Using this type of report offers several advantages. It clearly separates core business operations from peripheral activities, facilitating a deeper understanding of profit drivers and cost structures. This enhanced transparency enables stakeholders to assess the sustainability of a company’s earnings and identify areas for potential improvement. Furthermore, it provides a more accurate picture of profitability compared to simpler formats, supporting better-informed decision-making by management, investors, and creditors. The insights gained can be leveraged for strategic planning, performance evaluation, and investment analysis.

This structured approach to financial reporting plays a crucial role in understanding a company’s performance. The following sections will explore the specific components, preparation methods, and practical applications of this invaluable tool for financial analysis.

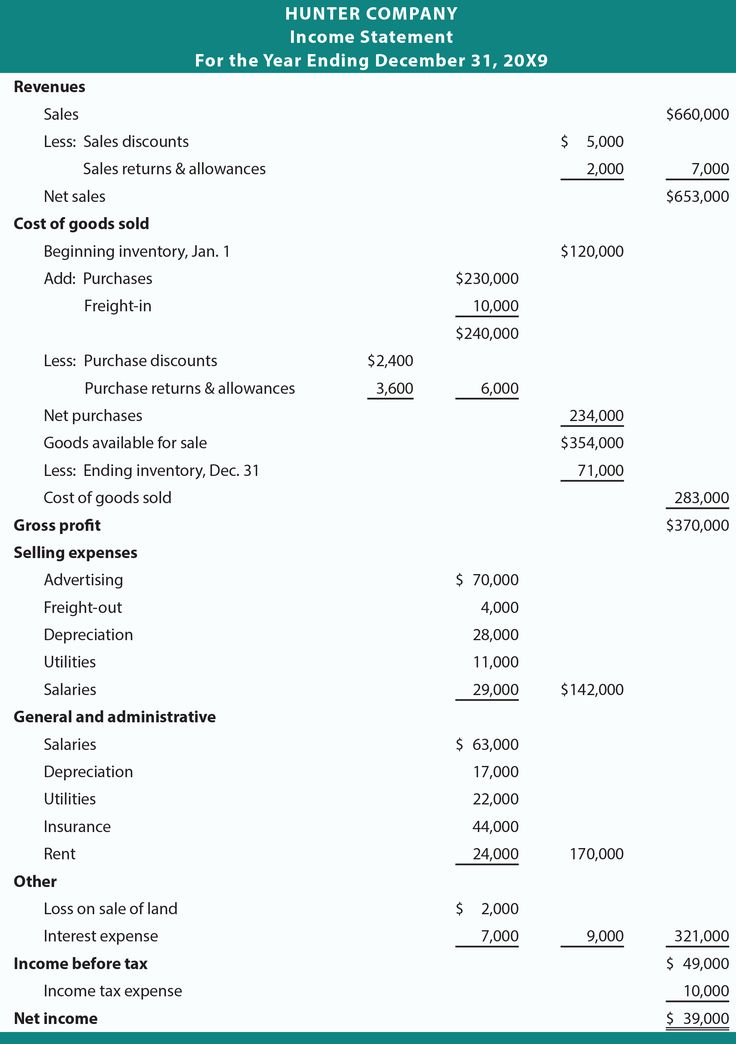

1. Revenues

Revenues represent the inflows of assets received in exchange for goods sold or services rendered. Within a multiple-step income statement template, revenues form the foundation for evaluating a company’s financial performance. Accurate revenue recognition is critical for determining profitability and provides key insights into market demand and pricing strategies. A detailed understanding of revenue components is essential for informed financial analysis.

- Sales RevenueSales revenue constitutes the primary income source for most businesses, derived from the sale of goods or services. For a retailer, this would be the proceeds from selling merchandise. For a service provider, this includes fees earned from providing services. In the context of a multiple-step income statement, sales revenue is the starting point for calculating gross profit and subsequent profitability metrics. Properly classifying and reporting sales revenue is crucial for accurate financial reporting.

