Using a standardized format offers several advantages. It simplifies financial reporting, making it easier for stakeholders like donors, grantors, and regulatory bodies to understand an organization’s financial standing. This clarity fosters trust and confidence. Moreover, a consistent structure facilitates comparison across different periods, allowing for trend analysis and informed decision-making regarding resource allocation and future planning. It also helps ensure compliance with accounting standards specific to the nonprofit sector.

This foundational document provides a crucial starting point for deeper exploration into topics such as financial statement analysis, nonprofit accounting practices, and regulatory requirements. Understanding its components and significance is key to effective financial management and responsible stewardship of resources within the nonprofit sector.

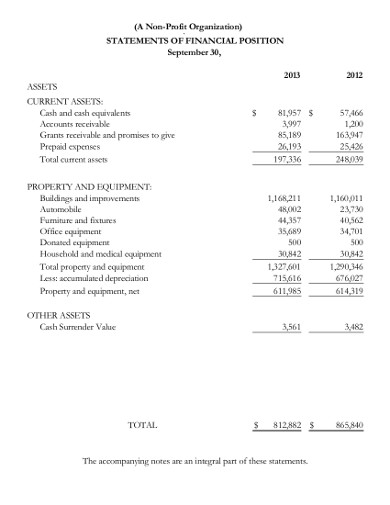

1. Assets

Assets represent the resources a nonprofit organization owns and utilizes to carry out its mission. Accurately representing assets on the statement of financial position is crucial for demonstrating financial health and responsible resource management to stakeholders.

- Current AssetsThese assets are expected to be converted into cash or used within one year. Examples include cash, accounts receivable (monies owed to the organization), and prepaid expenses. Properly accounting for current assets provides insight into the organization’s short-term liquidity and its ability to meet immediate obligations.

- Fixed AssetsAlso known as long-term assets, these resources are tangible and expected to benefit the organization for more than one year. Examples include property, buildings, equipment, and vehicles. Depreciation, representing the decrease in value over time, is a key consideration when reporting fixed assets.

- InvestmentsInvestments held by nonprofits can include stocks, bonds, and other financial instruments. These are reported at fair market value and represent resources intended to generate income or appreciate in value over time. Transparency in reporting investment holdings is crucial for demonstrating responsible financial stewardship.

- Intangible AssetsThese non-physical assets represent long-term rights and privileges that hold value for the organization. Examples include trademarks, copyrights, and goodwill. The valuation of intangible assets can be complex and requires careful consideration of factors such as useful life and potential impairment.

A comprehensive understanding of these asset categories and their proper representation within the statement of financial position provides stakeholders with a clear picture of the organization’s resources, financial strength, and capacity to fulfill its mission. Accurate and transparent asset reporting fosters trust and supports informed decision-making.

2. Liabilities

Liabilities represent the obligations a nonprofit organization owes to external parties. Accurate and transparent reporting of liabilities is essential for presenting a complete and truthful picture of the organization’s financial position within the statement of financial position. A clear understanding of liabilities allows stakeholders to assess the organization’s financial health and long-term sustainability.

- Accounts PayableThese represent short-term obligations owed to vendors or suppliers for goods and services received but not yet paid for. Examples include invoices for office supplies, program materials, or professional services. Managing accounts payable effectively is crucial for maintaining positive relationships with vendors and ensuring operational efficiency.

- Accrued ExpensesAccrued expenses represent expenses incurred but not yet paid. Examples include salaries payable, utilities, and interest expense. Recognizing accrued expenses ensures accurate matching of revenues and expenses within a given reporting period, adhering to sound accounting principles.

- Deferred RevenueThis represents payments received for goods or services that have not yet been delivered or rendered. For example, a nonprofit might receive a grant for a program that will be implemented over several years. The portion of the grant related to future periods is recognized as deferred revenue. This accurate reflection of unearned income prevents overstatement of revenue in the current period and ensures compliance with accounting standards.

- Loans PayableLoans payable represent long-term debt obligations, such as mortgages or other borrowed funds. Details regarding the principal amount, interest rate, and repayment terms are essential for assessing the organization’s long-term financial commitments and solvency. Properly accounting for loan balances and related interest expense demonstrates financial transparency and responsibility to lenders and other stakeholders.

