Utilizing such a framework allows for better control over finances, facilitating informed decisions about budgeting, saving, and spending. It helps identify areas of overspending and potential savings opportunities, promoting financial stability and goal achievement. Regular tracking also provides valuable historical data for future financial planning and analysis.

This understanding of financial tracking lays the groundwork for exploring related topics, such as budgeting methods, expense management strategies, and financial planning tools. It also highlights the importance of accurate record-keeping for informed decision-making and financial well-being.

1. Categorized Income

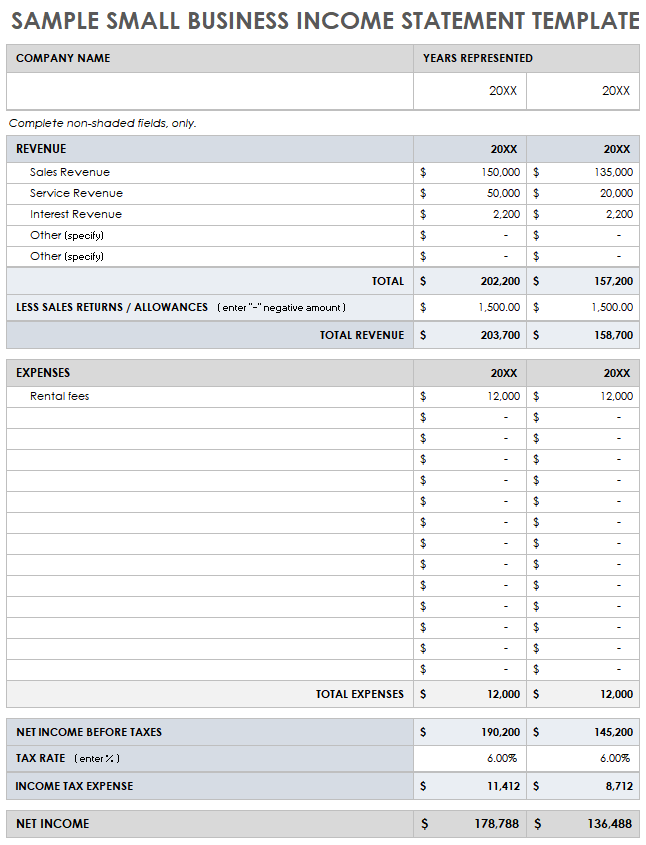

Categorization of income streams within a structured tracking document provides crucial granularity for financial analysis. Distinguishing between various sourcessalary, investment returns, rental income, side hustles, etc.allows for a more nuanced understanding of overall financial health. This detailed breakdown enables users to identify the stability and growth potential of each income stream, facilitating more informed financial decisions. For instance, understanding the proportion of income derived from a primary salary versus a freelance project informs decisions about budgeting and risk assessment.

This granular approach to income tracking offers several advantages. It enables accurate assessment of reliance on specific income sources, highlighting potential vulnerabilities and opportunities for diversification. It allows for targeted savings strategies, where specific income streams can be allocated towards different financial goals. Furthermore, categorized income data simplifies tax reporting and provides a clearer picture of financial progress. For example, tracking investment income separately allows for accurate calculation of capital gains and facilitates informed investment decisions.

In summary, categorized income is not merely a component of a financial tracking document, but a cornerstone of effective financial management. It empowers individuals and businesses to understand their financial landscape in detail, identify areas for improvement, and make data-driven decisions to achieve their financial goals. Challenges may arise in accurately classifying income sources, especially with diversified income streams. However, the long-term benefits of clear categorization outweigh the initial effort, contributing significantly to financial clarity and stability. This practice ultimately strengthens the overall utility of financial tracking as a tool for informed financial decision-making.

