A well-designed structure offers several advantages. It enables efficient tracking of income and expenses, aids in budgeting and financial planning, simplifies reconciliation with other financial records, and provides a clear overview of account activity for personal or business use. This can be particularly helpful for loan applications, visa applications, or any situation requiring proof of funds or consistent financial management.

Understanding the structure and purpose of such a document is crucial for effective financial management. The following sections will explore various aspects of creating and utilizing these standardized financial summaries, including best practices, different software options, and specific use cases.

1. Accurate Data Entry

Accurate data entry forms the bedrock of a reliable bank statement template. Errors in recording transaction details, such as amounts, dates, or descriptions, can have cascading effects, leading to discrepancies in the closing balance and misrepresenting the actual financial position. A template, while providing a standardized structure, cannot correct inherent data inaccuracies. For instance, entering an incorrect deposit amount will result in an inflated balance, regardless of the template’s formatting or calculation functionalities. This highlights the crucial role of meticulous data entry in ensuring the template’s effectiveness.

Consider a scenario where a business uses a template to track expenses. Inaccurately entering a supplier payment, even by a small margin, can lead to errors in budget forecasting and financial reporting. Over time, these seemingly minor discrepancies can accumulate, significantly impacting the overall financial picture. Similarly, in personal finance, incorrect entry of regular payments, such as mortgage or utility bills, can lead to inaccurate budget calculations and potentially overdraft fees. Therefore, ensuring the accuracy of every data point entered into the template is paramount.

Data accuracy, therefore, precedes the benefits offered by a standardized template. While a template provides the framework for organized financial record-keeping, its value is directly tied to the quality of data it contains. Addressing potential sources of data entry errors, such as manual typos or incorrect data sources, through validation checks and careful review processes is crucial. Understanding this relationship strengthens the integrity of financial records and ensures the reliability of any financial analysis based on the templated data.

2. Clear Date Formatting

Clear date formatting is essential for the efficacy of a bank statement template. A standardized date format eliminates ambiguity and facilitates accurate chronological sorting and analysis of transactions. Inconsistent or unclear date formats can hinder the ability to track financial activity over time, impacting reporting and analysis. Imagine a template containing dates presented in multiple formats (e.g., MM/DD/YYYY, DD/MM/YYYY, YYYY-MM-DD). This inconsistency complicates sorting and makes it difficult to identify transactions within specific periods, potentially leading to errors in financial reporting or analysis. A standardized format, consistently applied, ensures clarity and prevents such issues.

Consistent date presentation also plays a critical role in integrating the data with other financial tools or software. Many accounting and financial analysis applications rely on standardized date formats for import and processing. Using a consistent format in the template ensures seamless data transfer and compatibility, avoiding potential data conversion issues or errors during analysis. For example, using a format like YYYY-MM-DD allows for easy sorting and compatibility with various software, whereas a format like January 1st, 2024, while readable, could present compatibility challenges. This interoperability is crucial for maximizing the utility of the data contained within the template.

In summary, clear and consistent date formatting within a bank statement template significantly enhances data clarity, facilitates analysis, and ensures compatibility with other financial systems. Addressing potential formatting ambiguities through the consistent application of a standardized date representation improves data integrity and supports robust financial management. This reinforces the importance of clear date formatting as a fundamental component of a well-designed bank statement template.

3. Consistent Transaction Descriptions

Consistent transaction descriptions are crucial for maximizing the utility of a bank statement template. Clear, concise, and standardized descriptions provide immediate context for each transaction, facilitating efficient review and analysis. Vague or inconsistent descriptions can obscure the nature of transactions, hindering the ability to understand spending patterns, identify specific payments, or reconcile the statement with other financial records. For example, a description like “Online Transfer” provides minimal information, whereas “Online Transfer to Utility Company – Account #12345” offers significantly more clarity. This level of detail facilitates accurate categorization, analysis, and reconciliation.

Standardized descriptions also contribute to effective searching and filtering of transactions within the template. Consistent terminology allows for quick identification of specific transaction types using search functions or filters. This is particularly valuable when dealing with large volumes of transactions or when attempting to isolate specific payment categories for analysis. Imagine trying to analyze monthly spending on groceries. Consistent descriptions like “Grocery Purchase – Store A” and “Grocery Purchase – Store B” allow for easy filtering and aggregation of grocery expenses, whereas inconsistent descriptions like “Groceries,” “Food,” or “Supermarket” complicate this process. This demonstrates the practical value of standardized descriptions in facilitating efficient data analysis.

