Utilizing a pre-designed framework for this financial reporting offers numerous advantages. It ensures consistency, simplifies the process, and reduces the risk of errors. A standardized format facilitates comparison across different periods, enabling trend analysis and informed projections. This clarity and transparency build trust with donors, grantors, and regulatory bodies, ultimately strengthening the organization’s reputation and fostering long-term sustainability. It also streamlines the auditing process and simplifies tax compliance.

This document serves as a foundational element for understanding the financial landscape of a nonprofit. The following sections will delve deeper into the specific components, explore best practices for its creation and utilization, and discuss how this information can be leveraged for effective storytelling and organizational growth.

1. Revenue Recognition

Accurate revenue recognition is fundamental to the integrity of a nonprofit statement of activities. It governs how and when incoming funds are recorded, ensuring compliance with accounting standards and providing a true representation of financial performance. This process involves identifying the nature of the revenue (contributions, grants, program service revenue, etc.), determining when the organization has earned the revenue, and measuring its value. A robust revenue recognition policy, aligned with generally accepted accounting principles (GAAP), is crucial for building trust with stakeholders and maintaining financial stability. For example, a multi-year grant is recognized incrementally as the organization fulfills the grant requirements and delivers the associated services, rather than recording the entire grant amount upfront. Similarly, in-kind donations are recognized at fair market value at the time of receipt.

Within the statement of activities, revenue is categorized by source, providing transparency into funding streams and their impact on the organization’s overall financial health. This detailed breakdown enables stakeholders to understand the organization’s reliance on different revenue sources, assess its diversification efforts, and evaluate the sustainability of its funding model. Proper revenue recognition directly impacts the accuracy of the net assets calculation, influencing decisions related to program expansion, resource allocation, and future fundraising strategies. For instance, if revenue from a specific fundraising event is incorrectly recorded in the wrong period, it could skew the analysis of the event’s effectiveness and lead to inaccurate projections for future events.

Understanding the principles and practical application of revenue recognition within the context of the statement of activities is paramount for effective nonprofit financial management. Challenges can arise from complex funding arrangements or in-kind contributions. However, a well-defined policy, coupled with consistent implementation and thorough documentation, safeguards the organizations financial integrity and fosters confidence among donors and other stakeholders. This rigor contributes to informed decision-making, strengthens accountability, and ultimately supports the organization’s mission fulfillment.

2. Expense Categorization

A clear and consistent approach to expense categorization is critical for the effective utilization of a nonprofit statement of activities template. Proper categorization provides stakeholders with insights into how resources are deployed, supporting informed decision-making and promoting financial transparency. A well-defined expense categorization framework enables analysis of spending patterns, facilitates comparison across periods, and contributes to a more comprehensive understanding of an organization’s financial health.

- Functional ExpensesCategorizing expenses by functionprogram services, management and general, and fundraisingprovides a clear picture of resource allocation. This breakdown allows stakeholders to assess the proportion of resources dedicated directly to mission-related activities versus supporting functions. For instance, a high percentage of spending on program services demonstrates an organization’s commitment to its core mission. Within the statement of activities template, functional expenses offer a high-level overview of spending priorities, aiding in the evaluation of organizational efficiency and impact.

- Natural ClassificationsClassifying expenses by natural classificationssalaries, rent, supplies, etc.offers a granular view of resource utilization. This detailed breakdown facilitates cost analysis, identifies potential areas for cost savings, and supports budget development. For example, tracking supply expenses within program services allows for analysis of program efficiency and identification of potential cost-saving measures. In the context of the statement of activities template, natural classifications provide a detailed understanding of the composition of expenses within each functional area.

- Cost Centers/DepartmentsAssigning expenses to specific cost centers or departments enables a more nuanced understanding of resource allocation within the organization. This level of detail facilitates internal benchmarking, promotes accountability, and supports cost management at a departmental level. For example, tracking marketing expenses within the fundraising function provides insights into the effectiveness of different fundraising campaigns. Within the statement of activities template, this granular approach allows for a deeper analysis of cost drivers and resource allocation across different areas of the organization.

- Grant or Project-Specific ExpensesTracking expenses related to specific grants or projects enhances accountability and ensures compliance with grant requirements. This distinct categorization allows for accurate reporting to funders and facilitates evaluation of project effectiveness. For example, segregating expenses related to a specific health education grant demonstrates compliance with grant guidelines and allows for analysis of program outcomes. Within the statement of activities template, this segregation ensures transparency and supports informed decision-making related to grant management.

Consistent and detailed expense categorization within the statement of activities template empowers stakeholders to understand how resources are utilized in pursuit of the organization’s mission. This transparency strengthens accountability, informs strategic decision-making, and promotes financial sustainability. By providing a comprehensive view of expenses, the statement of activities serves as a crucial tool for evaluating organizational performance, identifying areas for improvement, and demonstrating the responsible stewardship of resources.