A complete and accurate representation of liabilities within the nonprofit statement of financial position is crucial for demonstrating financial transparency and accountability. Understanding the different types of liabilities and their implications allows stakeholders to assess the organization’s financial health, its ability to meet its obligations, and its long-term sustainability. This clarity fosters trust with funders, creditors, and the public, reinforcing the organizations credibility and mission-driven focus.

3. Net Assets

Net assets represent the residual value of a nonprofit organization’s assets after deducting its liabilities. Within the context of a nonprofit statement of financial position template, net assets provide a crucial indicator of an organization’s financial strength and long-term sustainability. Understanding the composition and classification of net assets is essential for interpreting the organization’s financial position and resource allocation strategies. Net assets are categorized into three classes: unrestricted, temporarily restricted, and permanently restricted. This classification reflects donor-imposed restrictions on the use of funds. For instance, a donation specifically designated for a new building project would be classified as temporarily restricted net assets until the project is completed. This distinction provides transparency regarding the availability of resources for various organizational activities.

The relationship between net assets and the statement of financial position is fundamental. Changes in net assets reflect the organization’s financial performance over time. Increases in net assets generally indicate positive financial outcomes, while decreases may signal financial challenges. Analyzing trends in net assets, particularly within specific classifications, provides valuable insights into the organization’s ability to manage resources effectively and fulfill its mission. For example, a significant increase in unrestricted net assets might demonstrate successful fundraising efforts or efficient program delivery, while a decline in temporarily restricted net assets could indicate delays in project implementation. This analysis is crucial for informed decision-making by management, the board, and external stakeholders.

A thorough understanding of net assets and their relationship to the statement of financial position is paramount for assessing a nonprofit’s financial health and long-term viability. The classification of net assets provides crucial context for interpreting the organization’s resource allocation and ability to meet its obligations. Consistent and transparent reporting of net assets strengthens accountability and fosters trust with donors, grantors, and the broader community. Regular review and analysis of net asset trends facilitate informed strategic planning and resource management, contributing to the organization’s overall effectiveness and mission accomplishment.

4. Standardized Format

A standardized format is fundamental to the efficacy of a nonprofit statement of financial position template. Consistency in presentation ensures comparability across organizations and over time, enabling stakeholders to readily understand and analyze financial information. Adherence to established accounting principles and reporting guidelines promotes transparency and accountability, fostering trust among donors, grantors, and regulatory bodies. A structured approach facilitates informed decision-making based on reliable and readily accessible financial data.

- ComparabilityStandardized templates allow for direct comparison of financial data between different nonprofits and across reporting periods within the same organization. This comparability is crucial for benchmarking performance, identifying trends, and assessing financial health relative to industry peers. For example, analyzing trends in net assets across multiple years reveals insights into an organization’s financial stability and growth trajectory.

- Transparency and AccountabilityConsistent presentation of financial information using a standardized template promotes transparency by ensuring all stakeholders have access to the same data in a clear and understandable format. This transparency reinforces accountability by enabling stakeholders to readily assess how resources are managed and utilized. Clear reporting builds trust and strengthens public confidence in the organization’s financial stewardship.

- Compliance and Regulatory RequirementsStandardized templates often align with regulatory requirements and generally accepted accounting principles (GAAP), ensuring compliance and simplifying audits. This adherence to established standards reinforces the credibility of the financial information presented and reduces the risk of reporting errors or inconsistencies. Consistent compliance strengthens the organization’s reputation and legal standing.

- Efficiency and Data AnalysisUtilizing a standardized template streamlines the financial reporting process, improving efficiency and reducing the likelihood of errors. The structured format facilitates data analysis, enabling stakeholders to quickly identify key financial indicators and trends. Efficient reporting allows for more timely and informed decision-making, supporting effective resource allocation and strategic planning.

The standardized format of a nonprofit statement of financial position template is integral to its value as a tool for communication, analysis, and accountability. By promoting comparability, transparency, and compliance, a standardized approach strengthens the organization’s financial management practices and fosters trust with stakeholders. This consistent structure ensures that financial information is readily accessible, understandable, and reliable, enabling informed decision-making and supporting the organization’s long-term sustainability.

