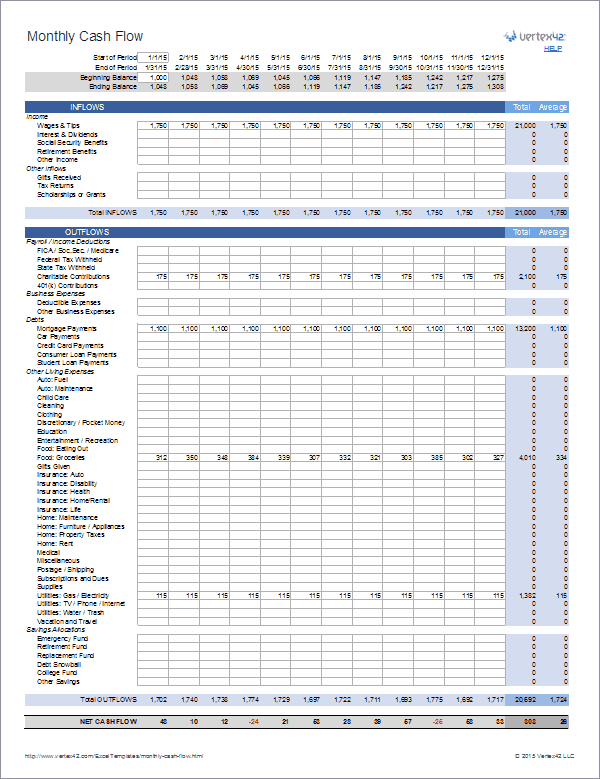

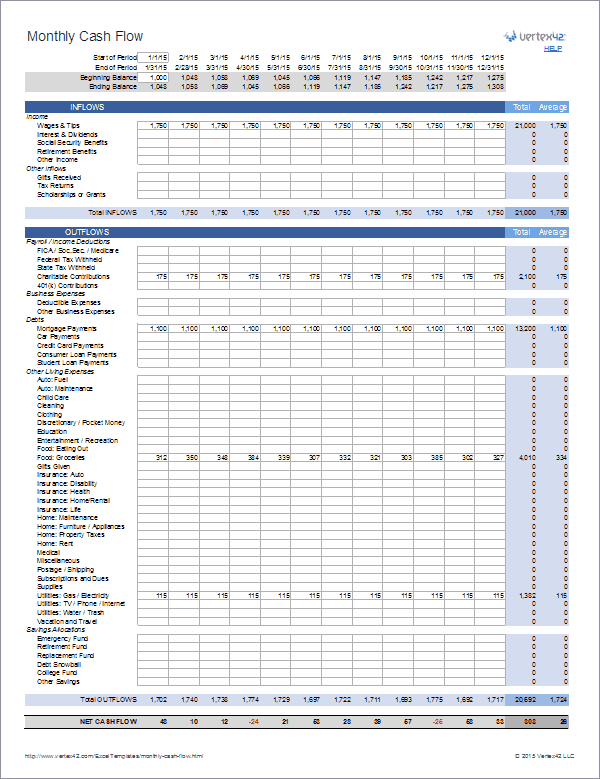

Utilizing such a structure offers several key advantages. It facilitates better budgeting by providing a concrete overview of financial inflows and outflows. This, in turn, can highlight areas of overspending and identify opportunities for savings. Furthermore, it helps in setting realistic financial goals, whether short-term, like paying off a credit card, or long-term, like retirement planning. The insights gained can also aid in securing loans or making informed investment decisions by demonstrating a clear financial picture.

The following sections will delve into the specific components of a typical structure, explore different methods for its creation and utilization, and offer practical tips for maximizing its effectiveness in managing personal finances.

1. Income Sources

Accurate representation of income sources within a cash flow framework is fundamental for effective financial management. A comprehensive understanding of these sources allows for realistic budgeting, informed financial decision-making, and a clear picture of overall financial health. This section explores key facets of income inclusion within such a framework.

- Earned IncomeThis constitutes the most common income source, encompassing salaries, wages, commissions, and bonuses received from employment. Accurate recording of net income, after tax deductions, is crucial for realistic budgeting. For example, an individual earning a salary should record their take-home pay, not the gross amount. This ensures the documented income accurately reflects the funds available for expenses and savings.

- Investment IncomeThis category includes income derived from investments such as dividends from stocks, interest from bonds, and rental income from properties. Tracking investment income separately allows for assessment of investment performance and its contribution to overall cash flow. For instance, an individual receiving monthly dividends can track these amounts to understand their investment portfolio’s performance and adjust their financial strategy accordingly.

