision-making. This structured approach to financial reporting empowers law firms to monitor their financial health, identify areas for improvement, and make data-driven decisions to achieve their business objectives. Choosing the right time period and consistently applying it allows for accurate benchmarking and facilitates effective financial planning for future growth and stability.

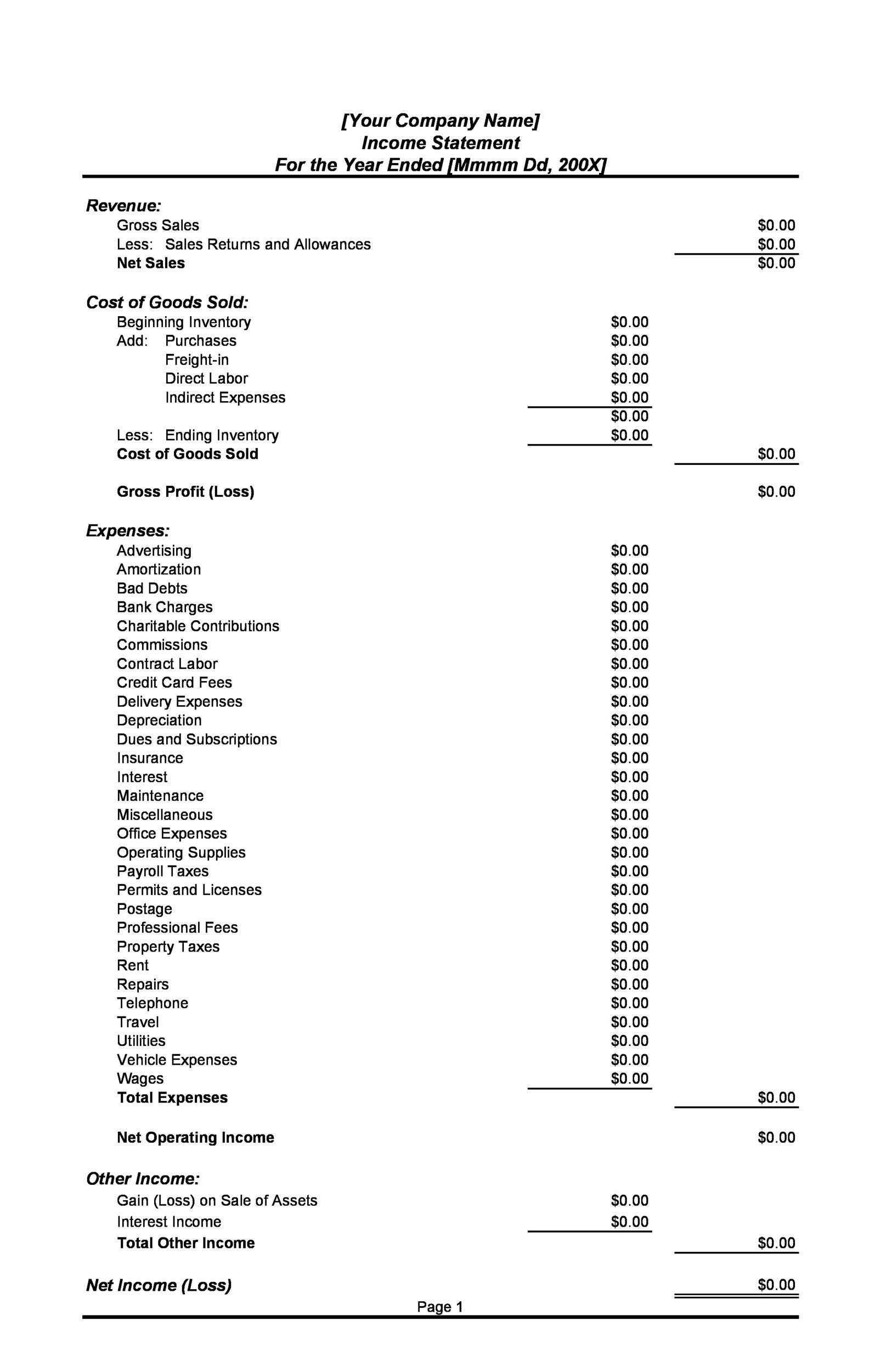

5. Standardized Format

A standardized format is crucial for law firm income statement templates, ensuring consistency, comparability, and ease of interpretation. This structured approach facilitates internal performance analysis, benchmarking against industry averages, and effective communication with stakeholders. Adherence to a standardized format ensures that financial data is presented clearly and systematically, enabling informed decision-making and promoting financial transparency.