3. Fund Accounting

Fund accounting is a critical aspect of nonprofit financial management and plays a vital role in the structure and interpretation of the statement of activities. It involves segregating resources into distinct funds based on donor restrictions and intended uses. This segregation ensures that funds are utilized in accordance with donor wishes and legal requirements, promoting transparency and accountability. The statement of activities reflects this segregation, providing a clear picture of how resources are managed within each fund.

- Unrestricted FundsUnrestricted funds represent resources available for use at the discretion of the organization’s governing board. These funds can support any aspect of the organization’s mission, including program services, administration, and fundraising. Examples include general contributions, unrestricted investment income, and revenue from fundraising events not designated for specific purposes. Within the statement of activities, unrestricted funds demonstrate the organization’s flexibility and capacity to respond to evolving needs. Their utilization reflects strategic priorities and operational efficiency.

- Temporarily Restricted FundsTemporarily restricted funds are subject to donor-imposed limitations on the timing or purpose of their use. These restrictions expire once specific conditions are met, such as a time constraint or the completion of a designated project. Examples include grants for specific programs, contributions designated for future use, and funds restricted for capital campaigns. The statement of activities tracks the release of these restrictions, demonstrating how temporarily restricted funds become unrestricted over time. This transparency ensures accountability and demonstrates adherence to donor intentions.

- Permanently Restricted FundsPermanently restricted funds are subject to donor stipulations that limit the use of the principal in perpetuity. Only the income generated from these funds can be utilized, typically for specific purposes designated by the donor. Examples include endowments and gifts designated for scholarships. Within the statement of activities, permanently restricted funds demonstrate the organization’s long-term financial stability and commitment to intergenerational impact. The income generated from these funds is reflected in the revenue section, showcasing its contribution to the organization’s operating budget.

- Reporting RequirementsFund accounting ensures compliance with accounting standards and regulatory requirements specific to nonprofits. The statement of activities reflects the financial activity within each fund group, providing a comprehensive overview of the organization’s financial position. This detailed reporting fosters transparency, builds trust with stakeholders, and facilitates informed decision-making. For example, demonstrating the appropriate use of restricted funds through clear reporting strengthens relationships with donors and enhances the organization’s reputation for responsible financial management.

Understanding the interplay between fund accounting and the statement of activities is essential for interpreting a nonprofit’s financial health and sustainability. The segregation of funds within the statement allows stakeholders to assess the organization’s resource allocation, adherence to donor restrictions, and long-term financial outlook. This transparency reinforces accountability and promotes informed decision-making by the board, management, and external stakeholders. Effective fund accounting, reflected in a well-structured statement of activities, is paramount for building trust and ensuring the long-term success of the organization.

4. Template Flexibility

Template flexibility is paramount for a nonprofit statement of activities template to effectively serve diverse organizational structures and reporting needs. A rigid template can hinder accurate representation of financial performance and limit the usefulness of the information presented. Adaptability allows the template to accommodate variations in revenue streams, expense categories, and fund structures, ensuring a comprehensive and accurate reflection of the organization’s financial activities. For example, a small nonprofit primarily reliant on individual donations may require a simpler template compared to a large organization with complex grant funding and multiple program areas. Similarly, organizations with distinct fund accounting needs require a template adaptable to specific fund restrictions and reporting requirements.

The ability to customize a template allows for the inclusion of organization-specific details, enhancing the informativeness and analytical value of the statement. This customization might involve adding specific revenue categories, such as in-kind donations or government grants, or disaggregating expenses by program, department, or project. For example, an organization focused on environmental conservation might benefit from categorizing expenses by project location or conservation initiative. This detailed breakdown facilitates targeted analysis of program effectiveness and cost efficiency. Furthermore, a flexible template can accommodate changes in accounting standards or reporting requirements, ensuring ongoing compliance and comparability. The capacity to adapt to evolving best practices maintains the relevance and usefulness of the financial information presented.

A flexible statement of activities template empowers nonprofits to tailor financial reporting to specific informational needs and stakeholder requirements. This adaptability facilitates informed decision-making, enhances transparency, and strengthens accountability. While standardized templates offer a valuable starting point, the ability to customize and adapt ensures that the statement accurately reflects the organization’s unique financial landscape. This flexibility is not merely a desirable feature; it is a fundamental requirement for a truly effective and insightful nonprofit statement of activities template. Failure to adapt the template to the organization’s specific circumstances can lead to misrepresentation of financial performance and hinder effective decision-making.