- Passive IncomeThis represents income generated from sources requiring minimal ongoing effort, including royalties, business ownership distributions, and income from online ventures. Clear documentation of passive income streams is essential for understanding long-term financial stability and potential growth. An example includes income from a blog or online course, which, while fluctuating, contributes to overall cash flow and requires separate tracking for a comprehensive financial overview.

- Other IncomeThis encompasses any other income sources not falling within the previous categories, such as gifts, inheritance, or government benefits. While potentially irregular, these sources should be included to provide a complete picture of all incoming funds. For instance, a one-time inheritance, while not recurring, can significantly impact short-term cash flow and influence financial decisions.

By meticulously documenting all income streams within a cash flow framework, individuals gain a comprehensive understanding of their financial resources, enabling more effective budgeting, informed financial planning, and a clearer path toward financial goals. This detailed income analysis forms the foundation for sound financial management.

2. Expense Tracking

Effective financial management necessitates a clear understanding of where money is spent. Expense tracking, a crucial component of a structured personal cash flow framework, provides this insight. By diligently monitoring expenditures, individuals gain a comprehensive view of their spending habits, enabling informed decisions about budgeting, saving, and overall financial well-being. This section explores key facets of expense tracking within a personal cash flow context.

- Fixed ExpensesThese recurring expenses remain relatively consistent in amount and frequency, encompassing necessities like rent or mortgage payments, loan installments, and insurance premiums. Understanding fixed expenses is crucial for establishing a baseline budget. For instance, knowing the monthly mortgage payment allows for accurate allocation of funds and informed decisions about other expenditures.

- Variable ExpensesThese expenses fluctuate in amount and frequency, including groceries, utilities, transportation costs, and entertainment. Tracking variable expenses reveals spending patterns and identifies areas for potential savings. For example, monitoring weekly grocery spending can highlight opportunities to reduce costs by planning meals or utilizing coupons.

- Discretionary ExpensesThese non-essential expenses represent lifestyle choices, including dining out, entertainment subscriptions, and hobbies. Analyzing discretionary spending allows for adjustments aligned with financial goals. For instance, evaluating monthly spending on entertainment subscriptions can reveal potential savings if subscriptions are underutilized.

- Periodic ExpensesThese occasional expenses occur less frequently but can be significant, such as annual insurance premiums, property taxes, or major repairs. Accounting for periodic expenses ensures accurate budgeting and avoids financial surprises. For example, setting aside funds monthly for an annual insurance premium prevents a large, unexpected outflow when the payment is due.

By meticulously tracking all expense categories within a structured framework, individuals gain valuable insights into their spending habits. This awareness empowers informed decisions about budgeting, saving, and financial prioritization, ultimately contributing to a more comprehensive and effective approach to personal financial management. This detailed expense analysis, combined with a clear understanding of income sources, forms the cornerstone of sound financial planning within a personal cash flow context.

3. Regular Monitoring

Regular monitoring of a personal cash flow statement is essential for maintaining financial health and achieving financial goals. A static template provides a framework, but its true value lies in its dynamic application through consistent review. This iterative process allows individuals to adapt to changing financial circumstances, identify potential issues, and make informed decisions. For example, a sudden increase in a variable expense, such as utility bills, can be quickly identified and addressed through adjustments in other areas of the budget or by investigating the cause of the increase. Without regular monitoring, such a change might go unnoticed, potentially leading to a budget deficit.

The frequency of monitoring depends on individual circumstances and financial goals. Some individuals may benefit from weekly reviews, particularly when closely managing expenses or working towards short-term financial objectives. Others may find monthly reviews sufficient for maintaining a general overview and tracking progress towards longer-term goals. Regardless of frequency, consistency is key. Consistent monitoring facilitates early detection of financial imbalances, allowing for timely corrective action. For instance, regularly reviewing investment income allows for adjustments to investment strategies based on performance and market conditions. This proactive approach minimizes potential losses and maximizes returns.

Regular monitoring is not merely a passive review of income and expenses; it is an active process of financial management. It provides the insights needed to make informed decisions about spending, saving, and investing. By understanding the dynamic relationship between income, expenses, and overall financial health, individuals can make adjustments to their financial strategies to stay on track towards their goals. Challenges may arise, such as unexpected expenses or fluctuating income, but regular monitoring provides the framework for navigating these challenges effectively. This proactive approach empowers individuals to maintain control of their finances and make informed decisions that contribute to long-term financial stability.

