Utilizing such a structure facilitates clear financial goal setting, debt management, and investment planning. It offers a readily available tool for monitoring financial progress, enabling proactive adjustments and optimized financial strategies. This proactive approach contributes significantly to long-term financial stability and growth.

Understanding the components, utilization, and advantages of this financial tool is fundamental to improving financial literacy and achieving financial well-being. The following sections will delve into the specific elements and practical applications of this crucial financial instrument.

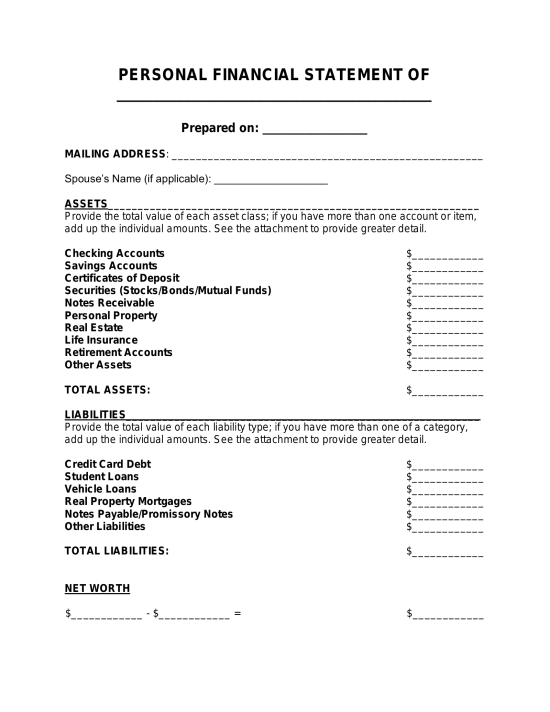

1. Assets

Accurate representation of assets within a net worth statement template is crucial for a realistic portrayal of financial standing. A comprehensive understanding of asset categorization and valuation is essential for effective utilization of this financial tool.

- Liquid AssetsLiquid assets, easily convertible to cash, form the foundation of short-term financial stability. Examples include checking and savings accounts, money market funds, and certificates of deposit. Accurate recording of these readily available funds provides insight into immediate financial capacity.

- Investment AssetsInvestment assets, held for long-term growth, represent potential future financial resources. Stocks, bonds, mutual funds, and retirement accounts fall under this category. Proper valuation and consistent tracking within the template are critical for monitoring investment performance and overall financial progress.

- Real EstateReal estate holdings, encompassing primary residences, rental properties, and land, represent significant, often illiquid, assets. Current market value estimations provide a realistic assessment of their contribution to overall net worth. Regular updates reflect market fluctuations and contribute to a dynamic understanding of financial health.

- Personal PropertyPersonal property encompasses tangible items of value, such as vehicles, jewelry, and collectibles. While not as readily liquid as other assets, their inclusion provides a complete picture of owned resources. Realistic valuations based on current market conditions ensure an accurate reflection of their contribution to net worth.

Thorough documentation and accurate valuation of these asset categories within the framework provide a comprehensive overview of financial resources and contribute to a more robust and informative net worth calculation. This comprehensive approach fosters a clearer understanding of ones financial position and facilitates informed financial planning.

2. Liabilities

Accurate representation of liabilities within a net worth statement template is crucial for a realistic portrayal of financial standing. A comprehensive understanding of liability categorization and accurate debt reporting are essential for effective utilization of this financial tool. Ignoring or underestimating liabilities leads to an inaccurate net worth calculation and potentially flawed financial decisions.

- Secured DebtSecured debt, tied to specific assets, typically carries lower interest rates due to the reduced lender risk. Examples include mortgages and auto loans. Accurate reporting of outstanding balances, interest rates, and payment terms within the template provides a clear picture of long-term financial obligations and their impact on net worth.

- Unsecured DebtUnsecured debt, not tied to specific assets, often carries higher interest rates due to increased lender risk. Credit card balances, personal loans, and student loans fall into this category. Diligent tracking of these balances within the template highlights potential high-interest burdens and facilitates strategic debt management.

