Regular use of such a document offers several advantages. It allows for prompt identification of potential issues, enabling proactive interventions to mitigate negative impacts. It facilitates efficient resource allocation by highlighting areas of strength and weakness. Furthermore, it serves as a valuable communication tool for stakeholders, providing transparency and demonstrating financial accountability.

Understanding the components and practical application of this financial tool is essential for effective business management. The following sections will explore the key elements, provide practical examples, and discuss best practices for its creation and utilization.

1. Revenue

Revenue, the lifeblood of any business, forms the cornerstone of a monthly profit and loss statement. Accurate revenue reporting is crucial for understanding financial performance and making informed decisions. It represents the total income generated from a company’s primary operations before deducting any expenses.

- Sales RevenueThis represents income generated from the sale of goods or services. For a retailer, this would be the total value of goods sold. For a service provider, it would be the fees earned from providing services. Accurate tracking of sales revenue is essential for assessing market demand and pricing strategies. Within the context of a monthly profit and loss statement, sales revenue is the starting point for calculating profitability.

- Other RevenueThis encompasses income generated from sources other than primary operations. Examples include interest earned on investments, rental income from owned properties, or royalties from intellectual property. While often secondary to sales revenue, other revenue streams can contribute significantly to overall profitability and should be meticulously tracked on the statement. This provides a comprehensive view of all income sources.

- Revenue RecognitionThis principle governs when revenue is recorded. Generally accepted accounting principles (GAAP) dictate that revenue should be recognized when earned, regardless of when cash is received. Understanding and applying appropriate revenue recognition principles is crucial for accurate financial reporting on the monthly statement. Misrepresenting revenue can lead to distorted profitability figures and flawed business decisions.

- Impact on ProfitabilityRevenue directly impacts profitability. Higher revenue, assuming expenses remain constant or decrease, leads to increased profit. Analyzing revenue trends within the monthly profit and loss statement provides insights into business growth, market share, and the effectiveness of sales and marketing strategies. This information is essential for making informed decisions regarding pricing, product development, and resource allocation.

By analyzing revenue streams within the context of a monthly profit and loss statement, businesses gain a comprehensive understanding of their financial performance. This understanding enables data-driven decision-making for optimizing profitability and ensuring long-term sustainability. Consistent and accurate revenue reporting provides a clear picture of financial health, allowing for proactive adjustments and informed strategic planning.

2. Expenses

A comprehensive understanding of expenses is crucial for interpreting a monthly profit and loss statement template. Accurate expense tracking and categorization provide insights into cost structures, operational efficiency, and ultimately, profitability. Analyzing expenses within this framework enables informed decision-making regarding resource allocation, cost control measures, and strategic planning.

- Cost of Goods Sold (COGS)COGS represents the direct costs associated with producing goods sold by a business. This includes raw materials, direct labor, and manufacturing overhead. For a retailer, COGS represents the purchase price of goods sold. Accurately calculating COGS is essential for determining gross profit and understanding the profitability of core business operations. Within the monthly profit and loss statement, COGS is a key determinant of overall financial performance. For example, a rising COGS relative to revenue may indicate inefficiencies in production or supply chain management.

- Operating ExpensesOperating expenses encompass the costs incurred in running the business outside of direct production or service delivery. These include rent, utilities, salaries, marketing and advertising expenses, and administrative costs. Careful monitoring of operating expenses is critical for maintaining cost efficiency and maximizing profitability. Within the context of the monthly profit and loss statement, analyzing trends in operating expenses can reveal areas for potential cost reduction and improved operational efficiency. For instance, a significant increase in marketing expenses without a corresponding rise in revenue might warrant a review of marketing strategies.

- Depreciation and AmortizationThese represent the allocation of the cost of tangible and intangible assets over their useful lives. Depreciation applies to physical assets like equipment and buildings, while amortization applies to intangible assets like patents and copyrights. Including depreciation and amortization in the monthly profit and loss statement provides a more accurate reflection of the true cost of doing business by accounting for the gradual decline in asset value. Understanding these non-cash expenses is crucial for long-term financial planning and asset replacement strategies.

- Interest ExpenseInterest expense reflects the cost of borrowing money. This includes interest paid on loans, lines of credit, and other forms of debt financing. Tracking interest expense is vital for assessing the financial burden of debt and optimizing capital structure. Within the monthly profit and loss statement, interest expense directly impacts net profit. Monitoring interest payments helps businesses evaluate the cost-effectiveness of financing decisions and identify potential opportunities for refinancing or debt reduction.