- Uniform Structure:A standardized template provides a pre-defined structure with designated sections for revenues, expenses, and net income. This uniform structure ensures consistency across reporting periods, facilitating trend analysis and performance comparisons. For example, consistently placing operating expenses like salaries and rent in the same section allows for easy tracking of these costs over time.

- Common Terminology:Utilizing standard accounting terminology ensures clarity and prevents misinterpretations. Terms like “gross profit,” “operating income,” and “net income” have specific meanings within accounting, and their consistent use eliminates ambiguity. This standardized language is essential for clear communication within the firm and with external parties like banks or investors.

- Comparability:Standardized income statements enable comparisons across different periods, departments, or even against industry benchmarks. This comparability allows firms to identify areas of strength and weakness, assess their performance relative to competitors, and make data-driven decisions for improvement. For example, a firm can compare its profitability margins to industry averages to identify areas for potential optimization.

- Compliance and Auditing:A standardized format simplifies compliance with regulatory requirements and facilitates external audits. Consistent reporting practices ensure that financial information is readily available for review, reducing the complexity of audits and ensuring transparency. This structured approach also strengthens the firm’s financial credibility with stakeholders.

The standardized format of a law firm income statement template provides a framework for clear, consistent, and comparable financial reporting. This structure enables effective internal analysis, benchmarking against industry standards, and transparent communication with stakeholders. By adhering to a standardized format, law firms enhance their financial management practices, enabling informed decision-making and promoting long-term financial health. This rigorous approach to financial reporting lays the groundwork for sound financial planning, strategic resource allocation, and sustainable growth.

6. Financial Analysis

Financial analysis is essential for leveraging the data within a law firm income statement template. It transforms raw financial data into actionable insights, enabling informed decision-making and strategic planning. Analyzing the income statement provides a comprehensive understanding of a firm’s financial performance, profitability, and operational efficiency.

- Trend AnalysisExamining financial data across multiple reporting periods reveals trends in revenue, expenses, and profitability. This analysis allows firms to identify patterns, anticipate future performance, and adapt strategies proactively. For example, consistently increasing administrative expenses might signal a need for process improvements. Declining revenue in a specific practice area could prompt a review of marketing strategies or client acquisition processes. Trend analysis provides valuable context for understanding the firm’s financial trajectory.

- BenchmarkingComparing a firm’s financial performance against industry benchmarks provides valuable context and identifies areas for potential improvement. Benchmarking data allows firms to assess their competitiveness, identify best practices, and set realistic financial goals. For instance, comparing a firm’s profitability margins to industry averages can highlight areas where cost optimization or revenue enhancement strategies might be necessary. Benchmarking facilitates data-driven decision-making and fosters continuous improvement.

- Ratio AnalysisCalculating key financial ratios, such as profitability ratios, liquidity ratios, and leverage ratios, provides deeper insights into a firm’s financial health. These ratios offer a standardized way to assess profitability, efficiency, and financial stability. For example, the current ratio, calculated by dividing current assets by current liabilities, provides insights into a firm’s ability to meet short-term obligations. Ratio analysis enhances the understanding of financial performance beyond the raw numbers presented in the income statement.

- ForecastingFinancial analysis plays a crucial role in forecasting future financial performance. By analyzing historical data and current trends, firms can project future revenue, expenses, and profitability. Accurate forecasting enables effective budgeting, resource allocation, and strategic planning. For instance, projecting future client growth allows firms to anticipate staffing needs and make informed decisions regarding office space or technology investments. Forecasting provides a roadmap for future financial success.

These facets of financial analysis, applied to data from the law firm income statement template, provide a comprehensive understanding of a firm’s financial health. This analysis empowers firms to identify areas for improvement, optimize resource allocation, make informed strategic decisions, and ultimately achieve financial sustainability and growth. The insights derived from financial analysis inform both short-term tactical adjustments and long-term strategic planning, contributing to a more robust and resilient legal practice.