5. Transparency

Transparency serves as a cornerstone of public trust for nonprofit organizations. The statement of financial position, acting as a public-facing document, plays a crucial role in achieving this transparency. Openly communicating financial information through a clear and accessible format demonstrates accountability to donors, grantors, and the broader community. This open access to financial data enables stakeholders to understand how resources are acquired, managed, and utilized in pursuit of the organization’s mission. For instance, disclosing details of administrative expenses demonstrates responsible stewardship and allows donors to assess the efficiency of fundraising efforts. Conversely, a lack of transparency can erode public trust, potentially impacting an organization’s ability to secure funding and support.

The practical significance of transparency within the nonprofit sector cannot be overstated. A clear and readily understandable statement of financial position empowers stakeholders to make informed decisions about their involvement with an organization. Donors can assess the alignment of their philanthropic goals with the organization’s financial priorities, while grantors can evaluate the organization’s financial stability and capacity to manage awarded funds effectively. Moreover, transparency facilitates internal accountability, enabling board members and staff to monitor financial performance and identify areas for improvement. For example, transparent reporting of program expenses allows for evaluation of program effectiveness and cost-efficiency, driving data-driven decision-making and continuous improvement.

Transparency, facilitated by a comprehensive and accessible statement of financial position, is essential for building and maintaining public trust, securing funding, and ensuring long-term sustainability within the nonprofit sector. Organizations that prioritize transparent financial reporting cultivate stronger relationships with stakeholders, demonstrating a commitment to responsible resource management and ethical operations. This commitment, in turn, strengthens the organization’s reputation and enhances its ability to fulfill its mission effectively. Addressing potential challenges related to data privacy and confidentiality while upholding transparency requires careful consideration and implementation of appropriate safeguards, further reinforcing the organization’s commitment to ethical practices.

6. Accountability

Accountability forms the bedrock of trust and ethical operations within the nonprofit sector. The statement of financial position serves as a critical instrument for demonstrating this accountability, providing a transparent record of financial activities and resource management. This document offers a clear picture of how an organization acquires, utilizes, and safeguards its assets, fulfilling its obligations to donors, grantors, beneficiaries, and the public. A well-structured statement of financial position demonstrates a commitment to responsible financial stewardship, enabling stakeholders to assess the organization’s effectiveness and integrity. For instance, accurately reporting fundraising expenses and program expenditures demonstrates how resources are aligned with the organization’s stated mission and provides a basis for evaluating the efficiency of resource allocation. Failure to maintain accurate and transparent financial records can severely damage an organization’s reputation, eroding public trust and jeopardizing future funding opportunities.

The practical application of accountability, as manifested through the statement of financial position, has far-reaching implications for nonprofit sustainability and effectiveness. Regular audits and independent reviews of financial statements further strengthen accountability, providing external validation of the organization’s financial practices. This external scrutiny enhances credibility and reinforces donor confidence. Moreover, internal financial controls and rigorous accounting procedures ensure the accuracy and reliability of reported information, mitigating the risk of fraud and mismanagement. For example, segregation of duties and regular reconciliation of accounts minimize opportunities for financial impropriety and ensure that financial information is accurate and reliable. Robust financial management practices, coupled with transparent reporting, enable organizations to attract and retain funding, build strong relationships with stakeholders, and achieve their mission effectively.

In conclusion, accountability, as embodied within the statement of financial position, is not merely a compliance requirement but a core principle that underpins ethical and effective operations within the nonprofit sector. Transparent financial reporting fosters trust, strengthens public confidence, and ensures responsible resource management. Organizations that prioritize accountability demonstrate a commitment to their stakeholders and contribute to the overall integrity and sustainability of the nonprofit sector. Addressing potential challenges related to capacity building and resource constraints for smaller organizations requires collaborative efforts and innovative solutions to strengthen financial management practices and promote greater accountability across the sector.

Key Components of a Nonprofit Statement of Financial Position

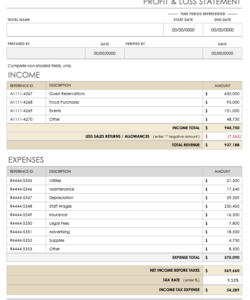

A clear understanding of the key components within a nonprofit statement of financial position is essential for interpreting an organization’s financial health and stability. These components provide a structured overview of resources, obligations, and the residual value available to support the organization’s mission.

1. Assets: Resources owned or controlled by the organization, including cash, investments, accounts receivable, property, and equipment. Assets represent the tools and resources available for program implementation and operational activities. Proper categorization (current vs. non-current) reflects their anticipated use within or beyond one year.