By meticulously tracking and categorizing expenses within the monthly profit and loss statement, businesses gain a comprehensive understanding of their cost structure and its impact on profitability. This detailed analysis empowers informed decision-making for cost optimization, resource allocation, and ultimately, sustained financial health. Comparing expense trends across multiple monthly statements allows for the identification of potential inefficiencies and the implementation of proactive cost control measures.

3. Profit/Loss Calculation

The core purpose of a monthly profit and loss statement template is to determine the net profit or loss for the period. This calculation provides a critical measure of financial performance, informing business decisions and strategic planning. Understanding the components and process of this calculation is fundamental to interpreting the statement effectively.

- Gross ProfitGross profit represents the difference between revenue and the cost of goods sold (COGS). This metric reflects the profitability of core business operations before considering operating expenses. For example, if a company generates $100,000 in revenue and incurs $60,000 in COGS, the gross profit is $40,000. A healthy gross profit margin is essential for covering operating expenses and generating net profit. Within the monthly profit and loss statement, gross profit provides a crucial indicator of production efficiency and pricing effectiveness.

- Operating IncomeOperating income is calculated by subtracting operating expenses from gross profit. This metric reflects the profitability of the business after accounting for the costs of running day-to-day operations. Using the previous example, if operating expenses total $25,000, the operating income would be $15,000. Analyzing operating income within the monthly profit and loss statement helps assess operational efficiency and cost management effectiveness. Trends in operating income can signal potential areas for improvement or cost reduction.

- Net IncomeNet income, also known as net profit or net earnings, represents the bottom line after all expenses, including taxes and interest, have been deducted from revenue. Continuing the example, if interest and taxes total $5,000, the net income would be $10,000. Net income is the ultimate measure of profitability, reflecting the financial gain or loss for the period. Within the monthly profit and loss statement, net income provides the clearest picture of overall financial performance and serves as a key indicator of business health.

- Impact of TimingThe timing of revenue and expense recognition directly impacts the profit/loss calculation for a specific month. Accrual accounting principles dictate that revenue and expenses be recognized when earned or incurred, regardless of when cash changes hands. This ensures that the monthly profit and loss statement accurately reflects the financial activity for that period, even if cash flow doesn’t perfectly align. Understanding the impact of timing differences is crucial for interpreting the statement and making informed financial decisions.

Accurate profit/loss calculation is the cornerstone of a meaningful monthly profit and loss statement. By analyzing these figures over time, businesses can identify trends, assess the impact of strategic decisions, and implement corrective actions to improve profitability. A consistent approach to calculating and interpreting these figures enables proactive financial management and supports informed business growth.

4. Time Period (Monthly)

The “monthly” in “monthly profit and loss statement template” signifies the specific time frame covered by the document: a four-week period. This recurring timeframe provides a consistent basis for evaluating financial performance. Regular monthly reporting enables timely identification of trends, both positive and negative. For example, a consistent decline in sales revenue over several consecutive months signals a potential problem requiring immediate attention. Conversely, a steady increase in profit margins suggests successful business strategies. This regular pulse check on financial health facilitates proactive management and informed decision-making.

The choice of a monthly reporting period offers a balance between detail and manageability. While daily or weekly reports can be overly granular for most businesses, quarterly or annual reports may not provide the timely insights needed to address emerging issues. The monthly profit and loss statement offers a practical compromise, providing sufficient detail to understand performance drivers without overwhelming management with excessive data. This frequency allows for adjustments to operational strategies, marketing campaigns, or pricing models before problems escalate. For instance, a monthly statement showing unexpectedly high utility costs might prompt an investigation into energy consumption and efficiency measures.

The consistent application of the monthly time frame allows for meaningful comparisons across reporting periods, revealing trends and supporting informed forecasting. Analyzing year-over-year monthly data can highlight seasonal patterns, the impact of specific marketing campaigns, or the effectiveness of cost-cutting measures. This historical context empowers data-driven decision-making for future planning and resource allocation. Understanding the significance of the monthly timeframe is crucial for maximizing the utility of the profit and loss statement as a management tool. Consistent and timely reporting contributes to informed financial decisions, improved operational efficiency, and ultimately, sustained business success.

5. Standardized Format

A standardized format is fundamental to the utility of a monthly profit and loss statement template. Consistency in structure and presentation ensures comparability across different reporting periods, facilitates efficient analysis, and supports informed decision-making. A standardized template provides a clear and organized framework for presenting financial data, enabling stakeholders to quickly grasp key performance indicators and identify trends.