Key Components of a Law Firm Income Statement Template

A well-structured income statement template provides a clear and comprehensive overview of a law firm’s financial performance. Understanding the key components is crucial for effective financial management and informed decision-making.

1. Revenue: This section details all income generated by the firm, including billable hours, fixed fees, retainers (appropriately allocated), and contingency fees. Accurate revenue recording is fundamental to understanding financial performance.

2. Direct Expenses: Costs directly associated with client services, such as court fees, expert witness fees, and travel expenses related to specific cases, are categorized here. Tracking these expenses is essential for assessing case profitability.

3. Operating Expenses: These expenses encompass the day-to-day costs of running the firm, including salaries, rent, utilities, marketing, and professional development. Managing operating expenses is crucial for maintaining profitability.

4. Overhead Expenses: Costs not directly tied to client services but essential for firm operations, such as insurance, bar dues, and depreciation, are classified as overhead. Understanding and controlling overhead contributes to a realistic profitability assessment.

5. Net Income: This bottom-line figure represents the firm’s profit after deducting all expenses from revenue. Net income is a key indicator of overall financial health and sustainability.

6. Time Period: The income statement covers a specific reporting period, such as a month, quarter, or year. The chosen time frame provides the context for evaluating performance and identifying trends. Consistent reporting periods facilitate meaningful comparisons.

Effective financial management relies on a thorough understanding of these components within the income statement template. This structured approach facilitates insightful analysis, enabling informed decisions related to pricing, expense control, and overall business strategy. This contributes to a more accurate assessment of financial performance, fostering long-term stability and growth.

How to Create a Law Firm Income Statement Template

Creating a tailored income statement template ensures accurate financial reporting for law firms. A well-structured template facilitates performance analysis, informs strategic decisions, and promotes financial transparency.

1. Define Reporting Period: Establish a consistent reporting period (monthly, quarterly, or annually) to facilitate comparisons and trend analysis. A consistent timeframe provides a stable basis for evaluating financial performance over time.

2. Structure Revenue Categories: Categorize revenue streams, including billable hours, fixed fees, retainers (appropriately allocated), and contingency fees. Clear revenue categorization ensures accurate income tracking and analysis by practice area or service type.

3. Outline Expense Categories: Establish clear expense categories, including direct expenses (e.g., court fees, expert witness fees), operating expenses (e.g., salaries, rent, marketing), and overhead expenses (e.g., insurance, professional dues). Detailed expense categorization enables cost management and profitability analysis.

4. Calculate Gross Profit: Deduct the cost of services (direct expenses) from revenues to determine gross profit. Gross profit analysis provides insights into the profitability of core legal services.

5. Calculate Operating Income: Subtract operating expenses from gross profit to arrive at operating income. Operating income reflects profitability before considering non-operating income and expenses.

6. Calculate Net Income: Deduct all remaining expenses, including overhead and any non-operating expenses, from operating income to determine net income. Net income represents the firm’s bottom line, indicating overall profitability.

7. Format for Clarity: Present the information in a clear, organized format using a standardized structure. This ensures readability and facilitates analysis. A well-formatted template enhances understanding and promotes transparency.

A comprehensive income statement template, encompassing these elements, provides a structured view of a law firm’s financial performance. This organized approach allows for in-depth analysis, informed decision-making, and effective financial management, contributing to long-term stability and growth. Regular review and analysis of the income statement are crucial for monitoring financial health, identifying trends, and adapting strategies to achieve financial objectives.

Effective financial management is crucial for the sustained success of any legal practice. A law firm income statement template provides the framework for organizing revenue and expenses, enabling a clear understanding of profitability and operational efficiency. Consistent use of a standardized template, coupled with thorough financial analysis, empowers informed decision-making regarding pricing strategies, cost optimization, and resource allocation. Accurate and detailed financial reporting, facilitated by a well-structured template, provides the foundation for data-driven insights and strategic planning.

By prioritizing meticulous financial record-keeping and leveraging the insights derived from a comprehensive income statement, law firms can enhance their financial health, optimize resource allocation, and position themselves for long-term growth and stability in a competitive legal landscape. Continuous monitoring and analysis of financial performance are essential for adapting to evolving market dynamics and achieving sustained success.