- Short-Term LiabilitiesShort-term liabilities, due within one year, represent immediate financial obligations. Utility bills, credit card balances (if paid monthly), and short-term loans are included here. Accurate accounting for these obligations within the template provides a clear picture of short-term cash flow requirements and informs budgeting decisions.

- Long-Term LiabilitiesLong-term liabilities, due over a period exceeding one year, represent extended financial commitments. Mortgages, student loans, and long-term installment loans fall under this category. Monitoring these balances within the template facilitates long-term financial planning and informs decisions regarding major purchases and investments.

A thorough understanding and accurate reporting of these liability categories contribute to a comprehensive and informative net worth calculation. This meticulous approach allows for a clearer understanding of financial obligations and supports effective debt management strategies. Ultimately, a comprehensive view of liabilities, combined with a clear understanding of assets, empowers informed financial decision-making and strengthens long-term financial health.

3. Calculation

The core function of a net worth statement template lies in facilitating accurate calculation of net worth. This calculation provides a quantifiable measure of financial health, representing the difference between total assets and total liabilities. A clear understanding of the calculation process is fundamental to leveraging the insights offered by this financial tool.

- Total Assets SummationAccurate calculation requires meticulous summation of all asset categories. This includes liquid assets, investment holdings, real estate, and personal property. Each asset should be valued appropriately, reflecting current market conditions. Overlooking or undervaluing assets leads to an underrepresentation of true net worth.

- Total Liabilities SummationSimilarly, accurate calculation necessitates meticulous summation of all liabilities. This includes secured debts, unsecured debts, short-term obligations, and long-term liabilities. Failing to account for all debts leads to an inflated and inaccurate net worth figure.

- The Net Worth EquationNet worth is calculated by subtracting total liabilities from total assets. A positive net worth indicates assets exceed liabilities, while a negative net worth indicates the opposite. This simple yet powerful equation provides a concise snapshot of financial health at a specific point in time.

- Interpreting the ResultThe calculated net worth provides a benchmark for assessing financial progress. Tracking net worth over time allows individuals to monitor the impact of financial decisions and adjust strategies as needed. This ongoing assessment fosters proactive financial management and contributes to long-term financial well-being.

A thorough understanding of the calculation process and its components is essential for effectively utilizing a net worth statement template. Accurate data input and consistent tracking provide valuable insights into financial health, empowering informed decision-making and fostering a proactive approach to financial management. This calculated figure serves as a crucial indicator for evaluating financial progress and guiding future financial strategies.

4. Regular Updates

Maintaining an up-to-date net worth statement template is crucial for accurate financial assessment. Regular updates transform a static snapshot into a dynamic tool, reflecting the ever-changing nature of financial circumstances. This ongoing process provides valuable insights into financial progress and informs proactive financial management.

- Frequency of UpdatesThe frequency of updates depends on individual financial activity and goals. While some prefer monthly updates, others find quarterly or semi-annual updates sufficient. More frequent updates offer a more granular view of financial changes, while less frequent updates provide a broader overview of long-term trends. The chosen frequency should align with individual needs and preferences.

- Tracking Financial ChangesRegular updates provide a mechanism for tracking financial changes, both large and small. New investments, debt reduction, or significant purchases are readily incorporated, ensuring the accuracy of the net worth calculation. This consistent tracking provides a clear picture of financial trajectory and facilitates informed decision-making.

- Identifying Trends and PatternsConsistent updates enable the identification of financial trends and patterns. Analyzing changes in net worth over time reveals the impact of financial habits and investment strategies. This analysis allows for course correction and optimization of financial practices for improved outcomes.

- Informed Financial DecisionsAn up-to-date net worth statement empowers informed financial decisions. Whether considering a major purchase, refinancing a loan, or adjusting investment strategies, access to current financial data provides the necessary context for sound decision-making. This informed approach reduces financial risks and maximizes opportunities for growth.

