Utilizing such a document offers several advantages. It enables users to track spending patterns, identify areas for potential savings, and monitor progress toward financial goals. This structured approach facilitates better control over finances, contributing to improved financial stability and the achievement of long-term objectives.

This understanding of financial inflows and outflows provides a crucial starting point for developing a comprehensive budget, managing debt effectively, and building a secure financial future. The following sections will delve deeper into the creation and utilization of this valuable tool.

1. Income Tracking

Accurate income tracking forms the cornerstone of a robust personal finance income statement. A comprehensive record of all income sourcesincluding salaries, wages, investment returns, rental income, and side hustlesprovides the foundation for meaningful financial analysis. Without a precise understanding of total income, it becomes impossible to accurately assess spending habits, create a realistic budget, or track progress toward financial goals. For instance, an individual aiming to save for a down payment might overestimate their capacity if various smaller income streams, like freelance work, are not meticulously documented.

Meticulous income tracking allows for the identification of income trends and potential fluctuations. This detailed record enables individuals to anticipate financial challenges and opportunities, facilitating proactive financial management. Consider a seasonal worker whose income varies throughout the year. Detailed income tracking allows them to budget effectively during peak earning periods to cover expenses during leaner months. This forward-thinking approach, enabled by accurate income documentation, minimizes financial stress and promotes long-term stability.

In summary, consistent and detailed income tracking is indispensable for a functional and informative income statement. This practice provides the essential data required for effective budgeting, financial planning, and informed decision-making. Failing to accurately track income can lead to unrealistic budgeting, hindering progress toward financial goals and potentially contributing to financial instability. It constitutes the crucial first step toward gaining control over one’s finances and building a secure financial future.

2. Expense Categorization

Effective expense categorization is essential for a comprehensive personal finance income statement. Organizing expenditures into distinct categories provides a clear picture of spending patterns, facilitating informed financial decisions and contributing to better budget management.

- Essential Expenses:These encompass necessities like housing, utilities, groceries, and transportation. Understanding the proportion of income allocated to essential expenses is crucial for evaluating financial health and identifying potential areas for adjustment. For example, high housing costs might necessitate exploring more affordable options or adjusting other budget areas. Accurately tracking these costs within a personal finance income statement clarifies financial obligations and informs budget allocation decisions.

- Discretionary Expenses:These non-essential expenditures include entertainment, dining out, hobbies, and travel. Analyzing discretionary spending reveals potential areas for savings and allows for conscious prioritization of expenses aligned with financial goals. For instance, tracking spending on entertainment subscriptions can highlight opportunities to reduce costs and redirect funds towards higher-priority goals like debt reduction or investing. Within a personal finance income statement, these expenses offer insights into lifestyle choices and their impact on overall financial health.

- Debt Payments:Categorizing debt payments, such as mortgage payments, student loans, and credit card payments, allows for clear tracking of debt reduction progress. This categorization facilitates informed decisions regarding debt management strategies, such as prioritizing high-interest debt repayment. Visualizing the portion of income dedicated to debt service within a personal finance income statement provides a powerful incentive for debt reduction and financial stability.

- Savings and Investments:Categorizing savings and investments, including retirement contributions, emergency funds, and investment portfolios, provides a clear picture of progress toward long-term financial goals. Monitoring these categories within the context of an income statement reinforces positive financial behaviors and supports informed investment decisions. For instance, regularly tracking contributions to a retirement account within an income statement reinforces the importance of long-term financial planning and allows for adjustments based on financial progress.

By meticulously categorizing expenses within a personal finance income statement, individuals gain a comprehensive understanding of their financial flows, empowering them to make informed decisions that contribute to long-term financial well-being. This structured approach enables proactive budgeting, informed spending choices, and strategic progress toward financial goals.

3. Regular Reporting

Regular reporting is a cornerstone of effective personal financial management, providing consistent insights into income and expenses. When utilized with a personal finance income statement template, it transforms raw financial data into actionable intelligence, enabling informed decisions and fostering financial stability. Consistent reporting frequency, whether monthly, quarterly, or annually, allows for the identification of trends, the evaluation of progress towards goals, and the proactive adjustment of financial strategies.

