Utilizing such a form offers numerous advantages. It promotes transparency and clarity in payroll processes, enabling employees to readily understand their compensation. This accessibility can reduce payroll-related inquiries and disputes. Furthermore, these forms are invaluable for budgeting, tax filing, loan applications, and other financial planning activities. Standardized documentation also aids in record-keeping and simplifies audits for employers.

This foundational understanding of such documentation allows for a deeper exploration of related topics, including payroll best practices, legal compliance, and strategies for optimizing compensation and benefits administration.

1. Standardized Format

Standardized formatting within leave and earnings statements promotes clarity, simplifies interpretation, and ensures consistency across all employee records. This structured approach streamlines payroll processes and reduces the likelihood of misunderstandings. Consistent presentation of information allows employees to quickly locate and understand their compensation and leave accrual details.

- Consistent Placement of InformationKey data points, such as gross pay, deductions, net pay, and leave balances, consistently appear in designated sections of the statement. This predictability allows employees to readily locate the information they need. For example, placing net pay consistently in the bottom right corner facilitates quick identification.

- Uniform TerminologyUsing standardized terminology ensures consistent language across all statements. This clarity minimizes confusion arising from varying terms for the same concept. For instance, consistently using “Gross Pay” instead of interchanging it with “Total Earnings” or “Pre-Tax Earnings” improves comprehension.

- Date Formatting and PresentationConsistent date formats eliminate ambiguity and facilitate record-keeping. Clear presentation of the pay period covered by the statement is essential for accurate tracking. For example, using YYYY-MM-DD format for all dates prevents misinterpretation.

- Clear Visual HierarchyUtilizing clear headings, subheadings, and visual separators, like lines or spacing, organizes information logically and improves readability. This structured presentation allows employees to easily differentiate between sections, such as earnings, deductions, and leave accruals.

These elements of standardized formatting contribute significantly to the efficacy of leave and earnings statements. A well-structured format ensures ease of use, promotes transparency, and facilitates efficient record-keeping for both employers and employees. This consistency also simplifies integration with payroll software and other financial systems.

2. Accurate Calculations

Precision in calculations forms the bedrock of a reliable leave and earnings statement template. Errors in these calculations can have significant financial and legal ramifications for both employers and employees. Accuracy ensures compliance with regulations, builds trust, and mitigates potential disputes. The following facets underscore the importance of accurate calculations:

- Gross Pay CalculationAccurate calculation of gross pay, encompassing regular wages, overtime, bonuses, and commissions, is paramount. Inaccurate gross pay figures cascade through subsequent calculations, affecting net pay, tax withholdings, and benefit contributions. For instance, miscalculating overtime hours can lead to underpayment, potentially resulting in legal issues and employee dissatisfaction.

- Deduction AccuracyPrecise calculation of deductions, including taxes (federal, state, local), social security, Medicare, insurance premiums, and retirement contributions, is crucial. Errors in deductions can impact an employee’s take-home pay and tax liabilities. For example, incorrect tax withholding can lead to penalties or unexpected tax bills.

- Leave Accrual PrecisionAccurate tracking and calculation of leave accrual, including vacation, sick leave, and other paid time off, are essential for both employee planning and compliance with company policies and legal requirements. Errors can disrupt employee scheduling, impact benefit costs, and potentially lead to disputes. For instance, inaccurate sick leave accrual can create issues when an employee needs to take time off for illness.

- Net Pay DeterminationNet pay, the final amount received by the employee, relies on the accuracy of all preceding calculations. Any errors in gross pay, deductions, or leave accrual will directly affect the net pay figure. Inaccurate net pay can lead to financial difficulties for employees and damage the employer’s reputation.

The accuracy of these calculations is fundamental to the integrity and reliability of the leave and earnings statement template. Maintaining precision in these areas ensures compliance, fosters trust between employers and employees, and minimizes the risk of financial and legal complications. This rigorous approach to accuracy further supports effective financial planning and analysis for both the individual and the organization.

3. Clear Presentation

Clear presentation within a leave and earnings statement template is paramount for ensuring effortless comprehension of complex financial information. A well-structured and visually accessible format empowers employees to quickly grasp their compensation details, minimizing confusion and promoting financial awareness. This clarity also facilitates efficient record-keeping and supports informed financial decision-making.

- Logical Flow of InformationPresenting information in a logical sequence, typically starting with gross pay and progressing through deductions to arrive at net pay, enhances understanding. This structured approach mirrors the actual payroll calculation process, making it intuitive and easy to follow. For instance, presenting earnings before deductions allows employees to understand how their net pay is derived.

