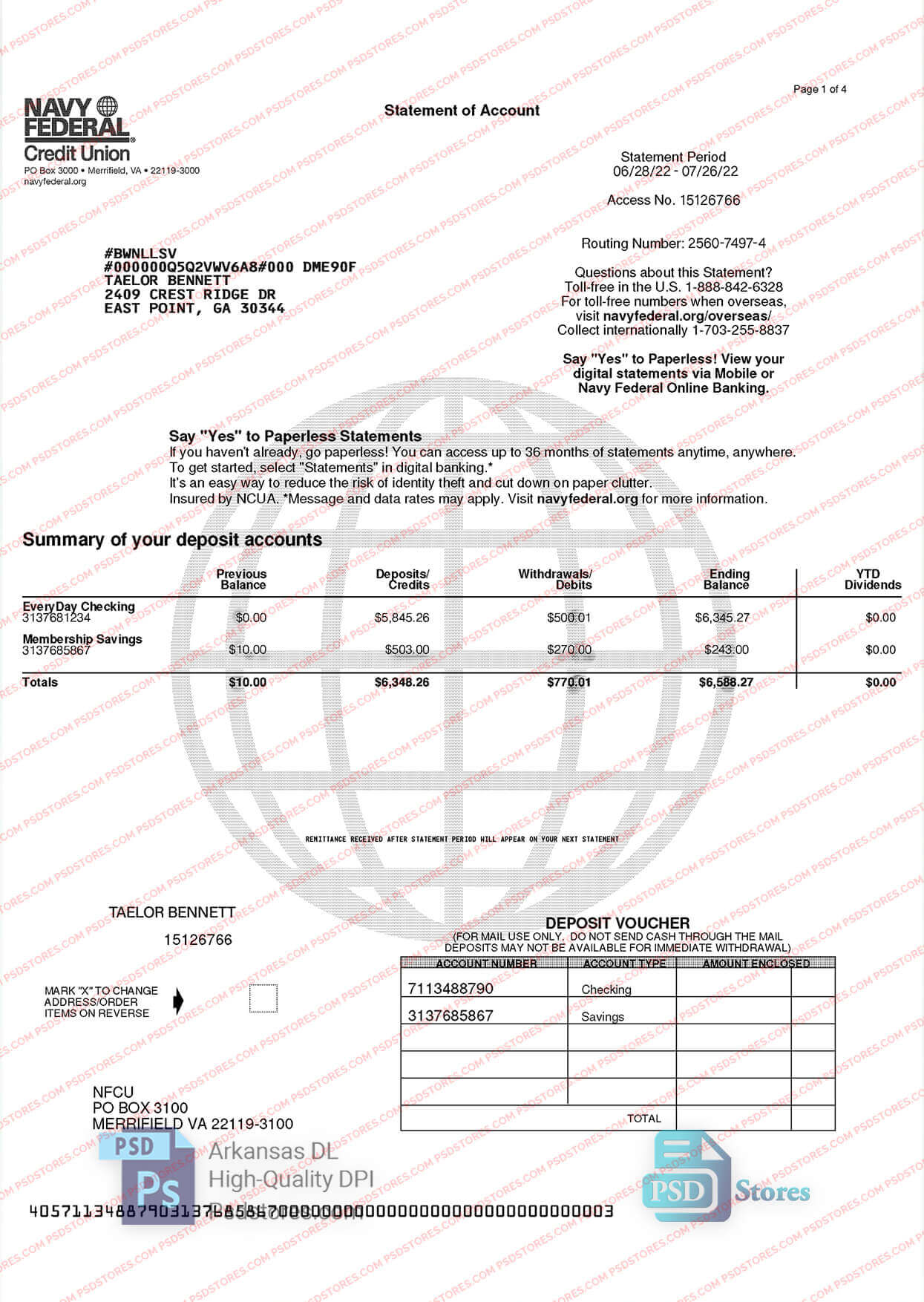

Access to such a standardized format offers several advantages. It allows for easy tracking of income and expenses, facilitating budgeting and financial planning. The consistent structure simplifies the process of verifying transactions and identifying any discrepancies. This documentation can also be crucial for loan applications, tax preparation, and other financial activities requiring proof of income or account history.

Understanding the structure and information contained within these documents is essential for effective financial management. The following sections will delve into specific aspects of account statements, including how to access them, interpret the data, and utilize them for various financial purposes.