- Frequency and Consistency:Establishing a consistent reporting schedule, such as monthly reviews, is crucial. Regular engagement with the income statement template fosters financial awareness and allows for timely identification of potential issues. For example, a consistent monthly review might reveal a gradual increase in discretionary spending, prompting adjustments before it significantly impacts savings goals. Consistent frequency reinforces disciplined financial practices.

- Trend Analysis:Regular reporting facilitates the identification of spending and income trends. Observing recurring patterns over time allows for proactive adjustments to financial strategies. For instance, consistently higher utility bills during summer months might prompt investigation into energy efficiency improvements. Recognizing these trends through regular reporting allows for informed adjustments and optimization of resource allocation.

- Progress Evaluation:Regularly generated income statements provide a mechanism for evaluating progress toward financial goals. Tracking progress against targets, such as debt reduction or savings accumulation, allows for adjustments to strategies as needed. For example, if savings are accumulating slower than anticipated, adjustments to the budget or income generation strategies can be implemented. This regular evaluation ensures alignment between financial activities and long-term objectives.

- Adaptability and Adjustment:Regular reporting allows for adaptability in the face of changing financial circumstances. Unexpected expenses or income fluctuations can be readily incorporated into the income statement, facilitating informed adjustments to the budget and financial plans. For example, a sudden job loss necessitates immediate budget adjustments, which are facilitated by the readily available data from regular income statement updates. This adaptability minimizes the impact of unforeseen events and promotes financial resilience.

By integrating regular reporting into the use of a personal finance income statement template, individuals gain a dynamic understanding of their financial position, enabling proactive adjustments and informed decision-making. This iterative process of review and adjustment is crucial for maintaining financial health, achieving financial goals, and navigating the complexities of personal finance effectively.

4. Financial Analysis

Financial analysis, facilitated by a personal finance income statement template, provides crucial insights into spending patterns, income streams, and overall financial health. The template serves as a structured repository of financial data, enabling users to identify trends, evaluate financial performance, and make informed decisions. Cause and effect relationships become clearer through analysis; for example, a consistent increase in discretionary spending might lead to a reduction in savings, prompting a need for budget adjustments. Analyzing the income statement reveals the impact of financial decisions, fostering a deeper understanding of personal finances.

As a critical component of a comprehensive personal finance strategy, financial analysis empowers proactive financial management. A detailed income statement allows for the calculation of key financial metrics such as savings rate, debt-to-income ratio, and investment returns. For example, tracking the debt-to-income ratio over time allows individuals to assess their debt burden and adjust repayment strategies accordingly. This understanding facilitates informed decisions regarding debt management, investment allocation, and other crucial financial matters. The practical significance of this understanding lies in its ability to empower informed financial choices, leading to improved financial outcomes.

In summary, consistent and thorough financial analysis, utilizing a personal finance income statement template, is essential for effective financial management. It provides a structured framework for understanding the interplay of income, expenses, and financial goals. While challenges such as maintaining accurate records and dedicating time for analysis exist, the benefits of improved financial awareness, proactive decision-making, and increased financial stability outweigh the effort. This analytical approach empowers individuals to take control of their financial well-being and work towards long-term financial security.

5. Budget Foundation

A well-structured budget is crucial for effective financial management, and a personal finance income statement template serves as its cornerstone. The template provides the necessary data on income and expenses, enabling the creation of a realistic and achievable budget. Without a clear understanding of financial inflows and outflows, a budget becomes an ineffective tool. The income statement provides the foundational understanding required for informed budget development.

- Income Allocation:The income statement facilitates strategic allocation of income across various budget categories. By understanding the proportion of income dedicated to essential expenses, discretionary spending, and savings, individuals can make informed decisions about resource allocation within their budget. For instance, if the income statement reveals a high percentage of income allocated to housing, adjustments to other budget categories might be necessary. The income statement informs these decisions, ensuring the budget aligns with financial realities.

- Expense Prioritization:The income statement enables prioritization of essential expenses within the budget. By clearly categorizing expenses, individuals can identify necessities and allocate resources accordingly. This prioritization ensures that essential needs are met before allocating funds to discretionary spending. For example, allocating sufficient funds for groceries and utilities takes precedence over entertainment expenses. The income statement data guides these prioritization decisions.