- Uniformity of CategoriesConsistent categorization of revenue and expenses is crucial for accurate analysis and comparison. A standardized template ensures that similar financial elements are grouped together consistently across all monthly statements. For example, all revenue from sales, regardless of product line, should be categorized under “Sales Revenue.” Similarly, all marketing expenses, whether for online advertising or print media, should be classified under “Marketing Expenses.” This uniformity allows for meaningful comparisons of performance across different months and years, facilitating trend identification and informed resource allocation.

- Consistent CalculationsUsing standard formulas for calculations, such as gross profit, operating income, and net income, ensures accuracy and comparability. A standardized template defines these calculations, eliminating inconsistencies that could arise from variations in methodology. This consistency is essential for tracking performance over time and making valid comparisons between different periods. Consistent calculations also facilitate benchmarking against industry averages or competitors, providing valuable context for evaluating performance.

- Clear PresentationA standardized format promotes clear and concise presentation of financial information. The use of headings, subheadings, and clear labels ensures that the information is easily understood by all stakeholders. Visual consistency in formatting, such as font size and spacing, further enhances readability and comprehension. A well-structured and clearly presented statement minimizes the risk of misinterpretation and facilitates effective communication of financial performance.

- Facilitates Trend AnalysisThe standardized format of a monthly profit and loss statement enables efficient trend analysis. By comparing data presented in the same format across multiple periods, trends in revenue, expenses, and profitability become readily apparent. This allows for timely identification of potential issues, proactive intervention, and informed adjustment of business strategies. For example, consistently increasing operating expenses relative to revenue might signal a need for cost-cutting measures or operational efficiency improvements.

The standardized format of a monthly profit and loss statement template is essential for its effectiveness as a management tool. It provides a framework for consistent data collection, accurate calculations, clear presentation, and efficient trend analysis. This standardization empowers businesses to monitor performance, identify areas for improvement, and make informed decisions to drive profitability and achieve financial objectives. Consistent formatting enables meaningful comparisons, supporting data-driven decision-making and contributing to long-term financial success.

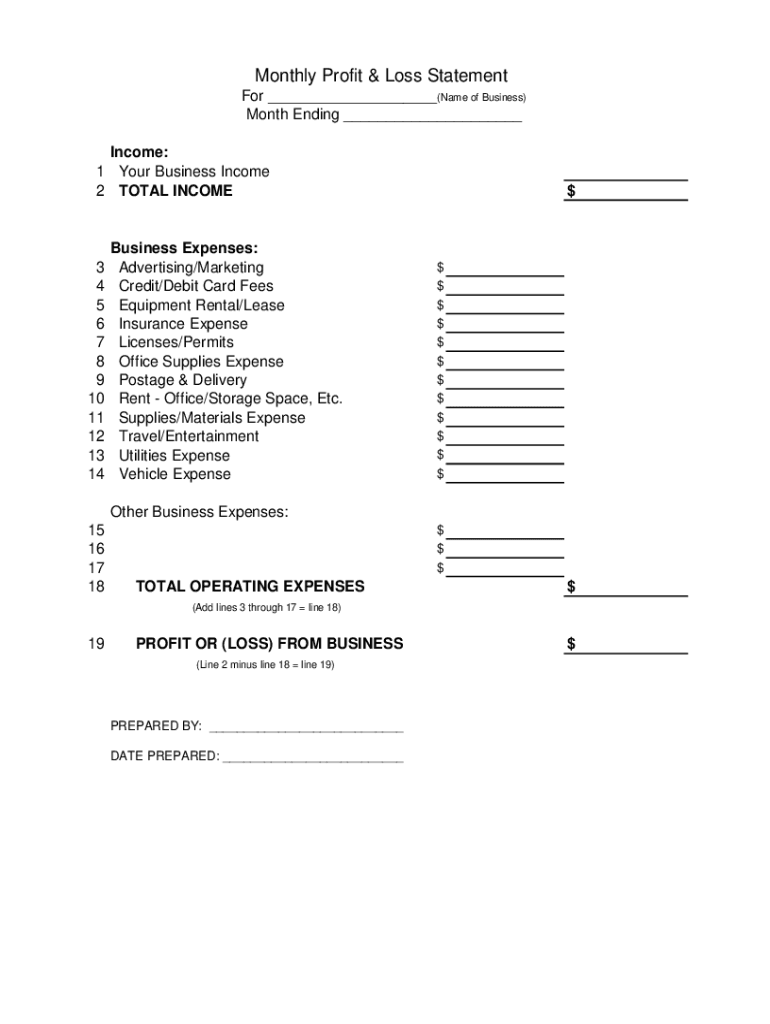

Key Components of a Monthly Profit and Loss Statement

A comprehensive understanding of key components is essential for effective interpretation and utilization of a monthly profit and loss statement. These elements provide a structured framework for analyzing financial performance and informing strategic decision-making.