- Service RevenueService revenue specifically represents income generated from providing services. Examples include consulting fees, subscription fees, or repair services. Distinguishing service revenue from sales revenue allows for a more granular analysis of revenue streams within the multiple-step format. This segregation can reveal the relative contribution of different service offerings to overall profitability.

- Interest RevenueWhile not the primary revenue source for most operating businesses, interest revenue represents income earned on cash and cash equivalents, or from lending activities. In the multiple-step income statement, interest revenue is typically categorized as non-operating income, providing a clearer view of profitability from core operations versus peripheral activities. This distinction enhances transparency and allows for a more focused evaluation of operational performance.

- Other RevenueThis category encompasses miscellaneous revenue streams not classified as sales, service, or interest income. Examples include royalty income, rent received, or gains from the sale of non-current assets. Including these items in a separate “Other Revenue” category within the multiple-step format maintains the clarity and integrity of core revenue streams, facilitating accurate analysis of operating performance and identifying potential non-recurring income sources.

Categorizing revenue streams within the multiple-step income statement framework provides crucial insights into a company’s financial health and operational efficiency. By distinguishing between operating and non-operating revenues, stakeholders can gain a clearer understanding of the primary drivers of profitability and make more informed decisions regarding resource allocation and future strategies. This granular approach to revenue recognition is fundamental to comprehensive financial analysis.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Within a multiple-step income statement template, COGS plays a crucial role in determining gross profit, a key indicator of operational efficiency. Accurately calculating COGS is essential for understanding the relationship between revenue, production costs, and profitability. This figure encompasses direct material costs, direct labor, and manufacturing overhead. For a manufacturer, this includes raw materials, wages of production line workers, and factory utilities. For a retailer, COGS represents the purchase price of merchandise resold to customers. Understanding the components of COGS allows for a deeper analysis of cost structures and profitability within the multi-step format.

Consider a furniture manufacturer. Their COGS includes the cost of lumber, hardware, finishes, and the labor directly involved in assembling the furniture. Overhead allocated to production, such as factory rent and depreciation of manufacturing equipment, also forms part of COGS. This detailed breakdown within the multiple-step income statement facilitates insights into cost control and pricing strategies. By analyzing COGS trends, management can identify potential inefficiencies and optimize production processes. A retailer’s COGS, primarily the purchase price of goods, is subtracted from sales revenue to determine gross profit. This calculation highlights the markup achieved and the profitability of sales activities. Comparing COGS to industry benchmarks allows for competitive analysis and identifies areas for potential cost improvements. This information is crucial for strategic decision-making, pricing adjustments, and inventory management.

Accurate COGS calculation is critical for financial reporting integrity and informed decision-making. Misrepresenting COGS can distort profitability metrics and lead to flawed business strategies. Properly classifying and allocating costs within the multiple-step income statement ensures a transparent and accurate representation of a company’s financial performance. This understanding is essential for investors, creditors, and management in assessing operational efficiency, profitability, and overall financial health. COGS, as a core component of the multiple-step income statement, provides valuable insights into cost management and the drivers of profitability.

3. Gross Profit

Gross profit, a key performance indicator, represents the profitability of a company’s core business operations after accounting for the direct costs associated with producing goods or services. Within a multiple-step income statement template, gross profit is derived by subtracting the cost of goods sold (COGS) from revenue. This calculation provides a crucial first level of insight into a company’s pricing strategies, cost management effectiveness, and the overall profitability of its products or services. Understanding gross profit is fundamental for assessing operational efficiency and forms a cornerstone of subsequent profitability analysis within the multi-step format.

For example, a retailer selling clothing generates revenue through sales. The cost of goods sold includes the purchase price of the clothing from manufacturers or wholesalers. The difference between these two figures constitutes the gross profit, reflecting the markup achieved and the profitability of sales activities. A higher gross profit margin generally indicates stronger pricing power and efficient cost control. Conversely, a declining gross profit margin may signal pricing pressures, increasing input costs, or inventory management issues. Analyzing gross profit trends within the context of a multiple-step income statement allows stakeholders to pinpoint potential challenges and opportunities within core business operations.