Regular updates transform a net worth statement template from a static document into a dynamic financial management tool. This ongoing process of reviewing and revising financial data provides valuable insights, facilitates informed decision-making, and ultimately contributes to long-term financial well-being. The insights gleaned from consistent updates empower individuals to take control of their financial health and work towards achieving their financial goals.

5. Financial Snapshot

A net worth statement template provides a crucial financial snapshot, offering a concise overview of an individual’s financial position at a specific point in time. This snapshot encapsulates the totality of assets and liabilities, providing a clear picture of financial health and serving as a foundation for informed financial planning. Understanding the components and implications of this financial snapshot is essential for leveraging the full potential of the net worth statement template.

- Holistic Financial PictureThe financial snapshot captures a holistic view of one’s financial standing, encompassing all aspects of assets and liabilities. This comprehensive view provides a more accurate assessment compared to focusing on isolated financial elements like income or savings. It considers the interplay between owned resources and outstanding obligations, offering a more realistic representation of financial health.

- Benchmark for Progress TrackingThis snapshot serves as a benchmark for tracking financial progress over time. By comparing snapshots from different periods, individuals can monitor the impact of financial decisions, identify trends, and adjust strategies as needed. This ongoing assessment facilitates proactive financial management and fosters a data-driven approach to achieving financial goals.

- Basis for Informed DecisionsThe financial snapshot provides the necessary context for informed financial decisions. Whether considering a major purchase, refinancing a loan, or adjusting investment strategies, access to a clear and concise overview of financial standing empowers individuals to make sound choices aligned with their overall financial goals. This data-driven approach minimizes financial risks and maximizes opportunities for growth.

- Foundation for Future PlanningThe snapshot serves as a foundation for future financial planning. By understanding current financial standing, individuals can set realistic financial goals, develop effective strategies, and monitor progress towards achieving those goals. This forward-looking perspective promotes financial stability and empowers individuals to take control of their long-term financial well-being.

The financial snapshot provided by a net worth statement template is not merely a static record; it’s a dynamic tool that empowers informed financial management. By understanding its components and implications, individuals can leverage this tool to track progress, make informed decisions, and build a solid foundation for long-term financial success. Regularly updating and analyzing this snapshot enables proactive adjustments to financial strategies, fostering consistent progress towards financial goals and a more secure financial future.

6. Informed Decisions

A net worth statement template facilitates informed financial decision-making by providing a clear and comprehensive overview of one’s financial position. This understanding of assets, liabilities, and overall net worth empowers individuals to make strategic choices regarding spending, saving, and investing. Without a clear understanding of one’s financial standing, decisions may be based on assumptions rather than concrete data, potentially leading to detrimental financial outcomes.

Consider an individual contemplating a significant purchase, such as a new vehicle. A net worth statement clarifies available resources, existing debt obligations, and the potential impact of the purchase on overall financial health. This informed perspective allows for a more reasoned decision, weighing the benefits of the purchase against its long-term financial implications. Similarly, when considering investment opportunities, understanding one’s current asset allocation and risk tolerance, as reflected in the net worth statement, enables more strategic investment choices aligned with individual financial goals. Conversely, without this comprehensive view, investment decisions may be driven by emotion or speculation rather than a sound understanding of one’s financial capacity and risk profile.

The ability to make informed financial decisions represents a cornerstone of effective financial management. A net worth statement template provides the necessary framework for achieving this clarity and control. By fostering a data-driven approach to financial decision-making, this tool minimizes financial risks, maximizes growth opportunities, and contributes significantly to long-term financial well-being and stability. Regularly updating and analyzing this statement allows individuals to adapt to changing financial circumstances and proactively navigate the complexities of personal finance, ultimately paving the way for a more secure financial future.

Key Components of a Net Worth Statement Template

A comprehensive net worth statement template facilitates a thorough understanding of one’s financial position. Key components provide a structured framework for organizing and analyzing financial data. Accurate and detailed information within each component is crucial for generating a meaningful representation of financial health.