1. Standardized Format

A standardized format is fundamental to the utility of bank statement templates. Consistency in presentation allows for efficient comprehension and analysis of financial data. This structured approach ensures that users can readily locate and interpret key information, regardless of the specific transaction details.

- Predictable Information PlacementInformation is consistently presented in designated areas. Account holder information, statement period, account number, and balance summaries are typically located in consistent positions. This predictability eliminates the need to search for crucial details, streamlining review and analysis.

- Uniform Transaction PresentationEach transaction, whether a deposit, withdrawal, or fee, follows a uniform presentation. Date, description, and amount are displayed in a consistent order. This uniformity facilitates quick scanning and comparison of individual transactions, simplifying reconciliation and budgeting processes.

- Clear and Concise LanguageStandardized terminology ensures clarity and minimizes ambiguity. Use of consistent terms for common transactions (e.g., “ATM Withdrawal,” “Direct Deposit”) promotes easy understanding across all statements. This precision reduces the likelihood of misinterpretation and enhances communication.

- Accessibility and ComparabilityThe standardized format promotes accessibility for diverse users. The predictable structure simplifies digital accessibility for users employing assistive technologies. Moreover, the consistent presentation across different statement periods facilitates comparison and trend analysis over time.

The standardized format of bank statement templates contributes significantly to effective financial management. By ensuring predictable presentation, uniform transaction details, clear terminology, and enhanced accessibility, these templates empower individuals and businesses to readily understand and utilize their financial data.

2. Transaction Details

Comprehensive transaction details are a cornerstone of any effective bank statement. Within the context of a financial institution’s statement template, these details provide a granular record of all account activities, enabling accurate tracking and analysis of financial behavior. Understanding these details is crucial for managing personal or business finances effectively.

- Date of TransactionThe date of each transaction provides a chronological record of account activity. This allows users to track spending and income patterns over time, identify potential discrepancies, and reconcile transactions with personal records. Accurate dating is essential for effective budgeting and financial planning.

- Transaction DescriptionA clear and concise description accompanies each transaction, providing context and aiding in identification. Descriptions may include merchant names, ATM locations, or transfer details. This information is crucial for categorizing expenses, identifying recurring payments, and verifying the legitimacy of each transaction.

- Transaction AmountThe amount of each transaction, whether a debit or credit, is clearly displayed. This allows for precise tracking of funds flowing in and out of the account. Accurate amounts are essential for calculating balances, identifying potential errors, and monitoring spending habits.

- Running BalanceThe running balance reflects the account balance after each transaction. This provides a dynamic view of how funds fluctuate throughout the statement period. Monitoring the running balance helps prevent overdrafts, track available funds, and maintain awareness of financial standing.

These detailed transaction records, presented within the structured framework of a bank statement template, empower account holders to maintain a comprehensive understanding of their financial activity. This granular view facilitates informed financial decision-making, accurate budgeting, and effective management of personal or business finances.

3. Account Summary

The account summary section within a financial institution’s statement template provides a consolidated overview of key account information for a specific period. This summarized view complements the detailed transaction listing, offering a readily accessible snapshot of overall account activity and financial standing. Understanding the components of the account summary is essential for effective financial management.

- Beginning and Ending BalancesThe account summary clearly displays the beginning balance at the start of the statement period and the ending balance at its close. These figures provide a concise view of overall account growth or decline during the period. Comparing these balances across multiple statements allows for trend analysis and assessment of long-term financial progress.

- Total Deposits and WithdrawalsSummaries of total deposits and withdrawals offer a consolidated view of cash flow during the statement period. This information provides insights into spending and saving habits, facilitating budget adjustments and financial planning. Analyzing these totals can reveal areas for potential improvement in financial management.

- Interest EarnedFor interest-bearing accounts, the account summary typically includes the total interest earned during the statement period. This information is crucial for tracking investment growth and understanding the return on deposited funds. Interest earned contributes to overall account growth and is an important factor in financial planning.

- Fees and ChargesAny applicable fees or charges assessed during the statement period are summarized in the account summary. This transparent presentation of costs allows for easy identification of potential areas for savings and facilitates inquiries regarding unexpected charges. Awareness of fees is essential for maintaining accurate financial records.