The significance of gross profit extends beyond its numerical value. Within the framework of a multiple-step income statement, gross profit serves as the foundation for calculating subsequent profitability metrics, such as operating income and net income. It provides a critical link between revenue generation and the various expenses incurred in running a business. Monitoring gross profit trends enables management to make informed decisions regarding pricing strategies, cost optimization initiatives, and product development. Furthermore, investors and creditors utilize gross profit margins to assess a company’s financial health and evaluate its potential for future growth. Therefore, understanding the calculation and implications of gross profit within the multiple-step income statement template is essential for informed financial analysis and effective business management.

4. Operating Expenses

Operating expenses represent the costs incurred from a company’s normal day-to-day business activities, excluding the direct costs of producing goods or services. Within a multiple-step income statement template, these expenses are distinctly separated from cost of goods sold (COGS) and non-operating expenses. This segregation provides critical insights into a company’s operational efficiency and profitability by revealing how much it costs to run the core business. Accurate categorization and analysis of operating expenses are essential for assessing management’s performance and making informed financial decisions.

- Selling ExpensesSelling expenses encompass all costs associated with marketing, selling, and distributing a company’s products or services. Examples include advertising costs, salaries and commissions of sales personnel, and shipping and handling expenses. Within a multiple-step income statement, these expenses provide a detailed view of the resources allocated to sales and distribution activities, allowing for an evaluation of their effectiveness in generating revenue. Analyzing trends in selling expenses can reveal insights into sales strategies and market competitiveness.

- General and Administrative ExpensesGeneral and administrative expenses (G&A) comprise the costs associated with running the overall organization. Examples include salaries of administrative staff, office rent, utilities, and depreciation of office equipment. In the context of the multiple-step income statement, G&A expenses provide a measure of the costs required to support the core business functions. Monitoring G&A expenses is crucial for identifying potential cost-saving opportunities and ensuring efficient resource allocation.

- Research and Development ExpensesResearch and development (R&D) expenses represent investments made in developing new products, services, or processes. These expenses can include salaries of research personnel, laboratory costs, and prototype development. Within the multiple-step format, R&D expenses provide insight into a company’s commitment to innovation and future growth. Analyzing R&D spending trends can help assess a company’s long-term competitive position and potential for future revenue generation.

- Depreciation and AmortizationDepreciation represents the allocation of the cost of tangible assets, such as buildings and equipment, over their useful lives. Amortization reflects a similar process for intangible assets, such as patents and copyrights. These non-cash expenses are included in operating expenses within the multiple-step income statement, impacting the calculation of operating income. Understanding depreciation and amortization policies is crucial for assessing a company’s asset base and its impact on profitability over time.

By separating these operating expense categories within the multiple-step income statement, analysts can gain a comprehensive understanding of a company’s cost structure and operational efficiency. This detailed breakdown allows for comparisons across different periods and against industry benchmarks, enabling informed assessments of management’s performance and the company’s financial health. The insights derived from analyzing operating expenses are essential for strategic planning, cost management, and investment decisions.

5. Non-Operating Income/Expenses

Non-operating income and expenses represent transactions that are not directly related to a company’s core business operations. Within a multiple-step income statement template, these items are presented separately from operating income and expenses, providing a clearer picture of profitability derived from the core business activities. This segregation allows stakeholders to assess the impact of peripheral financial activities on a company’s overall financial performance and understand the sustainability of its earnings.

- Interest IncomeInterest income represents earnings generated from investments in debt securities or from lending activities. This income stream is typically categorized as non-operating because it is not derived from the company’s primary business activities. Including interest income within the non-operating section of the multiple-step income statement provides a clearer picture of the company’s core operational profitability and highlights the contribution of investment activities.

- Interest ExpenseInterest expense represents the cost of borrowing funds. This expense is classified as non-operating as it relates to financing activities rather than core business operations. Presenting interest expense separately within the multiple-step income statement allows for a more focused analysis of operational performance and highlights the impact of debt financing on profitability.

- Gains/Losses on Sale of AssetsGains or losses arising from the sale of long-term assets, such as property, plant, and equipment (PP&E), or investments, are classified as non-operating items. These transactions are typically infrequent and not part of a company’s regular business activities. Including these gains or losses in the non-operating section of the multiple-step income statement prevents distortion of operating income and provides a more accurate reflection of ongoing profitability.