- Visual Cues and GroupingUtilizing visual cues, such as headings, subheadings, bolding, and spacing, effectively groups related information and improves readability. Clear visual separation between sections, like earnings, deductions, and leave accrual, prevents information overload and facilitates quick access to specific details. For example, grouping all tax-related deductions together simplifies tax filing.

- Concise Language and TerminologyEmploying concise and readily understandable language, avoiding technical jargon or complex terminology, ensures accessibility for all employees, regardless of their financial literacy. Clear definitions of terms, where necessary, further enhance comprehension. For instance, using “Overtime Pay” instead of a more technical term ensures clarity.

- Accessibility ConsiderationsConsidering accessibility requirements, such as font size, color contrast, and screen reader compatibility for digital formats, ensures inclusivity and equal access to information for all employees. Providing alternative formats, like large print or braille, further supports accessibility needs. This inclusivity demonstrates a commitment to providing equitable access to crucial information.

These elements of clear presentation contribute significantly to the overall effectiveness of a leave and earnings statement template. A well-designed format empowers employees with the ability to understand their compensation, fostering transparency and trust. This clarity also streamlines record-keeping processes and supports informed financial planning for employees, enhancing their overall financial well-being.

4. Data Security

Data security is paramount when handling sensitive employee information within leave and earnings statement templates. These documents contain personally identifiable information (PII) and financial details, making robust security measures essential for compliance with data privacy regulations and for maintaining employee trust. Protecting this information from unauthorized access, use, disclosure, disruption, modification, or destruction is crucial for mitigating risks and ensuring the integrity of payroll processes.

- Access ControlImplementing strict access controls limits access to sensitive data to authorized personnel only. Role-based access control (RBAC) ensures that individuals can only access information relevant to their job function. For example, only payroll staff should have access to complete leave and earnings statement data, while individual employees should only access their own statements. This minimizes the risk of unauthorized data viewing or manipulation.

- Data EncryptionEncrypting data, both in transit and at rest, safeguards information from unauthorized access even if a security breach occurs. Encryption transforms data into an unreadable format, requiring a decryption key for access. For instance, encrypting data transmitted between payroll systems and employee portals protects sensitive information during transfer. Encrypting stored data protects against data breaches.

- Secure Storage and RetentionStoring leave and earnings statement data on secure servers with appropriate physical and technical safeguards protects against unauthorized access and data loss. Adhering to data retention policies ensures that data is stored only for the necessary duration, minimizing the potential impact of a data breach. For example, storing data on servers with robust firewall protection and intrusion detection systems enhances security.

- Regular Audits and MonitoringConducting regular security audits and monitoring system activity helps identify vulnerabilities and detect potential breaches. Regular reviews of access logs and security protocols help ensure the ongoing effectiveness of security measures. For instance, monitoring system access for unusual activity can help identify and mitigate potential threats quickly.

These data security measures are integral to the responsible and ethical handling of leave and earnings statement templates. Implementing robust security protocols protects sensitive employee information, maintains compliance with data privacy regulations, and fosters a culture of trust and transparency within the organization. This commitment to data security reinforces the integrity of payroll processes and safeguards the financial well-being of employees.

5. Accessibility

Accessibility in the context of leave and earnings statement templates refers to the ease with which employees can obtain, understand, and utilize these crucial documents. Ensuring accessibility is not merely a matter of convenience; it directly impacts employee engagement, financial well-being, and overall organizational transparency. Furthermore, providing accessible statements is often a legal requirement, particularly for employees with disabilities.

- Format AvailabilityOffering leave and earnings statements in multiple formats caters to diverse needs and preferences. Providing options such as printed statements, downloadable PDFs, and online access through employee portals ensures flexibility and accommodates varying technological capabilities. For example, employees without regular computer access can still receive printed statements, while those comfortable with technology can access their information online anytime. This multi-format approach enhances convenience and inclusivity.

- Clarity and SimplicityPresenting information in a clear, concise, and easily understandable manner is fundamental to accessibility. Avoiding jargon, using plain language, and structuring information logically allows employees to quickly grasp their compensation details. For example, using clear headings and subheadings, defining unfamiliar terms, and providing a summary of key figures enhances comprehension, especially for employees with limited financial literacy.