2. Itemized Expenses

A comprehensive understanding of financial health necessitates meticulous tracking of expenditures. Itemized expenses, a crucial component of a structured financial tracking document, provide this granular detail. Instead of simply noting aggregate spending, itemization breaks down expenditures into specific categories: housing, transportation, food, utilities, entertainment, and so forth. This detailed breakdown allows for a clear view of where funds are allocated, revealing spending patterns and potential areas for adjustment. For example, a high percentage of spending allocated to dining out might prompt a reevaluation of food budgeting and meal planning.

The cause-and-effect relationship between itemized expenses and informed financial decisions is significant. Detailed expense tracking facilitates identification of spending leaks and areas of potential savings. This, in turn, allows for proactive budget adjustments and the development of more effective financial strategies. Consider the example of someone tracking transportation expenses. Itemizing costs associated with vehicle maintenance, fuel, public transit, and ride-sharing services can reveal opportunities to reduce spending by opting for more cost-effective transportation methods or consolidating trips.

In summary, itemized expenses are not merely a list of costs, but a powerful tool for financial analysis and control. The practice of itemization provides actionable insights into spending habits, empowers informed decision-making, and ultimately contributes to greater financial stability. While the process of itemizing every expense might initially seem tedious, the long-term benefits of increased financial awareness and control significantly outweigh the effort. This practice forms a cornerstone of effective financial management, providing the necessary foundation for building a sustainable financial future. Understanding this connection underscores the importance of accurate and detailed expense tracking within the broader context of financial planning.

3. Regular Tracking

Regular tracking forms the cornerstone of effective utilization of a structured financial document. Consistency in recording income and expenses, ideally on a monthly basis, provides a dynamic view of financial health. This ongoing process allows for the identification of trends, the early detection of potential financial imbalances, and the ability to adapt to changing financial circumstances. For instance, consistently increasing utility costs might prompt an investigation into energy efficiency or rate comparisons. Without regular tracking, such trends could go unnoticed, potentially leading to larger financial concerns.

The cause-and-effect relationship between regular tracking and informed financial management is undeniable. Consistent data collection empowers proactive decision-making. A clear understanding of monthly cash flow facilitates informed adjustments to spending habits, savings goals, and investment strategies. Consider the example of someone saving for a down payment on a house. Regular tracking allows them to monitor progress towards their goal, adjust savings contributions as needed, and make informed decisions about potential investment opportunities to accelerate progress. The absence of regular tracking would significantly hinder this process, potentially delaying or jeopardizing the achievement of the financial goal.

In summary, regular tracking is not merely a procedural component of financial management, but a critical driver of financial success. The discipline of consistent data entry translates into actionable insights, empowering informed financial decisions and contributing to long-term financial stability. While the task might require dedicated effort, the benefits of enhanced financial awareness and control significantly outweigh the investment of time. This practice enables individuals and businesses to not only react to financial changes but to anticipate and proactively manage them, fostering a stronger sense of financial security and control. This understanding reinforces the crucial role of regular tracking within a comprehensive financial management strategy.

4. Calculated Net Difference

The calculated net difference, representing the disparity between total income and total expenses, forms the core output of a structured financial tracking document. This key figure provides a concise snapshot of financial health within a given period, typically a month. Understanding this difference is essential for assessing financial stability, informing budgeting decisions, and planning for future financial goals.

- Surplus/Deficit IndicationThe net difference clearly indicates whether a surplus (income exceeds expenses) or a deficit (expenses exceed income) exists. A surplus suggests positive cash flow, offering opportunities for saving, investing, or debt reduction. Conversely, a deficit signals a need for budget adjustments, increased income generation, or a combination of both. For example, a consistent monthly surplus allows for contributions to an emergency fund, while a recurring deficit necessitates a review of spending habits and potential budget cuts.

- Budgetary Control MechanismThe calculated net difference serves as a control mechanism, providing feedback on the effectiveness of budgetary practices. Tracking this figure over time reveals the impact of budgetary adjustments and spending decisions. A consistent positive trend in the net difference, following budget adjustments, indicates effective financial management. Conversely, a stagnant or worsening net difference despite budgetary changes necessitates further analysis and potential revisions to the budget. For instance, reducing discretionary spending should ideally result in an increased net difference, providing quantifiable feedback on the effectiveness of the budget changes.