2. Liabilities: Obligations owed to external parties, representing claims against the organization’s assets. These include accounts payable, accrued expenses, deferred revenue, and loans payable. Liabilities provide insight into the organization’s financial commitments and the potential impact on future resource availability.

3. Net Assets: The residual value remaining after deducting liabilities from assets. Net assets represent the organization’s equity and are categorized as unrestricted, temporarily restricted, or permanently restricted, reflecting donor-imposed limitations on their use. This categorization reveals the flexibility and availability of resources for various organizational purposes.

4. Statement Date: The specific point in time to which the financial information applies. This date is crucial for understanding the snapshot of the organization’s financial position being presented and for comparing information across different periods.

5. Currency: The monetary unit in which the financial information is presented. Clarity regarding the currency used is essential for accurate interpretation, especially for organizations operating in multiple countries or receiving funds in different currencies.

6. Supporting Notes: Supplemental information providing further details and context for the amounts presented in the statement. These notes offer explanations of accounting policies, significant transactions, and other relevant disclosures necessary for a comprehensive understanding of the organization’s financial position. They ensure transparency and facilitate a deeper analysis of the financial data.

These interconnected components provide a comprehensive overview of a nonprofit’s financial standing at a specific point in time. Their proper presentation and interpretation are crucial for assessing financial health, evaluating resource management, and ensuring accountability to stakeholders.

How to Create a Nonprofit Statement of Financial Position

Creating a robust statement of financial position requires careful consideration of key components and adherence to established accounting principles. The following steps outline the process for developing this essential financial document.

1. Gather Necessary Information: Compile all relevant financial records, including bank statements, investment reports, invoices, loan documents, and grant agreements. Accurate and complete data is fundamental to creating a reliable statement of financial position.

2. Determine the Reporting Date: Establish the specific date for which the financial information will be reported. This date represents the snapshot in time reflected in the statement.

3. Identify and Categorize Assets: List all resources owned or controlled by the organization, categorizing them as current or non-current. Current assets are expected to be converted to cash or used within one year, while non-current assets have a longer lifespan. Ensure appropriate valuation methods are applied.

4. Identify and Categorize Liabilities: List all obligations owed to external parties, categorizing them based on their due dates (current or non-current). Accurate recognition of liabilities is essential for presenting a complete financial picture.

5. Calculate Net Assets: Determine net assets by subtracting total liabilities from total assets. Categorize net assets as unrestricted, temporarily restricted, or permanently restricted based on donor-imposed restrictions.

6. Prepare the Statement Format: Utilize a standardized template or software to organize the information clearly and logically. The statement should present assets, liabilities, and net assets in a structured manner, adhering to established accounting principles.

7. Include Supporting Notes: Prepare accompanying notes providing additional context and details regarding the information presented in the statement. These notes enhance transparency and facilitate a deeper understanding of the organization’s financial position.

8. Review and Verify: Thoroughly review the completed statement for accuracy and completeness. Independent review by a qualified professional strengthens the reliability and credibility of the financial information presented.

A well-prepared statement of financial position provides a clear and accurate representation of an organization’s financial health at a specific point in time. Adherence to these steps ensures the reliability and transparency of the financial information presented, supporting informed decision-making and strengthening accountability to stakeholders.

Careful consideration of a structured financial document tailored for nonprofit organizations is essential for transparent and accountable financial reporting. This document provides a snapshot of an organization’s financial health by presenting a clear overview of assets, liabilities, and net assets. Understanding the components, classifications, and relationships within this structured report enables informed decision-making regarding resource allocation, strategic planning, and compliance with regulatory requirements. Standardized formatting promotes comparability and enhances stakeholder understanding, fostering trust and confidence in the organization’s financial stewardship.

Effective utilization of this structured financial overview empowers nonprofit organizations to demonstrate financial responsibility and sustainability. Regular review and analysis of this document provide valuable insights into financial performance and inform strategic adjustments for optimal resource management. A commitment to accurate and transparent financial reporting strengthens accountability, reinforces public trust, and contributes to the long-term success and impactful mission fulfillment within the nonprofit sector. Further exploration of nonprofit accounting principles and reporting best practices will enhance the organization’s ability to utilize this document effectively and maintain financial integrity.