In summary, consistent transaction descriptions contribute significantly to the clarity, searchability, and analytical value of a bank statement template. Implementing a standardized approach to transaction descriptions, emphasizing clarity and consistency, enhances the overall usability of the template and strengthens its role as a robust financial management tool. This reinforces the importance of detailed, standardized transaction descriptions as a key component of a well-designed and informative bank statement template.

4. Correct Balance Calculations

Correct balance calculations are fundamental to the integrity and reliability of a bank statement template. The accuracy of the running balance, reflecting the cumulative effect of all transactions, is crucial for understanding one’s financial position. Errors in balance calculations can lead to misinformed financial decisions, inaccurate budgeting, and potential overdrafts. A template’s efficacy relies heavily on its ability to accurately compute and display the running balance after each transaction. Consider a scenario where a deposit is incorrectly added to the balance. This error will propagate through subsequent calculations, resulting in an inaccurate closing balance and a distorted view of the account’s actual financial status. The ripple effect of a single miscalculation underscores the critical importance of accuracy in balance computations.

The reliability of a bank statement template as a financial management tool hinges on the precision of its balance calculations. Individuals and businesses rely on these calculations to make informed decisions regarding spending, saving, and investment. An inaccurate balance can lead to overspending, missed investment opportunities, or inadequate financial planning. For instance, a business relying on an incorrectly calculated balance might overestimate its available funds and commit to expenditures it cannot afford, potentially leading to financial difficulties. Similarly, an individual might misjudge their savings progress based on an inflated balance, hindering their ability to reach financial goals. These practical implications highlight the crucial role of correct balance calculations in sound financial management.

In conclusion, accurate balance calculations are not merely a technical aspect of a bank statement template but a cornerstone of its value as a financial tool. Errors in these calculations can have significant repercussions, impacting financial decisions and undermining the reliability of the entire statement. Ensuring the accuracy of balance calculations through robust formulas and thorough validation is essential for maintaining the integrity of financial records and supporting informed financial management. This underscores the critical connection between correct balance calculations and the overall effectiveness of a bank statement template.

5. Professional Layout

A professional layout is a critical aspect of a well-designed bank statement template. It directly impacts readability, comprehension, and the overall credibility of the financial document. A clear and organized presentation of information ensures that the data is easily accessible and understandable, facilitating efficient review and analysis.

- Clear Visual HierarchyA clear visual hierarchy guides the reader’s eye through the information, prioritizing key elements such as dates, descriptions, and balances. This can be achieved through the use of headings, subheadings, font variations (bold, italics), and strategic spacing. For instance, clearly distinguishing the account holder’s information, statement period, and opening/closing balances from individual transactions enhances readability. A cluttered or poorly organized layout, on the other hand, can make it difficult to locate specific information quickly, hindering efficient analysis.

- Consistent FormattingConsistent formatting ensures uniformity throughout the document. This includes consistent font styles, sizes, and spacing for different data fields. For example, using a consistent font for all transaction descriptions and a separate, distinct font for balance figures promotes clarity and visual separation. Inconsistent formatting can create visual clutter and detract from the professionalism of the document, potentially impacting its perceived credibility, particularly in formal settings like loan applications.

- Effective Use of White SpaceStrategic use of white space, or negative space, prevents the document from appearing crowded and overwhelming. Sufficient spacing between rows, columns, and sections improves readability and allows the reader to process information more easily. A densely packed layout can be visually fatiguing and make it difficult to distinguish individual transactions, especially in statements covering numerous entries. Adequate white space contributes to a cleaner, more professional appearance and enhances the overall user experience.

- Logical Grouping of InformationLogical grouping of information enhances comprehension and facilitates efficient analysis. Related data points, such as date, description, and amount for each transaction, should be grouped together visually. For example, presenting each transaction as a distinct row with clearly defined columns for each data point allows for quick scanning and comparison. A layout that scatters related information can make it difficult to interpret individual transactions and understand the overall flow of financial activity.

These elements of professional layout contribute significantly to the usability and credibility of a bank statement template. A well-designed layout transforms raw financial data into an easily digestible and informative document, facilitating informed financial management. Whether for personal budgeting, business accounting, or formal financial reporting, a professional layout enhances the value and effectiveness of the bank statement.