- Realistic Goal Setting:A personal finance income statement provides the data necessary for setting realistic financial goals within a budget. Understanding current income and spending patterns allows individuals to set achievable savings targets, debt reduction goals, and other financial objectives. For instance, if the income statement reveals limited discretionary spending, setting an ambitious savings goal might be unrealistic. The income statement data informs realistic goal setting within the budget framework.

- Monitoring and Adjustment:The income statement facilitates ongoing budget monitoring and adjustment. By regularly comparing actual spending against the budget, individuals can identify areas of overspending or potential savings opportunities. This continuous monitoring and adjustment process ensures the budget remains relevant and effective in achieving financial goals. The income statement provides the data for these adjustments, ensuring the budget remains a dynamic tool for financial management.

The personal finance income statement template provides the essential foundation upon which a robust and effective budget is built. By providing detailed insights into income and expenses, the template empowers informed budget creation, realistic goal setting, and continuous monitoring, leading to greater financial control and progress toward financial objectives. It’s the crucial link between understanding financial reality and planning for a secure financial future.

6. Informed Decisions

Sound financial decisions rely on accurate and accessible financial data. A personal finance income statement template provides this crucial foundation, empowering informed choices across various financial domains. By offering a structured overview of income and expenses, the template facilitates clear-eyed assessments of financial health, enabling strategic planning and effective resource allocation.

- Debt Management:Analyzing debt payments within the income statement allows for strategic debt management. Understanding the proportion of income dedicated to servicing debt informs decisions regarding debt consolidation, prioritization of high-interest debt repayment, and the development of effective debt reduction strategies. For example, an individual with high credit card debt might choose to consolidate balances onto a lower-interest loan after reviewing their income statement. This informed decision, driven by data from the template, facilitates efficient debt reduction and improved financial stability.

- Investment Allocation:A comprehensive income statement informs investment decisions by providing a clear picture of available resources. Understanding income, expenses, and existing savings allows for informed asset allocation, risk assessment, and investment strategy development. For instance, an individual with a stable income and healthy savings, as revealed by the income statement, might consider allocating a portion of their portfolio to higher-growth investments. This informed approach to investment allocation stems from a clear understanding of financial capacity provided by the income statement.

- Emergency Preparedness:The income statement plays a crucial role in emergency preparedness. By analyzing income and expenses, individuals can assess their ability to handle unexpected financial setbacks and build an adequate emergency fund. For example, an individual with inconsistent income, as revealed by the income statement, might prioritize building a larger emergency fund to cover potential income gaps. This proactive approach to emergency preparedness is informed by the financial insights derived from the income statement.

- Goal Setting and Achievement:Realistic financial goal setting relies on accurate financial data. The income statement provides this data, enabling individuals to set achievable savings targets, plan for major purchases, and track progress toward long-term financial objectives. For instance, an individual aiming to purchase a home can use the income statement to assess their affordability range and develop a realistic savings plan. This informed approach to goal setting, grounded in the data from the income statement, increases the likelihood of achieving financial objectives.

A personal finance income statement template empowers informed financial decision-making by providing a structured framework for understanding financial realities. This data-driven approach facilitates strategic planning, proactive adjustments, and improved financial outcomes across various financial domains. The template serves as an essential tool for anyone seeking to take control of their financial well-being and build a secure financial future.

Key Components of a Personal Finance Income Statement

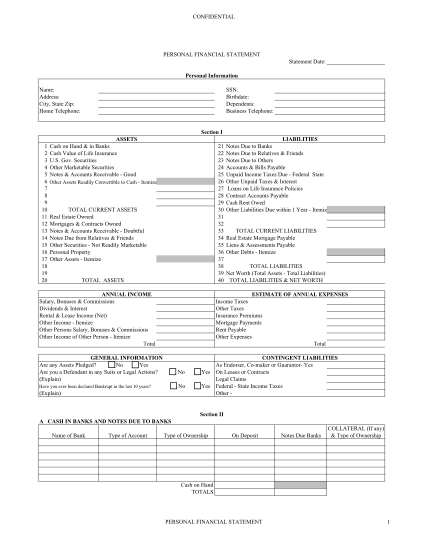

A comprehensive personal finance income statement template provides a structured framework for understanding financial health. Several key components contribute to its effectiveness as a financial management tool.

