Utilizing these structured reporting tools offers several advantages. They simplify financial management by providing a clear overview of income and expenditures. This clarity aids in budgetary planning and control, enabling more effective resource allocation. Furthermore, standardized reporting strengthens compliance with regulatory requirements, minimizing the risk of penalties and legal issues. Consistent financial records also streamline audits, saving valuable time and resources.

This structured approach to financial reporting enables a deeper exploration of key topics relevant to charitable organizations. The following sections will delve into the specific components of these forms, best practices for their completion, and their significance in demonstrating organizational effectiveness and impact.

1. Standardized Format

Standardized formatting is a cornerstone of effective financial reporting for non-profit organizations. Consistency ensures comparability across periods, simplifies analysis, and promotes transparency for stakeholders. A standardized template provides a structured framework for presenting financial data, ensuring key information is readily accessible and understandable.

- Uniformity of Presentation:Uniformity ensures financial data is presented consistently across all reporting periods. This allows for straightforward year-over-year comparisons, revealing trends and potential areas for improvement. For instance, consistent reporting of fundraising expenses allows for analysis of fundraising efficiency over time. This consistent presentation is crucial for internal evaluation and demonstrating accountability to external stakeholders.

- Defined Line Items:Clearly defined line items categorize revenue and expenses, ensuring all financial activities are accurately captured and reported. Standard categories like “Program Service Revenue” and “Administrative Expenses” facilitate understanding and comparison across different non-profit organizations. This clarity allows stakeholders to quickly grasp the organization’s financial priorities and resource allocation.

- Comparability and Benchmarking:Standardized formats allow for benchmarking against similar organizations. By using a common reporting framework, non-profits can compare their financial performance to industry averages, identify areas for improvement, and demonstrate their financial health relative to their peers. This comparative analysis provides valuable context for internal decision-making and external reporting.

- Enhanced Transparency and Trust:Consistent presentation builds trust with stakeholders. Donors, grantors, and regulators can readily access and understand the organization’s financial position, promoting confidence in its operations and financial management practices. This transparency reinforces accountability and strengthens public trust in the organization’s mission and activities.

By adhering to a standardized format, non-profit organizations create financial statements that are clear, concise, and comparable. This strengthens internal financial management, improves external communication, and ultimately contributes to the long-term sustainability and effectiveness of the organization.

2. Transparency and Trust

Transparency, fostered through clear and accessible financial reporting, is fundamental to building and maintaining trust with stakeholders of non-profit organizations. Stakeholders, including donors, grantors, regulators, and the public, rely on financial statements to understand how resources are utilized and whether the organization is fulfilling its mission effectively. Standardized templates provide the framework for this transparency, enabling consistent and readily understandable reporting of financial activities. A clear depiction of income sources, expenditure breakdowns, and asset management demonstrates accountability and fosters confidence in the organization’s operations. For instance, a detailed breakdown of program expenses demonstrates how donations directly support the organization’s mission, encouraging continued donor support.

The absence of transparent financial reporting can erode public trust and damage an organization’s reputation. Lack of clarity regarding financial activities can raise concerns about mismanagement, inefficiency, or even potential fraud. Conversely, readily available, easily understood financial statements demonstrate a commitment to accountability and ethical practices. This open approach strengthens stakeholder relationships, attracting donors and building a positive public image. Consider the case of a non-profit publishing an annual report with clearly defined financial statements: this act demonstrates responsible stewardship of resources and fosters confidence among potential donors and the broader community. This, in turn, can lead to increased funding opportunities and greater public support for the organization’s mission.

In conclusion, transparency in financial reporting, achieved through the consistent application of standardized templates, is essential for cultivating trust and ensuring the long-term sustainability of non-profit organizations. Clear, accessible financial information demonstrates accountability, strengthens stakeholder relationships, and fosters confidence in the organization’s ability to effectively fulfill its mission. Challenges may arise in adapting specific template elements to individual organizational circumstances; however, prioritizing clarity and consistency remains paramount. By embracing transparency as a core value, non-profits cultivate a culture of trust, paving the way for continued growth and impact.

3. Regulatory Compliance

Regulatory compliance represents a critical aspect of financial management for non-profit organizations. Adherence to specific reporting standards, such as those mandated by the Financial Accounting Standards Board (FASB), is not merely a formality; it is essential for maintaining legal standing and public trust. Utilizing standardized templates for financial statement preparation directly supports compliance efforts. These templates incorporate the required formatting and line items, ensuring consistency and accuracy in reporting. For instance, adherence to FASB 117, which governs reporting for not-for-profit entities, necessitates specific disclosures related to net assets and functional expenses. A template designed in accordance with these standards simplifies the process of generating compliant financial statements. Failure to comply with these regulations can result in penalties, legal action, and damage to an organization’s reputation.