6. Customizable Fields

Customizable fields are integral to maximizing the utility of a bank statement template. Adaptability to specific needs ensures relevance across diverse financial contexts. A generic template may lack the nuanced detail required for specialized tracking or reporting. Customizable fields address this limitation by allowing users to tailor the template to capture specific data points relevant to their individual or organizational requirements. This flexibility transforms a standardized document into a personalized financial management tool.

Consider a freelancer tracking project-based income. Customizable fields within their bank statement template could include “Project Name” and “Client.” This allows for clear association of income with specific projects, facilitating project profitability analysis and client-based reporting. Similarly, a small business might add fields for “Department” and “Cost Center” to categorize expenses for internal accounting purposes. These examples illustrate the practical value of customizable fields in tailoring the template to specific financial tracking needs.

The ability to incorporate user-defined fields significantly enhances the analytical capabilities of a bank statement template. Aggregated data within these custom fields can provide valuable insights into financial performance, enabling informed decision-making. Without customizable fields, extracting such granular insights would require manual data manipulation and analysis, increasing complexity and the risk of errors. The ability to tailor data capture directly within the template streamlines analysis and improves the efficiency of financial reporting and management.

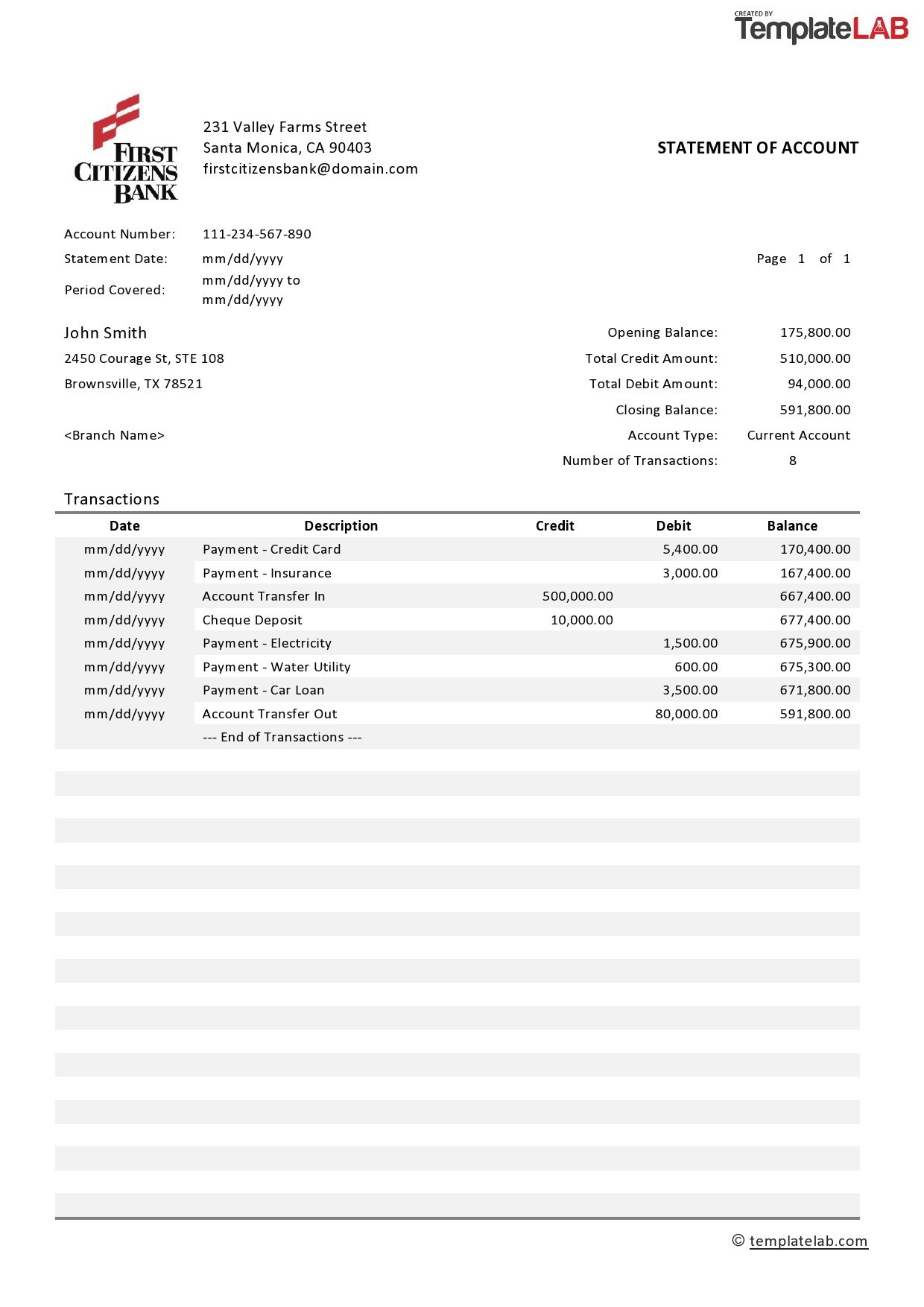

Key Components of a Bank Statement Template

Several key components contribute to a well-structured and informative bank statement template. Understanding these elements is crucial for creating a document that effectively captures and presents financial data.

1. Account Information: Clear identification of the account holder and account number is essential. This information anchors the statement and provides context for the transactional data.

2. Statement Period: A defined statement period (e.g., monthly, quarterly) specifies the timeframe covered by the document. This is crucial for tracking finances over specific durations.

3. Opening and Closing Balances: The opening balance establishes the starting point for the period, while the closing balance reflects the net effect of all transactions. These figures provide a snapshot of the account’s financial status.

4. Transaction Details: Each transaction requires detailed information, including date, description, and amount. Clear and consistent formatting of these details is vital for readability and analysis.

5. Running Balance: The running balance, updated after each transaction, provides a continuous view of the account’s balance throughout the statement period. This allows for tracking the cumulative impact of transactions.

6. Transaction Types: Clear differentiation between credits (deposits, incoming funds) and debits (withdrawals, outgoing funds) is essential for accurate financial representation. Visual cues, such as distinct columns or color coding, can enhance clarity.

7. Summary Information (Optional): Summary sections can provide aggregated information, such as total deposits and withdrawals for the period. This can facilitate quick analysis of overall financial activity.