The account summary, with its concise presentation of key financial data, serves as a valuable tool for monitoring account activity, tracking progress toward financial goals, and identifying areas for improvement in financial management. This consolidated overview, within the context of a standardized statement template, empowers informed financial decision-making.

4. Period Covered

The “period covered” designation is a crucial element of a financial institution’s statement template. It defines the specific timeframe for the reported financial activity, establishing the boundaries for the included transactions and balance calculations. This defined period allows for organized tracking of finances and facilitates accurate reconciliation. A clear understanding of this timeframe is essential for interpreting the statement’s contents and utilizing the information for financial planning.

The period covered acts as a filter, selecting only those transactions occurring within its timeframe for inclusion in the statement. For example, a statement covering January 1st to January 31st will only include transactions processed during January, excluding any transactions from December or February. This precise delineation allows for focused analysis of financial activity within a specific timeframe, facilitating accurate budgeting and expense tracking. Consider a recurring monthly subscription payment. If the statement period aligns with the subscription billing cycle, the statement will reflect the payment. However, if the statement period ends before the billing date, the payment will appear on the subsequent statement. Understanding this principle is crucial for reconciling payments and managing cash flow effectively.

Accurate interpretation and effective utilization of financial statements hinge on a clear understanding of the period covered. This defined timeframe provides the context for all reported data, ensuring accurate analysis and informed financial decision-making. Challenges can arise when comparing statements with misaligned periods or when overlooking the period covered altogether. Therefore, careful attention to this detail is fundamental for sound financial management. Recognizing the period covered allows individuals to track spending patterns within specific timeframes, compare financial performance across different periods, and accurately reconcile transactions with personal records. This understanding contributes significantly to responsible financial planning and effective management of personal or business finances.

5. Official Record

A bank statement serves as an official record of account activity within a specific financial institution. Generated by Navy Federal Credit Union, or any other financial entity, these documents hold significant weight due to their verifiable nature and the regulatory oversight governing their production. This official status stems from the institution’s responsibility to maintain accurate and auditable records of all member transactions. The statement reflects the institution’s official accounting of a member’s financial activity within their accounts. This formal documentation is crucial for legal, financial, and auditing purposes.

Consider a disputed transaction. The official record provided by the bank statement acts as a primary source of truth for resolving the issue. This documentation can be presented as evidence in legal proceedings or disputes with merchants. Similarly, during tax season, these statements serve as verifiable documentation of income, expenses, and interest earned. They underpin the accuracy of reported financial information and provide a basis for substantiating claims. Furthermore, in the case of audits, whether internal or external, bank statements provide the necessary detail to trace financial activity and ensure compliance with regulations. For loan applications, these statements serve as official proof of income and financial stability.

Understanding the role of a bank statement as an official record is crucial for navigating various financial situations. Failure to maintain these records can hinder dispute resolution, complicate tax preparation, and pose challenges during audits. Recognizing their official status underscores the importance of reviewing statements for accuracy and reporting any discrepancies promptly. This awareness empowers account holders to leverage these documents effectively for their financial well-being and legal protection.

6. Financial Management Tool

A Navy Federal Credit Union bank statement template functions as a crucial financial management tool, providing members with a structured overview of their account activity. This detailed record enables informed financial decision-making through meticulous tracking of income, expenses, and overall account balance. The template’s standardized format facilitates analysis of spending patterns, identification of potential budgetary discrepancies, and proactive management of financial resources. For example, a member might utilize the statement to track recurring monthly expenses, such as utility bills and subscription payments, allowing for accurate budgeting and forecasting of future expenditures. Furthermore, the statement can reveal areas of overspending, prompting adjustments in financial habits and promoting more responsible resource allocation.

The practical significance of understanding a bank statement as a financial management tool is substantial. Analyzing transaction details empowers members to identify and categorize expenses, aiding in the development of personalized budgeting strategies. Monitoring account balances over time allows for assessment of financial progress and facilitates adjustments to savings goals. For instance, a member saving for a down payment on a house can use the statement to track progress towards their savings target and modify their budget accordingly. Moreover, the statement serves as an invaluable resource during tax preparation, providing verifiable documentation of income and deductible expenses. This organized record simplifies the tax filing process and minimizes the risk of errors or omissions.