1. Assets: A detailed listing of everything owned with monetary value. This includes liquid assets (cash, checking and savings accounts), investments (stocks, bonds, retirement accounts), real estate (primary residence, rental properties), and personal property (vehicles, jewelry). Accurate valuation is critical for a realistic assessment of total assets.

2. Liabilities: A comprehensive record of all outstanding debts and financial obligations. This encompasses secured debt (mortgages, auto loans), unsecured debt (credit cards, personal loans), and both short-term and long-term liabilities. Accurate reporting of outstanding balances and payment terms is essential.

3. Net Worth Calculation: The core calculation derived by subtracting total liabilities from total assets. This figure provides a concise summary of one’s financial standing at a specific point in time. A positive net worth signifies assets exceed liabilities, while a negative net worth indicates the opposite.

4. Date: Clearly indicating the date of the statement provides a point of reference for tracking financial progress over time. This allows for comparisons between different periods and facilitates the identification of trends and patterns.

5. Supporting Documentation: Maintaining supporting documentation, such as account statements and loan documents, substantiates the information within the statement and facilitates accurate record-keeping. This organized approach simplifies future updates and provides a verifiable record of financial information.

Accurate completion of these key components provides a comprehensive and reliable assessment of one’s financial health. This structured approach empowers informed financial decision-making, facilitates effective financial planning, and fosters a proactive approach to managing one’s financial well-being.

How to Create a Net Worth Statement Template

Creating a net worth statement template provides a structured approach to organizing financial data and calculating net worth. A well-designed template facilitates accurate assessment of assets and liabilities, leading to a clear understanding of one’s financial position. The following steps outline the creation process.

1. Choose a Format: Select a format suitable for individual needs. Spreadsheet software offers flexibility and automated calculations, while a simple document or printable template provides a more accessible option. The chosen format should facilitate easy data entry and organization.

2. Create Asset Section: Establish a dedicated section for listing assets. Categorize assets into liquid assets, investments, real estate, and personal property. Include fields for describing each asset, its current value, and relevant account details. Ensure sufficient space for adding multiple entries within each category.

3. Create Liabilities Section: Establish a dedicated section for listing liabilities. Categorize liabilities into secured debts, unsecured debts, and short-term and long-term obligations. Include fields for describing each liability, outstanding balance, interest rate, and payment terms.

4. Incorporate Net Worth Calculation: Include a formula to automatically calculate net worth by subtracting total liabilities from total assets. This automated calculation ensures accuracy and provides a readily available overview of financial standing.

5. Add Date Field: Include a prominent field for specifying the date of the statement. This allows for tracking net worth over time and provides a point of reference for comparing financial snapshots from different periods.

6. Include Space for Supporting Documentation: Designate space or a section for noting supporting documentation, such as account statements and loan documents. This organized approach simplifies future updates and ensures data accuracy.

7. Review and Refine: Thoroughly review the template for completeness and clarity. Ensure all necessary fields are included and that the layout facilitates easy data entry and interpretation. Refine the template as needed to align with individual preferences and financial tracking requirements.

A well-structured template, encompassing these components, facilitates accurate data entry, automated calculations, and ongoing tracking of financial progress. Consistent use of this template contributes significantly to informed financial decision-making and proactive management of one’s financial health.

A net worth statement template provides a structured framework for organizing financial data, calculating net worth, and gaining a clear understanding of one’s financial position. Accurate completion and regular updates offer a dynamic snapshot of financial health, enabling informed decisions regarding spending, saving, and investing. Understanding the components, calculation methods, and benefits of utilizing such a template empowers informed financial management and contributes significantly to long-term financial stability and growth.

Regular use of a net worth statement template fosters proactive financial management and provides a crucial tool for navigating the complexities of personal finance. This organized approach to financial assessment empowers informed decisions, mitigates financial risks, and ultimately contributes to a more secure and prosperous financial future. Leveraging this tool effectively is a cornerstone of sound financial planning and a pathway toward achieving financial goals.