- Other Non-Operating Income/ExpensesThis category encompasses miscellaneous items that do not fit into the other non-operating classifications. Examples include lawsuit settlements, write-offs of bad debt, or foreign exchange gains or losses. Presenting these items separately ensures transparency and facilitates analysis of unusual or infrequent events that impact a company’s financial performance.

By segregating non-operating items, the multiple-step income statement provides a more nuanced understanding of a company’s financial performance. This detailed presentation allows analysts to distinguish between sustainable earnings generated from core operations and the impact of peripheral financial activities. This enhanced transparency facilitates more informed decision-making by management, investors, and creditors, enabling them to assess the long-term financial health and profitability of a company.

6. Net Income

Net income represents the ultimate measure of a company’s profitability after all revenues and expenses have been accounted for. Within the context of a multiple-step income statement template, net income is the culmination of a structured process that distinguishes between operating and non-operating activities, providing a comprehensive view of a company’s financial performance. Understanding net income and its components is crucial for evaluating a company’s financial health and making informed investment decisions.

- The Bottom LineNet income, often referred to as the “bottom line,” represents the profit available to shareholders after all expenses, including taxes, have been deducted from revenues. It signifies the residual earnings after all obligations have been met. In a multiple-step income statement, net income is positioned at the bottom, reflecting the final result of the detailed, layered presentation of revenues and expenses. This placement emphasizes its importance as the ultimate measure of profitability.

- Components of CalculationArriving at net income within a multiple-step income statement involves a series of calculations. Starting with gross profit (revenue minus cost of goods sold), operating expenses are then deducted to arrive at operating income. Subsequently, non-operating income and expenses are considered, along with income tax expense, to determine the final net income figure. This structured approach provides transparency into the various factors influencing profitability.

- Impact of Operating ActivitiesThe multiple-step format highlights the impact of operating activities on net income. By separating operating revenues and expenses from non-operating items, stakeholders gain a clearer understanding of the profitability derived from the core business. This distinction allows for a more accurate assessment of the sustainability and quality of earnings, as it isolates the results of ongoing business operations from potentially volatile non-operating gains or losses.

- Significance for Financial AnalysisNet income serves as a crucial input for various financial ratios and metrics used in evaluating a company’s performance. Metrics like earnings per share (EPS), return on equity (ROE), and profit margins all rely on net income as a key component. The detailed presentation within the multiple-step income statement facilitates a deeper understanding of the drivers of net income and provides a basis for comparing performance across different periods or against industry benchmarks.

Within the framework of a multiple-step income statement, net income emerges as a crucial metric, not simply a final number, but a comprehensive reflection of a company’s financial performance. Its position as the “bottom line” underscores its importance in evaluating a company’s profitability, operational efficiency, and overall financial health. The structured presentation within this format allows for in-depth analysis, making it a valuable tool for investors, creditors, and management alike. Understanding the components and implications of net income is essential for informed financial decision-making.

Key Components of a Multiple-Step Income Statement

A multiple-step income statement provides a detailed analysis of a company’s financial performance by categorizing revenues and expenses into distinct operational and non-operational activities. Understanding these key components is essential for a comprehensive assessment of profitability and financial health.

1. Revenues: Represent inflows from primary business activities. This section typically includes sales revenue, service revenue, and any other income directly generated from core operations. Accurate revenue recognition is crucial for determining top-line performance.

2. Cost of Goods Sold (COGS): Represents the direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead. COGS is subtracted from revenue to determine gross profit.

3. Gross Profit: Calculated as revenue minus COGS. This metric reflects the profitability of a company’s core products or services before considering operating expenses. Gross profit margin is a key indicator of pricing strategy and cost management effectiveness.

4. Operating Expenses: Represent the costs incurred from running the core business. This category includes selling, general and administrative (SG&A), research and development (R&D), and depreciation and amortization expenses. Analyzing operating expenses provides insights into operational efficiency.