4. Budgeting Tool

A personal cash flow statement template functions as a powerful budgeting tool. It provides a structured framework for understanding the relationship between income and expenses, forming the foundation for informed budget creation. By documenting all income sources and tracking expenditures, individuals gain a clear picture of their financial inflows and outflows. This awareness is crucial for developing a realistic budget that aligns with financial goals. For example, if the statement reveals consistent overspending in a particular category, such as dining out, adjustments can be made to the budget to curtail this expense and redirect funds towards savings or debt reduction.

The template facilitates proactive budgeting, not merely reactive adjustments. By projecting future income and anticipated expenses, individuals can anticipate potential shortfalls or surpluses, enabling proactive financial planning. This forward-looking approach allows for informed decisions regarding savings, investments, and large purchases. For instance, if an individual anticipates a significant expense, such as a home repair, the template allows them to plan ahead, adjust their budget accordingly, and accumulate the necessary funds without disrupting their overall financial stability. This proactive approach minimizes financial stress and promotes responsible financial management.

Effective budgeting hinges on accurate data and consistent monitoring. The template provides the structure for collecting and organizing this data, enabling informed budget creation and ongoing adjustments. Regular review of the statement allows for adjustments to the budget based on actual spending patterns and changing financial circumstances. This dynamic relationship between the template and the budgeting process ensures the budget remains a relevant and effective tool for achieving financial goals. The template becomes more than a static document; it evolves into a dynamic tool for ongoing financial management, empowering informed decisions and contributing to long-term financial well-being.

5. Financial Clarity

Financial clarity, a cornerstone of sound financial management, is intrinsically linked to the utilization of a personal cash flow statement template. The template serves as a tool for achieving this clarity, providing a structured framework for understanding income, expenses, and overall financial health. Without a clear understanding of these elements, informed financial decision-making becomes challenging. The following facets illustrate how the template contributes to financial clarity.

- Informed Decision-MakingA clear understanding of cash flow empowers informed financial decisions. By analyzing income sources and spending patterns documented within the template, individuals can make reasoned choices about budgeting, saving, and investing. For example, recognizing consistent surplus cash flow may prompt the decision to increase retirement contributions or invest in a diversified portfolio. Conversely, identifying a consistent deficit can lead to informed decisions about reducing discretionary spending or exploring additional income streams. The template provides the data-driven foundation for these decisions.

- Goal Setting and AchievementFinancial clarity, facilitated by the template, is essential for setting realistic financial goals and developing actionable plans for their achievement. Whether the goal is short-term, such as paying off a credit card balance, or long-term, such as saving for a down payment on a house, the template provides the necessary insights into current financial standing and potential for future growth. This understanding enables the creation of a structured plan with defined milestones, fostering a sense of purpose and direction in financial endeavors.

- Debt ManagementThe template provides a clear picture of debt obligations and their impact on overall cash flow. By analyzing income and expenses alongside existing debt, individuals can develop effective debt management strategies. For example, the template may reveal that a significant portion of income is allocated to servicing high-interest debt. This realization can prompt exploration of debt consolidation options or strategies for accelerating debt repayment, ultimately contributing to improved financial health and reduced financial stress.

- Financial Awareness and ControlUtilizing a template fosters increased financial awareness and a sense of control over personal finances. By actively tracking income and expenses, individuals gain a deeper understanding of their financial habits and the factors influencing their financial well-being. This awareness empowers proactive financial management, allowing for adjustments to spending patterns, savings strategies, and investment decisions based on data-driven insights rather than assumptions or guesswork. This sense of control contributes to reduced financial stress and improved overall financial confidence.

The insights derived from a diligently maintained personal cash flow statement template contribute significantly to financial clarity. This clarity, in turn, empowers informed decision-making, facilitates goal setting and achievement, supports effective debt management, and fosters a sense of control over one’s financial life. The template serves as a foundational tool for building a secure and prosperous financial future. It transforms financial management from a reactive process to a proactive endeavor, enabling individuals to navigate financial complexities with confidence and purpose.

Key Components of a Personal Cash Flow Statement

A well-structured template provides a comprehensive overview of an individual’s financial status. Several key components contribute to this comprehensive view, enabling informed financial management.

1. Income Section: This section details all sources of income. Categorization provides clarity. Common categories include salary, wages, investment income (dividends, interest, capital gains), business income, and other income (e.g., gifts, alimony). Accurate and detailed income documentation is crucial for a realistic assessment of financial resources.