- Accessibility for Employees with DisabilitiesCompliance with accessibility standards, such as WCAG (Web Content Accessibility Guidelines), is essential for ensuring that employees with disabilities can access and understand their leave and earnings statements. This may involve providing screen reader-compatible formats, large print versions, or braille statements. For instance, ensuring online portals are navigable using keyboard-only controls allows employees with visual impairments to access their information independently. This inclusivity reflects a commitment to equitable access for all employees.

- Timely and Reliable AccessProviding timely and reliable access to leave and earnings statements is a crucial aspect of accessibility. Ensuring statements are available on a predictable schedule, such as on a specific day each pay period, or on demand through an online portal, empowers employees to manage their finances effectively. Reliable access minimizes anxiety and uncertainty, allowing employees to access their financial information when needed. This predictability supports responsible financial planning and contributes to a positive employee experience.

These facets of accessibility underscore the importance of considering the diverse needs of employees when designing and distributing leave and earnings statements. By prioritizing accessibility, organizations demonstrate a commitment to transparency, inclusivity, and employee well-being. Accessible statements empower employees to understand their compensation, make informed financial decisions, and contribute to a more positive and productive work environment. This commitment to accessibility further strengthens the relationship between employer and employee.

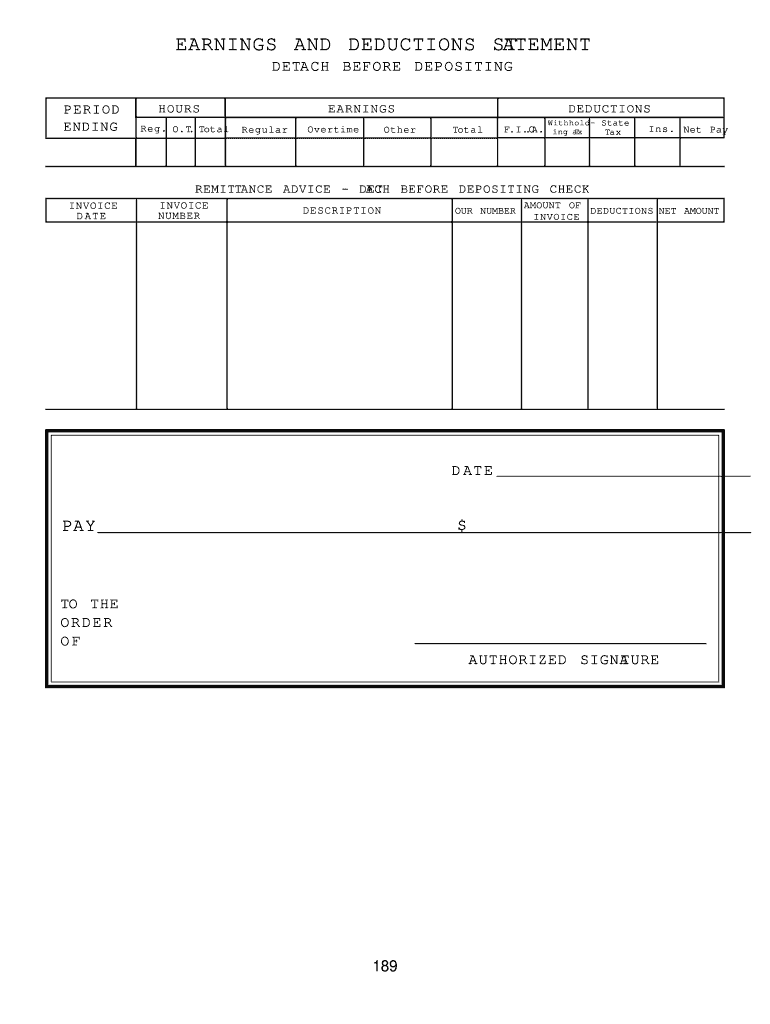

Key Components of a Leave and Earnings Statement Template

A comprehensive leave and earnings statement template provides essential information regarding employee compensation and accrued time off. Several key components ensure clarity, accuracy, and legal compliance.

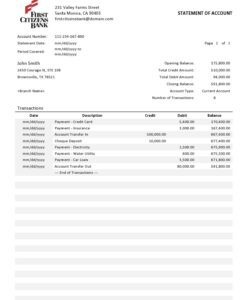

1. Employee Information: This section identifies the employee and employer. Accurate employee identification is crucial for record-keeping and payroll processing. Inclusion of employee name, address, and identification number ensures proper allocation of earnings and deductions.