These components work together to provide a comprehensive and informative overview of financial activity within a given period. Accurate data entry, consistent formatting, and clear presentation of these elements ensure the template’s effectiveness as a financial management tool.

How to Create a Bank Statement Template

Creating a bank statement template requires careful consideration of several key elements to ensure accuracy, clarity, and utility. The following steps outline the process of developing a robust and effective template.

1. Define the Purpose: Clarify the intended use of the template. A template for personal budgeting will differ from one used for business accounting or loan applications. Defining the purpose informs the structure and content of the template.

2. Choose a Software Tool: Select appropriate software for creating the template. Spreadsheet software (e.g., Microsoft Excel, Google Sheets) offers flexibility and formula capabilities for calculations. Word processing software or dedicated template creation tools can also be suitable.

3. Structure the Layout: Design a clear and organized layout, incorporating essential components such as account information, statement period, opening/closing balances, transaction details, and a running balance column. Consider using distinct sections and visual cues (e.g., borders, shading) to enhance readability.

4. Implement Formulas for Calculations: For spreadsheet-based templates, implement formulas to automatically calculate the running balance after each transaction. This ensures accuracy and eliminates manual calculation errors.

5. Incorporate Customizable Fields: Add customizable fields to capture specific data points relevant to the intended use. These fields enhance the template’s adaptability to various financial tracking needs.

6. Ensure Data Validation: Incorporate data validation rules to minimize data entry errors. For example, restricting entry formats for dates or amounts can prevent inconsistencies and improve data integrity.

7. Test and Refine: Thoroughly test the template with sample data to ensure accurate calculations and identify any formatting or usability issues. Refine the template based on testing results.

8. Document Usage Instructions (Optional): Create clear instructions for using the template, including data entry guidelines and any specific functionalities. This facilitates consistent and accurate usage by others.

A well-designed template provides a structured framework for recording and analyzing financial activity. Careful planning and implementation of these steps ensure the template’s effectiveness and contribute to sound financial management.

Development of a standardized financial document provides a structured approach to managing financial records. Key considerations include accurate data entry, consistent formatting of dates and transaction descriptions, precise balance calculations, a professional layout for enhanced readability, and the flexibility of customizable fields for specific tracking requirements. Understanding and implementing these elements ensures the creation of a robust and effective tool for financial management.

Effective financial management hinges on reliable and accessible financial data. A well-designed template empowers individuals and organizations to gain a clear understanding of their financial position, enabling informed decision-making, accurate reporting, and ultimately, greater financial control. Leveraging the power of structured financial records contributes to long-term financial stability and success.