5. Comparative Analysis

Comparative analysis is essential for extracting meaningful insights from a nonprofit statement of activities template. Examining financial data across multiple reporting periods reveals trends, assesses organizational performance, and informs strategic decision-making. This analysis provides a deeper understanding of financial health, program effectiveness, and operational efficiency, enabling stakeholders to evaluate progress toward organizational goals and identify areas for improvement. Without comparative analysis, the statement of activities remains a static snapshot, limiting its value for strategic planning and performance evaluation.

- Trend IdentificationAnalyzing revenue and expense trends over several years reveals patterns in financial performance. Increases or decreases in specific revenue streams, such as individual donations or grant funding, can signal the need for adjustments in fundraising strategies. Similarly, analyzing expense trends, such as program service costs or administrative overhead, can identify areas for potential cost savings or reallocation of resources. For example, a consistent decline in individual giving might necessitate a renewed focus on donor cultivation or diversification of funding sources.

- Performance EvaluationComparative analysis facilitates the evaluation of program effectiveness and operational efficiency. By comparing program expenses to outcomes achieved over time, organizations can assess the return on investment for different programs and identify areas for improvement. Similarly, comparing administrative expenses across periods can reveal opportunities to streamline operations and enhance efficiency. For example, an increase in program expenses coupled with a decline in program outcomes might indicate the need for program reevaluation or restructuring.

- BenchmarkingComparing an organization’s financial performance to industry benchmarks provides valuable context for evaluating its own performance. Benchmarking against similar organizations can reveal strengths and weaknesses, identify areas for improvement, and inform best practices. This comparative analysis can focus on various metrics, such as fundraising efficiency, program spending ratios, or administrative overhead. For example, if an organization’s fundraising expenses are significantly higher than the industry average, it may indicate inefficiencies in fundraising practices.

- Predictive ModelingComparative analysis supports informed financial forecasting and budgeting. By identifying historical trends and patterns, organizations can develop more accurate projections of future revenue and expenses. This predictive modeling informs resource allocation decisions, supports strategic planning, and enhances financial stability. For example, analyzing historical trends in government grant funding can inform projections for future grant revenue and guide budget development.

Comparative analysis transforms the nonprofit statement of activities from a static report into a dynamic tool for organizational learning and improvement. By examining trends, evaluating performance, benchmarking against peers, and developing predictive models, organizations gain valuable insights for strategic decision-making, enhanced accountability, and long-term financial sustainability. The ability to compare data across time and against relevant benchmarks unlocks the full potential of the statement of activities as a driver of organizational growth and mission fulfillment.

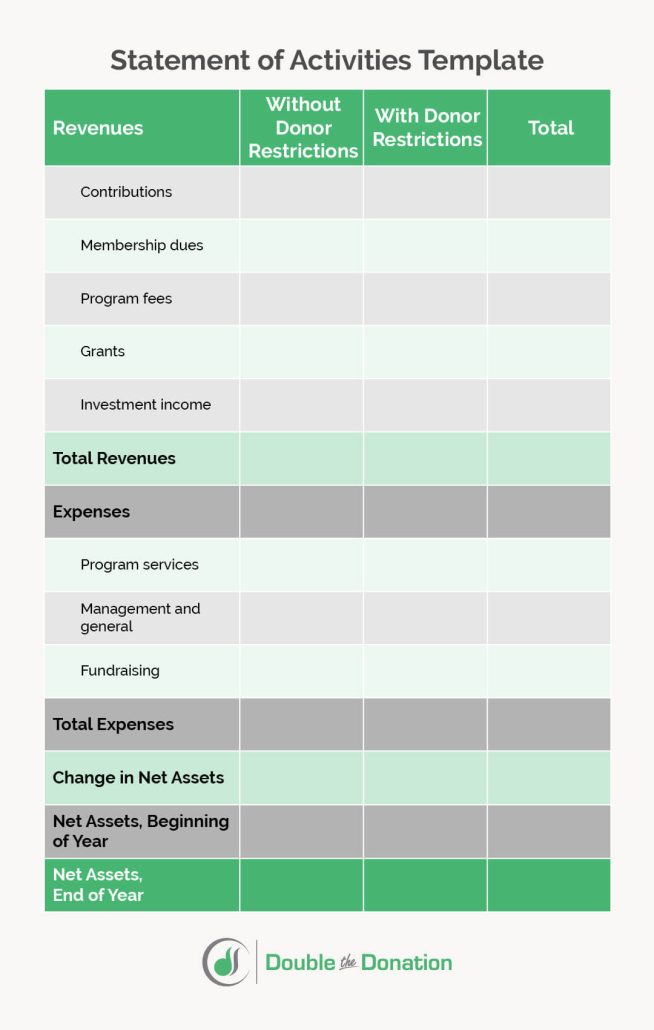

Key Components of a Nonprofit Statement of Activities Template

A well-structured statement of activities template provides a clear and consistent framework for reporting financial performance. Understanding the key components is crucial for accurate reporting, analysis, and informed decision-making.