Effective financial management hinges on access to clear and comprehensive financial data. The bank statement template provides this essential information in a structured and accessible format. While the template itself does not offer direct financial advice, it empowers informed decision-making by providing the raw data necessary for effective planning, budgeting, and analysis. Recognizing the statements role as a financial management tool allows individuals to take control of their finances, make informed decisions, and achieve their financial objectives. Failure to utilize this tool can result in missed opportunities for savings, inaccurate budgeting, and difficulty in achieving financial goals.

Key Components of a Bank Statement Template

A bank statement template, provided by a financial institution like Navy Federal Credit Union, offers a structured overview of account activity. Understanding its key components is crucial for effective financial management.

1. Account Information: This section identifies the account holder and the specific account. Details typically include the account holder’s name, address, account number, and the statement period.

2. Summary Information: Presents a concise overview of account activity during the statement period. Key figures include the beginning balance, total deposits, total withdrawals, interest earned (if applicable), fees charged, and the ending balance.

3. Transaction Details: This section forms the core of the statement, providing a chronological record of each transaction. Details typically include the transaction date, description, amount, and the running balance after each transaction.

4. Interest Summary (if applicable): For interest-bearing accounts, this section details the interest earned during the statement period, including the interest rate and the calculation method.

5. Fee Summary: Lists any fees incurred during the statement period, specifying the type of fee and the associated amount.

6. Important Messages/Disclaimers: This section may include important information from the financial institution, such as policy changes, upcoming maintenance, or contact information.

These components work together to provide a comprehensive and detailed record of account activity. Regular review and analysis of these components are essential for effective financial planning, budgeting, and identification of potential discrepancies.

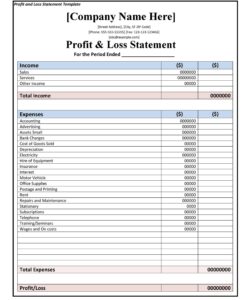

How to Create a Bank Statement Template

Creating a template resembling an official bank statement requires careful attention to detail and adherence to a standardized format. While replicating the exact security features and legal validity of an official document is neither feasible nor advisable, a functional template can be constructed for educational or illustrative purposes.

1. Software Selection: Spreadsheet software, such as Microsoft Excel or Google Sheets, or word processing software with table functionality, offers the necessary tools for creating a structured template. Selecting the appropriate software depends on the desired level of formatting complexity and the intended use of the template.

2. Header Section: The header should clearly identify the financial institution’s name and logo (for illustrative purposes only, avoiding copyright infringement). Account holder information, including name and address, should also be included. Crucially, the statement period should be prominently displayed.

3. Account Summary: This section should present key account figures, including beginning balance, total deposits, total withdrawals, and ending balance. Space should be allocated for interest earned and fees, even if these are not applicable in all instances.

4. Transaction Details Table: A table forms the core of the statement, providing a row for each transaction. Columns should include date, description, amount, and running balance. Ensure sufficient rows for a reasonable number of transactions.

5. Formatting and Design: Apply consistent formatting throughout the template. Use clear fonts, appropriate font sizes, and well-defined borders to enhance readability. Maintain a professional and organized appearance.

6. Disclaimer: Include a clear disclaimer stating that the document is a template for illustrative purposes only and does not represent an official bank statement. This protects against misuse and clarifies the document’s non-official nature.

Building a bank statement template requires a structured approach, incorporating essential elements within a clear and organized format. The resulting template can serve as a valuable tool for educational purposes, enabling exploration of financial concepts and practice in interpreting statement data.

Careful examination of a financial institution’s statement structure reveals its importance as a comprehensive record of account activity. Key elements like the standardized format, detailed transaction records, account summary, and specified period covered contribute to a clear and organized presentation of financial data. This structured approach empowers account holders to track income and expenses, identify trends, and reconcile transactions effectively. The document’s official status underscores its importance in legal and financial contexts, including dispute resolution, tax preparation, and audits. Moreover, understanding the statement’s structure facilitates its use as a powerful financial management tool, enabling informed decision-making, accurate budgeting, and proactive management of financial resources.

Effective financial management hinges on access to accurate and well-organized financial data. Leveraging the structure and information provided within these statements equips individuals and businesses with the insights necessary for responsible financial planning and confident navigation of the financial landscape. Regular review and thoughtful analysis of these records are essential practices for achieving financial goals and ensuring long-term financial well-being. Continued engagement with these documents and exploration of available resources for financial literacy will further empower informed financial decision-making and contribute to greater financial stability.