The connection between regulatory compliance and the use of financial statement templates extends beyond simply meeting reporting requirements. Consistent application of these templates enables organizations to establish robust internal controls, mitigating the risk of financial mismanagement and fraud. Clear, standardized reporting facilitates audits, simplifies the process of demonstrating compliance to regulatory bodies, and reduces associated costs. Consider the example of an organization undergoing an audit. The use of consistent, standardized templates simplifies the auditor’s review, reducing the time and resources required for the audit process. This, in turn, frees up organizational resources for core mission-related activities.

In summary, regulatory compliance is not a peripheral concern but an integral component of sound financial management for non-profit organizations. Standardized templates serve as essential tools in achieving and maintaining compliance. By streamlining reporting processes and promoting consistency, these templates contribute to organizational transparency, strengthen accountability, and protect the organization from potential legal and reputational risks. While navigating the complexities of regulatory requirements can be challenging, adopting a proactive approach, including the consistent use of appropriate templates, ultimately strengthens the organization and fosters public trust.

4. Simplified Audits

Streamlined audits directly correlate with the consistent application of standardized financial statement templates within non-profit organizations. Templates ensure uniformity in data presentation, categorization, and disclosure, facilitating the auditor’s review process. This structured approach reduces the time required for auditors to understand the organization’s financial activities, locate necessary information, and verify accuracy. Consequently, audit costs decrease, freeing up valuable resources for programmatic activities. For example, an organization consistently using a template aligned with generally accepted accounting principles (GAAP) will present financial data in a predictable format, simplifying the auditor’s task of verifying compliance. This predictability reduces the need for extensive inquiries and follow-up, thereby streamlining the entire audit process. Conversely, inconsistent reporting practices or a lack of standardized templates can lead to confusion, increased scrutiny, and extended audit timelines, ultimately driving up costs and diverting organizational attention from core mission-related activities.

The benefits of simplified audits extend beyond cost savings. A clean audit, facilitated by well-organized financial records based on consistent templates, enhances an organization’s credibility and reinforces public trust. Donors and grantors often require audited financial statements as a condition of funding. A smooth audit process signals strong financial management practices, increasing the likelihood of securing future funding. Moreover, a clear audit report provides valuable insights into an organization’s financial health, enabling informed decision-making by management and the board of directors. For instance, an auditor’s unqualified opinion, facilitated by clear and consistent financial reporting, can bolster an organization’s reputation and attract potential donors. This positive reinforcement strengthens the organization’s overall financial stability.

In summary, adopting standardized financial statement templates is a strategic investment that yields significant benefits during the audit process. Simplified audits translate to reduced costs, enhanced credibility, and improved decision-making. While implementing and maintaining consistent reporting practices requires initial effort, the long-term advantages in terms of efficiency, transparency, and stakeholder confidence are substantial. Addressing potential challenges, such as adapting templates to specific organizational needs, proactively strengthens financial management practices and contributes to the long-term sustainability of the non-profit sector.

5. Informed Decision-Making

Sound financial decisions are the bedrock of a thriving non-profit organization. Effective resource allocation, program development, and long-term sustainability hinge on the ability to analyze financial data and draw accurate conclusions. Standardized financial statement templates play a crucial role in enabling informed decision-making. By presenting financial information in a consistent, structured format, these templates facilitate analysis and support data-driven insights. For instance, comparing program expenses to outcomes, easily discernible within a standardized statement of activities, allows organizations to assess program effectiveness and make adjustments as needed. Similarly, analyzing trends in revenue sources, readily apparent in a standardized statement of financial position, informs fundraising strategies and diversification efforts. Without consistent, readily accessible financial data, decisions become guesswork, jeopardizing organizational effectiveness and long-term viability.

The practical significance of this connection becomes evident in various scenarios. Consider a non-profit seeking funding for a new program. Presenting potential funders with clear, concise financial statements, prepared using a standardized template, strengthens the organization’s credibility and demonstrates responsible financial management. This increases the likelihood of securing funding. Internally, consistent financial data enables management to identify areas of financial strength and weakness. For example, trends in administrative expenses, easily tracked within a standardized statement of activities, can reveal opportunities for cost savings and efficiency improvements. These data-driven insights empower leadership to make strategic decisions that optimize resource utilization and maximize impact.

In conclusion, the link between standardized financial statement templates and informed decision-making is essential for non-profit success. These templates empower organizations to analyze financial data effectively, understand performance trends, and make strategic choices that drive mission fulfillment. While adapting templates to specific organizational needs may present challenges, the benefits of consistent, structured financial reporting are undeniable. Embracing data-driven decision-making, supported by standardized financial statements, strengthens financial management, improves organizational effectiveness, and ultimately contributes to a more sustainable and impactful non-profit sector.

Key Components of Non-Profit Financial Statements

Effective financial reporting for non-profit organizations relies on several key components, presented within standardized templates. These components provide a comprehensive overview of financial health, enabling stakeholders to assess performance, transparency, and accountability.