1. Revenue Recognition: This section details how and when incoming funds are recorded, adhering to accounting principles. Clear categorization distinguishes between contributions, grants, program service revenue, and other income sources. Accurate revenue recognition is fundamental for transparency and accountability.

2. Expense Categorization: Expenses are categorized by function (program services, management and general, fundraising) and natural classification (salaries, rent, supplies). This breakdown allows for analysis of resource allocation and identification of cost-saving opportunities.

3. Fund Accounting: This component reflects the segregation of resources into unrestricted, temporarily restricted, and permanently restricted funds. Clear delineation ensures compliance with donor restrictions and provides insights into long-term financial stability.

4. Reporting Period: The statement covers a specific period, usually a fiscal year, enabling comparison across periods and trend analysis. Accurate timeframes are essential for evaluating progress and making informed projections.

5. Net Assets: The statement calculates the change in net assets, representing the difference between revenues and expenses. This crucial metric reflects the organization’s overall financial health and sustainability.

6. Supporting Documentation: A robust template allows for the inclusion of supporting documentation, such as footnotes or schedules, providing further detail and context for reported figures. This enhances transparency and facilitates auditability.

7. Comparative Information: Presenting prior-year data alongside current figures enables trend analysis, performance evaluation, and informed decision-making. Comparison across periods enhances the analytical value of the statement.

These components work together to provide a comprehensive overview of financial performance, enabling stakeholders to assess the organization’s financial health, program effectiveness, and adherence to donor intentions. A well-designed template ensures transparency, accountability, and informed decision-making, contributing to the long-term sustainability and mission fulfillment of the nonprofit.

How to Create a Nonprofit Statement of Activities Template

Creating a robust template requires careful consideration of key components and adherence to accounting principles. A well-structured template ensures accurate reporting, facilitates analysis, and supports informed decision-making.

1. Define Reporting Period and Frequency: Specify the time frame covered by the statement, typically a fiscal year, and establish the reporting frequency (monthly, quarterly, annually). Consistent reporting periods facilitate comparison and trend analysis.

2. Establish Chart of Accounts: Develop a detailed chart of accounts that aligns with the organization’s specific needs and activities. This chart categorizes revenues and expenses, ensuring consistency and accuracy in financial reporting. Consider both functional categories (program services, management and general, fundraising) and natural classifications (salaries, rent, supplies).

3. Determine Fund Structure: Clearly define the organization’s fund structure (unrestricted, temporarily restricted, permanently restricted) to ensure proper segregation of resources and compliance with donor restrictions.

4. Design Template Layout: Create a clear and organized template layout that facilitates data entry, review, and analysis. Include columns for current-year figures, prior-year comparisons, and budget amounts. Consider using a spreadsheet program or accounting software for ease of use and data manipulation.

5. Incorporate Formulas and Calculations: Build in formulas and automated calculations to ensure accuracy and efficiency. Automate the calculation of net assets (revenues minus expenses) and other key metrics.

6. Implement Internal Controls: Establish internal controls to ensure data integrity and prevent errors. Implement procedures for data entry, review, and approval to maintain accuracy and accountability.

7. Review and Refine: Regularly review and refine the template based on evolving organizational needs and reporting requirements. Ensure that the template remains relevant, accurate, and adaptable to changes in accounting standards or organizational structure. Seek input from finance professionals or auditors to ensure best practices are followed.

A well-designed template, incorporating these elements, provides a robust framework for tracking financial performance, analyzing trends, and making informed decisions. Regular review and refinement ensures its ongoing effectiveness in supporting the organization’s mission and financial sustainability. This structured approach to financial reporting strengthens accountability, builds trust with stakeholders, and promotes long-term organizational health.

Effective financial stewardship is paramount for nonprofit organizations. A well-designed template for the statement of activities provides a crucial framework for understanding financial performance, demonstrating accountability, and making informed decisions. From revenue recognition and expense categorization to fund accounting and comparative analysis, each component contributes to a comprehensive view of an organization’s financial health and sustainability. Template flexibility allows adaptation to diverse organizational structures and reporting needs, ensuring relevance and accuracy. Rigorous attention to these elements strengthens internal controls, promotes transparency, and builds trust with stakeholders.

The statement of activities serves not merely as a reporting requirement but as a dynamic tool for organizational learning and growth. Its effective utilization empowers nonprofits to evaluate program effectiveness, identify areas for improvement, and optimize resource allocation. By embracing best practices in financial reporting and analysis, organizations can strengthen their financial position, enhance their impact, and advance their missions. Continued focus on these principles ensures long-term sustainability and fosters public trust in the nonprofit sector.