1. Revenue: This section details all income generated during the month. It typically includes sales revenue from core business operations and any other income from secondary sources. Accurate revenue reporting is crucial for assessing market demand and pricing strategies.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit margins.

3. Gross Profit: Calculated as Revenue – COGS, gross profit reflects the profitability of core business operations before accounting for operating expenses. This metric is a key indicator of production efficiency and pricing effectiveness.

4. Operating Expenses: This section encompasses all costs incurred in running the business outside of direct production. Examples include rent, utilities, salaries, marketing expenses, and administrative costs. Careful monitoring of operating expenses is crucial for maintaining cost efficiency.

5. Operating Income: Calculated as Gross Profit – Operating Expenses, operating income reflects the profitability of the business after accounting for day-to-day operational costs. This metric helps assess operational efficiency and cost management effectiveness.

6. Other Income/Expenses: This section includes income or expenses not directly related to core business operations, such as interest income, interest expense, gains or losses from investments, and taxes. These items are essential for determining overall net income.

7. Net Income: Often referred to as the “bottom line,” net income represents the final profit or loss after all revenue and expenses have been accounted for. This crucial metric reflects the overall financial performance of the business for the month.

Careful analysis of these components within the monthly profit and loss statement provides valuable insights into financial performance, enabling data-driven decisions regarding pricing, resource allocation, cost control, and strategic planning. Consistent monitoring and interpretation of these elements contribute to informed financial management and support sustained business growth.

How to Create a Monthly Profit and Loss Statement

Creating a monthly profit and loss statement involves a systematic approach to organizing financial data. A well-structured template ensures consistency and facilitates accurate analysis of business performance. The following steps outline the process:

1. Choose a Template or Software: Start by selecting a pre-designed template or utilizing spreadsheet software. Several online resources offer free templates, while software solutions often provide automated calculations and reporting features. Selecting an appropriate tool streamlines the creation process.

2. Establish a Consistent Reporting Period: Define a clear monthly reporting period, typically aligning with the calendar month. Consistency is crucial for accurate trend analysis and comparison across periods.

3. Record Revenue: Meticulously document all revenue streams, including sales, services, and other income sources. Ensure accuracy and completeness to reflect the total income generated during the month. Categorize revenue for detailed analysis.

4. Calculate Cost of Goods Sold (COGS): Determine the direct costs associated with producing goods or services sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

5. Document Operating Expenses: Record all operating expenses, including rent, utilities, salaries, marketing, and administrative costs. Categorize expenses for detailed analysis and cost control. Accurate expense tracking is crucial for assessing operational efficiency.

6. Calculate Key Metrics: Calculate gross profit (Revenue – COGS), operating income (Gross Profit – Operating Expenses), and net income (Operating Income +/- Other Income/Expenses). These metrics provide insights into profitability at different levels of the business.

7. Review and Analyze: Carefully review the completed statement for accuracy and completeness. Analyze the data to identify trends, assess performance against targets, and identify areas for improvement. Regular review informs strategic decision-making.

8. Maintain Records: Retain copies of all monthly statements for future reference and comparison. These historical records provide valuable context for understanding long-term performance trends and informing future planning. Organized record-keeping supports financial analysis.

By following these steps and maintaining consistent practices, a robust and informative monthly profit and loss statement can be created. This document serves as a crucial tool for monitoring financial performance, identifying trends, and making data-driven decisions to optimize profitability and achieve business objectives. Regular review and analysis empower proactive management and informed strategic planning.

Regular utilization of a structured monthly profit and loss statement template provides essential insights into financial performance. From revenue streams and cost of goods sold to operating expenses and net income, each element contributes to a comprehensive understanding of a business’s financial health. Consistent tracking and analysis of these components over time empowers informed decision-making, enabling proactive adjustments to strategies, cost control measures, and resource allocation. Standardized formatting ensures comparability across periods, facilitating trend identification and supporting data-driven forecasting.

Effective financial management hinges on the accurate and consistent application of this crucial tool. Its insights empower businesses to navigate challenges, capitalize on opportunities, and ultimately, achieve sustained growth and profitability. Regular review and analysis of the monthly profit and loss statement are not merely accounting exercises; they are essential strategic practices for informed financial stewardship and long-term business success.