- Financial Goal Planning ToolThe net difference plays a critical role in financial goal planning. Understanding available surplus funds allows for realistic goal setting and the development of effective savings and investment strategies. For example, a consistent monthly surplus of $500 can be allocated towards a down payment on a house, allowing for the calculation of a realistic timeline for achieving that goal. Without a clear understanding of the net difference, financial goal planning becomes significantly more challenging and potentially less effective.

- Financial Health IndicatorTracking the net difference over time provides a valuable longitudinal view of financial health. Consistent surpluses suggest increasing financial stability, while recurring deficits may indicate underlying financial challenges requiring attention. For instance, a trend of decreasing net difference, even with consistent income, could signal creeping expenses or lifestyle inflation, necessitating a thorough review of spending habits and budget adjustments.

In conclusion, the calculated net difference derived from a structured financial document provides a critical foundation for informed financial decision-making. It not only reveals the current financial status but also empowers individuals and businesses to track progress, adjust strategies, and ultimately achieve their financial goals. Understanding the implications of this key figure is essential for anyone seeking to take control of their finances and build a secure financial future. The calculated net difference, therefore, serves as a powerful tool for enhancing financial awareness and promoting long-term financial well-being.

5. Financial Analysis

Financial analysis transforms data from a monthly income and expenditure statement template into actionable insights. This analytical process provides a deeper understanding of financial health, enabling informed decisions and effective financial management. Examining trends, identifying areas for improvement, and projecting future financial outcomes are key aspects of this crucial process.

- Trend IdentificationAnalyzing historical data from the statement reveals spending and earning patterns over time. Identifying increasing or decreasing trends in specific categories, such as rising housing costs or declining discretionary spending, allows for proactive adjustments to budgets and financial strategies. For example, a consistent upward trend in entertainment expenses may prompt a reevaluation of leisure activities and spending habits. Recognizing these trends enables informed decisions about resource allocation and future planning.

- Performance EvaluationFinancial analysis facilitates evaluation of the effectiveness of current financial strategies. Comparing actual spending against budgeted amounts reveals areas of overspending or underspending, providing valuable feedback on budget accuracy and adherence. For instance, consistently exceeding the allocated budget for groceries might indicate the need for revised meal planning or adjusted budgetary allocations. This evaluation process allows for ongoing refinement of financial management techniques.

- Goal-Oriented PlanningFinancial analysis supports informed financial goal setting and planning. Understanding historical income and expense patterns allows for realistic projections of future financial capacity and the development of effective strategies to achieve financial goals. For example, analyzing past savings rates and investment returns informs decisions about saving for retirement or a down payment on a house. This data-driven approach enhances the likelihood of successful goal attainment.

- Risk ManagementAnalyzing financial data helps identify and mitigate potential financial risks. Understanding the proportion of income derived from various sources, identifying fixed versus variable expenses, and assessing debt levels contribute to a comprehensive risk assessment. For example, a high reliance on a single income source represents a greater financial risk than a diversified income stream. Recognizing these risks allows for the development of mitigation strategies, such as diversifying income streams, building emergency funds, or reducing debt. This proactive approach strengthens financial resilience.

In conclusion, financial analysis elevates the monthly income and expenditure statement template from a simple record-keeping tool to a powerful instrument for financial management. By providing actionable insights into financial performance, it empowers individuals and businesses to make informed decisions, optimize resource allocation, and achieve financial goals. The analytical process, therefore, forms an indispensable component of a comprehensive financial strategy, contributing significantly to long-term financial health and stability.

Key Components of a Financial Tracking Document

Effective financial management necessitates a structured approach to tracking income and expenditures. Key components within a standardized tracking document provide the framework for comprehensive financial oversight.

1. Date: Recording the date for each entry establishes a clear timeline of financial activity. This chronological record facilitates accurate tracking of income and expenses, enabling analysis of financial trends over specific periods.