5. Operating Income: Calculated as gross profit minus operating expenses. This metric reflects the profitability of core business operations. It reveals how effectively management controls costs while generating revenue from primary activities.

6. Non-Operating Income/Expenses: Encompass transactions not directly related to core business operations, such as interest income, interest expense, gains or losses on asset sales, and other peripheral financial activities. These items are segregated to provide a clearer view of core business profitability.

7. Income Before Taxes: Represents a company’s earnings before accounting for income tax expense. This metric shows profitability after considering both operating and non-operating activities.

8. Income Tax Expense: Reflects the expense incurred due to corporate income taxes. This amount is deducted from income before taxes to arrive at net income.

9. Net Income: The final measure of a company’s profitability after all revenues and expenses have been accounted for, including taxes. This bottom line figure represents the residual earnings available to shareholders and is a crucial metric for evaluating financial performance.

This structured presentation allows for a detailed understanding of a company’s performance, enabling stakeholders to assess profitability, operational efficiency, and overall financial health. The segregation of operating and non-operating activities provides valuable insights into the sustainability and quality of earnings, supporting informed financial analysis and decision-making.

How to Create a Multiple-Step Income Statement

Creating a multiple-step income statement requires a systematic approach to organizing financial data. The following steps outline the process of constructing this detailed report, providing a clear and comprehensive view of a company’s financial performance.

1. Gather Financial Data: Collect all relevant financial records for the specific accounting period. This includes sales invoices, purchase orders, expense reports, and other documentation related to revenue and expense transactions.

2. Calculate Net Sales Revenue: Determine the total revenue generated from sales, deducting any sales returns, allowances, and discounts. This figure represents the company’s top-line revenue.

3. Determine Cost of Goods Sold (COGS): Calculate the direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead. For retailers, COGS represents the purchase price of merchandise.

4. Calculate Gross Profit: Subtract COGS from net sales revenue to arrive at gross profit. This metric represents the profitability of core products or services before considering operating expenses.

5. Categorize Operating Expenses: Group operating expenses into distinct categories, such as selling expenses, general and administrative expenses, research and development expenses, and depreciation and amortization. This categorization allows for a detailed analysis of operational efficiency.

6. Calculate Operating Income: Subtract total operating expenses from gross profit to determine operating income. This key metric reveals the profitability of the company’s core business operations.

7. Account for Non-Operating Items: Include non-operating income and expenses, such as interest income, interest expense, gains or losses on asset sales, and any other peripheral financial activities. These items are presented separately to distinguish them from core business operations.

8. Calculate Income Before Taxes: Add or subtract non-operating items to/from operating income to arrive at income before taxes. This represents the company’s earnings before accounting for income tax expense.

9. Determine Income Tax Expense: Calculate the income tax expense based on applicable tax rates and regulations. This expense is deducted from income before taxes.

10. Calculate Net Income: Subtract income tax expense from income before taxes to arrive at net income. This final figure represents the company’s bottom-line profit after all revenues and expenses have been considered.

A properly constructed multiple-step income statement provides a structured view of a companys financial performance, enabling detailed analysis of profitability, operational efficiency, and the impact of both core and non-core business activities. This comprehensive approach allows stakeholders to gain a deeper understanding of the factors driving a companys financial results and supports informed decision-making.

This structured approach to financial reporting provides a granular understanding of a company’s performance by distinctly categorizing revenues and expenses, differentiating between operational and non-operational activities. From revenue recognition and cost of goods sold analysis to the calculation of gross profit, operating income, and ultimately, net income, each component contributes to a comprehensive evaluation of profitability and operational efficiency. The segregation of non-operating items further enhances transparency, allowing for a clearer assessment of core business performance and the impact of peripheral financial activities.

Leveraging this detailed reporting framework empowers stakeholders with critical insights for informed decision-making. Management gains valuable data for strategic planning, cost control, and performance evaluation. Investors and creditors benefit from a transparent view of financial health, facilitating more accurate assessments of risk and return. The ability to dissect financial performance through a structured, multi-step approach provides a powerful tool for navigating the complexities of business finance and driving sustainable growth.