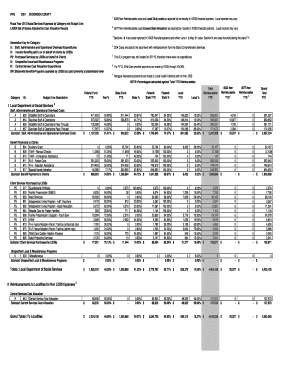

1. Statement of Financial Position (Balance Sheet): This statement presents a snapshot of an organization’s assets, liabilities, and net assets at a specific point in time. It provides insights into the organization’s financial strength and stability. Key elements include cash on hand, investments, accounts receivable, accounts payable, and various categories of net assets (unrestricted, temporarily restricted, and permanently restricted).

2. Statement of Activities (Income Statement): This statement reports revenues and expenses over a specific period, typically a fiscal year. It demonstrates how resources were generated and utilized. Key elements include program service revenue, contributions, grants, fundraising expenses, administrative expenses, and program service expenses. The statement reveals whether the organization operated at a surplus or deficit.

3. Statement of Cash Flows: This statement tracks the movement of cash both into and out of the organization during a specific period. It clarifies how cash was generated from operating, investing, and financing activities. Understanding cash flow is crucial for maintaining operational liquidity and planning for future investments.

4. Statement of Functional Expenses: This statement provides a detailed breakdown of expenses by functional area, such as program services, administration, and fundraising. This breakdown offers insights into how resources are allocated across different organizational activities, enhancing transparency and accountability.

5. Notes to the Financial Statements: These notes provide supplemental information that clarifies and expands upon the data presented within the core financial statements. They offer context, explain accounting policies, and disclose significant contingencies. These notes are essential for a complete understanding of an organization’s financial position.

These interconnected components, presented within standardized templates, offer a comprehensive view of financial performance. They provide stakeholders with the necessary information to assess an organization’s financial health, evaluate its effectiveness in fulfilling its mission, and determine its commitment to transparency and accountability. This standardized presentation allows for consistent analysis, comparison, and informed decision-making.

How to Create a Non-Profit Financial Statement Template

Developing a robust financial statement template requires careful consideration of regulatory requirements and organizational specifics. The following steps outline a structured approach to creating a template suitable for non-profit entities.

1. Determine Reporting Requirements: Identify the applicable accounting standards and regulatory guidelines. This includes determining the necessary reporting framework (e.g., GAAP) and any specific requirements imposed by funders or government agencies.

2. Select Key Financial Statements: Choose the relevant financial statements to include in the template. This typically includes a Statement of Financial Position, Statement of Activities, Statement of Cash Flows, and Statement of Functional Expenses. Consider the organization’s size and complexity when selecting statements.

3. Design the Template Structure: Create a clear and organized structure for each statement. Use consistent formatting, including column headings, row labels, and clear titles. Ensure the template aligns with chosen accounting standards.

4. Define Line Items: Establish specific line items within each statement to capture relevant financial data. Use standard terminology and categories to ensure comparability and consistency. Consider including subcategories for more detailed reporting.

5. Incorporate Formulas and Calculations: Integrate formulas and automated calculations within the template to minimize manual data entry and reduce the risk of errors. This includes calculations for totals, subtotals, and key financial ratios.

6. Include Notes to the Financial Statements: Provide space for explanatory notes within the template. These notes offer essential context, clarify accounting policies, and disclose any significant contingencies.

7. Review and Refine: Thoroughly review the completed template for accuracy, completeness, and clarity. Seek input from relevant stakeholders, including finance staff, auditors, and board members.

8. Implement and Maintain: Implement the template and ensure consistent usage across the organization. Regularly review and update the template to reflect changes in accounting standards or organizational needs.

A well-designed template provides a consistent framework for presenting financial information, promoting transparency, and enabling informed decision-making. Regular review and adaptation ensure the template remains relevant and effectively serves the organization’s evolving needs.

Standardized reporting structures for charitable financial activities provide essential tools for transparency, accountability, and effective resource management. From facilitating regulatory compliance and streamlining audits to empowering data-driven decisions, these frameworks play a vital role in organizational health and sustainability. Consistent application of these templates ensures clear communication with stakeholders, builds trust, and strengthens the overall financial stability of non-profit organizations. Understanding the key components within these statementsfrom the statement of financial position to the notesequips organizations to accurately represent their financial activities and effectively communicate their impact.

Rigorous financial reporting, facilitated by standardized templates, is not merely a procedural necessity but a strategic imperative for the non-profit sector. Embracing these tools enables organizations to demonstrate responsible stewardship of resources, build stronger relationships with stakeholders, and ultimately advance their missions more effectively. Continued focus on refining reporting practices, adapting to evolving regulatory landscapes, and prioritizing data-driven decision-making will further strengthen the sector and enhance its ability to create positive change.