2. Description: A concise description of each transaction provides context and clarity. Detailed descriptions facilitate accurate categorization and subsequent analysis of spending patterns. For example, differentiating between “Groceries” and “Dining Out” provides more granular insights into food expenditure.

3. Income Category: Categorizing income sources (e.g., Salary, Investments, Rental Income) allows for a nuanced understanding of income streams. This categorization aids in assessing the stability and growth potential of different income sources and facilitates targeted financial strategies.

4. Income Amount: Recording the precise amount for each income entry ensures accuracy in calculating total income. This precision forms the basis for accurate net income calculations and informed financial decision-making.

5. Expense Category: Categorizing expenses (e.g., Housing, Transportation, Utilities, Groceries) enables detailed analysis of spending habits. This categorization reveals areas of potential overspending and informs budget adjustments.

6. Expense Amount: Precise recording of each expense amount ensures accurate calculation of total expenses. This precision, combined with expense categorization, provides a granular view of spending patterns and facilitates informed budget management.

7. Notes (Optional): An optional notes section allows for additional context or details regarding specific transactions. This feature enhances record-keeping clarity and provides valuable information for future reference.

Accurate and detailed record-keeping within a structured framework provides the foundation for sound financial management. This structured approach facilitates analysis, informs decision-making, and ultimately promotes financial well-being.

How to Create a Monthly Income and Expenditure Statement

Creating a structured document for tracking income and expenses provides a clear overview of financial health. The following steps outline the process of developing such a document, enabling effective financial management.

1. Choose a Format: Select a formatspreadsheet software, budgeting apps, or even a simple notebooksuitable for individual needs and preferences. Digital formats offer advantages in terms of calculations and data manipulation, while physical formats offer a tangible record.

2. Establish a Timeframe: Define a consistent tracking period, typically a month, to ensure regular and comparable data. This consistent timeframe allows for the identification of trends and facilitates accurate financial analysis.

3. Categorize Income Sources: List all anticipated income sources, categorizing them for clarity (e.g., Salary, Investments, Business Income). This categorization allows for a nuanced understanding of income streams and their relative contributions.

4. Itemize Expense Categories: Create a comprehensive list of anticipated expense categories (e.g., Housing, Transportation, Food, Utilities). Detailed categorization facilitates analysis of spending patterns and identification of potential savings opportunities.

5. Input Data Regularly: Consistently record income and expenses within the chosen format. Regular data entry, ideally daily or weekly, ensures accuracy and provides a dynamic view of financial activity.

6. Calculate Net Difference: Subtract total expenses from total income to determine the net difference. This key figure provides a snapshot of financial health within the given timeframe and informs budget adjustments.

7. Analyze and Interpret: Review the collected data regularly, analyzing trends and identifying areas for improvement. This analysis provides valuable insights into financial habits and informs future financial decisions.

8. Adapt and Refine: Based on the analysis, adjust the document and financial strategies as needed. This iterative process ensures ongoing optimization of financial management practices and alignment with financial goals.

A well-structured document facilitates informed financial decisions. Consistent tracking, accurate categorization, and regular analysis contribute significantly to effective financial management and goal attainment.

Effective financial management hinges on a clear understanding of cash flow dynamics. Utilizing a structured framework for tracking income and expenses provides the necessary foundation for informed financial decision-making. Categorizing income sources, itemizing expenses, and regularly calculating the net difference between them empowers individuals and businesses to gain control over their finances. Analyzing historical data reveals spending patterns, identifies potential savings opportunities, and facilitates the development of effective budgeting strategies. This structured approach enables proactive management of financial resources and contributes significantly to achieving financial goals.

Financial well-being is an ongoing process requiring diligent effort and informed choices. Adopting a structured approach to financial tracking provides the necessary tools for navigating the complexities of personal or business finances. The insights gained from consistent tracking and analysis empower informed decisions, leading to greater financial stability and long-term prosperity. Embracing this practice equips individuals and businesses with the knowledge and control necessary to build a secure financial future.