2. Pay Period: Clear indication of the pay period covered by the statement is essential for accurate tracking and reconciliation. Precise date ranges prevent confusion and facilitate accurate record-keeping.

3. Earnings Breakdown: Detailed presentation of earnings components, including regular wages, overtime pay, bonuses, and commissions, provides transparency and allows for verification of compensation. Clear categorization of earnings facilitates understanding and budgeting.

4. Deductions Summary: Itemized deductions, such as taxes (federal, state, local), social security, Medicare, insurance premiums, and retirement contributions, provide a comprehensive view of withholdings. Accurate deduction calculations are crucial for compliance and financial planning.

5. Net Pay: The net pay, representing the final amount received by the employee after all deductions, is a critical element of the statement. Accurate calculation of net pay is essential for financial planning and budgeting.

6. Leave Accrual and Balances: Information regarding accrued vacation time, sick leave, and other paid time off empowers employees to manage their time off effectively. Accurate tracking and reporting of leave balances facilitate workforce planning and ensure compliance with company policies and legal requirements.

7. Year-to-Date Information: Cumulative year-to-date figures for earnings and deductions provide a valuable overview of compensation and tax withholdings throughout the year. This information is crucial for tax filing and financial planning.

8. Employer Contact Information: Inclusion of employer contact information, such as address, phone number, and email address, facilitates communication regarding payroll inquiries or discrepancies. Accessible contact information promotes transparency and supports efficient resolution of any payroll-related concerns.

These components, working in concert, form a robust and informative leave and earnings statement template. Accurate and accessible information empowers employees to manage their finances effectively, while simultaneously supporting employers in maintaining accurate payroll records and ensuring compliance with relevant regulations. This comprehensive approach fosters transparency and trust within the employer-employee relationship.

How to Create a Leave and Earnings Statement Template

Creating a comprehensive and compliant leave and earnings statement template requires careful consideration of various elements. A well-designed template ensures clarity, accuracy, and promotes transparency in payroll processes.

1. Define Template Objectives: Clearly outline the specific information to be included and the intended audience. Consider legal requirements, company policies, and employee needs when defining objectives. A focused approach ensures the template meets specific requirements.

2. Select a Format: Choose a formatdigital spreadsheet, word processing document, or dedicated payroll softwarebased on organizational needs and resources. Digital formats offer flexibility and automation, while printed formats provide physical records.

3. Structure Key Components: Organize essential elements logically, including employee information, pay period, earnings breakdown, deductions summary, net pay, leave accrual, year-to-date totals, and employer contact details. Logical structuring facilitates comprehension and efficient processing.

4. Ensure Accurate Calculations: Implement formulas and automated calculations for gross pay, deductions, and net pay to minimize errors and ensure compliance. Accuracy in calculations is paramount for maintaining trust and meeting legal obligations.

5. Prioritize Clarity and Readability: Utilize clear headings, subheadings, consistent formatting, and concise language for easy comprehension. Visual clarity improves accessibility and minimizes confusion.

6. Implement Security Measures: Incorporate data security measures, such as access controls and encryption, to protect sensitive employee information. Data security is crucial for compliance with privacy regulations and maintaining employee trust.

7. Test and Refine: Thoroughly test the template with sample data to identify and rectify any errors or inconsistencies. Testing ensures accuracy and functionality before implementation.

8. Maintain Compliance: Regularly review and update the template to reflect changes in tax laws, regulations, or company policies. Ongoing maintenance ensures compliance and accuracy over time.

A well-designed leave and earnings statement template provides a clear and accurate record of employee compensation and leave accrual, promoting transparency and facilitating informed financial decisions. Regular review and updates ensure the template remains compliant with evolving regulations and best practices.

Accurate, accessible, and secure leave and earnings statement templates are critical for transparent and compliant payroll practices. Standardized formatting, precise calculations, and clear presentation ensure employees readily understand their compensation, fostering trust and minimizing disputes. Robust data security protects sensitive information, while accessible formats empower informed financial decision-making. Effective implementation and ongoing maintenance of these templates contribute significantly to a positive employer-employee relationship and efficient organizational operations.

Organizations must prioritize the development and maintenance of robust leave and earnings statement templates to meet evolving legal requirements, technological advancements, and employee expectations. This proactive approach strengthens financial transparency, promotes employee well-being, and mitigates potential risks, contributing to a more equitable and efficient workplace. Continual evaluation and refinement of these practices will remain essential for organizations seeking to optimize payroll processes and foster a positive work environment.