1. Income: Accurate recording of all income sources is fundamental. This includes salaries, wages, investment returns, rental income, and any other sources of revenue. Precise income documentation provides the basis for accurate financial analysis.

2. Expenses: Detailed categorization of expenses is crucial. Categorization should encompass essential expenses (housing, utilities, food), discretionary expenses (entertainment, dining out), debt payments (loans, credit cards), and savings/investments. Clear categorization enables analysis of spending patterns and identification of potential savings opportunities.

3. Reporting Period: The income statement should cover a specific period, typically a month, quarter, or year. This defined timeframe allows for consistent tracking and analysis of financial performance over time. Regular reporting facilitates trend identification and informed adjustments to financial strategies.

4. Net Income: Calculated by subtracting total expenses from total income, net income represents the surplus or deficit for the reporting period. This key metric provides a snapshot of overall financial health and informs budget adjustments.

5. Savings Rate: This metric, calculated by dividing total savings by total income, provides insights into saving habits and progress toward financial goals. Tracking the savings rate over time allows for adjustments to savings strategies and promotes long-term financial security.

6. Debt-to-Income Ratio: This ratio, calculated by dividing total debt payments by total income, reflects the proportion of income dedicated to servicing debt. Monitoring this ratio helps assess debt burden and informs debt management strategies. A lower ratio generally indicates healthier financial standing.

These components work together to provide a comprehensive overview of financial health, enabling informed decision-making and proactive financial management. Regular review and analysis of these elements contribute to improved financial stability and progress toward long-term financial objectives.

How to Create a Personal Finance Income Statement

Creating a personal finance income statement involves a structured approach to organizing financial data. The following steps outline the process of developing this valuable tool for managing personal finances.

1. Choose a Reporting Period: Select a specific timeframe for the income statement, such as a month, quarter, or year. This consistent timeframe allows for accurate tracking and comparison of financial performance over time.

2. Document Income: Compile all sources of income within the chosen reporting period. This includes salaries, wages, investment returns, rental income, side hustles, and any other form of revenue. Accuracy in documenting all income streams is crucial for a realistic financial assessment.

3. Categorize Expenses: Organize all expenditures into distinct categories. Common categories include housing, utilities, groceries, transportation, healthcare, entertainment, debt payments, and savings/investments. Detailed categorization enables analysis of spending patterns and identification of potential areas for adjustment.

4. Calculate Net Income: Subtract total expenses from total income to determine net income. This key figure represents the surplus or deficit for the reporting period and provides a snapshot of overall financial health.

5. Calculate Key Financial Metrics: Calculate relevant financial metrics, such as the savings rate (total savings / total income) and debt-to-income ratio (total debt payments / total income). These metrics offer deeper insights into financial habits and debt management effectiveness. Tracking these metrics over time provides valuable data for financial planning.

6. Utilize a Template or Spreadsheet: Consider using a pre-designed template or spreadsheet software to organize the income statement. These tools offer a structured format for data entry, automated calculations, and easy generation of reports. Leveraging these resources simplifies the process and ensures accuracy.

7. Regularly Review and Analyze: Review the income statement regularly to identify trends, assess progress toward financial goals, and inform budget adjustments. Regular analysis facilitates proactive financial management and enhances financial awareness. Consistent engagement with the income statement is key to its effectiveness.

By following these steps, a comprehensive and informative personal finance income statement can be created, providing a powerful tool for managing personal finances, making informed decisions, and achieving long-term financial goals. This structured approach empowers proactive financial management and promotes financial stability.

A personal finance income statement template provides a structured framework for understanding financial health by offering a clear overview of income, expenses, and net income. Its value lies in facilitating informed financial decisions through expense tracking, budgeting, and analysis of key financial metrics such as savings rate and debt-to-income ratio. Regular utilization and analysis of this tool enable proactive adjustments to financial strategies, promoting responsible financial management and progress toward financial goals.

Effective financial management requires a commitment to understanding and actively managing one’s financial resources. A personal finance income statement template provides a crucial tool for achieving this objective, enabling informed choices that contribute to long-term financial stability and security. Consistent engagement with this tool empowers individuals to take control of their financial well-being and build a stronger financial future.