2. Expense Section: This section itemizes all expenditures, categorized for analysis. Typical categories include housing (rent, mortgage), transportation (car payments, fuel), food, utilities, healthcare, insurance, debt payments, and entertainment. Detailed expense tracking reveals spending patterns and informs budget adjustments.

3. Cash Flow Calculation: This crucial element determines net cash flowthe difference between total income and total expenses. A positive cash flow indicates more income than expenses, while a negative cash flow signifies the opposite. This calculation provides a fundamental understanding of financial health and informs financial planning.

4. Reporting Period: The template specifies a defined period, such as a month, quarter, or year. This timeframe provides a consistent basis for analysis and comparison. Analyzing cash flow over different periods reveals trends and facilitates more effective financial management.

5. Supporting Documentation: While not directly part of the template itself, supporting documentation, such as pay stubs, bank statements, and investment reports, substantiates the data entered and enhances accuracy. This documentation is crucial for verifying the accuracy of the information and provides a detailed audit trail for future reference.

6. Net Worth Calculation (Optional): Some templates incorporate a net worth section, although this is more commonly found in a balance sheet. Net worth represents the difference between assets (what is owned) and liabilities (what is owed). Including this element provides a broader view of financial health beyond cash flow.

Careful consideration of each component ensures a comprehensive and accurate representation of financial status, providing the foundation for informed financial decisions and long-term financial well-being. This structure enables effective tracking, analysis, and planning for present and future financial stability.

How to Create a Personal Cash Flow Statement Template

Creating a structured template provides a foundation for effective personal financial management. Several methods exist, each offering varying levels of complexity and customization. The following steps outline a straightforward approach to creating a template suitable for most individuals.

1. Choose a Format: One can opt for a spreadsheet program, dedicated budgeting software, or a simple paper-based system. Spreadsheet software offers flexibility and formula integration for automated calculations. Budgeting software often provides additional features like expense categorization and financial reporting. Paper-based systems offer simplicity but lack the computational advantages of digital tools.

2. Define the Reporting Period: Specify a timeframe for the cash flow statement, such as a month, quarter, or year. A monthly timeframe offers greater granularity for tracking and analyzing spending habits, while a quarterly or annual view provides a broader perspective on financial trends.

3. Create the Income Section: List all sources of income, categorizing them for clarity. Standard categories include salary, investments, business income, and other income. Ensure accurate recording of net income after taxes and deductions.

4. Create the Expense Section: Detail all expense categories, including fixed expenses (rent, mortgage), variable expenses (groceries, utilities), and periodic expenses (insurance premiums). Comprehensive expense tracking is crucial for identifying areas for potential savings and budget adjustments.

5. Include a Cash Flow Calculation: Dedicate a section to calculating the net cash flow, which represents the difference between total income and total expenses. This calculation serves as a key indicator of financial health and informs budgeting decisions.

6. (Optional) Add a Net Worth Section: While not strictly part of a cash flow statement, a net worth calculation can provide additional financial context. This involves listing assets (e.g., bank accounts, investments, property) and liabilities (e.g., loans, credit card debt), calculating the difference to determine net worth.

7. Regularly Update and Review: A template offers limited value without consistent usage. Regularly update the template with income and expense data to maintain an accurate and current view of financial status. Periodic review of the template is crucial for identifying trends, making informed budget adjustments, and tracking progress towards financial goals.

A consistently maintained and thoughtfully structured template provides a clear picture of financial health, enabling informed decisions, effective budgeting, and proactive management of personal finances. The chosen method and level of detail should align with individual needs and financial objectives.

A structured framework for managing personal finances provides a crucial tool for understanding the dynamics of income and expenses. From detailed income categorization to comprehensive expense tracking, a thoughtfully designed structure offers insights into spending patterns, facilitates informed budgeting decisions, and enables proactive planning for future financial stability. Regular monitoring and analysis of the documented data empower informed choices regarding saving, investing, and debt management. This structured approach transforms financial management from a reactive process to a proactive endeavor, fostering financial awareness and control.

Effective financial management requires more than just awareness; it demands action. The insights gained from utilizing such a structure provide the foundation for making informed financial decisions, setting achievable goals, and building a secure financial future. By embracing a structured approach to personal finance, individuals equip themselves with the tools and knowledge necessary to navigate financial complexities and achieve long-term financial well-being. The consistent application of these principles fosters financial stability and empowers informed choices for a more secure financial future.